TIDMMSMN

RNS Number : 6703I

Mosman Oil and Gas Limited

20 April 2022

20 April 2022

Mosman Oil and Gas Limited

("Mosman" or the "Company")

Q3 Production Update

Robust quarter with a 65% increase in net production

Mosman Oil and Gas Limited (AIM: MSMN) the oil exploration,

development and production company, announces its production

summary for the three months ended 31 March 2022 ("March Quarter"),

reporting a 65% increase in net production and significant further

development potential in existing production leases.

The Company has a portfolio of development and exploration

projects, with a clear focus on maximising the opportunity for

further production growth and increasing cashflow. In addition to

its US projects, Mosman has two exploration areas in Australia

which are well positioned to take advantage of the increasing

demand for Helium and Hydrogen, in addition to Oil and Gas.

US Production

Net Production attributable to Mosman for the three months was

11,756 boe, an increase of 4,633 boe, or 65% from the three months

to December 2021 of 7,123 boe. The numbers include increased

production from a re-completion at Falcon and initial production

from Winters-2 (March 2022) but does not reflect the recent

production increase at the Winters-2 well announced on 12 April

2022.

Production Summary

3 Months to 3 Months to

31 March 2022 31 December 2021

boe boe

Gross Project Net Production Gross Project Net Production

Production to Mosman Production to Mosman

Gross boe Net boe Gross boe Net boe

Falcon 10,488 7,866 5,944 4,458

Stanley 7,197 2,799 5,130 1,741

Livingston 686 137 172 35

Winters 3,335 778 173 50

Greater Stanley - - - -

Arkoma 703 176 3,362 839

Total boe 22,409 11,756 14,781 7,123

The Net Production of 11,756 boe produced in the March Quarter

consisted of 2,951 barrels of oil and 51,066 MMBtu of gas.

The average sale prices achieved during the period was US$89.53

per barrel for oil and US$4.13 (January and February only) per

MMBtu for gas (in each case after transport and processing costs

but before royalties). Current prices of both oil and gas have

increased since the end of the quarter, with the Henry Hub

reference gas price currently in excess of US$7.50 per MMBtu.

The Net Production of 29,100 boe in the first 9 months of this

Financial Year already exceeds the 22,284 boe produced in the 12

months of the 2021 Financial Year.

Production numbers in the March Quarter are based on the current

best available data and are subject to adjustment upon receipt of

final sales invoices from the purchasers of products.

Falcon (75% Working Interest)

The well was recompleted in December 2021 and since that time

has continued to produce steadily with minimal water production

.

Galaxie (85% Working Interest)

Several potential drilling locations have been identified.

Further technical work is required before making any decisions.

Stanley (various 34.85% to 38.5% Working Interests)

Details on the status of the five production wells at Stanley

are:

-- Stanley-5 was placed on production in December 2021.

-- Stanley-4 is now connected to the new gas infrastructure with

initial flow rates of c. 275 thousand cubic feet per day, which is

c. 53 boepd, and is providing gas for gas lift to Stanley-5 as well

as contributing to gas sales.

-- Stanley-3 continues to produce steady oil rates.

-- Stanley-2 production has declined and this well is a candidate for recompletion.

-- Stanley-1 gravel pack was not successful and the well will be worked over again.

Winters-2 (23% Working Interest)

Production of gas from the Winters-2 well commenced in late

February 2022 and as a result, this quarter reflects one full month

of initial gas production. As announced on 12 April 2022, the gross

production flow rate in the period from 6 to 10 April averaged 902

Mcfpd which is circa 1,012 MMBtu or 170 boepd. In addition, 10 bopd

were produced bringing the five-day average gross production to 180

boepd, representing an increase of c. 31% on the gross production

rate as previously reported.

Livingston (20% Working Interest)

The Livingston property was one part of the acquisition of

Nadsoilco LLC ("Nadsoil"). One well (Davis & Holmes 11) that

has been shut-in for over one year was successfully worked over and

put on production in December.

Greater Stanley (40% Working Interest)

The strategy on these leases remains under review. These leases

are adjacent to the Winters lease where Winters-2 was drilled and

is now on production.

Arkoma (27% Working Interest)

Production had been increasing in the previous quarter.

Unfortunately, the site was hit by lightning early in the March

Quarter, which caused a fire and some tanks and control systems

were damaged. One well has recently been brought back on production

and work is underway to restore production from the other wells.

This asset is being held for sale as other projects are preferred

for further investment.

John W Barr, Chairman, said: "Mosman is very pleased to report a

65% uplift in net production despite a temporary disruption at

Arkoma. The completion of gas infrastructure at Stanley/Winters in

East Texas is a significant milestone, which opens up development

potential and benefits revenue, especially with current strong gas

prices. We continue to make steady progress and are increasing

production, with significant further development potential in

existing leases.

"In Australia, we are well positioned to take advantage of the

increasing demand for Helium and Hydrogen, in addition to Oil and

Gas, through our two exploration areas and are excited to see the

opportunities that these projects will deliver in the medium

term."

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this information is now considered to

be in the public domain.

Glossary:

boe Barrels of oil equivalent based on calorific value as

opposed to dollar value

boepd Barrels of oil per day of oil equivalent based on calorific

value as opposed to dollar value

bopd Barrels of oil per day

Gross Project Means the production of BOE at a total project level

Production (100% basis) before royalties (where Mosman is the Operator)

and where Mosman is not the operator the total gross

production for the project

Mcf Thousand cubic feet

Mcfpd Thousand cubic feet per day

MBtu One thousand British Thermal Units

MMBtu One million British Thermal Units

Net Production Net to Mosman's Working Interest; Net Production attributable

to Mosman means net to Mosman's Working Interest before

royalties

Enquiries:

Mosman Oil & Gas Limited NOMAD and Joint Broker

John W Barr, Executive Chairman SP Angel Corporate Finance LLP

Andy Carroll, Technical Director Stuart Gledhill / Richard Hail / Adam

jwbarr@mosmanoilandgas.com Cowl

acarroll@mosmanoilandgas.com +44 (0) 20 3470 0470

Alma PR Joint Broker

Justine James / Joe Pederzolli Monecor (London) Ltd trading as ETX

+44 (0) 20 3405 0205 Capital Thomas Smith

+44 (0) 7525 324431 020 7392 1432

mosman@almapr.co.uk

Updates on the Company's activities are regularly posted on its

website:

www.mosmanoilandgas.com

Notes to editors

Mosman (AIM:MSMN) is an oil exploration, development, and

production company with projects in the US and Australia.

Mosman's strategic objectives remain consistent: to identify

opportunities which will provide operating cash flow and have

development upside, in conjunction with progressing exploration of

existing exploration permits.

The Company has seven projects in the US: Stanley, Greater

Stanley, Livingston, Winters, Challenger and Champion in East Texas

and Arkoma in Oklahoma in addition to exploration projects in the

Amadeus Basin in Central Australia.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGZGMDMLFGZZZ

(END) Dow Jones Newswires

April 20, 2022 02:10 ET (06:10 GMT)

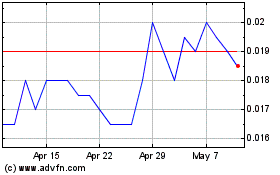

Mosman Oil And Gas (LSE:MSMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mosman Oil And Gas (LSE:MSMN)

Historical Stock Chart

From Apr 2023 to Apr 2024