U.S. Sanctions on Hong Kong Security Law Puts Banks in a Quandary

July 15 2020 - 11:37AM

Dow Jones News

By Frances Yoon and Quentin Webb

As the U.S. moves to punish Chinese officials involved in the

clampdown on Hong Kong, international banks and other businesses

have a problem: how to obey conflicting rules of both Washington's

coming sanctions regime and the territory's broad new

national-security law.

On Tuesday, President Trump signed into law a bill that requires

sanctions against not only Chinese officials and entities

materially contributing to the erosion of Hong Kong's autonomy, but

also financial institutions doing business with those who will

appear on the eventual blacklist.

At the same time Hong Kong's security law outlaws receiving

"instructions, control, funding or other kinds of support from a

foreign country" to impose sanctions against Hong Kong or

China.

The issue may come to a head swiftly: the U.S. Secretary of

State has 90 days to identify sanctions targets, and after that, a

30- to 60-day timetable kicks in for his counterpart at the

Treasury Department to name "foreign financial institutions" which

have conducted significant transactions with those people.

Mini vandePol, the Asia Pacific head of compliance and

investigations at law firm Baker McKenzie, said some banks were

already trying to identify likely sanctions targets and adapt

accordingly.

"The most important thing institutions can do at this time is to

have a thorough understanding of their business partners so that

they can address any potential risks proactively," she said.

However, she said she advised clients to focus more on the actual

risks posed by other, already existing sanctions programs.

Last week, the Trump administration imposed sanctions on senior

Chinese officials accused of carrying out human-rights abuses

against Turkic Muslims in the remote Xinjiang region. The sanctions

would ban travel to the U.S. and access to the U.S. financial

system. China vowed to impose retaliatory measures.

In a briefing dated July 13, lawyers from Norton Rose Fulbright

said the potential dilemma had "sparked considerable controversy

within the financial industry in Hong Kong."

"Companies may have to choose between breaching the national

security law and falling foul of U.S. sanctions. Several banks have

sought clarification in this regard, however guidance from Hong

Kong or Chinese authorities has not yet been received," they

wrote.

Almost all international banks have some presence in Hong Kong.

Some, including HSBC Holdings PLC, Standard Chartered PLC and

Citigroup Inc., have sizable retail networks. The three banks all

declined to comment.

The Norton Rose Fulbright team said some financial institutions

with significant operations in Hong Kong had already reviewed their

client base to identify potential sanctions targets. In addition,

they said that while political rhetoric suggested a focus on

Chinese state-owned banks, the Act's remit extended to insurers,

currency exchanges, travel agents and even car dealers.

Yuan Zheng, a lawyer for law firm Davis Polk, said Chinese

authorities might not enforce the national-security law provision

so aggressively that standard procedures like reviewing client

databases or reclassifying a client as higher-risk would count as a

breach. But she said freezing accounts or ending relationships

could draw more scrutiny.

For individuals, U.S. sanctions would include visa bans and

asset freezes. For financial institutions, the Washington's Hong

Kong Autonomy Act lists 10 possible punishments, including bans on

getting loans from U.S. banks, doing foreign-currency deals in the

U.S., and on their executives entering America. The president would

have to introduce five of these within a year, and all 10 within

two years.

Sanctions have long been a minefield for international banks,

and rising tensions between the U.S. and China have already created

other difficulties for some global lenders.

HSBC Holdings PLC was pilloried by pro-Beijing figures and the

state media for not getting behind the security law, and then faced

a backlash in the U.S. and U.K. after its Asia chief endorsed the

legislation.

The bank earlier had to respond to anger in Beijing over

information it provided in a U.S. criminal case against China's

Huawei Technologies Co., in a case tied to sanctions on Iran.

Write to Frances Yoon at frances.yoon@wsj.com and Quentin Webb

at quentin.webb@wsj.com

(END) Dow Jones Newswires

July 15, 2020 11:22 ET (15:22 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

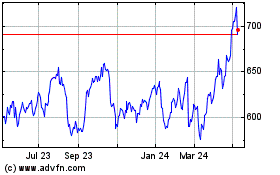

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

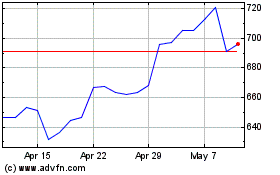

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024