TIDMMTL

RNS Number : 3485Z

Metals Exploration PLC

14 September 2022

METALS EXPLORATION PLC

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2022

Metals Exploration plc (AIM: MTL) ("Metals Exploration" or the

"Company"), the Philippine gold producer, announces its interim

results for the six months ended 30 June 2022, and will be made

available on the Company's website at www.metalsexploration.com

.

Highlights

-- Gold production of 31,348 ounces (H1 2021: 35,316 ounces);

-- Gold recoveries of 87.7% (H1 2021: 81.0%);

-- Operating profit of US$9.4 million achieved (H1 2021: US$14.2 million);

-- Positive cashflow from operations of US$17.0 million (H1 2021: US$21.3 million);

-- The Group's senior debt was US$8.1 million (H1 2021: US$42.4

million) - it is expected that the senior loan will be fully repaid

during Q4 2022.

-- Net Debt as at 30 June 2022 US$92.9 million (H1 2021: US$111.0 million);

-- Over 17 million man-hours since the last reported lost-time injury.

Production Summary

Runruno Project

------------------- ---------- -------------------

Production Summary Actual Actual Actual

------------------- ---------- -------------------

6 Months 6 Months 12 Months

to to to

30 June 30 June 31 December

Units 2022 2021 2021

--------- ----------

Mining

--------- ---------- -------------------

Ore Mined Tonnes 1,289,123 713,742 1,896,808

---------- ---------- -------------------

Waste Mined Tonnes 5,676,856 4,537,749 8,874,266

---------- ---------- -------------------

Total Mined Tonnes 6,965,979 5,251,491 10,771,074

---------- ---------- -------------------

Au Grade Mined g/tonne 1.10 1.27 1.21

---------- ---------- -------------------

Strip Ratio 4.28 5.92 4.43

---------- -------------------

Processing

--------- ---------- -------------------

Ore Milled Tonnes 1,017,258 1,048,290 2,136,875

---------- ---------- -------------------

Gold (Au) Grade g/tonne 1.09 1.29 1.26

---------- ---------- -------------------

Sulphur Grade % 0.98 1.11 0.97

---------- ---------- -------------------

Au Milled (contained) ounces 35,742 43,620 86,611

---------- ---------- -------------------

Recovery % 87.7 81.0 83.7

---------- ---------- -------------------

Au Poured ounces 31,348 35,316 73,206

---------- ---------- -------------------

Sales

--------- ---------- -------------------

Au Sold ounces 30,676 34,745 72,447

---------- ---------- -------------------

Au Price US$/oz 1,878 1,797 1,792

---------- ---------- -------------------

Review of Operations

Safety and health

The outstanding safety record of the operation continues with in

excess of 17 million man-hours with no lost time incidents

occurring since the last lost time incident in December 2016. All

employees and contractors are to be congratulated on this ongoing

achievement.

The COVID-19 vaccination programme has been successful in that

in excess of 95% of all staff and on-site contractors have received

at least two vaccine doses. This has contributed to the mine-site

operations being unaffected as a result of COVID-19.

Finance

A lower head grade of 1.10g/t for H1 2022 (H1 2021: 1.27g/t)

contributed to lower gold production and sales revenue. Gold sales

were US$57.6 million (H1 2021 US$62.4 million). Operations resulted

in positive free cash flow of US$17.0 million (H1 2021: US$21.3

million).

As at H1 2022 end, the Group's senior debt was US$8.1 million

(H1 2021: US$42.4 million) with net debt of US$92.9 million (H1

2021: US$109.6 million). Total debt repayments made during H1 2022

were US$17.0 million (H1 2021: US$20.6 million). It is expected

that the senior loan will be fully repaid during Q4 2022. Details

of these debt facilities can be found in Note 5.

Mining

Mining production of ore and waste was 7.0 Mt for H1 2022 (H1

2021: 5.3Mt) and the total ore mined was 1.3Mt (H1 2021:

0.7Mt).

Mining of Stage 1 of the mine plan was completed during H1 2022,

while mining of Stage 2 was completed in early Q3 2022. In-pit

back-filling of waste is well underway.

Full access to Stage 3 of the mine plan, which is critical to

the mining operation schedule, was not achieved during H1 2022.

Notwithstanding several court orders in the Company's favour,

access to a key area of Stage 3 was not achieved. This resulted in

changes to the Company mine plan delaying access to higher grade

material in Stage 3. Mining of this material is now scheduled to

commence in Q3 2022. These access issues have also temporarily

halted both the resource definition and exploration drill

programmes planned for Stages 4 and 5. Access to the final Stage 3

areas was secured during Q3 2022.

During H1 2022, due to macro-economic conditions, there was a

noticeable increase in the cost of essential consumables including

fuel, explosives etc, resulting in mining unit costs exceeding

budget. The Company's mining equipment fleet performed adequately

during H1 2022.

Process plant

Throughput for H1 2022 of 1.02Mt (H1 2021: 1.05Mt) was on

budget, however, operations were managed to a lower feed grade.

Delays in accessing mine plan Stage 3 and 4 affected the head grade

during H1 2022, with higher grade material from Stage 3 now

scheduled to be accessed during H2 2022.

Gold production for H1 2022 was 31,348 ounces (H1 2021: 35,316

ounces). Notwithstanding the below noted BIOX performance issues, a

higher gold recovery rate of 87.7% was achieved (H1 2021:

81.0%).

Adverse weather events resulted in numerous power failures

during Q2 2022. These power outages contributed to a lack of

stability of the BIOX bacteria culture; giving rise to resultant

production losses over several weeks. Difficulties were experienced

in re-establishing a stable bacteria culture in the BIOX circuit

due to an unknown contaminant that developed in the return water

sources that were being used to feed the BIOX circuit. As a result

of these issues BIOX has under-performed in H1 2022, impacting

overall gold produced during the period. Since period end, there

have been no further water contaminant issues, which are expected

to have a similar effect on the BIOX circuit's performance.

A major upgrade to the process plant return water and cooling

systems is underway. Once completed, the Company will have an

increased ability to control BIOX temperature and to reduce the

risk of contaminated return water feed.

Further unplanned process plant downtime during H1 2022 was

caused in the main by tails line failures and conveyor belt and

return water line repairs.

Residual Storage Impoundment ("RSI")

The RSI is operating to design with an excellent environmental

performance record. Construction of the final Stage 6 RSI lift has

commenced with completion expected by year end.

The performance of the RSI is continuously monitored by an

independent international consulting group. Engineering and final

detailed designs for the final in-rock spillway are well advanced

with the commencement of construction expected in H1 2023.

Community & Government Relations

Productive relations with both the community and the Philippine

government continue. The Company, with the assistance of various

government agencies, finally secured full access to Stage 3 mine

areas in Q3 2022. Further removal of illegal miners, their

infrastructure and dwellings from mine plan Stages 4 and 5 is

required to allow exploration drilling to be undertaken in these

areas.

Corporate

In June 2022 Tim Livesey replaced Jeremy Wrathall as an

Independent Non-Executive Director of the Company.

Mr Livesey has been appointed Chairman of the Remuneration

Committee and a member of the Audit Committee.

The 2022 AGM held in June 2022 approved acapital sub-division

and capital reduction. The capital sub-division corporate event

changed the nominal value of ordinary shares to GBP0.0001 while

creating a new class of Deferred Shares effective from the date of

the AGM.

Since period end, the Company completed the capital reduction

corporate event, eliminating both the Deferred Share capital

account and the Share Premium account, resulting in a capital

reduction of approximately US$224 million, with an offsetting

US$224 million credit applied against the accumulated profit and

loss account. This has simplified the Company's equity structure

whilst adding greater flexibility for both future equity raises and

shareholder distributions.

In addition, in June 2022, the Company issued 17,462,835

ordinary shares at an issue price of GBP0.01245 to certain members

of senior management in lieu of a GBP217,400 cash bonus.

For further information please visit or contact

www.metalsexploration.com

Metals Exploration PLC

Via Tavistock Communications

Limited +44 (0) 207 920 3150

-------------------------

Nominated & Financial Adviser: STRAND HANSON LIMITED

-------------------------

James Spinney, James Dance,

Rob Patrick +44 (0) 207 409 3494

-------------------------

Financial Adviser & Broker: HANNAM & PARTNERS

-------------------------

Matt Hasson, Franck Nganou +44 (0) 207 907 8500

-------------------------

Public Relations: TAVISTOCK COMMUNICATIONS

LIMITED

-------------------------

Jos Simson, Nick Elwes +44 (0) 207 920 3150

-------------------------

CONDENSED CONSOLIDATED STATEMENT OF TOTAL COMPREHENSIVE INCOME

for the six months ended 30 June 2022

Notes 6 month period ended 6 month period ended Year ended

30 June 2022 30 June 2021 31 December 2021

(unaudited) (unaudited) (audited)

US$ US$ US$

Continuing Operations

Revenue 57,621,936 62,439,246 129,843,489

Cost of sales (42,493,529) (44,363,193) (91,977,555)

---------------------- ----------------------- ----------------------

Gross profit 15,128,407 18,076,053 37,865,934

Administrative expenses (5,724,198) (3,897,168) (8,475,303)

---------------------- ----------------------- ----------------------

Operating profit 9,404,209 14,178,885 29,390,631

---------------------- ----------------------- ----------------------

Impairment loss (670,677) (798,275) (1,450,078)

Loss on sale of assets - (78,206) (78,206)

Net finance and other costs (7,271,289) (7,324,104) (16,232,196)

Loss on fair value changes to

derivatives (526,495) - (332,996)

Share based payment expense (75,698) - (10,982)

Share of (loss)/ profit of

associates (2,729) (6,642) 18,232

---------------------- ----------------------- ----------------------

Profit before tax 857,321 5,971,658 11,304,405

Tax expense (75,255) (29,910) (11,769)

---------------------- ----------------------- ----------------------

Profit for the period attributable

to equity holders of the parent 782,066 5,941,748 11,292,636

====================== ======================= ======================

Other comprehensive

income :

Items that may be

re-classified

subsequently

to profit or loss:

Exchange differences on

translating foreign operations 40,020 (1,428,287) (791,929)

Items that will not be

re-classified

subsequently

to profit or loss:

Re-measurement of pension

liabilities - - 123,855

---------------------- ----------------------- ----------------------

Total comprehensive profit for the

period attributable to equity

holders of the parent 822,086 4,513,461 10,624,562

====================== ======================= ======================

Earnings per share:

Basic cents per share 4 0.04 0.29 0.55

Diluted cents per share 0.04 0.28 0.52

CONDENSED CONSOLIDATED INTERIM BALANCE SHEET

as at 30 June 2022

Notes 30 June 2022 30 June 2021 (Unaudited) 31 December 2021

(Unaudited) (Audited)

US$ US$ US$

Non-current assets

Property, plant and

equipment 88,810,504 99,810,635 95,941,405

Other intangible assets 49,743 65,396 70,115

Investment in associate

companies 179,536 157,391 182,265

Trade and other

receivables 5,572,524 5,606,159 5,529,628

94,612,307 105,639,581 101,723,413

------------------------ ------------------------- ------------------------

Current assets

Inventories 22,136,388 16,524,182 17,217,885

Trade and other

receivables 6,890,283 7,023,876 5,968,568

Cash and cash

equivalents 288,439 4,702,995 4,736,970

29,315,110 28,251,053 27,923,423

------------------------ ------------------------- ------------------------

Non-current liabilities

Loans 5 (74,146,474) (85,041,950) (78,856,268)

Trade and other payables (1,871,640) (1,938,387) (1,950,535)

Deferred tax liabilities (880,935) (838,661) (805,680)

Provision for mine

rehabilitation (4,031,740) (3,310,074) (4,015,050)

(80,930,789) (91,129,072) (85,627,533)

------------------------ ------------------------- ------------------------

Current liabilities

Trade and other payables (12,791,908) (10,095,399) (10,328,000)

Loans - current portion 5 (18,711,883) (29,264,218) (23,834,279)

Derivative liabilities (805,124) - (332,996)

(32,308,915) (39,359,617) (34,495,275)

------------------------ ------------------------- ------------------------

Net assets 10,687,713 3,401,945 9,524,028

======================== ========================= ========================

Equity

Share capital 6 27,952,353 27,950,217 27,950,217

Share premium account 6 196,118,890 195,855,125 195,855,125

Acquisition of

non-controlling

interest reserve (5,107,515) (5,107,515) (5,107,515)

Translation reserve 14,708,496 16,262,872 14,668,476

Re-measurement reserve 162,003 38,148 162,003

Other reserves 1,613,617 1,526,937 1,537,919

Profit and loss account (224,760,131) (233,123,839) (225,542,197)

------------------------ ------------------------- ------------------------

Equity attributable to

equity holders of the

parent 10,687,713 3,401,945 9,524,028

======================== ========================= ========================

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2022

Acquisition of

Share non-controlling Profit and

Share premium interest Translation Re-measurement Other loss Total

capital account reserve reserve reserve reserve account equity

US$ US$ US$ US$ US$ US$ US$ US$

------------ ------------ ---------------- ------------ --------------- ------------ ----------- ------------

Balance at 1

January 2022 27,950,217 195,855,125 (5,107,515) 14,668,476 162,003 1,537,919 (225,542,197) 9,524,028

Exchange

differences

on

translating

foreign

operations - - - 40,020 - - - 40,020

Profit for the

period - - - - - - 782,066 782,066

Share based

payment - - - - - 75,698 - 75,698

----------- ------------ ------------ ----------- -------- ---------- -------------- -----------

Total

comprehensive

(loss)/profit

for the

period - - - 40,020 - 75,698 782,066 897,784

Equity issue 2,136 263,765 - - - - - 265,901

Balance at 30

June 2022 27,952,353 196,118,890 (5,107,515) 14,708,496 162,003 1,613,617 (224,760,131) 10,687,713

----------- ------------ ------------ ----------- -------- ---------- -------------- -----------

Equity is the aggregate of the following:

-- Share capital; being the nominal value of shares issued.

-- Share premium account; being the excess received over the

nominal value of shares issued less direct issue costs.

-- Acquisition of non-controlling interests reserve; being

amounts recognised on acquiring additional equity in a controlled

subsidiary.

-- Translation reserve; being the foreign exchange differences

on the translation of foreign subsidiaries.

-- Re-measurement reserve; being the cumulative actuarial gains

and losses, return on plan assets and changes in the effect of the

asset ceiling (excluding net interest on defined benefit liability)

recognised in the statement of total comprehensive income.

-- Other reserves; being the cumulative fair value of warrants

associated with certain mezzanine debt facilities and share-based

payments expense.

-- Profit and loss account; being the cumulative loss attributable to equity shareholders.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2021

Acquisition of

Share non-controlling

Share premium interest Translation Re-measurement Other Profit and Total

capital account reserve reserve reserve reserve loss account equity

US$ US$ US$ US$ US$ US$ US$ US$

----------- ------------ ---------------- ------------ --------------- ---------- -------------- ------------

Balance at 1

January 2021 27,950,217 195,855,125 (5,107,515) 17,691,159 38,148 1,526,937 (239,065,587) (1,111,516)

Exchange

differences

on

translating

foreign

operations - - - (1,428,287) - - - (1,428,287)

Profit for the

period - - - - - - 5,941,748 5,941,748

----------- ------------ ---------------- ------------ --------------- ---------- -------------- ------------

Total

comprehensive

(loss)/profit

for the

period - - - (1,428,287) - - 5,941,748 4,513,461

Balance at 30

June 2021 27,950,217 195,855,125 (5,107,515) 16,262,872 38,148 1,526,937 (233,123,839) 3,401,945

----------- ------------ ---------------- ------------ --------------- ---------- -------------- ------------

Equity is the aggregate of the following:

-- Share capital; being the nominal value of shares issued.

-- Share premium account; being the excess received over the

nominal value of shares issued less direct issue costs.

-- Acquisition of non-controlling interests reserve; being

amounts recognised on acquiring additional equity in a controlled

subsidiary.

-- Translation reserve; being the foreign exchange differences

on the translation of foreign subsidiaries.

-- Re-measurement reserve; being the cumulative actuarial gains

and losses, return on plan assets and changes in the effect of the

asset ceiling (excluding net interest on defined benefit liability)

recognised in the statement of total comprehensive income.

-- Other reserves; being the cumulative fair value of warrants

associated with certain mezzanine debt facilities.

-- Profit and loss account; being the cumulative loss attributable to equity shareholders.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

for the year ended 31 December 2021

Acquisition of

Share non-controlling

Share premium interest Translation Re-measurement Other Profit and Total

capital account reserve reserve reserve reserve loss account equity

US$ US$ US$ US$ US$ US$ US$ US$

----------- ------------ ---------------- ------------ --------------- ---------- -------------- ------------

Balance at 1

January 2021 27,950,217 195,855,125 (5,107,515) 15,460,405 38,148 1,526,937 (236,834,833) (1,111,516)

Exchange

differences

on

translating

foreign

operations - - - (791,929) - - - (791,929)

Change in

pension

liability - - - - 123,855 - - 123,855

Profit for the

year - - - - - - 11,292,636 11,292,636

Share based

payments - - - - - 10,982 - 10,982

----------- ------------ ---------------- ------------ --------------- ---------- -------------- ------------

Total

comprehensive

profit/(loss)

for the

period - - - (791,929) 123,855 10,982 11,292,636 10,635,544

Balance at 31

December 2021 27,950,217 195,855,125 (5,107,515) 14,668,476 162,003 1,537,919 (225,542,197) 9,524,028

----------- ------------ ---------------- ------------ --------------- ---------- -------------- ------------

Equity is the aggregate of the following:

-- Share capital; being the nominal value of shares issued.

-- Share premium account; being the excess received over the

nominal value of shares issued less direct issue costs.

-- Acquisition of non-controlling interests reserve; being

amounts recognised on acquiring additional equity in a controlled

subsidiary.

-- Translation reserve; being the foreign exchange differences

on the translation of foreign subsidiaries.

-- Re-measurement reserve; being the cumulative actuarial gains

and losses, return on plan assets and changes in the effect of the

asset ceiling (excluding net interest on defined benefit liability)

recognised in the statement of total comprehensive income.

-- Other reserves; being the cumulative fair value of warrants

associated with certain mezzanine debt facilities and share-based

payments expense.

-- Profit and loss account; being the cumulative loss attributable to equity shareholders.

CONDENSED CONSOLIDATED INTERIM CASH FLOW STATEMENT for the six

months ended 30 June 2022

6 month period ended 6 month period ended Year ended

30 June 2022 (unaudited) 30 June 2021 (unaudited) 31 December 2021

Notes (audited)

US$ US$ US$

Net cash arising from operating

activities 17,037,683 21,274,714 46,515,768

------------------------- ------------------------- ------------------------

Investing activities

Exploration expenses incurred - (285,885)* (338,203)

Purchase of property, plant and

equipment (3,991,767) (4,636,801) (11,542,751)

Purchase of intangible assets - (45,993)* (45,993)

Proceeds from sale of plant and

equipment - 60,000 60,000

------------------------- ------------------------- ------------------------

Net cash used in investing

activities (3,991,767) (4,908,679) (11,866,947)

------------------------- ------------------------- ------------------------

Financing activities

Repayment of borrowings -

principal and interest (17,000,000) (20,600,000) (39,675,000)

Net cash arising from financing

activities (17,000,000) (20,600,000) (39.675.000)

------------------------- ------------------------- ------------------------

Net(decrease)/increase in cash

and cash equivalents (3,954,084) (4,233,965) (5,026,179)

Cash and cash equivalents at

beginning of period 4,736,970 8,931,792 8,931,792

Foreign exchange difference (494,447) 5,168 831,357

Cash and cash equivalents at end

of period 288,439 4,702,995 4,736,970

========================= ========================= ========================

* Restated 30 June 2021 to be consistent with subsequent

disclosure as at the 31 December 2021 year end

Notes to the condensed consolidated interim financial

statements

1. General information

These condensed consolidated interim financial statements of

Metals Exploration and its subsidiaries (the "Group") were approved

by the Board of Directors on 13 September 2022. Metals Exploration

is the parent company of the Group. Its shares are quoted on AIM

market of the London Stock Exchange plc. The registered address of

Metals Exploration plc is 38 - 43 Lincoln's Inn Fields, London,

WC2A 3PE.

The condensed consolidated interim financial statements for the

period 1 January 2022 to 30 June 2022 are unaudited. The financial

information has been prepared on the basis of IFRS that the

Directors expect to be adopted in the UK and applicable as at 31

December 2022. The group has chosen not to adopt IAS 34 "Interim

Financial Statements" in preparing the interim financial

information the condensed consolidated interim financial statements

incorporate unaudited comparative figures for the interim period

fro m 1 January 2021 to 30 June 2021 and the audited financial year

ended 31 December 2021.

The financial information set out in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory accounts for the year

ended 31 December 2021, which were prepared under International

Financial Reporting Standards, were filed with the Registrar of

Companies. The auditors reported on these accounts and their report

was unqualified and did not contain a statement under either

Section 498 (2) or Section 498 (3) of the Companies Act 2006.

2. Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with UK-adopted

international accounting standards. The financial information has

been prepared based on UK-adopted international accounting

standards that the Board of Directors expect to be applicable as at

31 December 2022.

These condensed consolidated interim financial statements have

been prepared under the historical cost convention, except for

derivative financial instruments, which are measured at fair value,

and in accordance with UK-adopted international accounting

standards . There have been no changes in accounting policies as

described in the 2021 annual financial statements.

3. Going concern

These condensed consolidated interim financial statements of the

Group have been prepared on a going concern basis, which

contemplates the continuity of business activities, the realisation

of assets and the settlement of liabilities in the normal course of

business.

Although as at 30 June 2022, the Group's current liabilities

continue to exceed its current assets, primarily due to the

estimated external borrowings the Group expects to repay within the

next 12 months, there is no obligation to adhere to a set loan

principal or interest repayment schedule.

The Group is not subject to any set principal or interest

repayment schedule. Excess free cashflow is required to be paid to

lenders on a minimum quarterly basis only when net working capital

is in excess of US$5million. In addition, the Group is not in

default if it is unable to make a quarterly payment to the lenders,

but would continue to be obliged to pay out the excess free cash

flow as soon as possible. As a result of these debt repayment

arrangements, including the ongoing existence of a US$5million

positive net working capital balance, together with the sustained

positive cash flows being produced by the Runruno Project, the

Directors believe there is no material uncertainty over the Group's

going concern.

The Group and its ability to operate as a going concern and to

meet its commitments as and when they fall due is dependent upon

the ability of the Group to operate the Runruno Project

successfully so as to generate sufficient cash flows to enable the

Group to settle its liabilities (including the restructured debt

facilities) as they fall due.

T he Board of Directors believes that the Runruno Project will

continue to operate successfully and produce positive cash flows

for at least 12 months from the date of this interim report, being

13 September 2022. As a result, the Board of Directors considers it

appropriate that the half-year financial information should be

prepared on a going concern basis.

4. Earnings per share

The earnings per share was calculated on the basis of net

profit/(loss) attributable to equity shareholders divided by the

weighted average number of ordinary shares.

6 month period ended 30 June 6 month period ended 30 June Year ended

2022 2021 31 December 2021

(unaudited) (unaudited) (audited)

US$ US$ US$

Earnings

Net profit/(loss) attributable

to equity shareholders for the

purpose of basic and diluted

earnings per share 782,066 5,941,748 11,292,636

Number of shares

Weighted average number of

ordinary shares for the

purpose of basic earnings per

share 2,072,588,751 2,071,334,586 2,071,334,586

------------------------------- ------------------------------- ------------------

Number of dilutive shares under

warrant/option 114,083,011 30,950,049 115,983,670

Weighted average number of

ordinary shares for the

purpose of diluted earnings

per share 2,186,671,762 2,102,284,635 2,187,318,256

------------------------------- ------------------------------- ------------------

Basic earnings cents per share 0.04 0.29 0.55

Diluted earnings cents per

share 0.04 0.28 0.52

------------------------------- ------------------------------- ------------------

5. Loans

Senior debt

On 28 May 2015, the Group entered into a loan with two foreign

international resource banks for US$83,000,000 in project finance

(the "Facility Agreement"). In January 2020 the Facility Agreement

was acquired by companies associated with the Mezzanine Lenders

(the "New Lenders").

In October 2020 the Group completed a debt restructuring with

the New Lenders, whereby the Group no longer has an obligation to

meet any fixed interest and principal repayment schedule (the "New

Senior Debt"). The Group's repayment obligation under the New

Senior Debt is limited to making a quarterly repayment of that

amount which equals the available net working capital ("NWC") over

and above a minimum US$5 million NWC buffer. NWC is defined as the

Group's available cash on hand plus gold sales proceeds due, and

gold doré on hand or in transit, less all current liabilities

(including budgeted operational, CAPEX and exploration expenses,

taxes, hedging costs and government charges, but excluding all

unpaid debt principal and interest).

The principal plus capitalised interest balance owing by the

Group under the Facility Agreement as at 30 June 2022 was

US$8,109,129 (30 June 2021: US$42,410,937).

Mezzanine debt

Since 2015, the Company has entered into numerous facility

agreements with two major shareholders, MTL (Luxembourg) Sarl and

Runruno Holdings Limited (the "Mezzanine Lenders"). The purpose of

these unsecured advances was for general corporate and working

capital requirements of the Company and to enable completion of the

Runruno Project.

In October 2020 the various original mezzanine facilities were

consolidated into two new facilities (the "New Mezzanine

Facilities") and a GBP100,000 revolving credit facility. There is

no obligation to make any repayment of any amounts due under the

New Mezzanine Facilities until the New Senior Debt is fully repaid.

The New Mezzanine Facilities interest rate will initially be 15%

per annum, reducing to 7% per annum once the New Senior Debt has

been fully repaid. The principal and accrued interest/fees balance

owing by the Company to the Mezzanine Lenders as at 30 June 2022

was US$85,117,009 (30 June 2021: US$73,314,888).

The Group's outstanding debt is summarised as follows:

June 2022 June 2021 December 2021

US$ US$ US$

Total loans due within one year* 18,711,883 29,264,218 23,834,279

=========== =========== ==============

Total loans due after more than one year* 74,146,474 85,041,950 78,856,268

=========== =========== ==============

* Given the Group is not subject to a fixed repayment schedule

then, in accordance with the restructured debt facilities, there is

no certainty as to what amount of debt will be repaid within one

year from period end. Thus the determination of what debt is deemed

current and what is deemed non-current is subject to estimation. In

making this calculation the Group has taken into account the

Group's estimate of what principal repayments will be made during

the next 12 month period.

6. Share capital

The 17 June 2022 AGM approved a capital reorganisation which

consisted of both a capital sub-division and a capital reduction.

The capital sub-division effected a change in the nominal value of

ordinary shares. This was achieved by dividing the existing

ordinary shares of GBP0.01 nominal value into one New Ordinary

Share, with a nominal value of GBP0.0001 and one Deferred Share

with a nominal value of GBP0.0099 each. The Deferred Shares have

limited rights and the restrictions as set out in the new Articles

of the Company adopted at the AGM. This capital sub-division was

effective as from the day of the AGM.

The capital reduction element was to cancel, for no

consideration the deferred shares and share premium account by way

of creating a reserve to be offset against accumulated losses. This

capital reduction was subsequently completed in July 2022 and is a

non-adjusting post-balance sheet event. The issued capital of the

Company as at 30 June 2022 is shown below.

December

June 2022 June 2021 December 2021 June 2022 June 2021 2021

Number of Number of

Number of shares shares shares US$ US$ US$

Ordinary shares

of GBP0.01 par

value

Opening balance 2,071,334,586 2,071,334,586 2,071,334,586 27,950,217 27,950,217 27,950,217

Sub-division ( 2,071,334,586) - - (27,950,217) - -

Closing balance - 2,071,334,586 2,071,334,586 - 27,950,217 27,950,217

----------------- -------------- -------------- ------------- ------------ -----------

Ordinary shares of

GBP0.0001 par value

Opening balance - - - - - -

Sub-division 2,071,334,586 - - 279,502 - -

Issued in period 17,461,835 - - 2,136 - -

----------------- -------------- -------------- ------------- ------------ -----------

Closing balance 2,088,796,421 - - 281,638 - -

----------------- -------------- -------------- ------------- ------------ -----------

Deferred shares of

GBP0.0099 par value*

Opening balance - - - - - -

Sub-division 2,071,334,586 - - 27,670,715 - -

----------------- -------------- -------------- ------------- ------------ -----------

Closing balance* 2,071,334,586 - - 27,670,715 - -

----------------- -------------- --------------

Total share capital 27,952,353 27,950,217 27,950,217

============= ============ ===========

* Following completion of the necessary court approval process

these Deferred Shares were cancelled in July 2022.

7. Contingent liabilities

The Group has no contingent liabilities identified as at 30 June

2022 (2021: US$nil).

8. Subsequent events

There have been no subsequent disclosable events other than the

completion of the capital reduction referred to in note 6.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDATIVLIF

(END) Dow Jones Newswires

September 14, 2022 02:01 ET (06:01 GMT)

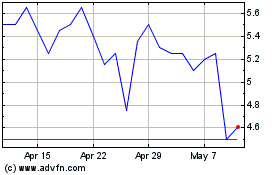

Metals Exploration (LSE:MTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Metals Exploration (LSE:MTL)

Historical Stock Chart

From Apr 2023 to Apr 2024