TIDMKGF

RNS Number : 6132M

Kingfisher PLC

12 May 2020

Kingfisher plc

Company update

12 May 2020: Kingfisher plc ('Company', 'Group' or 'Kingfisher')

is today providing its Q1 20/21 sales, and an update on how it is

managing the impact of COVID-19 on its business.

Key points

-- Q1 20/21 sales of GBP2.2 billion, down 24.0% in constant currency; LFL(1) down 24.8%.

- Trading up to 14 March continued the positive trends seen in

Q4 19/20, reflecting operational improvements in France and the

implementation of a new trading approach across the Group,

including reintroducing trading events.

- Balance of quarter saw significant impact from COVID-related disruption.

-- Committed to colleague and customer safety, our obligations

as a responsible employer, and support for communities and

governments during the COVID-19 pandemic.

-- Quickly adapted operating model driving:

- Strong e-commerce growth (up to fourfold growth since mid-March),

- Phased reopening of stores in the UK and France in the second half of April, and

- Improving relative sales trend (Group LFL sales moved from

(74.0)% in first week of April to +2.7% in first week of May).

-- Effective actions taken to reduce costs and preserve cash.

-- Sufficient liquidity headroom against assumption of prolonged

period of reduced sales, based on current cash balance(2) of

c.GBP700 million.

-- Additional liquidity arrangements provide further security,

over and above existing cash balance:

- Eligibility confirmed for Bank of England's Covid Corporate Financing Facility.

- EUR600 million (c.GBP525 million) term facility, guaranteed by

the French State, arranged with three French banks.

- Additional Revolving Credit Facility for GBP250 million agreed.

-- As at 8 May 2020, the Company had access to over GBP2 billion in total liquidity

-- Continuing to follow the FCA's recommendations regarding publication of FY 19/20 results.

Unaudited Q1 20/21 sales (three months ended 30 April 2020)

Sales % Total % Total % LFL

2020/21 Change Change Change

------------------------- --------- --------- ------------------ ------------------

GBPm Reported Constant currency Constant currency

UK & Ireland 1,095 (14.7)% (14.7)% (16.0)%

- B&Q 663 (22.1)% (22.1)% (21.8)%

- Screwfix 432 (0.1)% (0.1)% (4.7)%

France 596 (41.5)% (42.0)% (41.5)%

- Castorama 300 (43.6)% (44.0)% (43.6)%

- Brico Dépôt 296 (39.3)% (39.8)% (39.2)%

Other International 464 (12.8)% (11.2)% (13.6)%

- Poland 320 (7.8)% (6.0)% (9.6)%

- Romania(3) 43 10.6% 11.2% 2.3%

- Iberia(4) 43 (46.8)% (47.2)% (47.2)%

- Russia(3) 58 (7.6)% (2.9)% 4.4%

Total Group 2,155 (24.0)% (24.0)% (24.8)%

------------------------- --------- --------- ------------------ ------------------

Thierry Garnier, Chief Executive Officer, said:

"Since the COVID-19 crisis started, our priorities have been

clear - to provide support to the communities we serve, to fulfil

our obligations to colleagues as a responsible employer, to our

customers as a retailer of essential goods, and to protect our

business for the long term.

"Having initially closed our stores in France and the UK, we

have rapidly adapted how we operate to meet the essential needs of

our customers safely during lockdown. We started by transforming

our operations to meet a material increase in online transactions

through our click & collect and home delivery services. We

reconfigured our retail space and processes, allowing a phased and

safe reopening of stores whilst preserving the social distancing

and other health & safety protocols that are likely to be with

us for some time. In addition, we have donated over GBP1 million of

PPE to frontline health workers, with more on the way.

"We have also taken significant actions throughout the business

to reduce costs and protect cash, in part supported by governments.

Our current cash balance provides us with sufficient financial

headroom based on assumptions of a prolonged period of reduced

sales. Over and above this we have put in place some further

liquidity arrangements, including support from the UK and French

governments, which give us additional security in case of even more

severe scenarios. Overall, the operational and financial actions we

have taken give us a sound footing in the current crisis and

beyond.

"It has been inspiring and humbling for all of us to see how

Kingfisher's teams have risen to meet these significant challenges.

We have adapted to government guidelines, listened to colleague and

customer feedback, and made major changes to our operating model in

a matter of days. These challenging times have underscored both the

agility of our teams and the importance to customers of our

offering, which gives me a lot of confidence for the future."

Supporting our communities and governments

Kingfisher reaffirms its commitment to supporting communities

and governments in managing the COVID-19 pandemic. As a responsible

retailer we are focused on making sure that we can continue to

serve our customers' essential needs as effectively as possible,

while protecting the safety of all concerned.

As part of this commitment, in March we ringfenced all remaining

stock of personal protective equipment (PPE) and donated it to

frontline healthcare workers. Total committed donations to our

communities and health authorities amount to over GBP1 million so

far. Additional PPE continues to be ordered and as a priority is

being donated to health authorities in the countries in which we

operate as well as being used to equip our colleagues.

Update on Kingfisher's operational status

Social distancing and safety measures

Based on government advice and learnings from the operating

protocols set by Castorama in Poland and major food retailers

across Europe, all reopened Kingfisher stores are operating with

strict social distancing and safety measures. The measures put in

place to protect customers and colleagues include:

-- The provision of gloves, visors and masks to colleagues

-- Limiting the number of customers in store

-- Safe queuing before entering the store

-- Sanitiser stations throughout the store

-- Floor navigational markers to help enforce social distancing

-- Perspex screens at checkouts

-- Contactless or card payments only(5)

Similar measures are also in place at our distribution and

fulfilment centres, and training has been provided to colleagues to

help support and implement these changes to their work

environment.

In most cases, the measures applied have gone beyond government

recommendations in each market. Furthermore, we have set up formal

and regular internal audits of the application of health, hygiene

and safety rules. To date these measures have been met with strong

approval by both customers and colleagues and we will continue to

both monitor and improve the effectiveness of these on a day-to-day

basis.

Operational status by market

Following our previous update on 23 March 2020, over 95% of our

stores are currently either open and/or offering a contactless

click & collect service:

Stores

Number of stores open Stores offering contactless click & collect only

----------------------- ------------------ ------ ------------------------------------------------

B&Q 289 288 -

Screwfix 683 - 683

----------------------- ------------------ ------ ------------------------------------------------

United Kingdom 972 288 683

----------------------- ------------------ ------ ------------------------------------------------

Republic of Ireland 13 - -

----------------------- ------------------ ------ ------------------------------------------------

Castorama 99 99 -

Brico Dépôt 121 121 -

----------------------- ------------------ ------ ------------------------------------------------

France 220 220 -

Poland 81 81 -

Romania 35 35 -

Spain 28 - -

Portugal 3 3 -

----------------------- ------------------ ------ ------------------------------------------------

Iberia 31 3 -

Russia 18 4 14

----------------------- ------------------ ------ ------------------------------------------------

Total 1,370 631 697

The current status in each of our markets is as follows:

-- United Kingdom:

- On 23 March the UK government ordered the closure of all shops selling 'non-essential' goods.

- Hardware shops have been categorised as 'essential', and

therefore B&Q and Screwfix are eligible to remain open.

- Despite this, from 23 March, we took the decision to close all

B&Q and Screwfix stores to customers for browsing and in-store

purchasing while we established the safe store operating protocols

described above.

- To ensure the continued supply of essential goods, from 24

March we progressively introduced a contactless click & collect

service for our B&Q and Screwfix customers, alongside a home

delivery service.

- On 17 April we trialled the reopening of 14 B&Q stores,

listening to feedback from our store colleagues and adapting our

approach as a result. Following the success of this trial we

progressively reopened further B&Q stores (288, to date).

- For all 683 Screwfix stores, we continue successfully to offer

a contactless click & collect service under similarly strict

social distancing and safety measures.

-- Republic of Ireland:

- Since 28 March, all stores in Ireland (eight B&Q and five

Screwfix) have been closed following the Irish government's

lockdown restrictions, which apply until 18 May.

- Hardware shops were categorised as 'online only', and therefore not eligible to remain open.

- The government announced plans on 1 May to ease lockdown

restrictions. We are actively monitoring our position with regards

to potential store reopenings.

- In the meantime, Screwfix is offering a home delivery service from its stores.

-- France:

- On 14 March the French government ordered the closure of all

shops selling 'non-essential' goods during the confinement period,

which ended on 11 May.

- Kingfisher's 220 stores in France were categorised as

'essential', and therefore were eligible to remain open during this

period.

- To establish safe store operating protocols, from 15 March all

stores were closed to customers for browsing and in-store

purchasing. A contactless click & collect service via

'drive-through' was gradually introduced from 23 March, alongside a

home delivery service.

- Home delivery from stores commenced during the third week of April.

- Following consultation with trade union representatives in

stores and head offices, from 24 April we started to reopen

Castorama and Brico Dépôt stores in phases, with a 'self-service'

range only and under the strict social distancing and safety

measures described above.

- As of 11 May, all 99 Castorama stores and 121 Brico Dépôt

stores have reopened, under the same strict measures.

-- Poland:

- All 81 stores in Poland remain open, operating with strict

social distancing and safety measures.

- Contactless click & collect and home delivery services remain available.

- In addition to the existing Sunday trading ban, all stores in

Poland were temporarily required to close on Saturdays. This

restriction was lifted on 4 May.

-- Romania:

- All 35 stores in Romania remain open, operating under strict

social distancing and safety measures.

-- Iberia:

- All 28 stores in Spain remain closed following the

government's declaration of a state of emergency on 14 March.

Stores could reopen from late May, in line with the government's

plan to ease lockdown restrictions as announced on 28 April.

- A home delivery service in Spain was made available in late

March, and a click & collect service for tradespeople was

launched in late April.

- Our three stores in Portugal remain open, operating under

strict social distancing and safety measures.

-- Russia:

- 14 out of 18 stores are closed for browsing and in-store

purchasing, with one store open and three partly reopened.

- A contactless click & collect service is available in 14

stores and 'click & delivery' is available from all stores.

Trading since 1 February 2020

Q1 20/21 LFL sales by month

Q1 20/21 sales % LFL(1) Change

-------------------------------

(unaudited) Feb 2020 Mar 2020 Apr 2020

-------------------------------- --------- --------- ---------

UK & Ireland +6.2% (5.7)% (43.0)%

France +8.6% (52.0)% (69.0)%

Poland +11.1% (13.7)% (20.4)%

Romania(3) +16.4% +15.9% (15.0)%

Total Group(6) incl. leap year +7.6% (24.6)% (49.6)%

-------------------------------- --------- --------- ---------

Total Group(6) excl. leap year +2.3%

-------------------------------- --------- --------- ---------

E-commerce sales(7) +30.2% +59.0% +251.7%

March, April and May to-date LFL sales by week

Sales: 4 weeks % LFL(1) Change

to

28 March 2020

----------------------------------------------------------------------

(unaudited) Mar 2020 week Mar 2020 week Mar 2020 week Mar 2020 week

1(8) 2(8) 3(8) 4(8)

---------------- ---------------- ---------------- ---------------- ----------------

UK & Ireland +2.1% +8.6% +37.8% (42.2)%

France (0.2)% +5.6% (97.7)% (93.3)%

Poland +3.6% +3.7% (21.7)% (23.7)%

Romania +9.1% (1.3)% (4.8)% (47.1)%

Total Group(6) +1.5% +6.4% (22.9)% (59.1)%

---------------- ---------------- ---------------- ---------------- ----------------

E-commerce

sales(7) +28.4% +23.9% +49.5% +96.2%

Sales: 6 weeks % LFL(1) Change

to

9 May 2020

-------------------------------------------------------------------

(unaudited) Apr 2020 Apr 2020 Apr 2020 Apr 2020 Apr 2020 May 2020

week week week week 4(8) week 5(8) week 1(8)

1(8) 2(8) 3(8)

----------------- --------- --------- --------- ---------- ---------- ------------

UK & Ireland (70.3)% (56.1)% (60.8)% (23.9)% (1.6)% +18.9%

France (86.8)% (83.3)% (77.0)% (63.1)% (35.2)% (18.7)%

Poland (52.0)% (38.9)% (42.1)% +14.5% (8.8)% +35.8%

Romania (48.6)% (28.4)% (27.9)% (5.3)% +42.4% +16.0%

Total Group(6) (74.0)% (64.8)% (64.6)% (35.6)% (17.5)% +2.7%

----------------- --------- --------- --------- ---------- ---------- ------------

E-commerce

sales(7) +159.7% +277.9% +273.6% +307.0% +186.7% +199.0%

Up to 14 March (pre-coronavirus lockdown measures)

As previously announced, trading from 1 February up to 14 March

(before any COVID-related store closures) continued the positive

trends we saw in Q4 19/20, benefiting from operational improvements

in France and a new trading approach across the Group, including

local trading events.

In February 2020, Group LFL sales growth was +7.6%, or +2.3%

excluding the leap year impact. In France, we performed slightly

better than the market(9) in February.

In the first two weeks of March (up to and including 14 March)

Group LFL sales continued to be positive, with growth across all

businesses within our core markets, strongly supported by

e-commerce sales.

Weekly trading since 14 March

In the third week of March, the UK continued to see positive LFL

sales growth, France was severely impacted by the closure of all

its stores and Poland experienced lower footfall and sales. The

fourth week of March was impacted by UK store closures following

the government's announcement on 23 March, together with lower

footfall in Romania.

The first week of April reflected the first full week of store

closures in both the UK and France, although we saw an increasing

contribution from e-commerce sales in France. The trend improved in

the second and third weeks of April as e-commerce sales increased

week-on-week in the UK and France. Furthermore, in France we

started to reopen some of our stores' Building & Joinery

external courtyards in the third week of April.

The fourth week of April reflected a significant improvement in

the UK at both B&Q and Screwfix, largely due to increasing

demand via contactless click & collect, and the reopening of

some B&Q stores towards the end of the week. In addition, the

trend in France improved as we opened more of our stores' Building

& Joinery external courtyards. Poland experienced growth as

lockdown measures started to be eased.

In the final week of April and first week of May, the Group LFL

sales trend continued to improve due to phased store reopenings in

the UK and France (as noted in the 'Operational status by market'

above). Sales growth in the first week of May was largely driven by

exceptional demand at B&Q and Castorama Poland.

Actions to reduce costs and preserve cash

Kingfisher continues to monitor closely the financial impact of

COVID-19 and take mitigating actions. It has implemented multiple

actions to reduce costs and preserve cash, including the benefit

from several government support measures:

-- Furloughing: Kingfisher welcomed the announcement of the

Coronavirus Job Retention Scheme (CJRS) in the UK, 'activité

partielle' relief measures in France, and similar schemes in Spain

and Romania. The Group is supportive of each of these government's

measures and, since mid-March 2020, gradually announced furlough

programmes to colleagues in the UK, France, Spain and Romania. This

initially led to c.50% of our total Group colleagues being

furloughed, although this figure is reducing significantly as we

reopen stores in the UK and France.

-- UK business rates: The UK government announced in March that

retail premises in England will be granted a 'holiday' from paying

business rates in the 2020/21 tax year. Kingfisher's annual

business rates bill for retail premises in England is c.GBP120

million. Similar measures (a combination of payment deferrals and

'holidays') have been announced by the local governments and

assemblies of Scotland, Wales and Northern Ireland, where in

aggregate our annual business rates bill for retail premises is

c.GBP20 million.

-- Store operating efficiencies: In conjunction with our

furlough programmes and the operational requirements of our stores,

other measures have been put in place to reduce store variable

costs, including reducing non-essential store maintenance costs and

optimising store opening hours.

-- Discretionary costs: Discretionary P&L spend has been

significantly reduced, including marketing, advertising,

consumables and other GNFR spend, stopping all travel, and freezing

all pay reviews and full-time staff recruitment.

-- Inventory purchases: Beyond the corresponding reductions from

lower sales, we have adjusted our purchasing plans in response to

the significant changes in operational requirements across our

Group. We continue to monitor trends in demand closely, working

with suppliers to reduce product purchasing in certain categories,

and increase stock in others.

-- Capital expenditure: All non-committed development capital

expenditure (for example, IT and new stores) has been stopped and

repairs and maintenance capital expenditure has been reduced to

essential items. Obligatory contractual, legal or health and safety

expenditures continue.

-- Dividend: As announced on 23 March 2020, in light of the

unprecedented uncertainty caused by COVID-19, the Board will not

propose a final dividend in relation to FY 19/20. The Board intends

to consider the appropriateness, quantum and timing of future

dividend payments when it has a clearer view of the scale and

duration of the impact of COVID-19 on the business. The cash cost

of last year's final dividend was GBP157 million.

-- Rental payments: We remain in active discussions with

landlords in all our markets and have seen a positive and

constructive response. In the UK and France, we have moved a

significant proportion of our quarterly-in-advance rental payments

to monthly payments.

-- Deferral of indirect taxation (VAT) payments: The UK

government announced in March that all UK VAT-registered businesses

have the option to defer any VAT payments due between 20 March 2020

and 30 June 2020. Payments must be made on or before 31 March

2021.

-- Deferral of tax and social security payments in France: The

French government has permitted the deferral of corporate income

tax in March, along with social security payments for April.

-- Other working capital optimisation measures: We are taking

other steps to optimise working capital in the short term,

including mutual agreements with certain larger suppliers to extend

payment terms by 30 days or more. Notwithstanding this, we have

maintained our policy to pay all suppliers in full and according to

contractual payment terms.

Board and Group Executive team remuneration

In recognition of the impact of the above measures on the

Company's stakeholders and, at the request of the Board and Group

Executive team, in March the Company's Remuneration Committee

applied the following discretionary measures regarding executive

remuneration:

-- The entire Board and Group Executive team has voluntarily

offered to temporarily forego 20% of their base salaries or Board

fees.

-- The Group CEO and Group CFO will receive no annual FY 19/20 bonus payment.

Cash and liquidity update

Cash position

As at 31 January 2020, the Company had cash and cash equivalents

of GBP195 million. Kingfisher drew down on its two Revolving Credit

Facilities (RCFs) totalling GBP775 million on 17 March 2020. The

RCFs expire in March 2022 (GBP225 million) and August 2022 (GBP550

million).

As at 8 May 2020, the Company had cash at bank(2) of c.GBP700

million.

Since the start of FY 20/21, over a 14-week period, the

Company's net cash outflow (10) was c.GBP250 million. This reflects

lower sales over the last eight weeks, along with significant

payments to suppliers during this period for orders made prior to

the coronavirus crisis (in anticipation of the Company's usual peak

trading period).

Given: (i) adjustments made to the Company's forward purchasing

plans, (ii) the impact of the actions detailed above to reduce

costs and preserve cash, and (iii) the reopening of stores in the

UK and France, the Company anticipates that it will be able to

recover the cash outflows of the past weeks over the course of the

year, assuming a gradual recovery of sales levels.

Liquidity headroom

The Company has sufficient liquidity headroom with its current

cash balance to cover a prolonged period of reduced sales, based on

the expected impact of lockdown restrictions and the gradual

recovery of sales thereafter.

To further protect the Company against extended lockdown

measures and deeper periods of disruption than currently planned

for, the Company has secured access to additional funding

arrangements.

The Company has received confirmation of its eligibility for the

Bank of England's Covid Corporate Financing Facility (CCFF).

In addition, the Company has arranged a EUR600 million (c.GBP525

million) term facility with three French banks in support of its

operations in France. The loan is guaranteed at 80% by the French

State ('Prêt garanti par l'État') and will have a maturity of one

year, extendable for up to five years. Under the terms of the loan,

the full amount must be drawn down shortly after confirmation of

the guarantee by the French State.

Finally, the Company has agreed an additional RCF of GBP250

million with a syndicate of its relationship banks. This facility

is currently undrawn, and expires in May 2021.

These funding arrangements are not anticipated to be used under

our current planning assumptions (notwithstanding the requirement

to draw down on the Prêt garanti par l'État as noted above). They

do however provide the Company with significant additional

liquidity headroom. As at 8 May 2020, the Company had access to

over GBP2 billion in total liquidity, including cash at bank and

eligibility to access funding under the CCFF, Prêt garanti par

l'État and the additional RCF.

Update on publication of FY 2019/20 preliminary financial

statements

As announced on 23 March 2020, the Company complied with the

Financial Conduct Authority's (FCA) strong request to all listed

companies to delay the publication of preliminary financial

statements for at least two weeks.

The Company notes the FCA's subsequent statement on 26 March

2020, announcing temporary relief measures for corporate reporting

during the coronavirus crisis. This temporary relief permits listed

companies an extra two months (six months in total) from their

financial year-end in which to publish audited financial

statements. The FCA furthermore strongly recommends that listed

companies review all elements of their timetables for publication

of financial information in order to make appropriate use of the

time available within regulatory deadlines to ensure accurate and

carefully prepared disclosures.

The Company confirms that it will continue to follow the FCA's

recommendations. During this rapidly changing period of

uncertainty, the additional time will give the Company the

opportunity to assess the day-to-day changes in events within our

markets, gather further information on the expected duration of the

measures that governments are taking to contain the crisis, and

review and refine its planning assumptions accordingly.

Footnotes

(1) Like-for-like sales growth representing the constant

currency, year on year sales growth for stores that have been open

for more than a year. Stores temporarily closed or otherwise

impacted due to COVID-19 are also included.

(2) Represents cash at bank excluding physical cash in tills and

cash in transit.

(3) Kingfisher's subsidiaries in Romania and Russia prepare

their financial statements to 31 December. Their Q1 results

presented are for January to March, with monthly results also

presented one month in arrears. The weekly results presented have

no corresponding delay.

(4) Brico Dépôt Spain & Portugal.

(5) Notwithstanding the legal obligation in some markets to

accept cash as payment.

(6) Total Group including Iberia and Russia. Excludes Koçta ,

Kingfisher's 50% JV in Turkey.

(7) E-commerce sales are sales derived from online transactions,

including click & collect. This includes sales transacted on

any device, however not sales through a call centre. E-commerce

sales change includes UK & Ireland, France and Poland, and the

benefit from the leap year.

(8) March, April and May weekly sales figures are for

Sunday-to-Saturday weeks from 1 March 2020 (compared against prior

year Sunday-to-Saturday weeks from 3 March 2019). The figures are

provisional, and exclude certain non-cash accounting adjustments

relating to revenue recognition.

(9) Based on Banque de France data for DIY retail sales

(non-seasonally adjusted).

(10) Represents net change in cash at bank excluding physical

cash in tills and cash in transit, excluding drawdown on RCFs.

Information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain. This announcement is being released on behalf of

Kingfisher by Paul Moore, Company Secretary.

Contacts

Tel: Email:

Investor Relations +44 (0) 20 7644 1082 investorenquiries@kingfisher.com

Media Relations +44 (0) 20 7644 1030 corpcomms@kingfisher.com

Teneo +44 (0) 20 7420 3184 Kfteam@teneo.com

About Kingfisher plc

Kingfisher plc is an international home improvement company with

over 1,350 stores in nine countries across Europe. We operate under

retail brands including B&Q, Castorama, Brico Dépôt, Screwfix

and Koçta , supported by a team of over 76,000 colleagues. We offer

home improvement products and services to consumers and trade

professionals who shop in our stores and via our e-commerce

channels. At Kingfisher, our purpose is to make home improvement

accessible for everyone.

Forward-looking statements

You are not to construe the content of this announcement as

investment, legal or tax advice and you should make your own

evaluation of the Company and the market. If you are in any doubt

about the contents of this announcement or the action you should

take, you should consult a person authorised under the Financial

Services and Markets Act 2000 (as amended) (or if you are a person

outside the UK, otherwise duly qualified in your jurisdiction).

This announcement has been prepared at a time when the Company's

accounts are not yet finalised and the Company is still preparing

its financial results for the full year ended 31 January 2020. The

financial information referenced in this announcement is not

audited and does not contain sufficient detail to allow a full

understanding of the results of the Group. It has been necessary to

make an announcement in response to the COVID-19 pandemic health

crises causing countries in which the Group operates to react in

ways that impact the freedom of movement of citizens and changing

normal working, living and supply and demand patterns. Nothing in

this announcement should be construed as either an offer or

invitation to sell or any offering of securities or any invitation

or inducement to any person to underwrite, subscribe for or

otherwise acquire securities in any company within the Group or an

invitation or inducement to engage in investment activity under

section 21 of the Financial Services and Markets Act 2000 (as

amended).

Certain information contained in this announcement may

constitute "forward-looking statements" (including within the

meaning of the safe harbour provisions of the United States Private

Securities Litigation Reform Act of 1995), which can be identified

by the use of terms such as "may", "will", "would", "could",

"should", "expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "plan", "goal", "aim" or "believe" (or the

negatives thereof) or other variations thereon or comparable

terminology. These forward-looking statements include all matters

that are not historical facts and include statements regarding the

Company's intentions, beliefs or current expectations and those of

our Officers, Directors and employees concerning, amongst other

things, the Company's results of operations, financial condition,

changes in global or regional trade conditions, changes in tax

rates, liquidity, prospects, growth and strategies, acts of war or

terrorism worldwide, work stoppages, slowdowns or strikes, public

health crises, outbreaks of contagious disease or environmental

disaster. By their nature, forward-looking statements involve

inherent risks, assumptions and uncertainties that could cause

actual events or results or actual performance of the Company to

differ materially from those reflected or contemplated in such

forward-looking statements. For further information regarding risks

to Kingfisher's business, please consult the risk management

section in the company's Annual Report (as published). No

representation or warranty is made as to the achievement or

reasonableness of and no reliance should be placed on such

forward-looking statements.

The Company does not undertake any obligation to update or

revise any forward-looking statement to reflect any new information

or change in circumstances or in the Company's expectations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDEASSAFSLEEEA

(END) Dow Jones Newswires

May 12, 2020 02:00 ET (06:00 GMT)

Kingfisher (LSE:KGF)

Historical Stock Chart

From Mar 2024 to Apr 2024

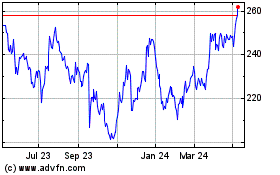

Kingfisher (LSE:KGF)

Historical Stock Chart

From Apr 2023 to Apr 2024