TIDM94WP TIDMLLOY

RNS Number : 5024L

Lloyds Bank PLC

30 April 2020

Lloyds Bank plc

Q1 2020 Interim Management Statement

30 April 2020

REVIEW OF PERFORMANCE

Income statement

During the three months to 31 March 2020, the Group recorded a

profit before tax of GBP404 million compared with a profit before

tax in the three months to 31 March 2019 of GBP1,420 million, a

decrease of GBP1,016 million which was largely driven by a

significantly increased impairment charge due to changes to the

Group's economic outlook as a result of the coronavirus

pandemic.

Total income decreased by GBP172 million, or 4 per cent, to

GBP3,902 million in the three months to 31 March 2020 compared with

GBP4,074 million in the three months to 31 March 2019; there was a

GBP166 million decrease in net interest income coupled with a small

decrease of GBP6 million in other income.

Net interest income was GBP2,885 million in the three months to

31 March 2020, a decrease of GBP166 million, or 5 per cent,

compared to GBP3,051 million in the three months to 31 March 2019.

The net interest margin reduced as a result of continued pressure

from competitive asset markets and reduced liability spreads; and

average interest-earning assets reduced with growth in the open

mortgage book and targeted segments, including UK motor finance,

more than offset by lower balances in the closed mortgage book and

the effects of the Commercial Banking portfolio optimisation.

Other income was GBP6 million, or 1 per cent, lower at GBP1,017

million in the three months to 31 March 2020 compared to GBP1,023

million in the three months to 31 March 2019.

Operating expenses decreased by GBP192 million, or 8 per cent,

to GBP2,187 million in the three months to 31 March 2020 compared

to GBP2,379 million in the three months to 31 March 2019. There was

a GBP39 million decrease in regulatory provisions and a GBP153

million decrease in other operating expenses. Other operating

expenses were lower, despite continued strategic investment and

absorbing some emerging expenses related to the Group's response to

the coronavirus outbreak, as a result of the Group's continued cost

discipline and efficiencies gained through digitalisation and other

process improvements; the decrease also reflects a lower level of

restructuring costs.

No further provision has been taken for payment protection

insurance (PPI). Good progress has been made with the review of PPI

information requests received and the conversion rate remains low

and consistent with the provision assumption of around 10 per cent,

although operations have been impacted by the coronavirus pandemic

in recent weeks. The unutilised provision at 31 March 2020 was

GBP1,014 million.

The Group's impairment charge increased by GBP1,036 million to

GBP1,311 million in the three months to 31 March 2020 compared to

GBP275 million in the three months to 31 March 2019, with the

increase primarily driven by updates to the Group's economic

outlook following the coronavirus outbreak resulting in a charge of

GBP774 million and coronavirus impacts on existing restructuring

cases leading to an additional charge of GBP172 million. Underlying

credit quality remains robust, however increased charges will

inevitably arise from existing and new lending. Although market

dynamics are challenging a number of sectors and corporate

customers within the Commercial book, particularly within the

Business Support Unit, the corporate portfolio's diverse client

base and limits are being proactively managed and have relatively

low exposure to the most vulnerable sectors affected by the

coronavirus outbreak. The Group's management of concentration risk

includes single name and country limits as well as controls over

the Group's overall exposure to certain higher risk and vulnerable

sectors and asset classes.

The Group's outlook and IFRS 9 base case economic scenario used

to calculate expected credit loss (ECL) allowance has been updated

since the 2019 year end through post model adjustments. Reflecting

these post model adjustments, which take into account the Group's

best estimate of the impact of the coronavirus outbreak on the

Group's customer and client base, has resulted in an additional

impairment charge of GBP774 million in the quarter. The Group's ECL

allowance continues to reflect a probability-weighted view of

future economic scenarios including a 30 per cent weighting of base

case, upside and downside and a 10 per cent weighting of severe

downside, although all scenarios have deteriorated significantly

since the 2019 year end.

REVIEW OF PERFORMANCE (continued)

Significant uncertainty remains. Although the existing book and

new lending, including Government supported lending, will

inevitably experience losses, partially offset by applicable

Government guarantees, the extent of the impairment charge will

depend on the severity and the duration of the economic shock

experienced in the UK.

There was a tax credit of GBP396 million in the three months to

31 March 2020 compared to a charge of GBP435 million in the three

months to 31 March 2019 reflecting the reduced profit before tax in

2020 and a credit of GBP447 million arising on remeasurement of the

Group's deferred tax balances following the UK government's

decision to maintain the corporation tax rate at 19 per cent on 1

April 2020, which was substantively enacted on 17 March 2020.

Profit for the period, after tax, was GBP800 million compared to

GBP985 million in the three months to 31 March 2019.

Balance sheet and capital

The Group is committed to supporting its customers in financial

distress and with increased liquidity needs during the coronavirus

pandemic and continues to optimise funding and target current

account balance growth as well as accessing wholesale funding

markets across currencies and investors to maintain a stable and

diverse source of funds.

Total assets were GBP30,705 million, or 5 per cent, higher at

GBP612,073 million at 31 March 2020 compared to GBP581,368 million

at 31 December 2019. Cash and balances at central banks were

GBP19,374 million higher at GBP58,254 million reflecting the

increased liquidity needs. Financial assets at amortised cost

increased by GBP715 million to GBP487,216 million at 31 March 2020

compared to GBP486,501 million at 31 December 2019 as increased

corporate lending, primarily drawdowns of existing facilities, was

partially offset by expected reductions in the mortgage book along

with reductions in credit cards, where customer activity reduced in

March. Derivative balances were GBP3,689 million higher at

GBP12,183 million compared to GBP8,494 million at 31 December 2019,

this increase reflects movements in both interest rates and

exchange rates, particularly the US dollar, over the quarter. Other

assets were GBP4,614 million higher at GBP25,206 million compared

to GBP20,592 million at 31 December 2019 mainly due to a GBP4,723

million increase in retirement benefit assets as credit spreads

widened; since the period end the net surplus has reduced as credit

spreads have started to narrow.

Total liabilities were GBP25,621 million, or 5 per cent, higher

at GBP568,090 million compared to GBP542,469 million at 31 December

2019. Deposits from banks were GBP12,563 million higher at

GBP36,156 million as the Group drew down on available funding

facilities and customer deposits were GBP13,132 million, or 3 per

cent, higher at GBP409,971 million compared to GBP396,839 million

at 31 December 2019, as a result of growth in retail current

accounts and commercial deposits.

Total equity increased by GBP5,084 million, or 13 per cent, from

GBP38,899 million at 31 December 2019 to GBP43,983 million at 31

March 2020, mainly due to profit for the period and a positive

remeasurement of the Group's post-retirement defined benefit

schemes as credit spreads widened significantly in the quarter.

The Group's common equity tier 1 capital ratio reduced to 14.1

per cent(1) from 14.3 per cent at 31 December 2019, primarily as a

result of an increase in risk-weighted assets. The tier 1 capital

ratio reduced to 17.9 per cent(1) from 18.3 per cent at 31 December

2019 and the total capital ratio reduced to 21.7 per cent(1) from

22.1 per cent at 31 December 2019.

Risk-weighted assets increased by GBP3.7 billion, or 2 per cent,

to GBP175.6 billion at 31 March 2020, compared to GBP171.9 billion

at 31 December 2019 largely as a result of the full implementation

of the new securitisation framework, resulting in an increase of

GBP2.1 billion; increases of approximately GBP0.4 billion in

counterparty credit risk and credit valuation adjustments; and

retail, an increase of approximately GBP1.0 billion. Optimisation

activity undertaken in Commercial Banking prior to the coronavirus

pandemic has been largely offset by drawdowns by corporate

customers towards the end of the quarter.

The Group's UK leverage ratio remains at 5.1 per cent(1) .

Incorporating profits for the period that remain subject to formal

(1) verification in accordance with the Capital Requirements Regulation.

CONDENSED CONSOLIDATED INCOME Three Three

STATEMENT (UNAUDITED) months months

ended ended

31 March 31 March

2020 2019

GBPmillion GBPmillion

Net interest income 2,885 3,051

Other income 1,017 1,023

----------------------------------- ----------------------------------

Total income 3,902 4,074

Total operating expenses (2,187) (2,379)

----------------------------------- ----------------------------------

Trading surplus 1,715 1,695

Impairment (1,311) (275)

----------------------------------- ----------------------------------

Profit before tax 404 1,420

Taxation 396 (435)

----------------------------------- ----------------------------------

Profit for the period 800 985

----------------------------------- ----------------------------------

Profit attributable to ordinary

shareholders 685 906

Profit attributable to other equity

holders 104 69

----------------------------------- ----------------------------------

Profit attributable to equity holders 789 975

Profit attributable to non-controlling

interests 11 10

----------------------------------- ----------------------------------

Profit for the period 800 985

----------------------------------- ----------------------------------

CONDENSED CONSOLIDATED BALANCE SHEET At 31 March At 31 Dec

2020 2019

GBPmillion GBPmillion

(unaudited) (audited)

Assets

Cash and balances at central banks 58,254 38,880

Financial assets at fair value through profit

or loss 2,406 2,284

Derivative financial instruments 12,183 8,494

Financial assets at amortised cost 487,216 486,501

Financial assets at fair value through other

comprehensive income 26,808 24,617

Other assets 25,206 20,592

----------- ------------

Total assets 612,073 581,368

----------- ------------

Liabilities

Deposits from banks 36,156 23,593

Customer deposits 409,971 396,839

Deposits from fellow Lloyds Banking Group undertakings 6,207 4,893

Financial liabilities at fair value through profit

or loss 7,341 7,702

Derivative financial instruments 10,348 9,831

Debt securities in issue 75,425 76,431

Subordinated liabilities 12,222 12,586

Other liabilities 10,420 10,594

----------- -----------

Total liabilities 568,090 542,469

Shareholders' equity 38,663 33,973

Other equity interests 5,248 4,865

Non-controlling interests 72 61

----------- -----------

Total equity 43,983 38,899

----------- -----------

Total equity and liabilities 612,073 581,368

----------- -----------

ADDITIONAL FINANCIAL INFORMATION

Basis of presentation

This release covers the results of Lloyds Bank plc (the Bank)

together with its subsidiaries (the Group) for the three months

ended 31 March 2020.

Accounting policies

The accounting policies are consistent with those applied by the

Group in its 2019 Annual Report and Accounts.

Capital

The Group's Q1 2020 Interim Pillar 3 Report can be found at

www.lloydsbankinggroup.com/investors/financial-performance/

economic assumptions

The key UK economic assumptions made by the Group, averaged over

a five-year period, used to calibrate the impairment overlay in the

first quarter are shown below:

Severe

Base case Upside Downside downside

% % % %

At 31 March 2020

GDP 0.9 1.2 0.4 (0.1)

Interest rate 0.24 0.88 0.08 0.02

Unemployment rate 5.0 4.7 6.5 7.6

House price growth 1.4 4.7 (3.7) (8.8)

Commercial real estate price growth (0.3) 1.0 (4.8) (7.2)

At 31 December 2019

GDP 1.3 1.6 1.1 0.4

Interest rate 1.25 2.04 0.49 0.11

Unemployment rate 4.3 3.9 5.8 7.2

House price growth 1.3 5.0 (2.6) (7.1)

Commercial real estate price growth (0.2) 1.8 (3.8) (7.1)

ADDITIONAL FINANCIAL INFORMATION (continued)

Economic assumptions (continued)

Scenarios by year

2020 2021 2022 2020-22

% % % %

Base Case

GDP (5.0) 3.0 3.5 1.2

Interest rate 0.10 0.25 0.25 0.20

Unemployment rate 5.9 5.4 4.7 5.3

House price growth (5.0) 2.0 2.5 (0.7)

Commercial real estate

price growth (15.0) 5.0 5.0 (6.3)

Upside

GDP (5.0) 3.8 3.7 2.2

Interest rate 0.26 1.03 1.08 0.79

Unemployment rate 5.9 5.0 4.3 5.0

House price growth (2.2) 6.8 6.8 11.6

Commercial real estate

price growth (11.9) 8.9 6.0 1.7

Downside

GDP (6.5) 1.8 3.6 (1.4)

Interest rate 0.00 0.03 0.06 0.03

Unemployment rate 6.3 6.7 6.4 6.5

House price growth (7.6) (4.1) (5.3) (16.1)

Commercial real estate

price growth (26.6) (3.3) 2.1 (27.5)

Severe downside

GDP (7.8) (0.1) 3.1 (5.1)

Interest rate 0.00 0.00 0.00 0.00

Unemployment rate 6.7 8.0 8.0 7.6

House price growth (10.0) (10.9) (12.9) (30.2)

Commercial real estate

price growth (39.2) (5.7) 3.8 (40.5)

ADDITIONAL FINANCIAL INFORMATION (continued)

Lending within Commercial Banking to key coronavirus-impacted

sectors(1)

Drawn Undrawn

GBPbn GBPbn

Retail non-food 2.5 1.0

Automotive dealerships 2.3 1.3

Oil and gas 1.3 1.7

Construction 1.2 1.5

Hotels 1.8 0.3

Passenger transport 1.2 0.5

Leisure 0.8 0.5

Restaurants and bars 0.7 0.3

Lending classified using ONS SIC codes at legal entity level.

(1)

FORWARD LOOKING STATEMENTS

This document contains certain forward looking statements within

the meaning of Section 21E of the US Securities Exchange Act of

1934, as amended, and section 27A of the US Securities Act of 1933,

as amended, with respect to the business, strategy, plans and/or

results of Lloyds Bank plc together with its subsidiaries (the

Lloyds Bank Group) and its current goals and expectations relating

to its future financial condition and performance. Statements that

are not historical facts, including statements about the Lloyds

Bank Group's or its directors' and/or management's beliefs and

expectations, are forward looking statements. Words such as

'believes', 'anticipates', 'estimates', 'expects', 'intends',

'aims', 'potential', 'will', 'would', 'could', 'considered',

'likely', 'estimate' and variations of these words and similar

future or conditional expressions are intended to identify forward

looking statements but are not the exclusive means of identifying

such statements. Examples of such forward looking statements

include, but are not limited to: projections or expectations of the

Lloyds Bank Group's future financial position including profit

attributable to shareholders, provisions, economic profit,

dividends, capital structure, portfolios, net interest margin,

capital ratios, liquidity, risk-weighted assets (RWAs),

expenditures or any other financial items or ratios; litigation,

regulatory and governmental investigations; the Lloyds Bank Group's

future financial performance; the level and extent of future

impairments and write-downs; statements of plans, objectives or

goals of the Lloyds Bank Group or its management including in

respect of statements about the future business and economic

environments in the UK and elsewhere including, but not limited to,

future trends in interest rates, foreign exchange rates, credit and

equity market levels and demographic developments; statements about

competition, regulation, disposals and consolidation or

technological developments in the financial services industry; and

statements of assumptions underlying such statements. By their

nature, forward looking statements involve risk and uncertainty

because they relate to events and depend upon circumstances that

will or may occur in the future. Factors that could cause actual

business, strategy, plans and/or results (including but not limited

to the payment of dividends) to differ materially from forward

looking statements made by the Lloyds Bank Group or on its behalf

include, but are not limited to: general economic and business

conditions in the UK and internationally; market related trends and

developments; fluctuations in interest rates, inflation, exchange

rates, stock markets and currencies; any impact of the transition

from IBORs to alternative reference rates; the ability to access

sufficient sources of capital, liquidity and funding when required;

changes to the Lloyds Bank Group's or Lloyds Banking Group plc's

credit ratings; the ability to derive cost savings and other

benefits including, but without limitation as a result of any

acquisitions, disposals and other strategic transactions; the

ability to achieve strategic objectives; changing customer

behaviour including consumer spending, saving and borrowing habits;

changes to borrower or counterparty credit quality; concentration

of financial exposure; management and monitoring of conduct risk;

instability in the global financial markets, including Eurozone

instability, instability as a result of uncertainty surrounding the

exit by the UK from the European Union (EU) and as a result of such

exit and the potential for other countries to exit the EU or the

Eurozone and the impact of any sovereign credit rating downgrade or

other sovereign financial issues; political instability including

as a result of any UK general election; technological changes and

risks to the security of IT and operational infrastructure,

systems, data and information resulting from increased threat of

cyber and other attacks; natural, pandemic (including but not

limited to the coronavirus disease (COVID-19) outbreak) and other

disasters, adverse weather and similar contingencies outside the

Lloyds Bank Group's or Lloyds Banking Group plc's control;

inadequate or failed internal or external processes or systems;

acts of war, other acts of hostility, terrorist acts and responses

to those acts, geopolitical, pandemic or other such events; risks

relating to climate change; changes in laws, regulations, practices

and accounting standards or taxation, including as a result of the

exit by the UK from the EU, or a further possible referendum on

Scottish independence; changes to regulatory capital or liquidity

requirements and similar contingencies outside the Lloyds Bank

Group's or Lloyds Banking Group plc's control; the policies,

decisions and actions of governmental or regulatory authorities or

courts in the UK, the EU, the US or elsewhere including the

implementation and interpretation of key legislation and regulation

together with any resulting impact on the future structure of the

Lloyds Bank Group; the ability to attract and retain senior

management and other employees and meet its diversity objectives;

actions or omissions by the Lloyds Bank Group's directors,

management or employees including industrial action; changes to the

Lloyds Bank Group's post-retirement defined benefit scheme

obligations; the extent of any future impairment charges or

write-downs caused by, but not limited to, depressed asset

valuations, market disruptions and illiquid markets; the value and

effectiveness of any credit protection purchased by the Lloyds Bank

Group; the inability to hedge certain risks economically; the

adequacy of loss reserves; the actions of competitors, including

non-bank financial services, lending companies and digital

innovators and disruptive technologies; and exposure to regulatory

or competition scrutiny, legal, regulatory or competition

proceedings, investigations or complaints. Please refer to the

latest Annual Report on Form 20-F filed by Lloyds Bank plc with the

US Securities and Exchange Commission for a discussion of certain

factors and risks together with examples of forward looking

statements. Lloyds Banking Group may also make or disclose written

and/or oral forward looking statements in reports filed with or

furnished to the US Securities and Exchange Commission, Lloyds

Banking Group annual reviews, half-year announcements, proxy

statements, offering circulars, prospectuses, press releases and

other written materials and in oral statements made by the

directors, officers or employees of Lloyds Banking Group to third

parties, including financial analysts. Except as required by any

applicable law or regulation, the forward looking statements

contained in this document are made as of today's date, and the

Lloyds Bank Group expressly disclaims any obligation or undertaking

to release publicly any updates or revisions to any forward looking

statements contained in this document to reflect any change in the

Lloyds Bank Group's expectations with regard thereto or any change

in events, conditions or circumstances on which any such statement

is based. The information, statements and opinions contained in

this document do not constitute a public offer under any applicable

law or an offer to sell any securities or financial instruments or

any advice or recommendation with respect to such securities or

financial instruments.

CONTACTS

For further information please contact:

INVESTORS AND ANALYSTS

Douglas Radcliffe

Group Investor Relations Director

020 7356 1571

douglas.radcliffe@lloydsbanking.com

Edward Sands

Director of Investor Relations

020 7356 1585

edward.sands@lloydsbanking.com

Nora Thoden

Director of Investor Relations - ESG

020 7356 2334

nora.thoden@lloydsbanking.com

CORPORATE AFFAIRS

Grant Ringshaw

Director of Media Relations

020 7356 2362

grant.ringshaw@lloydsbanking.com

Matt Smith

Head of Corporate Media

020 7356 3522

matt.smith@lloydsbanking.com

Copies of this interim management statement may be obtained

from:

Investor Relations, Lloyds Banking Group plc, 25 Gresham Street,

London EC2V 7HN

The statement can also be found on the Group's website -

www.lloydsbankinggroup.com

Registered office: Lloyds Bank plc, 25 Gresham Street, London

EC2V 7HN

Registered in England no. 2065

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

QRFSDMFSSESSEDL

(END) Dow Jones Newswires

April 30, 2020 07:01 ET (11:01 GMT)

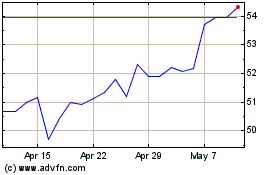

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024