TIDMHUM

RNS Number : 1726T

Hummingbird Resources PLC

22 November 2021

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

22 November 2021

Hummingbird Resources plc

("Hummingbird" or the "Company")

Updated Mineral Resource Estimates for the Dugbe Gold Project,

Libera

3.40 Moz in Measured & Indicated Mineral Resources, a 1 Moz

increase from the last MRE update

Hummingbird Resources plc (AIM: HUM) is pleased to announce

Pasofino Gold Ltd ("Pasofino") (TSXV: VEIN) has released an updated

Mineral Resource Estimates ("MRE") for the Dugbe F and Tuzon

deposits at the Dugbe Gold Project ("The Project") in Liberia. For

the full Pasofino release details and graphics, please follow the

link here .

Pasofino has an earn-in agreement for a 49% stake in the

Project, with Hummingbird maintaining a controlling interest of

51%. For further details on the option and earn-in agreement with

Pasofino, please refer to the Company's RNS dated 4 June 2020.

Highlights

-- Using a 1.0 g/t Au cut-off, the Measured and Indicated part

of the MRE model boasts 2.88 million ounces ("Moz") of gold

contained in 56.6 million tonnes ("Mt") grading 1.58 grams per

tonne ("g/t") Au in two deposits:

o Tuzon deposit : 40.2 Mt grading 1.64g/t Au containing 2.11 Moz

gold

o Dugbe F deposit : 16.5Mt grading 1.45g/t Au containing 0.77

Moz gold

-- This higher-grade material comprises the bulk of the MRE, and

selective processing of it should benefit the project economics

-- Reporting using the 0.5 g/t Au cut-off grade, which was used

for the previous (August 2020) MRE:

o An increase of 1.0 Moz gold in the Measured and Indicated

category

o Measured and Indicated tonnage is now 75.2 Mt grading 1.37 g/t

Au containing 3.31 Moz gold

o Plus, an Inferred tonnage of 14.9 Mt at 1.23 g/t Au containing

588 thousand ounces ("koz") gold

-- Using the lower 'marginal' cut-off grade (0.34 to 0.40 g/t

Au), the Total Measured and Indicated Mineral Resource inside of

the pit-shell is 81.2 Mt grading 1.30 g/t Au containing 3.40 Moz

gold

-- This has led to a Total MRE of 4.0 Moz (Measured, Indicated

and Inferred as detailed in Table 1 below)

-- There are clear opportunities to expand the MRE beyond the

pit-shell, increase grade and make new discoveries highlighted by

recent outcrop sampling returning up to 3.0 g/t on strike from

Tuzon and the 100+ targets on the over 2,500 Kilometre squared

("km(2) ") land package in Liberia

-- Taking advantage of the significantly increased Measured and

Indicated gold, DRA Global will now progress with the mine design

and Mineral Reserve Estimation for the Feasibility Study ("FS"),

which is on schedule for completion by the end of Q2 2022. It is

expected to benefit from the robust and flexible MRE

Dan Betts, CEO of Hummingbird Resources, commented:

"Pasofino's work to date demonstrates what we have always

believed, which is Dugbe is underpinned by a robust mineral

deposit. Of the total updated 4.0 Moz resource base, 3.4 Moz is in

the Measured and Indicated category, which is a significant uplift

on the previous MRE."

We are excited to see the results from the continuing DFS work

that Pasofino are doing as they complete the earn in requirements

of our JV agreement to earn a 49% interest in the Project. We are

increasingly confident that Dugbe has all the hallmarks of a

robust, large scale mine and remain very enthused by the upside

potential to expand the resource base. We continue to see Dugbe as

a very valuable asset within the Hummingbird portfolio which can

help us to drive value for our shareholders as that value becomes

more clearly articulated through the DFS work scheduled for

completion in Q2 2022."

Ian Stalker, CEO of Pasofino Gold Ltd, commented:

"We have achieved an updated Measured and Indicated Mineral

Resource Estimate (MRE) of 3.4 Moz of gold which is the main input

for the well-advanced Feasibility Study; of this, 2.88 Moz grading

1.58 g/t Au above a 1.0 g/t Au cut off provides an opportunity to

deliver higher grade ore to the plant and should have a knock-on

benefit on operating costs and capex, potentially without detriment

to planned annual production. It is also important to note that

there are avenues for further resource expansion and grade increase

which is exciting, and we plan to take advantage of these as we

work full speed to finalize the FS in early 2022."

Table 1: MRE for the Dugbe F and Tuzon deposits, with an

effective date 17 November 2021, using cut-off grade values defined

in the footnotes.

Subtotal above 0.5 Tonnage (Mt) Grade (Au g/t) Contained Gold (koz)

Au cut-off grade Classification

--------------------- ---------------------

Tuzon deposit Measured - - -

--------------------- ----------------- --------------------- ------------- --------------- ---------------------

Indicated 53.2 1.40 2,396

------------------------------------------------------------- ------------- --------------- ---------------------

Measured & Indicated 53.2 1.40 2,396

------------------------------------------------------------- ------------- --------------- ---------------------

Inferred 7.5 1.13 270

------------------------------------------------------------- ------------- --------------- ---------------------

Dugbe F deposit Measured 1.2 1.44 56

----------------- ---------------------

Indicated 20.8 1.28 860

------------------------------------------------------------- ------------- --------------- ---------------------

Measured & Indicated 22.1 1.29 916

------------------------------------------------------------- ------------- --------------- ---------------------

Inferred 7.4 1.34 317

------------------------------------------------------------- ------------- --------------- ---------------------

Subtotal Measured 1.2 1.44 56

================= ------------------------------------------- ------------- --------------- ---------------------

Indicated 74.0 1.37 3,256

-------------------------------------------------------------

Measured & Indicated 75.2 1.37 3,312

------------------------------------------------------------- ---------------------

Inferred 14.9 1.23 588

============================================================= ============= =============== =====================

Subtotal MRE for Tonnage (Mt) Grade (Au g/t) Contained Gold (koz)

material above

marginal cut-off

grade and below 0.5

g/t Au Classification

--------------------- ---------------------

Tuzon deposit Measured - - -

--------------------- ----------------- --------------------- ------------- --------------- ---------------------

Indicated 5.8 0.43 81

------------------------------------------------------------- ------------- --------------- ---------------------

Measured & Indicated 5.8 0.43 81

------------------------------------------------------------- ------------- --------------- ---------------------

Inferred 2.0 0.44 29

------------------------------------------------------------- ------------- --------------- ---------------------

Dugbe F deposit Measured - - -

----------------- ---------------------

Indicated 0.2 0.45 3

------------------------------------------------------------- ------------- --------------- ---------------------

Measured & Indicated 0.2 0.45 3

------------------------------------------------------------- ------------- --------------- ---------------------

Inferred 0.01 0.44 0.2

------------------------------------------------------------- ------------- --------------- ---------------------

Subtotal Measured - - -

================= --------------------- ------------- --------------- ---------------------

Indicated 6.0 0.43 84

------------------------------------------------------------- ------------- --------------- ---------------------

Measured & Indicated 6.0 0.43 84

------------------------------------------------------------- ------------- --------------- ---------------------

Inferred 2.1 0.44 29

============================================================= ============= =============== =====================

Total MRE - all Tuzon deposit Measured

material above the

marginal cut-off

grade

----------------- ---------------------

Indicated 59.0 1.31 2,477

------------------------------------------------------------- ------------- --------------- ---------------------

Measured + Indicated 59.0 1.31 2,477

------------------------------------------------------------- ------------- --------------- ---------------------

Inferred 9.5 0.98 300

------------------------------------------------------------- ------------- --------------- ---------------------

Dugbe F deposit Measured 1.2 - 56

----------------- ---------------------

Indicated 21.0 1.28 863

------------------------------------------------------------- ------------- --------------- ---------------------

Measured + Indicated 22.2 1.29 919

------------------------------------------------------------- ------------- --------------- ---------------------

Inferred 7.40 1.33 318

------------------------------------------------------------- ------------- --------------- ---------------------

Total Measured 1.2 - 56

================= ------------------------------------------- ------------- --------------- ---------------------

Indicated 80.0 1.30 3,340

------------------------------------------------------------- ------------- --------------- ---------------------

Measured + Indicated 81.2 1.30 3,396

------------------------------------------------------------- ------------- --------------- ---------------------

Inferred 16.9 1.13 617

============================================================= ============= =============== =====================

Notes

1. The effective date of the Mineral Resource Estimate is 17 November 2021

2. The marginal cut-off grades for Tuzon are 0.34 g/t Au for

fresh material and 0.39 g/t Au for weathered material. The marginal

cut-off grades for Dugbe F are 0.36 g/t Au for fresh material and

0.40 g/t Au for weathered material

3. Rounding errors may be evident when combining totals in the table but are immaterial

4. The Qualified Person is Mr. Martin Pittuck (CEng, MIMMM)

5. The Mineral Resource has been classified under the guidelines

of the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)

Standards on Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by CIM Council (2014), and procedures for

classifying the reported Mineral Resources were undertaken within

the context of the Canadian Securities Administrators National

Instrument 43-101 (NI 43-101)

6. Mineral Resources are not Mineral Reserves and have no

demonstrated economic viability. The estimate of Mineral Resources

may be materially affected by environmental, permitting, legal,

marketing, or other relevant issues

7. Mineral Resource estimates are stated within conceptual pit

shells that have been used to define Reasonable Prospects for

Eventual Economic Extraction (RPEEE). The pit shells used the

following main parameters: (i) Au price of US$1700/ounce; (ii)

plant recovery of 90%; and (iii) mean specific gravity of 2.78

t/m3for fresh rock and 2.1 t/m3for oxide material

Clear opportunities for an increase in grade and size

The following opportunities are apparent from the MRE and recent

fieldwork:

-- The higher-grade domain at Tuzon can be followed for most of

the length of the deposit and may represent an opportunity for

preferential treatment of higher-grade material to maximise project

economics

-- Incorporation of internal barren/low-grade intervals into the

updated block model contributed to the lower grade than the 2020

estimates but was considered necessary for the Indicated

classification - infill drilling may allow some of these intervals

to be modelled and excluded from future MRE work, or at mining

stage and is, therefore, an opportunity to increase grade

-- Both deposits extend beyond the MRE pit shell and there is an

opportunity to expand the high-grade zone at Tuzon beyond its

current modelled extent. At Tuzon, the 'SE limb' in particular

needs further drilling to follow it. The last drill-hole on this

limb was TDC186 which intersected 17.3 metres ("m") with an average

grade of 2.70 g/t Au[1]

-- Potential to identify satellite deposits. At a new target on

strike from Tuzon, four rock-chip samples from outcrops returned

0.39, 0.72, 2.41 and 3.07 g/t Au. These were collected as part of

mapping to finalise the drill-hole location for a hole testing

trench TZTR091, which returned an interval of 36 m with an average

grade of 0.60 g/t Au 6 km to the southwest of Tuzon[2]

Drilling and MRE objectives achieved

The updates to the Dugbe F and Tuzon MREs utilised approximately

14,000 m of additional diamond core drilling completed in 2021,

adding to the 68,832 m drilled by Hummingbird Resources between

2009 and 2014. The objectives of the 2021 drilling were as

follows:

1. To support conversion of Inferred resources to Indicated particularly at Dugbe F

2. Initial testing of potential extensions of the mineralisation at Tuzon

3. Targeted holes to firm up on the geological model

4. To provide holes for geotechnical testwork and manual and

acoustic televiewer logging for the DFS pit-design

All four objectives were firmly achieved. At Dugbe F the infill

drilling converted most of the previous Inferred MRE to Indicated;

73% of the Dugbe F deposit is now in the Measured and Indicated

category. Drilling to test the extension of the 'SE limb' and 'main

fold hinge' at Tuzon was largely limited to 180 m beyond the

previous drilling to test the concept before further holes were

drilled. The work has shown that further drilling has the potential

to expand these parts of the deposit.

Geology of the deposits

The Tuzon and Dugbe F deposits are approximately 4 km apart. The

hosting mineralised layer at both is orthopyroxene gneiss with

increased sulphide (typically 0.1 to 1%) content (visible

pyrrhotite, arsenopyrite and pyrite). At Tuzon, the mineralised

layer is between 2 and approximately 100 m thick at the largest

fold hinge. At Tuzon, the mineralised layer has been folded into a

large synform plunging approximately 20 degrees southwest. The

synform was later refolded, notably by the 'F3' folds and so has

relatively complex geometry. At Dugbe F the layer is typically 5-10

m thick and gently southeast dipping, and flat to undulating. At

both Dugbe F and Tuzon the layer outcrops for most of the length of

the deposits. Two localised recumbent folds affect the mineralised

layer at Dugbe F causing repetition and thickening of the

mineralised layer. The deposits are cut by whitish younger granitic

bodies and pegmatites which are generally barren. These intrusions

are interpreted to be dominantly parallel with the F3 fold axial

planes forming semi-concordant moderately dipping sheets of varying

thickness. The base of the oxide zone at both deposits is shallow,

rarely more than 10-12 m below surface and there is little to no

transitional zone.

Qualified Persons Statement

The independent Qualified Person responsible for the Mineral

Resource Estimates at the Dugbe F and Tuzon deposits, is Mr. Martin

Pittuck, CEng, MIMMM, FGS and is a full-time employee with SRK

Consulting (UK) Ltd. By virtue of his education, professional

registration and experience, Mr. Pittuck is a Qualified Person for

the purpose of NI 43-101 reporting and is independent of Pasofino.

Mr. Pittuck consents to the content of this press release relating

to the Tuzon Mineral Resource Estimate.

Content in this disclosure that relates to exploration results

was prepared and approved by Mr. Andrew Pedley Pr. Sci. Nat FGSSA.

Mr. Pedley is a full-time consultant of Pasofino Gold Ltd.'s

wholly-owned subsidiary ARX Resources Limited. By virtue of his

education, professional registration and experience, Mr. Pedley is

a Qualified Person for the purpose of NI 43-101

About the Dugbe Gold Project

The 2,559 km(2) Dugbe Project is located in southern Liberia and

situated within the south westmost part of the Birimian Supergroup,

which is host to the majority of West African gold deposits. To

date, two gold deposits have been identified on the Project; Dugbe

F and Tuzon. Both deposits outcrop at surface and may be amenable

to open-cut mining. The deposits are located within 4 km of the

Dugbe Shear Zone which is thought to have played a role in large

scale gold mineralisation in the area. A large amount of

exploration in the area was conducted by Hummingbird including

74,497 m of diamond coring. 70,700 m of this was at the Dugbe F and

Tuzon deposits, discovered by Hummingbird in 2009 and 2011

respectively. In 2020 and 2021 Pasofino drilled a further 14,638 m

mostly at Dugbe F and Tuzon. Pasofino is well underway with a

definitive feasibility study for gold production from these

deposits. In addition, there are a number of gold targets within

the Project. In 2019, Hummingbird signed a 25-year Mineral

Development Agreement ("MDA") with the Government of Liberia

providing the necessary long-term framework and stabilisation of

taxes and duties. Under the terms of the MDA, the royalty rate on

gold production is 3%, the income tax rate payable is 25% (with

credit given for historic exploration expenditures), the fuel duty

is reduced by 50%, and the Government of Liberia is granted a free

carried interest of 10% in the Project.

**ENDS**

Notes to Editors:

Hummingbird Resources (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold production, development and exploration

Company, member of the World Gold Council and founding member of

Single Mine Origin (www.singlemineorigin.com). The Company

currently has two core gold projects, the operational Yanfolila

Gold Mine in Mali, and the Kouroussa Gold Mine in Guinea, which

will more than double current gold production when in operation,

scheduled for first gold pour end of Q2 2023. Further, the Company

has a controlling interest in the Dugbe Gold Project in Liberia

that is being developed by Pasofino Gold Limited through an earn-in

agreement. Our vision is to continue to grow our asset base,

producing profitable ounces, while central to all we do being our

Environmental, Social & Governance ('ESG') policies and

practices.

For further information please visit www. Hummingbird or contact:

Daniel Betts, CEO Hummingbird Resources plc Tel: +44 (0) 20 7409 6660

Thomas Hill, FD

Anthony Kocken, COO

Edward Montgomery, CSO & ESG

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409 3494

Ritchie Balmer Nominated Adviser

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523 8000

Thomas Diehl Broker

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466 5000

Ariadna Peretz Financial PR/IR Email: HUM@buchanan.uk.com

James Husband

-------------------------- ----------------------------

[1] Pasofino Gold announcement dated 18(th) August 2021

[2] Pasofino Gold announcement dated 18(th) May 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDKBBQPBDDADB

(END) Dow Jones Newswires

November 22, 2021 10:48 ET (15:48 GMT)

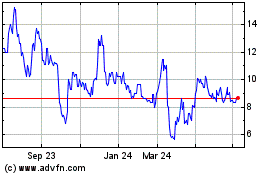

Hummingbird Resources (LSE:HUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

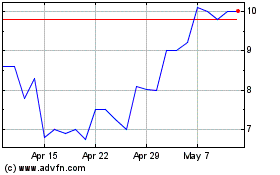

Hummingbird Resources (LSE:HUM)

Historical Stock Chart

From Apr 2023 to Apr 2024