TIDMIQE

IQE plc

("IQE" or the "Group")

2019 HALF YEAR RESULTS

Performance in line with half-year guidance and full year guidance

reiterated

Strategic and operational progress to ensure business is well-positioned

for future growth

Cardiff, UK 3 September 2019: IQE plc (AIM: IQE) the leading supplier of

advanced wafer products and material solutions to the semiconductor

industry, announces its results for the six months ended 30(th) June

2019.

FINANCIAL HIGHLIGHTS

H1 2019 H1 2018

GBP'm* GBP'm*

REVENUE 66.7 73.4

ADJUSTED EBITDA*** 7.4 13.5

OPERATING (LOSS) / PROFIT (3.1) 6.6

ADJUSTED OPERATING (LOSS) / PROFIT (1.9) 7.6

REPORTED (LOSS) / PROFIT BEFORE TAX (3.7) 6.6

REPORTED (LOSS) / PROFIT AFTER TAX (10.7) 4.2

DILUTED EPS (1.38p) 0.50p

ADJUSTED DILUTED EPS (1.29p) 0.76p

CASH GENERATED FROM OPERATIONS 4.0 7.6

CAPITAL INVESTMENT (PP&E) 19.1 19.4

NET (DEBT) / FUNDS** (0.8) 40.6

* All figures GBP'm excluding adjusted diluted EPS

** Net (debt) / funds excludes IFRS16 lease liabilities (see note 4.5)

Adjusted Measures: The Directors believe that the adjusted measures

provide a more useful comparison of business trends and performance.

Adjusted measures exclude exceptional items, share based payments and

non-cash acquisition accounting charges as detailed in note 7. The

following highlights of the first half results is based on these

adjusted profit measures, unless otherwise stated.

-- Revenue of GBP66.7m (H1 2018: GBP73.4m) is 9% down year on year, impacted

by a weak smartphone handset market and reductions in demand in the

context of a technology market slowdown, international trade tensions and

fall in demand from a major InP laser customer.

-- Adjusted operating loss of GBP1.9m (H1 2018: profit GBP7.6m) reflects

negative operating leverage from a cost base scaled for volume which

includes an increase in depreciation and amortisation of GBP2.4m

resulting from the investment in capacity.

-- Negative EPS of 1.29p due to the operating loss plus a one-off non-cash

deferred US tax charge resulting from a shift in the balance of future

projected manufacturing between the US and UK / Asia.

-- Cash generated from operations of GBP4.0m (H1 2018: GBP7.6m) reduced due

to lower trading volumes. Additional asset financing facility agreed post

half year-end.

Dr Drew Nelson, Chief Executive Officer of IQE, said:

"I am pleased that IQE has delivered results which are in line with the

trading update from June this year and to reiterate our full-year

guidance, despite a number of challenging market conditions facing our

industry in the first half of 2019.

"We remain confident in IQE's ability to adapt to global supply chain

shifts and have made significant strategic and operational progress with

our global expansion projects. This includes completing the

infrastructure phase at our Mega Foundry in Newport, South Wales as well

as the capacity expansion in Taiwan and Massachusetts, US.

These investments in the Group's global manufacturing footprint, coupled

with IQE's unique breadth of compound semiconductor materials experience

and IP portfolio, position the Group well for future growth and margin

expansion as volumes increase, driven by the growth opportunities in 5G

and connected devices."

OPERATIONAL HIGHLIGHTS

-- Major Investment Programme substantially completed:

-- Infrastructure phase at Mega Foundry in Newport, South Wales now

finished with ten tools installed and optionality to add up to 90

more

-- Capacity in Taiwan has been increased by 40%, enabling growth in

revenues with Asian supply chains

-- Investment in GaN capacity in Massachusetts to capitalise on

forthcoming 5G infrastructure deployments

-- Newport Mega-Foundry Commencement of Production:

-- First mass production order from IQE's leading VCSEL customer

-- Extensive product qualifications ongoing with twelve other chip

customers across broad supply chains

-- Commencement of production, post half year-end, with a second

customer, serving Android supply chains.

-- Signature of a contract extension, post half year end, with one of

its largest VCSEL customers, running through to the end of 2021.

In addition, two other existing contracts have also been extended

with several other new contracts anticipated.

-- 5G Product Development:

-- Continued strong results in the development of Filters and

Switches for 5G, based on IQE's patented cREO technology, with

customer engagement for commercialisation proceeding well

-- Introduction of a Full Service Distributed Feedback (DFB) Laser

for high-speed datacoms using Nano-Imprint Lithography

-- New management structure implemented to support growth ambitions and

scalability of operations:

-- Dr Drew Nelson, Chief Executive Officer (CEO)

-- Tim Pullen, Chief Financial Officer (CFO)

-- Dr Rodney Pelzel as Executive VP, Global Innovation (CTO)

-- Keith Anderson as Executive VP, Global Operations (COO)

-- Dr Wayne Johnson as Executive VP, Global Business Development,

Wireless and Emerging Products

-- Dr Mark Furlong as Executive VP, Global Business Development,

Photonics and InfraRed

-- Development of the IQE Board

-- Appointment of Phil Smith CBE, as Chairman

-- Appointment of Carol Chesney, FCA, as Non-Executive Director and

Chair of the Audit Committee

-- Post half year end increase to available credit facilities

-- GBP30m asset financing facility in place, increasing total

available facilities to GBP57m (GBP12m drawn down at 30th June

2019)

CURRENT TRADING AND FULL YEAR OUTLOOK

Outlook and guidance remain in line with the trading update from June

21st, 2019.

Three key factors affect IQE's revenue outlook for 2019

1. Continued uncertainty related to the geo-political landscape, the effects

on global technology markets and, in particular,the confidence for supply

chains to rebuild inventory;

2. The market for smartphone handsets in the second half of 2019;

3. The speed of formation of new Asian supply chains, the associated product

qualifications and volumes of initial orders.

Balancing these factors, full year revenue guidance of GBP140m to

GBP160m is reiterated.

Segmental revenue guidance is reiterated on a like-for-like basis, but

restated to reflect a change in allocation methodology based on (i) the

newly implemented business unit structure upon the formation of the

Executive Management Board and (ii) certain revenues pertaining to a

specific site which has shared production, being reclassified between

segments due to an allocation methodology change (USD constant

currency):

Previous Segmentation Revised Segmentation Previous Segmentation Revised Segmentation

FY18 Revenue GBPm FY18 Revenue GBPm FY19 YoY FY19 YoY

---------- --------------------- -------------------- --------------------- --------------------

Wireless 97.8 87.9 -20% to -25% decline -25% to -30% decline

---------- --------------------- -------------------- --------------------- --------------------

Photonics 43.8 66.8 <30% growth <30% growth

---------- --------------------- -------------------- --------------------- --------------------

Infrared 13.1 N/A c15% growth N/A

---------- --------------------- -------------------- --------------------- --------------------

Second half revenues are expected to represent between 52% and 58% of

full year revenues. As such, given the additional contribution against a

largely fixed cost base, a return to adjusted operating profitability is

expected in H2. This will be strengthened by cost management actions

that support the strategic direction of the Group.

EBITDA margins will remain low in FY19 as the utilisation of facilities

remains low versus capacity and a high number of product qualifications

continue. Full year adjusted operating profit margin guidance, whereby

IQE expects to remain profitable in 2019 but with adjusted operating

profit margin significantly below the original FY19 guidance of over 10%,

is reiterated.

With the infrastructure phase of the capital investment programme

substantially complete in H1, full year capex guidance of GBP30m to

GBP40m is reiterated. The range relates to the timing of the decision to

invest in further tools at either Newport or Taiwan, which is

discretionary depending on prevailing market conditions. The Group has

sufficient installed capacity to underpin significant revenue growth.

CONTACTS:

IQE plc

+44 (0) 29 2083 9400

Drew Nelson

Tim Pullen

Peel Hunt LLP (Nomad and Joint Broker)

+44 (0) 20 7418 8900

Edward Knight

Nick Prowting

Citigroup Global Markets Limited (Joint Broker)

+44 (0) 20 7986 4000

Christopher Wren

Peter Catterall

Headland Consultancy (Financial PR)

+ 44 (0) 20 38054822

Andy Rivett-Carnac: +44 (0) 7968 997 365

Chloe Francklin: +44 (0) 7834 974 624

ABOUT IQE

https://www.globenewswire.com/Tracker?data=uEvGnOzn20iaySA-qkXqZzyaBwHDfHhFXlBslpMrB6yevRa5JixIh9IcTnzgqwFhw1xkHftg7jvpE4lRe0HS9sQG9_pVMuCAPGsSbLqL4wGTlwS-ksJz9MKZ1GEJSftGgY7oJzxFn-lqooC4CiwGPkAsdZr4mj1PNC_-8wAjR5C4OPjvQZfSXYvoS6wLzZ_Dy4FrDIGty3bhwI4Q5eSWPnQdkDEWCflfqgyQjjA625E=

http://iqep.com

IQE is the leading global supplier of advanced compound semiconductor

wafers that enable a diverse range of applications across:

-- handset devices

-- global telecoms infrastructure

-- connected devices

-- 3D sensing

The macro trends of 5G and connected devices are expected to drive

significant growth for compound semiconductors over the coming years.

As a scaled global epitaxy wafer manufacturer, IQE is uniquely

positioned in this market which has high barriers to entry. IQE supplies

the whole market and is agnostic to the winners and losers at chip and

OEM level. By leveraging the Group's intellectual property portfolio

including know-how and patents, it produces epitaxy wafers of superior

quality, yield and unit economics.

IQE is headquartered in Cardiff UK, with c. 650 employees, and is listed

on the AIM stock Exchange in London.

Consolidated Income Statement 6 months to 6 months to 12 months to

30 Jun 2019 30 Jun 2018 31 Dec 2018

(All figures GBP'000s) Note Unaudited Unaudited Audited

------------------------------------------------------ ---- ------------- ------------- --------------

Revenue 66,720 73,396 156,291

Cost of sales (56,128) (57,279) (118,840)

------------------------------------------------------ ---- ------------- ------------- --------------

Gross profit 10,592 16,117 37,451

Other income and expenses - 1,648 1,097

Selling, general and administrative expenses (13,667) (11,163) (29,888)

Operating (loss) / profit (3,075) 6,602 8,660

Net finance (costs) / income (394) 46 87

Share of losses of joint ventures accounted for using

the equity method (254) - (2,000)

Adjusted (loss) / profit before income tax (2,623) 7,615 13,974

Adjustments 7 (1,100) (967) (7,227)

------------------------------------------------------ ---- ------------- ------------- --------------

(Loss) / Profit before income tax (3,723) 6,648 6,747

Taxation (6,926) (2,485) (5,558)

------------------------------------------------------ ---- ------------- ------------- --------------

(Loss) / Profit for the period (10,649) 4,163 1,189

------------------------------------------------------------ ------------- ------------- --------------

(Loss) / Profit attributable to:

Equity shareholders (10,805) 4,023 966

Non-controlling interests 156 140 223

------------------------------------------------------------ ------------- ------------- --------------

(10,649) 4,163 1,189

------------------------------------------------------------ ------------- ------------- --------------

(Loss) / earnings per share attributable to owners

of the parent during the period

Basic (loss) / earnings per share 9 (1.38) 0.53p 0.13p

Diluted (loss) / earnings per share 9 (1.38) 0.50p 0.12p

------------------------------------------------------------ ------------- ------------- --------------

Adjusted basic and diluted earnings per share are presented in Note 9.

All items included in the (loss) / profit for the period relate to

continuing operations.

Consolidated statement of comprehensive income 6 months to 6 months to 12 months to

30 Jun 2019 30 Jun 2018 31 Dec 2018

(All figures GBP'000s) Unaudited Unaudited Audited

----------------------------------------------------- ------------- ------------- --------------

(Loss) / Profit for the period (10,649) 4,163 1,189

Currency translation differences on foreign currency

net investments* (741) 3,028 11,140

----------------------------------------------------- ------------- ------------- --------------

Total comprehensive (expense) / income for the period (11,390) 7,191 12,329

----------------------------------------------------- ------------- ------------- --------------

Total comprehensive (expense) / income attributable

to:

Equity shareholders (11,507) 7,063 12,010

Non-controlling interest 117 128 319

----------------------------------------------------- ------------- ------------- --------------

(11,390) 7,191 12,329

----------------------------------------------------- ------------- ------------- --------------

* Balance might subsequently be reclassified to the income statement

when it becomes realised.

Consolidated Balance Sheet As At As At As At

30 Jun 2019 30 Jun 2018 31 Dec 2018

(All figures GBP'000s) Note Unaudited Unaudited Audited

--------------------------------- ---- ----------- ----------- -----------

Non-current assets

Intangible assets 123,328 116,607 121,775

Fixed asset investments 75 75 75

Property, plant and equipment 136,628 107,494 124,445

Right of use assets 40,990 - -

Lease receivable 1,408 - -

Deferred tax assets 7,095 15,372 13,244

Financial assets 8,085 7,776 7,937

--------------------------------- ---- ----------- ----------- -----------

Total non-current assets 317,609 247,324 267,476

--------------------------------- ---- ----------- ----------- -----------

Current assets

Inventories 37,277 35,433 35,709

Trade and other receivables 37,313 40,590 38,015

Lease receivable 588 - -

Cash and cash equivalents 11 11,173 40,634 20,807

--------------------------------- ---- ----------- ----------- -----------

Total current assets 86,351 116,657 94,531

--------------------------------- ---- ----------- ----------- -----------

Total assets 403,960 363,981 362,007

--------------------------------- ---- ----------- ----------- -----------

Current liabilities

Trade and other payables (43,039) (61,056) (45,908)

Lease liabilities 11 (2,897) - -

Current tax liabilities (1,242) (405) (431)

Provisions for other liabilities

and charges 12 - (1,477) (2,554)

--------------------------------- ---- ----------- ----------- -----------

Total current liabilities (47,178) (62,938) (48,893)

--------------------------------- ---- ----------- ----------- -----------

Non-current liabilities

Borrowings 11 (12,008) - -

Lease liabilities 11 (46,375) - -

Provisions for other liabilities

and charges 12 - - (3,836)

--------------------------------- ---- ----------- ----------- -----------

Total non-current liabilities (58,383) - (3,836)

--------------------------------- ---- ----------- ----------- -----------

Total liabilities (105,561) (62,938) (52,729)

--------------------------------- ---- ----------- ----------- -----------

Net assets 298,399 301,043 309,278

--------------------------------- ---- ----------- ----------- -----------

Equity attributable to

shareholders of the parent

Share capital 13 7,913 7,608 7,767

Share premium 151,592 147,318 151,147

Retained earnings 88,494 102,356 99,299

Other reserves 46,735 40,404 47,517

--------------------------------- ---- ----------- ----------- -----------

294,734 297,686 305,730

Non-controlling Interest 3,665 3,357 3,548

--------------------------------- ---- ----------- ----------- -----------

Total equity 298,399 301,043 309,278

--------------------------------- ---- ----------- ----------- -----------

Consolidated Statement of Changes in Equity

Exchange

Unaudited Share Share Retained rate Other Non-controlling Total

(All figures GBP'000s) capital premium earnings reserve reserves interests equity

At 1 January 2019 7,767 151,147 99,299 31,113 16,404 3,548 309,278

------------------------ ------- ------- -------- -------- -------- --------------- --------

(Loss) / Profit for the

period - - (10,805) - - 156 (10,649)

Other comprehensive

expense for the year - - - (702) - (39) (741)

Total comprehensive

(expense) / income - - (10,805) (702) - 117 (11,390)

Share based payments - - - - 12 - 12

Tax relating to share

options - - - - (60) - (60)

Proceeds from shares

issued 146 445 - - (32) - 559

------------------------ ------- ------- -------- -------- -------- --------------- --------

Total transactions with

owners 146 445 - - (80) - 511

At 30 June 2019 7,913 151,592 88,494 30,411 16,324 3,665 298,399

------------------------ ------- ------- -------- -------- -------- --------------- --------

Exchange

Unaudited Share Share Retained rate Other Non-controlling Total

(All figures GBP'000s) capital premium earnings reserve reserves interests equity

At 1 January 2018 7,560 145,927 98,333 20,069 16,061 3,229 291,179

------------------------ ------- ------- -------- -------- -------- --------------- --------

Profit for the period - - 4,023 - - 140 4,163

Other comprehensive

income for the year - - - 3,040 - (12) 3,028

Total comprehensive

income - - 4,023 3,040 - 128 7,191

Share based payments - - - - 2,586 - 2,586

Tax relating to share

options - - - - (455) - (455)

Proceeds from shares

issued 48 1,391 - - (897) - 542

------------------------ ------- ------- -------- -------- -------- --------------- --------

Total transactions with

owners 48 1,391 - - 1,234 - 2,673

At 30 June 2018 7,608 147,318 102,356 23,109 17,295 3,357 301,043

------------------------ ------- ------- -------- -------- -------- --------------- --------

Exchange

Audited Share Share Retained rate Other Non-controlling Total

(All figures GBP'000s) capital premium earnings reserve reserves interests equity

At 1 January 2018 7,560 145,927 98,333 20,069 16,061 3,229 291,179

------------------------ ------- ------- -------- -------- -------- --------------- -------

Profit for the year - - 966 - - 223 1,189

Other comprehensive

income for the year - - - 11,044 - 96 11,140

Total comprehensive

income - - 966 11,044 - 319 12,329

Share based payments - - - - 1,826 - 1,826

Tax relating to share

options - - - - (437) - (437)

Proceeds from shares

issued 207 5,220 - - (1,046) - 4,381

------------------------ ------- ------- -------- -------- -------- --------------- -------

Total transactions with

owners 207 5,220 - - 343 - 5,770

At 31 December 2018 7,767 151,147 99,299 31,113 16,404 3,548 309,278

------------------------ ------- ------- -------- -------- -------- --------------- -------

Consolidated Cash Flow Statement 6 months to 6 months to 12 months to

30 Jun 2019 30 Jun 2018 31 Dec 2018

(All figures GBP'000s) Note Unaudited Unaudited Audited

---------------------------------------- ----------- ------------- ------------- --------------

Cash flows from operating activities

----------------------------------------- ---------- ------------- ------------- --------------

Adjusted cash inflow from operations 6,677 8,303 16,982

Cash impact of adjustments 7 (2,694) (723) 6

----------------------------------------- ---------- ------------- ------------- --------------

Cash generated from operations 10 3,983 7,580 16,988

Net interest (paid)/received (195) 1 (66)

Income tax paid (101) (232) (665)

----------------------------------------- ---------- ------------- ------------- --------------

Net cash generated from operating activities 3,687 7,349 16,257

----------------------------------------------------- ------------- ------------- --------------

Cash flows from investing activities

Purchase of property, plant and equipment (19,048) (6,292) (30,375)

Purchase of intangible assets (940) (317) (1,550)

Capitalised development expenditure (4,752) (6,372) (10,437)

Net cash used in investing activities (24,740) (12,981) (42,362)

----------------------------------------- ---------- ------------- ------------- --------------

Cash flows from financing activities

Proceeds from issuance of ordinary shares 559 542 813

Proceeds from borrowings 12,060 - -

Transaction costs related to loans and

borrowings (161) - -

Payment of lease liabilities (1,035) - -

----------------------------------------- ---------- ------------- ------------- --------------

Net cash generated from financing activities 11,423 542 813

----------------------------------------------------- ------------- ------------- --------------

Net decrease in cash and cash equivalents (9,630) (5,090) (25,292)

Cash and cash equivalents at the beginning of the

period 20,807 45,612 45,612

Exchange (losses) / gains on cash and

cash equivalents (4) 112 487

----------------------------------------- ---------- ------------- ------------- --------------

Cash and cash equivalents at the end of

the period 11 11,173 40,634 20,807

----------------------------------------- ---------- ------------- ------------- --------------

1. REPORTING ENTITY

IQE plc is a public limited company incorporated in the United Kingdom

under the Companies Act 2006. The Company is domiciled in the United

Kingdom and is quoted on the Alternative Investment Market (AIM).

These condensed consolidated interim financial statements ('interim

financial statements') as at and for the six months ended 30 June 2019

comprise the Company and its Subsidiaries (together referred to as 'the

Group'). The principal activities of the Group are the development,

manufacture and sale of advanced semiconductor materials.

1. BASIS OF PREPARATION

These interim financial statements have been prepared in accordance with

IAS 34 'Interim Financial Reporting', and should be read in conjunction

with the Group's last annual consolidated financial statements as at and

for the year ended 31 December 2018 which were approved by the Board of

Directors on 20 March 2019 and have been delivered to the Registrar of

Companies. The report of the auditors on those financial statements was

unqualified, did not contain an emphasis of matter paragraph and did not

contain any statement under section 498 of the Companies Act 2006.

The interim financial statements do not include all of the information

required for a complete set of IFRS financial statements and do not

constitute statutory accounts within the meaning of section 434 of the

Companies Act 2006. However, selected explanatory notes are included to

explain events and transactions that are significant to an understanding

of the changes in the Group's financial position and performance since

the last annual financial statements.

This is the first set of the Group's financial statements where IFRS 16,

'Leases' has been applied. Changes to significant accounting policies

are described in Note 4.

Comparative information in the interim financial statements as at and

for the year ended 31 December 2018 has been taken from the published

audited financial statements as at and for the year ended 31 December

2018. All other periods presented are unaudited.

The Company's auditor in accordance with ISRE 2410 has reviewed the

financial information contained in these interim financial statements.

This review does not constitute an audit.

The Board of Directors and the Audit Committee approved the interim

financial statements on 3 September 2019.

1. USE OF JUDGEMENTS AND ESTIMATES

In preparing these interim financial statements, management has made

judgements and estimates that affect the application of accounting

policies and the reported amounts of assets, liabilities, income and

expense. Actual results may differ from these estimates.

The significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty were

the same as those described in the last annual financial statements

except as follows:

-- New significant judgements and key sources of estimation uncertainty

related to the application of IFRS 16, which are described in Note 4; and

-- Changes in estimates associated with the recognition of deferred tax

assets.

Deferred Tax Assets

Deferred tax assets are only recognised to the extent that it is

probable that future taxable profits will be available against which

deductible temporary differences can be utilised. This necessitates an

assessment of future trading forecasts, capital expenditure and the

utilisation of tax losses for each relevant tax jurisdiction where the

Group operates.

At 31 December 2018, the Group recognised deferred tax assets in

relation to historical losses at its operations in the United States of

America ('US'). Recognition of the deferred tax asset was based on an

assessment of future cash flow forecasts and the associated

profitability of the US operations.

Increased international trade tension and resultant shifts in the

balance of future forecast manufacturing between the Group's global

operations has resulted in current period changes to estimated forecast

future cash flows and associated recognition of deferred tax assets

relating to the Group's US operations (see note 8).

1. CHANGES IN SIGNIFICANT ACCOUNTING POLICIES

The accounting policies adopted are consistent with those of the annual

financial statements for the year ended 31 December 2018, as described

in note 2 of those financial statements, except for the impact of the

implementation of IFRS 16 'Leases'.

4.1 Recent accounting developments

In preparing the interim financial statements, the Group has adopted the

following Standards, amendments and interpretations, which are effective

for 2019 and will be adopted in the financial statements for the year

ended 31 December 2019:

-- IFRS 16 'Leases'.

-- Amendments to IAS 19 'Employee Benefits' which clarifies the accounting

for defined benefit plan amendments, curtailments and settlements.

-- Amendment to IAS 28 'Investments in associates and joint ventures' which

clarifies the accounting for long-term interests in an associate or joint

venture, which in substance form part of the net investment in the

associate or joint venture, but to which equity accounting is not

applied.

-- Amendments to IFRS 10 'Consolidated financial statements' and IAS 28

'Investments in associates and joint ventures' which clarifies the

accounting treatment for sales or contribution of assets between an

investor and its associates or joint ventures.

-- Interpretation 23 'Uncertainty over Income Tax Treatments' which explains

how to recognise and measure deferred and current income tax assets and

liabilities where there is uncertainty over a tax treatment.

The adoption of these standards and amendments has not had a material

impact on the interim financial statements, except for IFRS 16,

'Leases'.

4.2 Change in accounting policy -- IFRS 16 'Leases'

IFRS 16 'Leases' addresses the definition of a lease, the recognition

and measurement of leases and establishes principles for reporting

useful information to users of financial statements about the leasing

activities of both lessees and lessors. A key change arising from IFRS

16 is that most operating leases will be accounted for on balance sheet

for lessees. The standard replaces IAS 17 'Leases', IFRIC 4 'Determining

whether an arrangement contains a lease', SIC-15 'Operating leases --

Incentives' and SIC-17 'Evaluating the substance of transactions

involving the legal form of a lease' and is effective for annual periods

beginning on or after 1 January 2019.

4.3 Change in accounting policy - IFRS 16 'Leases' -

Transition

The Group currently leases a number of assets principally relating to

property, including its newly constructed Newport facility as well as

leasing property, plant and equipment from its joint venture, Compound

Semiconductor Centre Limited.

The group has implemented the requirements of IFRS 16 'Leases' from 1

January 2019 using the modified retrospective approach applying the

following practical expedients on a lease-by-lease basis to its

portfolio of leases:

-- Application of a single discount rate to the portfolio of property and

plant leases that are deemed to have reasonably similar characteristics;

-- Adjustment on transition to the right of use asset value associated with

the leased Singapore manufacturing facility by the amount of the

previously recognised onerous lease provision as an alternative to

performing an impairment review;

-- Application of recognition and measurement exemptions for all leases

where the lease term ends within 12 months or fewer of the date of

initial application with those leases accounted for as short-term leases;

-- Application of hindsight in applying the new standard to determine the

lease term where lease contracts contain options to extend or terminate

the lease; and

-- Exclusion of any initial direct costs in the measurement of the right of

use asset.

4.4 Change in accounting policy IFRS 16 'Leases' -

Accounting policy

The Group recognises a right-of-use asset and a lease liability at the

lease commencement date. The right-of-use asset is initially measured at

cost, and subsequently at cost less any accumulated depreciation and

impairment losses, and adjusted for certain remeasurements of the lease

liability.

The lease liability is initially measured at the present value of the

lease payments that are not paid at the commencement date, discounted

using the interest rate implicit in the lease or, if that rate cannot be

readily determined, the Group's incremental borrowing rate. Generally,

the Group uses its incremental borrowing rate as the discount rate.

The lease liability is subsequently increased by the interest cost on

the lease liability and decreased by lease payments made. It is

remeasured when there is a change in future lease payments arising from

a change in an index or rate, or as appropriate, changes in the

assessment of whether a purchase or extension option is reasonably

certain to be exercised or a termination option is reasonably certain

not to be exercised.

1. CHANGES IN SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

4.4 Change in accounting policy IFRS 16 'Leases' -

Accounting policy (continued)

The Group has applied judgement to determine the lease term for some

lease contracts in which as lessee there includes a renewal option. The

assessment of whether the Group is reasonably certain to exercise such

options impacts the lease term, which affects the amount of lease

liabilities and right-of-use assets recognised.

4.5 Change in accounting policy -- IFRS 16 'Leases' -

Implementation impact

Implementation of IFRS 16 'Leases' requires the Group to recognise new

right of use assets and lease liabilities for certain operating leases

that principally relate to the Group's manufacturing facilities. The

nature of expenses related to these leases has changed in the six months

ended 30 June 2019 because the Group now recognises a depreciation

charge for the right of use assets and an interest expense on lease

liabilities. Previously, for non-variable lease expenses, the Group

recognised operating lease costs on a straight-line basis over the lease

term and recognised assets and liabilities only to the extent that there

was a timing difference between actual lease payments and the expense

recognised.

The implementation of IFRS 16 at 1 January 2019, which had no impact on

total net assets or cash, is summarised in the narrative and table set

out below:

Non-Current Assets

-- Increase in non-current assets of GBP40,545k to reflect the recognition

of right of use lease assets (net of the previously recognised Singapore

onerous lease of GBP5,256k);

-- Increase in non-current assets of GBP1,645k to reflect the recognition of

non-current lease receivables associated with sub-let property;

-- Decrease in property, plant and equipment and corresponding increase in

right of use assets of GBP2,178k to reflect the reclassification of

previously capitalised Newport foundry rent free period costs during the

asset commissioning phase;

Non-Current Liabilities

-- Increase in non-current liabilities of GBP48,116k to reflect the

non-current recognition of lease liabilities associated with the right of

use lease assets;

-- Decrease in non-current provisions of GBP3,836k to reflect

reclassification of the non-current element of the previously recognised

Singapore onerous lease to right of use lease assets

Current Assets and Liabilities

-- Increase in current assets of GBP588k to reflect the recognition of lease

receivables associated with sub-let property due within one year;

-- Increase in current liabilities of GBP2,097k to reflect the recognition

of lease liabilities associated with the right of use lease assets

payable within one year;

-- Decrease in provisions due within one year of GBP1,420k to reflect

reclassification of the current element of the previously recognised

Singapore onerous lease to right of use lease assets; and

-- Decrease in trade and other payables of GBP2,178k to reflect

reclassification of deferred Newport foundry rent-free period costs to

lease liabilities.

1. CHANGES IN SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

4.5 Change in accounting policy -- IFRS 16 'Leases' --

Implementation impact (continued)

Impact on the condensed consolidated balance sheet

as at Reported Right of Lease Lease Working Onerous

1 January 2019 2018 use asset Receivable liability capital lease 1 January 2019

---------------------------------------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

Intangible assets 121,775 - - - - - 121,775

Fixed asset investments 75 - - - - - 75

Property, plant & equipment 124,445 - - - (2,178) - 122,267

Right of use lease assets - 45,801 - - 2,178 (5,256) 42,723

Lease receivable - - 1,645 - - - 1,645

Deferred tax assets 13,244 - - - - - 13,244

Financial assets 7,937 - - - - - 7,937

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

Non-current assets 267,476 45,801 1,645 - - (5,256) 309,666

Inventories 35,709 - - - - - 35,709

Trade and other receivables 38,015 - - - - - 38,015

Lease receivable - - 588 - - - 588

Cash and cash equivalents 20,807 - - - - - 20,807

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

Current assets 94,531 - 588 - - - 95,119

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

Total assets 362,007 45,801 2,233 - - (5,256) 404,785

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

Trade and other payables (45,908) - - - 2,178 - (43,730)

Current tax liabilities (431) - - - - - (431)

Provisions (2,554) - - - - 1,420 (1,134)

Lease liabilities - - - (2,097) - - (2,097)

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

Current liabilities (48,893) - - (2,097) 2,178 1,420 (47,392)

Provisions (3,836) - - - - 3,836 -

Lease liabilities - - - (48,115) - - (48,115)

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

Non-current liabilities (3,836) - - (48,115) - 3,836 (48,115)

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

Total liabilities (52,729) - - (50,212) 2,178 5,256 (95,507)

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

Net assets 309,278 45,801 2,233 (50,212) 2,178 - 309,278

--------------------------------------------------- ---------- ----------- ------------ ----------- --------- --------- ----------------

1. CHANGES IN SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

4.2 Change in accounting policy -- IFRS 16 'Leases'

(continued)

4.6 Critical accounting judgements and key sources of

estimation uncertainty - IFRS 16 'Leases'

(a) Critical accounting judgements in applying IFRS 16 'Leases'

Joint Ventures -- Right to use assets

The Group established CSC with its joint venture partner as a centre of

excellence for the development and commercialisation of advanced

compound semiconductor wafer products.

On establishment of the joint venture, the Group contributed assets as

part of its initial investment and entered into an agreement with the

joint venture that conveys to the Group the right to use the assets of

the joint venture for a minimum five-year period. This agreement, which

contains rights attaching to the use of the joint venture's assets,

meets the definition of a lease. The variable nature of the lease

payments, which are directly linked to the actual usage of the assets,

have been excluded from the measurement of right of use assets and lease

liabilities with the variable lease costs recognised in operating

expenses in the income statement as incurred.

(b) Critical accounting estimates and key sources of estimation

uncertainty

Valuation of lease liabilities and right of use assets

The application of IFRS 16 requires the Group to make judgments that

affect the valuation of the lease liabilities and the valuation of

right-of-use assets that includes determining the contracts in scope of

IFRS 16, determining the contract term and determining the interest rate

used for discounting of future cash flows.

The lease term determined by the Group generally comprises the

non-cancellable period of lease contracts, periods covered by an option

to extend the lease if the Group is reasonably certain to exercise that

option and periods covered by an option to terminate the lease if the

Group is reasonably certain not to exercise that option. Exercise of

extension options, principally existing in the Group's property leases

are assumed to be reasonably certain, except for the Group's Newport

facility where it has been assumed that it is reasonably certain that

the Group will exercise its buy-out option at the end of the initial

lease term. The same term applied to the length of the lease contract

has been applied to the useful economic life of right-of-use assets.

The present value of the lease payments applicable to the Group's

portfolio of property and plant leases has been determined using a

discount rate that represents the Group's incremental rate of borrowing,

assessed as 2.25% - 2.65% depending on the lease characteristics.

1. PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks and uncertainties affecting the Group are set out in

the Strategic Report in the 2018 Annual report and financial statements

and remain unchanged at 30 June 2019.

The principal risks and uncertainties include competition, technological

change, market conditions, health, safety and environment, human

resourcing, natural disasters, financial liquidity, business

interruption (supply chain), customer concentration, legal compliance,

loss of intellectual property, information technology failure and tax

compliance.

1. SEGMENTAL INFORMATION

6 Months to 30 June 2018 12 Months to 31 Dec 2018

6 Months to 30 June 2019 Unaudited Audited

Unaudited Restated Restated

Revenue GBP'000 GBP'000 GBP'000

Wireless 30,147 42,481 87,862

Photonics 35,483 30,081 66,807

CMOS++ 1,090 834 1,622

Revenue 66,720 73,396 156,291

----------------------------------------------------- -------------------------- -------------------------- --------------------------

Adjusted operating (loss) / profit

Wireless 3,256 8,522 16,548

Photonics 1,540 4,370 10,239

CMOS++ (533) (791) (1,295)

Central corporate costs (6,141) (4,487) (9,452)

Adjusted operating (loss) / profit (1,878) 7,614 16,040

Adjusted items (1,197) (1,012) (7,380)

----------------------------------------------------- -------------------------- -------------------------- --------------------------

Operating (loss) / profit (3,075) 6,602 8,660

Share of losses of joint venture accounted for using

the equity method (254) - (2,000)

Finance (costs)/income (394) 46 87

(Loss) / Profit before tax (3,723) 6,648 6,747

----------------------------------------------------- -------------------------- -------------------------- --------------------------

Segmental information has been restated to reflect changes in the

Group's operating and reporting structure following the establishment of

an Executive Management Board that has consolidated responsibility for

the Group's primary markets and operating segments under the leadership

of an Executive VP, Global Business Development, Wireless and Emerging

Products and an Executive VP, Global Business Development, Photonics &

Infrared.

As part of this change, certain revenues and associated costs pertaining

to a specific site, which has shared production, have also been

reclassified between segments to reflect a change in allocation

methodology.

Restatement of the operating segments has had no impact on consolidated

(loss) / profit, net assets or cash.

1. ADJUSTED PROFIT MEASURES

The Group's results report certain financial measures after a number of

adjusted items that are not defined or recognised under IFRS including

adjusted operating profit, adjusted profit before income tax and

adjusted earnings per share. The Directors believe that the adjusted

profit measures provide a more useful comparison of business trends and

performance and allow management and other stakeholders to better

compare the performance of the Group between the current and prior year,

excluding the effects of certain non-cash charges and one-off or

non-operational items. The Group uses these adjusted profit measures for

internal planning, budgeting, reporting and assessment of the

performance of the business.

The tables below show the adjustments made to arrive at the adjusted

profit measures and the impact on the Group's reported financial

performance.

6 months to 30 Jun 2019 6 months to 30 Jun 2018 2018

Adjusted Adjusted Reported Adjusted Adjusted Reported Adjusted Adjusted Reported

GBP'000s Results Items Results Results Items Results Results Items Results

---------- ---------- ---------- ----------------------- ---------- ---------- ----------------------- ---------- ---------- ----------

Revenue 66,720 - 66,720 73,396 - 73,396 156,291 - 156,291

Cost of

sales (56,083) (45) (56,128) (56,279) (1,000) (57,279) (119,536) 696 (118,840)

---------- ---------- ---------- ----------------------- ---------- ---------- ----------------------- ---------- ---------- ----------

Gross

profit 10,637 (45) 10,592 17,117 (1,000) 16,117 36,755 696 37,451

Other

income - - - - 1,648 1,648 - 1,097 1,097

SG&A (12,515) (1,152) (13,667) (9,503) (1,660) (11,163) (20,715) (9,173) (29,888)

Profit on

disposal

of PPE - - - - - - - - -

---------- ---------- ---------- ----------------------- ---------- ---------- ----------------------- ---------- ---------- ----------

Operating

(loss) /

profit (1,878) (1,197) (3,075) 7,614 (1,012) 6,602 16,040 (7,380) 8,660

Share of

JV

losses (254) - (254) - - - (2,000) - (2,000)

Finance

costs (491) 97 (394) 1 45 46 (66) 153 87

---------- ---------- ---------- ----------------------- ---------- ---------- ----------------------- ---------- ---------- ----------

(Loss) /

Profit

before

tax (2,623) (1,100) (3,723) 7,615 (967) 6,648 13,974 (7,227) 6,747

Taxation (7,291) 365 (6,926) (1,369) (1,116) (2,485) (2,745) (2,813) (5,558)

(Loss) /

Profit

for the

period (9,914) (735) (10,649) 6,246 (2,083) 4,163 11,229 (10,040) 1,189

---------- ---------- ---------- ----------------------- ---------- ---------- ----------------------- ---------- ---------- ----------

6 months to 30 Jun 2019 6 months to 30 Jun 2018 2018

Pre tax Tax Reported Pre tax Tax Reported Pre tax Tax Reported

GBP'000s Adjustment Impact Results Adjustment Impact Results Adjustment Impact Results

-------------- ---------- ------ ----------------------- ---------- ------- ----------------------- ---------- ------- ----------

Share based

payments (135) 182 47 (1,500) (1,317) (2,817) 1,044 (3,607) (2,563)

Amortisation

of acquired

intangibles (266) 56 (210) (252) 45 (207) (518) 109 (409)

Restructuring (223) 47 (176) - - - (3,337) 701 (2,636)

Insurance

income - - - 1,648 - 1,648 1,097 (197) 900

Patent dispute

legal fees (573) 109 (464) (908) 164 (744) (1,262) 227 (1,035)

Onerous

property

lease - - - - - - (4,404) - (4,404)

Discounting 97 (29) 68 45 (8) 37 153 (46) 107

Total (1,100) 365 (735) (967) (1,116) (2,083) (7,227) (2,813) (10,040)

-------------- ---------- ------ ----------------------- ---------- ------- ----------------------- ---------- ------- ----------

1. ADJUSTED PROFIT MEASURES (CONTINUED)

The nature of the adjusted items is as follows:

-- Share based payments -- The charge recorded in accordance with IFRS 2

'share based payment' of which GBP0.1m (H1 2018: GBP1.0m, FY18 income

GBP0.7m) has been classified within cost of sales in gross profit and

GBP0.05m (H1 2018: GBP0.5m, FY18 income GBP0.3m) in selling, general and

administrative expenses within operating profit.

-- Amortisation of acquired intangibles arising in respect of fair value

exercises associated with previous corporate acquisitions -- The charge

of GBP0.3m (H1 2018: GBP0.3m, FY18 GBP0.5m) has been classified as

selling, general and administrative expenses within operating profit and

is non-cash.

-- Restructuring -- The charge of GBP0.2m (H1 2018: GBPnil, FY18: GBP3.3m)

relates to the closure of the Group's manufacturing facility in New

Jersey, USA and the transfer of the associated trade and assets to the

Group's manufacturing facility in Massachusetts, USA. The charge

comprises cash costs of GBP0.2m (H1 2018: GBPnil, FY18 GBP1.1m) relating

to severance and reactor decommissioning and non-cash asset impairment

costs of GBPnil (H1 2018: GBPnil, FY18: GBP2.2m) that have been

classified as selling, general and administrative expenses within

operating profit. Cash costs defrayed in the period total GBP1.3m (H1

2018: GBPnil, FY18: GBPnil).

-- Insurance income -- The income in the prior periods (H1 2018: GBP1.7m,

FY18: GBP1.1m) relates to the net insurance proceeds received following

the death of the Chief Financial Officer, Phillip Rasmussen, in April

2018. Obligations payable to Phillip Rasmussen's estate and fees

associated with the recruitment of Phillip Rasmussen's successor (H1

2018: GBP0.4m, FY18: GBP1.0m) were netted off the gross insurance

proceeds (H1 2018: GBP2.1m, FY18: GBP2.1m). The net insurance proceeds

received were classified as other income within operating profit. Cash

costs defrayed in the period total GBPnil (H1 2018: GBP1.7m income, FY18:

GBP1.5m income).

-- Patent dispute legal costs -- The charge relates to legal fees incurred

in respect of a patent dispute defence. Costs of GBP0.6m (H1 2018:

GBP0.9m, FY18: GBP1.3m) (2017: GBPnil) have been classified within

selling, general and administrative expenses within operating profit.

Cash costs defrayed in the period total GBP0.7m (H1 2018: GBPnil, FY18:

GBPnil).

-- Onerous property lease -- The charge of GBPnil (H1 2018: GBPnil, FY18:

GBP4.4m) relates to an increase in the provision for an onerous property

lease that was originally made in 2014 following the restructuring of the

Group's operations in Singapore. The increase in the provision made in

2018 for unused and unlet space at the manufacturing site extended the

provision to the end of the lease obligation in 2022. The extension of

the onerous lease provision resulted in a charge of GBP4.4m that was

classified within selling, general and administrative expenses within

operating profit. Cash costs associated with the annual rental for the

unused and unlet space total GBP0.7m (H1 2018: GBP0.7m, FY18: GBP1.5m).

The group has implemented the requirements of IFRS 16 'Leases' from 1

January 2019 with the Singapore property lease accounted for on balance

sheet from this date. IFRS 16 'Leases' has been implemented using the

modified retrospective approach applying the practical expedient that

allows on transition an adjustment to the value of the right of use

asset by the amount of any previously recognised onerous lease provision

as an alternative to performing an impairment review. The adoption of

this practical expedient results in the reclassification of the lease

provision as part of the net value of the right of use asset in the

Group's balance sheet from 1 January 2019 (see note 4).

-- Discounting -- This relates to the unwinding of the discounting on long

term financial assets of GBP0.1m (H1 2018: GBP0.1m, FY18: GBP0.3m) and

the unwinding of discounting on long term financial liabilities of GBPnil

(H1 2018: GBP0.1m, FY18 GBP0.1m) and has been classified as finance costs

within profit before tax.

1. ADJUSTED PROFIT MEASURES (CONTINUED)

Adjusted EBITDA (adjusted earnings before interest, tax, depreciation

and amortisation) has been calculated as follows:

6 months to 6 months to 12 months to

30 June 2019 30 June 2018 31 Dec 2018

(All figures GBP'000s) Unaudited Unaudited Audited

---------------------------------- ------------- ------------- ------------

(Loss) / Profit attributable to

equity shareholders (10,805) 4,023 966

Non-controlling interest 156 140 223

Finance costs/(income) 394 (46) (87)

Tax 6,926 2,485 5,558

Depreciation of property, plant

and equipment 4,761 3,162 6,773

Depreciation of right of use

assets 1,025 - -

Amortisation of intangible fixed

assets 3,981 2,944 6,109

Share based payments 135 1,500 (1,044)

Adjusted Items 796 (740) 7,906

---------------------------------- ------------- ------------- ------------

Restructuring 223 - 3,337

Insurance income - (1,648) (1,097)

Patent dispute legal costs 573 908 1,262

Onerous property lease - - 4,404

---------------------------------- ------------- ------------- ------------

Adjusted EBITDA 7,369 13,468 26,404

---------------------------------- ------------- ------------- ------------

1. TAXATION

The Group's consolidated effective tax rate for the six months ended 30

June 2019 was 186.0% (H1 2018: 37.4%, 2018: 82.4%). The effective tax

rate differs from the theoretical amount that would arise from applying

the standard corporation tax in the UK of 19.0% (H1 FY18: 19%, FY18:

19.0%) principally due to the following factors:

-- The current geo-political context affecting the markets in which IQE

operates has resulted in a shift in the balance of projected

manufacturing production and hence profits between the US and rest of the

world. As a result, lower utilisation of US deferred tax assets is

projected in coming years. This in-turn has resulted in a partial

reversal of the previously recognised US deferred tax assets with a

combined tax impact of GBP8m.

-- The Group's results report certain financial measures after a number of

adjusted items with a tax impact of GBP0.4m as detailed in note 7.

1. (LOSS) / EARNINGS PER SHARE

6 months to 6 months to 12 months to

30 June 2019 30 June 2018 31 Dec 2018

(All figures GBP'000s) Unaudited Unaudited Audited

(Loss) / Profit attributable to ordinary

shareholders (10,805) 4,023 966

Adjustments to profit after tax (note 7) 735 2,083 10,040

Adjusted (loss) / profit attributable to ordinary

shareholders (10,070) 6,106 11,006

-------------------------------------------------- ------------- ------------- ------------

Number of shares:

Weighted average number of ordinary shares 780,640,261 756,614,361 761,750,145

Dilutive share options 24,149,201 51,197,646 37,072,892

-------------------------------------------------- ------------- ------------- ------------

804,789,462 807,812,007 798,823,037

-------------------------------------------------- ------------- ------------- ------------

Adjusted basic (loss) / earnings per share (1.29p) 0.81p 1.44p

Basic (loss) / earnings per share (1.38p) 0.53p 0.13p

Adjusted diluted (loss) / earnings per share (1.29p) 0.76p 1.38p

Diluted (loss) / earnings per share (1.38p) 0.50p 0.12p

Basic (loss)/earnings per share is calculated by dividing the

(loss)/profit attributable to ordinary shareholders by the weighted

average number of ordinary shares during the period.

Diluted (loss)/earnings per share is calculated by dividing the

(loss)/profit attributable to ordinary shareholders by the weighted

average number of shares and 'in the money' share options in issue.

Share options are classified as 'in the money' if their exercise price

is lower than the average share price for the period. As required by IAS

33, this calculation assumes that the proceeds receivable from the

exercise of 'in the money' options would be used to purchase shares in

the open market in order to reduce the number of new shares that would

need to be issued.

1. CASH GENERATED FROM OPERATIONS

6 months to 6 months to 12 months to

30 June 2019 30 June 2018 31 Dec 2018

(All figures GBP'000s) Unaudited Unaudited Audited

------------------------------------------------------ ------------- ------------- ------------

(Loss)/Profit before tax (3,723) 6,648 6,747

Finance costs/(income) 394 (46) (87)

Depreciation of property, plant and equipment 4,761 3,162 6,773

Depreciation of right of use assets 1,025 - -

Amortisation of intangible assets 3,981 2,944 6,109

Impairment of property, plant and equipment - - 1,651

Non cash provision movements - - 5,495

Share based payments 135 1,500 (1,044)

------------------------------------------------------ ------------- ------------- ------------

Cash inflow from operations before changes in working

capital 6,573 14,208 25,644

Increase in inventories (1,605) (2,058) (1,387)

Decrease / (increase) in trade and other receivables 439 (4,772) (4,032)

(Decrease) / increase in trade and other payables (1,424) 202 (3,237)

------------------------------------------------------ ------------- ------------- ------------

Cash inflow from operations 3,983 7,580 16,988

------------------------------------------------------ ------------- ------------- ------------

1. ANALYSIS OF NET FUNDS / (DEBT)

6 months to 6 months to 12 months to

30 June 2019 30 June 2018 31 Dec 2018

(All figures GBP'000s) Unaudited Unaudited Audited

------------------------------ ------------- ------------- ------------

Bank borrowings due after one

year (12,008) - -

Bank borrowings due within one

year - - -

Lease liabilities due after

one year (46,375) - -

Lease liabilities due within

one year (2,897) - -

------------------------------ ------------- ------------- ------------

Total borrowings (61,280) - -

Cash and cash equivalents 11,173 40,634 20,807

------------------------------ ------------- ------------- ------------

Net (debt) / funds (50,107) 40,634 20,807

------------------------------ ------------- ------------- ------------

Bank borrowings relate to amounts drawn down on the Group's GBP27.3m

(US$35.0m) multi-currency revolving credit facility, provided by HSBC.

The facility is secured over the assets of IQE plc and certain

subsidiary companies and has a three-year term with an interest margin

of between 1.45% and 1.95% per annum over LIBOR.

Cash and cash equivalents comprise balances held in instant access bank

accounts and other short-term deposits

with a maturity of less than 3 months.

1. PROVISIONS FOR OTHER LIABILITIES AND CHARGES

6 months to 6 months to 12 months to

30 June 2019 30 June 2018 31 Dec 2018

(All figures GBP'000s) Unaudited Unaudited Audited

---------------------------------- ------------- ------------- ------------

As at 1 January 6,390 2,200 2,200

Charged to the income statement 223 - 5,495

Utilised during the period (1,357) (723) (1,539)

Transferred to right of use asset (5,256) - -

Foreign exchange - - 234

---------------------------------- ------------- ------------- ------------

As at 30 June / 31 December - 1,477 6,390

---------------------------------- ------------- ------------- ------------

Provisions for other liabilities and charges consists of an onerous

lease provision of GBPnil (H1 2018: GBP1,477,000, 2018: GBP5,256,000)

and a restructuring provision of GBPnil (H1 2018: GBPnil, 2018:

GBP1,134,000).

During 2014, as part of the re-organisation and rationalisation of the

Group's operations the Group restructured its activities in Singapore

and established with its joint venture partners the Compound

Semiconductor Development Centre. The Group sub-lets space at its

Singapore manufacturing facility to its joint venture and established an

onerous lease provision for vacant space at the property following the

re-organisation. The provision for unused and unlet space at the

manufacturing site was reassessed in 2018 and extended to the end of the

lease obligation in 2022 given the low level of interest from external

parties to sublet the residual unused space. The onerous lease provision

has been reclassified from 1 January 2019 as an adjustment to the right

of use asset relating to the Group's leased Singapore manufacturing

facility on implementation of IFRS 16'Leases' (see note 4).

The restructuring provision relates to costs associated with the closure

of the Group's manufacturing facility in New Jersey, USA and the

transfer of the trade and assets to the Group's manufacturing facility

in Massachusetts, USA. The provision principally comprised severance and

reactor decommissioning costs and has been fully utilised during 2019.

1. SHARE CAPITAL

6 months to 6 months to 12 months to

30 June 2019 30 June 2018 31 Dec 2018

Number of shares Unaudited Unaudited Audited

--------------------------------- ------------- ------------- ------------

As at 1 January 776,699,681 756,050,549 756,050,549

Employee share schemes 14,596,208 4,749,808 16,386,876

Translucent equity consideration - - 4,262,256

--------------------------------- ------------- ------------- ------------

As at 30 June / 31 December 791,295,889 760,800,357 776,699,681

--------------------------------- ------------- ------------- ------------

6 months to 6 months to 12 months to

30 June 2019 30 June 2018 31 Dec 2018

(All figures GBP'000s) Unaudited Unaudited Audited

--------------------------------- ------------- ------------- ------------

As at 1 January 7,767 7,561 7,561

Employee share schemes 146 47 164

Translucent equity consideration - - 42

--------------------------------- ------------- ------------- ------------

As at 30 June / 31 December 7,913 7,608 7,767

--------------------------------- ------------- ------------- ------------

1. RELATED PARTY TRANSACTIONS

Transactions with Joint Ventures

Compound Semiconductor Development Centre Private Limited ('CSDC')

The Group established CSDC with its joint venture partners as a centre

of excellence for the development and commercialisation of advanced

compound semiconductor wafer products in Asia and on its formation, CSDC

entered into an agreement to license certain intellectual property and

plant and equipment from the Group.

The activities of CSDC include research and development into advanced

compound semiconductor wafer products and the provision of contract

manufacturing services for compound semiconductor wafers to a subsidiary

of the IQE plc Group, MBE Technology Pte Limited.

CSDC operates from space within the Group's manufacturing facility in

Singapore. During the period the Group sub-let space at its

manufacturing facility to CSDC for GBP297,000 (H1 2018: GBP268,000,

2018: GBP565,000) at a rental cost per square foot equivalent to the

cost paid by the Group on the head lease associated with the property.

Intellectual property and equipment is licensed to CSDC and wafer

products are procured from CSDC at prices mutually agreed by the Group

and its joint venture partners, WIN Semiconductors Corp, Nangyang

Technological University and four representatives of the University. The

Group recognised no license revenue in the period (H1 2018: GBPnil,

2018: GBPnil) and purchased advanced compound semiconductor wafer

products from CSDC for GBP2,596,000 (H1 2018: GBP2,395,000, 2018:

GBP4,429,000).

During the period payments of GBP254,000 (H1 2018: GBPnil, 2018:

GBP2,000,000) have been made on behalf of CSDC which in accordance with

the Group's accounting policy has been recognised in the income

statement as the Group's share of losses in CSDC exceeds the carrying

value of its investment.

Compound Semiconductor Centre Limited ('CSC')

The Group established CSC with its joint venture partner as a centre of

excellence for the development and commercialisation of advanced

compound semiconductor wafer products in Europe and on its formation,

the Group contributed assets to the joint venture valued at

GBP12,000,000 as part of its initial investment.

The activities of CSC include research and development into advanced

compound semiconductor wafer products, the provision of contract

manufacturing services for compound semiconductor wafers to certain

subsidiaries within the IQE plc Group and the provision of compound

semiconductor manufacturing services to other third parties.

CSC operates from its manufacturing facilities in Cardiff, United

Kingdom and leases certain additional administrative building space from

the Group. During the period the CSC leased this space from the Group

for GBP57,500 (H1 2018 GBP57,500, 2018: GBP115,000) and procured certain

administrative support services from the Group for GBP117,500 (H1 2018:

GBP117,500, 2018: GBP235,000). As part of the administrative support

services provided to CSC the Group procured goods and services,

recharged to CSC at cost, totalling GBP2,235,135 (H1 2018: GBP1,893,060,

2018: GBP3,130,000).

CSC granted the Group the right to use its assets following its

formation for a minimum five-year period. Costs associated with the

right to use the CSC's assets are treated by the Group as operating

lease costs (see note 4) and are charged by the CSC at a price which

reflects the CSC's cash cost of production (including direct labour,

materials and site costs) but excludes any related depreciation or

amortisation of the CSC's property, plant and equipment and intangible

assets respectively under the terms of the joint venture agreement

between the parties. Costs associated with the right to use the CSC's

assets totalled GBP3,464,000 (H1 2018: GBP3,407,000, 2018: GBP6,655,000)

in the period.

At 30 June 2019 an amount of GBP233,700 (H1 2018: GBP188,342 2018:

GBP586,000) was owed from the CSC.

In the Groups balance sheet 'A' Preference Shares with a nominal value

of GBP8,800,000 (H1 2018: GBP8,800,000, 2018: GBP8,800,000) are included

in financial assets at an amortised cost of GBP8,085,000 (H1 2018:

GBP7,776,000, 2018: GBP7,937,000) and the Group has a shareholder loan

of GBP238,500 (H1 2018: GBP235,500, 2018: GBP237,000) due from CSC.

1. POST BALANCE SHEET EVENTS

On 29 August 2019, the Company agreed a new GBP30,000,000 Asset Finance

Loan facility, provided by HSBC, which is secured over the assets of

certain IQE subsidiary companies. The facility has a five year term and

an interest margin of 1.65% per annum over base rate on any drawn

balances.

(END) Dow Jones Newswires

September 03, 2019 02:00 ET (06:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

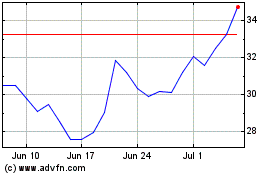

Iqe (LSE:IQE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iqe (LSE:IQE)

Historical Stock Chart

From Apr 2023 to Apr 2024