HSBC Investment Bank Chief Moves Aside as Restructuring Gathers Pace

November 20 2019 - 7:40AM

Dow Jones News

By Margot Patrick

LONDON -- HSBC Holdings PLC is parting ways with another

long-serving executive, investment bank head Samir Assaf, in a

reshuffling of its management team that could see more division

heads leave the bank.

Mr. Assaf is in talks to move out of his current role and become

a non executive at HSBC's global banking and markets division,

people familiar with the matter said. The Financial Times reported

on the job change earlier Wednesday.

A successor hasn't been named and it isn't clear if one has been

lined up. One of the people said the job change talks were at an

early stage. Shares in HSBC were down 1% in a lower market, in line

with other bank stocks.

A wider shake-up in the bank's management team also could be

announced before the end of the year, as Chairman Mark Tucker looks

to speed up restructuring, one of the people said. HSBC embarked on

a board-led revamp earlier this year that has seen Chief Executive

John Flint ousted and its large French retail bank put up for

sale.

The bank's interim CEO since August, Noel Quinn, has a broad

mandate to shutter underperforming businesses and cut jobs and is

aiming to give a strategy update to investors by February. He's

vying with external candidates to take the CEO job permanently, and

has signaled there are no sacred cows in his plans.

Mr. Assaf, 59, is a markets veteran who handles some of HSBC's

key client relationships. HSBC goes head-to-head with Wall Street

in some areas of investment banking and trading, but the division

is relatively small and gets much of its revenue from corporate

clients using the bank for other services. Mr. Assaf joined the

bank in 2000 when it bought a French bank where he was treasurer,

and he rose swiftly through the ranks.

In 2011, he became head of the global banking and markets unit,

just as HSBC embarked on a vast restructuring that saw it shut

dozens of businesses and exit countries. The Lebanon-born executive

came to be seen as a survivor after rounds of restructuring and

infighting in his division.

Among Mr. Assaf's underlings to leave were the global markets

head, Thibaut de Roux, who departed last year after 28 years at the

bank, and the global banking co-head, Robin Phillips, who was

phased-out this year after a 15-year stint.

Last month, Mr. Quinn said the bank needs to simplify its

structure and shed some operations, to improve shareholder returns.

The board's call for a restructuring came in response to

geopolitical shifts and tougher economic conditions in HSBC's two

home markets, Hong Kong and the U.K. Violent antigovernment

protests are rocking Hong Kong, while the U.K. economy is being

tested by uncertainty over its planned exit from the European

Union.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

November 20, 2019 07:25 ET (12:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

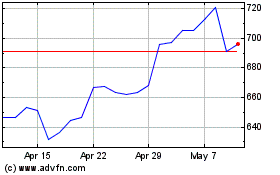

Hsbc (LSE:HSBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

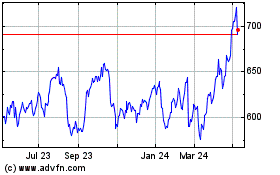

Hsbc (LSE:HSBA)

Historical Stock Chart

From Apr 2023 to Apr 2024