TIDMMNL

MANCHESTER AND LONDON INVESTMENT TRUST PLC

(the "Company")

ANNUAL FINANCIAL REPORT FOR THE YEARED 31 JULY 2020

The full Annual Report and Financial Statements for the year ended 31 July 2020

can be found on the Company's website at www.mlcapman.com/

manchester-london-investment-trust-plc.

STRATEGIC REPORT

Financial Summary

Total Return Year to Year to Percentage

31 July 31 July increase

2020 2019

Total return (GBP'000) 24,037 15,900 51.18%

Return per Share 74.74p 58.75p 27.22%

Total revenue return per Share (5.47p) (3.17p) 72.56%

Dividend per Share 14.00p 14.00p 0.00%

Capital As at As at Percentage

31 31 increase

July July

2020 2019

Net assets attributable to equity 225,933 166,981 35.30%

Shareholders(i) (GBP'000)

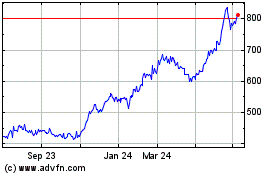

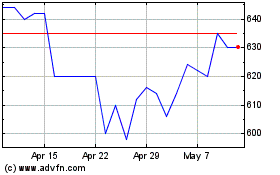

Net asset value ("NAV") per Share 625.23p 568.66p 9.95%

NAV total return(ii)? 12.84% 9.80%

Benchmark performance - total return basis (19.60%) 0.98%

(iii)

Share price 630.00p 538.00p 17.10%

Share price premium/(discount) to NAV? 0.76% (5.39%)

(i) NAV as at 31 July 2020 includes a net GBP39,894,000 increase in respect of

new Shares issued in the year (2019: GBP24,604,000 increase).

(ii) Total return including dividends reinvested, as sourced from Bloomberg.

(iii) The Company's benchmark is the MSCI UK Investable Market Index ("MXGBIM

or the "benchmark"), as sourced from Bloomberg.

Ongoing Charges Year to Year to

31 July 31 July

2020 2019

Ongoing charges as a percentage of

average net assets*? 0.77% 0.83%

* Based on total expenses, excluding finance costs and certain non-recurring

items for the year and average monthly NAV.

** Ongoing charges is based on a base fee of GBP940,000 and a Risk & Valuation

fee of GBP59,000 and excludes the variable fees of GBP470,000 (2019: GBP352,000) in

accordance with AIC guidelines.

? See Glossary below.

CHAIRMAN'S STATEMENT

Results for the year ended 31 July 2020

The portfolio remains focused on larger capitalisation, intellectual property

rich companies listed in developed markets which are investing for growth.

Manchester and London Investment Trust plc (the "Company")'s portfolio

performance for the financial year under review has led to a NAV total return

per Share of 12.8%* (2019: 9.8%*). The outperformance of the Company against

our benchmark for the three years to 31 July 2020 on a total return basis now

stands at 68.5%* (2019: 50.2%*).

At the year end, the Shares traded at 0.8% premium to their NAV per Share,

compared to a discount of 5.4% in 2019.

Dividend

The Directors are proposing a final ordinary dividend of 7.0 pence per Share

for the financial year 2020. Accordingly, on a per Share basis, the dividends

proposed or paid out in respect of the 2020 financial year total 14.0 pence,

including the 7.0 pence interim dividend paid in May 2020. These dividends

represent a yield of 2.2% on the Share price as at the year-end (2019: 2.6%).

Board appointment and Annual General Meeting

The Board is delighted with the appointment of Sir James Waterlow as a Director

of the Company on 17 August 2020. Our forty-eighth Annual General Meeting

("AGM") will be held on Monday, 2 November 2020 at 12.00 noon at 12a Princes

Gate Mews, London, SW7 2PS. Please do read further details on restrictions on

attendance at this year's AGM, which are contained within the AGM notice.

David Harris

Chairman

29 September 2020

* Source: Bloomberg, See Glossary below.

MANAGER'S REVIEW

Portfolio management

The portfolio delivered a 32.4%* outperformance against the benchmark driven by

our sector positioning. This was despite a 7.6% increase in the value of

Sterling against the US Dollar which acts as a headwind against performance.

The Total Return of the portfolio broken down by sector holdings in local

currency (separating costs and foreign exchange) is shown below:

Total return of underlying sector holdings in local

currency 2020

(excluding costs and foreign exchange)

Information Technology 7.2%

Communication Services 5.0%

Consumer Discretionary 7.6%

Other investments (including funds, ETFs and beta 2.5%

hedges)

Foreign exchange, cost & carry (9.6%)

Total NAV per Share return 12.8%

Total return of underlying sector holdings in local

currency 2019

(excluding costs and foreign exchange)

Technology investments 6.4%

Consumer investments 0.7%

Healthcare investments (0.4%)

Other (including cost, carry and foreign exchange) 3.1%

Total NAV per Share return 9.8%

Source: Bloomberg.

Information Technology

The Information Technology sector delivered 56.3% of the NAV total return per

Share.

Microsoft Corporation accounted for over half of this sector's return. Other

material positive performers included Adobe Inc, Salesforce.com Inc, Nvidia

Corp, Mastercard Inc and Visa Inc.

Paypal Holdings Inc was the only material negative contributor (due to the

timing of the disposal).

The portfolio's weighting to this sector at the year end was 38.1% of the net

assets (2019: 49.6%).

Communication Services

The Communication Services sector delivered roughly 39.3% of the NAV total

return per share.

Material positive contributors included Alphabet Inc, Facebook Inc and Tencent

Holdings Ltd.

The Walt Disney Co was the only material negative contributor (we sold this in

March due to perceived greater COVID-19 risks).

The portfolio's weighting to this sector at year end was 33.4% of the net

assets (2019: 37.0%).

Consumer Discretionary

The Consumer discretionary sector delivered 59.4% of the NAV total return per

share.

The material positive contributors in this sector were Alibaba Group Holding

Ltd and Amazon.com Inc.

The only material negative contributor was Expedia Group Inc.

The portfolio's weighting to this sector at year end was 29.8% of the net

assets (2019: 33.1%).

Other (including funds, ETFs and beta hedges)

Other holdings delivered 19.6% of the NAV total return per Share.

We employed various sector and thematic index hedges during the year in an

attempt to combat market volatility. Most of these market hedges were removed

(at a profit) during the Q1 market fall.

Of the long fund and ETF holdings in this segment, the material positive

contributors were the Morgan Stanley US SAAS Basket and Polar Capital

Technology Trust Plc.

The portfolio's weighting to this sector at year end was 5.9% of the net assets

(2019: -8.2%).

Professional negligence liability risks

M & L Capital Management Limited ("MLCM"), the Manager of the Company,

allocates additional own funds against professional liability risks and hence

it no longer requires professional liability insurance.

M&L Capital Management Limited

Manager

29 September 2020

*Source: Bloomberg. See Glossary below.

Equity exposures and portfolio sector analysis

Equity exposures (longs)

As at 31 July 2020

Company Sector * Valuation % of net

GBP'000 assets

Amazon.com Inc. Consumer 45,031 19.93

Discretionary

Microsoft Corporation** Information 34,028 15.06

Technology

Alibaba Group Holding Ltd** Information 30,356 13.44

Technology

Alphabet Inc.** Communication 29,797 13.19

services

Facebook Inc.** Communication 21,912 9.70

services

Tencent Holdings Ltd** Information 17,573 7.78

Technology

salesforce.com,inc.** Information 16,972 7.51

Technology

Adobe inc.** Information 13,200 5.84

Technology

Visa Inc. Information 12,241 5.42

Technology

Mastercard Incorporated Information 10,305 4.56

Technology

Netflix** Communication 8,193 3.63

services

Polar Capital Technology Trust Fund 5,558 2.46

plc

SAP SE** Information 4,198 1.86

Technology

Dassault Systèmes SA** Information 4,166 1.84

Technology

NetEase, Inc. Communication 4,120 1.82

services

China Software Basket** CFD Basket 4,118 1.82

Invesco QQQ (Nasdaq 100) ETF Index 1,923 0.85

US SaaS Basket** CFD Basket 1,591 0.70

Hang Seng TECH index** Index 1,003 0.44

Total long positions 266,285 117.85

Short positions > 1%

US Restaurants Basket** CFD Basket (911) (0.40)

Total short position > 1% (911) (0.40)

Cash and other net assets and (39,441) (17.45)

liabilities

Net assets 225,933 100.00

* GICS - Global Industry Classification Standard.

** Including equity swap exposures as detailed in note 13.

Portfolio sector analysis

As at 31 July 2020

% of net

Sector assets

Information Technology 63.3

Communication services 28.3

Consumer Discretionary 19.9

Fund 2.5

Index 1.3

CFD Basket 2.1

Cash and other net assets and liabilities (17.4)

Net assets 100.0

PRINCIPAL PORTFOLIO HOLDINGS

Amazon.com Inc. ("Amazon")

Amazon is the world's largest e-commerce platform and remains a disruptive

force in the retail market. Amazon also provides other large scale content and

services platforms to consumers and businesses such as Amazon Prime, Amazon Web

Services and Amazon Logistics.

Alphabet Inc. ("Alphabet")

Alphabet is a global technology company with products and platforms across a

wide range of tech verticals, including online advertising, cloud-based

technology, autonomous vehicles, artificial intelligence and smart phones.

Microsoft Corporation ("Microsoft")

Microsoft is another global tech company and a leader in cloud-based

technology, business software, operating systems and gaming.

Alibaba Group Holding Ltd ("Alibaba")

Alibaba is China's largest technology company with leading platforms in

e-commerce, payments, media, entertainment and cloud computing.

Facebook Inc. ("Facebook")

Facebook is the largest global social media platform with over 2.7 billion

monthly active users and has the second largest global online advertising

revenue after Google.

Salesforce.com Inc. ("Salesforce")

Salesforce is the global leader in CRM software and a major enterprise cloud

platform and software-as-a-service ("SAAS") provider.

Tencent Holdings Ltd ("Tencent")

Tencent is a Chinese internet company, with platforms in online gaming, social

media, digital payments and digital entertainment. Through WeChat, Tencent has

built one of Asia's leading SuperApps with over 1.1 billion monthly active

users.

Visa Inc. ("Visa")

Visa is a financial services company and a key facilitator of electronic funds

transfers throughout the world.

Adobe Inc. ("Adobe")

Adobe is a SAAS company that provides cloud-based creative, marketing and

analytics tools to businesses, professionals and prosumers. Adobe is perhaps

best known for Photoshop - imaging, design and photo-editing software.

Mastercard Inc. ("Mastercard")

Mastercard is a leader in global digital payments. Together, Mastercard and

Visa account for a dominant share of card transactions in the US and EU.

Percentage of portfolio by holding at the year end*:

Amazon.com Inc. 16.3%

Microsoft Corporation 13.5%

Alibaba Group Holding Ltd 13.5%

Alphabet Inc. 12.7%

Facebook Inc. 8.4%

Salesforce.com Inc. 7.2%

Tencent Holdings Ltd 6.8%

VISA Inc. 5.3%

Adobe Inc. 5.2%

Mastercard Inc. 4.4%

* Net of market value of options.

Investment record of the last ten years

Year ended Total Return per Dividend per Net NAV per

Return Share* Share assets Share*

(GBP'000) (p) (p) (GBP'000) (p)

31 July 2011 15,691 69.87 12.50 98,267 437.60

31 July 2012 (19,945) (88.81) 13.00 75,515 336.26

31 July 2013 2,522 11.23 13.75 75,050 334.19

31 July 2014 (6,295) (28.08) 13.75 64,361 293.20

31 July 2015 2,483 11.47 6.00 63,074 293.35

31 July 2016 13,424 62.50 13.36 75,546 350.81

31 July 2017 20,055 92.43 9.00 94,661 429.05

31 July 2018 26,792 115.27 12.00 130,388 532.81

31 July 2019 15,900 58.75 14.00 166,981 568.66

31 July 2020 24,037 74.74 14.00 225,933 625.23

* Basic and fully diluted.

Business model

The Company is an investment company as defined by Section 833 of the Companies

Act 2006 and operates as an investment trust in accordance with Section 1158 of

the Corporation Tax Act 2010.

The Company is also governed by the Listing Rules and Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority (the "FCA") and is listed

on the Premium Segment of the Main Market of the London Stock Exchange.

A review of investment activities for the year ended 31 July 2020 is detailed

in the Manager's Review above.

Investment objective

The investment objective of the Company is to achieve capital appreciation

together with a reasonable level of income.

Investment policy

Asset allocation

The Company's investment objective is sought to be achieved through a policy of

actively investing in a diversified portfolio, comprising UK and overseas

equities and fixed interest securities. The Company seeks to invest in

companies whose shares are admitted to trading on a regulated market. However,

it may invest in a small number of equities and fixed-interest securities of

companies whose capital is not admitted to trading on a regulated market.

Investment in overseas equities is utilised by the Company to increase the risk

diversification of the Company's portfolio and to reduce dependence on the UK

economy in addressing the growth and income elements of the Company's

investment objective.

The Company may invest in derivatives, money market instruments, currency

instruments, CFDs, futures, forwards and options for the purposes of (i)

holding investments and (ii) hedging positions against movements in, for

example, equity markets, currencies and interest rates.

There are no maximum exposure limits to any one particular classification of

equity or fixed-interest security. The Company's investments are not limited to

any one industry sector and its current investment portfolio is spread across a

range of sectors. The Company has no specific criteria regarding market

capitalisation or credit ratings in respect of investee companies.

Risk diversification

The Company intends to maintain a relatively focused portfolio, seeking capital

growth by investing in approximately 20 to 40 securities. The Company will not

invest more than 15% of the gross assets of the Company at the time of

investment in any one security. However, the Company may invest up to 50% of

the gross assets of the Company at the time of investment in an investment

company subsidiary, subject always to other restrictions set out in this

investment policy and the Listing Rules.

The Company intends to be fully invested whenever possible. However, during

periods in which changes in economic conditions or other factors so warrant,

the Manager may reduce the Company's exposure to one or more asset classes and

increase the Company's position in cash and/or money market instruments.

Gearing

The Company may borrow to gear the Company's returns when the Manager believes

it is in Shareholders' interests to do so. The Company's investment policy and

the Articles permit the Company to incur borrowing up to a sum equal to two

times the adjusted total of capital and reserves. Any change to the Company's

borrowing policy will only be made with the approval of Shareholders by special

resolution.

The effect of gearing may be achieved without borrowing by investing in a range

of different types of investments including derivatives. The Company will not

enter into any investments which have the effect of increasing the Company's

net gearing beyond the above limit.

General

In addition to the above, the Company will observe the investment restrictions

imposed from time to time by the Listing Rules which are applicable to

investment companies with shares listed on the Official List of the FCA under

Chapter 15.

In line with the Listing Rules, the Company will manage and invest its assets

in accordance with the Company's investment policy. Any material changes in the

principal investment policies and restrictions (as set out above) of the

Company will only be made with the approval of Shareholders by ordinary

resolution.

In the event of any breach of the investment restrictions applicable to the

Company, Shareholders will be informed of the remedial actions to be taken by

the Board and the Manager by an announcement issued through a regulatory

information service approved by the FCA.

Dividend policy

The Company may declare dividends as justified by funds available for

distribution. The Company will not retain in respect of any accounting period

an amount which is greater than 15% of net revenue in that period.

The dividend payments are split in order to better reflect the sources of the

Company's income. Recurring income from dividends on underlying holdings is

paid out as ordinary dividends.

Results and dividends

The results for the year are set out in the Statement of Comprehensive Income

and in the Statement of Changes in Equity below.

For the year ended 31 July 2020, the net revenue return attributable to

Shareholders was negative GBP1,759,000 (2019: negative GBP857,000) and the net

capital return attributable to Shareholders was GBP25,796,000 (2019: GBP

16,757,000). Total Shareholders' funds increased by 35% to GBP225,933,000 (2019:

GBP166,981,000).

The dividends paid/proposed by the Board for 2019 and 2020 are set out below:

Year ended 31 Year ended

July 2020 31 July 2019

(pence per (pence per

Share) Share)

Interim dividend 7.00 6.00

Proposed final dividend 7.00 8.00

14.00 14.00

Subject to the approval of Shareholders at the forthcoming AGM, the proposed

final ordinary dividend will be payable on 6 November 2020 to Shareholders on

the register at the close of business on 16 October 2020. The ex-dividend date

will be 15 October 2020.

Further details of the dividends paid in respect of the years ended 31 July

2020 and 31 July 2019 are set out in note 7 below.

Principal risks and uncertainties

The Board considers that the following are the principal risks and

uncertainties facing the Company. The actions taken to manage each of these are

set out below. If one or more of these risks materialised, it could potentially

have a significant impact upon the Company's ability to achieve its investment

objective. These risks are formalised within the risk matrix maintained by the

Company's Manager.

Risk How the risk is managed

Investment Performance Risk Investment performance is monitored and

The performance of the reviewed daily by MLCM as AIFM through:

Company may not be in line * Intra-day portfolio statistics; and

with its investment * Daily Risk, Liquidity & Volatility reports.

objectives.

The metrics and statistics within these reports

may be used (in combination with other factors)

to help inform investment decisions.

The AIFM also provides the Board with monthly

performance updates, key portfolio stats

(including performance attribution, valuation

metrics, VaR and liquidity analysis) and

performance charts of top portfolio holdings.

It should be noted that none of the above steps

guarantee that Company performance will meet

its stated objectives.

Key Man Risk and The Manager has a remuneration policy that

Reputational Risk incentivises key staff to take a long-term view

The Company may be unable to as variable rewards are spread over a five-year

fulfil its investment period. MLCM also has documented policies and

objectives following the procedures, including a business continuity

departure of key staff of plan, to ensure continuity of operations in the

the Manager. unlikely event of a departure.

MLCM has a comprehensive compliance framework

to ensure strict adherence to relevant

governance rules and requirements.

Fund Valuation Risk NAVs are produced independently by the

The Company's valuation is Administrator, based on the Company's valuation

not accurately represented policy.

to investors.

Valuation is overseen and reviewed by the

AIFM's valuation committee which reconciles and

checks NAV reports prior to publication.

It should be noted that the vast majority of

the portfolio consists of quoted equities,

whose prices are provided by independent market

sources; hence material input into the

valuation process is rarely required from the

valuation committee.

Third-Party Service All outsourced relationships are subject to an

Providers extensive dual-directional due diligence

Failure of outsourced process and to ongoing monitoring. Where

service providers in possible, the Company appoints a diversified

performing their contractual pool of outsourced providers to ensure

duties. continuity of operations should a service

provider fail.

The cyber security of third-party service

providers is a key risk that is monitored on an

ongoing basis. The safe custody of the

Company's assets may be compromised through

control failures by the Depositary or

Custodian, including cyber security incidents.

To mitigate this risk, the AIFM receives

monthly reports from the Depositary confirming

safe custody of the Company's assets held by

the Custodian.

Regulatory Risk The AIFM adopts a series of pre-trade and

A breach of regulatory rules post-trade controls to minimise breaches. MLCM

/ other legislation uses a fully integrated order management

resulting in the Company not system, electronic execution system, portfolio

meeting its objectives or management system and risk system developed by

investors' loss. Bloomberg. These systems include automated

compliance checks, both pre- and

post-execution, in addition to manual checks by

the investment team. The AIFM undertakes

ongoing compliance monitoring of the portfolio

through a system of daily reporting.

Furthermore, there is additional oversight from

the Depositary, which ensures that there are

three distinct layers of independent

monitoring.

Fiduciary Risk The Company has a clear documented investment

The Company may not be policy and risk profile. A strong system and

managed to the agreed monitoring culture, with an independent

guidelines. second-line function, provide oversight on a

daily basis and more formally through various

monthly governance committees.

Fraud Risk The AIFM has extensive fraud prevention

Fraudulent actions may cause controls and adopts a zero tolerance approach

harm to the Company's towards fraudulent behaviour and breaches of

investment activities and protocol surrounding fraud prevention. The

objectives. transfer of cash or securities involve the use

of dual authorisation and two-factor

authentication to ensure fraud prevention, such

that only authorised personnel are able to

access the core systems and submit transfers.

The second line of defence has access to core

systems to ensure complete oversight of all

transactions.

In addition to the above, the Board considers the following to be the principal

financial risks associated with investing in the Company: market risk, interest

rate risk, liquidity risk, currency rate risk and credit and counterparty risk.

An explanation of these risks and how they are managed along with the Company's

capital management policies are contained in note 16 of the Financial

Statements below.

The Board, through the Audit Committee, has undertaken a robust assessment and

review of all the risks stated above and in note 16 of the Financial

Statements, together with a review of any emerging or new risks which may have

arisen during the year, including those that would threaten the Company's

business model, future performance, solvency or liquidity. Whilst reviewing the

principal risks and uncertainties, the Board was cognisant of the risks posed

by the COVID-19 pandemic.

In accordance with guidance issued to directors of listed companies, the

Directors confirm that they have carried out a review of the effectiveness of

the systems of internal financial control during the year ended 31 July 2020,

as set out in the full Annual Report. There were no matters arising from this

review that required further investigation and no significant failings or

weaknesses were identified.

Year-end gearing

At the year end, gross long equity exposure represented 117.86% (2019: 125.98%)

of net assets.

Key performance indicators

The Board considers the most important key performance indicator to be the

comparison with its benchmark index. This is referred to in the Financial

Summary above.

Other key measures by which the Board judges the success of the Company are the

Share price, the NAV per Share and the ongoing charges measure.

Total net assets at 31 July 2020 amounted to GBP225,933,000 compared with GBP

166,981,000 at 31 July 2019, an increase of 35%, whilst the fully diluted NAV

per Share increased to 625.23p from 568.66p.

Net revenue return after taxation for the year was a negative GBP1,759,000 (2019:

negative GBP857,000).

The quoted Share price during the period under review has ranged from a

discount of 13.2% to a premium of 6.1%.

Ongoing charges, which are set out above, are a measure of the total expenses

(including those charged to capital) expressed as a percentage of the average

net assets over the year. The Board regularly reviews the ongoing charges

measure and monitors Company expenses.

Future development

The Board and the Manager do not currently foresee any material changes to the

business of the Company in the near future. As the majority of the Company's

equity investments are denominated in US Dollar, any currency volatility caused

by Brexit as well as the US elections may have an impact (either positive or

negative) on the Company's NAV per Share, which is denominated in Sterling.

Management arrangements

Under the terms of the management agreement, MLCM manages the Company's

portfolio in accordance with the investment policy determined by the Board. The

management agreement has a termination period of three months. In line with the

management agreement, the Manager receives a variable portfolio management fee.

Details of the revised fee arrangements and the fees paid to the Manager during

the year are disclosed in note 3 to the Financial Statements.

The Manager is authorised and regulated by the FCA.

M&M Investment Company Plc ("MMIC"), which is controlled by Mr Mark Sheppard

who forms part of the Manager's investment management team, is the controlling

Shareholder of the Company. Further details regarding this are set out in the

Directors' Report in the full Annual Report.

Alternative Investment Fund Managers Directive (the "AIFMD")

The Company permanently exceeded the sub-threshold limit under the AIFMD in

2017 and MLCM was appointed as the Company's AIFM with effect from 17 January

2018. Following their appointment as the AIFM, MLCM receives an annual risk

management and valuation fee of GBP59,000 to undertake its duties as the AIFM in

addition to the portfolio management fees set out above.

The AIFMD requires certain information to be made available to investors before

they invest and requires that material changes to this information be disclosed

in the Annual Report.

Remuneration

In the year to 31 July 2020, the total remuneration paid to the employees of

the Manager was GBP429,000 (2019: GBP402,000), payable to an average employee

number throughout the year of four (2019: three).

The management of MLCM is undertaken by Mr Mark Sheppard and Mr Richard Morgan,

to whom a combined total of GBP347,000 (2019: GBP284,000) was paid by the Manager

during the year.

The remuneration policy of the Manager is to pay fixed annual salaries, with

non-guaranteed bonuses, dependent upon performance only. These bonuses are

generally paid in the Company's Shares, released over a three-year period.

Leverage

Leverage is defined in the Glossary below.

The leverage policy has been approved by the Company and the AIFM. The policy

limits the leverage ratio that can be deployed by the Company at any one time

to 275% (gross method) and 250% (commitment method). This includes any gearing

created by its investment policy. This is a maximum figure as required by

regulation and not necessarily the amount of leverage that is actually used.

The leverage ratio as at 31 July 2020 measured by the gross method was 187.9%

and that measured by the commitment method was 100.8%.

Risk profile

The risk profile of the Company as measured through the Synthetic Risk Reward

Indicator ("SRRI") score, is currently at 6 on a scale of 1 to 7 as at 31 July

2020. This score is calculated on the Company's five-year annualised NAV

volatility. Liquidity, counterparty and currency risks are not captured on the

scale. The Manager will periodically disclose the current risk profile of the

Company to investors. The Company will make this disclosure on its website at

the same time as it makes its Annual Report and Financial Statements available

to investors or more frequently at its discretion.

Liquidity arrangements

The Company currently holds no assets that are subject to special arrangements

arising from their illiquid nature. If applicable, the Company would disclose

the percentage of its assets subject to such arrangements on its website at the

same time as it makes its Annual Report and Financial Statements available to

investors, or more frequently at its discretion.

Continuing appointment of the Manager

The Board keeps the performance of MLCM, in its capacity as the Company's

Manager, under continual review. It has noted the good long-term performance

record and commitment, quality and continuity of the team employed by the

Manager. As a result, the Board concluded that it is in the best interests of

the Shareholders as a whole that the appointment of the Manager on the agreed

terms should continue.

Human rights, employee, social and community issues

The Board consists entirely of non-executive Directors. The Company has no

employees and day-to-day management of the business is delegated to the Manager

and other service providers. As an investment trust, the Company has no direct

impact on the community or the environment, and as such has no human rights,

social or community policies. In carrying out its investment activities and in

relationships with suppliers, the Company aims to conduct itself responsibly,

ethically and fairly. Further details of the Environmental, Social and

Governance policy and of the Company's Board composition and related diversity

considerations can be found in the Statement of Corporate Governance in the

full Annual Report.

Gender diversity

At 31 July 2020 and throughout the majority of the year under review, the Board

comprised three male Directors. Following Sir James Waterlow's appointment on

17 August 2020 and to date of this report, the Board comprised four male

Directors. As stated in the Statement of Corporate Governance, the appointment

of any new Director is made on the basis of merit. The appointment process of

Sir Waterflow is explained in more detail in the Statement of Corporate

Governance in the full Annual Report.

Approval

This Strategic Report has been approved by the Board and signed on its behalf

by:

David Harris

Chairman

29 September 2020

DIRECTORS

David Harris (Chairman of the Board)

Brett Miller

Daniel Wright (Chairman of the Audit Committee and Senior Independent Director)

Sir James Waterlow

All the Directors are non-executive. Mr Harris, Sir James Waterlow and Mr

Wright are independent of the Company's Manager.

EXTRACTS FROM THE DIRECTORS' REPORT

Share capital

At 31 July 2020, the Company's issued Share capital comprised 36,135,738 Shares

of 25 pence each, of which none were held in Treasury.

At general meetings of the Company, Shareholders are entitled to one vote on a

show of hands and on a poll, to one vote for every Share held. Shares held in

Treasury do not carry voting rights.

In circumstances where Chapter 11 of the Listing Rules would require a proposed

transaction to be approved by Shareholders, the controlling Shareholder (see

the full Annual Report for further details) shall not vote its Shares on that

resolution. In addition, any Director of the Company appointed MMIC, the

controlling Shareholder, shall not vote on any matter where conflicted and the

Directors will act independently from MMIC and have due regard to their

fiduciary duties.

Issue of Shares

At the Annual General Meeting held on 14 January 2020, Shareholders approved

the Board's proposal to authorise the Company to allot Shares up to an

aggregate nominal amount of GBP2,446,994. In addition, the Directors were

authorised to issue shares up to an aggregate nominal value of GBP734,098 on a

non-pre-emptive basis. This authority is due to expire at the Company's

forthcoming AGM on 2 November 2020.

In addition to this authority, at the General Meeting held on 16 July 2020,

Shareholders approved the Board's proposal to authorise the Company to allot

further Shares up to an aggregate nominal amount of GBP2,275,000 on a

non-pre-emptive basis. This authority expired on 30 July 2020, being 10

business days from the passing of the resolution.

During the period, MMIC subscribed to Shares on six occasions. The details of

all subscriptions by and allotments to MMIC during the period are listed below.

Date of Number of Price paid per Market price Date of

subscription Shares share (pence) on date on admission to

subscription trading

(pence)

25 September 2019 807,573 535.00 530.00 1 October 2019

4 December 2019 781,985 547.10 522.00 10 December 2019

17 December 2019 1,500,000 550.10 524.00 23 December 2019

8 January 2020 157,250 580.50 550.00 14 January 2020

12 February 2020 1,250,000 609.50 587.00 18 February 2020

22 July 2020 1,747,000 646.50 654.00 28 July 2020

At the placing on 22 July 2020, a further 60,000 Shares were subscribed for by

Winterflood Securities Limited and 468,000 Shares by Singer Nominees Limited,

both for a price of 646.5 pence per Share. These Shares were admitted to

trading on the same date as the Shares allotted to MMIC, being 28 July 2020.

All Share issues detailed above were made at a price equal to the latest

reported NAV as at the day of the issue.

As at the date of this report, the total voting rights were 36,135,738.

Purchase of Shares

At the Annual General Meeting held on 14 January 2020, Shareholders approved

the Board's proposal to authorise the Company to acquire up to 14.99% of its

issued Share capital (excluding Treasury Shares) amounting to 3,769,238 Shares.

This authority is due to expire at the Company's forthcoming AGM on 2 November

2020.

The Company did not purchase any of its own Shares during the year or since the

year end.

Sale of Shares from Treasury

At the Annual General Meeting held on 14 January 2020, Shareholders approved

the Board's proposal to authorise the Company to waive pre-emption rights in

respect of Treasury Shares up to an aggregate amount of GBP734,098 and to permit

the allotment or sale of Shares from Treasury at a discount to NAV. This

authority is due to expire at the Company's forthcoming AGM on 2 November 2020.

No Shares were held in Treasury and no Shares were sold from Treasury during

the year. As at the date of this report, no Shares are held in Treasury

Going concern

The Directors consider that it is appropriate to adopt the going concern basis

in preparing the Financial Statements. After making enquiries, and considering

the nature of the Company's business and assets, the Directors consider that

the Company has adequate resources to continue in operational existence for the

foreseeable future. In arriving at this conclusion, the Directors have

considered the liquidity of the portfolio and the Company's ability to meet

obligations as they fall due for a period of at least 12 months from the date

that these Financial Statements were approved. In making this assessment, the

Directors have considered any likely impact of the current COVID-19 pandemic on

the Company, its operations and the investment portfolio.

Cashflow projections have been reviewed provide evidence that the Company has

sufficient funds to meet both its contracted expenditure and its discretionary

cash outflows in the form of the dividend policy.

Viability statement

The Directors have assessed the prospects of the Company over a five-year

period. The Directors consider five years to be a reasonable time horizon to

consider the continuing viability of the Company, however they also consider

viability for the longer-term foreseeable future.

In their assessment of the viability of the Company, the Directors have

considered each of the Company's principal risks and uncertainties as set out

in the Strategic Report above and in particular, have considered the potential

impact of a significant fall in global equity markets on the value of the

Company's investment portfolio overall. The Directors have also considered the

Company's income and expenditure projections and the fact that the Company's

investments mainly comprise readily realisable securities which could be sold

to meet funding requirements if necessary. On that basis, the Board considers

that five years is an appropriate time period to assess continuing viability of

the Company.

In forming their assessment of viability, the Directors have also considered:

* internal processes for monitoring costs;

* expected levels of investment income;

* the performance of the Manager;

* portfolio risk profile;

* liquidity risk;

* gearing limits;

* counterparty exposure; and

* financial controls and procedures operated by the Company.

The Board has reviewed the influence of the COVID-19 pandemic on its service

providers and is satisfied with the ongoing services provided to the Company.

Based upon these considerations, the Directors have concluded that there is a

reasonable expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the five-year period.

By order of the Board

Link Company Matters Limited

Company Secretary

29 September 2020

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN RELATION TO THE ANNUAL REPORT AND

FINANCIAL STATEMENTS

The Directors are responsible for preparing the Company's Annual Report and

Financial Statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare Financial Statements for each

financial period. Under that law, they have elected to prepare the Financial

Statements in accordance with International Financial Reporting Standards

("IFRS"). Under Company law, the Directors must not approve the Financial

Statements unless they are satisfied that they give a true and fair view of the

state of affairs of the Company and of the profit or loss of the Company for

that period.

In preparing the Financial Statements, the Directors are required to:

* select suitable accounting policies in accordance with IAS 8 'Accounting

Policies, Changes in Accounting Estimates and Errors' and then apply them

consistently;

* present information, including accounting policies, in a manner that

provides relevant, reliable, comparable and understandable information;

* provide additional disclosure when compliance with specific requirements in

IFRS is insufficient to enable users to understand the impact of particular

transactions, other events and conditions on the Company's financial

position and financial performance;

* state that the Company has complied with IFRS, subject to any material

departures disclosed and explained in the Financial Statements;

* make judgements and estimates that are reasonable and prudent; and

* prepare Financial Statements on a going concern basis unless it is

inappropriate to presume that the Company will continue in business.

The Directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions and disclose with

reasonable accuracy, at any time, the financial position of the Company and to

enable them to ensure that the Financial Statements comply with the Companies

Act 2006 and Article 4 of the IAS Regulation. They are also responsible for

safeguarding the assets of the Company and hence for taking reasonable steps

for the prevention and detection of fraud and other irregularities.

Under applicable law and regulations, the Directors are also responsible for

preparing a Strategic Report, Directors' Report, Directors' Remuneration Report

and Corporate Governance Statement that comply with that law and those

regulations, and ensuring that the Annual Report includes information required

by the Listing Rules and Disclosure Guidance and Transparency Rules of the FCA.

The Financial Statements are published on the Company's website,

www.mlcapman.com/manchester-london-investment-trust-plc, which is maintained on

behalf of the Company by the Manager. The Manager has agreed to maintain, host,

manage and operate the Company's website and to ensure that it is accurate and

up-to-date and operated in accordance with applicable law. The work carried out

by the Auditor does not involve consideration of the maintenance and integrity

of this website and accordingly, the Auditor accepts no responsibility for any

changes that have occurred to the Financial Statements since they were

initially presented on the website. Visitors to the website need to be aware

that legislation in the United Kingdom covering the preparation and

dissemination of the Financial Statements may differ from legislation in their

jurisdiction.

We confirm that to the best of our knowledge:

i. the Financial Statements, prepared in accordance with the IFRS as adopted

by the European Union, give a true and fair view of the assets, liabilities,

financial position and return of the Company; and

ii. the Annual Report includes a fair review of the development and

performance of the business and position of the Company, together with a

description of the principal risks and uncertainties that it faces.

The Directors consider that the Annual Report and Financial Statements, taken

as a whole, are fair, balanced and understandable and provide the information

necessary for Shareholders to assess the Company's position and performance,

strategy and business model and strategy.

On behalf of the Board

David Harris

Chairman

29 September 2020

NON-STATUTORY ACCOUNTS

The financial information set out below does not constitute the Company's

statutory accounts for the years ended 31 July 2020 and 31 July 2019 but is

derived from those accounts. Statutory accounts for the year ended 31 July 2019

have been delivered to the Registrar of Companies and statutory accounts for

the year ended 31 July 2020 will be delivered to the Registrar of Companies in

due course. The Auditor has reported on those accounts; their report was (i)

unqualified, (ii) did not include a reference to any matters to which the

Auditor drew attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under Section 498 (2) or (3) of the Companies

Act 2006. The text of the Auditor's report can be found on page 50 and further

of the Company's full Annual Report at www.mlcapman.com/

manchester-london-investment-trust-plc.

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 July 2020

2020 2019

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gains

Gains on investments at

fair value through 9 (285) 27,368 27,083 - 17,777 17,777

profit or loss

Investment income 2 647 - 647 749 - 749

Gross return 362 27,368 27,730 749 17,777 18,526

Expenses

Management fee 3 (1,470) - (1,470) (1,115) - (1,115)

Other operating expenses 4 (555) - (555) (406) - (406)

Total expenses (2,025) - (2,025) (1,521) - (1,521)

Return before finance

costs and tax (1,663) 27,368 25,705 (772) 17,777 17,005

Finance costs 5 (37) (1,572) (1,609) (37) (1,020) (1,057)

Return on ordinary

activities before tax (1,700) 25,796 24,096 (809) 16,757 15,948

Taxation 6 (59) - (59) (48) - (48)

Return on ordinary

activities after tax (1,759) 25,796 24,037 (857) 16,757 15,900

Return per Ordinary pence Pence Pence pence pence pence

Share

Basic and fully diluted 8 (5.47) 80.21 74.74 (3.17) 61.92 58.75

The total column of this statement is the Income Statement of the Company

prepared in accordance with IFRS, as adopted by the European Union. The

supplementary revenue and capital columns are presented in accordance with the

Statement of Recommended Practice issued by the AIC ("AIC SORP").

All revenue and capital items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the year.

There is no other comprehensive income, and therefore the return for the year

after tax is also the total comprehensive income.

The notes below form part of these Financial Statements.

STATEMENT OF CHANGES IN EQUITY

For the year ended 31 July 2020

Share Share Capital Retained

capital premium reserve* earnings** Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 August 2019 7,341 68,987 73,365 17,288 166,981

Changes in equity for 2020

Total comprehensive income/(loss) - - 25,796 (1,759) 24,037

Dividends paid 7 - - - (4,979) (4,979)

Shares issued 14 1,693 38,201 - - 39,894

Balance at 31 July 2020 9,034 107,188 99,161 10,550 225,933

Balance at 1 August 2018 6,118 45,606 56,608 22,056 130,388

Changes in equity for 2019

Total comprehensive income/(loss) - - 16,757 (857) 15,900

Dividends paid 7 - - - (3,911) (3,911)

Shares issued 14 1,223 23,381 - - 24,604

Balance at 31 July 2019 7,341 68,987 73,365 17,288 166,981

* Within the balance of the capital reserve, GBP7,138,000 relates to realised

gains (2019: GBP13,335,000) and is distributable by way of a dividend. The

remaining GBP92,023,000 relates to unrealised gains and losses on financial

instruments (2019: GBP60,030,000) and is non-distributable.

** Fully distributable by way of a dividend.

STATEMENT OF FINANCIAL POSITION

As at 31 July 2020

2020 2019

Notes GBP'000 GBP'000

Non-current assets

Investments at fair value through 9 137,333 132,059

profit or loss

Current assets

Unrealised derivative assets 13 29,229 8,887

Trade and other receivables 10 18 137

Cash and cash equivalents 11 86,177 32,880

115,424 41,904

Current liabilities

Unrealised derivative liabilities 13 (24,278) (6,512)

Trade and other payables 12 (2,546) (470)

(26,824) (6,982)

Net current assets 88,600 34,922

Net assets 225,933 166,981

Capital and reserves

Share capital 14 9,034 7,341

Share premium 107,188 68,987

Capital reserve 99,161 73,365

Retained earnings 10,550 17,288

Total equity 225,933 166,981

Basic and fully diluted NAV per 15 625.23 568.66p

Share

The Financial Statements were approved by the Board of Directors and authorised

for issue on 29 September 2020 and are signed on its behalf by:

David Harris

Chairman

Manchester and London Investment Trust Public Limited Company

Company Number: 01009550

The notes below form part of these Financial Statements.

STATEMENT OF CASH FLOWS

For the year ended 31 July 2020

2020 2019

GBP'000 GBP'000

Cash flow from operating activities

Return on operating activities before tax 24,096 15,948

Interest expense 1,609 1,057

Gains on investments held at fair value through (30,119) (16,649)

profit or loss

Decrease/(increase) in receivables 32 (106)

Increase in payables 192 34

Derivative instruments cash flows (3,028) (2,334)

Tax paid (59) (48)

Net cash (used in)/generated from operating (7,277) (2,098)

activities

Cash flow from investing activities

Purchases of investments (38,134) (57,456)

Sales of investments 65,630 45,000

Net cash inflow/(outflow) from investing activities 27,496 (12,456)

Cash flow from financing activities

Equity dividends paid (4,979) (3,911)

Issue of Shares 39,894 24,604

Interest paid (1,837) (1,117)

Net cash generated in financing activities 33,078 19,576

53,297 5,022

Net increase in cash and cash equivalents

Cash and cash equivalents at beginning of year 32,880 27,858

Cash and cash equivalents at end of year 86,177 32,880

The notes below form part of these Financial Statements.

NOTES FORMING PART OF THE FINANCIAL STATEMENTS

For the year ended 31 July 2020

1. General information and accounting policies

Manchester and London Investment Trust plc is a public limited company

incorporated in the UK and registered in England and Wales. The principal

activity of the Company is that of an investment trust company within the

meaning of Sections 1158/1159 of the Corporation Tax Act 2010 and its

investment approach is detailed in the Strategic Report.

The Financial Statements of the Company have been prepared in accordance with

IFRS as adopted by the European Union, which comprise standards and

interpretations approved by the International Accounting Standards Board

("IASB"), and as applied in accordance with the provisions of the Companies Act

2006. The annual Financial Statements have also been prepared in accordance

with the AIC SORP for the financial statements of investment trust companies

and venture capital trusts, except to any extent where it is not consistent

with the requirements of IFRS.

Basis of preparation

In order to better reflect the activities of an investment trust company and in

accordance with the AIC SORP, supplementary information which analyses the

Statement of Comprehensive Income between items of revenue and capital nature

has been prepared alongside the Statement of Comprehensive Income.

The Financial Statements are presented in Sterling, which is the Company's

functional currency as the UK is the primary environment in which it operates,

rounded to the nearest GBP'000s, except where otherwise indicated.

The Financial Statements have been prepared on the historical cost basis,

except for the revaluation of certain investments that are measured at revalued

amounts or fair values at the end of each reporting period, as explained in the

accounting policies below. Historical cost is generally based on the fair value

of the consideration given in exchange for goods and services.

Fair value is the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at

the measurement date, regardless of whether that price is directly observable

or estimated using another valuation technique. In estimating the fair value of

an asset or a liability, the Company takes into account the characteristics of

the asset or liability if market participants would take those characteristics

into account when pricing the asset or liability at the measurement date.

Going concern

The financial statements have been prepared on a going concern basis and on the

basis that approval as an investment trust company will continue to be met. The

Directors have made an assessment of the Company's ability to continue as a

going concern and are satisfied that the Company has the resources to continue

in business for the foreseeable future, being a period of at least 12 months

from the date these financial statements were approved. In making the

assessment, the Directors have considered the likely impacts of the current

COVID-19 pandemic on the Company, its operations and the investment portfolio.

The Directors noted that the cash balance exceeds any short term liabilities,

the Company holds a portfolio of liquid listed investments and is able to meet

the obligations of the Company as they fall due. The surplus cash enables the

Company to meet any funding requirements and finance future additional

investments. The Company is a closed end fund, where assets are not required to

be liquidated to meet day to day redemptions. The Directors have completed

stress tests assessing the impact of changes in market value and income with

associated cashflows. Whilst the economic future is uncertain, and it is

possible the Company could experience further reductions in income and/or

market value the Directors believe that this should not be to a level which

would threaten the Company's ability to continue as a going concern.

The Directors, the Manager and other service providers have put in place

contingency plans to minimise disruption. Furthermore, the Directors are not

aware of any material uncertainties that may cast significant doubt upon the

Company's ability to continue as a going concern, having taken into account the

liquidity of the Company's investment portfolio and the Company's financial

position in respect of its cash flows, borrowing facilities and investment

commitments (of which there are none of significance). Therefore, the financial

statements have been prepared on the going concern basis.

Segmental reporting

The Directors are of the opinion that the Company is engaged in a single

segment of business, being investment business. The Company primarily invests

in companies listed in the UK and other recognised international exchanges.

Accounting developments

In the current year, the Company has applied amendments to IFRS, issued by the

IASB. These include annual improvements to IFRS, legislative and regulatory

amendments, changes in disclosure and presentation requirements.

The adoption of the changes to accounting standards has had no material impact

on the current or prior years' financial statements. The Company held no leases

during the current or prior years.

There are amendments to IFRS, legislation and regulatory requirements that will

apply from 1 August 2020. These will not impact the financial statements other

than requiring changes in disclosure and presentation amendments.

Critical accounting judgements and key sources of estimation uncertainty

The preparation of financial statements in conformity with IFRS requires

management to make judgements, estimates and assumptions that affect the

application of policies and the reported amounts in the financial statements.

The estimates and associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making judgements about

carrying values of assets and liabilities that are not readily apparent from

other sources. Actual results may differ from these estimates.

The areas requiring the most significant judgement and estimation in the

preparation of the Financial Statements are: valuation of derivatives;

accounting for revenue and expenses in relation to CFD; and setting the level

of dividends paid and proposed in satisfaction of both the Company's long-term

objective and its obligations to adhere to investment trust status rules under

Section 1158 of the Corporation Tax Act 2010. The policies for these are set

out in the notes to the Financial Statements.

The estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period, or in the period

of the revision and future period if the revision affects both current and

future periods.

There were no significant accounting estimates or critical accounting

judgements in the year.

Investments

Investments are measured initially, and at subsequent reporting dates, at fair

value, and derecognised at trade date where a purchase or sale is under a

contract whose terms require delivery within the timeframe of the relevant

market. For listed investments, this is deemed to be bid market prices or

closing prices for Stock Exchange Electronic Trading Service - quotes and

crosses ("SETSqx").

Changes in fair value of investments are recognised in the Statement of

Comprehensive Income as a capital item. On disposal, realised gains and losses

are also recognised in the Statement of Comprehensive Income as capital items.

All investments for which fair value is measured or disclosed in the Financial

Statements are categorised within the fair value hierarchy in note 9.

Financial instruments

The Company may use a variety of derivative instruments, including CFD,

futures, forwards and options under master agreements with the Company's

derivative counterparties to enable the Company to gain long and short exposure

on individual securities.

The Company recognises financial assets and financial liabilities when it

becomes a party to the contractual provisions of the instrument. Listed options

and futures contracts are recognised at fair value through profit or loss

valued by reference to the underlying market value of the corresponding

security, traded prices and/or third party information.

Notional dividend income arising on long positions is recognised in the

Statement of Comprehensive Income as revenue. Interest expenses on long

positions are allocated to capital.

Unrealised changes to the value of securities in relation to derivatives are

recognised in the Statement of Comprehensive Income as capital items.

Foreign currency

Transactions denominated in foreign currencies are converted to Sterling at the

actual exchange rate as at the date of the transaction. Monetary assets and

liabilities and non-monetary assets held at fair value denominated in foreign

currencies at the year end are translated at the Statement of Financial

Position date. Any gain or loss arising from a change in exchange rate

subsequent to the date of the transaction is included as an exchange gain or

loss in the capital reserve or the revenue account depending on whether the

gain or loss is capital or revenue in nature.

Cash and cash equivalents

Cash comprises cash in hand, overdrafts and demand deposits. Cash equivalents

are short-term, highly liquid investments that are readily convertible to known

amounts of cash and which are subject to insignificant risk of changes in

value.

For the purposes of the Statement of Financial Position and the Statement of

Cash Flows, cash and cash equivalents consist of cash and cash equivalents as

defined above, net of outstanding bank overdrafts when applicable.

Trade receivables, trade payables and short-term borrowings

Trade receivables, trade payables and short-term borrowings are measured at

amortised cost.

Revenue recognition

Revenue is recognised when it is probable that economic benefits associated

with a transaction will flow to the Company and the revenue can be reliably

measured.

Dividends from overseas companies are shown gross of any non-recoverable

withholding taxes which are disclosed separately in the Statement of

Comprehensive Income.

Dividends receivable on quoted equity shares are taken to revenue on an

ex-dividend basis. Dividends receivable on equity shares where no ex-dividend

date is quoted are brought into account when the Company's right to receive

payment is established.

All other income is accounted for on a time-apportioned basis and recognised in

the Statement of Comprehensive Income.

Expenses

All expenses are accounted for on an accruals basis and are charged to revenue.

All other administrative expenses are charged through the revenue column in the

Statement of Comprehensive Income.

Expenses incurred in issuing or the buyback of Shares to be held in Treasury

are charged to the share premium account.

Finance costs

Finance costs are accounted for on an accruals basis.

Financing charged by the Prime Brokers on open long positions are allocated to

capital, with other finance costs being allocated to revenue.

Taxation

The charge for taxation is based on the net revenue for the year and any

deferred tax.

Deferred tax is provided using the liability method on temporary differences

between the tax bases of assets and liabilities and their carrying amount for

financial reporting purposes at the reporting date. Deferred tax assets are

only recognised if it is considered more likely than not that there will be

suitable profits from which the future reversal of timing differences can be

deducted. In line with recommendations of the AIC SORP, the allocation method

used to calculate the tax relief on expenses charged to capital is the

"marginal" basis. Under this basis, if taxable income is capable of being

offset entirely by expenses charged through the revenue account, then no tax

relief is transferred to the capital account.

No taxation liability arises on gains from sales of fixed asset investments by

the Company by virtue of its investment trust status. However, the net revenue

(excluding investment income) accruing to the Company is liable to corporation

tax at prevailing rates.

Dividends payable to Shareholders

Dividends to Shareholders are recognised as a liability in the period in which

they are approved and are taken to the Statement of Changes in Equity.

Dividends declared and approved by the Company after the Statement of Financial

Position date have not been recognised as a liability of the Company at the

Statement of Financial Position date.

Share capital

Nominal value of total Shares issued.

Shares held in Treasury

Consideration paid for the purchase of Shares held in Treasury.

Share premium

The Share premium account represents the accumulated premium paid for Shares

issued in previous periods above their nominal value less issue expenses. This

is a reserve forming part of the non-distributable reserves. The following

items are taken to this reserve:

* costs associated with the issue of equity;

* premium on the issue of Shares; and

* premium on the sales of Shares held in Treasury over the market value.

Capital reserve

The following are taken to capital reserve:

* gains and losses on the realisation of investments;

* increases and decreases in the valuation of the investments held at the year

end;

* cost of share buy backs;

* exchange differences of a capital nature; and

* expenses, together with the related taxation effect, allocated to this

reserve in accordance with the above policies.

Retained earnings

The revenue reserve represents accumulated profits and losses and any surplus

profits. The surplus accumulated profits are distributable by way of dividends.

2. Income

2020 2019

GBP'000 GBP'000

Dividends from listed 392 383

investments

Interest 255 448

647 831

3. Management fee

2020 2019

GBP'000 GBP'000

Base fee 941 704

Variable fee 470 352

Risk management and valuation fee 59 59

1,470 1,115

The Management Fee payable to the Manager is equal to 0.5% per annum of the

Company's NAV (the "Base Fee"), calculated as at the last business day of each

calendar month (the "Calculation Date"), and is paid monthly in arrears. An

uplift of 0.25% of the NAV will be applied to the fee, should the performance

of the Company over the 36-month period to the Calculation Date be above that

of the Company's benchmark. Should the performance of the Company over the

36-month period to the Calculation Date be below that of the Company's

benchmark, the fee will be reduced to the lower adjusted amount of 0.25% of the

NAV. The Manager is also reimbursed any expenses incurred by it on behalf of

the Company. In addition, a Risk Management and Valuation fee equating to GBP

59,000 on an annualised basis is charged by the AIFM. The Manager is also

reimbursed any expenses incurred by it on behalf of the Company.

The fee is not subject to Value Added Tax ("VAT"). Transactions with the

Manager during the year are disclosed in note 17.

The management fee is chargeable to revenue.

4. Other operating expenses

2020 2019

GBP'000 GBP'000

Directors' fees 55 58

Auditors' remuneration 38 35

Registrar fees 31 26

Depositary fees 68 51

Other expenses 363 236

555 406

Fees payable to the Company's Auditor for the audit

of the Company Financial Statements 38 35

38 35

Other operating expenses include irrecoverable VAT where appropriate.

No non-audit services were provided by Deloitte LLP in the year to 31 July

2020.

5. Finance costs

2020 2019

GBP'000 GBP'000

Charged to revenue 37 37

Charged to capital 1,572 1,020

1,609 1,057

6. Taxation

2020 2019

Revenue Capital Total Revenue Capital GBP Total

GBP'000 GBP'000 GBP'000 GBP'000 '000 GBP'000

Current tax:

Overseas tax not recoverable 59 - 59 48 - 48

59 - 59 48 - 48

The charge for the year can be reconciled to the profit per the Statement of

Comprehensive Income as follows:

Profit/(loss) before tax (1,700) 25,796 24,096 (809) 16,757 15,948

Tax at the UK corporation tax

rate of 19% (2019: 19%) (323) 4,901 4,578 (154) 3,184 3,030

Tax effect of non-taxable

dividends/ unrealised profits - - - (4) - (4)

Income not subject to UK

corporation tax - - - (69) - (69)

Profits on investment

appreciation not taxable - (4,901) (4,901) - (3,378) (3,378)

Unrelieved tax losses and

other deductions arising in 323 - 323 227 194 421

the year

Overseas tax not recoverable 59 - 59 48 - 48

Total tax charge 59 - 59 48 - 48

As at 31 July 2020, the Company had unrelieved capital losses of GBP9,329,000

(2019: GBP10,349,000). There is therefore, a related unrecognised deferred tax

asset of GBP1,772,000 (2019: GBP1,759,000). These capital losses can only be

utilised to the extent that the Company does not qualify as an investment trust

in the future and, as such, the asset has not been recognised.At 31 July 2020,

there was an unrecognised deferred tax asset of GBP1,603,000 (2019: GBP807,000).

This deferred tax asset relates to surplus management expenses. It is unlikely

that the Company will generate sufficient taxable profits in the foreseeable

future to recover these amounts and therefore the asset has not been recognised

in the year, or in prior years.

7. Dividends

2020 2019

Amounts recognised as distributions to equity holders in GBP'000 GBP'000

the period:

Final ordinary dividend for the year ended 31 July 2019 2,609 2,209

of 8.0p (2018: 8.0p) per Share

Interim ordinary dividend for the year ended 31 July 2020 2,370 1,702

of 7.0p (2019: 6.0p) per Share

4,979 3,911

The Directors are proposing a final ordinary dividend of 7.0p for the financial

year 2020. These proposed dividends have been excluded as a liability in these

Financial Statements in accordance with IFRS.

We also set out below the total dividend payable in respect of the financial

year, which is the basis on which the requirements of Section 1158 of the

Corporation Tax Act 2010 are considered.

2020 2019

GBP'000 GBP'000

Interim ordinary dividend for the year ended 31 July 2020 2,370 1,702

of 7.0p

(2019: 6.0p) per Share

Proposed final ordinary dividend for the year ended 31 2,530 2,349

July 2020 of 7.0p (2019: 8.0p) per Share*

4,900 4,051

8. Return per Share

2020 2019

Net Return Weighted Total Net Weighted Total

GBP'000 Average (p) Return Average (p)

Shares GBP'000 Shares

Net revenue return (1,759) 32,160,449 (5.47) (857) 27,061,801 (3.17)

after taxation

Net capital return 25,796 32,160,449 80.21 16,757 27,061,801 61.92

after taxation

Total 24,037 32,160,449 74.74 15,900 27,061,801 58.75

Basic revenue, capital and total return per Share is based on the net revenue,

capital and total return for the period and on the weighted average number of

Shares in issue of 32,160,449 (2019: 27,061,801).

9. Investments at fair value through profit or loss

2020 2019

GBP'000 GBP'000

Investments

Listed investments 137,333 132,023

Unlisted investments - 36

137,333 132,059

2020 2019

Listed Unlisted Total Total

GBP'000 GBP'000 GBP'000 GBP'000

Analysis of investment

portfolio movements

Opening cost at 1 August 78,700 100 78,800 57,133

Opening unrealised

appreciation at 53,323 (64) 53,259 45,071

1 August

Opening fair value at 1 132,023 36 132,059 102,204

August

Movements in the year

Purchases at cost 40,238 100 40,338 57,456

Sales proceeds (65,539) (95) (65,634) (45,000)

Realised profit on sales 15,829 (105) 15,724 9,211

Increase/(decrease) in 14,782 64 14,846 8,188

unrealised appreciation

Closing fair value at 31 137,333 - 137,333 132,059

July

Closing cost at 31 July 69,228 - 69,228 78,800

Closing unrealised -

appreciation at 68,105 68,105 53,259

31 July

Closing fair value at 31 137,333 - 137,333 132,059

July

Fair value hierarchy

Financial assets of the Company are carried in the Statement of Financial

Position at fair value. The fair value is the amount at which the asset could

be sold or the liability transferred in an orderly transaction between market

participants, at the measurement date, other than a forced or liquidation sale.

The Company measures fair values using the following hierarchy that reflects

the significance of the inputs used in making the measurements.

Categorisation within the hierarchy has been determined on the basis of the

lowest level input that is significant to the fair value measurement of the

relevant assets as follows:

* Level 1 - valued using quoted prices unadjusted in an active market.

* Level 2 - valued by reference to valuation techniques using observable

inputs for the asset or liability other than quoted prices included in

Level 1.

* Level 3 - valued by reference to valuation techniques using inputs that are

not based on observable market data for the asset or liability.

The tables below set out fair value measurements of financial instruments as at

the year end, by their category in the fair value hierarchy into which the fair

value measurement is categorised.

Financial assets at fair value through profit or loss at 31 July 2020

Level 1 Level 2 Total

GBP'000 GBP'000 GBP'000

Equity investments 137,333 - 137,333

Derivatives - assets - 29,229 29,229

Total 137,333 29,229 166,562

Financial assets at fair value through profit or loss at 31 July 2019

Level 1 Level 2 Total

GBP'000 GBP'000 GBP'000

Equity investments 132,023 - 132,023

Debentures - 36 36

Derivatives - assets - 8,887 8,887

Total 132,023 8,923 140,946

There have been no transfers during the year between Level 1 and 2 fair value

measurements.

Financial liabilities at 31 July 2020

Level 2 Total

GBP'000 GBP'000

Derivatives - liabilities 24,278 24,278

Financial liabilities at 31 July 2019

Level 2 Total

GBP'000 GBP'000

Derivatives - liabilities 6,512 6,512

Transaction costs

During the year, the Company incurred transaction costs of GBP25,000 (2019: GBP

212,000) on the purchase and disposal of investments.

Analysis of capital gains and losses

2020 2019

GBP'000 GBP'000

Gains on sales investments 15,724 9,211

Investment holding gains 14,846 8,188

Realised losses on derivative instruments (20,424) (4,363)

Unrealised gains on derivative instruments 19,973 3,612

Realised (losses)/ gains on currency balances and (2,751) 1,129

trade settlements

27,368 17,777

Income cost in respect of contracts for (285) (82)

difference

27,083 17,695

10. Trade and other receivables

2020 2019

GBP'000 GBP'000

Dividends receivable 11 19

Due from brokers 4 -

Prepayments 3 118

18 137

2020 2019

GBP'000 GBP'000

Cash and cash equivalents 86,177 32,880

86,177 32,880

11. Cash and cash equivalents

Details of what comprises cash and cash equivalents can be found in note 1.

12. Trade and other payables

2020 2019

GBP'000 GBP'000

Due to Brokers 2,204 253

Accruals 342 217

2,546 470

13. Derivatives

The Company may use a variety of derivative contracts, including equity swaps,

futures, forwards and options under master agreements with the Company's

derivative counterparties to enable it to gain long and short exposure on

individual securities. Derivatives are valued by reference to the underlying

market value of the corresponding security.

The net fair value of derivatives at 31 July 2020 was a positive GBP4,951,000

(2019: positive GBP2,375,000). The corresponding gross exposure on equity swaps

as at 31 July 2020 was GBP128,951,000 (2019: GBP78,314,000). The total exposure of

negative equity swaps was GBP24,448,000 (2019: GBP21,751,000). The net marked to

market futures and options total value as at 31 July 2020 was negative GBP

23,538,000 (2019: negative GBP4,491,000).

2020 2019

GBP'000 GBP'000

Assets

Unrealised derivative assets 29,229 8,887

Current liabilities

Unrealised derivative liabilities 24,278 6,512

The above liabilities are secured against assets held with the Prime Brokers.

The levels of collateral as at 31 July 2020 were:

* Morgan Stanley & Co. International plc GBP116.9m (2019: GBP69.7m)

* JP Morgan Chase & Co. GBP111.1m (2019: GBP97.2m)

The assets listed above are covered by the terms and conditions described by

the Prime Brokerage agreements between the Company and the respective Prime

Brokers above.

14. Share capital

2020 2019

Share capital Number GBP'000 Number GBP'000

('000) ('000)

Shares of 25p each issued and fully

paid