Mondi PLC Trading Update

October 14 2022 - 2:00AM

UK Regulatory

TIDMMNDI

Mondi plc

(Incorporated in England and Wales)

(Registered number: 6209386)

LEI: 213800LOZA69QFDC9N34

LSE share code: MNDI ISIN: GB00B1CRLC47

JSE share code: MNP

14 October 2022

Trading update: Strong Q3 performance

Underlying EBITDA from continuing operations (Group excluding the Russian

operations) for the third quarter was ?450 million, up 55% compared to the

prior year period (Q3 2021: ?290 million). Higher average selling prices and

overall volume growth more than offset significant cost pressures.

Andrew King, Chief Executive Officer, said: "Mondi delivered strongly in the

third quarter. My sincere thanks go to all of my colleagues for their ongoing

agility and commitment in challenging times. We continue to partner with our

customers, helping to lead the way towards a circular economy with our unique

portfolio of innovative and sustainable packaging and paper solutions. We also

remain focused on operational efficiency and cost control.

Our ambitious expansionary capital investment programme is progressing well, as

we continue to invest in our cost advantaged asset base to capture

opportunities in our structurally growing packaging markets, enhance our

competitiveness and deliver sustainably into the future."

Business unit overview

Corrugated Packaging benefitted from higher average selling prices compared to

the prior year period, leveraging our innovative product portfolio and strong

customer proposition. Corrugated Solutions box volumes were lower in the

quarter driven by generally softer demand when compared with the strong volume

growth delivered in the prior year.

Flexible Packaging performed well, with resilient demand during the period.

Price increases across our range of kraft papers and packaging products were

implemented during the quarter, where not fixed by annual or semi-annual

contracts.

Uncoated Fine Paper achieved higher average selling prices and grew pulp

volumes in the quarter while uncoated fine paper volumes were lower. The

non-cash forestry fair value gain was higher.

Input costs

Input costs were significantly higher in the quarter, both year-on-year and

sequentially, largely due to higher wood and energy costs. Increased demand and

tight market conditions for wood continue to impact availability and pricing.

We were able to mitigate the impact of significantly higher European gas and

electricity costs as most of our pulp and paper mills generate the majority of

their energy needs internally, with around 80% of the fuels used in this

process from biomass sources, and only around 10% of our fuel sourced from

natural gas. We look to mitigate the effect of inflationary pressures on the

cost base through our cost control initiatives.

Investing for growth

Our ?1 billion expansionary capital investment programme is progressing well,

and we expect these projects to deliver mid-teen returns when in full

operation.

As part of this programme, we are pleased to have recently approved the

investment in a new 210,000 tonne per annum kraft paper machine at our flagship

Steti mill (Czech Republic) for ?400 million. This cost advantaged machine will

meet the growing demand for sustainable paper-based flexible packaging to

better serve our customers. Start-up is expected in 2025 with full production

ramp up by 2027.

Adding to our pipeline of growth projects, in August 2022 we agreed to acquire

the Duino mill near Trieste (Italy). We plan to convert the existing

lightweight coated mechanical paper machine into a high-quality,

cost-competitive recycled containerboard machine with an annual capacity of

around 420,000 tonnes. The total acquisition and capital investment cost is

estimated at around ?240 million. The mill is ideally located to source paper

for recycling, supply the Group's Corrugated Solutions plants in Central

Europe and Turkey as well as to serve the growing local Italian market. This

project provides an opportunity to grow our packaging business, build on our

integrated platform and broaden our geographic reach. The acquisition is

subject to competition clearance and other closing conditions with completion

expected in the fourth quarter of 2022. The converted machine is expected to

start-up in 2025 and deliver mid-teen returns when in full operation.

We continue to actively consider further investment opportunities to serve our

customers' growing demand for sustainable packaging solutions, improve our

environmental footprint and further improve our cost competitiveness.

Russian operations

Trading update

The Group's Russian operations have been classified as held for sale and

presented as discontinued operations. In the third quarter of 2022, the Russian

operations generated profit after tax of ?104 million (EBITDA of ?129 million).

Update on proposed disposal of Mondi Syktyvkar

On 12 August 2022 we announced that the Group had entered into an agreement to

sell its most significant facility in Russia, Joint Stock Company Mondi

Syktyvkar, together with two affiliated entities (together "Syktyvkar") to

Augment Investments Limited for a consideration of RUB 95 billion (around ?1.5

billion at current exchange rate), payable in cash on completion (the

"Disposal").

The Disposal is conditional on the approval of the Russian Federation's

Government Sub-Commission for the Control of Foreign Investments and customary

antitrust approvals. Furthermore, the planned remittance of the excluded cash

balance of RUB 16 billion by form of dividend to Mondi before completion

requires the approval of the Ministry of Finance of the Russian Federation.

These approvals remain outstanding.

Summary and outlook

While significant geopolitical and macroeconomic uncertainties remain and we

anticipate continued inflationary pressures on our cost base as we enter the

fourth quarter, we are confident that the Group will continue to demonstrate

its resilience and deliver a year of good progress.

The Group remains well-placed to deliver sustainably into the future,

underpinned by our integrated cost advantaged asset base, culture of continuous

improvement, portfolio of sustainable packaging solutions and the strategic

flexibility offered by our unique platform for growth, strong cash generation

and financial position.

Contact details

Investors/analysts

Mike Powell +44 193 282 6322

Mondi Group Chief Financial Officer

Media

Chris Gurney +44 193 282 6358

Mondi Group Senior Communications Manager

Richard Mountain +44 790 968 4466

FTI Consulting

Conference call dial-in details

A conference call will be held today at 08:00 (BST) / 09:00 (CEST/SAST).

To access the facility please register your name and contact details: https://

register.vevent.com/register/BI356338855df84991843961483b13bc38

Replay details

Following the call a replay will be made available until 21 October 2022:

https://edge.media-server.com/mmc/p/r4iybh8a

Notes

This trading update provides an overview of our financial performance since the

half-year ended 30 June 2022. Financial metrics have not been audited or

reviewed by Mondi's external auditors.

Underlying EBITDA is an Alternative Performance Measure that is not defined or

specified according to International Financial Reporting Standards. This

measure is defined as operating profit before special items, depreciation,

amortisation and impairments not recorded as special items.

About Mondi

Mondi is a global leader in packaging and paper, contributing to a better world

by making innovative solutions that are sustainable by design. Our business is

integrated across the value chain - from managing forests and producing pulp,

paper and films, to developing and manufacturing sustainable consumer and

industrial packaging solutions using paper where possible, plastic when useful.

Sustainability is at the centre of our strategy, with our ambitious commitments

to 2030 focused on circular driven solutions, created by empowered people,

taking action on climate.

In 2021, Mondi had revenues of ?7.0 billion and underlying EBITDA of ?1.2

billion from continuing operations, and employed 21,000 people worldwide. Mondi

has a premium listing on the London Stock Exchange (MNDI), where the Group is a

FTSE100 constituent, and also has a secondary listing on the JSE Limited (MNP).

mondigroup.com

Sponsor in South Africa: Merrill Lynch South Africa Proprietary Limited t/a

BofA Securities.

END

(END) Dow Jones Newswires

October 14, 2022 02:00 ET (06:00 GMT)

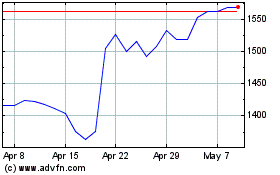

Mondi (LSE:MNDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mondi (LSE:MNDI)

Historical Stock Chart

From Apr 2023 to Apr 2024