TIDMMSMN

RNS Number : 7315G

Mosman Oil and Gas Limited

31 March 2022

31 March 2022

Mosman Oil and Gas Limited

("Mosman" or the "Company")

Half Year Results

Mosman Oil and Gas Limited (AIM: MSMN) the oil exploration,

development and production company, announces its Half Year results

to 31 December 2021, a period in which it significantly increased

oil and gas production across its US projects.

Summary

-- Revenue increased 95% to AUD 745,790 (compared to AUD

$383,138 in the six months ending 30 June 2021)

-- Gross Profit increased 232% to AUD188,487 (compared to AUD

$56,828 in the six months ending 30 June 2021)

-- Net loss narrowed to AUD 498,940 (compared to AUD $708,822 in

the six months ending 30 June 2021)

-- Net Production to Mosman increased 43% to 17,344 BOE

-- Completed acquisition of Nadsoilco increasing working

interest in Stanley Project, Livingston and Winters leases and

became operator of these leases, providing more day to day

control

-- Acquired additional working interests in Falcon-1 and

Cinnabar in East Texas. Completed 3D seismic reprocessing and

interpretation and identified potential development drilling

locations with multiple Wilcox sand targets at Cinnabar.

(1) BOE/boe - barrels of oil equivalent

(2) Gross Project Production - means the production of BOE at a

total project level (100% basis) before royalties (where Mosman is

the Operator) and where Mosman is not the operator the total gross

production for the project

(3) Net Production - Net to Mosman's Working interest before

royalties

Post Period end

-- Completed the construction of a gas network in East Texas in

February, enabling the sale of gas from Winters-2 and Stanley-4 and

enabling ongoing production optimisation.

-- 12 month extension of EP-145 in Australia secured and an

on-site environmental survey completed.

John W Barr, Chairman of Mosman commented: "We remain focussed

on delivering on our strategic objectives to build oil and gas

production and development upside, delivering solid progress on

this objective through the acquisition of Nadsoilco and additional

working interests at Falcon-1 and Cinnabar in East Texas.

"Good progress was made across our development projects,

increasing production. Revenues have benefitted from the increasing

oil and gas prices, which remain very strong. We have identified

potential drilling locations to target further increases in

production."

Enquiries:

Mosman Oil & Gas Limited NOMAD and Broker

John W Barr, Executive Chairman SP Angel Corporate Finance LLP

Andy Carroll, Technical Director Stuart Gledhill / Richard Hail /

jwbarr@mosmanoilandgas.com Adam Cowl

acarroll@mosmanoilandgas.com +44 (0) 20 3470 0470

Alma PR Joint Broker

Justine James / Joe Pederzolli Monecor (London) Ltd trading as ETX

+44 (0) 20 3405 0205 Capital Thomas Smith

+44 (0) 7525 324431 020 7392 1432

mosman@almapr.co.uk

Updates on the Company's activities are regularly posted on its

website:

www.mosmanoilandgas.com

Notes to editors

Mosman (AIM:MSMN) is an oil exploration, development, and

production company with projects in the US and Australia.

Mosman's strategic objectives remain consistent: to identify

opportunities which will provide operating cash flow and have

development upside, in conjunction with progressing exploration of

existing exploration permits.

The Company has seven projects in the US: Stanley, Greater

Stanley, Livingston, Winters, Challenger and Champion in East Texas

and Arkoma in Oklahoma in addition to exploration projects in the

Amadeus Basin in Central Australia.

Operations Review

Mosman's strategic objective remains to identify opportunities

which will provide operating cash flow and have further development

upside, in conjunction with adding value to the Company's existing

exploration permits.

Mosman has established increasing strong oil and gas production.

The company has a portfolio of development and exploration

projects, which provide the opportunity for further production

growth and increasing cashflow. Two exploration areas in Australia

are positioned to take advantage of the increasing demand for

Helium and Hydrogen as well as Oil and Gas.

Oil and gas prices have increased as economies recover from

Covid19 and the recent events in Europe. These increased prices

mean more cashflow from production, and added value to the

portfolio of development projects such as Cinnabar.

More than $940,000 was spent on increasing production and

exploration during the period.

The Company's production base continues to build with the

purchase of Working Interest (WI) in producing wells and the

drilling and completions of Stanley-5 and Winters-2.

East Texas Highlights

-- Drilled the Stanley-5 and Winters-2 wells:

- Both of these wells are now on production

- Continued the 100% success rate on development wells being put on production

-- Completed installation of the gas infrastructure to enable

gas sales from Stanley and Winters

-- Completed the Acquisition of Nadsoilco LLC:

- 20% increase in WI in the Stanley Project from 15-19% to 35-39%

- 20% WI in the oil producing Livingston Leases

- 23.3% WI in oil producing Winters Lease with development well to be drilled

- Mosman becomes Operator of these leases, providing more

control over day-to-day operations and drilling new wells

-- Completed the acquisition of an additional 25% WI in Falcon-1 well increasing WI to 75% WI:

- Production is steady

-- Cinnabar project:

- Completed the acquisition of an additional 15% WI increasing WI to 85%

- Completed 3D seismic reprocessing and interpretation

- Identified potential development drilling locations with multiple Wilcox sand targets

Results

The unaudited results for the six months to 31 December 2021

reflect the ongoing recovery from the drop in oil prices in

2019/2020. Revenue increased by $363,652 to $745,790 (2020:

$383,138) mainly due to the increased working interests following

the acquisition of Nadsoilco LLC and additional interest in Falcon.

Gross Profit increased to $188,487 (2020: $56,828).

The average sale prices achieved during the period was US$71.07

per barrel for oil, and US$3.74 per MMBtu for gas (in each case

after transport and processing costs and prior to royalties).

Corporate and administrative expenses were tightly controlled

which resulted in a decrease of $92k to $506,610 (2020:

$598,802).

The overall result for the period was a net loss of $498,940

(2020: $708,822), and total comprehensive loss of $326,289 (2020:

$537,739).

Projects

Mosman has Working Interests in several onshore producing

projects located in the USA. The Company also owns one granted

exploration permit and one application for an exploration permit in

the Amadeus Basin in Central Australia.

Producing Projects in the USA

PRODUCING

------------------------------------------------------------------------------------

Project Location Approx

Working Interest

Falcon (Falcon-1 well) Texas 75%

Stanley (various wells) Texas 34.85% to 38.5%

Livingston Texas 20%

Winters (Winters-1 and Winters-2 wells) Texas 29% Winters-1

23% Winters-2

Greater Stanley (Duff wells) Texas 40%

Arkoma Stacked Pay Oklahoma 27% (held for sale)

UNDEVELOPED

-----------------------------------------------------------------------------------

Project Location Approx

Working Interest

Galaxie Texas 85%

Cinnabar Texas 97% (potentially reducing to 85% after drilling))

Australia

EXPLORATION

----------------------------------------------------------------------------------------------------------------------

Project Location Approx

Working Interest

Amadeus Basin Northern Territory, Australia 100% in EP145

100% in EPA 155 (potentially reducing to 10% subject to

farmout conditions)

Production Summary for the six months ending 31 December

2021

Net Production attributable to Mosman before royalties for the

six months to 31 December 2021 was 17,344 boe, an increase of 5,201

boe, or 43% compared to the six months to June 2021 of 12,143 boe.

This is despite the operational issues experienced in December that

reduced the production in the 3 months to 31 December 2021. This

progress reflects the uplift in production from growth of existing

projects, the acquisition of Nadsoilco LLC and an increased

interest in Falcon.

It does not reflect recent increases in production at Falcon

which occurred after 31 December 2021 and does not include the

Winters-2 well which was drilled in November and was recently

recompleted and flowed gas. It also only includes minor production

from Stanley-5.

Subsequent Events

In the quarter ending 31 March 2022, the Company completed the

construction of a gas network to allow gas to be transferred to

market. This development has already enabled sale of gas from

Winters-2 and Stanley-4.

A 12 month extension of the Amadeus Basin Permit EP-145 License

was approved by the Minister for Mining and Industry in the

Northern Territory Government in February 2022. An on-site

environmental survey was completed in March 2022.

Condensed Consolidated Statement of Profit or Loss and Other

Comprehensive Income

For The Half Year Ended 31 December 2021

Notes Consolidated Consolidated

6 months to 6 months to

31 December 2021 31 December 2020

$ $

Revenue 745,790 383,138

Cost of sales 2 (557,303) (326,310)

----------------------------------- ------------------------------------

Gross profit 188,487 56,828

Interest i ncome - 37

Other income 8,684 51,512

Gain on sale of oil and gas

assets - 122,000

Administrative expenses (148,375) (158,325)

Corporate expenses 3 (358,235) (440,477)

Directors fees (60,000) (60,000)

Exploration expenses incurred

not capitalised (8,100) (10,090)

Employee b enefits expense (35,408) (29,337)

Finance costs (3,324) (6,362)

Amortisation expense (81,564) (63,297)

Depreciation expense (1,105) (1,559)

Loss on foreign exchange - (19,846)

Loss on sale of OCI financial

assets - (149,906)

Loss from ordinary activities

before income tax expense (498,940) (708,822)

Income tax expense - -

Net l oss for the period (498,940) (708,822)

----------------------------------- ------------------------------------

Other c omprehensive income

Items that may be reclassified

to profit or loss

Gain on financial assets at fair

value through other

comprehensive income (FVOCI) 4 - 525,118

Foreign currency (loss)/gain 4 172,651 (354,035)

----------------------------------- ------------------------------------

Other comprehensive income for

the period, net of tax 172,651 171,083

----------------------------------- ------------------------------------

Total comprehensive loss

attributable to members of the

entity (326,289) (537,739)

=================================== ====================================

Basic and diluted loss per share (0.01) cents (0.04) cents

The accompanying notes form part of these consolidated financial

statements.

All amounts are in Australian Dollars

Condensed Consolidated Statement of Financial Position

As at 31 December 2021

Notes Consolidated Consolidated

Balance as at 31 December 2021 Balance as at 30 June 2021

$ $

Current Assets

Cash and cash equivalents 948,376 2,289,674

Funds held in trust - 1,197,127

Trade and other receivables 5 1,099,486 172,500

Other assets 6 223,969 23,418

Total Current Assets 2,271,831 3,682,719

-------------------------------- ----------------------------

Non-Current Assets

Property, plant & equipment 15,999 7,147

Oil and gas assets 7 5,406,696 3,328,029

Capitalised o il and g as exploration 8 1,003,256 706,702

-------------------------------- ----------------------------

Total Non-Current Assets 6,425,951 4,041,878

-------------------------------- ----------------------------

Total Assets 8,697,782 7,724,597

-------------------------------- ----------------------------

Current Liabilities

Trade and other payables 10 1,287,403 377,727

Provisions 24,039 22,423

Total Current Liabilities 1,311,442 400,150

Non-Current Liabilities

Provisions 36,664 -

Other payables 10 137,817 -

-------------------------------- ----------------------------

Total Non-Current Liabilities 174,481 -

-------------------------------- ----------------------------

Total Liabilities 1,485,923 400,150

-------------------------------- ----------------------------

Net Assets 7,211,859 7,324,447

================================ ============================

Shareholders' Equity

Contributed equity 11 36,914,082 36,700,381

Reserves 12 518,540 436,247

Accumulated losses (30,220,763) (29,812,181)

--------------------------------

Equity attributable to shareholders 7,211,859 7,324,447

Total Shareholders' Equity 7,211,859 7,324,447

================================ ============================

The accompanying notes form part of these consolidated financial

statements.

All amounts are in Australian Dollars

Condensed Consolidated Statement of Changes in Equity

For the Half Year Ended 31 December 2021

Accumulated Contributed Equity Reserves Total

Losses

$ $ $ $

Balance at 1 July 2020 (28,939,390) 30,691,497 712,134 2,464,241

-------------- ------------------- --------- --------------

Comprehensive income

Loss for the period (708,822) - - (708,822)

Other comprehensive loss for the period - - 171,083 171,083

-------------- ------------------- --------- --------------

Total comprehensive loss for the period (708,822) - 171,083 (537,739)

Transactions with owners, in their capacity as owners, and other transfers:

New shares issued - 3,095,575 - 3,095,575

Cost of raising equity - (141,948) - (141,948)

Total transactions with owners and other

transfers - 2,953,627 - 2,953,627

-------------- ------------------- --------- --------------

Balance at 31 December 2020 (29,648,212) 33,645,124 883,217 4,880,129

============== =================== ========= ==============

Balance at 1 July 2021 (29,812,181) 36,700,381 436,247 7,324,447

-------------- ------------------- --------- --------------

Comprehensive income

Loss for the period (498,940) - - (498,940)

Other comprehensive loss for the period - - 172,651 172,651

-------------- ------------------- --------- --------------

Total comprehensive loss for the period (498,940) - 172,651 (326,289)

-------------- ------------------- --------- --------------

Transactions with owners, in their capacity as owners, and other transfers:

New shares issued - 213,701 - 213,701

Cost of raising equity - - - -

Lapsed warrants 90,358 - (90,358) -

Total transactions with owners and other

transfers 90,358 213,701 (90,358) 213,701

-------------- ------------------- --------- --------------

Balance at 31 December 2021 (30,220,763) 36,914,082 518,540 7,211,859

============== =================== ========= ==============

These accompanying notes form part of these consolidated

financial statements

All amounts are in Australian Dollars

Condensed Consolidated Statement of Cash Flows

For the Half Year Ended 31 December 2021

Consolidated Consolidated

6 months to 31 December 2021 6 months to 31 December 2020

$ $

Cash flows from operating activities

Receipts from customers 635,709 387,356

Interest received & other income 47,309 51,511

Payments to suppliers and employees (1,307,346) (1,423,368)

Interest paid (3,324) (6,361)

Net cash used in operating activities (627,652) (990,862)

------------------------------ ------------------------------

Cash flows from investing activities

Payments for exploration and evaluation (296,553) (82,359)

Deposits paid for acquisition - (135,223)

Payments for oil and gas acquisitions (209,212) -

Payments for oil and gas assets (436,452) (1,602,290)

Proceeds from sale of assets - 261,177

------------------------------ ------------------------------

Net cash used in investing activities (942,217) (1,558,695)

------------------------------ ------------------------------

Cash flows from financing activities

Proceeds from shares issued 180,111 3,095,575

Payments for costs of capital - (141,948)

Net cash provided by financial activities 180,111 2,953,627

------------------------------ ------------------------------

Net increase/(decrease) in cash and cash

equivalents (1,389,758) 404,070

------------------------------ ------------------------------

Cash and cash equivalents at the beginning of the

financial period 2,289,674 372,479

------------------------------ ------------------------------

Effects of foreign currency exchange 48,460 -

------------------------------ ------------------------------

Cash and cash equivalents at the end of the

financial period 948,376 776,549

------------------------------ ------------------------------

The accompanying notes from part of these consolidated financial

statements

All amounts are in Australian Dollars

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

1. Summary of Significant Accounting Policies

Statement of Compliance

The half-year financial report is a general purpose financial

report prepared in accordance with the Corporations Act 2001 and

AASB 134 Interim Financial Reporting. Compliance with AASB 134

ensures compliance with International Financial Reporting Standard

IAS34 Interim Financial Reporting. The half-year report does not

include notes of the type normally included in an annual financial

report and should be read in conjunction with the most recent

annual financial report.

Basis of preparation

The condensed consolidated financial statements have been

prepared on the basis of historical cost, except for the

revaluation of certain non-current assets and financial

instruments. Cost is based on the fair values of the consideration

given in exchange for assets. All amounts presented in Australian

dollars, unless otherwise noted.

The accounting policies and methods of computation adopted in

the preparation of the half-year financial report are consistent

with those adopted and disclosed in the Group's 2021 annual

financial report for the financial year ended 30 June 2021, except

for the impact of the Standards and Interpretations described

below. These accounting policies are consistent with Australian

Accounting Standards and with International Financial Reporting

Standards (IFRS).

Going Concern

The condensed consolidated financial statements have been

prepared on the going concern basis, which contemplates continuity

of normal business activities and the realisation of assets and the

discharge of liabilities in the normal course of business.

The directors have considered the funding and operational status

of the business in arriving at their assessment of going concern

and believe that the going concern basis of preparation is

appropriate, based upon the following:

-- The ability to further vary cash flow depending upon the

achievement of certain milestones within the business plan and;

-- The ability of the Company to obtain funding through various

sources, including debt and equity.

However, should the Group be unable to raise further required

financing from equity markets or other sources, there is

uncertainty which may cast doubt as to whether or not the Group

will be able to continue as a going concern and whether it will

realise its assets and extinguish its liabilities in the normal

course of business and at the amounts stated in the financial

statements.

The financial statements do not include any adjustments relating

to the recoverability and classification of recorded asset amounts

nor to the amounts and classification of liabilities that might be

necessary should the Group not continue as a going concern.

Exploration and Evaluation Costs

Exploration and evaluation expenditure incurred is accumulated

in respect of each identifiable area of interest. These costs are

carried forward in respect of an area for which the rights to

tenure are current and that has not at reporting date reached a

stage which permits a reasonable assessment of the existence or

otherwise of economically recoverable reserves, and active and

significant operations in, or relating to, the area of interest are

continuing.

Impairment of Exploration and Evaluation Assets

The ultimate recoupment of the value of exploration and

evaluation assets is dependent on the successful development and

commercial exploitation, or alternatively, sale, of the exploration

and evaluation assets.

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

1. Summary of Significant Accounting Policies (Continued)

Impairment tests are carried out when there are indicators of

impairment in order to identify whether the asset carrying values

exceed their recoverable amounts. There is significant estimation

and judgement in determining the inputs and assumptions used in

determining the recoverable amounts. If, after having capitalised

the expenditure under the policy, a judgement is made that the

recovery of the expenditure is unlikely, the relevant capitalised

amount will be written off to profit and loss.

The key areas of judgement and estimation include:

-- Recent exploration and evaluation results and resource estimates;

-- Environmental issues that may impact on the underlying tenements; and

-- Fundamental economic factors that have an impact on the

operations and carrying values of assets and liabilities.

Revenue Reporting

Revenue is measured at the fair value of the consideration

received or receivable. Amounts disclosed as revenue are net of

returns, trade allowances, rebates and amounts collected on behalf

of third parties.

The group recognises revenue when the amount of revenue can be

reliably measured, it is probable that future economic benefits

will flow to the entity and specific criteria have been met for

each of the Group's activities as described below. The group bases

its estimates on historical results, taking into consideration the

type of customer, the type of transaction and the specifics of each

arrangement.

Revenue from joint operations is recognised based on the Group's

share of the sale by the joint operation.

Interest revenue is recognised using the effective interest rate

method, which, for floating rate financial assets, is the rate

inherent in the instrument.

Oil and Gas assets

The cost of oil and gas producing assets and capitalised

expenditure on oil and gas assets under development are accounted

for separately and are stated at cost less accumulated amortisation

and impairment losses. Costs include expenditure that is directly

attributable to the acquisition or construction of the item as well

as past exploration and evaluation costs.

When an oil and gas asset commences production, costs carried

forward are amortised on a units of production basis over the life

of the economically recoverable reserves. Changes in factors such

as estimates of economically recoverable reserves that affect

amortisation calculations do not give rise to prior financial

period adjustments and are dealt with on a prospective basis.

Segment Reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The chief operating decision maker, who is responsible for

allocating resources and assessing performance.

New standards and interpretations

The consolidated entity has adopted all of the new or amended

Accounting Standards and Interpretations issued by the Australian

Standards Board ('AASB') that are mandatory for the current

reporting period.

Any new or amended Accounting Standards or Interpretations that

are not yet mandatory have not been early adopted.

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

Consolidated Consolidated

6 months 6 months to

to 31 December 31 December

2021 2020

$ $

2. Cost of sales

Cost of sales 40,933 70,571

Lease operating expenses 516,370 255,739

557,303 326,310

---------------- -------------

3. Corporate costs

Accounting, Company Secretary and Audit

fees 92,945 97,174

Consulting fees - Board 140,000 166,000

Consulting fees - Other 79,793 83,176

Legal and compliance fees 45,497 94,127

358,235 440,477

---------------- -------------

4. Other comprehensive income

Gain on financial assets at fair value

through other comprehensive income (FVOCI) - 525,118

Foreign currency (loss)/gain 172,651 (354,035)

------------

172,651 171,083

------------ -----------

5. Trade and other receivables

Joint interest billing receivables 888,947 (1) -

Deposits 54,875 54,875

GST receivable 25,348 39,867

Accrued revenue 125,464 73,768

Other receivables 4,852 3,990

------------ -----------

1,099,486 172,500

------------ -----------

1. Amounts receivable from other royalty holders in projects

operated by Nadsoilco LLC, and funds are to be used predominantly

for new well workovers.

6. Other assets

Prepayments 223,969 23,418

223,969 23,418

-------- -------

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

Consolidated

Balance as

Consolidated at 30 June

Balance as

at 31 December

2021 2021

$ $

7. Oil and gas assets

Cost brought forward 3,328,029 2,061,131

Acquisition of oil and gas assets during 1,003,420

the period (1) 158,486

Revaluation of acquisition assets to 593,789(2) -

fair value(2)

Disposal of oil and gas assets on sale

during the period - (441,384)

Capitalised equipment workovers 418,641 1,899,759

Amortisation for the period (82,274) (170,388)

Impairment of oil and gas assets - -

Impact of foreign exchange 145,091 (179,575)

-------------------

Carrying value at end of the period 5,406,696 3,328,029

------------------- -------------

1. $796,637 relates to new oil and gas assets recognised as part

of the Nadsoilco LLC acquisition. $206,783 relates to the acquisition

of an additional 25% working interest in the Falcon lease.

2. Refer to Note 9 for further information.

8. Capitalised oil and gas expenditure

Costs brought forward 706,702 301,242

Exploration costs incurred during the

period 296,554 405,460

Impairment of oil and gas expenditure - -

Carrying value at the end of the period 1,003,256 706,702

------------------- -------------

9. Business combinations

On 1 July 2021, the Group acquired 100% of the shares in Texas

based oil and gas producer, Nadsoilco LLC. The Group acquired

Nadsoilco LLC for US$1,100,000, of which US$900,000 was paid

in cash in July 2021, with a further $100,000 payable on 1 July

2022 and $100,000 payable on 1 July 2023.

Consideration transferred

Cash consideration paid 1,202,726

Cash consideration payable 267,272

----------

1,469,998

----------

Net assets acquired in Nadsoilco at the date

of acquisition 876,209

Fair value adjustment to be allocated to oil

and gas assets 593,789

----------

1,469,998

----------

Goodwill -

----------

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December

2021

All amounts are Australian Dollars

10. Trade and other payables

Consolidated Consolidated

Balance as Balance as

at 31 December at 30 June

2021 2021

$ $

CURRENT

Trade creditors 1,062,634(1) 295,243

Amounts owing for acquisition of Nadsoilco -

LLC 137,817

Other creditors and accruals 86,952 82,484

1,287,403 377,727

---------------- -------------

NON-CURRENT

Amounts owing for acquisition of Nadsoilco -

LLC 137,817

---------------- -------------

137,817 -

---------------- -------------

1. The increase in trade creditors is primarily attributable to

creditors in Nadsoilco LLC and relates to amounts owing for prepaid

workover costs. The balance includes amounts payable on behalf of

other royalty holders for which there are also receivables owing

for their share of the workover costs (refer Note 5).

11. Contributed Equity

Ordinary Shares

Total shares at 31 December 2021: 3,845,138,052 (30 June 2021:

3,767,763,052) ordinary shares fully paid.

Contributed

Equity

a) Shares movements during the half-year $ No. of shares

Balance at 30 June 2021 36,700,381 3,767,763,052

Shares issued 213,701 77,375,000

Cost of issued shares - -

Balance at 31 December 2021 36,914,082 3,845,138,052

---------------- --------------

Consolidated Consolidated

Balance as Balance as

at 31 December at 30 June

2021 2021

12. Reserves

Options reserve - 90,358

Foreign currency translation reserve 518,540 345,889

---------------- --------------

518,540 436,247

---------------- --------------

a) Options Reserve

Options Reserve at the beginning of the

period 90,358 471,818

Options issued - 90,358

Options expired (90,358)(2) (471,818)

------------ ----------

Options Reserve at the end of the period - 90,358

------------ ----------

2. 104,452,083 warrants issued to Directors expired on 22 December 2021.

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

12. Reserves (continued)

b) Foreign Currency Translation Reserve

Foreign Currency Translation Reserve

at the beginning of the period 345,889 603,841

Current movement in the period 172,651 (257,952)

Foreign Currency Translation Reserve

at the end of the period 518,540 345,889

-------- ----------

13. Segment Information

The Group has identified its operating segments based on the

internal reports that are reviewed and used by the board to make

decisions about resources to be allocated to the segments and

assess their performance. Operating segments are identified by the

board based on the Oil and Gas projects in Australia the United

States. Discrete financial information about each project is

reported to the board on a regular basis.

The reportable segments are based on aggregated operating

segments determined by the similarity of the economic

characteristics, the nature of the activities and the regulatory

environment in which those segments operate. The Group has two

reportable segments based on the geographical areas of the mineral

resource and exploration activities in Australia, the United

States. Unallocated results, assets and liabilities represent

corporate amounts that are not core to the reportable segments.

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

13. Segment Information (continued)

(i) Segment performance

United States Australia Total

$ $ $

------------------ ------------------ -------------

Period ended 31 December 2021

Revenue

Revenue 745,790 - 745,790

Other income - 8,684 8,684

Segment revenue 745,790 8,684 754,474

------------------ ------------------ -------------

Segment Result

Loss

Allocated

- Corporate costs (35,045) (323,190) (358,235)

- Administrative costs (94,108) (54,267) (148,375)

- Lease operating expenses (516,370) - (516,370)

- Cost of sales (40,933) - (40,933)

Segment net profit/(loss) before tax 59,334 (368,773) (309,439)

------------------ ------------------ -------------

Reconciliation of segment result to net loss before tax

Amounts not included in segment result but reviewed by

the Board

- Evaluation expenses incurred not capitalised - (8,100) (8,100)

- Amortisation (81,564) - (81,564)

- Impairment - - -

Unallocated items

- Employee benefits expense (95,408)

- Finance costs (3,324)

- Depreciation (1,105)

Net Loss before tax from continuing operations (498,940)

-------------

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

13 . Segment Information (continued)

(i) Segment performance (continued)

United States Australia Total

$ $ $

-------------- ------------------ --------------

Period ended 31 December 2020

Revenue

Revenue 383,138 - 383,138

Interest income - 37 37

Gain on sale of oil and gas assets 122,000 - 122,000

Other income 41,512 10,000 51,512

Segment revenue 546,650 10,037 556,687

-------------- ------------------ --------------

Segment Result

Loss

Allocated

- Corporate costs (65,123) (375,354) (440,477)

- Administrative costs (93,693) (64,632) (158,325)

- Lease operating expenses (255,739) - (255,739)

- Cost of sales (70,571) - (70,571)

- Loss on sale of OCI financial assets (149,906) - (149,906)

-------------- ------------------ --------------

Segment net profit/(loss) before tax (88,382) (429,949) (518,331)

-------------- ------------------ --------------

Reconciliation of segment result to net loss before tax

Amounts not included in segment result but reviewed by the

Board

- Evaluation expenses incurred not capitalised - (10,090) (10,090)

- Amortisation (63,297) - (63,297)

- Impairment - - -

Unallocated items

- Employee benefits expense (89,337)

- Finance costs (6,362)

- Foreign exchange (19,846)

- Depreciation (1,559)

--------------

Net Loss before tax from continuing operations (708,822)

--------------

Period ended 31 December 2020

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

13. Segment Information (continued)

(ii) Segment assets

United States Australia Total

$ $ $

-------------- ------------ ------------

As at 31 December 2021

Segment assets as at 1 July 2021 4,925,917 2,798,680 7,724,597

Segment asset balances at end of

period

- Exploration and evaluation - 8,184,174 8,184,174

- Capitalised Oil and Gas 6,509,155 - 6,509,155

- Less: Amortisation (271,686) - (271,686)

- Less: Impairment (1,424,562) (7,180,918) (8,605,480)

-------------- ------------ ------------

4,812,907 1,003,256 5,816,163

-------------- ------------ ------------

Reconciliation of segment assets to total assets:

Other assets 2,120,098 761,521 2,881,619

-------------- ------------ ------------

Total assets from continuing operations 6,933,005 1,764,777 8,697,782

-------------- ------------ ------------

United States Australia Total

$ $ $

-------------- ------------ ------------

As at 30 June 2021

Segment assets as at 1 July

2020 2,350,564 683,037 3,033,601

Segment asset balances at

end of

year

- Exploration and evaluation - 7,887,620 7,887,620

- Capitalised oil and gas

assets 4,885,757 - 4,885,757

- Less: Amortisation (182,811) - (182,811)

- Less: Impairment (1,374,917) (7,180,918) (8,555,835)

-------------- ------------ ------------

3,328,029 706,702 4,034,731

-------------- ------------ ------------

Reconciliation of segment

assets to total assets:

Other assets 1,597,888 2,091,978 3,689,866

-------------- ------------ ------------

Total assets from continuing

operations 4,925,917 2,798,680 7,724,597

-------------- ------------ ------------

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

13. Segment Information (continued)

(iii) Segment liabilities

United States Australia Total

$ $ $

-------------- ---------- ----------

As at 31 December 2021

Segment liabilities as at 1 July 2021 29,380 370,770 400,150

Segment liability increase/(decrease) for the year 1,238,118 (152,345) 1,085,773

-------------- ---------- ----------

1,267,498 218,425 1,485,923

-------------- ---------- ----------

Reconciliation of segment liabilities to total liabilities:

Other liabilities - - -

-------------- ---------- ----------

Total liabilities from continuing operations 1,267,498 218,425 1,485,923

-------------- ---------- ----------

As at 30 June 2021

Segment liabilities as at 1 July 2020 87,486 481,874 569,360

Segment liability (decrease) for the year (58,106) (111,104) (169,210)

-------------- ---------- ----------

29,380 370,770 400,150

-------------- ---------- ----------

Reconciliation of segment liabilities to total liabilities:

Other liabilities - - -

-------------- ---------- ----------

Total liabilities from continuing operations 29,380 370,770 400,150

-------------- ---------- ----------

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

14. Producing assets

The Group currently has 3 producing assets, which the Board monitors as separate items to

the geographical and operating

segments. The Stanley and Welch are Oil and Gas producing assets in the United States along

with some other projects.

Project performance is monitored by the line items below.

(i) Project performance

Stanley Falcon Winters Livingston Arkoma Other Total

$ $ $ $ $ Projects $

$

---------- ---------- -------- ----------- --------- ---------- ----------

Half-Year Ended 31 December

2021

Revenue

Oil and gas project related

revenue 321,220 322,803 6,390 7,455 41,386 46,536 745,790

Producing assets revenue 321,220 322,803 6,390 7,455 41,386 46,536 745,790

---------- ---------- -------- ----------- --------- ---------- ----------

Project-related expenses

* Cost of sales (15,008) (22,307) (294) (344) (2,980) - (40,933)

* Lease operating expenses (223,615) (138,701) (3,956) (6,483) (8,133) (135,482) (516,370)

Project cost of sales (238,623) (161,008) (4,250) (6,827) (11,113) (135,482) (557,303)

---------- ---------- -------- ----------- --------- ---------- ----------

Project gross profit

Gross profit 82,597 161,795 2,140 628 30,273 (88,946) 188,487

---------- ---------- -------- ----------- --------- ---------- ----------

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

14. Producing assets (continued)

(i) Project performance

Arkoma Stanley Welch Other Projects Total

$ $ $ $ $

-------- --------- ---------- --------------- ----------

Half-Year Ended 31 December 2020

Revenue

Oil and gas project related revenue - 174,245 203,650 5,243 383,138

Producing assets revenue - 174,245 203,650 5,243 383,138

-------- --------- ---------- --------------- ----------

Project-related expenses

* Cost of sales - (10,618) (59,953) - (70,571)

* Lease operating expenses - (26,588) (227,974) (1,177) (255,739)

Project cost of sales - (37,206) (287,927) (1,177) (326,310)

-------- --------- ---------- --------------- ----------

Project gross profit

Gross profit - 137,039 (84,277) 4,066 56,828

-------- --------- ---------- --------------- ----------

Condensed Notes to the Financial Statements

For the Half-Year Ended 31 December 2021

All amounts are Australian Dollars

15. Expenditure Commitments

(a) Exploration

The Company has certain obligations to perform minimum

exploration work on Oil and Gas tenements held. These obligations

may vary over time, depending on the Company's exploration programs

and priorities. At 31 December 2021, total exploration expenditure

commitments for the next 12 months are as follows:

31 December 31 December

2021 2020

Entity Tenement $ $

Trident Energy Pty Ltd EP145(1) - -

Oilco Pty Ltd EPA155 - -

- -

------------ ------------

1. EP145 is currently under extension until 21 August 2022,

therefore there are no committed expenditures as of the date of

this report.

(b) Capital Commitments

The Company had no capital commitments at 31 December 2021 (2020

- $Nil).

16. Subsequent Events

In the quarter ending 31 March 2022, the Company completed the

construction of a gas network to allow gas to be transferred to

market. This development has already seen the initial sale of gas

from Winters-2 and Stanley-4.

On 14 February 2022 the Amadeus Basin Permit EP-145 License

Extension was approved by the Minister for Mining and Industry in

the Northern Territory Government after application by the

Company.

Other than the above, there were no significant events

subsequent to the date of statement of financial position.

17. Dividends

No dividends have been paid or proposed during the half year

ended 31 December 2021.

Directors' Declaration

T he Directors of the Consolidated Group de c l a re that:

1. The fin ancial s t a t e m e nts a nd not e s, as s et out on

pages 5-21, are in a c c o rdance with the Australian Corpo r a

tions A ct 2001:

(a) comply with Accounting Standards, which, as stated in Note 1

- Statement of Accounting Policies to the consolidated financial

statements, constitutes compliance with International Financial

Reporting Standards (IFRS); and

(b) give a t rue and f a ir v i ew of the consolidated f ina n c

i al pos ition as at 31 December 2021 a nd of the pe r for m a n ce

f or the ye ar ended on th at date of the G r o up.

2. In the Dir ectors' opinion the re a re r e a sonable g rounds

to beli eve that the Group w ill be able to pay its debts as a nd w

h en they become due and pa y able.

T his d e cla r a tion is m ade in a c cordance with a r e

solution of the Boa rd of Dir e c tors and is sig n ed by autho

rity for a nd on be h a lf of the D i r e cto rs by:

John W Barr

Executive Chairman

Dated this 31 March 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SDISIFEESEDD

(END) Dow Jones Newswires

March 31, 2022 02:01 ET (06:01 GMT)

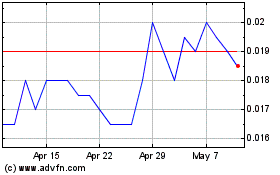

Mosman Oil And Gas (LSE:MSMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mosman Oil And Gas (LSE:MSMN)

Historical Stock Chart

From Apr 2023 to Apr 2024