TIDMHSBA

RNS Number : 6315V

HSBC Holdings PLC

10 August 2020

http://www.rns-pdf.londonstockexchange.com/rns/6315V_1-2020-8-10.pdf

HSBC Holdings plc

Pillar 3 Disclosures at 30 June 2020

Contents

Page

Introduction 2

----------------------------------------------------- ----

Highlights 2

----------------------------------------------------- ----

Regulatory framework for disclosures 2

----

Pillar 3 disclosures 2

----

Key metrics 3

----------------------------------------------------- ----

Regulatory developments 3

----

Risk management response to Covid-19 4

----------------------------------------------------- ----

Linkage to the Interim Report 5

----------------------------------------------------- ----

Capital and RWAs 7

----

Own funds 7

----

Leverage ratio 9

----------------------------------------------------- ----

Capital buffers 10

----

Pillar 1 minimum capital requirements

and RWA flow 10

----

Minimum requirement for own funds

and eligible liabilities 13

----------------------------------------------------- ----

Credit risk 19

----

Credit quality of assets 19

----------------------------------------------------- ----

Non-performing and forborne exposures 22

----------------------------------------------------- ----

Defaulted exposures 27

----------------------------------------------------- ----

Risk mitigation 27

----

Counterparty credit risk 37

----

Securitisation 42

----

Market risk 46

----

Other information 50

----------------------------------------------------- ----

Abbreviations 50

----

Cautionary statement regarding

forward-looking statements 51

----

Contacts 52

----------------------------------------------------- ----

Tables

Ref Page

1 Key metrics (KM1/IFRS9-FL) a 3

------- -------------------------------------- ---- ----

Reconciliation of balance

sheets - financial accounting

2 to regulatory scope of consolidation 6

------- -------------------------------------- ---- ----

3 Own funds disclosure b 7

----

Leverage ratio common disclosure

4 ('LRCom') a 9

------- -------------------------------------- ---- ----

Summary reconciliation of

accounting assets and leverage

5 ratio exposures ('LRSum') b 9

------- -------------------------------------- ---- ----

Leverage ratio - Split of

on-balance sheet exposures

(excluding derivatives,

SFTs and exempted exposures)

6 ('LRSpl') a 10

------- -------------------------------------- ----

7 Overview of RWAs ('OV1') b 11

----

RWA flow statements of credit

risk exposures under IRB

8 ('CR8') 11

----

RWA flow statements of CCR

9 exposures under IMM ('CCR7') 12

----

RWA flow statements of market

risk exposures under IMA

10 ('MR2-B') 12

----

Key metrics of the European

11.i resolution group ('KM2') a 13

------- -------------------------------------- ---- ----

Key metrics of the Asian

11.ii resolution group ('KM2') 14

------- -------------------------------------- ---- ----

Key metrics of the US resolution

11.iii group ('KM2') 14

------- -------------------------------------- ---- ----

12 TLAC composition ('TLAC1') a 15

------- -------------------------------------- ---- ----

HSBC Holdings plc creditor

13 ranking ('TLAC3') 16

------- -------------------------------------- ---- ----

HSBC UK Bank plc creditor

14 ranking ('TLAC2') 16

------- -------------------------------------- ---- ----

HSBC Bank plc creditor ranking

15 ('TLAC2') 17

------- -------------------------------------- ---- ----

HSBC Asia Holdings Ltd creditor

16 ranking ('TLAC3') 17

------- -------------------------------------- ---- ----

The Hongkong and Shanghai

Banking Corporation Ltd

17 creditor ranking ('TLAC2') 18

------- -------------------------------------- ---- ----

Hang Seng Bank Ltd creditor

18 ranking ('TLAC2') 18

------- -------------------------------------- ---- ----

HSBC North America Holdings

19 Inc. creditor ranking ('TLAC3') 18

------- -------------------------------------- ---- ----

Credit quality of exposures

by exposure class and instrument

20 ('CR1-A') 19

----

Credit quality of exposures

by industry or counterparty

21 types(1), ('CR1-B') 21

----

Credit quality of exposures

22 by geography 1,2 ('CR1-C') 22

----

Credit quality of forborne

23 exposures 23

------- -------------------------------------- ----

Collateral obtained by taking

possession and execution

24 processes 23

------- -------------------------------------- ----

Credit quality of performing

and non-performing exposures

25 by past due days 24

------- -------------------------------------- ----

Performing and non-performing

26 exposures and related provisions 25

-------------------------------------- ----

Changes in stock of general

and specific credit risk

27 adjustments ('CR2-A') 27

-------------------------------------- ---- ----

Changes in stock of defaulted

loans and debt securities

28 ('CR2-B') 27

------- -------------------------------------- ---- ----

Credit risk mitigation techniques

29 - overview ('CR3') 27

-------------------------------------- ---- ----

Standardised approach -

credit conversion factor

and credit risk mitigation

30 ('CRM') effects ('CR4') b 28

---- ----

Standardised approach -

exposures by asset classes

31 and risk weights ('CR5') b 29

----

IRB - Credit risk exposures

by portfolio and PD range

32 ('CR6') a 30

-------------------------------------- ----

IRB - Effect on RWA of credit

derivatives used as CRM

33 techniques ('CR7') 36

----

Specialised lending on slotting

34 approach ('CR10') 36

---- ----

Analysis of counterparty

credit risk exposure by

approach (excluding centrally

35 cleared exposures) ('CCR1') 37

----

Credit valuation adjustment

36 capital charge ('CCR2') 37

----

Standardised approach -

CCR exposures by regulatory

portfolio and risk weights

37 ('CCR3') 37

---- ----

IRB - CCR exposures by portfolio

38 and PD scale ('CCR4') 38

----

Impact of netting and collateral

held on exposure values

39 ('CCR5-A') 40

---- ----

Composition of collateral

40 for CCR exposure ('CCR5-B') 40

-------------------------------------- ---- ----

Exposures to central counterparties

41 ('CCR8') 40

------- -------------------------------------- ----

Credit derivatives exposures

42 ('CCR6') 41

------- -------------------------------------- ---- ----

Securitisation exposures

in the non-trading book

43 ('SEC1') 43

------- -------------------------------------- ----

Securitisation exposures

44 in the trading book ('SEC2') 44

------- -------------------------------------- ---- ----

Securitisation exposures

in the non-trading book

and associated regulatory

capital requirements - bank

acting as originator or

45 as sponsor ('SEC3') 44

------- -------------------------------------- ---- ----

Securitisation exposures

in the non-trading book

and associated capital requirements

- bank acting as investor

46 ('SEC4') 45

------- -------------------------------------- ---- ----

Market risk under standardised

47 approach (MR1) 46

------- -------------------------------------- ---- ----

48 Market risk under IMA (MR2-A) 46

------- -------------------------------------- ---- ----

IMA values for trading portfolios

49 (MR3) 47

------- -------------------------------------- ---- ----

Comparison of VaR estimates

50 with gains/losses (MR4) 48

------- -------------------------------------- ---- ----

The Group has adopted the EU's regulatory transitional

arrangements for IFRS 9 'Financial Instruments'. A number of tables

in this document report under this arrangement as follows:

a. Some figures have been prepared on an IFRS 9 transitional

basis. Details are provided in the table footnotes.

b. All figures have been prepared on an IFRS 9 transitional basis.

All other tables report numbers on the basis of the full

adoption of IFRS 9.

This document should be read in conjunction with the Interim

Report 2020, which has been published on our website

www.hsbc.com

Certain defined terms

Unless the context requires otherwise, 'HSBC Holdings' means

HSBC Holdings plc and 'HSBC', the 'Group', 'we', 'us' and 'our'

refer to HSBC Holdings together with its subsidiaries. Within this

document the Hong Kong Special Administrative Region of the

People's Republic of China is referred to as 'Hong Kong'. When used

in the terms 'shareholders' equity' and 'total shareholders'

equity', 'shareholders' means holders of HSBC Holdings ordinary

shares and those preference shares and capital securities issued by

HSBC Holdings classified as equity. The abbreviations '$m', '$bn'

and '$tn' represent millions, billions (thousands of millions) and

trillions of US dollars, respectively.

Introduction

Highlights

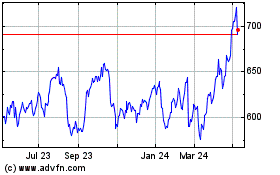

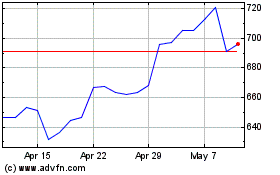

Common equity tier 1 ('CET1') ratio increased over 2Q20 to 15%

due to higher CET1 capital, which included an increase from the

cancellation of the 4Q19 dividend and the current suspension of

dividends on ordinary shares, more than offsetting the impact of

RWA growth.

Please click on the link below to view the following chart and

Pillar 3 document in full:

http://www.rns-pdf.londonstockexchange.com/rns/6315V_1-2020-8-10.pdf

Common equity tier 1 ($bn and %)

Risk-weighted assets by risk type

and global business ($bn)

Credit risk

Counterparty

credit risk

Market risk

Operational

risk

Commercial

Banking

Global Banking

and Markets

Wealth and

Personal

Banking

Corporate

Centre

Regulatory framework for disclosures

We are supervised on a consolidated basis in the UK by the

Prudential Regulation Authority ('PRA'), which receives information

on the capital adequacy of, and sets capital requirements for, the

Group as a whole. Individual banking subsidiaries are directly

regulated by their local banking supervisors, which set and monitor

their local capital adequacy requirements. In most jurisdictions,

non-banking financial subsidiaries are also subject to the

supervision and capital requirements of local regulatory

authorities.

At a consolidated Group level, capital is calculated for

prudential regulatory reporting purposes using the Basel III

framework of the Basel Committee on Banking Supervision ('Basel'),

as implemented by the European Union ('EU') in the revisions to the

Capital Requirements Regulation, as implemented ('CRR II'), and in

the PRA Rulebook for the UK banking industry. The regulators of

Group banking entities outside the EU are at varying stages of

implementing the Basel III framework, so the Group may have been

subject to local regulations in the first half of 2020 that were on

the basis of the Basel I, II or III frameworks.

The Basel Committee's framework is structured around three

'pillars': Pillar 1, minimum capital requirements; Pillar 2,

supervisory review process; and Pillar 3, market discipline. The

aim of Pillar 3 is to produce disclosures that allow market

participants to assess the scope of banks' application of the Basel

Committee's framework. It also aims to assess their application of

the rules in their jurisdiction, capital conditions, risk exposures

and risk management processes, and hence their capital

adequacy.

Pillar 3 disclosures

Our Pillar 3 Disclosures at 30 June 2020

comprises quantitative and qualitative information required

under Pillar 3. They are made in accordance with Part Eight of the

Capital Requirements Regulation, as implemented by CRR II and the

European Banking Authority ('EBA') guidelines on disclosure

requirements. These disclosures are supplemented by specific

additional requirements of the PRA and discretionary disclosures on

our part.

The Pillar 3 disclosures are governed by the disclosure policy

framework approved by the Group Audit Committee.

To give insight into movements during the year, we provide

comparative figures, commentary of variances and flow tables for

capital requirements. In all tables where the term 'capital

requirements' is used, this represents the minimum total capital

charge set at 8% of risk-weighted assets ('RWAs') by article 92 of

the Capital Requirements Regulation.

Where disclosures have been enhanced, or are new, we do not

generally restate or provide comparatives. Wherever specific rows

and columns in the tables prescribed by the EBA or Basel are not

applicable or immaterial to our activities, we omit them and follow

the same approach for comparatives.

Pillar 3 requirements may be met by inclusion in other

disclosure media. Where we adopt this approach, references are

provided to the relevant pages of the Interim Report 2020 or to

other documents.

We continue to engage in the work of the UK authorities and

industry associations to improve the transparency and comparability

of UK banks' Pillar 3 disclosures.

Reporting and disclosure of exposures subject to measures

applied in response to the Covid-19 outbreak

On 2 June, the EBA announced temporary additional reporting and

disclosure requirements concerning payment moratoria and

forbearance measures related to the Covid-19 outbreak.

On 28 July, the PRA issued a statement setting out its

expectations on how the disclosure guidelines are to be applied,

amending the EBA instructions and definitions to reflect the UK

approach to payment deferrals.

We will publish these disclosures on or around 24 August 2020 on

the HSBC website, hsbc.com.

Key metrics

Table 1: Key metrics (KM1/IFRS9-FL)

At

30 Jun 31 Mar 31 Dec 30 Sep 30 Jun

Ref* Footnotes 2020 2020 2019 2019 2019

--------- --------- --------- --------- ---------

Available capital ($bn)(1) 2

----------

1 Common equity tier 1 ('CET1') capital ^ 128.4 125.2 124.0 123.8 126.9

---------- -------

CET1 capital as if IFRS 9 transitional

2 arrangements had not been applied 127.4 124.5 123.1 122.9 126.0

3 Tier 1 capital ^ 152.5 149.2 148.4 149.7 152.8

----------

Tier 1 capital as if IFRS 9 transitional

4 arrangements had not been applied 151.4 148.5 147.5 148.8 151.9

5 Total capital ^ 177.2 174.0 172.2 175.1 178.3

----------

Total capital as if IFRS 9 transitional

6 arrangements had not been applied 176.1 173.3 171.3 174.2 177.4

-------

Risk-weighted assets ('RWAs') ($bn)

--------- ---------

7 Total RWAs 854.6 857.1 843.4 865.2 886.0

-------

Total RWAs as if IFRS 9 transitional

8 arrangements had not been applied 854.1 856.7 842.9 864.7 885.5

-------------------------------------------- ---------- ------- -------

Capital ratios (%) 2

----------

9 CET1 ^ 15.0 14.6 14.7 14.3 14.3

---------- -------

CET1 as if IFRS 9 transitional arrangements

10 had not been applied 14.9 14.5 14.6 14.2 14.2

------- -------

11 Tier 1 ^ 17.8 17.4 17.6 17.3 17.2

---------- ------- -------

Tier 1 as if IFRS 9 transitional

12 arrangements had not been applied 17.7 17.3 17.5 17.2 17.2

------- -------

13 Total capital ^ 20.7 20.3 20.4 20.2 20.1

---------- ------- -------

Total capital as if IFRS 9 transitional

14 arrangements had not been applied 20.6 20.2 20.3 20.1 20.0

------- -------

Additional CET1 buffer requirements

as a percentage of RWA (%)

----- -------------------------------------------- ---------- --------- ---------

Capital conservation buffer requirement 2.50 2.50 2.50 2.50 2.50

-------

Countercyclical buffer requirement 0.20 0.22 0.61 0.69 0.68

------- ------- -------

Bank G-SIB and/or D-SIB additional

requirements 2.00 2.00 2.00 2.00 2.00

------- -------

Total of bank CET1 specific buffer

requirements 4.70 4.72 5.11 5.19 5.18

------- ------- ------- -------

Total capital requirement (%) 3

-------------------------------------------- ---------- --------- ---------

Total capital requirement 11.1 11.0 11.0 11.0 11.0

-------------------------------------------- ---------- -------

CET1 available after meeting the

bank's minimum capital requirements 8.8 8.4 8.5 8.1 8.1

---------- ------- ------- ------- ------- -------

Leverage ratio 4

----------

Total leverage ratio exposure measure

15 ($bn) 2,801.4 2,782.7 2,726.5 2,708.2 2,786.5

---------- -------

16 Leverage ratio (%) ^ 5.3 5.3 5.3 5.4 5.4

---------- ------- -------

Leverage ratio as if IFRS 9 transitional

arrangements had not been applied

17 (%) 5.3 5.2 5.3 5.4 5.3

-------------------------------------------- ------- -------

Liquidity coverage ratio ('LCR') 5

----- -------------------------------------------- ---------- --------- ---------

Total high-quality liquid assets

($bn) 654.4 617.2 601.4 513.2 532.8

----------

Total net cash outflow ($bn) 442.9 395.0 400.5 378.0 391.0

----------

LCR ratio (%) 147.8 156.3 150.2 135.8 136.3

----- -------------------------------------------- ---------- ------- ------- ------- ------- -------

* The references in this and subsequent tables identify lines

prescribed in the relevant EBA template where applicable and where

there is a value.

^ Figures have been prepared on an IFRS 9 transitional basis.

1 Where applicable, our reporting throughout this document also

reflects government relief schemes intended to mitigate the impact

of the Covid-19 outbreak.

2 Capital figures and ratios are reported on a CRR II

transitional basis for capital instruments.

3 Total capital requirement is defined as the sum of Pillar 1

and Pillar 2A capital requirements set by the PRA. The minimum

requirements represent the total capital requirement to be met by

CET1.

4 Leverage ratio is calculated using the CRR II end point basis for capital.

5 The EU's regulatory transitional arrangements for IFRS 9

'Financial Instruments' in article 473a of the Capital Requirements

Regulation do not apply to liquidity coverage measures. LCR is

calculated as at the end of each period rather than using average

values. For further details, refer to page 83 of the Interim Report

2020.

We have adopted the regulatory transitional arrangements for

IFRS 9 'Financial Instruments', including paragraph four within

article 473a of the Capital Requirements Regulation, published by

the EU on 27 December 2017. These transitional arrangements permit

banks to add back to their capital base a proportion of the impact

that IFRS 9 has upon their loan loss allowances during the first

five years of use. The impact of IFRS 9 on loan loss allowances is

defined as:

-- the increase in loan loss allowances on day one of IFRS 9 adoption; and

-- any subsequent increase in expected credit losses ('ECL') in

the non-credit-impaired book thereafter.

Any add-back must be tax affected and accompanied by a

recalculation of capital deduction thresholds, exposure and RWAs.

The impact is calculated separately for portfolios using the

standardised ('STD') and internal-ratings based ('IRB') approaches.

For IRB portfolios, there is no add-back to capital unless loan

loss allowances exceed regulatory 12-month expected losses.

The EU's CRR 'Quick Fix' relief package enacted in June 2020

increased from 70% to 100% the relief that banks may take

for

loan loss allowances recognised since 1 January 2020 on the

non-credit-impaired book.

In the current period, the add-back to the capital base amounted

to $1.4bn under the STD approach with a tax impact of $0.3bn.

At 31 December 2019, the add-back to the capital base under the

STD approach was $1.0bn with a tax impact of $0.2bn.

Regulatory developments

Covid-19

The current Covid-19 pandemic has created an unprecedented

challenge to the global economy. Governments, central banks and

regulatory authorities have responded to this challenge with a

number of regulatory measures. The substance of the announcements

and the pace of response varies by jurisdiction, but broadly these

have included a number of customer support measures, operational

capacity measures and amendments to the RWAs, capital and liquidity

frameworks.

In the EU, the relief measures have included a package known as

the 'CRR Quick Fix' that was enacted in June 2020. The package

represents an acceleration of some of the beneficial elements of

the amendments to CRR II that were originally scheduled for June

2021, together with other amendments to mitigate the potential

volatility in capital ratios arising from the pandemic. The

material changes that were finalised in June, include:

-- a resetting of the transitional provisions in relation to

recognising IFRS 9 provisions in CET1 capital;

-- the acceleration of the timetable for the changes to the CET1

deduction of software assets so that once the EBA finishes its

current consultation on the new methodology, the rules can go

live;

-- the CRR II changes to the small and medium-sized enterprises

('SME') supporting factor and the new infrastructure supporting

factor; and

-- the CRR II change to the netting in the leverage ratio

exposure measure of regular-way purchases and sales.

The PRA has published a statement in response to the package,

stating that it will be undertaking a quantitative analysis of the

benefits, which will be used to inform its supervisory approach.

This will include an assessment of whether further action is

necessary in Pillar 2. The accelerated application of the revised

SME and infrastructure supporting factors will be implemented by

the Group in the second half of 2020.

In addition to the CRR Quick Fix package, there were other

changes to the regime in response to the Covid-19 outbreak. These

included the enactment by the EU of beneficial changes to the CET1

deduction for prudent valuation adjustments, which will remain in

place until 1 January 2021, and the PRA announcing that it is

setting all Pillar 2A requirements in 2020 and 2021 as a nominal

amount, instead of as a percentage of total RWAs.

The Basel Committee

In December 2017, the Basel Committee ('Basel') published the

Basel III Reforms. The package was finalised in July 2020 when

Basel published the final revisions to the credit valuation

adjustment ('CVA') framework.

In March 2020, Basel announced a one-year delay to the

implementation of the package. It is now to be implemented on

1 January 2023, with a five-year transitional provision for the

output floor. This floor ensures that, at the end of the

transitional period, banks' total RWAs will be no lower than 72.5%

of those generated by the standardised approaches. The final

standards will need to be transposed into the relevant local law

before coming into effect. The EU, the UK and Hong Kong authorities

have already indicated that they will apply the new timetable.

There remains a significant degree of uncertainty about the

impact of these changes due to the number of national discretions

within Basel's reforms and the need for further supporting

technical standards to be developed. Furthermore, any impact needs

to be viewed in light of the possibility of offsets against Pillar

2, which may arise as shortcomings within Pillar 1 are

addressed.

The Capital Requirements Regulation amendments

In June 2019, the EU enacted CRR II. This is the EU's

implementation of changes to the own funds regime and to the

Financial Stability Board's ('FSB') requirements for total

loss-absorbing capacity ('TLAC'), known in the EU as the minimum

requirements for own funds and eligible liabilities ('MREL'). CRR

II will also implement the first tranche of changes to the EU's

legislation to reflect the Basel III Reforms, including the changes

to market risk ('FRTB') rules, revisions to the standardised

approach for measuring counterparty risk, changes to the equity

investments in funds rules and the new leverage ratio rules. The

CRR II rules will follow a phased implementation with significant

elements entering into force in 2021, in advance of Basel's

timeline.

The EU's implementation of the Basel III Reforms

The remaining elements of the Basel III Reforms will be

implemented in the EU by a further set of amendments to the Capital

Requirements Regulation. In 2019, the European Commission began

consulting on its implementation, which will include reforms to the

credit and operational risk rules and a new output floor. However,

draft legislative text has not yet been published. The EU

implementation will be subject to an extensive negotiation process

with the EU Council and Parliament. As a result, the final form of

the rules remains unclear.

The UK's withdrawal from the EU

The UK left the EU on 31 January 2020. In order to smooth the

transition, the UK remains subject to EU law during an

implementation period, which will end on 31 December 2020. The PRA

has announced its intention that, save for in certain limited

circumstances, the changes to the prudential framework arising as a

result of the UK's withdrawal will be delayed until 31 March

2022.

In June, Her Majesty's Treasury ('HMT') published an update on

the framework to implement future prudential changes in the UK.

This will be in the form of a Financial Services Bill in which

powers will be delegated to the PRA for detailed rule making. The

UK has stated that it intends to implement its own version of CRR

II to the same timetable as the EU.

At the same time, HMT published a consultation on the

implementation of the amendments to the Bank Recovery and

Resolution Directive, the main EU regulation overseeing resolution

and MREL standards. It also subsequently published a consultation

on aspects of the amendments to the Capital Requirements Directive

('CRD V'). HMT proposes to implement in UK law only those elements

of the Bank Recovery and Resolution Directive and CRD V that will

be live on 31 December 2020.

In July 2020, the PRA also issued a consultation on implementing

parts of CRD V, which includes its requirements for Pillar 2,

remuneration and governance. In the autumn, the PRA will consult on

the remaining elements of CRD V and the CRR II elements that apply

from December 2020.

Other developments

In July 2020, the PRA published its final policy on reducing

Pillar 2A to reflect the additional resilience associated with the

higher countercyclical capital buffer ('CCyB') in a standard risk

environment proposed by the Bank of England's Financial Policy

Committee. However, reflecting the reduction of the UK's CCyB to 0%

and the fact that the UK's structural CCyB rate set in a standard

risk environment has not changed, the PRA introduced a requirement

to temporarily increase the PRA buffer to offset some of the

reductions in Pillar 2A that firms receive under this proposal. The

rules take immediate effect.

Also in July, the PRA published a statement outlining its views

on the implications of London interbank offered rate ('Libor')

transition for contracts in scope of its resolution-related rules.

The EBA also published its final guidelines on the treatment of

structural foreign exchange positions, which will apply from

1 January 2022, one year later than originally planned.

On 1 July, the PRA sent a letter to CEOs outlining its

expectations of firms in managing climate-related financial risks

and advising firms that they must have fully embedded their

approaches to managing such risk by the end of 2021.

Risk management response to Covid-19

The first half of 2020 was marked by unprecedented global

economic events, leading to banks playing an expanded role to

support society and customers. The Covid-19 outbreak and its impact

on the global economy have impacted many of our customers' business

models and income, requiring significant levels of support from

both governments and banks. In response, we have enhanced our

approach to the management of risk in this rapidly changing

environment.

Throughout the Covid-19 outbreak, we have supported our

customers and adapted our operational processes. Our people,

processes and systems have responded to the changes needed and

increased the workload in serving our customers through this time.

To meet the additional challenges, we supplemented our existing

approach to risk management with additional tools and practices. We

increased our focus on the quality and timeliness of the data used

to inform management decisions, through measures such as early

warning indicators, prudent active risk management against our risk

appetite, and ensuring regular communication with our Board and

other key stakeholders. This section sets out how we have managed

our key risks resulting from the outbreak and its impacts.

Capital and liquidity management

The management of capital was a key focus in 1H20 to ensure the

Group responded to unprecedented customer and capital demands

arising from Covid-19 outbreak. All major entities remained in

excess of their capital risk appetite.

In response to a written request from the PRA, we cancelled the

fourth interim dividend for 2019 of $0.21 per ordinary share.

Similar requests were also made to other UK incorporated banking

groups. We also announced that until the end of 2020, we will make

no quarterly or interim dividend payments or accruals in respect of

ordinary shares. We also plan to suspend share buy-backs in respect

of ordinary shares in 2020 and 2021.

The reduction of the UK countercyclical buffer rate to 0% was

reflected in the Group's risk appetite statement, and together with

other regulatory relief, resulted in a reduction to Group CET1 and

leverage ratio requirements.

In 1H20, all entities remained within the CET1 risk appetite and

the Group continues to maintain the appropriate resources required

to adequately support risks to which it is exposed. This has been

further informed by additional internal stress tests carried out in

response to the Covid-19 outbreak. Capital risk management

practices continued to be enhanced across the Group through the

capital risk management function, focusing on both adequacy of

capital and sufficiency of returns.

The management of liquidity risk was enhanced during 1H20 in

response to the Covid-19 pandemic to ensure the Group anticipated,

monitored and responded to the impacts both at Group and entity

level. Liquidity levels were impacted by drawdown of committed

facilities and buy-backs of short-term debt. However, this was

offset by an increase in deposits, use of central bank facilities

where appropriate and the ability to issue in the short-term

markets as they stabilised. As a result of these liability

enhancing actions, the Group and all entities have significant

surplus liquidity, resulting in heightened liquidity coverage

ratios ('LCR') in 1H20.

Prudential valuation adjustment

To achieve the degree of certainty prescribed for prudent

valuation, banks must adjust fair valued exposures for valuation

uncertainties and deduct the resulting prudent valuation adjustment

('PVA') charge from CET1. Market turmoil caused by the Covid-19

outbreak resulted in a significant increase in asset price

dispersion, bid-offer spreads and subsequent hypothetical exit

costs, leading to a material increase of the PVA charge in 1Q20

when compared with 4Q19. For 2Q20, the charge materially reduced

from bid offer spreads and price dispersion reduction as market

volatility reduced, as well as from the application of a higher

diversification benefit temporarily permitted by regulators.

Credit risk management

During 1Q20, a number of relief programmes were initiated across

the Group in response to the Covid-19 outbreak. These remained in

place during the second quarter, with some programmes extended to

support our customers where required.

Enhanced model monitoring has been established to detect any

trends, shifts in key risk drivers or early performance indicators

that could signal that our IRB models are no longer performing as

expected. Using the latest available data from May 2020 for our

retail models, the monitoring outputs indicate there have been

limited impacts on the performance of IRB models as a direct

consequence of the outbreak. Within wholesale, the most recent

financial data received from customers do not always reflect

current business performance during the outbreak, so we apply

appropriate levels of judgemental overrides to the model outputs.

As better information emerges on the outbreak's impact on the

credit quality of loan portfolios and the creditworthiness of

groups of borrowers, credit risk evaluations will be modified

accordingly. We will continue to monitor the credit risk within our

business and take the appropriate mitigating actions to help

support our customers and our franchise.

For further details of the customer relief programmes that we

are participating in, see page 66 of the Interim Report 2020.

Non-financial risk

As a result of the Covid-19 outbreak, business continuity plans

have been implemented successfully. Despite high levels of working

from home, the majority of service level agreements are being

maintained. We have experienced no major impacts to the supply

chain from our third-party service providers. The risk of damage or

theft to our physical assets or criminal injury to our employees

remains unchanged. No significant incidents have impacted our

buildings or staff. Expedited decisions to ensure the continuity of

critical customer services are being documented through

governance.

Market risk management

We managed market risk prudently in the first half of 2020.

Sensitivity exposures remained within appetite as the business

pursued its core market-making activity in support of our customers

during the pandemic. We have also undertaken hedging activities to

protect the business from potential future deterioration in credit

conditions. Market risk continued to be managed using a

complementary set of exposure measures and limits, including stress

and scenario analysis.

Linkage to the Interim Report

Structure of the regulatory group

Assets, liabilities and post-acquisition reserves of

subsidiaries engaged in insurance activities are excluded from the

regulatory consolidation. Our investments in these insurance

subsidiaries are recorded at cost and deducted from CET1 capital,

subject to thresholds.

The regulatory consolidation also excludes special purpose

entities ('SPEs') where significant risk has been transferred to

third parties. Exposures to these SPEs are risk weighted as

securitisation positions for regulatory purposes.

Participating interests in banking associates are proportionally

consolidated for regulatory purposes by including our share of

assets, liabilities, profits and losses, and RWAs in accordance

with the PRA's application of EU legislation. Non-participating

significant investments along with non-financial associates are

deducted from capital, subject to thresholds.

For further explanation of the differences between the

accounting and regulatory scope of consolidation and their

definition of exposure, see pages 8 to 13 of the Pillar 3

Disclosures at 31 December 2019.

Table 2: Reconciliation of balance sheets - financial accounting to

regulatory scope of consolidation

Accounting Deconsolidation Consolidation Regulatory

balance of insurance/ of banking balance

sheet other entities associates sheet

Ref $m $m $m $m

Assets

------------------------------------------------------------ ----- ---------- ----------------- --------------- ------------

Cash and balances at central banks 249,673 (10) 323 249,986

Items in the course of collection

from other banks 6,289 - - 6,289

Hong Kong Government certificates

of indebtedness 39,519 - - 39,519

Trading assets 208,964 (810) - 208,154

--------- ----

Financial assets designated and

otherwise mandatorily measured

at fair value through profit or

loss 41,785 (31,488) 535 10,832

--------- ----------- --- --------- ---- ---------

* of which: debt securities eligible as tier 2 issued

by Group Financial Sector Entities ('FSEs') that are

outside the regulatory scope of consolidation r - 597 - 597

------------------------------------------------------------ ----- --------- ----------- ---- --------- ---- ---------

Derivatives 313,781 (169) 160 313,772

Loans and advances to banks 77,015 (2,071) 1,248 76,192

Loans and advances to customers 1,018,681 (1,074) 12,306 1,029,913

* of which: lending eligible as tier 2 to Group FSEs

outside the regulatory scope of consolidation r - 411 - 411

------------------------------------------------------------ ----- --------- ----------- ---- --------- ---- ---------

expected credit losses on IRB

portfolios h (10,630) - - (10,630)

------------------------------------------------------------ ----- --------- ----------- ---- --------- ---- ---------

Reverse repurchase agreements -

non-trading 226,345 2,078 161 228,584

----------- ----

Financial investments 494,109 (70,116) 4,625 428,618

------------------------------------------------------------------- --------- ----------- --- --------- ---- ---------

* of which: lending eligible as tier 2 to Group FSEs

outside the regulatory scope of consolidation r - 369 - 369

------------------------------------------------------------ ----- --------- --------- ----

Capital invested in insurance and

other entities - 2,286 - 2,286

------------------------------------------------------------------- --------- ----------- ---- --------- ---- ---------

Prepayments, accrued income and

other assets 197,425 (6,414) 452 191,463

--------- ----------- --- --------- ---- ---------

- of which: retirement benefit

assets j 9,894 - - 9,894

----- --------- ----------- ---- --------- ---- ---------

Current tax assets 821 (69) 14 766

------------------------------------------------------------------- --------- ----------- --- --------- ---- ---------

Interests in associates and joint

ventures 24,800 (410) (4,626) 19,764

------------------------------------------------------------------- --------- ----------- --- --------- --- ---------

- of which: positive goodwill on

acquisition e 478 (12) - 466

--------- ----------- --- --------- ---- ---------

Goodwill and intangible assets e 19,438 (9,651) 1,222 11,009

Deferred tax assets f 4,153 128 16 4,297

Total assets at 30 Jun 2020 2,922,798 (117,790) 16,436 2,821,444

------------------------------------------------------------------- --------- ----------- --- --------- ---- ---------

Liabilities and equity

------------------------------------------------------------ -----

Hong Kong currency notes in circulation 39,519 - - 39,519

--------- ----------- ---- --------- ---- ---------

Deposits by banks 82,715 (29) 624 83,310

Customer accounts 1,532,380 3,432 14,656 1,550,468

Repurchase agreements - non-trading 112,799 - - 112,799

Items in the course of transmission

to other banks 6,296 - - 6,296

Trading liabilities 79,612 - - 79,612

Financial liabilities designated

at fair value 156,608 (4,396) - 152,212

---------

o,

q,

* of which: included in tier 2 i 10,054 - - 10,054

------------------------------------------------------------ ----- --------- ----------- ---- --------- ---- ---------

Derivatives 303,059 72 229 303,360

- of which: debit valuation adjustment i 138 - - 138

------------------------------------------------------------ ----- --------- ----------- ---- --------- ---- ---------

Debt securities in issue 110,114 (1,611) - 108,503

Accruals, deferred income and other

liabilities 173,181 (2,823) 640 170,998

------------------------------------------------------------------- --------- ----------- --- --------- ---- ---------

Current tax liabilities 1,141 (28) 106 1,219

--------- ----------- --- --------- ---- ---------

Liabilities under insurance contracts 98,832 (98,832) - -

Provisions 3,209 (7) 55 3,257

------------------------------------------------------------------- --------- ----------- --- --------- ---- ---------

* of which: credit-related contingent liabilities and

contractual commitments on IRB portfolios h 687 - - 687

------------------------------------------------------------ ----- --------- ----------- ---- --------- ---- ---------

Deferred tax liabilities 4,491 (1,455) 8 3,044

Subordinated liabilities 23,621 1 118 23,740

--------- ----------- ---- --------- ---- ---------

- of which:

l,

included in tier 1 n 1,763 - - 1,763

o,

included in tier 2 q 20,168 - - 20,168

--------- ----------- ---- --------- ---- ---------

Total liabilities at 30 Jun 2020 2,727,577 (105,676) 16,436 2,638,337

------------------------------------------------------------------- --------- ----------- --- --------- ---- ---------

Equity

Called up share capital a 10,346 - - 10,346

------------------------------------------------------------ ----- --------- ----------- ---- --------- ---- ---------

a,

Share premium account l 14,268 - - 14,268

Other equity instruments k 20,914 - - 20,914

c,

Other reserves g (301) 1,888 - 1,587

b,

Retained earnings c 141,809 (12,851) - 128,958

-----

Total shareholders' equity 187,036 (10,963) - 176,073

------------------------------------------------------------------- --------- ----------- --- --------- ---- ---------

d,

m,

n,

Non-controlling interests p 8,185 (1,151) - 7,034

--------- ----------- --- --------- ---- ---------

Total equity at 30 Jun 2020 195,221 (12,114) - 183,107

------------------------------------------------------------------- --------- ----------- --- --------- ---- ---------

Total liabilities and equity at

30 Jun 2020 2,922,798 (117,790) 16,436 2,821,444

------------------------------------------------------------------- --------- ----------- --- --------- ---- ---------

The references (a)-(r) identify balance sheet components that

are used in the calculation of regulatory capital in Table 3: Own

funds disclosure. This table shows such items at their accounting

values, which may be subject to analysis or adjustment in the

calculation of regulatory capital shown in Table 3.

Capital and RWAs

Capital management

Approach and policy

Our approach to capital management is driven by our strategic

and organisational requirements, taking into account the

regulatory, economic and commercial environment. We aim to maintain

a strong capital base to support the risks inherent in our business

and invest in accordance with our strategy, meeting both

consolidated and local regulatory capital requirements at all

times.

Our capital management process culminates in the annual Group

capital plan, which is approved by the Board. HSBC Holdings is the

primary provider of equity capital to its subsidiaries and also

provides them with non-equity and loss-absorbing capital where

necessary. These investments are substantially funded by HSBC

Holdings' issuance of equity and non-equity capital and by profit

retention. As part of its capital management process, HSBC

Holdings seeks to maintain a balance between the composition of

its capital and its investment in subsidiaries, including

management of double leverage.

The main features of capital securities issued by the Group,

categorised as tier 1 ('T1') capital and tier 2 ('T2') capital, are

set out on the HSBC website, www.hsbc.com.

The values disclosed are the IFRS balance sheet carrying

amounts, not the amounts that these securities contribute to

regulatory capital. For example, the IFRS accounting and the

regulatory treatments differ in their approaches to issuance costs,

regulatory amortisation and regulatory eligibility limits

prescribed by the relevant regulatory legislation.

A list of the main features of our capital instruments, in

accordance with Annex III of Commission Implementing Regulation

1423/2013, is also published on our website. This is in addition to

the full terms and conditions of our securities, also available on

our website.

For further details on our management of capital, see page 77 of

the Interim Report 2020.

Own funds

Table 3: Own funds disclosure

----------

At

30 Jun 31 Dec

2020 2019

Ref $m $m

---------- ----------

Common equity tier 1 ('CET1') capital: instruments

and reserves

--- ----------------------------------------------------------- ---- ---------- ----------

Capital instruments and the related share premium

1 accounts 23,209 22,873

- ordinary shares a 23,209 22,873

---- -------

2 Retained earnings b 127,989 127,188

----

Accumulated other comprehensive income (and other

3 reserves) c 2,594 1,735

----

Minority interests (amount allowed in consolidated

5 CET1) d 4,036 4,865

----

Independently reviewed interim net profits net of

5a any foreseeable charge or dividend b 1,729 (3,381)

---- -------

6 Common equity tier 1 capital before regulatory adjustments 159,557 153,280

--- ----------------------------------------------------------- ---- ------- -------

Common equity tier 1 capital: regulatory adjustments

--- ----------------------------------------------------------- ---- ---------- ----------

7 Additional value adjustments(1) (1,162) (1,327)

----

8 Intangible assets (net of related deferred tax liability) e (11,181) (12,372)

----

10 Deferred tax assets that rely on future profitability

excluding those arising from temporary differences

(net of related tax liability) f (1,505) (1,281)

----

Fair value reserves related to gains or losses on

11 cash flow hedges g (426) (41)

----

Negative amounts resulting from the calculation of

12 expected loss amounts h (1,191) (2,424)

----

Gains or losses on liabilities valued at fair value

14 resulting from changes in own credit standing i 5 2,450

----

15 Defined-benefit pension fund assets j (7,409) (6,351)

----

16 Direct and indirect holdings of own CET1 instruments(2) (40) (40)

--- ----------------------------------------------------------- ---- ------- -------

19 Direct, indirect and synthetic holdings by the institution

of the CET1 instruments of financial sector entities

where the institution has a significant investment

in those entities (amount above 10% threshold and

net of eligible short positions)(3) (8,202) (7,928)

--- ----------------------------------------------------------- ---- ------- -------

Total regulatory adjustments to common equity tier

28 1 (31,111) (29,314)

-------

29 Common equity tier 1 capital 128,446 123,966

--- ----------------------------------------------------------- ---- ------- -------

Additional tier 1 ('AT1') capital: instruments

--- ----------------------------------------------------------- ----

30 Capital instruments and the related share premium

accounts 20,914 20,871

31 - classified as equity under IFRSs k 20,914 20,871

--- ----------------------------------------------------------- ----

33 Amount of qualifying items and the related share

premium accounts subject to phase out

from AT1 l 2,305 2,305

----

34 Qualifying tier 1 capital included in consolidated

AT1 capital (including minority interests not included

in CET1) issued by subsidiaries and held by third m,

parties n 872 1,277

-------

35 - of which: instruments issued by subsidiaries subject

to phase out m 812 1,218

--- ----------------------------------------------------------- ---- -------

36 Additional tier 1 capital before regulatory adjustments 24,091 24,453

--- ----------------------------------------------------------- ---- ------- -------

Additional tier 1 capital: regulatory adjustments

--- ----------------------------------------------------------- ---- ---------- ----------

37 Direct and indirect holdings of own AT1 instruments(2) (60) (60)

-------

Total regulatory adjustments to additional tier 1

43 capital (60) (60)

--- ----------------------------------------------------------- ---- ------- -------

44 Additional tier 1 capital 24,031 24,393

--- ----------------------------------------------------------- ---- ------- -------

45 Tier 1 capital (T1 = CET1 + AT1) 152,477 148,359

-------

Table 3: Own funds disclosure (continued)

At

30 Jun 31 Dec

2020 2019

Ref $m $m

----

Tier 2 capital: instruments and provisions

---- -------------------------------------------------------------- ---- ---------- ----------

Capital instruments and the related share premium

46 accounts o 21,338 20,525

---- -------

- of which: instruments grandfathered under CRR II 7,572 7,067

-------------------------------------------------------------- ---- -------

48 Qualifying own funds instruments included in consolidated

T2 capital (including minority interests and AT1

instruments not included in CET1 or AT1) issued by p,

subsidiaries and held by third parties q 4,843 4,667

----

49 - of row 48: instruments issued by subsidiaries subject

to phase out q 2,172 2,251

----

- of row 48: instruments issued by subsidiaries grandfathered

under CRR II 1,500 1,452

---- -------------------------------------------------------------- ---- ------- -------

51 Tier 2 capital before regulatory adjustments 26,181 25,192

---- -------------------------------------------------------------- ---- ------- -------

Tier 2 capital: regulatory adjustments

52 Direct and indirect holdings of own T2 instruments (40) (40)

---- -------------------------------------------------------------- ---- ------- -------

55 Direct and indirect holdings by the institution of

the T2 instruments and subordinated loans of financial

sector entities where the institution has a significant

investment in those entities (net of eligible short

positions) r (1,376) (1,361)

---- -------------------------------------------------------------- ---- ------- -------

57 Total regulatory adjustments to tier 2 capital (1,416) (1,401)

---- -------------------------------------------------------------- ---- ------- -------

58 Tier 2 capital 24,765 23,791

---- -------------------------------------------------------------- ---- ------- -------

59 Total capital (TC = T1 + T2) 177,242 172,150

---- -------------------------------------------------------------- ---- ------- -------

60 Total risk-weighted assets 854,552 843,395

---- -------------------------------------------------------------- ---- ------- -------

Capital ratios and buffers

---- -------------------------------------------------------------- ---- ---------- ----------

61 Common equity tier 1 15.0% 14.7%

----------

62 Tier 1 17.8% 17.6%

63 Total capital 20.7% 20.4%

----------

64 Institution specific buffer requirement 4.70% 5.11%

---- -------------------------------------------------------------- ----

65

* capital conservation buffer requirement 2.50% 2.50%

66

* countercyclical buffer requirement 0.20% 0.61%

67a

* Global Systemically Important Institution ('G-SII')

buffer 2.00% 2.00%

----------

68 Common equity tier 1 available to meet buffers 8.8% 8.5%

---- -------------------------------------------------------------- ---- ---------- ----------

Amounts below the threshold for deduction (before

risk weighting)

---- -------------------------------------------------------------- ---- ---------- ----------

72 Direct and indirect holdings of the capital of financial

sector entities where the institution does not have

a significant investment in those entities (amount

below 10% threshold and net of eligible short positions) 2,425 2,938

73 Direct and indirect holdings by the institution of

the CET1 instruments of financial sector entities

where the institution has a significant investment

in those entities (amount below 10% threshold and

net of eligible short positions) 13,556 13,189

75 Deferred tax assets arising from temporary differences

(amount below 10% threshold, net of related tax liability) 3,915 4,529

Applicable caps on the inclusion of provisions in

tier 2

---- -------------------------------------------------------------- ---- ---------- ----------

77 Cap on inclusion of credit risk adjustments in T2

under standardised approach 2,035 2,163

79 Cap for inclusion of credit risk adjustments in T2

under IRB approach 3,233 3,128

Capital instruments subject to phase out arrangements

(only applicable between 1 Jan 2013 and 1 Jan 2022)

---- -------------------------------------------------------------- ---- ---------- ----------

82 Current cap on AT1 instruments subject to phase out

arrangements 3,461 5,191

-------

83 Amount excluded from AT1 due to cap (excess over

cap after redemptions and maturities) 51 122

-------

84 Current cap on T2 instruments subject to phase out

arrangements 1,825 2,737

---- -------------------------------------------------------------- ---- ------- -------

The references (a)-(r) identify balance sheet components in

Table 2: Reconciliation of balance sheets - financial accounting to

regulatory scope of consolidation which is used in the calculation

of regulatory capital. This table shows how they contribute to the

regulatory capital calculation. Their contribution may differ from

their accounting value in Table 2 as a result of adjustment or

analysis to apply regulatory definitions of capital.

1 Additional value adjustments are deducted from CET1. These are

calculated on assets measured at fair value.

2 The deduction for holdings of own CET1, T1 and T2 instruments is set by the PRA.

3 The threshold deduction for significant investments relates to

balances recorded on numerous lines on the balance sheet and

includes: investments in insurance subsidiaries and

non-consolidated associates, other CET1 equity held in financial

institutions, and connected funding of a capital nature etc.

At 30 June 2020, our common equity tier 1 ('CET1') capital ratio

increased to 15.0% from 14.7% at 31 December 2019.

CET1 capital increased in 1H20 by $4.5bn, mainly as a result

of:

-- the cancellation of the 4Q19 unpaid dividend of $3.4bn at the PRA's request;

-- a $1.8bn increase as a result of lower deductions for excess

expected loss. ECL against IRB exposures rose by $4.3bn compared

with 31 December 2019, while regulatory expected losses rose by

$2.5bn;

-- capital generation of $1.7bn through profits, net of

dividends relating to other equity instruments; and

-- a $1.5bn increase in the fair value through other comprehensive income reserve.

These increases were partly offset by:

-- foreign currency translation differences of $3.7bn; and

-- a $0.8bn fall in allowable non-controlling interests in CET1.

This partly reflected the acquisition in May 2020 of additional

shares representing 18.66% of the capital of HSBC Trinkaus &

Burkhardt AG from Landesbank Baden-Württemberg, the principal

minority shareholder.

At 30 June 2020, our Pillar 2A requirement was $26.3bn,

equivalent to 3.1% of RWAs. Of this, 1.7% was met by CET1. Pillar

2A requirements are set by the PRA as part of our total capital

requirement.

Leverage ratio

The risk of excessive leverage is managed as part of HSBC's

global risk appetite framework and monitored using a leverage ratio

metric within our risk appetite statement ('RAS'). The RAS

articulates the aggregate level and types of risk that HSBC is

willing to accept in its business activities in order to achieve

its strategic business objectives.

The RAS is monitored via the risk appetite profile report, which

includes comparisons of actual performance against the risk

appetite and tolerance thresholds assigned to each metric. This is

to ensure that any excessive risk is highlighted, assessed and

mitigated appropriately. The risk appetite profile report is

presented monthly to the Risk Management Meeting of the Group

Management Board and the Group Risk Committee.

Our approach to risk appetite is described on page 73 of the

Annual Report and Accounts 2019.

Table 4: Leverage ratio common disclosure ('LRCom')

At

30 Jun 31 Dec

2020 2019

Footnotes $bn $bn

------ ------------------------------------------------------ ---------- ----------------- -------------

On-balance sheet exposures (excluding derivatives

and SFTs)

------ ------------------------------------------------------ ---------- ----------------- -------------

On-balance sheet items (excluding derivatives,

1 SFTs and fiduciary assets, but including collateral) 2,232.1 2,119.1

--------------

2 (Asset amounts deducted in determining tier

1 capital) (29.6) (30.5)

3 Total on-balance sheet exposures (excluding

derivatives, SFTs and fiduciary assets) 2,202.5 2,088.6

------ ------------------------------------------------------ ---------- -------------- ----------

Derivative exposures

------ ------------------------------------------------------ ---------- ----------------- -------------

4 Replacement cost associated with all derivatives

transactions (i.e. net of eligible cash variation

margin) 85.4 53.5

5 Add-on amounts for potential future exposure

associated with all derivatives transactions

(mark-to-market method) 146.3 162.1

6 Gross-up for derivatives collateral provided

where deducted from the balance sheet assets

pursuant to IFRSs 13.3 8.3

7 (Deductions of receivables assets for cash variation

margin provided in derivatives transactions) (58.5) (43.1)

8 (Exempted central counterparty ('CCP') leg of

client-cleared trade exposures) (80.3) (53.2)

9 Adjusted effective notional amount of written

credit derivatives 153.6 159.4

--------------

10 (Adjusted effective notional offsets and add-on

deductions for written credit derivatives) (147.1) (150.4)

11 Total derivative exposures 112.7 136.6

------ ------------------------------------------------------ ---------- -------------- ----------

Securities financing transaction exposures

------ ------------------------------------------------------ ---------- ----------------- -------------

12 Gross SFT assets (with no recognition of netting),

after adjusting for sales accounting transactions 483.0 451.0

13 (Netted amounts of cash payables and cash receivables

of gross SFT assets) (228.3) (196.1)

14 Counterparty credit risk exposure for SFT assets 10.7 10.7

16 Total securities financing transaction exposures 265.4 265.6

------ ------------------------------------------------------ ---------- -------------- ----------

Other off-balance sheet exposures

------ ------------------------------------------------------ ---------- ----------------- -------------

17 Off-balance sheet exposures at gross notional

amount 859.9 865.5

18 (Adjustments for conversion to credit equivalent

amounts) (639.1) (629.8)

19 Total off-balance sheet exposures 220.8 235.7

------ ------------------------------------------------------ ---------- -------------- ----------

Capital and total exposures

20 Tier 1 capital 1 149.4 144.8

------ ------------------------------------------------------ ---------- -------------- ----------

21 Total leverage ratio exposure 2,801.4 2,726.5

------ ------------------------------------------------------ ---------- -------------- ----------

22 Leverage ratio (%) 1 5.3 5.3

------ ------------------------------------------------------ ---------- -------------- ----------

EU-23 Choice of transitional arrangements for the Fully

definition of the capital measure Fully phased-in phased-in

------ ------------------------------------------------------ ---------- ----------------- -------------

1 Leverage ratio is calculated using the CRR II end point basis for capital.

Table 5: Summary reconciliation of accounting assets and leverage ratio

exposures ('LRSum')

At

30 Jun 31 Dec

2020 2019

$bn $bn

1 Total assets as per published financial statements 2,922.8 2,715.2

---------------------------------------------------------- ------- -------

Adjustments for:

2 - entities which are consolidated for accounting

purposes but are outside the scope of regulatory

consolidation (101.4) (101.2)

4 * derivative financial instruments (201.0) (106.4)

5 * SFTs 12.2 2.8

6

* off-balance sheet items (i.e. conversion to credit

equivalent amounts of off-balance sheet exposures) 220.8 235.7

7 * other (52.0) (19.6)

---------------------------------------------------------- ------- -------

8 Total leverage ratio exposure 2,801.4 2,726.5

---------------------------------------------------------- ------- -------

Table 6: Leverage ratio - Split of on-balance sheet exposures (excluding

derivatives, SFTs and exempted exposures) ('LRSpl')

At

30 Jun 31 Dec

2020 2019

$bn $bn

Total on-balance sheet exposures (excluding derivatives,

EU-1 SFTs and exempted exposures) 2,173.6 2,076.0

EU-2 - trading book exposures 181.2 230.8

EU-3 - banking book exposures 1,992.4 1,845.2

------- -------

'banking book exposures' comprises:

EU-4 covered bonds 2.6 2.6

------- -------

EU-5 exposures treated as sovereigns 682.3 539.3

------- -------

exposures to regional governments, multilateral

development banks, international organisations

EU-6 and public sector entities not treated as sovereigns 8.8 9.4

------- -------

EU-7 institutions 66.3 59.3

------- -------

EU-8 secured by mortgages of immovable properties 342.9 330.4

------- -------

EU-9 retail exposures 83.6 106.2

------- -------

EU-10 corporate 589.8 603.2

------- -------

EU-11 exposures in default 12.7 9.9

------- -------

other exposures (e.g. equity, securitisations and

EU-12 other non-credit obligation assets) 203.4 184.9

------- ---------------------------------------------------------- ------- -------

Capital buffers

Our geographical breakdown and institution-specific

countercyclical capital buffer ('CCyB') disclosure and G-SIB

Indicators Disclosure are published annually on the HSBC website,

www.hsbc.com.

Pillar 1 minimum capital requirements

and

RWA flow

Pillar 1 covers the minimum capital resource requirements for

credit risk, counterparty credit risk ('CCR'), equity,

securitisation, market risk and operational risk. These

requirements are expressed in terms of RWAs.

Credit The Basel Committee's framework For consolidated Group reporting,

risk applies three approaches of increasing we have adopted the AIRB approach

sophistication to the calculation for the majority of our business.

of Pillar 1 credit risk capital Some portfolios remain on the

requirements. The most basic level, standardised or FIRB approaches:

the standardised approach, requires * pending the issuance of local regulations or model

banks to use external credit ratings approval;

to determine the risk weightings

applied to rated counterparties.

Other counterparties are grouped * following supervisory prescription of a non-advanced

into broad categories and standardised approach; or

risk weightings are applied to

these categories. The next level,

the foundation IRB ('FIRB') approach, * under exemptions from IRB treatment.

allows banks to calculate their

credit risk capital requirements

on the basis of their internal

assessment of a counterparty's

probability of default ('PD'),

but subjects their quantified

estimates of exposure at default

('EAD') and loss given default

('LGD') to standard supervisory

parameters. Finally, the advanced

IRB ('AIRB') approach allows banks

to use their own internal assessment

in both determining PD and quantifying

EAD and LGD.

Counterparty Four approaches to calculating We use the mark-to-market and

credit CCR and determining exposure values IMM approaches for CCR. Details

risk are defined by the Basel Committee: of the IMM permission we have

mark-to-market, original exposure, received from the PRA can be found

standardised and internal model in the Financial Services Register

method ('IMM'). These exposure on the PRA website. Our aim is

values are used to determine capital to increase the proportion of

requirements under one of the positions on IMM over time.

credit risk approaches: standardised,

FIRB or AIRB.

Equity For the non-trading book, equity For Group reporting purposes,

exposures can be assessed under all non-trading book equity exposures

standardised or IRB approaches. are treated under the standardised

approach.

--------------- -------------------------------------------------------- ------------------------------------------------------------

Securitisation On 1 January 2019, the new securitisation Under the new framework:

framework came into force in the * Our originated positions are reported under SEC-IRBA.

EU for new transactions. This

framework prescribes the following

approaches: * Our positions in the sponsored Solitaire programme

* internal ratings-based approach ('SEC-IRBA'); and our investment in third-party positions are

reported under SEC-SA and SEC-ERBA.

* standardised approach ('SEC-SA');

* Our sponsored positions in Regency are reported under

IAA. Our IAA approach is audited annually by internal

* external ratings-based approach ('SEC-ERBA'); and model review and is subject to review by the PRA.

* internal assessment approach ('IAA').

From 1 January 2020, all transactions

were subject to the new framework.

Market Market risk capital requirements The market risk capital requirement

risk can be determined under either is measured using internal market

the standard rules or the internal risk models, where approved by

models approach ('IMA'). The latter the PRA, or under the standard

involves the use of internal value rules. Our internal market risk

at risk ('VaR') models to measure models comprise VaR, stressed

market risks and determine the VaR and IRC. Non-proprietary details

appropriate capital requirement. of the scope of our IMA permission

In addition to the VaR models, are available in the Financial

other internal models include Services Register on the PRA website.

stressed VaR ('SVaR'), incremental We are in compliance with the

risk charge ('IRC') and comprehensive requirements set out in articles

risk measure. 104 and 105 of the Capital Requirements

Regulation.

--------------- -------------------------------------------------------- ------------------------------------------------------------

Operational The Basel Committee allows firms We currently use the standardised

risk to calculate their operational approach in determining our operational

risk capital requirement under risk capital requirement. We have

the basic indicator approach, in place an operational risk model

the standardised approach or the that is used for economic capital

advanced measurement approach. calculation purposes.

--------------- -------------------------------------------------------- ------------------------------------------------------------

Table 7: Overview of RWAs ('OV1')

At

30 Jun 31 Mar 30 Jun

2020 2020 2020

-------- -------- ---------------

Capital

RWAs RWAs requirements

Footnotes $bn $bn $bn

-------- ---------------

Credit risk (excluding counterparty credit

1 risk) 632.6 631.9 50.6

---- ----------------------------------------------- ---------- -------------

2 - standardised approach 116.8 119.9 9.3

3 - foundation IRB approach 103.9 101.2 8.3

---- -----------------------------------------------

4 - advanced IRB approach 411.9 410.8 33.0

---- ----------------------------------------------- ----------

6 Counterparty credit risk 43.1 47.3 3.4

---- ----------------------------------------------- ---------- -------------

7 - mark-to-market 20.6 23.2 1.6

---- ----------------------------------------------- ----------

10 - internal model method 18.3 20.0 1.5

---- ----------------------------------------------- ----------

11 - risk exposure amount for contributions

to the default fund of a central counterparty 0.5 0.6 -

---- ----------------------------------------------- ----------

12 - credit valuation adjustment 3.7 3.5 0.3

---- ----------------------------------------------- ---------- ------ ------ -------------

13 Settlement risk - 0.2 -

---- ----------------------------------------------- ---------- ------ ------ -------------

14 Securitisation exposures in the non-trading

book 10.4 10.4 0.8

---- ----------------------------------------------- ---------- ------

14a - internal ratings-based approach ('SEC-IRBA') 1.8 1.8 0.1

---- ----------------------------------------------- ----------

14b - external ratings-based approach ('SEC-ERBA') 3.9 3.6 0.3

---- ----------------------------------------------- ----------

14c - internal assessment approach ('IAA') 2.3 2.5 0.2

---- ----------------------------------------------- ----------

14d - standardised approach ('SEC-SA') 2.4 2.5 0.2

---- ----------------------------------------------- ----------

19 Market risk 35.2 34.8 2.8

---- ----------------------------------------------- ---------- -------------

20 - standardised approach 8.4 8.8 0.7

---- ----------------------------------------------- ----------

21 - internal models approach 26.8 26.0 2.1

---- ----------------------------------------------- ----------

23 Operational risk 89.6 89.2 7.2

---- ----------------------------------------------- ---------- ------ ------ -------------

25 - standardised approach 89.6 89.2 7.2

---- ----------------------------------------------- ----------

27 Amounts below the thresholds for deduction

(subject to 250% risk weight) 43.7 43.3 3.5

---- ----------------------------------------------- ---------- ------ ------ -------------

29 Total 854.6 857.1 68.3

---- ----------------------------------------------- ---------- ------ ------ -------------

Credit risk, including amounts below the thresholds for

deduction

Credit risk RWAs increased by $1.1bn in 2Q20. This included a

$11.7bn fall in asset size attributable to repayments and

management initiatives, largely offset by an increase in RWAs due

to changes in asset quality of $11.6bn. Asset quality movements

reflected significant credit migration, largely in North America,

Europe and Asia. A $3.9bn increase in RWAs due to foreign currency

exchange differences was partly offset by a decrease due to

methodology and policy changes of $3.3bn, mainly due to risk

parameter refinements.

Counterparty credit risk

The $4.0bn decrease in counterparty credit risk RWAs was

primarily due to management initiatives, lower market volatility

and trade maturities.

Market risk

The $0.4bn increase in market risk RWAs included a $3.5bn

increase from asset size movements largely due to market

volatility, partly offset by management initiatives. This was

largely offset by a $2.1bn decrease due to methodology and policy

changes, mostly in the calculation of foreign exchange risk, and a

$1.0bn fall due to model updates from a temporary adjustment to the

calculation of risks not in VaR.

Table 8: RWA flow statements of credit risk exposures under IRB(1)

('CR8')

Capital

RWAs requirements

$bn $bn

---- ---------------------------------------------- ------------ ---------------

1 RWAs at 1 Apr 2020 512.0 41.0

----------------------------------------------

2 Asset size (10.2) (0.8)

3 Asset quality 11.4 0.8

4 Model updates 0.8 0.1

5 Methodology and policy (1.4) (0.1)

7 Foreign exchange movements 3.2 0.3

---- ---------------------------------------------- --------- ------------

9 RWAs at 30 Jun 2020 515.8 41.3

---- ---------------------------------------------- --------- ------------

1 Securitisation positions are not included in this table.

IRB RWAs increased by $3.8bn in 2Q20, including a rise of $3.2bn

due to foreign currency translation differences. The remaining

increase of $0.6bn was mostly from a $11.4bn RWA rise due to asset

quality movements, reflecting an increase in credit migration in

North America, Europe and Asia. This was partly offset by a

fallfrom asset size movements of $10.2bn due to customer repayments

and active portfolio management in the same regions. A $1.4bn fall

in RWAs from methodology and policy was largely due to risk

parameter refinements, and a $0.8bn increase from model updates

included changes to global corporate models.

Table 9: RWA flow statements of CCR exposures under IMM ('CCR7')

Capital

RWAs requirements

$bn $bn

------------ ---------------

1 RWAs at 1 Apr 2020 22.9 1.8

-------------------------------------------

2 Asset size (1.6) (0.1)

3 Asset quality 0.4 -

5 Methodology and policy (0.3) -