Lloyds Cuts Executive Remuneration, Pension, Bonus Policies in Fairness Effort

February 20 2020 - 11:10AM

Dow Jones News

By Sabela Ojea

Lloyds Banking Group PLC announced Thursday that it has updated

its executive remuneration, pension and bonus policies to make it

fair, consistent and appropriately rewarding.

The U.K.'s largest retail bank said that this measure--taken by

the remuneration committee--would translate to a 8% cut in Chief

Executive Antonio Horta-Osorio's fixed pay, as well as a 29%

reduction to his maximum total remuneration opportunity.

"Remuneration should be designed in a manner that is clear for

all stakeholders and reflects their expectations," Chairman Lord

Blackwell said.

In terms of the pension scheme, the FTSE 100 lender said that

the maximum amount executive directors can receive has been reduced

to 15% of their salary.

Furthermore, the bank said the additional payment protection

insurance charges significantly impacted its statutory results and

has therefore decreased its total group performance share

factors--or bonus--by 33% to 310.1 million pounds ($402.1

million).

Lloyds reported Thursday a pretax profit of GBP1.45 billion for

the three months ended Dec. 31, 2019 compared with GBP1.03 billion

for the same period a year earlier.

For the whole year, the bank posted a pretax profit of GBP4.39

billion down from 5.96 billion in 2018--a profit drop that came

after booking GBP2.45 billion in PPI charges and a GBP1.4 billion

tax expense in the year, Lloyds said.

The bank's share buyback program remains suspended.

Shares at 1515 GMT were up 2.5% at 57.16 pence.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

February 20, 2020 10:55 ET (15:55 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

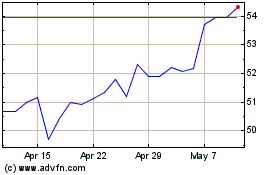

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024