TIDMGMS

RNS Number : 3407O

Gulf Marine Services PLC

29 May 2020

FOR IMMEDIATE RELEASE 29 May 2020

Gulf Marine Services PLC

('Gulf Marine Services', 'GMS', 'the Company' or 'the

Group')

2019 ANNUAL REPORT AND NOTICE OF ANNUAL GENERAL MEETING

The Company advises that the 2019 Annual Report, the Notice of

the 2020 Annual General Meeting and Proxy Form are being made

available to shareholders electronically today, 29 May 2020. The

2019 Annual Report and the Notice of 2020 Annual General Meeting

will be available shortly on the Company's website at

www.gmsuae.com .

In accordance with Listing Rule 9.6.1R, copies of these

documents are being submitted to the UK Listing Authority via a

National Storage Mechanism and will shortly be available to the

public for inspection at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

.

In accordance with Disclosure Guidance and Transparency Rule

6.3.5, additional information is set out in the appendices to this

announcement. This information is extracted from the 2019 Annual

Report. The appendices should be read in conjunction with the

Company's Full Year 2019 Results Announcement , issued at 07:00 on

1 May 2020, RNS Number 5839L . This material is not a substitute

for reading the full 2019 Annual Report.

Mailing of the 2019 Annual Report, Notice of the 2020 Annual

General Meeting and Proxy Form to shareholders will commence

shortly.

The Company will hold its Annual General Meeting (the 'AGM') at

12:00 noon on Tuesday, 30 June 2020. Further details are included

in the Notice of the Notice AGM. In light of prevailing public

health advice and following the compulsory measures imposed by the

UK Government in response to the COVID-19 pandemic, among other

things, prohibiting non-essential travel and public gatherings of

more than two people (the 'COVID-19 Measures'), shareholders should

not attempt to attend this year's AGM in person. The Board will be

implementing the following changes to the usual AGM

arrangements:

-- The Company expects only one Director and another GMS

designated shareholder representative to be in attendance at the

venue for quorum purposes to conduct the business of the

meeting.

-- No other Directors will be present in person.

-- Shareholders will not be permitted to attend the Company's

AGM in person and, if they attempt to do so, will be refused entry

to the meeting in line with the COVID-19 Measures and under the

Company's Articles.

-- There will be no update on trading or other management

statements given at the AGM, although a trading and operations

update will be published on the Company's website in advance of the

AGM.

-- Shareholders are encouraged to submit questions about the

business of the AGM in advance of the meeting by email and, in so

far as relevant to the business of the meeting, questions will be

responded to by email and taken into account as appropriate at the

meeting itself.

-- In the event that our meeting arrangements change subsequent

to publication of this notice of AGM, the Company will publish

details on its website at http://www.gmsuae.com and, if

practicable, issue a further communication via a regulatory news

service.

-- Voting at the AGM will be by way of a poll so that all the

votes cast in advance by shareholders appointing the Chairman of

the Meeting as their proxy to vote on their behalf, can be taken

into account. Shareholders have one vote for each ordinary share

held when voting on a poll and this procedure ensures that every

vote can be cast.

-- The results of the AGM will be announced as soon as practical after it has taken place.

Shareholders wishing to vote on any of the matters of business

at the AGM are therefore strongly encouraged to:

1. Submit their votes (as soon as possible) in advance of the

meeting through the proxy and electronic voting facilities and to

appoint the Chairman of the meeting as their proxy for this

purpose.

2. Submit any questions in connection with the business of the

meeting in advance to the Company Secretary at cosec@gmsuae.com

.

3. Look out for any updates in connection with the arrangements

for the AGM via RNS and on the Company's website.

Appendix A

Statement of Directors' Responsibilities

The following responsibility statement is repeated here solely

for the purpose of complying with DTR 6.3.5. This statement relates

to and is extracted from page 79 of the 2019 Annual Report.

These responsibilities are for the full 2019 Annual Report and

not the extracted information presented in this announcement or

otherwise.

"We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the

relevant financial reporting framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole;

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face;

-- the Annual Report and financial statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Company's performance,

business model and strategy; and

-- all relevant information for report preparation was provided to the external auditor.

The Directors of the Company and their responsibilities as at 30

April 2020 are set out below:

Tim Summers, Executive Chairman

Steve Kersley, Chief Financial Officer

Mike Turner, Senior Independent Non-Executive Director

Dr Shona Grant, Independent non-executive Director

David Blewden, Independent Non-Executive Director

Mo Bississo, Non-Executive Director

Appendix B

Principal risks and uncertainties

The following has been extracted from pages 21 to 24 of the 2019

Annual Report:

The rating of the principal risks facing the Group in the short

to medium term are set out below, together with the mitigation

measures. These risks are not intended to be an exhaustive analysis

of all risks.

Risk Mitigating factors and actions

1 Liquidity and debt servicing

Due to the Group's current level of Renegotiation of bank facilities

debt, relative to cash flow and EBITDA, The Group has agreed a non-binding

it faces the risk that: term sheet to amend and extend bank

1. It might be unable to service capital facilities with its Lending Group.

and interest obligations as they fall If the documentation is completed

due. by 30 June 2020 as expected, this

2. It might fail to meet its covenant will reduce the severity of existing

obligations at the relevant testing covenant tests, while extending the

dates. tenor for the repayment of principal.

It will also deliver access to adequate

This would precipitate an event of working capital facilities and bonding.

Default under the Loan Agreements,

which would, in turn, give lenders Liquidity management

the right to accelerate repayment The Group has significantly reduced

of the outstanding loans, and then overdue receivables and continues

exercise security over the Group's to manage

assets, should immediate payment not liquidity carefully through focusing

be made. on receivables collections and managing

This would trigger an insolvency. the timing

of supplier payments. Short term cash

In that context, the business is highly flow, through to the finalisation

exposed to short-term liquidity management of the loan deal,

risks arising is tight.

from potential:

1. Increases in interest rates, which The need to complete binding loan

further increase debt service obligations. documentation in respect of the Group's

2. Unexpected increases in working restructured banking facilities and

capital (particularly through inability the Group's tight short-term liquidity

to collect receivables). position indicate a material uncertainty

3. Supplier disruption due to high that may cast significant doubt as

level of supplier overdues. to the Group's ability to continue

as a going concern. Notwithstanding

If access to bonding facilities is this material uncertainty, the Directors

restricted, precipitated by the current believe that based on the progress

funding difficulties, then our cash made to date in this regard, there

flows will be impacted, either through is good reason to believe that final

the requirement to cash collateralise loan documentation will be completed

bonds or turn away business. in a timely fashion; and that the

Group's working capital and liquidity

position can be managed effectively.

Refer to Note 3 of the consolidated

financial statements.

Cost management

The Group has implemented a comprehensive

cost reduction programme, removing

over US$ 13 million of annualised

costs in order to generate higher

EBITDA and increased cash to service

debt. Continual review of costs and

search for further efficiencies is

ongoing.

Hedging strategies

The Group has taken out hedges to

help mitigate the risk of volatility

of interest rates. See Note 10 of

the consolidated financial statements

for further details.

-------------------------------------------------------

2 Inability to secure an appropriate capital structure - equity

A continuing low share price driven Renegotiation of the debt facilities

by not having a suitable long-term (discussed above) will provide a platform

debt profile may prevent GMS from for rebuilding confidence in equity

raising sufficient levels of equity holders by giving the business time

to get an acceptable capital structure to deliver its turnaround plan, without

solution. the risk of lenders precipitating

an insolvency.

Beyond that, the delivery of lower

operating costs and higher utilisation,

through improved efficiencies, safe

and reliable operations and building

strong customer/stakeholder relationships,

will be key to driving improved profitability

and cash flow, which is expected to

deliver shareholder confidence and

a higher share price.

-------------------------------------------------------

3 Oil and Gas Market

Despite the current drop in global Business segment and geographical

oil demand arising from COVID-19, diversity

the Middle East Oil and Gas market The Group has established businesses

is active, with new vessels entering outside its core Middle Eastern markets

the market from Far Eastern shipyards (particularly in the North Sea), and

offering attractive financing structures outside of oil and gas (renewables).

in order to reduce high levels of

inventory of completed vessels. An Targeting

increase in supply could lead to lost We target contracts that align with

opportunities to charter our vessels. availability of vessel spec and that

This in turn could reduce our ability comply with client requirements.

to secure contracts.

Market knowledge and operational expertise

MENA NOCs have introduced local content The Group has a track record of established

requirements as part of their tender long-term relationships in the MENA

processes designed to giving preference region and North West Europe, which

to suppliers that commit to improving provides an understanding of our clients'

their local content and levels of requirements and operating standards.

spend and investment in-country. This

may prevent GMS from winning contracts Modification flexibility for clients

or lead to financial loss and/or reduction Our vessels are built to be as flexible

in margins on existing contracts which as possible allowing us to compete

will ultimately impact cash flows for a wide share of the market, helping

and profitability. us to maximise utilisation levels

and charter day rates. The Group is

The change in ownership/structures capable of modifying assets to satisfy

for North Sea oil and gas businesses client requirements and can do so

could lead to changes in client requirements in its own yard where appropriate.

or demand for our services, which

we may not be able to meet and therefore We embrace local content requirements

our customer base may reduce, and with a long history of operating for

contracts may be lost. NOCs in the

Middle East.

-------------------------------------------------------

4 Operations: inability to deliver safe and reliable operations

The Group may suffer commercial and Safety awareness

reputational damage from an environmental Safety and reliability are top priorities

or safety incident involving our employees, and are underpinned by our HSEQ management

visitors or contractors. system and strong safety-focused culture.

Management ensures appropriate safety

Inadequate preparation for emergency practices and procedures; disaster

situations such as pandemics, natural recovery plans and the insurance coverage

disasters, geopolitical instability, of all commercial contracts are in

could have a negative impact on our place.

business.

Training and compliance

Insufficient insurance coverage may Our employees undergo continuous training

lead to financial loss. This is generally on operational best practices.

relevant but also specifically in

relation to the relocation of our Scheduled maintenance

vessels. The Group follows regular maintenance

schedules on its vessels and the condition

of the vessels is consistently monitored.

Business continuity plan

The Group has in place a business

continuity management plan which it

regularly maintains.

Insurance

The Group regularly liaise with insurance

brokers to ensure sufficient coverage.

-------------------------------------------------------

5 Customer concentration

The Group is reliant on a limited Continuous communication with clients

number of NOCs, IOCs and international The Group maintains strong relationship

EPC clients. If one of our clients with its clients though continuous

were to move away from us to a competitor, communication and a history of providing

this would lead to changes in our safe and reliable services.

contract profile and pipeline and

expose us to losses. Business Segment and Geographical

Diversity

The Group has established businesses

outside its core Middle Eastern markets

(particularly in the North Sea), and

outside of oil and gas (renewables).

It is actively looking to diversify

its market footprint.

-------------------------------------------------------

6 Legal, economic, and political conditions

Political instability in the regions Emergency response planning and insurance

in which we operate (and recruit from) For all our major assets and areas

may adversely affect our operations. of operation, the Group maintains

emergency preparedness plans. We regularly

Continuing uncertainty surrounding review the insurance coverage over

trade arrangements following the UK's the Group's assets to ensure adequate

exit from the European Union ('Brexit') cover is in place.

and potential legislative changes

results in increased uncertainty over Workforce planning and monitoring

future policy, and regulation in the Workforce planning and demographic

United Kingdom, which could impact analysis is completed in order to

Group operations increase diversity.

Brexit

We support the free movement of goods,

services and people. Management continue

to monitor the status of the UK Government's

negotiations, changes in legislation

and future policies.

-------------------------------------------------------

7 People

Attracting, retaining, recruiting Communication

and developing a skilled workforce Communication aligns towards our common

is key. goals. Feedback from employees is

actively sought, using employee surveys.

Losing skills or failing to attract A Board member is explicitly tasked

new talent to our business has the with monitoring the level of engagement

potential to undermine performance. and alignment across the organisation.

Inadequate succession planning and Remuneration Policy

lack of identification of critical The Short Term Incentive Plan (STIP)

roles may result in disruption if has been restructured around a single

the related personnel leave the Group. Business Scorecard to ensure all staff

are incentivised around a single set

of common goals. In December 2019

we completed the first formal Employee

Survey and results are being evaluated

and appropriate actions are being

implemented.

Equal opportunities

GMS are engaged in fair and transparent

recruitment practices. We have a zero-tolerance

policy towards discrimination and

we provide equal opportunities for

all employees.

Resource planning

The Group is in the process of identifying

critical roles and preparing plans

to ensure smooth transition in case

of changes in personnel.

-------------------------------------------------------

8 Cyber crime - security and integrity

Phishing attempts result in inappropriate Cybersecurity monitoring and defence

transactions, data leakage and financial GMS operates multi-layer cybersecurity

loss. The Group is at risk of loss defences which are monitored for effectiveness

through financial cybercrime. to ensure they remain up to date.

We engage with 3rd party specialists

to provide security services.

-------------------------------------------------------

9 Compliance and regulation

Non-compliance with anti-bribery and Code of conduct

corruption regulations could damage The Group has a Code of Conduct which

stakeholder relations and lead to includes anti-bribery and corruption

reputational and financial loss. policies and all employees are required

to comply with this Code when conducting

Failure to appropriately identify business on behalf of the Group. Employees

and comply with laws and regulations are required to undergo in-house training

and other regulatory statutes in new on anti corruption. All suppliers

and existing markets could lead to are pre-notified of anti-bribery and

regulatory investigations. corruption policies and required to

confirm compliance with these policies.

Regulations

A central database is maintained which

documents all our policies and procedures

which comply with laws and regulations

within the countries in which we operate.

On specialist topics, we make use

of external advisors, where appropriate.

In 2019 we appointed a dedicated Company

Secretary to help monitor compliance,

in particular, with regard to UK legal

and corporate governance obligations.

External Review

Our Internal Audit function helps

ensure compliance with GMS policies,

procedures, internal controls and

business processes. The Group's vessels

are also audited by external bodies

such as the American Bureau of Shipping

(ABS).

-------------------------------------------------------

10 Failure to meet customers' requirements

There is a risk that the Group's fleet Flexibility and innovation

capabilities no longer match with We respond directly to client feedback,

changing client requirements. which allows us to bid on a wide range

Failure to deliver the specifications of contracts.

and expected performance could lead

to reputational damage and impact Vessel monitoring

our ability to win work. The Group has procedures in place

such as the Planned Maintenance System

to ensure that the vessels undergo

regular preventative maintenance.

The Group's robust operating standards

result in minimal downtime.

-------------------------------------------------------

11 COVID-19 pandemic

There is a health and safety risk Hygiene measures

to staff, both onshore and offshore, We have implemented extensive hygiene

who come in contact with confirmed control and prevention measures across

cases. the fleet and for our onshore staff.

Our clients have adopted similar measures,

There is the risk that offshore staff in many cases in compliance with strict

will be unable to board or leave Group Government directives in force across

vessels, given restrictions on movement the countries in which we operate.

placed by the countries in which we

operate. Offshore rotations

Crew change restrictions are in place

There is the risk that onshore staff to protect offshore staff from exposure

will be unable to work as normal due to infection.

to mandatory health and safety restrictions,

placed by Government, including quarantine Remote working

and travel restrictions. Onshore staff are working virtually

from their homes, with only a skeleton

Disruption might be caused to the workforce in our main office.

supply chain, caused by the impact

of COVID-19 on our suppliers' operations. Supply chain

We have reviewed our supply chain

The impact of COVID-19 and the resultant to ensure we can make alternative

adverse impact on oil prices, on our arrangements, in the event of supply

client's financial position might disruption. In most critical cases

lead to loss of new business development we have UAE based alternatives.

opportunities, the re-negotiation

of existing contracts, or failure Customer base

of clients to pay. 76% utilisation has already been secured

on committed contracts in 2020. Demand

in the Middle East remains robust

with core customers continuing with

extensive tender programmes. 12 of

our 13 vessels are now based in the

Middle East. Most of our major customers

are well capitalised National or International

Oil Companies.

-------------------------------------------------------

- Ends -

Enquiries: GMS

Tim Summers, Executive Chairman

Tony Hunter, Company Secretary +44 (0) 207 603 1515

Brunswick (PR Adviser to GMS)

Patrick Handley - UK

Will Medvei - UK +44 (0) 20 7404 5959

Jade Mamarbachi - UAE +971 (0) 50 600 3829

Gulf Marine Services PLC's Legal Entity Identifier is

213800IGS2QE89SAJF77

www.gmsuae.com

Disclaimer

The content of the Gulf Marine Services PLC website should not

be considered to form a part of or be incorporated into this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSGUGDUBUDDGGC

(END) Dow Jones Newswires

May 29, 2020 02:05 ET (06:05 GMT)

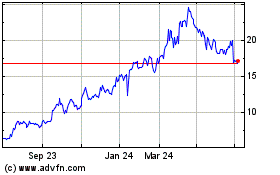

Gulf Marine Services (LSE:GMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

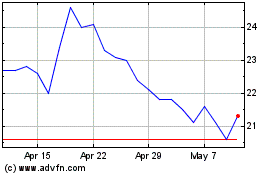

Gulf Marine Services (LSE:GMS)

Historical Stock Chart

From Apr 2023 to Apr 2024