TIDMGMR

RNS Number : 7052N

Gaming Realms PLC

26 September 2019

Gaming Realms plc

(the "Company" or the "Group")

Interim results for the six months ended 30 June 2019

Adjusted EBITDA for H1 2019 at breakeven and 167% licensing

revenue growth

Gaming Realms plc (GMR.L), the developer and licensor of mobile

focused, real money games, today announces its interim results for

the six months to 30 June 2019.

Upon completion of the sale of the remaining real money gaming

("RMG") business, announced on 17 July 2019, the remaining business

is now focused on development and licensing of games for third

party real money and social gaming operators. This is the part of

the Company which we have grown organically and is showing

significant growth with some global market leading partners.

Financial highlights:

Like-for-like ongoing business* H1 2019 H1 2018 Movement

GBPm GBPm %

Revenue - Licensing 1.6 0.6 167%

Revenue - Social 1.5 2.1 (29%)

Revenue - Other 0.1 - 100%

-------- -------- ----------

Total 3.2 2.7 18%

* excludes RMG and Affiliates segments classified as

discontinued operations (see note 10)

-- Licensing revenue grew 167% to GBP1.6m (H1/18: GBP0.6m) with

increased distribution and games portfolio

-- Adjusted EBITDA loss for continuing operations reduced to

GBP6,280 (H1/18: Loss of GBP441,133)

-- Social Publishing revenue decreased 29% to GBP1.5m (H1/18:

GBP2.1m) generating EBITDA of GBP0.5m (H1/18: GBP1.0m). However,

after capitalisation of costs the net cash outflow was GBP0.1m

(H1/18: inflow GBP0.4m)

-- EBITDA loss for discontinued Real Money Gaming Operations was

GBP0.9m (H1/18: GBP0.6m profit)

Operational highlights:

-- Entered into an agreement with River iGaming plc ("River"),

to sell the Company's B2C RMG assets, for a total of GBP11.5m, of

which GBP1.5m is deferred for receipt until 31 December 2020. The

Group's cash position today is c.GBP4m following completion of the

deal in July 2019, settlement of certain liabilities connected to

the B2C RMG assets and deal expenses, and further investment in the

Group's operations

-- Licensing highlights include:

-- Went live with tier 1 operator William Hill

-- Released 3 new games into the market

-- Signed worldwide distribution deals with Relax Gaming and Scientific Games

Post-period end trading:

-- Completed the disposal of the RMG business to River

-- The sale of the B2C RMG assets has allowed the Group to

reduce headcount by 45 people and reduce annual costs by

GBP2.0m

-- Licensing revenue increased 88% in the 9 weeks post period

end vs comparative period in 2018

-- Live with 3 new operators (total 37); including News

International and Betsson which could add up to a further 33 new

sites, covering UK and Nordics

-- Significant partnership agreement established with Instant

Win Gaming to distribute Slingo Games into the iLottery market.

This includes a release to The North American Association of State

and Provincial Lotteries (NASPL) and World Lottery Association

(WLA) lottery members worldwide, and is scheduled to go live H2

2020

-- Release of 3 new games including Monopoly Slingo with more

releases scheduled for the remainder of the year

Outlook for FY 2019:

The ongoing success that the Company has had from developing and

licensing real money games gives the Group confidence to commit

additional investment to drive further growth. Therefore, the Group

will continue to be investing significantly into developing new

games and improving its proprietary Remote Game Server platform.

Following the disposal of the RMG business, the board believes the

Group has an adequacy of available cash resources to fund this in

addition to existing known working capital requirements.

Given the growth of this division, we anticipate it becoming

cashflow positive by the end of 2020. As previously disclosed, the

Group is in the latter stages of rationalising its social gaming

division which is no longer a core part of the business. Gaming

Realms will update the market on the conclusion of this process in

due course.

The investment in game development and licencing continues to

yield strong growth. Taking this into account, the Company expects

the 2019 full year to be in line with market expectations as the

current pipeline of new partners go live and new integrations are

completed.

Commenting on the first half performance, Patrick Southon, Chief

Executive, said:

"Our strategy to leverage our market leading 'Slingo Originals'

games library into the UK and international gaming markets

continues to gain momentum. Licensing our content to leading brands

and gaming operators is delivering high margin revenues and the

disposal of the RMG assets has given us greater resources to invest

in content creation. We are currently performing in line with

management's forecasts and with new commercial developments in the

pipeline we are confident in meeting our full year objectives."

For more information contact

Gaming Realms plc

Patrick Southon, CEO

Mark Segal, CFO 0845 123 3773

Peel Hunt LLP, Nomad and Broker

George Sellar, Guy Pengelley 020 7418 8900

Yellow Jersey 020 3004 9512

Charles Goodwin 07747 788 221

Georgia Colkin 07825 916 715

About Gaming Realms

Gaming Realms creates and publishes innovative real money and

social games for mobile, with operations in the UK, U.S. and

Canada. Through its market leading mobile platform and unique IP

and brands, Gaming Realms is bringing together media, entertainment

and gaming assets in new game formats. The Gaming Realms management

team includes accomplished entrepreneurs and experienced executives

from a wide range of leading gaming and media companies.

Business review

Overview

The board is pleased to report that the Group has operated at

almost breakeven at the adjusted EBITDA level on continuing

activities in H1 2019 (H1/18: loss of GBP0.4m). This improvement

was primarily driven through the 167% growth in Licensing revenues

compared with the comparative period, while overall continuing

expenses remained stable at GBP3.2m (H1/18: GBP3.1m).

Licensing

The Group has made significant progress with its licensing

business with revenue increasing 167% to GBP1.6m (H1/18: GBP0.6m)

for the period. This growth is driven by the 13 partners that went

live through 2018 as well as going live in H1 2019 with tier 1

operator, William Hill. 4 Slingo games were released to the market

in H1 2019, with an additional 3 in H2 2019 to date and further

releases planned.

Social publishing

Social Publishing delivered GBP0.5m, in H1 2019, of adjusted

EBITDA profit (H1/18: GBP1.0m). Marketing spend in this segment was

reduced by 48% and other administrative and operating expenses

remained stable at GBP0.9m. The Group is in the latter stages of

rationalizing this division.

Discontinued operations

Discontinued operations relate to B2C RMG and affiliates. The

loss before tax for the period from discontinued operations was

GBP0.7m (H1/18: GBP0.3m profit). In July 2019, after the period end

the Group concluded the sale of its RMG assets to River.

The Group continues to review its allocation of resources and

investment.

Consolidated statement of comprehensive income

for the 6 months ended 30 June 2019

6M

6M 30 June

Note 30 June 2019 2018

Unaudited Unaudited

Continuing GBP GBP

------------------------------------------ ----- --------------------------------- -------------------------------

Revenue 2 3,188,364 2,703,068

Marketing expenses (113,220) (194,862)

Operating expenses (717,162) (658,615)

Administrative expenses (2,785,160) (2,188,936)

Share-based payments - (154,986)

------------------------------------------ ----- --------------------------------- -------------------------------

Adjusted EBITDA - total (946,052) 195,462

Adjusted EBITDA - discontinued 10 (939,772) 636,595

------------------------------------------ ----- --------------------------------- -------------------------------

Adjusted EBITDA - continuing 2 (6,280) (441,133)

Loss on disposal 15 (320,853) (53,198)

Restructuring expenses (100,045) -

EBITDA - continuing 2 (427,178) (494,331)

----- ---------------------------------

Amortisation of intangible assets 6 (1,535,449) (2,085,703)

Depreciation of property, plant

and equipment 5 (141,617) (68,943)

Finance expense 3 (378,446) (511,774)

Finance income 3 25,738 88,012

------------------------------------------ ----- --------------------------------- -------------------------------

Loss before tax (2,456,952) (3,072,739)

Tax credit 104,835 194,557

------------------------------------------ ----- --------------------------------- -------------------------------

Loss for the financial period

- continuing (2,352,117) (2,878,182)

(Loss) / profit for the financial

period - discontinued 10 (829,041) 254,008

------------------------------------------ ----- --------------------------------- -------------------------------

Loss for the financial period

- total (3,181,158) (2,624,174)

------------------------------------------ ----- --------------------------------- -------------------------------

Other comprehensive income

Items that will or may be reclassified

to profit or loss:

Exchange gain arising on translation

of foreign operations 25,418 195,067

------------------------------------------ ----- --------------------------------- -------------------------------

Total other comprehensive income 25,418 195,067

------------------------------------------ ----- --------------------------------- -------------------------------

Total comprehensive income (3,155,740) (2,429,107)

------------------------------------------ ----- --------------------------------- -------------------------------

Loss attributable to:

Owners of the parent (3,120,172) (2,618,121)

Non-controlling interest (60,986) (6,053)

--------------------------------- -------------------------------

(3,181,158) (2,624,174)

------------------------------------------ ----- --------------------------------- -------------------------------

Total comprehensive income attributable

to:

Owners of the parent (3,094,754) (2,423,054)

Non-controlling interest (60,986) (6,053)

------------------------------------------ ----- --------------------------------- -------------------------------

(3,155,740) (2,429,107)

------------------------------------------ ----- --------------------------------- -------------------------------

(Loss)/gain per share Pence Pence

Basic and diluted - continuing 4 (0.83) (1.01)

Basic and diluted - discontinued 4 (0.29) 0.09

------------------------------------------ ----- --------------------------------- -------------------------------

Basic and diluted - total (1.12) (0.92)

------------------------------------------ ----- --------------------------------- -------------------------------

Consolidated statement of financial position

as at 30 June 2019

Note 30 June 31 December

2019 2018

Unaudited Audited

GBP GBP

-------------------------------------- ----- ------------- -------------

Non-current assets

Intangible assets 6 12,366,894 12,848,623

Other investments 424,089 535,130

Property, plant and equipment 5 1,040,069 127,556

Other assets 150,922 132,577

-------------------------------------- ----- ------------- -------------

13,981,974 13,643,886

-------------------------------------- ----- ------------- -------------

Current assets

Trade and other receivables 7 1,817,707 2,681,500

Deferred consideration 302,723 665,690

Cash and cash equivalents 8 277,510 467,033

-------------------------------------- ----- ------------- -------------

2,397,940 3,814,223

Assets classified as held for

sale 11 10,795,969 11,392,013

-------------------------------------- ----- ------------- -------------

Total assets 27,175,883 28,850,122

-------------------------------------- ----- ------------- -------------

Current liabilities

Trade and other payables 9 4,731,391 2,484,592

Liabilities classified as held

for sale 11 4,101,471 4,830,076

-------------------------------------- ----- ------------- -------------

8,832,862 7,314,668

-------------------------------------- ----- ------------- -------------

Non-current liabilities

Deferred tax liability 543,982 607,943

Other Creditors 13 3,031,870 3,004,602

Derivative liabilities 13 200,000 200,000

-------------------------------------- ----- ------------- -------------

3,775,852 3,812,545

-------------------------------------- ----- ------------- -------------

Total liabilities 12,608,714 11,127,213

-------------------------------------- ----- ------------- -------------

Net assets 14,567,169 17,722,909

-------------------------------------- ----- ------------- -------------

Equity

Share capital 12 28,442,874 28,442,874

Share premium 87,198,410 87,198,410

Merger reserve (67,673,657) (67,673,657)

Foreign exchange reserve 1,936,871 1,911,453

Retained earnings (35,428,667) (32,308,495)

-------------------------------------- ----- ------------- -------------

Total equity attributable to owners

of the parent 14,475,831 17,570,585

-------------------------------------- ----- ------------- -------------

Non-controlling interest 91,338 152,324

-------------------------------------- ----- ------------- -------------

Total equity 14,567,169 17,722,909

-------------------------------------- ----- ------------- -------------

Consolidated statement of cash flows

for the 6 months ended 30 June 2019

Note 30 June 30 June

2019 2018

Unaudited Unaudited

GBP GBP

----------------------------------------------- ------ ------------ ------------

Cash flows from operating activities

Loss for the period (3,181,158) (2,624,174)

Adjustments for:

Depreciation of property, plant and

equipment 5 147,430 75,093

Amortisation of intangible fixed assets 6 1,535,449 2,462,140

Finance income (299,589) (88,012)

Finance expense 3 378,446 511,774

Income tax credit (104,835) (194,557)

Unrealised currency translation gains 538 38,272

Loss / (profit) on disposal of property,

plant and equipment 28,747 (11,734)

Loss on disposal of assets 84,377 43,748

Share of loss of associate 10 157,307 -

Share based payments expense - 154,986

Decrease in trade and other receivables 1,319,608 673,969

Decrease in trade and other payables (476,085) (2,202,200)

----------------------------------------------- ------ ------------ ------------

Net cash flows used in operating activities

before taxation (409,765) (1,160,695)

----------------------------------------------- ------ ------------ ------------

Tax credit received in the period 39,988 -

----------------------------------------------- ------ ------------ ------------

Net cash flows used in operating activities (369,777) (1,160,695)

----------------------------------------------- ------ ------------ ------------

Investing activities

Acquisition of property, plant and equipment 5 (110,678) (23,503)

Capitalised development costs 6 (1,532,978) (1,464,628)

Proceeds from disposal of assets - 1,849,133

Interest received 3,705 58,253

Receipt of deferred consideration 385,000 -

----------------------------------------------- ------ ------------ ------------

Net cash (used in) / from investing

activities (1,254,951) 419,255

----------------------------------------------- ------ ------------ ------------

Financing activities

Cost relating to issue of convertible

debt - (24,846)

Interest paid (191,309) (107,831)

----------------------------------------------- ------ ------------ ------------

Net cash used in financing activities (191,309) (132,677)

----------------------------------------------- ------ ------------ ------------

Net decrease in cash and cash equivalents (1,816,037) (874,117)

Cash and cash equivalents at beginning

of period 8 1,550,140 1,319,098

Exchange gain / (losses) on cash and

cash equivalents 1,992 (16,440)

----------------------------------------------- ------ ------------ ------------

Cash and cash equivalents at end of

period 8 (263,905) 428,541

----------------------------------------------- ------ ------------ ------------

Consolidated statement of changes in equity

for the 6 months ended 30 June 2019

Total

Foreign Shares to equity

Share Share Merger Exchange to be Retained holders Non-controlling Total

capital premium reserve Reserve issued earnings of parents interest equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

1 January 2018 28,442,874 87,198,410 (67,673,657) 1,419,842 145,000 (33,530,345) 16,209,345 169,824 16,379,170

---------------- ----------- ----------- ------------- ---------- -------- ------------- ------------ ----------------- ------------

Loss for the

period - - - - - (2,618,121) (2,618,121) (6,053) (2,624,174)

Other

comprehensive

income - - - 195,067 - - 195,067 - 195,067

Total

comprehensive

income /

(loss) for

the period - - - 195,067 - (2,618,121) (2,423,054) (6,053) (2,429,107)

---------------- ----------- ----------- ------------- ---------- -------- ------------- ------------ ----------------- ------------

Contributions

by and

distributions

to owners

Share-based

payment

on share

options - - - - - 154,986 154,986 - 154,986

30 June 2018

(unaudited) 28,442,874 87,198,410 (67,673,657) 1,614,909 145,000 (35,993,480) 13,941,277 163,771 14,105,049

---------------- ----------- ----------- ------------- ---------- -------- ------------- ------------ ----------------- ------------

31 December

2018 28,442,874 87,198,410 (67,673,657) 1,911,453 - (32,308,495) 17,570,585 152,324 17,722,909

---------------- ----------- ----------- ------------- ---------- -------- ------------- ------------ ----------------- ------------

Loss for the

period - - - - - (3,120,172) (3,120,172) (60,986) (3,181,158)

Other

comprehensive

income - - - 25,418 - - 25,418 - 25,418

Total

comprehensive

income/(loss)

for the

period - - - 25,418 - (3,120,172) (3,094,754) (60,986) (3,155,740)

---------------- ----------- ----------- ------------- ---------- -------- ------------- ------------ ----------------- ------------

Contributions

by and

distributions

to owners

Share-based - - - - - - - - -

payment

on share

options

30 June 2019

(unaudited) 28,442,874 87,198,410 (67,673,657) 1,936,871 - (35,428,667) 14,475,831 91,338 14,567,169

---------------- ----------- ----------- ------------- ---------- -------- ------------- ------------ ----------------- ------------

Notes forming part of the consolidated financial statements

For the 6 months ended 30 June 2019

1. Accounting policies

General Information

Gaming Realms plc ("the Company") and its subsidiaries (together

"the Group").

The Company is admitted to trading on AIM of the London Stock

Exchange. It is incorporated and domiciled in the UK. The address

of its registered office is Two Valentine Place, London,

SE18QH.

The results for the six months ended 30 June 2019 and 30 June

2018 are unaudited.

Basis of preparation

The financial information for the year ended 31 December 2018

included in these financial statements does not constitute the full

statutory accounts for that year. The Annual Report and Financial

Statements for 2018 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Financial Statement for 2018 was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

This interim report, which has neither been audited nor reviewed

by independent auditors, was approved by the board of directors on

25 September 2019. The financial information in this interim report

has been prepared in accordance with the recognition and

measurement requirements of International Financial Reporting

Standards as adopted for use in the EU (IFRSs). The accounting

policies applied by the Group in this financial information are the

same as those applied by the Group in its financial statements for

the year ended 31 December 2018 and which will form the basis of

the 2019 financial statements.

The consolidated financial statements are presented in

Sterling.

Going concern

The Group meets its day-to-day working capital requirements from

the cash flows generated by its trading activities and its

available cash resources. These are supplemented when required by

the Group's bank overdraft facility, which is available until April

2020.

After the period end on 17 July 2019, the Group concluded the

sale of the remaining B2C RMG business to River. On completion of

the transaction, the Group received initial consideration of

GBP7.35m, with a further GBP1.5m receivable on or before 31

December 2020. Further, the transaction resulted in River assuming

the GBP2.65m net liability position of Bear Group Limited at the

point of disposal.

The Group's strategic forecasts, based on reasonable

assumptions, together with the above RMG disposal, indicate that

the Group will be able to operate within the level of its currently

available resources.

The directors therefore have a reasonable expectation that the

Group has adequate resources to continue in existence for the

foreseeable future. Accordingly, these financial statements have

been prepared on a going concern basis.

Changes in significant accounting policies

Except as described below, the accounting policies applied in

these interim financial statements are the same as those applied in

the latest annual financial statements.

The changes in accounting policies are also expected to be

reflected in the Group's consolidated financial statements as at

and for the year ended 31 December 2019.

The Group has adopted IFRS 16: Leases from 1 January 2019.

Several other amendments and interpretations apply for the first

time in 2019, but do not have an impact on the interim consolidated

financial statements of the Group. The Group has not early adopted

any other standard, interpretation or amendment that has been

issued but is not yet effective.

IFRS 16: Leases

IFRS 16 'Leases' has replaced IAS 17 in its entirety. The

distinction between operating leases and finance leases for lessees

is removed and it results in most leases being recognised on the

Statement of Financial Position as a right-of-use asset and a lease

liability. For leases previously classified as operating leases,

the lease cost has changed from an in-period operating lease

expense to recognition of depreciation of the right-of-use (ROU)

asset and interest expense on the lease liability.

The Group has applied IFRS 16 using the modified retrospective

approach. A lease liability has been recognised equal to the

present value of the remaining lease payments discounted using an

incremental borrowing rate. A ROU asset has been recognised equal

to the lease liability adjusted for prepaid and accrued lease

payments.

The Group has applied the below practical expedients permitted

under the modified retrospective approach;

-- Exclude leases for measurement and recognition for leases

where the term ends within 12 months from the date of initial

application and account for these leases as short-term leases;

-- Applied portfolio level accounting for leases with similar characteristics;

-- Excluded initial direct costs from measuring the right of use

asset at the date of initial application; and

-- Used hindsight when determining the lease term if the

contract contains options to extend or terminate the lease.

The table below presents the cumulative effects of the items

affected by the initial application on the statement of financial

position as at 1 January 2019:

1 January

2019 (as

previously IFRS 16 1 January

reported) adoption 2019

GBP GBP

-------------------------- ------------------------ ------------------------ ---------------------

Non-current assets

Property, plant and

equipment 127,556 455,008 582,564

-------------------------- ------------------------ ------------------------ ---------------------

Total assets 28,850,122 455,008 29,305,130

-------------------------- ------------------------ ------------------------ ---------------------

Current liabilities

Lease liabilities - (115,964) (115,964)

Non-current liabilities

Lease liabilities - (339,044) (339,044)

-------------------------- ------------------------ ------------------------ ---------------------

Total liabilities (11,127,213) (455,008) (11,582,221)

-------------------------- ------------------------ ------------------------ ---------------------

Net assets 17,722,909 - 17,722,909

-------------------------- ------------------------ ------------------------ ---------------------

In measurement of the lease liability, the Group discounted

future lease payments using the nominal incremental borrowing rate

at 1 January 2019, being 14.5%.

As a result of initially applying IFRS 16, the right-of-use

asset and lease liability recognised as at 30 June 2019 are

GBP889,270 and GBP906,075 respectively. Under IFRS 16, the Group

has recognised amortisation and interest costs, as opposed to an

operating lease expense. During the six months ended 30 June 2019,

the Group recognised GBP85,187 of additional depreciation charges

and GBP43,829 of additional interest costs from leases.

The impact on EBITDA as a result of the implementation of IFRS

16 is an increase of GBP102,432 during the six months ended 30 June

2019, and a decrease of GBP26,913 in the Group's net profit.

6M 6M

30 June 30 June

2019 2018

GBP GBP

--------------------------------- --------------------- ------------------------

EBITDA reported - continuing (427,178) (494,331)

Impact of IFRS 16 (102,432) -

--------------------------------- --------------------- ------------------------

EBITDA reported - continuing -

prior to impact of IFRS 16 (529,610) (494,331)

--------------------------------- --------------------- ------------------------

Set out below, are the carrying amount of the Group's

right-of-use asset and lease liability and the movement during the

period:

Right

of use Lease

asset liability

GBP GBP

--------------------------------- ------------------------ ------------------------

As at 1 January 2019 455,008 455,008

Leases entered into during the

period 519,449 519,449

Amortisation of ROU asset (85,187) -

Interest expense - 43,829

FX on lease liability - 5,605

Payments - (117,816)

As at 30 June 2019 889,270 906,075

--------------------------------- ------------------------ ------------------------

The lease liability at 1 January 2019 can be reconciled to the

operating lease commitments as of 31 December 2018 as follows:

GBP

---------------------

Minimum lease payments under operating

leases at 31 December 2018 380,900

Short term leases not recognised

as liabilities (109,026)

Sub-lease to recognise as liability

under IFRS 16 302,546

Gross lease liabilities as at

1 January 2019 574,420

Effect of discounting at incremental

borrowing rate (119,412)

Present value of lease liabilities

at 1 January 2019 455,008

---------------------

As a lessor

The Group has one leased property which is also sublet. The

accounting policies applicable to the Group as a lessor are not

different from those under IAS 17.

Adjusted EBITDA

EBITDA is a non-GAAP company specific measure defined as loss

before tax adjusted for finance income and expense, depreciation

and amortisation.

Adjusted EBITDA excludes non-recurring material items which are

outside the normal scope of the Group's ordinary activities.

Adjusted EBITDA is considered to be a key performance measure by

the Directors as it serves as an indicator of financial

performance. The adjusting items are separately disclosed in order

to enhance the reader's understanding of the Group's profitability

and cash flow generation. Adjusting items include EBITDA from

discontinued operations and costs arising from a fundamental

restructuring of the Group's operations.

2. Segment information

The Board is the Group's chief operating decision-maker.

Management has determined the operating segments based on the

information reviewed by the Board for the purposes of allocating

resources and assessing performance.

The Group has two continuing reportable segments.

-- Licensing - B2B brand and content licensing to partners in the US and Europe; and

-- Social publishing - provides B2C freemium games to the US and Europe.

The results of the discontinued segments are included in note

10. Management do not report segmental assets and liabilities

internally and as such an analysis is not reported.

Revenue by product

6M 6M

30 June 30 June

2019 2018

GBP GBP

------------------------------------- --------------------------- ---------------------------

Licensing 1,649,576 628,215

Social publishing 1,452,376 2,074,853

Other 86,412 -

------------------------------------- --------------------------- ---------------------------

Total - continuing 3,188,364 2,703,068

------------------------------------- --------------------------- ---------------------------

Real money gaming - discontinued

(note 10) 5,762,066 8,262,231

Affiliate marketing - discontinued

(note 10) - 170,384

------------------------------------- --------------------------- ---------------------------

Total 8,950,430 11,135,683

------------------------------------- --------------------------- ---------------------------

Geographical information

The Group considers that its primary geographic regions are the

UK, including Channel Islands, USA and the rest of the world. No

revenue is derived from real money gaming in the US. With the

exception of the ROU assets recognised on adoption of IFRS 16 (see

note 1), all of the Group's non-current assets are based in the

UK.

External revenue

by location of customers

6M 6M

30 June 30 June

2019 2018

GBP GBP

-------------------------------- --------------------------- -------------------------

UK, including Channel Islands - 34,568

US 2,175,422 2,462,436

Rest of the World 1,012,942 206,064

-------------------------------- --------------------------- -------------------------

Total - continuing 3,188,364 2,703,068

-------------------------------- --------------------------- -------------------------

Adjusted EBITDA

Licensing Social Head Office Total 6M

publishing 30 June

2019

H1 2019 GBP GBP GBP GBP

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

Revenue 1,649,576 1,452,376 86,412 3,188,364

Marketing

expense - (104,692) (8,529) (113,220)

Operating

expense (279,976) (436,249) (936) (717,162)

Administrative

expense (646,539) (437,851) (1,279,872) (2,364,262)

Share-based - - - -

payments

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

Adjusted EBITDA

- continuing 723,061 473,584 (1,202,925) (6,280)

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

Loss on

disposal (320,853)

Restructuring

expenses (100,045)

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

EBITDA -

continuing (427,178)

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

Licensing Social Head Office Total 6M

publishing 30 June

2018

H1 2018 GBP GBP GBP GBP

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

Revenue 628,215 2,074,853 - 2,703,068

Marketing

expense - (202,542) 7,680 (194,862)

Operating

expense (88,679) (569,536) (400) (658,615)

Administrative

expense (456,890) (285,438) (1,393,410) (2,135,738)

Share-based

payments - - (154,986) (154,986)

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

Adjusted EBITDA

- continuing 82,646 1,017,337 (1,541,116) (441,133)

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

Loss on

disposal (53,198)

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

EBITDA -

continuing (494,331)

----------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

3. Finance income and expense

6M 6M

30 June 30 June

Note 2019 2018

GBP GBP

--------------------------------------- ------ ----------------------------- -----------------------------

Finance income

Interest received 3,705 58,253

Unwind of interest on deferred

consideration receivable 22,033 -

Fair value gain on other investments - 29,759

--------------------------------------- ------ ----------------------------- -----------------------------

Total finance income 25,738 88,012

--------------------------------------- ------ ----------------------------- -----------------------------

Finance expense

Bank & loan interest paid 68,917 52,439

Fair value loss on other investments 111,041 -

Effective interest on other

creditor 13 198,488 459,335

--------------------------------------- ------ ----------------------------- -----------------------------

Total finance expense 378,446 511,774

--------------------------------------- ------ ----------------------------- -----------------------------

4. Loss per share

Basic profit / (loss) per share is calculated by dividing the

result attributable to ordinary shareholders by the weighted

average number of shares in issue during the period. For fully

diluted loss per share, the weighted average number of ordinary

shares is adjusted to assume conversion of dilutive potential

ordinary shares. The Group's potentially dilutive securities

consist of share options, performance shares and a convertible

bond. As the continuing operations of the Group are loss making,

none of the potentially dilutive securities are currently

dilutive.

6M 6M

30 June 30 June

Note 2019 2018

GBP GBP

------------------------------------------- ------ ------------ ------------

Loss after tax - continuing (2,352,117) (2,878,182)

(Loss) / profit after tax - discontinued 10 (829,041) 254,008

------------------------------------------- ------ ------------ ------------

Loss after tax - total (3,181,158) (2,624,174)

------------------------------------------- ------ ------------ ------------

Number Number

------------------------------------------- ------ ------------ ------------

Weighted average number of ordinary

shares used in calculating basic

loss per share 12 284,428,747 284,428,747

------------------------------------------- ------ ------------ ------------

Weighted average number of ordinary

shares used in calculating dilutive

loss per share 284,428,747 284,428,747

------------------------------------------- ------ ------------ ------------

Pence Pence

------------------------------------------- ------ ------------ ------------

Basic and diluted loss per share

- continuing (0.83) (1.01)

Basic and diluted (loss) / profit

per share - discontinued (0.29) 0.09

------------------------------------------- ------ ------------ ------------

Basic and diluted loss per share

- total (1.12) (0.92)

------------------------------------------- ------ ------------ ------------

5. Property, plant and equipment

Computers Office

ROU lease Leasehold and related furniture

assets improvements equipment and equipment Total

GBP GBP GBP GBP GBP

-------------------------- ------------------------- --------------- -------------- ---------------- ----------

Cost

Balance at 31 December

2018 - 197,580 180,899 92,475 470,954

Additions arising

from IFRS 16 adoption 455,008 - - - 455,008

Additions 519,449 67,309 12,539 30,830 630,127

Reclassified as held

for sale - - (1,125) - (1,125)

Disposals - (179,438) (12,304) (46,456) (238,198)

Exchange differences - (1,730) 1,164 1,091 525

Balance at 30 June

2019 974,457 83,721 181,173 77,940 1,317,291

-------------------------- ------------------------- --------------- -------------- ---------------- ----------

Accumulated deprecation

Balance at 31 December

2018 - 148,968 126,631 67,799 343,398

Depreciation charge 85,187 31,736 22,920 7,587 147,430

Reclassified as held

for sale - - (4,770) (1,043) (5,813)

Disposals - (173,275) (12,082) (24,094) (209,451)

Exchange differences - (246) 1,016 888 1,658

At 30 June 2019 85,187 7,183 133,715 51,137 277,222

-------------------------- ------------------------- --------------- -------------- ---------------- ----------

Net book value

At 31 December 2018 - 48,612 54,268 24,676 127,556

-------------------------- ------------------------- --------------- -------------- ---------------- ----------

At 30 June 2019 889,270 76,538 47,458 26,803 1,040,069

-------------------------- ------------------------- --------------- -------------- ---------------- ----------

6. Intangible assets

Customer Development Domain Intellectual

Goodwill database Software costs names Property Total

GBP GBP GBP GBP GBP GBP GBP

---------- ----------- ---------- ------------- -------- -------------- -----------

Cost

Balance at 31

December 2018 7,056,768 1,582,190 1,488,600 9,708,137 29,418 6,194,372 26,059,485

Additions - - - 1,532,978 - - 1,532,978

Disposals - - - (144,766) - - (144,766)

Reclassified

as held for sale - - - (420,242) - - (420,242)

Exchange differences 19,718 5,819 (4,474) 784 36 32,933 54,816

Balance at 30

June 2019 7,076,486 1,588,009 1,484,126 10,676,891 29,454 6,227,305 27,082,271

----------------------- ---------- ----------- ---------- ------------- -------- -------------- -----------

Accumulated amortisation and

impairment

Balance at 31

December 2018 1,650,000 1,582,190 1,407,255 5,923,789 29,418 2,618,210 13,210,862

Amortisation

charge - - 75,226 1,078,771 - 381,452 1,535,449

Disposals - - - (60,389) - - (60,389)

Reclassified - - - - - - -

as held for sale

Exchange differences - 5,819 (4,634) 512 36 27,722 29,455

Balance at 30

June 2019 1,650,000 1,588,009 1,477,847 6,942,683 29,454 3,027,384 14,715,377

----------------------- ---------- ----------- ---------- ------------- -------- -------------- -----------

Net book value

At 31 December

2018 5,406,768 - 81,345 3,784,348 - 3,576,162 12,848,623

----------------------- ---------- ----------- ---------- ------------- -------- -------------- -----------

At 30 June 2019 5,426,486 - 6,279 3,734,208 - 3,199,921 12,366,894

----------------------- ---------- ----------- ---------- ------------- -------- -------------- -----------

7. Trade and other receivables

30 June 31 December

2019 2018

GBP GBP

------------------------------ ------------------------ -------------

Trade and other receivables 1,170,938 1,541,665

Prepayments and accrued

income 646,769 1,139,835

------------------------------ ------------------------ -------------

1,817,707 2,681,500

------------------------------ ------------------------ -------------

All amounts shown fall due for payment within one year.

8. Cash and cash equivalents

30 June 31 December

Note 2019 2018

GBP GBP

------------------------------- ------ -------------------------- ----------------------------

Cash and cash equivalents 277,510 467,033

Cash - held for sale 11 447,961 1,101,489

Restricted cash (18,382) (18,382)

Bank overdraft (970,994) -

------------------------------- ------ -------------------------- ----------------------------

Cash and cash equivalents

for Statement of cash flows (263,905) 1,550,140

------------------------------- ------ -------------------------- ----------------------------

Restricted cash relates to funds held in Swiss subsidiaries

which are currently undergoing liquidation. The funds are

restricted and are not included in the consolidated statement of

cash flows.

In July 2019, the bank overdraft was repaid in full on receipt

of the proceeds received on the RMG B2C disposal (see note 15).

9. Trade and other payables

30 June 31 December

Note 2019 2018

GBP GBP

--------------------------- ------ ------------------------ ----------------------------

Trade and other payables 3,209,567 1,896,184

Bank Overdraft 8 970,994 -

Accruals 550,830 588,408

--------------------------- ------ ------------------------ ----------------------------

4,731,391 2,484,592

--------------------------- ------ ------------------------ ----------------------------

The carrying value of trade and other payables classified as

financial liabilities measured at amortised cost approximates fair

value.

10. Discontinued operations

At the period end, the Group was sufficiently progressed with

active discussions concerning the remainder of the B2C real money

gaming brands and real money gaming platform, that these elements

have been classified as held for sale as at 30 June 2019. The sale

of the real money gaming assets completed in July 2019 (see note

15).

During the prior period, on 22 March 2018 the Group sold its

Affiliate Marketing CGU.

The results of both the real money gaming and affiliate

marketing segments are therefore presented as discontinued

operations in these financial statements.

Results of discontinued operations:

6M 6M

30 June 30 June

2019 2018

Unaudited Unaudited

B2C RMG GBP GBP

------------------------------- ---------------------------- ----------------------------

Revenue 5,762,066 8,262,231

Marketing expenses (640,772) (2,583,698)

Operating expenses (4,493,143) (3,479,517)

Administrative expenses (1,567,923) (1,610,505)

-------------------------------- ---------------------------- ----------------------------

EBITDA - RMG (939,772) 588,511

----------------------------

Amortisation of intangible

assets - (376,437)

Depreciation of property,

plant and equipment (5,813) (6,150)

Share of loss of associate (157,307) -

Finance income 273,851 -

------------------------------- ---------------------------- ----------------------------

(Loss) / profit for the

period - RMG (829,041) 205,924

-------------------------------- ---------------------------- ----------------------------

Affiliate Marketing

------------------------------- ---------------------------- ----------------------------

Revenue - 170,384

Marketing expenses - (20,834)

Operating expenses - (15,809)

Administrative expenses - (85,657)

-------------------------------- ---------------------------- ----------------------------

EBITDA - Affiliate Marketing - 48,084

-------------------------------- ---------------------------- ----------------------------

EBITDA for the period -

discontinued (939,772) 636,595

-------------------------------- ---------------------------- ----------------------------

(Loss) / profit for the

period - discontinued (829,041) 254,008

-------------------------------- ---------------------------- ----------------------------

11. Assets and liabilities classified as held for sale

The following major classes of assets and liabilities have been

classified as held for sale in the consolidated statement of

financial position at 30 June 2019 and 31 December 2018. These

assets and liabilities were disposed of on completion of the real

money gaming assets disposal in July 2019 (see note 15).

30 June 31 December

Note 2019 2018

GBP GBP

-------------------------------- ------ ----------- ------------

Non-current assets

Intangible assets - goodwill 1,699,000 1,699,000

Intangible assets - platform

development costs 1,687,030 1,266,788

Investment in associate 2,110,885 2,268,192

Property, plant and equipment 8,100 12,789

Other assets 32,000 32,000

---------------------------------------- ----------- ------------

5,537,015 5,278,769

--------------------------------------- ----------- ------------

Current assets

Trade and other receivables 913,717 1,388,330

Deferred consideration 3,897,276 3,623,425

Cash and cash equivalents 447,961 1,101,489

---------------------------------------- -----------

Assets held for sale 10,795,969 11,392,013

---------------------------------------- ----------- ------------

Current liabilities

Trade and other payables 4,101,471 4,830,076

---------------------------------------- ----------- ------------

Liabilities held for sale 4,101,471 4,830,076

---------------------------------------- ----------- ------------

12. Share capital

Ordinary Shares

30 June 30 June 31 December 31 December

2019 2019 2019 2019

Number GBP Number GBP

---------------------

Ordinary shares of 284,428,747 28,442,874 284,428,747 28,442,874

------------ ----------- ------------ ------------

10 pence each

--------------------- ------------ ----------- ------------ ------------

13. Arrangement with JackpotJoy

In December 2017 the Group entered into a complex transaction

with Jackpotjoy plc and Group companies (together 'Jackpotjoy

Group'). The transaction includes a GBP3.5m secured convertible

loan agreement alongside a 10-year framework services agreement for

the supply of various real money services.

The convertible loan principal of GBP3.5m was paid directly by

Jackpotjoy Group to RealNetworks to settle the outstanding $4.5m

(GBP3.4m) deferred consideration obligation, with the excess cash

of GBP0.1m transferred to the Group. Under the framework services

agreement the first GBP3.5m of services are provided free of charge

within the first 5 years.

The convertible loan has a duration of 5 years and carried

interest at 3-month LIBOR plus 5.5%. It is secured over the Group's

Slingo assets and business. At any time after the first year,

Jackpotjoy Group may elect to convert all or part of the principal

amount into ordinary shares of Gaming Realms plc at a discount of

20% to the share price prevailing at the time of conversion. To the

extent that the price per share at conversion is lower than 10p

(nominal value), then the shares can be converted at nominal value

with a cash payment equal to the aggregate value of the convertible

loan outstanding multiplied by the shortfall on nominal value

payable to Jackpotjoy Group. Under this arrangement the maximum

dilution to Gaming Realms shareholders will be approximately 11%

assuming the convertible loan is converted in full.

The option violates the fixed-for-fixed criteria for equity

classification as the number of shares is variable and as a result

is classified as a liability.

The fair value of the conversion feature is determined each

reporting date with changes recognised in profit or loss. The

initial fair value was GBP0.6m based on a probability assessment of

conversion and future share price. This is a level 3 valuation as

defined by IFRS 13. The fair value as at 30 June 2019 was GBP0.2m

(31 December 2018: GBP0.2m) based on revised probabilities of when

and if the option will be exercised. The key inputs into the

valuation model included timing of exercise by the counterparty

(based on a probability assessment) and the share price.

The initial fair value of the host debt was calculated as

GBP2.7m, being the present value of expected future cash outflows.

The rate used to discount future cash flows was 14.1%, being the

Group's incremental borrowing rate. The rate was calculated by

reference to the Group's cost of equity in the absence of reliable

alternative evidence of the Group's cost of borrowing given it is

predominantly equity funded. Expected cash flows are based on the

directors' judgement that a change in control event would not

occur. Subsequently the loan is carried at amortised cost.

The residual GBP0.2m of proceeds were allocated to the

obligation of provide free services.

Fair Fair

value Obligation value

of debt to provide of derivative

host free services Liability Total

GBP GBP GBP GBP

----------------------------- ---------- ---------------- ---------------- ----------

At 31 December 2018 2,795,602 209,000 200,000 3,204,602

Utilisation of free

services - (4,999) - (4,999)

Effective interest (14.4%) 198,488 - - 198,488

Interest paid (166,221) - - (166,221)

At 30 June 2019 2,827,869 204,001 200,000 3,231,870

----------------------------- ---------- ---------------- ---------------- ----------

14. Related party transactions

Jim Ryan is a non-executive Director of the Group and the CEO of

Pala Interactive. On 22 March 2016, Pala Interactive launched a

real-money online bingo site in New Jersey. The Bingo software is

provided by AlchemyBet Limited on a revenue share basis. During the

period, the total licence fees earned were $6,507 (H1 2018: $8,146)

with $1,390 due at 30 June 2019 (30 June 2018: $nil).

Jim Ryan is a non-executive Director of JackpotJoy Plc. In

December 2017 Gaming Realms entered into a 10-year framework

services agreement and a 5-year convertible loan agreement for

GBP3.5m with the Jackpotjoy Group (see note 13).

During the period GBP75,000 (H1 2018: GBP75,000) of consulting

fees were paid to Dawnglen Finance Limited, a company controlled by

Michael Buckley. No amounts were owed at the period end (H1 2018:

GBPnil).

Atul Bali is an advisor of Gamerail Entertainment LLC, a social

lottery gaming company. During H1 2018, a balance of $253,454

receivable in Blastworks, Inc. which arose from historical

transactions was fully provided for. No services were provided in

2018.

Atul Bali is an advisor to Instant Win Gaming. In April 2016,

Instant Win Gaming entered into an agreement with Bear Group

Limited to supply Instant Win Games on its online gaming websites.

During the period ended 30 June 2018, the total revenue share

payable by Bear Group Limited for the supply of game content

totalled GBP22,033 with GBP5,280 owed at 30 June 2018.

In addition, Instant Win Gaming has entered into a licensing

agreement with Blastworks Limited for the Slingo Brand. Instant Win

Game licensed the Slingo Brand to create and distribute Slingo

Branded Instant Win Games. During the period to 30 June 2018, total

license fees earned were GBP18,781, with GBP2,227 due at 30 June

2018.

Atul resigned on 30 June 2018 and therefore the above entities

ceased to be a related party on this date.

15. Events after reporting date

On 17 July 2019, the Group completed the proposed transaction to

(i) sell the entire issued share capital of Bear Group Limited,

(ii) license the Company's real money gaming platform, and (iii)

sell the Company's residual interest in River UK Casino Limited, to

River iGaming plc.

The cash consideration of the transaction is GBP11.5m on a

cash-free, debt-free basis. The transaction terminated the GBP4.2m

deferred consideration due on 31 August 2019 and the put/call

option over the Group's 30% shareholding of River UK Casino. The

Company has received an initial cash sum of GBP7.35m, with a

deferred consideration of GBP1.5m due on or before 31 December

2020. As part of the transaction, River has assumed GBP2.65m, being

the net liabilities of Bear Group Limited.

Included within the GBP0.3m loss on disposal expenses incurred

during the period, are GBP0.2m of expenses associated with the

above B2C RMG disposal. These expenses associated with the B2C RMG

disposal will be included in the profit on disposal of the segment

presentation which will be included in the 2019 full year financial

statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR CKPDDKBKBQCB

(END) Dow Jones Newswires

September 26, 2019 02:01 ET (06:01 GMT)

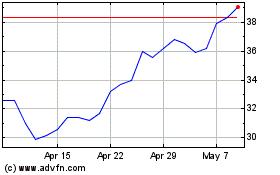

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Apr 2023 to Apr 2024