Johnson Matthey PLC Johnson Matthey Q1 AGM trading update (7906T)

July 23 2020 - 2:00AM

UK Regulatory

TIDMJMAT

RNS Number : 7906T

Johnson Matthey PLC

23 July 2020

AGM trading update

Johnson Matthey will hold its Annual General Meeting today at 11.00am

and has issued the following trading update ahead of the meeting.

Robert MacLeod, Chief Executive, commented

I am pleased with the progress we continue to make across our businesses

during this pandemic, despite the decline in first quarter sales. We

are seeing recovery in customer demand and automotive production across

Clean Air. Efficient Natural Resources was resilient and we signed a

large licence in China, whilst Health is benefiting from our new customer

contracts. We continue to make progress in commercialising eLNO and

anticipate soon having five customers in full cell testing. We have

also started to deliver the additional efficiency benefits we recently

outlined and expect initial benefits of at least GBP30 million this

year.

Visibility on demand remains limited and we cannot provide financial

guidance for the current year. Having said that, we expect operating

performance will be heavily weighted to the second half with first half

operating performance materially below last year, largely due to weaker

activity in Clean Air.

We are busy on multiple fronts and I remain grateful to all our employees

for their hard work and dedication as we navigate through this difficult

period. Appointments in the last year have strengthened our senior executive

team and brought increased commercial focus to the group, enabling us

to execute at pace and focus on creating a simpler and more efficient

business. I am also excited about all of our strategic growth projects,

consistent with our vision for a world that's cleaner and healthier,

as well as the attractive returns they will deliver over the medium

term. We look forward to sharing more detail on our growth opportunities

in Fuel Cells and Hydrogen at an investor seminar in September.

Improving trend through the first quarter

In the first quarter, group sales were down materially at constant currency,

as expected, due to the effects of the COVID-19 pandemic. The decline

was driven by Clean Air as a result of lower consumer demand and temporary

customer shutdowns, although sales in this sector steadily improved

through the quarter. In aggregate, sales from our other sectors were

broadly flat compared with the prior year.

Clean Air performance improved sequentially through the first quarter

Clean Air sales were down c.50% in the quarter, primarily driven by

weaker consumer demand and temporary customer shutdowns in Europe and

the Americas. As the quarter progressed, we saw improvement with April,

May and June sales across Clean Air down 75%, 60% and 20% respectively.

All of our plants are now operating. By region, better consumer demand

drove a strong recovery in automotive production in China supported

by early implementation of China 6 legislation, and in Europe and the

US there was a steady ramp up in demand.

Looking forward we anticipate July sales to be down c.20%, with improvement

through the remainder of the second quarter. That said, the market remains

volatile with consumer demand, inventory through the chain and the extent

of automotive OEM summer shutdowns hard to forecast. External data continue

to suggest automotive production in Europe and the US will be down c.25%

in our fiscal year, better in China, but down slightly more in heavy

duty. However, visibility on the path of recovery remains low and the

outcome could be materially different. We have a flexible cost base

in Clean Air enabling us to manage different levels of activity, with

c.75% of costs being variable before mitigation.

Efficient Natural Resources affected by end market weakness and delayed

customer orders

Sales in Efficient Natural Resources were slightly down in the first

quarter. Catalyst Technologies sales were lower due to weaker demand

in some of our end markets such as additives and formaldehyde, and as

we began to see some customers delaying orders. Whilst business has

been disrupted by COVID-19 in the short term, we are seeing medium term

decisions being made and we signed a new oxoalcohol licence in China

in the period, which will benefit future years. PGM Services (PGMS)

saw sales growth, benefiting from continued strength in precious metals

prices.

Looking ahead, we expect first half operating performance in Efficient

Natural Resources to be lower than the prior year driven by Catalyst

Technologies (weaker demand and delayed orders), Advanced Glass Technologies

(lower automotive production) and Diagnostic Services (lower oil price).

PGMS is expected to be broadly flat with the benefit from higher average

precious metal prices being offset by lower refining intakes.

Health started to benefit from new customer contracts

Health is relatively unaffected by changes in the macroeconomic environment.

Sales were up in the quarter as we started to benefit from new customer

contracts and orders delayed from March into April due to COVID-19.

For the full year, we expect to benefit from new customer contracts

for active pharmaceutical ingredients (APIs) used in generic opioid

addiction therapies as well as our continued work with innovator customers.

In the first half, these benefits will be offset by the cancellation

of an innovator project in the prior year. Consequently, we expect operating

performance in the half to be close to the first half of the prior year.

New Markets - further progress with commercialisation of eLNO

In Battery Materials, commercialisation of eLNO remains on track. We

made further progress with customer testing and anticipate soon having

five customers in full cell testing, comprising two automotive, two

non-automotive and one cell manufacturer for autos. We continue to expect

our first commercial plant in Konin, Poland, to be on stream in 2022

and supplying platforms in production in 2024. Fuel cells grew strongly

and our investment to double our manufacturing capacity is on track

and expected to be completed by the end of 2020/21.

Progress on efficiency measures in 2020/21

We are on track to deliver initial benefits of at least GBP30 million

in 2020/21 from our recently announced efficiency initiatives, weighted

to the second half. Over three years, these initiatives are expected

to result in a headcount reduction of c.2,500. We have begun some consultation

processes and anticipate completing around 50% of the targeted reduction

within the next 12 months. We expect to deliver total annualised cost

savings of c.GBP225 million by the end of 2022/23 and continue to evaluate

ways in which we can delayer, simplify and focus the group further.

Investing for our future

We continue to invest in our strategic growth projects, consistent with

our vision for a world that's cleaner and healthier, which are expected

to drive attractive returns for the group. As previously guided, we

expect capex for the year to be up to GBP400 million.

We have a number of exciting growth opportunities including battery

materials with our portfolio of eLNO cathode materials and hydrogen-based

technologies. We will host a hydrogen seminar, rescheduled for 18(th)

September, which will provide an insight into the market dynamics, our

capabilities and the attractive growth prospects in this area.

Maintained strong balance sheet and liquidity

We maintained a strong balance sheet and currently have good access

to liquidity of c.GBP1.3 billion. In the first half, we expect net debt

to be higher than at 31(st) March 2020 due to normal seasonality and

increasing activity in Clean Air. Despite the impact of COVID-19 on

EBITDA, we anticipate net debt to EBITDA being well within our debt

covenant(3) levels.

Outlook for 2020/21

Visibility on demand remains limited and we remain unable to provide

financial guidance for the year ending 31(st) March 2021. However, we

expect operating performance will be heavily weighted to the second

half with first half operating performance materially below last year,

largely due to weaker activity in Clean Air.

Ends

Enquiries:

Investor Relations

Martin Dunwoodie Director of Investor Relations 020 7269 8241

Louise Curran Senior Investor Relations Manager 020 7269 8235

Jane Crosby Investor Relations Manager 020 7269 8242

Media

Sally Jones Director of Corporate Relations 020 7269 8407

Simon Pilkington Tulchan Communications 020 7353 4200

Notes:

1. Unless otherwise stated, commentary in this statement is based on

sales for the quarter ended 30(th) June 2020 and compares this quarter

with the quarter ended 30(th) June 2019 at constant rates.

2. eLNO is a trademark of Johnson Matthey Public Limited Company.

3. Debt covenants are tested annually, with the next test based on

financials for the period ending 31(st) March 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKZGZNZZMGGZM

(END) Dow Jones Newswires

July 23, 2020 02:00 ET (06:00 GMT)

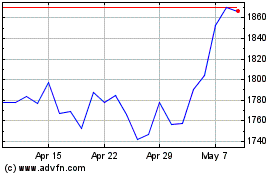

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

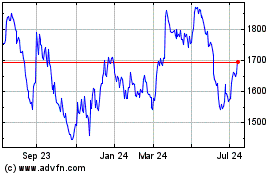

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024