TIDMLLOY

RNS Number : 1546Z

Lloyds Banking Group PLC

12 September 2022

News Release

12 September 2022

LLOYDS BANKING GROUP PLC ANNOUNCES A TER OFFER FOR ONE SERIES OF

ITS STERLING DENOMINATED ADDITIONAL TIER 1 SECURITIES

Lloyds Banking Group plc (the "Offeror" or "LBG"), is today

announcing that it is commencing a tender offer (the "Offer") to

purchase for cash any and all of one series of its outstanding

Sterling denominated Additional Tier 1 Securities.

The Offer

The Offer is being made on the terms and subject to the

conditions set out in the Offer to Purchase dated 12 September 2022

(the "Offer to Purchase"). Capitalized terms not otherwise defined

in this announcement have the same meaning as in the Offer to

Purchase.

The Offer consists of offers to purchase for cash any and all of

the outstanding 7.625% Fixed Rate Reset Additional Tier 1 Perpetual

Subordinated Contingent Convertible Securities Callable 2023 of LBG

(the "Securities").

Rationale of the Offer

The Offer is part of LBG's continuous review and management of

its outstanding capital base, maintaining a prudent approach to the

management of LBG's capital position.

The table below sets forth certain information relating to the

Offer:

Principal

First Amount Purchase

Securities ISIN Interest Rate(1) Call Date Outstanding Price (2)

----------------------- ------------ -------------------- ----------- ---------------- ----------

LBG 7.625% Fixed XS1043552188 7.625% to (but June 27, GBP1,059,632,000 GBP1,020

Rate Reset Additional excluding) June 2023 .00

Tier 1 Perpetual 27, 2023. From

Subordinated (and including)

Contingent Convertible June 27, 2023,

Securities Callable the Reset Reference

2023 Rate plus 5.287%

per annum.

(1) "Reset Reference Rate" means in respect of the relevant

Reset Period, (i) the applicable annual mid-swap rate for swap

transactions in pounds sterling (with a maturity equal to 5 years)

where the floating leg pays daily compounded SONIA annually and

calculated and published by ICE Benchmark Administration Limited on

the relevant Reset Determination Date and displayed at 11.15 a.m.

(London time) on the relevant Reset Determination Date on such

Bloomberg or Reuters page (the "Screen Page") or, as the case may

be, on such other information service that may replace Bloomberg or

Reuters, in each case, as may be nominated by ICE Benchmark

Administration Limited; or (ii) if such rate is not displayed on

the Screen Page at such time and date (other than in certain

specified circumstances), the relevant Reset Reference Bank Rate.

All capitalized terms are used as defined in the Trust Deed dated

April 1, 2014 between LBG and BNY Mellon Corporate Trustee Services

Limited as supplemented.

(2) Per GBP1,000 in principal amount of Securities accepted for

purchase. The Securities can only be tendered in minimum

denominations of GBP200,000 and integral multiples of GBP1,000

thereafter.

Offer Consideration

For each GBP1,000 of the Securities validly tendered and

accepted for purchase pursuant to the Offer (subject to the minimum

denomination), holders of the Securities will be eligible to

receive a cash purchase price of GBP1,020.00 (the "Purchase

Price"). In addition to the Purchase Price, holders whose

Securities are accepted for purchase will also receive accrued and

unpaid interest on such Securities (rounded to the nearest GBP0.01,

with GBP0.005 being rounded upwards) from the last interest payment

date up to, but not including, the Settlement Date (as defined

herein) (the "Accrued Interest"). Accrued interest will be

calculated from September 27, 2022.

Offer Conditions

The consummation of the Offer is not conditioned upon any

minimum amount of Securities being tendered and not subject to a

financing condition. However, the Offer is subject to, and

conditioned upon, the satisfaction or waiver of certain conditions

described in the Offer to Purchase.

Withdrawal Rights

Validly tendered Securities may be withdrawn at any time prior

to the Expiration Deadline.

Offer Period

The Offer commenced today and will expire at 11:59 p.m., New

York City time, on 7 October 2022, unless extended, re-opened or

earlier terminated as provided in the Offer to Purchase. Assuming

that the conditions to the Offer are satisfied or waived, LBG

expects that the Settlement Date will be 13 October 2022.

The relevant deadline set by the relevant Clearing System or any

intermediary for the submission of Tender Instructions may be

earlier than the deadlines set out herein.

Indicative Timetable

The following table sets out the expected dates and times of the

key events relating to the Offer. This is an indicative timetable

and is subject to change.

Events Dates and Times

------------------------------------- ----------------------------------

Commencement of the Offer

Offer announced. Offer to Purchase 12 September 2022

made available to holders of

Securities.

Withdrawal Deadline

The deadline for holders to 11:59 p.m., New York City time,

validly withdraw tenders of on 7 October 2022

Securities.

Expiration Deadline

The deadline for receipt of 11:59 p.m., New York City time,

all Tender Instructions. on 7 October 2022

Announcement of Offer Results

Announcement of the aggregate As soon as reasonably practicable

principal amounts of the Securities on 11 October 2022

which the Offeror will be accepting

for purchase.

Settlement Date

Settlement Date of the Offer, Expected on 13 October 2022

including payment of the Purchase

Price and any Accrued Interest

in respect of Securities validly

tendered and accepted for purchase

in the Offer.

The times and dates above are subject, where applicable, to the

right of LBG to extend, re-open, amend, limit, terminate or

withdraw the Offer, subject to applicable law. Accordingly, the

actual timetable may differ significantly from the expected

timetable set out above.

Holders should confirm with any bank, securities broker or other

intermediary through which they hold Securities whether such

intermediary needs to receive instructions from a holder before the

deadlines specified in the Offer to Purchase in order for that

holder to be able to participate in, or (in the circumstances in

which withdrawal is permitted) withdraw their instruction to

participate in, the Offer.

Further Information

Requests for copies of the Offer to Purchase and information in

relation to the procedures for tendering should be directed to:

Tender Agent

Kroll Issuer Services Limited Email: lbg@is.kroll.com

The Shard Telephone: +44 207 704 0880

32 London Bridge Street, SE1 9SG

London, United Kingdom

Dealer Managers

Lloyds Securities Inc. Tel: +1 (212) 827-3145

Email: lbcmliabilitymanagement@lloydsbanking.com

Attn: Liability Management Group

UBS AG London Branch Tel: +1 888 719 4210 (U.S. Toll Free)

Tel: +1 203 719 4210 (U.S.)

Tel: +44 20 7568 1121 (Europe)

Email: ol-liabilitymanagement-eu@ubs.com

Attn: Liability Management Group

Disclaimer

This announcement and the Offer to Purchase (including the

documents incorporated by reference therein) contain important

information which should be read carefully before any decision is

made with respect to the Offer. If you are in any doubt as to the

contents of this announcement or the Offer to Purchase or the

action you should take, you are recommended to seek your own

financial and legal advice, including as to any tax consequences,

immediately from your stockbroker, bank manager, solicitor,

accountant or other independent financial or legal adviser. Any

individual or company whose Securities are held on its behalf by a

broker, dealer, bank, custodian, trust company or other nominee or

intermediary must contact such entity if it wishes to participate

in the Offer. None of the Offeror, the Dealer Managers or the

Tender Agent makes any recommendation as to whether holders should

tender Securities pursuant to the Offer.

ADDITIONAL INFORMATION IN RESPECT OF THE OFFER AND WHERE TO FIND

IT

The Offeror will file with the Securities and Exchange

Commission (the "SEC") a tender offer statement on Schedule TO,

accompanied by the Offer to Purchase and related documents relating

to the Offer. Holders are advised to read carefully the tender

offer statement, the Offer to Purchase and other documents which

the Offeror will file with the SEC, when they become available, as

they will contain important information about the Offer and

procedures for participating in the Offer. Copies of these

documents will be available for free by visiting EDGAR on the SEC

website at www.sec.gov. In addition, copies of the Schedule TO and

the documents filed with it may be obtained free of charge by

contacting the Group at 25 Gresham Street, London EC2V 7HN,

England.

Offer restrictions

This announcement or the Offer to Purchase do not constitute an

offer or an invitation to participate in the Offer in any

jurisdiction in or from which, or to any person to whom, it is

unlawful to make the relevant offer or invitation under applicable

laws. The distribution or communication of this announcement or the

Offer to Purchase in certain jurisdictions may be restricted by

law. Persons into whose possession this announcement or the Offer

to Purchase comes are required by each of the Offeror, the Dealer

Managers and the Tender Agent to inform themselves about, and to

observe, any such restrictions.

United Kingdom

The communication of this announcement, the Offer to Purchase

and any other documents or materials relating to the Offer is not

being made, and such documents and/or materials have not been

approved, by an authorized person for the purposes of section 21 of

the FSMA. Accordingly, such documents and/or materials are not

being distributed to, and must not be passed on to, the general

public in the United Kingdom. The communication of such documents

and/or materials is exempt from the restriction on financial

promotions under section 21 of the FSMA on the basis that it is

only directed at and may be communicated to (1) those persons who

are existing members or creditors of the Group or other persons

within Article 43(2) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, and (2) any other persons to whom

these documents and/or materials may lawfully be communicated.

France

This announcement, the Offer to Purchase and any other documents

or offering materials relating to the Offer may not be distributed

in the Republic of France except to qualified investors

(investisseurs qualifiés) as defined in Article 2(e) of the

Prospectus Regulation. This announcement and Offer to Purchase have

not been and will not be submitted for clearance to the Autorité

des marchés financiers.

Republic of Italy

None of the Offer, the Offer to Purchase, this announcement or

any other documents or materials relating to the Offer have been or

will be submitted to the clearance procedure of the CONSOB pursuant

to Italian laws and regulations.

The Offer is being carried out in the Republic of Italy as an

exempted offer pursuant to article 101-bis, paragraph 3-bis of the

Legislative Decree No. 58 of 24 February 1998, as amended (the

"Financial Services Act") and article 35-bis, paragraph 4 of CONSOB

Regulation No. 11971 of 14 May 1999, as amended.

A holder located in the Republic of Italy can tender some or all

of its Securities through authorised persons (such as investment

firms, banks or financial intermediaries permitted to conduct such

activities in the Republic of Italy in accordance with the

Financial Services Act, CONSOB Regulation No. 20307 of 15 February

2018, as amended from time to time, and Legislative Decree No. 385

of 1 September 1993, as amended) and in compliance with applicable

laws and regulations or with requirements imposed by CONSOB or any

other Italian authority.

Each intermediary must comply with the applicable laws and

regulations concerning information duties vis-à-vis its clients in

connection with the Securities or the Offer.

Canada

The Offer and any solicitation in respect thereof, are not being

made, directly or indirectly, in Canada or to holders of the

Securities who are resident and/or located in any province or

territory of Canada. This announcement and Offer to Purchase have

not been filed with any securities commission or similar regulatory

authority in Canada in connection with the Offer, and the

Securities have not been, and will not be, qualified for tender

under the securities laws of Canada or any province or territory

thereof and no securities commission or similar regulatory

authority in Canada has reviewed or in any way passed upon this

announcement or the Offer to Purchase, any other documents or

materials relating to the Offer and any representation to the

contrary is an offence. Accordingly, Canadian holders of the

Securities are hereby notified that, to the extent such holders of

Securities are persons or entities resident and/or located in

Canada, the Offer is not available to them and they may not accept

the Offer. As such, any tenders of Securities received from such

persons or entities shall be ineffective and void. Copies of this

announcement or the Offer to Purchase or of any other document

relating to the Offer be distributed or made available in Canada.

This announcement, the Offer to Purchase and any other documents or

offering materials relating to the Offer may not be distributed in

Canada and this announcement or the Offer to Purchase do not

constitute an offer or an invitation to participate in the Offer to

any person resident in Canada.

General

The Offer does not constitute an offer to buy or the

solicitation of an offer to sell Securities in any circumstances in

which such offer or solicitation is unlawful. In those

jurisdictions where the securities or other laws require the Offer

to be made by a licensed broker or dealer or registered dealer and

the Dealer Manager or, where the context so requires, any of its

affiliates is such a licensed broker or dealer or registered dealer

in that jurisdiction, the Offer shall be deemed to be made on

behalf of the Offeror by such Dealer Manager or affiliate (as the

case may be) in such jurisdiction.

The Offeror and its affiliates expressly reserve the right at

any time or from time to time following completion or termination

of the Offer (subject to Rule 13e-4(f) under the Exchange Act which

prohibits us and our affiliates from purchasing any Securities

other than in the Offer until at least ten business days after the

Expiration Date), to purchase or exchange or offer to purchase or

exchange Securities or to issue an invitation to submit offers to

sell Securities (including, without limitation, those tendered

pursuant to the Offer but not accepted for purchase) through open

market purchases, privately negotiated transactions, tender offers,

exchange offers or otherwise, in each case on terms that may be

more or less favorable than those contemplated by the Offer.

FORWARD-LOOKING STATEMENTS

This announcement contains certain forward-looking statements

within the meaning of Section 21E of the US Securities Exchange Act

of 1934, as amended, and section 27A of the US Securities Act of

1933, as amended, with respect to Lloyds Banking Group plc together

with its subsidiaries (the "Group") and its current goals and

expectations. Statements that are not historical or current facts,

including statements about the Group's or its directors' and/or

management's beliefs and expectations, are forward looking

statements. Words such as, without limitation, 'believes',

'achieves', 'anticipates', 'estimates', 'expects', 'targets',

'should', 'intends', 'aims', 'projects', 'plans', 'potential',

'will', 'would', 'could', 'considered', 'likely', 'may', 'seek',

'estimate', 'probability', 'goal', 'objective', 'deliver',

'endeavour', 'prospects', 'optimistic' and similar expressions or

variations on these expressions are intended to identify forward

looking statements. These statements concern or may affect future

matters, including but not limited to: projections or expectations

of the Group's future financial position, including profit

attributable to shareholders, provisions, economic profit,

dividends, capital structure, portfolios, net interest margin,

capital ratios, liquidity, risk-weighted assets (RWAs),

expenditures or any other financial items or ratios; litigation,

regulatory and governmental investigations; the Group's future

financial performance; the level and extent of future impairments

and write-downs; the Group's ESG targets and/or commitments;

statements of plans, objectives or goals of the Group or its

management and other statements that are not historical fact;

expectations about the impact of COVID-19; and statements of

assumptions underlying such statements. By their nature, forward

looking statements involve risk and uncertainty because they relate

to events and depend upon circumstances that will or may occur in

the future. Factors that could cause actual business, strategy,

plans and/or results (including but not limited to the payment of

dividends) to differ materially from forward looking statements

include, but are not limited to: general economic and business

conditions in the UK and internationally; market related risks,

trends and developments; risks concerning borrower and counterparty

credit quality; fluctuations in interest rates, inflation, exchange

rates, stock markets and currencies; volatility in credit markets;

volatility in the price of the Group's securities; any impact of

the transition from IBORs to alternative reference rates; the

ability to access sufficient sources of capital, liquidity and

funding when required; changes to the Group's credit ratings; the

ability to derive cost savings and other benefits including, but

without limitation, as a result of any acquisitions, disposals and

other strategic transactions; inability to capture accurately the

expected value from acquisitions; potential changes in dividend

policy; the ability to achieve strategic objectives; insurance

risks; management and monitoring of conduct risk; exposure to

counterparty risk; credit rating risk; tightening of monetary

policy in jurisdictions in which the Group operates; instability in

the global financial markets, including within the Eurozone, and as

a result of ongoing uncertainty following the exit by the UK from

the European Union (EU) and the effects of the EU-UK Trade and

Cooperation Agreement; political instability including as a result

of any UK general election and any further possible referendum on

Scottish independence; operational risks; conduct risk;

technological changes and risks to the security of IT and

operational infrastructure, systems, data and information resulting

from increased threat of cyber and other attacks; natural pandemic

(including but not limited to the COVID-19 pandemic) and other

disasters; inadequate or failed internal or external processes

or systems; acts of hostility or terrorism and responses to those

acts, or other such events; geopolitical unpredictability; the war

between Russia and Ukraine; risks relating to sustainability and

climate change (and achieving climate change ambitions), including

the Group's ability along with the government and other

stakeholders to measure, manage and mitigate the impacts of climate

change effectively; changes in laws, regulations, practices and

accounting standards or taxation; changes to regulatory capital or

liquidity requirements and similar contingencies; assessment

related to resolution planning requirements; the policies and

actions of governmental or regulatory authorities or courts

together with any resulting impact on the future structure of the

Group; failure to comply with anti-money laundering, counter

terrorist financing, anti-bribery and sanctions regulations;

failure to prevent or detect any illegal or improper activities;

projected employee numbers and key person risk; increased labour

costs; assumptions and estimates that form the basis of the Group's

financial statements; the impact of competitive conditions; and

exposure to legal, regulatory or competition proceedings,

investigations or complaints. A number of these influences and

factors are beyond the Group's control. Please refer to the latest

Annual Report on Form 20-F filed by Lloyds Banking Group plc with

the US Securities and Exchange Commission (the SEC), which is

available on the SEC's website at www.sec.gov , for a discussion of

certain factors and risks. Lloyds Banking Group plc may also make

or disclose written and/or oral forward-looking statements in other

written materials and in oral statements made by the directors,

officers or employees of Lloyds Banking Group plc to third parties,

including financial analysts. Except as required by any applicable

law or regulation, the forward-looking statements contained in this

document are made as of today's date, and the Group expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward looking statements contained in

this document whether as a result of new information, future events

or otherwise. The information, statements and opinions contained in

this document do not constitute a public offer under any applicable

law or an offer to sell any securities or financial instruments or

any advice or recommendation with respect to such securities or

financial instruments.

Further Information

This announcement contains inside information in relation to the

Securities and is disclosed in accordance with the Market Abuse

Regulation (EU) 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 ("UK MAR"). For

the purposes of UK MAR and Article 2 of the binding technical

standards published by the Financial Conduct Authority in relation

to UK MAR as regards Commission Implementing Regulation (EU)

2016/1055, this announcement is made by Douglas Radcliffe, Group

Investor Relations Director.

For further information please contact:

Group Corporate Treasury:

Liz Padley

Non Bank Entities Treasurer & Head of Capital and Recovery

and Resolution

Telephone: +44 (0)20 7158 1737

Email: Claire-Elizabeth.Padley@LloydsBanking.com

Investor Relations:

Douglas Radcliffe

Group Investor Relations Director

Telephone: +44 (0)20 7356 1571

Email: Douglas.Radcliffe@LloydsBanking.com

Corporate Affairs:

Matthew Smith

Head of Media Relations

Tel: +44 (0)20 7356 3522

Email: matt.smith@lloydsbanking.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ISEGPUUWBUPPGCP

(END) Dow Jones Newswires

September 12, 2022 10:34 ET (14:34 GMT)

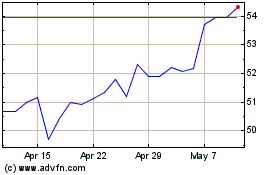

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024