TIDMMNL

MANCHESTER AND LONDON INVESTMENT TRUST PUBLIC LIMITED COMPANY

(the "Company")

Half-yearly report for the six months ended 31 January 2021

A copy of the Half-Yearly Report can be accessed via the Company's website at

www.mlcapman.com/manchester-london-investment-trust-plc or by contacting the

Company Secretary by telephone on 01392 477500.

Summary of Results

At At

31 January 31 July Change

2021 2020

Net assets attributable to Shareholders (£ 256,791 225,933 13.66%

'000)

Net asset value ("NAV") per Ordinary Share 633.62 625.23 1.34%

(pence)

Six months

to 31 January

2021

Total return to Shareholders* 2.4%

Benchmark - MSCI UK Investable Market Index (MXGBIM)* 11.8%

* Total NAV return including dividends reinvested, as sourced from Bloomberg.

Six months Six months

to to Change

31 January 31 January

2021 2020

Interim dividend per Ordinary Share (pence) 7.00 7.00 0.00

Dates for the interim dividend

Ex-dividend date 15 April 2021

Record date 16 April 2021

Payment date 4 May 2021

Chairman's Statement

Results for the half year ended 31 January 2021

During the half year under review, the total NAV per Share return was 2.4 per

cent, compared to an increase in the benchmark of 11.8 per cent.

It has been a period where small capitalisation stocks, unprofitable Technology

hopes, Cryptocurrencies and Reflation Value plays have been in vogue, whilst

mega-capitalisation Technology (with the exception of Apple and Tesla) has

lagged.

The portfolio has remained focused on stocks with profitable and cash

generative business models that are aligned with some of the most exciting

forward-looking themes.

The Manager's Report sets out in more detail the reasons for the

underperformance against the benchmark.

Dividends

With these results, we have announced an interim dividend of 7.0 pence per

Ordinary Share. This is the same level as the prior year (31 January 2020: 7.0

pence per Ordinary Share).

Other

During the period the Company has actively increased its issued share capital

with the aim of improving liquidity in the shares and spreading fixed operating

costs over a larger asset base. The Company released a prospectus at the end

2020 providing material capacity for future fund raising and issued its first

shares under this authority to the market via a new Blocklisting programme.

The number of Shares in issue at the period end was roughly 12 per cent higher

than at the start of the year.

The Company has also applied to reduce its Share Premium account, thereby

increasing the amount of distributable reserves available for future dividends.

Outlook

Key variables for our second half performance are likely to be the success of

Covid-19 vaccine rollouts, movements in the US sovereign yield curve, the

GBPUSD foreign exchange rates, whether there is any material shakeout in

certain crowded trades (such as unprofitable Technology stocks), and the

regulation of Technology companies globally. Since this interim period end,

the Fund has reported a new all-time high Net Asset Value per Share hence our

exciting Journey continues through the Era of Software.

Please do not forget to consider the fund for this year's ISA allowance.

David Harris

Chairman

16 March 2021

Manager's Report

Portfolio management

The portfolio delivered a total return of 2.4 per cent which was a 9.4 per cent

underperformance against the benchmark. The relative underperformance was

driven partly by a period of rotation from growth to value stocks, which saw

Big Technology plays materially lag cyclical sectors (to which the benchmark is

significantly more exposed). The 4.7 per cent increase in value of the British

Pound compared to the US Dollar, was once again a strong foreign exchange

translation headwind for the portfolio's Net Asset Value per Share return.

A more up to date analysis of our portfolio can be found in our Fund

Factsheets: https://mlcapman.com/manchester-london-investment-trust-plc/

The Total return of the portfolio broken down by sector holdings in local

currency (excluding costs and foreign exchange) is shown below:

Total return of underlying sector holdings in local currency

(excluding costs and foreign exchange)

Information technology 2.7%

Consumer services 3.6%

Consumer discretionary (0.1%)

Other investments (including beta hedges) 2.5%

Foreign exchange, costs & carry (6.3%)

Total NAV per Share return 2.4%

Source: Bloomberg L.P.

Information Technology

Material positive contributors to the portfolio's performance included

Microsoft Corporation (which accounted for more than half of the sector's

return), AMSL Holding NV and Visa Inc.

Material negative contributors included Adobe Inc. and Salesforce.com Inc.

During the period, we disposed of both Visa and Mastercard Inc. due to their

greater sensitivity to Covid lockdowns, the growth of Cryptocurrencies and

their failure to fit with our new requirement that our investments have

predominantly virtual or digital business models rather than physical.

The portfolio's delta-adjusted exposure to this sector at period end was around

28 per cent of net assets.

Communication Services

Material positive contributors from this sector for the portfolio included

Alphabet Inc. and Tencent Holdings Ltd which together accounted for nearly all

of the sector's return. There were no material negative contributors.

The portfolio's delta-adjusted exposure to this sector at the period end was

around 29 per cent of net assets.

Consumer Discretionary

Amazon.com, Inc was the only material positive contributor to this sector.

There were no material negative contributors, although Alibaba Group Holding

Ltd had a volatile 2nd half of the period due to the suspension of the ANT IPO

and expectations of increased regulatory scrutiny going forward.

Overall, the portfolio's delta-adjusted exposure to the sector at the period

end was around 29 per cent of net assets, of which the vast majority related to

Amazon and Alibaba.

Other investments including beta hedges

Material positive contributors for the portfolio included the CSOP Hang Seng

Tech Index ETF and the iShares Expanded Tech-Software Sector ETF (IGV). There

were no material negative contributors.

The portfolio's delta-adjusted exposure to equity investments in this sector at

the period end was around 15 per cent of net assets.

Please:

Visit our website: https://mlcapman.com/about/

Follow our Tweets at: https://twitter.com/MLCapMan

Read our previous articles at https://www.linkedin.com/company/m-&

-l-capital-management-ltd/

Long the Future.

M&L Capital Management Limited

Manager

@MLCapMan

16 March 2021

Equity Exposures

Equity exposures (longs)

As at 31 January 2021

Company Sector* Exposure % of net

assets

Amazon.com, Inc.** Consumer Discretionary 44,615 17.37

Microsoft Corporation** Information Technology 43,859 17.08

Alphabet Inc.** Communication services 39,749 15.48

Alibaba Group Holdings Ltd*** Consumer Discretionary 32,712 12.74

Tencent Holdings Ltd*** Information Technology 29,909 11.65

Adobe Inc.** Information Technology 22,321 8.69

Csop Hang Seng Tech Index ETF** ETF 22,257 8.67

Facebook Inc.** Communication services 21,732 8.46

Salesforce.com, inc.** Information Technology 17,686 6.89

Netflix, Inc.** Communication services 17,178 6.69

ASML Holding N.V. CFD *** Information Technology 11,082 4.32

Kraneshares CSI China Internet F* ETF 10,773 4.20

*

Prosus N.V.** Consumer Discretionary 10,132 3.95

Polar Capital Technology Trust Fund 6,470 2.52

plc

Zynga Inc.** Communication services 5,338 2.08

iShares MSCI China ETF** ETF 4,143 1.61

NetEase, Inc. CFD*** Communication services 229 0.08

Total long equities exposure 340,185 132.48

Cash and other assets and (83,394) (32.48)

liabilities (inc Options)

Net assets 256,791 100

* GICS - Global Industry Classification Standard.

** Including equity swap exposures.

*** CFD - Contract for differences

Interim Management Report

The important events that have occurred during the period under review and the

key factors influencing the financial statements are set out in the Chairman's

Statement and the Manager's Report above.

The principal risks facing the Company are substantially unchanged since the

date of the latest Annual Report and Financial Statements and continue to be as

set out in the Strategic Report and note 16 of that report. Risks faced by the

Company include, but are not limited to, investment performance risk; key man

risk and reputational risk; fund valuation risk; risk associated with

engagement of third-party service providers; regulatory risk; fiduciary risk;

fraud risk; market risk; interest rate risk; liquidity risk; currency rate

risk; and credit and counterparty risk. Details of the Company's management of

these risks are set out in the Annual Report and Financial Statements.

M&M Investment Company plc is the controlling Shareholder of the Company. This

company was controlled throughout the six months ended 31 January 2021, and

continues to be controlled by Mark Sheppard, who forms part of the investment

management team at M&L Capital Management Limited. Details of related party

disclosures are set out in note 7 of this Report.

Statement of Directors' Responsibilities

The Directors confirm that to the best of their knowledge:

. the condensed set of financial statements has been prepared in accordance

with International Accounting Standard 34, Interim Financial Reporting; and

gives a true and fair view of the assets, liabilities, financial position and

return of the Company; and

. this Half-Yearly Report includes a fair review of the information required

by:

a. DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six months

of the financial year and their impact on the condensed set of financial

statements; and a description of the principal risks and uncertainties for the

remaining six months of the year; and

b. DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being related

party transactions that have taken place in the first six months of the current

financial year and that have materially affected the financial position or

performance of the Company during that period; and any changes in the related

party transactions described in the last Annual Report that could do so.

This Half-Yearly Report was approved by the Board of Directors and the above

responsibility statement was signed on its behalf by:

David Harris

Chairman

16 March 2021

Condensed Statement of Comprehensive Income

For the six months ended 31 January 2021

(Unaudited) (Unaudited) (Audited)

Six months ended Six months ended Year ended

31 January 2021 31 January 2020 31 July 2020

Revenue Capital Total Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000

Gains / (losses) on 93 7,932 8,025 (305) 8,938 8,633 (285) 27,368 27,083

investments at fair

value through

profit or loss

Investment income 375 - 375 400 - 400 647 - 647

Gross return 468 7,932 8,400 95 8,938 9,033 362 27,368 27,730

Expenses

Management fee (941) - (941) (673) - (673) (1,470) - (1,470)

Other operating (464) (464) (245) - (245) (555) - (555)

expenses

Total expenses (1,405) (1,405) (918) - (918) (2,025) - (2,025)

Return before (937) 7,932 6,995 (823) 8,938 8,115 (1,663) 27,368 25,705

finance costs and

taxation

Finance costs (19) (501) (520) (15) (956) (971) (37) (1,572) (1,609)

(956) 7,431 6,475

Return on ordinary (956) 7,431 6,475 (838) 7,982 7,144 (1,700) 25,796 24,096

activities before

tax

Taxation (26) - (26) (38) - (38) (59) - (59)

Return on ordinary (982) 7,431 6,449 (876) 7,982 7,106 (1,759) 25,796 24,037

activities after

tax

Return per Ordinary (2.63) 19.90 17.27 (2.88) 26.20 23.32 (5.47) 80.21 74.74

Share:

Basic and fully

diluted (pence)

The total column of this statement represents the Condensed Statement of

Comprehensive Income, prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act 2006. The

supplementary revenue and capital columns are both prepared under the Statement

of Recommended Practice published by the Association of Investment Companies

("AIC SORP").

All items in the above statement are derived from continuing operations. No

operations were acquired or discontinued during the period.

There is no other comprehensive income, and therefore the return for the period

after tax is also the total comprehensive income.

The notes below form part of these financial statements.

Condensed Statement of Changes in Equity

For the six months ended 31 January 2021

For the six months from 1 August Share Share Capital Retained Total

2020 to capital premium reserve earnings £'000

31 January 2021 (unaudited) £'000 £'000 £'000 £'000

Balance at 1 August 2020 9,034 107,188 99,161 10,550 225,933

Total comprehensive income / - - 7,431 (982) 6,449

(loss)

Shares issued 1,098 25,929 - - 27,027

Equity dividends paid - - (2,618) (2,618)

Balance at 31 January 2021 10,132 133,117 106,592 6,950 256,791

For the six months from 1 August Share Share Capital Retained Total

2019 to capital premium reserve earnings £'000

31 January 2020 (unaudited) £'000 £'000 £'000 £'000

Balance at 1 August 2019 7,341 68,987 73,365 17,288 166,981

Total comprehensive income / - - 7,982 (876) 7,106

(loss)

Shares issued 812 16,888 - - 17,700

Equity dividends paid - - - (2,609) (2,609)

Balance at 31 January 2020 8,153 85,875 81,347 13,803 189,178

For the year from 1 August 2019 to Share Share Capital Retained Total

31 July 2020 (audited) capital premium reserve earnings £'000

£'000 £'000 £'000 £'000

Balance at 1 August 2019 7,341 68,987 73,365 17,288 166,981

Total comprehensive income / - - 25,796 (1,759) 24,037

(loss)

Shares issued 1,693 38,201 - - 39,894

Equity dividends paid - - - (4,979) (4,979)

Balance at 31 July 2020 9,034 107,188 99,161 10,550 225,933

The notes below form part of these financial statements.

Condensed Statement of Financial Position

As at 31 January 2021

(Unaudited) (Unaudited) (Audited)

31 January 31 January 31 July

2021 2020 2020

£'000 £'000 £'000

Non-current assets

Investments held at fair value through 165,834 130,406 137,333

profit and loss

Current assets

Unrealised derivative assets 34,673 16,929 29,229

Trade and other receivables (25) 35 18

Cash and cash equivalents 73,064 52,419 86,177

107,712 69,383 115,424

Gross assets 273,546 199,789 252,757

Current liabilities

Unrealised derivative liabilities (16,476) (10,355) (24,278)

Trade and other payables (279) (256) (2,546)

(16,755) (10,611) (26,824)

Net assets 256,791 189,178 225,933

Equity attributable to equity holders

Ordinary Share capital 10,132 8,153 9,034

Share premium 133,117 85,875 107,188

Capital reserves 106,592 81,347 99,161

Retained earnings 6,950 13,803 10,550

Total equity Shareholders' funds 256,791 189,178 225,933

Net asset value per Ordinary Share 633.62 580.11 625.23

(pence)

The notes below form part of these financial statements.

Condensed Statement of Cash Flows

For the six months ended 31 January 2021

Six months to Six months to Year ended

31 January 31 January 31 July

2021 2020 2020

(Unaudited) (Unaudited) (Audited)

£'000 £'000 £'000

Cash flow from operating activities

Return on operating activities before tax 6,475 7,144 24,096

Interest expense 520 971 1,609

(Gains) / losses on investments held at (9,244) (10,346) (30,119)

fair value through profit or loss

(Increase) / decrease in receivables 33 102 32

(Decrease) / increase in payables (58) (32) 192

Derivative instruments cash flows (13,039) (110) (3,028)

Tax paid (26) (38) (59)

Net cash generated from operating (15,339) (2,309) (7,277)

activities

Cash flow from investing activities

Purchase of investments (80,249) (11,079) (38,134)

Sale of investments 58,586 18,989 65,630

Net cash used in investing activities (21,663) 7,910 27,496

Cash flow from financing activities

Equity dividends paid (2,618) (2,609) (4,979)

Share issue 27,027 17,700 39,894

Interest paid (520) (1,153) (1,837)

Net cash generated from financing 23,889 13,938 33,078

activities

Net increase in cash and cash equivalents (13,113) 19,539 53,297

Cash and cash equivalents at the beginning 86,177 32,880 32,880

of the period

Cash and cash equivalents at the end of 73,064 52,419 86,177

the period

The notes below form part of these financial statements.

Notes to the Condensed Financial Statements

1. Significant accounting policies

Basis of preparation

The condensed financial statements of the Company have been prepared in

accordance with international accounting standards, International Accounting

Standard 34 "Interim Financial Reporting", in conformity with the requirements

of the Companies Act 2006.

The accounting policies used by the Company are as set out in the Annual Report

for the year ended 31 July 2020.

Going concern

The financial statements have been prepared on a going concern basis and on the

basis that approval as an investment trust company will continue to be met. The

Directors have made an assessment of the Company's ability to continue as a

going concern and are satisfied that the Company has the resources to continue

in business for the foreseeable future, being a period of at least 12 months

from the date these financial statements were approved. In making the

assessment, the Directors have considered the likely impacts of the current

COVID-19 pandemic on the Company, its operations and the investment portfolio.

The Directors noted that the cash balance exceeds any short term liabilities,

the Company holds a portfolio of liquid listed investments and is able to meet

the obligations of the Company as they fall due. The surplus cash enables the

Company to meet any funding requirements and finance future additional

investments. The Company is a closed end fund, where assets are not required to

be liquidated to meet day to day redemptions. The Directors have completed

stress tests assessing the impact of changes in market value and income with

associated cashflows. Whilst the economic future is uncertain, and it is

possible the Company could experience further reductions in income and/or

market value the Directors believe that this should not be to a level which

would threaten the Company's ability to continue as a going concern.

The Directors, the Manager and other service providers have put in place

contingency plans to minimise disruption. Furthermore, the Directors are not

aware of any material uncertainties that may cast significant doubt upon the

Company's ability to continue as a going concern, having taken into account the

liquidity of the Company's investment portfolio and the Company's financial

position in respect of its cash flows, borrowing facilities and investment

commitments (of which there are none of significance). Therefore, the financial

statements have been prepared on the going concern basis.

Comparative information

The financial information contained in this Half-Yearly Report does not

constitute statutory accounts as defined by the Companies Act 2006. The

financial information for the periods ended 31 January 2021 and 31 January 2020

have not been audited or reviewed by the Company's Auditors. The comparative

figures for the year ended 31 July 2020 are an extract from the latest

published audited statements and do not constitute the Company's statutory

accounts for that financial year. Those accounts have been reported on by the

Company's Auditor and delivered to the Registrar of Companies. The report of

the Auditor was unqualified, did not include a reference to any matters to

which the Auditor drew attention by way of emphasis without qualifying their

report, and did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

2. Return per Ordinary Share

Returns per Ordinary Share are based on the weighted average number of Shares

in issue during the period. Normal and diluted return per Share are the same as

there are no dilutive elements of share capital.

Six months to Six months to Year ended

31 January 2021 31 January 2020 31 July 2020

(unaudited) (unaudited) (audited)

Net Net Net

return Per Share return Per Share Return Per Share

£'000 pence £'000 Pence £'000 Pence

Return on ordinary

activities after tax

Revenue (982) (2.63) (876) (2.88) (1,759) (5.47)

Capital 7,431 19.90 7,982 26.20 25,796 80.21

Total return on 6,449 17.27 7,106 23.32 24,037 74.74

ordinary activities

Weighted average 37,333,536 25,639,432 32,160,449

number of Ordinary

Shares

3. Share capital

Six months to Six months to Year ended

31 January 31 January 31 July

2021 2020 2020

(unaudited) (unaudited) (audited)

25p Ordinary Shares Number £'000 Number £'000 Number £'000

Opening Ordinary Shares in 36,135,738 9,034 29,363,930 7,341 29,363,930 7,341

issue

Shares issued 4,392,500 1,098 3,246,808 812 6,771,808 1,693

Closing Ordinary Shares in 40,528,238 10,132 32,610,738 8,153 36,135,738 9,034

issue

The Company's Share capital comprises Ordinary Shares of 25p each with one vote

per Share.

During the six months to 31 January 2021, the Company issued 4,392,500 Ordinary

Shares (six months to 31 January 2020: 3,246,808; year ended 31 July 2020:

6,771,808), with net consideration of £27,027,000 (six months to 31 January

2020: £17,700,000; year ended 31 July 2020: £39,938,000).

4. Dividends per Ordinary Share

The Board has declared an interim dividend of 7p per Ordinary Share (2020:

interim dividend of 7p per Ordinary Share) which will be paid on 4 May 2021 to

Shareholders registered at the close of business on 16 April 2021.

This dividend has not been included as a liability in these financial

statements.

5. Net asset value per Ordinary Share

Net asset value per Ordinary Share is based on net assets of £256,791,000 (31

January 2020: £189,178,000; 31 July 2020: £225,933,000) at the period end and

40,528,238 (31 January 2020: 32,610,738; 31 July 2020: 36,135,738) Ordinary

Shares in issue at the period end.

6. Fair value hierarchy

The Company measures fair values using the following hierarchy that reflects

the significance of the inputs used in making the measurements.

The fair value is the amount at which the asset could be sold in an ordinary

transaction between market participants, at the measurement date, other than a

forced or liquidation sale.

The Company measures fair values using the following hierarchy that reflects

the significance of the inputs used in making the measurements. Categorisation

within the hierarchy has been determined on the basis of the lowest level input

that is significant to the fair value measurement of the relevant asset as

follows:

* Level 1 - valued using quoted prices, unadjusted in active markets for

identical assets and liabilities.

* Level 2 - valued by reference to valuation techniques using observable

inputs for the asset or liability other than quoted prices included in

Level 1.

* Level 3 - valued by reference to valuation techniques using inputs that are

not based on observable market data for the asset or liability.

The tables below set out fair value measurement of financial instruments,

by the level in the fair value hierarchy into which the fair value

measurement is categorised.

Financial assets at fair value through profit or loss at 31 January 2021

Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Equity investments 165,834 - 165,834

Derivatives - assets - 34,673 34,673

Total 165,834 34,673 200,507

Financial assets at fair value through profit or loss at 31 January 2020

Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Equity investments 130,269 - - 130,269

Debentures - 137 - 137

Derivatives - assets - 16,929 - 16,929

Total 130,269 17,066 - 147,335

Financial assets at fair value through profit or loss at 31 July 2020

Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Equity investments 137,333 - 137,333

Derivatives - assets - 29,229 29,229

Total 137,333 29,229 166,562

Financial liabilities at fair value through profit or loss at 31 January 2021

Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Derivatives - liabilities - 16,476 - 16,476

Financial liabilities at fair value through profit or loss at 31 January 2020

Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Derivatives - liabilities - 10,355 - 10,355

Financial liabilities at fair value through profit or loss at 31 July 2020

Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Derivatives - liabilities - 24,278 24,278

7. Transactions with the Manager and related parties

M&L Capital Management Limited ("MLCM"), a company controlled by Mark Sheppard,

acts as Manager to the Company. Mark Sheppard is also a director of M&M

Investment Company plc ("MMIC") which is the controlling Shareholder of the

Company.

During the six months to 31 January 2021, MMIC subscribed for 4,392,500

Ordinary, with net consideration of £27,027,000. As at 31 January 2021, MMIC

was interested in a total of 22,619,772 Ordinary Shares of 25 pence each in the

Company, representing 55.81% of the issued share capital.

Total fees charged by the Manager for the six months to 31 January 2021 were £

941,000 (six months to 31 January 2020: £673,000; year ended 31 July 2020: £

1,470,000), of which £168,000 was outstanding as at 31 January 2021 (31 January

2020: £125,000; 31 July 2020: £148,000).

The fees payable to Directors are set out in the 2020 Annual Report.

There were no other related party transactions in the period.

8. Post Statement of Financial Position event

Following Court approval and the subsequent registration of the Court order

with the Registrar of Companies on 10 February 2021, the reduction of the

Company's share premium account became effective. Accordingly, the amount of £

107,188,488 previously held in the share premium account was transferred to the

special reserve. The special reserve is distributable.

There were no other significant events since the end of the reporting period.

Investment Objective

The investment objective of the Company is to achieve capital appreciation.

Investment Policy

Asset allocation

The Company's investment objective is sought to be achieved through a policy of

actively investing in a diversified portfolio, comprising any of global

equities and/or fixed interest securities and/or derivatives.

The Company may invest in derivatives, money market instruments, currency

instruments, contracts for differences ("CFDs"), futures, forwards and options

for the purposes of (i) holding investments and (ii) hedging positions against

movements in, for example, equity markets, currencies and interest rates.

The Company seeks investment exposure to companies whose shares are listed,

quoted or admitted to trading. However, it may invest up to 10% of gross assets

(at the time of investment) in the equities and/or fixed interest securities of

companies whose shares are not listed, quoted or admitted to trading.

Risk diversification

The Company intends to maintain a diversified portfolio and it is expected that

the portfolio will have between approximately 20 to 100 holdings. No single

holding will represent more than 20% of gross assets at the time of investment.

In addition, the Company's five largest holdings (by value) will not exceed (at

the time of investment) more than 75% of gross assets.

Although there are no restrictions on the constituents of the Company's

portfolio by geography, industry sector or asset class, it is intended that the

Company will hold investments across a number of geographies and industry

sectors. During periods in which changes in economic, political or market

conditions or other factors so warrant, the Manager may reduce the Company's

exposure to one or more asset classes and increase the Company's position in

cash and/or money market instruments.

The Company will not invest more than 15% of its total assets in other listed

closed-ended investment funds. However, the Company may invest up to 50% of

gross assets (at the time of investment) in an investment company subsidiary,

subject always to the other restrictions set out in this investment policy and

the Listing Rules.

Gearing

The Company may borrow to gear the Company's returns when the Manager believes

it is in Shareholders' interests to do so. The Company's Articles of

Association ("Articles") restrict the level of borrowings that the Company may

incur up to a sum equal to two times the net asset value of the Company as

shown by the then latest audited balance sheet of the Company.

The effect of gearing may be achieved without borrowing by investing in a range

of different types of investments including derivatives. Save with the approval

of Shareholders, the Company will not enter into any investments which have the

effect of increasing the Company's net gearing beyond the limit on borrowings

stated in the Articles.

General

In addition to the above, the Company will observe the investment restrictions

imposed from time to time by the Listing Rules which are applicable to

investment companies with shares listed on the Official List of the Financial

Conduct Authority ("FCA").

No material change will be made to the investment policy without the approval

of Shareholders by ordinary resolution.

In the event of any breach of the investment restrictions applicable to the

Company, Shareholders will be informed of the remedial actions to be taken by

the Board and the Manager by an announcement issued through a regulatory

information service approved by the FCA.

Investment Strategy and Style

The fund's portfolio is constructed with flexibility but is more often than not

focused on stock that exhibit the attributes of growth.

Target Benchmark

The Company was originally set up by Brian Sheppard as a vehicle for British

retail investors to invest in with the hope that total returns would exceed the

total returns on the UK equity market. Hence, the benchmark the Company uses

to assess performance is one of the many available UK equity indices being the

MSCI UK Investable Market Index (MXGBIM). The Company is not set on just using

this index for the future and currently uses this particular UK index because

at the current time it is viewed as the most cost advantageous. However, once

the Company announces the use of an index, then this index will be used across

all of the Company's documentation.

Investments for the portfolio are not selected from constituents of this index

and hence the investment remit is in no way constrained by the index, although

the Manager's management fee is varied depending on performance against the

benchmark. It is suggested that Shareholders review the Company's Active Share

Ratio that is on the fund factsheets as this illustrates to what degree the

holdings in the portfolio vary from the underlying benchmark.

Environmental, Social, Community and Governance

The Company considers that it does not fall within the scope of the Modern

Slavery Act 2015 and it is not, therefore, obliged to make a slavery and human

trafficking statement. In any event, the Company considers its supply chains to

be of low risk as its suppliers are typically professional advisers.

In its oversight of the Manager and the Company's other service providers, the

Board seeks assurances that they have regard to the benefits of diversity and

promote these within their respective organisations. The Company has given

discretionary voting powers to the Manager. The Manager votes against

resolutions they consider may damage Shareholders' rights or economic interests

and report their actions to the Board. The Company believes it is in the

Shareholders' interests to consider environmental, social, community and

governance factors when selecting and retaining investments and has asked the

Manager to take these issues into account. The Manager does not exclude

companies from their investment universe purely on the grounds of these factors

but adopts a positive approach towards companies which promote these factors.

The portfolio's Sustainalytic's Environmental Percentile was 75.8 per cent as

at the Latest Factsheet date.

Shareholder Information

Investing in the Company

The Shares of the Company are listed on the Official List of the FCA and traded

on the London Stock Exchange. Private investors can buy or sell Shares by

placing an order either directly with a stockbroker or through an independent

financial adviser.

Electronic communications from the Company

Shareholders now have the opportunity to be notified by email when the

Company's Annual Report, Half-Yearly Report and other formal communications are

available on the Company's website, instead of receiving printed copies by

post. This reduces the cost to the Company as well as having an environmental

benefit in the reduction of paper, printing, energy and water usage. If you

have not already elected to receive electronic communications from the Company

and now wish to do so, visit www.signalshares.com . All you need to register is

your investor code, which can be found on your Share certificate or your

dividend confirmation statement.

Alternatively, you can contact Link's Customer Support Centre which is

available to answer any queries you have in relation to your shareholding:

By phone: 0371 664 0300 (from overseas call +44 (0) 371 664 0300). Calls cost

12p per minute plus your phone company's access charge. Calls outside the

United Kingdom will be charged at the applicable international rate. Lines are

open between 09:00 - 17:30, Monday to Friday excluding public holidays in

England and Wales.

By email - shareholder.enquiries@linkgroup.co.uk

By post - Link Group, 10th Floor, Central Square, 29 Wellington Street, Leeds,

LS1 4DL.

Frequency of NAV publication

The Company's NAV is released to the London Stock Exchange on a weekly basis

and also published in the Investment Companies sector of The Financial Times.

Sources of further information

Copies of the Company's Annual and Half-Yearly Reports, factsheets and further

information on the Company can be obtained from its website: www.mlcapman.com/

manchester-london-investment-trust-plc.

Key dates

Half-Yearly results March

announced

Interim dividend payment May

Company's year end 31 July

Annual results announced October

Annual General Meeting November

Expected final dividend November

payment

Company's half-year end 31 January

Corporate Information

Directors and advisers

Directors Auditor

David Harris (Chairman) Deloitte LLP

Brett Miller Saltire Court

Sir James Waterlow 20 Castle Terrace

Daniel Wright (Senior Independent Director) Edinburgh EH1 2DB

Manager and Alternative Investment Fund Manager Administrator

M&L Capital Management Limited Link Alternative Fund Administrators

12a Princes Gate Mews Limited

London SW7 2PS Beaufort House

Tel: 0207 584 5733 51 New North Road

ir@mlcapman.com Exeter EX4 4EP

www.mlcapman.com

Company Secretary Registrar

Link Company Matters Limited Link Group

Beaufort House 10th Floor

51 New North Road Central Square

Exeter EX4 4EP 29 Wellington Street

Tel: 01392 477 500 Leeds LS1 4DL

Tel: 0871 664 0300

Email:

shareholder.enquiries@linkgroup.co.uk

Depositary Bank

Indos Financial Limited National Westminster Bank plc

54 Fenchurch Street 11 Spring Gardens

London EC3M 3JY Manchester M60 2DB

COMPANY DETAILS

Registered office Country of incorporation

12a Princes Gate Mews Registered in England and Wales

London SW7 2PS Company Number: 01009550

Company website

www.mlcapman.com/manchester-london-investment-trust-plc

National Storage Mechanism

A copy of the Half-Yearly Report will be submitted shortly to the National

Storage Mechanism ('NSM') and will be available for inspection at the NSM,

which is situated at www.morningstar.co.uk/uk/NSM.

Neither the contents of the Company's website nor the contents of any website

accessible through hyperlinks on the Company's website (or any website) or this

announcement is incorporated into, or forms part of this announcement.

LEI: 213800HMBZXULR2EEO10

17 March 2021

END

(END) Dow Jones Newswires

March 17, 2021 03:00 ET (07:00 GMT)

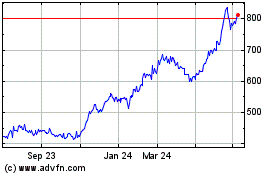

Manchester & London Inve... (LSE:MNL)

Historical Stock Chart

From Mar 2024 to Apr 2024

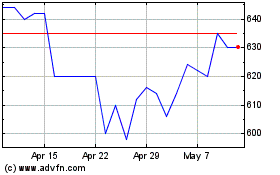

Manchester & London Inve... (LSE:MNL)

Historical Stock Chart

From Apr 2023 to Apr 2024