Johnson Matthey PLC Johnson Matthey pre-close trading statement (9555H)

March 30 2020 - 2:00AM

UK Regulatory

TIDMJMAT

RNS Number : 9555H

Johnson Matthey PLC

30 March 2020

Pre-close trading update

Johnson Matthey releases a pre-close trading update for the financial

year ending 31(st) March 2020, ahead of its full year results scheduled

for 28(th) May 2020. The company also provides an update on the impact

of the COVID-19 pandemic on its business, along with the measures it

is taking to actively manage the risks to its people, operations and

customers.

Robert MacLeod, Chief Executive, commented:

In these unprecedented times, our priority is to ensure the health

and safety of our people, customers and suppliers as well as the communities

in which we operate. I am extremely grateful to our employees around

the world for their dedication to our business in the face of COVID-19.

Whilst there is significant ongoing uncertainty around the full impact

of COVID-19 we are taking steps to manage our costs and cash flow.

We have a high quality, resilient and diverse business portfolio; a

strong balance sheet and good access to liquidity, and are further

strengthening our financial position.

In 2019/20, we have made good strategic progress and were on track

to deliver results in line with market expectations this year, prior

to developments with COVID-19. The ongoing pandemic has led to a deterioration

in some of our end markets and consequently we now expect to deliver

group operating performance below market expectations. Looking beyond

the current environment, given our leading market positions, strong

technology offering, and operational and investment discipline, we

remain confident in our medium term strategy.

Results for the year ended 31(st) March 2020 impacted by COVID-19

Strategic progress in the year has been good. Prior to the ongoing

uncertainty around COVID-19, the business was on track to deliver group

operating performance in line with market expectations for the year

ended 31(st) March 2020. We currently expect an impact of around GBP50

million on our trading performance from COVID-19. This was due to a

combination of reduced demand in Clean Air and around GBP20 million

of delayed shipments caused by logistics challenges across our other

businesses. As a result, we now expect to deliver group operating performance

below current market expectations.

Operational update and actions to protect our business

We have a high quality, resilient and diverse business portfolio which

is exposed to a range of end markets and geographies. We are closely

monitoring the ongoing developments in relation to

COVID-19 and taking rapid and decisive action to maintain the health

and safety of our people and to ensure business continuity.

Recently, a number of our automotive customers globally have announced

temporary closures of their manufacturing facilities because of lower

consumer demand and some governments are mandating the temporary cessation

of non-critical business activities, which includes automotive production.

As a result, we have taken the decision to temporarily close most of

our Clean Air plants across the world. This is with the exception of

our operations in China which are ramping back up as the region starts

to recover from COVID-19.

In Efficient Natural Resources, currently we have not seen a material

fall in demand, although some customers in Catalyst Technologies have

delayed orders due to supply chain challenges. In China we are seeing

demand starting to improve. The vast majority of our Catalyst Technologies

plants are running, although we are monitoring events closely and are

ready to take action if demand changes. Our pgm refineries continue

to operate, albeit at lower capacity due to reduced availability of

our people.

A number of our other businesses provide critical products and services

into the health, pharmaceutical and agricultural sectors and are relatively

resilient to macroeconomic weakness. They are therefore maintaining

operations but we have experienced some delays to shipment of orders

following increased border controls. This includes operations in our

Health and Medical Device Components businesses.

We have a flexible cost base, especially in Clean Air where c.75% of

costs are variable. Given the considerable uncertainty around demand

and the duration of our site closures, we are tightly managing our

cash position and costs, with a focus on lowering our inventory, collecting

accounts receivable and reducing our cost base. We will give more detail

on the cost reduction actions we are taking with our full year results

planned for 28(th) May 2020.

Outlook for the year ending 31(st) March 2021

For the year ending 31(st) March 2021, given the high levels of uncertainty

we are not able to reasonably forecast the impact on our operations

and financial performance. We will provide a further update at our

full year results.

Strong balance sheet and good access to liquidity

The group has a strong balance sheet and good access to liquidity with

substantial cash resources and significant undrawn bank facilities.

We have c.GBP250 million of unrestricted cash and a GBP1 billion Revolving

Credit Facility in place to March 2025 and extendable on its first

and second anniversary by a further one year, of which

GBP400 million is currently drawn. We also have around GBP130 million

available under other committed facilities. This means our overall

liquidity is c.GBP1 billion. Committed facilities are renewed regularly

to maintain a balanced maturity profile across different lenders. There

is no material refinancing due in 2020 or 2021.

Our leverage ratio (net debt to EBITDA) is well within our covenant

level. In the second half of our financial year, we have made substantial

progress in managing our precious metal working capital against a backdrop

of rising pgm (platinum group metal) prices, with volume reductions

of

c.GBP200 million. At 30(th) September 2019, net debt to EBITDA was

2.1x and we anticipate being at a similar level at 31(st) March 2020,

despite the impact of COVID-19 on EBITDA.

Confident in our strategy

The world is facing unprecedented challenges but we are taking steps

to ensure we are in the best possible position to navigate this period.

We remain focused on protecting our people and our financial position,

so that we are able to meet demand and serve our customers when conditions

normalise.

We continue to invest for the future and remain committed to our strategic

growth projects, including our new world class Clean Air plants, our

Battery Materials commercial plant and upgrading our precious metal

refineries. As we manage cash, we will postpone a number of discretionary

capex projects.

With our leading positions in high margin, technology driven growth

markets, we remain confident in our strategy. We will continue to apply

our world class science to address the challenges posed by key global

megatrends and in doing so we will drive value for our shareholders

and society.

Full year results: We currently plan to announce our full year results

for the year ended 31(st) March 2020 as scheduled on Thursday 28(th)

May.

Ends

Enquiries:

Investor Relations Director of Investor Relations 020 7269 8241

Martin Dunwoodie Senior Investor Relations Manager 020 7269 8235

Louise Curran Investor Relations Manager 020 7269 8242

Jane Crosby

Media 020 7269 8407

Sally Jones Director of Corporate Relations 020 7353 4200

Simon Pilkington Tulchan Communications

Notes:

1. Precious metal working capital volume reduction at 30(th) September

2019 metal prices

2. Vara consensus for full year underlying operating profit in 2019/20

is GBP581 million (range: GBP562 million to GBP593 million)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKKCBDOBKDNNB

(END) Dow Jones Newswires

March 30, 2020 02:00 ET (06:00 GMT)

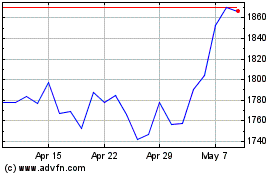

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

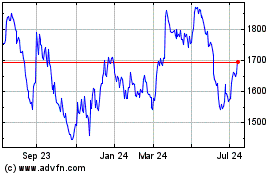

Johnson Matthey (LSE:JMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024