TIDMHUM

RNS Number : 1314J

Hummingbird Resources PLC

25 April 2022

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

25 April 2022

Hummingbird Resources plc

("Hummingbird" or the "Company")

Q1 2022 Operational and Trading Update

Hummingbird Resources plc (AIM: HUM) provides an operational

update for the first quarter of 2022 ("Q1 2022").

An interview with COO Anthony Köcken discussing the operational

and trading update can be viewed here.

Q1 2022 updates:

-- Quarter production: As forecast at the start of that year, Q1

2022 production was a lower production quarter at 15,548 ounces

("oz") of gold (Q4 2021: 18,181oz), driven primarily by the planned

essential maintenance work on the processing plant, and the gradual

improvement in mining rates as extra excavators were added during

the later end of the quarter, in particular. With additional

excavators now operating on site, daily mining volume rates have

continued to increase.

-- All-in Sustaining Cost ("AISC"): Increased AISC of US$2,235

per oz for Q1 2022 (Q4 2021: US$1,803 per oz) primarily due to the

lower quarterly production, with a lower AISC profile forecast for

the remainder of the year, in line with forecast production

improvements as detailed above

-- Gold sold: 15,179 oz of gold sold in Q1 2022 at an average

realised price of US$1,837 per oz (Q4 2021: 18,489 oz at an average

realised price of US$1,782). The Company held 2,557 oz of gold

inventory at 31 March 2022, valued at US$5.0 million

-- Kouroussa, Guinea: As previously announced, official

construction began at Kouroussa in January and is rapidly

advancing, with civil works now underway. The project remains on

schedule for first gold pour by the end of Q2 2023

Outlook:

-- Guidance: The Company maintains its 2022 guidance of 87,000 -

97,000 oz of gold, with an AISC of US$1,300 - US$1,450 per oz of

gold with forecast improving trends in production and AISC as

detailed above

-- Company reserve update: An updated Company Resources and

Reserve statement, to include the 2021 drilling campaigns at

Yanfolila and Kouroussa, remains on schedule to be released later

in Q2 2022

-- Dugbe, Liberia: Earn-in partner, Pasofino Gold Ltd

("Pasofino"), remains on track to release details of the Definitive

Feasibility Study ("DFS") on the Dugbe gold mine in Liberia in Q2

2022. Once finalised this will be a significant milestone for the

project and will complete its journey from being a pure exploration

asset to a proven project with economic fundamentals of strategic

value to Hummingbird

Dan Betts, CEO of Hummingbird, commented:

"Significant work has been completed in Q1 to deliver more

consistent and elevated future production at Yanfolila, including

integrating additional excavators on site to improve mining volume

rates, something that we are already starting to see. As guided at

the start of the year, Q1 production was lower, with improvements

expected from here.

Alongside the work at Yanfolila, we continue to make strong

progress at Kouroussa, with construction officially starting in the

new year and rapidly advancing, with major civil works now

underway. At Dugbe, the DFS is being finalised via our earn-in

partner Pasofino, with details expected to be released soon.

We continued to receive the final results from our 2021

group-wide drilling campaign during the quarter for both Yanfolila

and particularly Kouroussa where we have continued to intersect

many significant intercepts. These results are now being

incorporated i nto our updated Company Resources and Reserves

statement, which is expected to be released later this quarter.

As a Company, we remain focused on the year ahead as we look to

drive operational and productivity improvements at Yanfolila,

remain diligent in terms of timeframe, cost, and quality delivery

at Kouroussa towards first gold pour at the end of Q2 2023 and show

a pathway to delivering shareholder value from Dugbe with a DFS to

be issued soon. "

Operational Summary

Unit Q1 2022 Q4 2021 Q3 2021 Q2 2021 Q1 2021

----------------------- ------ ---------- ---------- ---------- ---------- ----------

Gold poured oz 15,548 18,181 22,102 24,494 22,781

------ ---------- ---------- ---------- ---------- ----------

Mined BCMs bcms 2,164,253 1,920,311 2,095,935 2,672,788 2,865,292

------ ---------- ---------- ---------- ---------- ----------

Ore mined t 502,800 445,808 392,005 443,490 364,114

------ ---------- ---------- ---------- ---------- ----------

Ore processed t 298,925 341,936 326,020 391,652 345,374

------ ---------- ---------- ---------- ---------- ----------

Avg. grade mill feed g/t 1.71 1.79 2.27 2.14 2.16

------ ---------- ---------- ---------- ---------- ----------

Recovery % 95.39% 92.38% 91.95% 91.88% 92.97%

------ ---------- ---------- ---------- ---------- ----------

Gold inventory - incl

SMO oz 2,557 2,246 2,769 1,972 2,596

------ ---------- ---------- ---------- ---------- ----------

* Ore mined includes high grade, low grade, and marginal

material. Ore processed is a blend based on preferential feed of

high-grade and low grade, with marginal ore added as an incremental

feed source

-- Q1 2022 production of 15,548 oz was a low production quarter,

however, as detailed in the Company's Q4 2021 operational update

and 2022 outlook release, the quarter was forecast to be a lower

production quarter versus the remaining quarters of 2022 due to the

completion of planned essential maintenance on the processing plant

and the gradual implementation of extra excavator fleet to improve

daily mining volume rates

-- Additional excavators are now on site and operating, which

has led to increased daily mining volume rates. Further, we note

additional maintenance programmes were undertaken during the

quarter to improve the overall fleet performance of our contract

miner, with some positive productivity improvements starting to be

seen on the existing fleet

-- Grade mill feed for Q1 2022 averaged 1.71 g/t versus 1.79 g/t averages in Q4 2021

o The Q1 2022 grade profile was again relatively low primarily

due to lower grade sections of the orebody accessed during the

period and a run of mine ("ROM") pad not fully optimised to allow

for more consistent better grade ore feed into the mill, resulting

in lower grades being processed for the quarter

o With improved mining rates and practices taking place, the

quantity and quality of ore on our ROM pad is scheduled to improve,

with expectations to then allow for better mill grade feed to be

processed

o Further, we are also looking to increase throughput at the

mill in Q2 before the wet season, in particular utilising

increasing oxide stockpiles from mining at the Sanioumale West

("SW") deposit, which is now taking place

o Mined bank cubic meters ("BCMs") totalled 2,164,253 in Q1 2022

versus Q4 2021 in 1,920,311 being a c.12% improvement as the

additional excavator fleet became operational, especially in the

later end of the quarter

-- Processing plan recovery rates for Q1 2022 improved versus previous quarters, at 95.39%

-- The Company continues to finalise the analysis of the optimal

Yanfolila underground development route to then put into the future

mine plans and will provide more updates once our analysis is

completed

-- During the quarter, the Company received and analysed a

further c.12,000 m of assays from the Sanioumale East ("SE")

deposit showing continuing high-grade intercepts being received,

and c.3,179 m of assays from the first round of drill testing done

at greenfield deposit BBC, which showed the potential to establish

new resources at this deposit

Kouroussa, Guinea

During the quarter, significant progress was made on

constructing the Company's second producing gold mine, Kouroussa,

with the scheduled timeline remaining on track to achieve the first

gold pour by the end of Q2 2023. Key updates included:

-- The commencement of civil works on-site and near completion

of the processing plant and camp site accommodation earth works

-- The construction of several key components of the processing

plant, including the fabrication of the CIL tanks and the

finalisation of their foundation works

-- The ordering of several long lead items, including apron

feeders, jaw crusher, SAG mill, cyclone cluster, and agitators

-- Excavation of the Tailing Storage Facility ("TSF") pond area commenced

-- The temporary construction camp was completed and

operational. The main site operations camp was cleared, and base

layers were installed ahead of foundation works

-- The arrival of key equipment, tooling, machinery, personnel,

and consumables to the site continued during the quarter, with

operational readiness planning and preparations underway

-- The power and mining contractor contracts negotiations are

nearing finalisation and expected to be awarded soon

-- In Q1 2022, the Company released a further c.8,767m of infill

drilling results at Kouroussa's key deposit Koekoe, with multiple

high-grade intercepts received, further strengthening the Company's

knowledge base and confidence in the Kouroussa asset

-- Future exploration review studies are underway on near-mine

targets, with the expectation that further exploration drilling

campaigns to be initiated in the future with the focus to increase

Kouroussa's overall Resources and Reserves base

-- Community engagement remains a key feature of all workstreams

Dugbe, Liberia

The Company's earn-in partner at Dugbe, Pasofino, provided a

positive progress update on the DFS, which is scheduled to be

released in Q2 2022.

Financial Summary:

Unit Q1 2022 Q4 2021 Q3 2021 Q2 2021 Q1 2021

---------------------- ------- -------- -------- -------- -------- --------

Gold sales oz 15,179 18,489 22,255 24,790 22,019

------- -------- -------- -------- -------- --------

Avg. gold sale price $/oz $1,871 $1,782 $1,782 $1,802 $1,788

------- -------- -------- -------- -------- --------

Operating cash costs $'000 $32,177 $32,486 $33,472 $33,986 $31,588

------- -------- -------- -------- -------- --------

AISC on gold sold $/oz $2,235 $1,803 $1,520 $1,386 $1,494

------- -------- -------- -------- -------- --------

Net (debt) / cash $'m ($47.4) ($25.0) ($5.9) $9.0 $0.5

------- -------- -------- -------- -------- --------

Net (debt) / cash

incl gold inventory

value $'m ($42.4) ($21.0) ($1.0) $12.4 $4.9

------- -------- -------- -------- -------- --------

Debt repayments $'m - - - $4.7 $8.6

------- -------- -------- -------- -------- --------

-- Q1 AISC of US$2,231 per oz was high, driven by lower ounces

of gold poured during the quarter, and as noted in the key updates

above, a lower ASIC profile is forecast for the remainder of the

year, in line with production improvements

-- Cost inflation is being felt in general, particularly in fuel

and consumables. The Company has instigated a programme to analyse

ways to deliver cost efficiency improvements at the Yanfolila

operations to mitigate these pressures. However, the key focus is

on improving Yanfolila's production profile, to then deliver an

improved AISC profile

-- For Kouroussa, although similar cost pressures are being

felt, the bulk of the construction contract is at a fixed price,

with our forecast capex as detailed on 12 October 2021 remaining on

budget

-- Net debt position c.US$47.4 million end of Q1 2022 (c.US$42.4

million including gold inventory value), with the final c.US$30

million loan available from Coris Bank International ("Coris Bank")

expected to be drawn in Q2 2022 to help facilitate the Kouroussa

construction build

ESG Q1 2022 updates include:

-- COVID-19: Mitigation measures remained in place at our

operations, and importantly the rise in cases as seen in Q4 2021

has reduced materially during the quarter

-- Kouroussa community engagement: Increased overall community

engagement took place during the quarter as construction advanced,

with more detailed longer term community project planning now

taking place as the Company rapidly moves towards the production

phase in 2023

-- Energy Efficiency: The Company is in the final stages of

negotiations of our power contract at Kouroussa, to then deliver on

low carbon emission initiatives including a +7 megawatt ("Mw")

solar power plant and energy saving waste heat recovery systems to

be imbedded into the overall build process

-- Dugbe, Liberia: During Q1 saw the advancement of the

Environmental and Social Impact Assessment ("ESIA") study, which is

expected to be finalised post the DFS

Notes to Editors:

Hummingbird Resources (AIM: HUM) is a multi-asset,

multi-jurisdiction gold production, development and exploration

Company, a member of the World Gold Council and a founding member

of Single Mine Origin ( singlemineorigin.com ). The Company

currently has two core gold projects, the operational Yanfolila

Gold Mine in Mali, and the Kouroussa Gold Mine in Guinea, which

will more than double current gold production when in production,

scheduled for first gold pour end of Q2 2023. Further, the Company

has a controlling interest in the Dugbe Gold Project in Liberia

that is being developed by Pasofino Gold Limited through an earn-in

agreement. Our vision is to continue to grow our asset base,

producing profitable ounces while placing our Environmental, Social

& Governance ('ESG') policies and practices at the heart of all

we do.

For further information, please visit hummingbirdresources.co.uk

or subscribe to our investor releases via investor email alerts

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill,

FD

Anthony Köcken

, COO

Edward Montgomery,

CSO & ESG

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer Nominated Adviser 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

Thomas Diehl Broker 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466

Ariadna Peretz Financial PR/IR 5000

James Husband Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFFISAISFIF

(END) Dow Jones Newswires

April 25, 2022 02:01 ET (06:01 GMT)

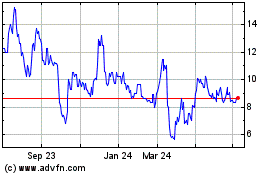

Hummingbird Resources (LSE:HUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

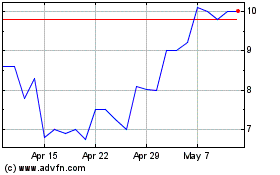

Hummingbird Resources (LSE:HUM)

Historical Stock Chart

From Apr 2023 to Apr 2024