TIDMKINO

RNS Number : 5366K

Kinovo PLC

06 May 2022

6 May 2022

Kinovo plc

("Kinovo" or the "Company")

Year-End Trading Update

Kinovo Plc (AIM: KINO), the specialist property services Group

that delivers compliance and sustainability solutions, provides the

following trading update for the year ending 31 March 2022.

Trading and Financial Position

In the 12 month period to 31 March 2022 the Company performed

well following a year of Covid-related disruption, winning new

contracts and revenue streams under its three strategic pillars of

Regulation, Regeneration and Renewables. This performance has been

achieved despite challenges posed by supply chain disruptions and

labour availability. Kinovo has continued to build on its strong

client relationships, adding new workstreams under existing

contracts due to our track record of delivering excellence in both

quality and service.

Revenues, for Continuing operations, during the period increased

by 36% to GBP53.5 million (2021: GBP39.4 million), while Adjusted

EBITDA (after the effect of a charge for lease payments) rose by

100% to GBP4.2 million (2021: GBP2.1 million).

Net debt fell to GBP0.3 million at 31 March 2022 (31 March 2021:

GBP2.7 million) including cash balances of GBP2.5 million (31 March

2021: GBP1.3 million).

As mentioned above, the Company won a number of new contracts

during the period. The total potential value attributed from new

business won during the year could rise to GBP43.8 million over the

life of these contracts.

Update on the disposal of DCB Kent Limited ("DCB")

On 12 January 2022, Kinovo announced the sale of DCB, the

Company's non-core construction business (the "Disposal") which was

categorised under "Discontinued activities" in the Half Year

Results, as published on 7 December 2021.

The Disposal was undertaken to allow the Company to harmonise

operations and increase the focus on its three strategic pillars:

Regulation, Regeneration and Renewables. These pillars are centred

on compliance driven, regulatory-led specialist services that offer

long-term contracts, recurring revenue streams and strong cash

generation.

Consideration to be received by Kinovo from the Disposal was

dependent on the future financial performance of DCB.

Under the terms of the Disposal agreement with the purchasers,

the Company agreed to provide a working capital facility to support

DCB in completing active projects. The Directors assumed at the

time of entering into the Disposal agreement the overall net

outflow of cash to support DCB would be minimal, with the initial

working capital support necessary to optimise the potential

deferred consideration.

The Company has been notified that DCB has experienced delays in

completing active projects and has not secured new project work to

the levels anticipated at the time of the Disposal and has

therefore had to provide unanticipated working capital support to

date of GBP3.7 million, and the Directors expect this to increase

in the short term, absent any additional investment into DCB.

This additional support was provided due to a lack of new

business receipts, ongoing challenges and delays in the period. As

part of our obligation under the terms of the Disposal, the Company

provided parent company guarantees which run through to practical

completion on each of the construction projects that were in

existence at the time of the Disposal. It was, however, anticipated

that the purchaser would make all reasonable endeavours to transfer

these parent company guarantees post-disposal.

During the year, discontinued activities traded at a loss of

GBP0.5 million. In addition, the pre-tax loss on the disposal of

DCB for the Company is expected to be around GBP5.0 million, which

will be taken as a non-underlying exceptional charge. This includes

an impairment of GBP2.3 million of intangible assets relating to

goodwill and customer relationships.

The Company as at 30 April 2022, had net cash of GBP0.4 million

(30 September 2021: GBP1.7m net debt), which includes the impact of

the working capital support to DCB. The Company has debt facilities

of GBP5.0 million in place with HSBC UK Bank plc. This debt

facility is structured as a GBP2.5 million term loan, repayable by

September 2022, and a GBP2.5 million overdraft facility. The

Company expects to meet financial covenants at the next test, being

the year ended 31 March 2022..

There remains significant uncertainty around the amount of

further support required to be provided to DCB under the parent

company guarantees, and a number of claims and recoveries are being

pursued by Kinovo. The Company is currently reviewing its legal

position in relation to recoverability of funds provided by way of

the working capital support to DCB. A further announcement updating

shareholders will be made as and when appropriate.

David Bullen, Chief Executive Officer of Kinovo plc,

commented:

"I am pleased to announce this year-end trading update, with

Kinovo's underlying continuing businesses performing well,

notwithstanding difficult market conditions. Kinovo is winning new

business at a strong rate, and continues to add new revenue streams

from existing clients.

Whilst we have incurred a loss on the disposal of DCB, it

streamlines our operations and allows us to focus on our core

activities of compliance and regulatory work.

Kinovo continues to focus on long-term partnerships and

relationships, and currently over 90% of revenue can be attributed

to recurring contracts."

Enquiries

Kinovo plc

Sangita Shah, Chairman +44 (0)20 7796 4133

David Bullen, Chief Executive Officer (via Hudson Sandler)

Canaccord Genuity Limited (Nominated Adviser

and Sole Broker) +44 (0)20 7523 8000

Corporate Broking:

Bobbie Hilliam

Andrew Potts

Georgina McCooke

Sales:

Jonathan Barr

Hudson Sandler (Financial PR) +44 (0)20 7796 4133

Dan de Belder

Harry Griffiths

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSSMFUIEESEFI

(END) Dow Jones Newswires

May 06, 2022 02:00 ET (06:00 GMT)

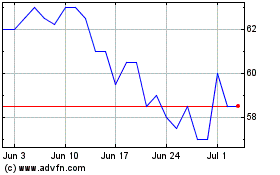

Kinovo (LSE:KINO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kinovo (LSE:KINO)

Historical Stock Chart

From Apr 2023 to Apr 2024