Kibo Energy PLC Mast Energy Developments Plc Admission to Trading (3416V)

April 14 2021 - 2:00AM

UK Regulatory

TIDMKIBO

RNS Number : 3416V

Kibo Energy PLC

14 April 2021

Kibo Energy PLC (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE Limited: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

("Kibo" or "the Company")

Dated: 14 April 2021

Mast Energy Developments Plc - Admission to Trading

Kibo Energy PLC ('Kibo' or the 'Company'), the multi-asset,

Africa focused, energy company, is pleased to announce that the

ordinary shares of MAST Energy Developments Plc ("MED"), in which

Kibo holds a 55.42% interest, will today commence trading on the

Official List for listed securities of the London Stock Exchange

plc ('LSE') under the ticker MAST ('Admission').

More information on MED and access to the MED-prospectus is

available on the MED-website at https://med.energy/ and

https://med.energy/wp-content/uploads/2021/03/MAST-prospectus-IPO.pdf

respectively.

Louis Coetzee, CEO of Kibo Energy, commented:

"I am delighted with the strong support that MED has received

from key institutions and retail investors, which has valued this

business at GBP23 million on Admission. As MED's majority

shareholder, with an interest of 55.42%, this crystallises the

value of this component of our company and also provides us with

significant upside to the UK flexible energy industry. We believe

that MED is entering a period of high impact news flow and we look

forward to updating the market on this in due course."

MED Overview

As part of the Admission process MED has raised GBP5.54 million

through a placing of 47,150,000 Ordinary Shares (representing 25%

of MED issued share capital on Admission) at 12.5 pence per

Ordinary Share to institutional and retail investors, with a market

capitalisation of circa GBP23 million on Admission. On Admission,

MED will have 188,564,036 Ordinary Shares in issue.

MED was established to acquire and develop a portfolio of

flexible power plants in the UK and become a multi-asset operator

in the rapidly growing Reserve Power market; this is critical for

the renewable energy market, which needs natural gas as a back-up

source of energy given renewable supply can be intermittent.

To this end, MED has an initial portfolio of small-scale power

generation assets, which, on listing, will be in a position to

develop at scale and pace, as opposed to a project-by-project

basis, and will advance rapidly towards significant revenue

generation. On listing, MED expects to have c.9 MW in immediate

production capacity, c.20 MW in production capacity within the

first six months from listing, and another c.20 MW in production

capacity over the next six months. Various other "shovel ready"

sites have already been identified in the UK.

**ENDS**

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014.

For further information please visit www.kibo.energy or

contact:

Louis Coetzee info@kibo.energy Kibo Energy CEO

PLC

Andreas Lianos +357 99 53 1107 River Group JSE Corporate and Designated

Adviser

---------------------------- ------------------- -----------------------------

Claire Noyce +44 (0) 20 3764 Hybridan LLP Broker

2341

---------------------------- ------------------- -----------------------------

Bhavesh Patel +44 20 3440 6800 RFC Ambrian NOMAD on AIM

/ Stephen Limited

Allen

---------------------------- ------------------- -----------------------------

Isabel de info@stbridespartners.co.uk St Brides Partners Financial PR

Salis / Charlie Ltd

Hollinshead

---------------------------- ------------------- -----------------------------

Notes

Kibo Energy PLC is a multi-asset, Africa focused, energy company

positioned to address the acute power deficit, which is one of the

primary impediments to economic development in Sub-Saharan Africa.

To this end, it is the Company's objective to become a leading

independent power producer in the region.

Kibo is simultaneously developing three similar coal-fuelled

power projects: the Mbeya Coal to Power Project ('MCPP') in

Tanzania; the Mabesekwa Coal Independent Power Project ('MCIPP') in

Botswana; and the Benga Independent Power Project ('BIPP') in

Mozambique. By developing these projects in parallel, the Company

intends to leverage considerable economies of scale and timing in

respect of strategic partnerships, procurement, equipment, human

capital, execution capability / capacity and project finance.

Johannesburg

14 April 2021

Corporate and Designated Adviser

River Group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCXXLFFFZLZBBX

(END) Dow Jones Newswires

April 14, 2021 02:00 ET (06:00 GMT)

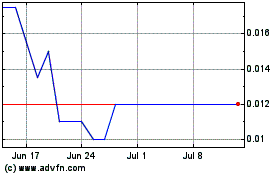

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Apr 2023 to Apr 2024