GlaxoSmithKline to Acquire Sierra Oncology for $1.9 Billion -- Update

April 13 2022 - 3:24AM

Dow Jones News

By Ian Walker and Joe Hoppe

Pharmaceutical giant GlaxoSmithKline PLC said Wednesday that it

is buying biopharmaceutical company Sierra Oncology Inc. for $1.9

billion as it complements its own expertise, and backed its

guidance.

GlaxoSmithKline will pay $55 per share in cash, a 39% premium to

its closing price of $39.52 on Tuesday. The deal has the support of

Sierra's board as well as shareholders owning 28% of its stock.

The acquisition is expected to close in the third quarter of

2022 or earlier. Glaxo forecasts that the purchase will be

accretive to its adjusted earnings per share by 2024, the expected

first full year of sales of Sierra's flagship treatment,

differentiated momelotinib.

Glaxo said differentiated momelotinib is a potential treatment

for patients with both myelofibrosis--a fatal bone marrow

cancer--and anemia, a high unmet medical need.

The treatment complements Glaxo's own existing portfolio and is

set for both a U.S. regulatory submission in the second quarter and

a European submission in the second half. Sales contributions are

expected to start in 2023, with significant growth potential

thereafter.

Glaxo reaffirmed its guidance. It expects 2021-2026 sales growth

of more than 5% and for 10% adjusted operating profit.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

April 13, 2022 03:09 ET (07:09 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

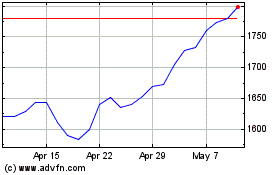

Gsk (LSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

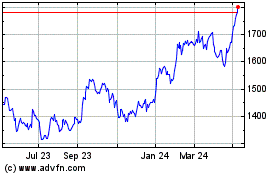

Gsk (LSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024