Lloyds 4Q Pretax Profit Rose But Missed Full-Year Expectations

February 20 2020 - 2:57AM

Dow Jones News

By Sabela Ojea

Lloyds Banking Group PLC reported Thursday a rise in pretax

profit for the fourth quarter of 2019 but it undershot consensus

expectations for the year overall.

The British lender made a pretax profit of 1.45 billion pounds

($1.88 billion) for the three months ended Dec. 31 compared with

GBP1.03 billion for the same period a year earlier.

For the whole year, the FTSE 100 bank posted a pretax profit of

GBP4.39 billion, down from 5.96 billion in 2018. This compares with

analysts' expectations of GBP4.51 billion.

The profit drop came after booking GBP2.45 billion in payment

protection insurance charges and a GBP1.4 billion tax expense in

the year, Lloyds said.

Underlying pretax profit came to GBP7.53 billion from GBP8.07

billion in 2018. This was below expectations of GBP7.85 billion,

taken from FactSet and based on eleven analysts' estimates.

"Underlying performance was resilient, reflecting the health of

our customer franchise and the strength of the business model,"

Chief Executive Officer Antonio Horta-Osorio said.

Lloyds' common equity Tier 1 capital ratio--a measure of a

bank's financial strength--stood at 13.8% from 13.9% at the end of

the previous year, while its return on tangible equity for the

quarter was 11.0%, down from 11.7%. The bank said it expects a RoTE

of 12% to 13% for 2020.

The board declared a final dividend of 3.37 pence a share, up

from 3.21 pence a share in 2018.

"Although uncertainty remains given the ongoing negotiation of

international trade agreements, there is now a clearer sense of

direction and some signs of an improving outlook," CEO Mr.

Horta-Osorio said.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

February 20, 2020 02:42 ET (07:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

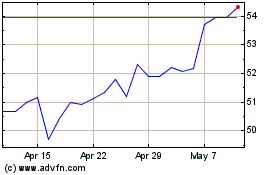

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024