TIDMGMR

RNS Number : 7375D

Gaming Realms PLC

28 June 2019

Gaming Realms Plc

("Gaming Realms", the "Company" or the "Group")

Annual Results 2018

Delivering on Licensing Strategy and Real Money Gaming

Divestment

Gaming Realms plc (AIM: GMR), the developer and licensor of

mobile focused gaming content, announces its annual results for the

year ended 31 December 2018 and Q1 highlights for 2019.

Due to the difficult UK regulatory environment the Board took

the decision to dispose of the Affiliate Marketing business in

March 2018, dispose of part of the B2C Real Money Gaming ("RMG")

business in July 2018 and, in February 2019, exchanged contracts to

sell the remaining B2C RMG business.

Upon completion of the sale of the remaining B2C RMG business

(which is expected very shortly having received the necessary

regulatory approvals), the remaining business will be focused on

development and licensing of games for third party real money and

social gaming operators. This is a part of the business that we

have grown organically and is showing significant growth with some

global market leading partners.

2018 Financial Highlights:

-- Total profit of GBP0.9m (2017: GBP8.2m loss)

-- Continuing revenue down by 19% to GBP6.2m (2017: GBP7.6m) for the year;

o Licensing revenue increased 167% to GBP2.2m (2017:

GBP0.8m)

o Social publishing revenue decreased by 43% to GBP3.9m (2017:

GBP6.9m), with 63% reduction in costs

-- Total Adjusted EBITDA loss GBP0.5m (2017: GBP0.8m profit)

-- Continuing Adjusted EBITDA loss GBP0.1m (2017: GBP2.8m loss);

o Licensing GBP1.0m Adjusted EBITDA profit (2017: GBP0.2m

loss)

o Social publishing GBP1.6m Adjusted EBITDA profit (2017:

GBP0.1m loss)

-- Net cash inflow GBP0.2m (2017: GBP1.3m outflow) with a

further GBP10m due post the completion of the sale of the remaining

B2C RMG business, which is expected shortly

2018 Operational Highlights:

Licensing

-- Launched with 13 new partners for "Slingo Originals" content

-- 19 new games launched in period

Other

-- Affiliate Marketing business sale completed in March 2018 for GBP2.4m

-- Sale of part of the B2C RMG business to River iGaming plc

("River") in August 2018 for minimum proceeds of GBP8.4m (of which

GBP4.2m was payable on completion and GBP4.2m deferred)

Q1 2019 Highlights:

-- Gross gaming revenue ("GGR"), measuring the total revenue

generated by Gaming Realms' partners from its licensed content,

increased by 37% quarter-on-quarter to GBP10.8m (Q4 2018:

GBP7.9m).

-- Slingo Originals content went live on 8 new sites during the

quarter, taking the total distribution to 34 gaming sites

globally

-- Announced proposed sale of remaining B2C RMG business to

River for total consideration of GBP11.5m (which includes

settlement of the GBP4.2m deferred consideration mentioned above,

and of which GBP1.5m is deferred until 2020)

Outlook:

-- We have recently received necessary regulatory approvals to

complete the sale of the remaining B2C RMG business. We are now

working through the closing documents and expect to complete

shortly

-- Having developed the Licensing business in 2017, and seen the

great growth we have been achieving, we are hugely excited about

the future

-- 42% of Licensing play is currently outside the UK, and this

should increase with recent deals signed:

o Scientific Games deal gives access to up to 200 new worldwide

customers

o Relax Gaming deal opens up the Nordics with access to 80

potential new customers

-- Business is targeting to be cashflow positive by Q1 2020 based on delivery of above deals

Commenting on the results, Patrick Southon, CEO, said: "We began

our licensing business in 2017 as part of the strategy to fully

capitalise on the strength of our games development operations. In

a period of 24 months we have developed, licensed and launched 34

games via major gaming partners such as GVC and 888 and captured

over 3.5% market share in New Jersey. As a result, and post the

imminent completion of the sale of the remaining B2C RMG business,

we are looking forward to focusing solely on increasing the cadence

of game development and licensing delivery as more B2B partners

come online.

"The success to date in licensing our Slingo content illustrates

a clear market opportunity to grow our revenue and profitability on

an international level. This view has been further reinforced by

the recent deal with Scientific Games to distribute of all our

Slingo games via its global platform, which we expect to start

contributing revenue in the latter part of 2019."

Enquiries:

Gaming Realms plc 0845 123 3773

Patrick Southon, CEO

Mark Segal, CFO

Peel Hunt LLP 020 7418 8900

George Sellar

Guy Pengelley

Yellow Jersey 07747 788 221

Charles Goodwin

Georgia Colkin

Abena Affum

About Gaming Realms

Gaming Realms creates and publishes innovative real money and

social games for mobile, with operations in the UK, U.S. and

Canada. Through its market leading mobile platform and unique IP

and brands, Gaming Realms is bringing together media, entertainment

and gaming assets in new game formats. The Gaming Realms management

team includes accomplished entrepreneurs and experienced executives

from a wide range of leading gaming and media companies.

Chairman's Statement

During 2016 and 2017 it became increasingly difficult to operate

profitably within the UK online gaming market. This was due

initially to competition from the plethora of operators, coupled

with pressure on margins from the introduction of Point of

Consumption Tax.

Continued increases in costs to be borne by operators has only

increased with the passage of time;

-- Point of Consumption Tax has increased by 40% in April 2019

-- Changes in European data laws

-- Provisions to combat money laundering

-- Regulations relating to responsible gaming and gambling

All of these items encompassing new legislation and regulations,

have increased costs to the point where a smaller B2C gaming

company finds it difficult to operate at a profit in the UK, let

alone grow the business for the future.

Given the adverse changes in the B2C marketplace, your Board

decided towards the end of 2017 that the best course of action was

to sell the larger part of our B2C sites and concentrate on game

development and distribution to a worldwide audience. This resulted

in a deal with River which closed in August 2018, and was followed

by an announcement on 22nd February 2019 of a further sale to River

of all the remaining assets involved in operating B2C sites in the

UK online market, subject to a number of conditions, for an

aggregate consideration of GBP11.5m. We expect to complete this

disposal very shortly.

This introduction is intended to give shareholders an outline

and some background to the difficulties your Company has faced, and

which have led to the reorganisation which is nearing

completion.

Your Board is also considering its options to sell or

rationalise the Social Publishing division. This process, coupled

with the imminent sale of the B2C RMG assets, will lead to a

dramatic reduction in overall Company costs, with a decrease in

employees of over 60%.

The Group will then concentrate on game development and

international licensing using primarily its Slingo brand, and this

division which is experiencing heathy growth will become its main

focus. An increasing number of gaming companies are signing up to

distribute our content on their sites, both in the UK and overseas.

We are licensed as a game supplier in New Jersey, USA, where our

games account for approximately 3.5% of sales from slot products.

The Company is engaged in applying for a license in Pennsylvania

and will continue to pursue direct opportunities outside the UK to

distribute its games.

The Group delivered an Adjusted EBITDA loss for 2018 of GBP0.5m

(2017 GBP0.8m profit). These results mask the excellent progress

made by our Licensing division, where revenue increased by 167% to

GBP2.2m (2017: GBP0.8m) with an EBITDA surplus of GBP1.0m (2017:

GBP0.2m loss) before allocation of central costs. The Licensing

division went live with 17 new partners during the year, and our

library of proprietary games increased to 28 games from 9 games at

the start of the year under review. A number of new deals with game

distributors have been announced during 2019, which will further

increase worldwide exposure and income from our games once the

necessary integrations have been completed.

Further details on the 2018 results are contained in the

Statements from the Chief Executive and Finance Director which

follow.

Outlook for 2019

The operating plan for 2019 adopted by the Board, is to continue

the development and licence of mobile focused games using our

unique Slingo brand, with increased income from our game portfolio

through international distribution. Capitalising on our success in

New Jersey, we intend to enter any new states in America which

regulate online gaming.

With regard to the future, I am pleased to welcome Chris Ash to

the Board of Directors. Chis has a long and successful history in

online game development and distribution, and I am sure will make a

valuable contribution to this ongoing Company activity.

Once the sale of the remaining B2C RMG business is completed and

we conclude on the Social Publishing strategy, your Board believes

shareholders can look forward to a period of increasing stability.

This will show growth in Licensing income and a very significant

reduction in Group costs, and a trend towards Group

profitability.

In our 2019 Interim Results, we will report on the cash

availability post transaction, forecast working capital needs, and

the Board's intentions with regard to any surplus.

Michael Buckley

Chairman

Chief Executive's Review

Overview

In 2018, the Group's strategy continued to build its proprietary

"Slingo Originals" content and increase its distribution with new

partnerships. The Group also disposed of non-core assets as it

moved away from being a RMG operator in order to focus on content

licensing.

The Group's decision to dispose of its B2C RMG operations has

been driven by further regulatory headwinds and the recent increase

in Point of Consumption Tax effective from 1 April 2019. The first

phase of this asset disposal was completed in August 2018, with the

sale of four B2C RMG brands to River. We also streamlined our

Social Publishing business further, resulting in positive EBITDA of

GBP1.6m (2017: GBP0.1m loss). However, after capitalisation the net

cash inflow was GBP0.3m (2017: GBP1.3m outflow).

We have invested resources into new proprietary games and

introduced a further 19 games to the market, bringing the total

number of licensed games at the end of 2018 to 28 (2017: 9). At the

same time, we increased our content distribution and were live with

17 partners at the end of 2018 (2017: 4). Partners we have gone

live with during the year include GVC, 888, Rank as well as Golden

Nugget and Hard Rock Casino.

This increase in taking our Slingo Originals games to market, as

well as launching with new partners, has resulted in revenue

growing 167% to GBP2.2m (2017: GBP0.8m). Our Licensing business

also became profitable in the year, generating an Adjusted EBITDA

of GBP1.0m (2017: GBP0.2m loss) before the allocation of central

costs.

In 2019, to date, we have grown revenues in the online casino

market in New Jersey and now account for c.3.5% of the growing

market. We have also signed deals with several "tier 1 operators"

in Europe and are now live with William Hill and Gaming Innovation

Group. We are aiming to finalise our integration with NYX, which

will vastly increase our international footprint, by Q3 2019. Relax

Gaming will also give us reach into new markets, in particular with

the large tier 1 Scandinavian operators. Our games are also now

certified for the newly regulated Swedish market, as well as with

the Maltese regulator, and we are planning to obtain licences in

other regulated jurisdictions in 2019.

We are excited to announce that we are due to release our

Monopoly Slingo game to the international market in Q3 2019. We

expect this to deliver increased revenue and also greater exposure

on our partner sites. We are already creating a "Slingo" genre of

games and this very much complements our portfolio of unique IP and

a well-known gaming brand.

Market overview

The games market is a very crowded environment, in which most

operators have 700 plus games available on their sites. We are

seeing that Slingo can cut through this with its unique brand and

format. As such we are seeing enhanced placements on our partner

sites. With the increase in Point of Consumption Tax, together with

increased regulation in the UK, it is becoming more important to

grow our revenues outside the UK market. We have a good footprint

in the New Jersey market and have also gone live with Gaming

Innovation Group, as well as currently integrating into Relax

Gaming and NYX - both of whom allow access to a much larger market

for Slingo.

Key Goals for 2019

1. To complete the sale of the B2C RMG operations

2. Conclude on options to sell or rationalise the Social Publishing division

3. Continue the strategic investment in Slingo Originals

content, with a view to branded partnerships with other brand

owners

4. Increase new licensees for Slingo Original content

5. Further expansion of strategic brand licensing in adjacent markets

Patrick Southon

Chief Executive Officer

Financial Review

Overview

The operations of the Group have changed significantly in 2018

and into 2019 as the Group has continued with its strategy of

disposing of non-core assets and focusing its resources on

Licensing.

Gaming Realms delivered a profit after tax of GBP0.9m (2017:

GBP8.2m loss) due to the sale of B2C real money gaming and

Affiliate assets in year. We have treated the B2C real money gaming

and Affiliate marketing segments as discontinued operations in the

current year and the comparative period.

Adjusted EBITDA totalled GBP0.5m loss (2017: GBP0.8m profit) as

a result of declining revenues off the back of reduced marketing

spend.

Profit on disposal initially totalled GBP12.5m in real money

gaming for the disposal of four of our B2C brands in August 2018.

Regulatory pressures adversely impacted the performance of these

brands post sale, therefore at the year-end we impaired the

investment in associate by GBP2.8m and recognised a fair value loss

on contingent earn-out consideration of GBP1.9m This has resulted

in a net realised profit for the transaction of GBP7.8m.

The table below sets out the split of revenue and Adjusted

EBITDA on a continuing and discontinued basis:

2018

Discontinued Continuing

Real Affiliate Total Licensing Social Head Total Total

money marketing discontinued publishing office continuing 2018

gaming 2018 2018

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- --------- ----------- -------------- ----------- ------------ --------- ------------ ---------

Revenue 16,365 168 16,533 2,248 3,921 394 6,563* 23,096

Marketing

expense (4,319) (15) (4,334) - (414) (251) (665) (4,999)

Operating

expense (9,170) (16) (9,186) (200) (1,092) - (1,292) (10,478)

Administrative

expense (3,324) (116) (3,440) (1,055) (861) (2,738) (4,654) (8,094)

Share-based

payments - - - - - (68) (68) (68)

----------------- --------- ----------- -------------- ----------- ------------ --------- ------------ ---------

Adjusted EBITDA (448) 21 (427) 993 1,554 (2,663) (116) (543)

----------------- --------- ----------- -------------- ----------- ------------ --------- ------------ ---------

2017

Discontinued Continuing

Real Affiliate Total Licensing Social Head Total Total

money marketing discontinued publishing office continuing 2017

gaming 2017 2017

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- --------- ----------- -------------- ----------- ------------ --------- ------------ ---------

Revenue 22,718 1,323 24,041 840 6,879 179 7,898* 31,939

Marketing

expense (8,022) (128) (8,150) - (2,171) (110) (2,281) (10,431)

Operating

expense (8,868) (76) (8,944) (25) (1,755) - (1,780) (10,724)

Administrative

expense (3,155) (226) (3,381) (1,036) (3,010) (2,721) (6,767) (10,148)

Share-based

payments - - - - - 150 150 150

----------------- --------- ----------- -------------- ----------- ------------ --------- ------------ ---------

Adjusted EBITDA 2,673 893 3,566 (221) (57) (2,502) (2,780) 786

----------------- --------- ----------- -------------- ----------- ------------ --------- ------------ ---------

* Licensing revenue includes GBP389,464 (2017: GBP291,506) of

inter-segment revenue. This is shown as an Operating Expense under

the Real Money Gaming segment and eliminates on consolidation.

EBITDA and Adjusted EBITDA are non-GAAP measures and exclude

exceptional items, interest, depreciation, tax and amortisation.

Exceptional items are items the Group considers to be non-recurring

or material in nature that may distort an understanding of

financial performance or impair comparability.

Continuing operations

Continuing operations generated Adjusted EBITDA loss of GBP0.1m

(2017: GBP2.8m loss).

EBITDA from continuing operations was a GBP0.6m loss (2017:

GBP3.7m loss) including restructuring costs of GBP0.2m.

Year-on-year revenue declined 19% to GBP6.2m (2017: GBP7.6m) due

to the declining performance in Social, partially offset by the

growth in Licensing.

Marketing for the year totalled GBP0.7m (2017: GBP2.3m) as the

Group restricted spend for the Social division.

Administrative expenses reduced to GBP4.9m (2017: GBP7.5m) as a

result of restructuring the Social business in 2017 including the

closure of our Seattle office.

Licensing

Licensing revenue increased 167% to GBP2.2m (2017: GBP0.8m) due

to the continued success of distributing our proprietary games via

our remote game server ("RGS") to key operators in Europe and New

Jersey.

During 2018 we went live with an additional 13 partners in

Europe and New Jersey bringing the total to 17 (2017: 4).

Social Publishing

Social Publishing achieved profitability in 2018, delivering

Adjusted EBITDA profit of GBP1.6m (2017: Adjusted EBITDA loss

GBP0.1m) as a result of reducing marketing spend by 81% and

administrative expenses by 71%. Despite the significant reduction

in marketing investment, Social Publishing revenue decreased at a

lower rate of 43% to GBP3.9m (2017: GBP6.9m).

During 2017, Gaming Realms closed its Seattle operations

resulting in significant cost savings for 2018 of GBP2.5m.

Impairment of Social goodwill of GBP1.7m was recognised in the

year as a result of revised forecasts based on the reduced

performance of this segment.

Discontinued operations

Discontinued operations relate to B2C real money gaming and

affiliates. Profit after tax from discontinued operations was

GBP6.6m (2017: GBP0.2m) including profit on disposal of GBP12.5m,

write down of contingent consideration of GBP1.9m, impairment of

associate of GBP2.8m, and loss for the year of GBP1.0m.

Real money gaming

Revenue fell by 28% to GBP16.4m (2017: GBP22.7m) due to ongoing

reductions in marketing of 46% to GBP4.4m as a result of regulatory

pressures (2017: GBP8.0m).

In August 2018 four of the Group's real money gaming brands were

sold to River generating an initial profit on disposal of GBP12.5m.

The Group continues to operate these brands via a white label

agreement until River obtains their own operating licence,

recognising revenue and costs with net profit passed back to River

after retaining a platform fee. As a result, additional operational

costs of GBP1.4m were incurred, being the profit share payable to

River.

Post year end the Group has entered into an agreement for the

sale of the remaining B2C real money gaming business to River for

GBP11.5m, which includes settlement of the remaining proceeds from

the 2018 disposal and the Group's associate interest in River UK

Casino. This sale is subject to regulatory approvals. As a result,

this segment has been disclosed as a discontinued operation.

Operating expenses include point of consumption tax, third party

royalties and transaction costs which have reduced due to declining

revenues. Operating costs in total have increased 3% to GBP9.2m

(2017: GBP8.9m) as a result of the additional GBP1.4m profit share

payable to River.

This segment became EBITDA loss making in 2018 due to declining

revenues, the new profit share to River coupled with fixed

administrative costs increasing 5% on prior year.

Affiliates

The Affiliate marketing business was sold in March 2018 for

GBP2.4m after generating revenues of GBP0.2m in 2018 (2017:

GBP1.3m). The loss on disposal was GBP0.1m.

Cashflow, Balance Sheet and Going Concern

Net cash increased by GBP0.2m in 2018 (2017: decreased by

GBP1.3m). The current year cash position was boosted by the sale of

the Affiliate business for GBP2.4m plus the sale of certain real

money gaming assets to River for GBP4.2m cash in 2018. The post

year end sale agreement with River will, subject to completion,

generate an additional GBP11.5m, of which GBP1.5m is deferred to

2020.

Net assets totalled GBP17.7m (2017: GBP16.4m).

Following the global high margin opportunities in game content

licensing and the 2019 sale of the remaining B2C real money gaming

segment the Directors believe the Group is in a strong position and

expects to continue to be cash generative for 2019. As a result,

the Directors consider that the Group has adequate resources to

continue its normal course of operations for the foreseeable

future.

Dividend

During the year, Gaming Realms did not pay an interim or final

dividend. The Board of Directors are not proposing a final dividend

for the current year.

Corporation and deferred taxation

The Group received GBP0.1m (2017: GBP0.4m) in research and

development credits in Canada and has recognised an unwind of

deferred tax of GBP0.3m (2017: GBP0.2m) which arose on prior year

business combinations.

Mark Segal

Chief Financial Officer

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2018

2018 2017

Continuing GBP GBP

------------------------------------------ --------------------------------- ----------------------------

Revenue 6,173,196 7,606,110

Marketing expenses (665,363) (2,280,855)

Operating expenses (901,807) (1,487,905)

Administrative expenses (4,870,226) (7,502,371)

Impairment of financial asset (228,451) -

Share-based payments (67,824) 4,810

------------------------------------------ --------------------------------- ----------------------------

Adjusted EBITDA* total (542,911) 786,402

Adjusted EBITDA - discontinued 427,242 (3,566,356)

------------------------------------------ --------------------------------- ----------------------------

Adjusted EBITDA - continuing (115,669) (2,779,954)

Impairment of financial asset (228,451) -

Restructuring costs (216,355) (880,257)

EBITDA* continuing (560,475) (3,660,211)

---------------------------------

Amortisation of intangible assets (3,535,972) (4,292,283)

Depreciation of property, plant

and equipment (145,269) (173,638)

Impairment of goodwill (1,650,000) -

Finance expense (576,107) (752,600)

Finance income 419,894 239,603

------------------------------------------ --------------------------------- ----------------------------

Loss before tax (6,047,929) (8,639,129)

Tax credit 412,987 612,903

------------------------------------------ --------------------------------- ----------------------------

Loss for the financial year -

continuing (5,634,942) (8,026,226)

Profit/(Loss) for the financial

year - discontinued 6,564,246 (201,441)

------------------------------------------ --------------------------------- ----------------------------

Profit/(Loss) for the financial

year - total 929,304 (8,227,667)

------------------------------------------ --------------------------------- ----------------------------

Other comprehensive income

Items that will or may be reclassified

to profit or loss:

Fair value gain on available

for sale assets (pre 31 Dec 2017) - 207,222

Exchange gain/(loss) arising

on translation of foreign operations 491,611 (1,022,056)

------------------------------------------ --------------------------------- ----------------------------

Total other comprehensive income 491,611 (814,834)

------------------------------------------ --------------------------------- ----------------------------

Total comprehensive income 1,420,915 (9,042,501)

------------------------------------------ --------------------------------- ----------------------------

Profit/(loss) attributable to:

Owners of the parent 946,804 (8,225,956)

Non-controlling interest (17,500) (1,711)

--------------------------------- ----------------------------

929,304 (8,227,667)

------------------------------------------ --------------------------------- ----------------------------

Total comprehensive income attributable

to:

Owners of the parent 1,443,741 (9,007,324)

Non-controlling interest (22,826) (35,177)

------------------------------------------ --------------------------------- ----------------------------

1,420,915 (9,042,501)

------------------------------------------ --------------------------------- ----------------------------

(Loss)/gain per share Pence Pence

Basic and diluted - continuing (1.98) (2.89)

Basic and diluted - discontinued 2.31 (0.07)

------------------------------------------ --------------------------------- ----------------------------

Basic and diluted - total 0.33 (2.96)

------------------------------------------ --------------------------------- ----------------------------

Consolidated Statement of Financial Position

As at 31 December 2018

31 December 31 December

2018 2017

GBP GBP

--------------------------------- ------------- -------------

Non-current assets

Intangible assets 12,848,623 20,464,170

Other investments 535,130 747,222

Property, plant and equipment 127,556 263,069

Other assets 132,577 163,865

--------------------------------- ------------- -------------

13,643,886 21,638,326

--------------------------------- ------------- -------------

Current assets

Trade and other receivables 2,681,500 3,759,434

Deferred consideration 665,690 -

Cash and cash equivalents 467,033 2,283,302

--------------------------------- ------------- -------------

3,814,223 6,042,736

Assets classified as held for

sale 11,392,013 2,292,881

--------------------------------- ------------- -------------

Total assets 28,850,122 29,973,943

--------------------------------- ------------- -------------

Current liabilities

Trade and other payables 2,484,592 9,269,732

Liabilities classified as held 4,830,076 -

for sale

--------------------------------- ------------- -------------

7,314,668 9,269,732

--------------------------------- ------------- -------------

Non-current liabilities

Deferred tax liability 607,943 881,512

Other Creditors 3,004,602 2,843,529

Derivative liabilities 200,000 600,000

--------------------------------- ------------- -------------

3,812,545 4,325,041

--------------------------------- ------------- -------------

Total liabilities 11,127,213 13,594,773

--------------------------------- ------------- -------------

Net assets 17,722,909 16,379,170

--------------------------------- ------------- -------------

Equity

Share capital 28,442,874 28,442,874

Share premium 87,198,410 87,198,410

Merger reserve (67,673,657) (67,673,657)

Available for sale reserve - 207,222

Foreign exchange reserve 1,911,453 1,419,842

Shares to be issued - 145,000

Retained earnings (32,308,495) (33,530,345)

--------------------------------- ------------- -------------

Total equity attributable to

owners of the parent 17,570,585 16,209,346

--------------------------------- ------------- -------------

Non-controlling interest 152,324 169,824

--------------------------------- ------------- -------------

Total equity 17,722,909 16,379,170

--------------------------------- ------------- -------------

Consolidated Statement of Cash Flows

For the year ended 31 December 2018

2018 2017

GBP GBP

-------------------------------------------------- ------------- ------------

Cash flows from operating activities

Profit/(loss) for the period 929,304 (8,227,667)

Adjustments for:

Depreciation of property, plant and

equipment 145,269 173,638

Amortisation of intangible fixed assets 4,319,920 4,932,699

Impairment 4,479,026 3,127,381

Share of loss of associate 172,360 -

Finance income (679,160) (239,603)

Finance expense 576,107 792,891

Income Tax credit (412,987) (612,903)

Unrealised currency translation gains (11,076) (57,957)

Loss on disposal of property, plant

and equipment 41,646 11,670

Profit on disposal of assets (12,421,621) -

Fair value movement on contingent consideration 1,900,065 -

Cash settlement of director share-based (145,000) -

payment

Share-based payments (release)/expense 67,824 (4,810)

Increase in trade and other receivables (310,396) (411,839)

(Decrease)/increase in trade and other

payables (951,414) 1,166,029

-------------------------------------------------- ------------- ------------

Net cash flows from operating activities

before taxation (2,300,133) 649,529

-------------------------------------------------- ------------- ------------

Research and Development tax receipts

in the year 133,130 389,286

-------------------------------------------------- ------------- ------------

Net cash flows from operating activities (2,167,003) 1,038,815

-------------------------------------------------- ------------- ------------

Investing activities

Acquisition of associate (3,000) -

Purchases of property, plant and equipment (34,712) (91,447)

Purchase of intangibles (3,017,674) (3,197,971)

Proceeds from disposal of property,

plant and equipment - 382

Proceeds from disposal of assets, net 5,725,593 -

of disposal costs

Interest received 120 1,294

-------------------------------------------------- ------------- ------------

Net cash used in investing activities 2,670,327 (3,287,742)

-------------------------------------------------- ------------- ------------

Financing activities

Proceeds of Ordinary Share issue - 1,132,499

Proceeds from issue of convertible debt - 122,966

Cost relating to issue of convertible

debt (24,846) (96,763)

Interest paid (232,241) (173,192)

-------------------------------------------------- ------------- ------------

Net cash from financing activities (257,087) 985,510

-------------------------------------------------- ------------- ------------

Net (decrease)/increase in cash and

cash equivalents 246,237 (1,263,417)

Cash and cash equivalents at beginning

of period 1,319,098 2,597,465

Exchange (gain)/losses on cash and cash

equivalents (15,194) (14,950)

-------------------------------------------------- ------------- ------------

Cash and cash equivalents at end of

period 1,550,141 1,319,098

-------------------------------------------------- ------------- ------------

Consolidated Statement of Changes in Equity

For the year ended 31 December 2018

Share Share Merger Available Foreign Shares Retained Total Non-controlling Total

capital premium reserve for sale Exchange to be earnings to equity interest equity

reserve Reserve issued holders

of parents

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

1 January 2017 27,413,329 87,095,455 (67,673,657) - 2,408,432 - (25,154,580) 24,088,979 205,001 24,293,980

---------------- ----------- ----------- ------------- ----------- ---------- ---------- ------------- ------------ ----------------- ------------

Loss for the

year - - - - - - (8,225,956) (8,225,956) (1,711) (8,227,667)

Other

comprehensive

income - - - 207,222 (988,590) - - (781,368) (33,466) (814,834)

Total

comprehensive

income for

the year - - - 207,222 (988,590) - (8,225,956) (9,007,324) (35,177) (9,042,501)

---------------- ----------- ----------- ------------- ----------- ---------- ---------- ------------- ------------ ----------------- ------------

Contributions

by and

distributions

to owners

Shares issued

as part

of the

capital

raising 1,029,545 102,955 - - - - - 1,132,500 - 1,132,500

Share-based

payment

to Director - - - - - 145,000 - 145,000 - 145,000

Share-based

payment

on share

options - - - - - - (149,810) (149,810) - (149,810)

31 December

2017 28,442,874 87,198,410 (67,673,657) 207,222 1,419,842 145,000 (33,530,345) 16,209,345 169,824 16,379,169

---------------- ----------- ----------- ------------- ----------- ---------- ---------- ------------- ------------ ----------------- ------------

Impact of

adoption

of IFRS 9 - - - (207,222) - - 207,222 - - -

---------------- ----------- ----------- ------------- ----------- ---------- ---------- ------------- ------------ ----------------- ------------

1 January 2018 28,442,874 87,198,410 (67,673,657) - 1,419,842 145,000 (33,323,123) 16,209,346 169,824 16,379,170

---------------- ----------- ----------- ------------- ----------- ---------- ---------- ------------- ------------ ----------------- ------------

Loss for the

year - - - - - - 946,804 946,804 (17,500) 929,304

Other

comprehensive

income - - - - 491,611 - - 491,611 - 491,611

Total

comprehensive

income/(loss)

for the

year - - - - 491,611 - 946,804 1,438,415 (17,500) 1,420,915

---------------- ----------- ----------- ------------- ----------- ---------- ---------- ------------- ------------ ----------------- ------------

Contributions

by and

distributions

to owners

Share-based

payment

to Director

settled

via cash - - - - - (145,000) - (145,000) - (145,000)

Share-based

payment

on share

options - - - - - - 67,824 67,824 - 67,824

31 December

2018 28,442,874 87,198,410 (67,673,657) - 1,911,453 - (32,308,495) 17,570,585 152,324 17,722,909

---------------- ----------- ----------- ------------- ----------- ---------- ---------- ------------- ------------ ----------------- ------------

Notes to the Preliminary Results

For the year ended 31 December 2018

1. Accounting policies

General information

Gaming Realms Plc (the "Company") and its subsidiaries (together

the "Group").

The Company is admitted to trading on AIM of the London Stock

Exchange. It is incorporated and domiciled in the UK. The address

of its registered office is One Valentine Place, London, SE1

8QH.

Basis of preparation

The consolidated financial statements are presented in

sterling.

These financial statements have been prepared in accordance with

International Financial Reporting Standards, International

Accounting Standards and Interpretations (collectively IFRSs) as

adopted by the EU and on a basis consistent with those policies set

out in our audited financial statements for the year ended 31

December 2017.

The financial information set out in this document does not

constitute the Group's statutory accounts for the year ended 31

December 2017 or 31 December 2018.

Statutory accounts for the year ended 31 December 2017 have been

filed with the Registrar of Companies and those for the year ended

31 December 2018 will be delivered to the Registrar in due course;

both have been reported on by independent auditors. The independent

auditors' reports on the Annual Report and Accounts for the year

ended 31 December 2018 includes a material uncertainty in respect

of going concern.

The auditors draw attention to the disclosures made in note 1 to

the financial statements concerning the Group and the Company's

ability to continue as a going concern. The report states that that

the business is dependent on the receipt of the deferred

consideration due following the disposal of brands to River iGaming

Plc, or the completion of the proposed sale of the remainder of the

Group's real money gaming business to the same purchaser to enable

it to continue as a going concern. The matters referred to in note

1 to the financial statements indicate that a material uncertainty

exists that may cast significant doubt on the Group and Company's

ability to continue as a going concern. The auditor's opinion is

not modified in respect of this matter.

The independent auditors' reports on the Annual Report and

Accounts for the year ended 31 December 2018 and 31 December 2017

were unqualified and did not contain a statement under 498(2) or

498(3) of the Companies Act 2006.

Going concern

The Group meets its day-to-day working capital requirements from

the cash flows generated by its trading activities and its

available cash resources. These are supplemented when required by

the Group's bank overdraft facility, which is available until

August 2019.

Whilst there are a number of risks to the Group's trading

performance, as summarised in the full Annual Report, the Group is

confident of its ability to continue to access sources of funding

in the medium term. The Group's strategic forecasts, based on

reasonable assumptions, indicate that the Group should be able to

operate within the level of its currently available facilities.

After making enquiries and after consideration of the Group's

existing operations, cash flow forecasts and assessment of

business, regulatory and financing risks, the potential risks and

impacts of Brexit, the directors have a reasonable expectation that

the Company and the Group have adequate resources to continue in

operational existence for the foreseeable future.

As of the date of approval of these financial statements, the

proposed sale of the remaining B2C RMG business to River is yet to

complete. If this sale does not go through as planned, GBP4.2m is

still receivable under the original 2018 sale and is due in August

2019. The Group's facility with its banker expires in August 2019.

As such, if there is a material delay in either the completion of

the sale of the remaining B2C RMG business or the receipt of the

GBP4.2m deferred consideration, alternative funding arrangements

would be required in the interim which are not yet in place. This

therefore represents a material uncertainty which may cast

significant doubt over the Group's ability to continue as a going

concern.

Accordingly, they continue to adopt the going concern basis in

preparing the Annual Report and Accounts.

The preparation of financial statements in compliance with

adopted IFRSs requires the use of certain critical accounting

estimates. It also requires Group management to exercise judgement

in applying the Group's accounting policies.

Basis of consolidation

The Group financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(subsidiaries). Control is achieved when the Company is exposed, or

has rights, to variable returns from its involvement with the

investee and has the ability to affect those returns through its

power over the investee.

The results of subsidiaries acquired or disposed of during the

period are included in the Consolidated Statement of Comprehensive

Income from the effective date of acquisition up to the effective

date of disposal. Where necessary, adjustments are made to the

financial statements of subsidiaries to bring the accounting

policies used in line with those used by the Group.

All intra-Group transactions, balances, income and expenses are

eliminated on consolidation.

Business combinations

On acquisition, the assets, liabilities and contingent

liabilities of a subsidiary are measured at their fair values at

the date of acquisition. Any excess of the cost of acquisition over

the fair values of the identifiable net assets acquired, including

separately identifiable intangible assets, is recognised as

goodwill. Any discount on acquisition, i.e. where the cost of

acquisition is below the fair value of the identifiable net assets

acquired, is credited to the Statement of Comprehensive Income in

the period of acquisition.

Interests in associates

Where the Group has the power to participate in (but not

control) the financial and operating policy decisions of another

entity, it is classified as an associate. Associates are initially

recognised in the consolidated statement of financial position at

cost. Where the interest in the associate arises as a result of the

disposal of a subsidiary, the amount recognised as cost is the fair

value of the interest retained in the associate.

Subsequently associates are accounted for using the equity

method, where the Group's share of post-acquisition profits and

losses and other comprehensive income is recognised in the

consolidated statement of profit and loss and other comprehensive

income (except for losses in excess of the Group's investment in

the associate unless there is an obligation to make good those

losses).

Profits and losses arising on transactions between the Group and

its associates are recognised only to the extent of unrelated

investors' interests in the associate. The investor's share in the

associate's profits and losses resulting from these transactions is

eliminated against the carrying value of the associate.

Any premium paid for an associate above the fair value of the

Group's share of the identifiable assets, liabilities and

contingent liabilities acquired is capitalised and included in the

carrying amount of the associate. Where there is an indicator that

the investment in an associate may have been impaired the carrying

amount of the investment is tested for impairment in the same way

as other non-financial assets.

2. Adjusted EBITDA

EBITDA and Adjusted EBITDA are non-GAAP measures and exclude

exceptional items, depreciation, and amortisation. Exceptional

items are those items the Group considers to be non-recurring or

material in nature that may distort an understanding of financial

performance or impair comparability.

Adjusted EBITDA is stated before exceptional items as

follows:

2018 2017

GBP GBP

------------------------------------ ---------- ----------

Restructuring costs - share-based

payment - (145,000)

Restructuring costs (216,355) (735,257)

------------------------------------ ---------- ----------

Adjusting items (216,355) (880,257)

------------------------------------ ---------- ----------

Disposal of RMG assets to River

On 16th August 2018 the Group entered into an Asset Purchase

Agreement with River for the sale of 4 of the Group's Real Money

brands including customer lists, domain names and contractual

agreements. The resulting initial profit on disposal of GBP12.5m

has been classified as exceptional due to its one-off nature.

Disposal of Affiliate business

On 22 March 2018, the Group sold its Affiliate business to First

Leads Ltd. The resulting loss on disposal of GBP0.1m has been

classified as exceptional due to its one-off nature.

Restructuring costs

During 2018 restructuring costs of GBP0.2m were incurred

relating to redundancy and consulting costs.

During 2017 the Group closed the Seattle office. Restructuring

costs in the prior year related to the closure costs associated

with this including employee severance payments.

3. Segment information

The Board is the Group's chief operating decision-maker.

Management has determined the operating segments based on the

information reviewed by the Board for the purposes of allocating

resources and assessing performance.

The Group has 2 continuing reportable operating segments:

-- Licensing - brand and content licensing to partners in the US and Europe

-- Social publishing - provides freemium games to the US and Europe

There were no customers who generated more than 10% of total

revenue. Management do not report segmental assets and liabilities

internally and as such an analysis is not reported.

Licensing Social Head Total

publishing Office 2018

GBP GBP GBP GBP

------------------------------- --------------------- --------------------- ------------ ------------

Revenue 2,248,003 3,920,619 394,038 6,562,660*

Marketing expense - (414,064) (251,298) (665,362)

Operating expense (199,412) (1,091,460) (400) (1,291,272)

Administrative expense (1,054,712) (861,253) (2,737,906) (4,653,871)

Share-based payments - - (67,824) (67,824)

------------------------------- --------------------- --------------------- ------------ ------------

Adjusted EBITDA 993,879 1,553,842 (2,663,390) (115,669)

------------------------------- --------------------- --------------------- ------------ ------------

Restructuring costs (216,355)

------------------------------- --------------------- --------------------- ------------ ------------

EBITDA - continuing (332,024)

------------------------------- --------------------- --------------------- ------------ ------------

Amortisation of Intangible

assets (3,535,972)

Depreciation of property,

plant and equipment (145,269)

Impairment (1,878,451)

Finance expense (576,107)

Finance income 419,894

------------------------------- --------------------- --------------------- ------------ ------------

Loss before tax - continuing (6,047,929)

------------------------------- --------------------- --------------------- ------------ ------------

Licensing Social Head Total

publishing Office 2017

GBP GBP GBP GBP

------------------------------- --------------------- --------------------- --------------------- ------------

Revenue 839,541 6,878,760 179,315 7,897,616*

Marketing expense - (2,171,341) (109,514) (2,280,855)

Operating expense (24,961) (1,754,450) - (1,779,411)

Administrative expense (1,036,352) (3,010,164) (2,720,598) (6,767,114)

Share-based payments - - 149,810 149,810

------------------------------- --------------------- --------------------- --------------------- ------------

Adjusted EBITDA (221,772) (57,195) (2,500,987) (2,779,954)

------------------------------- --------------------- --------------------- --------------------- ------------

Restructuring costs (735,257)

Restructuring costs -

share-based payment (145,000)

------------------------------- --------------------- --------------------- --------------------- ------------

EBITDA - continuing (3,660,211)

------------------------------- --------------------- --------------------- --------------------- ------------

Amortisation of Intangible

assets (4,292,283)

Depreciation of property,

plant and equipment (173,638)

Finance expense (752,600)

Finance income 239,603

------------------------------- --------------------- --------------------- --------------------- ------------

Loss before tax - continuing (8,639,129)

------------------------------- --------------------- --------------------- --------------------- ------------

* Segmental revenue includes GBP389,464 (2017: GBP291,506) of

inter-segment Licensing revenue. This is shown as an Operating

Expense under the real money gaming discontinued operations and

eliminates on consolidation.

4. finance income and expense

2018 2017

GBP GBP

--------------------------------------- ----- ------------------------------- -------------------------------

Finance income

Interest received 120 1,295

Unwind of interest on deferred

consideration receivable 20A 19,774 -

Fair value gain on derivative

liability 23 400,000 -

Foreign exchange movement on

deferred consideration - 238,309

--------------------------------------- ----- ------------------------------- -------------------------------

Total finance income 419,894 239,604

--------------------------------------- ----- ------------------------------- -------------------------------

Finance expense

Bank & loan interest paid 364,014 272,613

Unwind of interest on deferred

consideration payable - 479,987

Fair value loss on other investments 15 212,093 -

--------------------------------------- ----- ------------------------------- -------------------------------

Total finance expense 576,107 752,600

--------------------------------------- ----- ------------------------------- -------------------------------

The deferred consideration in relation to the acquisition from

RealNetworks Inc. was denominated in USD and the final payment of

$4.5m was settled on 15(th) December 2017.

The retranslation of this balance resulted in a GBP238,309 gain

in the prior year.

5. tax credit

2018 2017

GBP GBP

-------------------------------------- --------- --------

Current tax

Adjustment for current tax of prior

periods (11,078) (67)

R&D tax credit for the period 144,208 389,354

-------------------------------------- --------- --------

Total current tax credit 133,130 389,286

-------------------------------------- --------- --------

Deferred tax

(Decrease)/increase in deferred tax

liabilities 279,857 223,617

-------------------------------------- --------- --------

Total deferred tax credit 279,857 223,617

-------------------------------------- --------- --------

Total tax credit 412,987 612,903

-------------------------------------- --------- --------

The reasons for the difference between the actual tax credit for

the period and the standard rate of corporation tax in the UK

applied to profits for the year are as follows:

2018 2017

GBP GBP

------------------------------------------------ ------------ ------------

Loss for the period - continuing (6,047,930) (8,639,129)

Profit/(loss) for the period - discontinued 6,564,247 (201,441)

------------------------------------------------ ------------ ------------

Profit/(loss) for the period 516,317 (8,840,570)

Expected tax at effective rate of corporation

tax in the UK of 19% (2017: 19.3%) 98,100 (1,701,507)

Expenses not deductible for tax purposes 920,066 7,840

Income not chargeable for tax purposed (1,999,096) -

Effects of overseas taxation 290,594 179,516

Adjustment for over provision in prior

periods 11,078 67

Research and Development tax credit (144,208) (389,354)

Timing difference not recognised 115,285 -

Tax losses for which no deferred tax

assets have been recognised 295,194 1,290,535

------------------------------------------------ ------------ ------------

Total tax credit (412,987) (612,902)

------------------------------------------------ ------------ ------------

6. Loss per share

Basic profit/(loss) per share is calculated by dividing the

result attributable to ordinary shareholders by the weighted

average number of shares in issue during the year. For fully

diluted loss per share, the weighted average number of ordinary

shares in issue is adjusted to assume conversion of dilutive

potential ordinary shares. The Group's potentially dilutive

securities consist of share options, performance shares and a

convertible bond. As the continuing operations of the Group are

loss-making, none of the potentially dilutive securities are

currently dilutive.

2018 2017

GBP GBP

------------------------------------------------ ------------ ------------

Loss after tax - continuing (5,634,942) (8,026,226)

Profit/(loss) after tax - discontinued 6,564,246 (201,441)

------------------------------------------------ ------------ ------------

Profit/(loss) after tax - total 929,304 (8,227,667)

------------------------------------------------ ------------ ------------

Number Number

------------------------------------------------ ------------ ------------

Weighted average number of ordinary shares

used in calculating basic loss per share 284,428,746 278,166,853

------------------------------------------------ ------------ ------------

Weighted average number of ordinary shares

used in calculating dilutive loss per share 284,428,746 278,166,853

------------------------------------------------ ------------ ------------

Pence Pence

------------------------------------------------ ------------ ------------

Basic and diluted loss per share - continuing (1.98) (2.89)

Basic and diluted profit/(loss) per share

- discontinued 2.31 (0.07)

------------------------------------------------ ------------ ------------

Basic and diluted profit/(loss) per share

- total 0.33 (2.96)

------------------------------------------------ ------------ ------------

7. Intangible assets

Goodwill Customer Software Development Domain Intellectual Total

database costs names Property

GBP GBP GBP GBP GBP GBP GBP

Cost

Balance at 1

January 2017 16,545,864 4,111,971 1,538,500 6,858,335 429,618 6,401,430 35,885,718

Additions - - - 3,197,971 - - 3,197,971

Disposals - - - - - - -

Reclassified

as held for sale (5,420,262) (2,343,632) - - - - (7,763,894)

FX Movement (480,045) (141,830) (134,559) (9,198) (35,287) (558,338) (1,359,257)

-------------------- ------------ ------------ ---------- ---------- -------------- ------------

At 31 December

2017 10,645,557 1,626,509 1,403,941 10,047,108 394,331 5,843,092 29,960,538

-------------------- ------------ ------------ ---------- ------------- ---------- -------------- ------------

Additions - - - 3,017,674 - - 3,017,674

Disposals (2,191,809) (133,550) - - (364,986) - (2,690,345)

Reclassified

as held for sale (1,699,000) - - (3,374,902) - - (5,073,902)

FX Movement 302,020 89,231 84,659 18,257 73 351,280 845,520

At 31 December

2018 7,056,768 1,582,190 1,488,600 9,708,137 29,418 6,194,372 26,059,485

-------------------- ------------ ------------ ---------- ------------- ---------- -------------- ------------

Amortisation

Balance at 1

January 2017 - 2,841,672 642,988 2,438,105 198,932 1,102,184 7,223,881

Amortisation

charge - 916,459 490,691 2,627,075 135,287 763,187 4,932,699

Reclassified

as held for sale - (2,343,632) - - - - (2,343,632)

FX Movement - (86,841) (76,019) (3,918) (21,606) (128,196) (316,580)

At 31 December

2017 - 1,327,658 1,057,660 5,061,262 312,613 1,737,175 9,496,368

-------------------- ------------ ------------ ---------- ------------- ---------- -------------- ------------

Amortisation

charge - 300,949 277,088 2,946,864 52,470 742,549 4,319,920

Disposals - (133,550) - - (336,262) - (469,812)

Impairment 1,650,000 - - - - - 1,650,000

Reclassified

as held for sale - - - (2,108,114) - - (2,108,114)

FX Movement - 87,133 72,507 23,777 597 138,486 322,500

At 31 December

2018 1,650,000 1,582,190 1,407,255 5,923,789 29,418 2,618,210 13,210,862

-------------------- ------------ ------------ ---------- ------------- ---------- -------------- ------------

Net book value -

At 1 January

2017 16,545,864 1,270,299 895,512 4,420,230 230,686 5,299,246 28,661,837

At 31 December

2017 10,645,557 298,851 346,281 4,985,846 81,718 4,105,917 20,464,170

At 31 December

2018 5,406,768 - 81,345 3,784,348 - 3,576,162 12,848,623

-------------------- ------------ ------------ ---------- ------------- ---------- -------------- ------------

8. discontinued operations

During the year, the Group sold its affiliate CGU, disposed of

certain elements of the real money gaming CGU and was sufficiently

progressed with active discussions concerning the remainder of the

real money gaming CGU that this element has been classified as held

for sale as at 31 December 2018.

Analysis of profit for the financial year - discontinued

operations:

2018 2017

Real money gaming GBP GBP

------------------------------------ --- ------------ ----------

2018 Disposal

Profit on disposal A 12,492,369 -

(Loss)/profit for the financial

year C (977,362) 2,033,894

Real money gaming business

reclassified as held for sale

Share of loss of associate (172,360) -

Impairment in associate (2,829,026) -

Fair value movement on contingent

consideration (1,900,065)

----------------------------------------- ------------ ----------

6,613,556 2,033,894

---------------------------------------- ------------ ----------

Affiliate

---------------------------------- --- ---------- ------------

2018 Disposal

Loss on disposal B (70,748) -

(Loss)/profit for the financial

year C 21,438 892,046

Affiliate business reclassified - -

as held for sale

Impairment - (3,127,381)

--------------------------------------- ---------- ------------

(49,310) (2,235,335)

-------------------------------------- ---------- ------------

Profit/(loss) for the financial

year - discontinued 6,564,246 (201,441)

--------------------------------------- ---------- ------------

Real money gaming

Disposal in 2018

On 16th August 2018 the Group entered into an Asset Purchase

Agreement with River for the sale of 4 of the Group's real money

brands.

The disposed brands and associated activities were contributed

to a newly incorporated company in Malta, River UK Casino. As part

of the sale agreement, the Group received a 30% equity interest in

this company. In addition, a put and call option was entered into

giving River the right to purchase, and the Group the right to sell

to River, Gaming Realms' 30% share of River UK Casino at the end of

the earn-out period based on an Enterprise value of 5.5 times River

UK Casino's EBIT.

The minimum consideration receivable of GBP8.4m is structured as

follows; GBP4.2m received on completion plus a further GBP4.2m

payable 31 August 2019. Further consideration is achievable on an

earn-out basis, payable no later than 30 September 2019 based on

5.5 times River UK Casino's EBIT for the 12 months to 30 June 2019

to a maximum of GBP14.7m.

Further to this, River UK Casino has entered into a five-year

B2B platform and content agreement with the Group.

Transfer to held for sale

The B2C RMG CGU has been classified as held for sale as at 31

December 2018. Management were actively seeking a sale for the

remainder of this business prior to the year end and heads of terms

had been signed with River. The sale is expected to complete very

shortly, following regulatory approvals.

A - RMG profit on disposal

GBP

--------------------------- ------ ------------

Cash consideration 4,200,000

Deferred consideration i 3,629,074

Contingent consideration ii 1,900,065

Fair value of put/call -

option iii

Investment in River UK

Casino iv 5,266,579

Less: Disposal costs (311,540)

Net proceeds 14,684,178

Less: Assets disposed

Intangible assets (2,191,809)

----------------------------------- ------------

Profit on disposal of

discontinued operation 12,492,369

----------------------------------- ------------

i A discount rate of 14.5% was used to calculate the present

value of GBP4.2m due 31 August 2019 at inception based

on the Group's Weighted Average Cost of Capital. The

deferred consideration is recognised in the respective

subsidiaries involved in the disposal. As a result of

the proposed disposal of Bear Group Limited and the

transfer of the company to held for sale, GBP3.6m of

deferred consideration is included in the disposal group,

and interest unwind of GBP0.3m included in discontinued

operations. The remaining deferred consideration of

GBP0.3m is included in continuing operations.

ii At inception the Group was expecting to achieve an additional

GBP2.2m earn-out. A discount rate of 14.5% was used

to calculate the fair value at inception based on the

Group's incremental borrowing rate.

iii The put/call option was considered to have nil value

at inception and as at 31 December 2018 on the basis

the 5.5x multiple is considered a market rate.

iv The initial carrying value of the Group's investment

in River UK Casino has been calculated as the expected

proceeds receivable upon exercise of the option to dispose

of the interest (see iii) in 2020. Based on management's

forecast at the date of the transaction, a further GBP7.1m

was expected to be received in August 2020. A discount

rate of 14.5% was used to calculate the present value

at inception based on the Group's Weighted Average Cost

of Capital.

Held

Continuing for sale Total

------------------------- --- ------------------- ---------------------- ----------------

Deferred consideration

for RMG A 260,916 3,368,159 3,629,074

Deferred consideration

for Affiliate B 385,000 - 385,000

Unwind of discount 19,774 255,266 275,040

------------------------------ ------------------- ---------------------- ----------------

665,690 3,623,425 4,289,115

----------------------------- ------------------- ---------------------- ----------------

Affiliate business

On 22 March 2018 the Group sold its Affiliate CGU for total

consideration of GBP2.4m to First Leads Ltd. First Leads paid

GBP2.0m on closing, and a further GBP0.4m was received in January

2019 based on the achievement of performance targets.

B - Loss on disposal of the Affiliate CGU

GBP

----------------------------------- --- ------------

Cash consideration 2,000,000

Deferred consideration i 385,000

Less: Disposal costs (162,867)

Net proceeds 2,222,133

Less: Assets disposed

Intangible assets (2,292,881)

---------------------------------------- ------------

Loss on disposal of discontinued

operation (70,748)

---------------------------------------- ------------

i The amount of deferred consideration was capped at GBP400,000

and reduced based on performance targets. The amount

receivable of GBP385,000 was confirmed with First Lead

Ltd as at 31 December 2018 and was received in January

2019.

C - Results of discontinued operations:

2018 2017

Real money gaming GBP GBP

----------------------------- ------------ ------------

Revenue 16,364,816 22,717,729

Marketing expenses (4,318,842) (8,022,410)

Operating expenses (9,169,594) (8,867,787)

Administrative expenses (3,325,060) (3,153,222)

------------------------------ ------------ ------------

EBITDA (448,680) 2,674,310

------------------------------ ------------ ------------

Amortisation of intangible

assets (783,948) (640,416)

Finance income 255,266 -

----------------------------- ------------ ------------

(977,362) 2,033,894

----------------------------- ------------ ------------

Affiliates

--------------------------------- ---------- ----------

Revenue 168,018 1,322,713

Marketing expenses (14,833) (128,316)

Operating expenses (15,809) (76,316)

Administrative expenses (115,938) (226,035)

---------------------------------- ---------- ----------

21,438 892,046

--------------------------------- ---------- ----------

Adjusted EBITDA - discontinued (427,242) 3,566,356

---------------------------------- ---------- ----------

The results of the discontinued RMG operations include the

results generated by the brands disposed to River UK Casino and

operated under the B2B platform and content agreement.

9. assets and liabilities classfified as held for sale

On 22 March 2018 the Group sold its Affiliate CGU, which was

classified as held for sale in the comparative balance sheet, for

total consideration of GBP2.4m to First Leads Ltd. During H2 2018

the Board concluded to pursue the sale of the remaining RMG

business and to accelerate the conclusion of the put/call option

over the Group's 30% interest in River UK Casino. Advisors were

appointed and offers invited, which were actively being discussed

during late 2018. The group has therefore reclassified this

business and the Group's interest in River UK Casino as held for

sale as at 31 December 2018.

No impairment has been recognised based on the recoverable

amount of goodwill attributable to this segment. Recoverable amount

has been calculated as fair value less the costs of disposal. Fair

value is measured at GBP11.5m based on active offers received

during late 2018.

Analysis of assets and liabilities classified as held for sale

in the year

The following major classes of assets and liabilities relating

to these operations have been classified as held for sale in the

consolidated statement of financial position on 31 December

2018:

31 December 31 December

2018 2017

GBP GBP

-------------------------------- ------------ ------------

Non-current assets

Intangible assets - goodwill 1,699,000 2,292,881

Intangible assets - platform 1,266,788 -

development costs

Investment in associate 2,268,192 -

Property, plant and equipment 12,789 -

Other assets 32,000 -

-------------------------------- ------------ ------------

5,278,769 2,292,881

-------------------------------- ------------ ------------

Current assets

Trade and other receivables 1,388,330 -

Deferred consideration 3,623,425 -

Cash and cash equivalents 1,101,489 -

--------------------------------

Assets held for sale 11,392,013 2,292,881

-------------------------------- ------------ ------------

Current liabilities

Trade and other payables 4,830,076 -

-------------------------------- ------------ ------------

Liabilities held for sale 4,830,076 -

-------------------------------- ------------ ------------

Associate investment in River UK Casino

The Group uses the equity method of accounting for associates.

The following table shows the aggregate movement in the Group's

interests in associates:

2018

GBP

----------------------- ------------

At 1 January 2018 -

Initial recognition

of associate 5,269,578

Share of associate's

loss (172,360)

Impairment (2,829,026)

----------------------- ------------

At 31 December

2018 2,268,192

----------------------- ------------

On 16 August Gaming Realms Plc acquired an investment of 30% of

the ordinary share capital of River UK Casino Limited, a newly

incorporated company in Malta, for consideration of GBP3,000. The

Group is able to exert significant influence over River UK Casino

by way of its 30% holding and its seat on the Board of

directors.

10. Arrangement with JackpotJoy group

In December 2017 the group entered into a complex transaction

with Jackpotjoy plc and group companies (together "Jackpotjoy

Group"). The transaction includes a GBP3.5m secured convertible

loan agreement alongside a 10-year framework services agreement for

the supply of various real money services.

The convertible loan principle of GBP3.5m was paid directly by

Jackpotjoy Group to RealNetworks to settle the outstanding $4.5m

(GBP3.4m) deferred consideration obligation, with the excess cash

of GBP0.1m transferred to the Group. Under the framework services

agreement the first GBP3.5m of services are provided free-of-charge

within the first 5 years.

The convertible loan has a duration of 5 years and carries

interest at 3-month LIBOR plus 5.5%. It is secured over the Group's

Slingo assets and business. At any time after the first year,

Jackpotjoy Group may elect to convert all or part of the principal

amount into ordinary shares of Gaming Realms Plc at a discount of

20% to the share price prevailing at the time of conversion. To the

extent that the price per share at conversion is lower than 10p

(nominal value), then the shares can be converted at nominal value

with a cash payment equal to the aggregate value of the convertible

loan outstanding multiplied by the shortfall on nominal value

payable to Jackpotjoy Group. Under this arrangement, the maximum

dilution to Gaming Realms shareholders will be approximately 11%,

assuming the convertible loan is converted in full.

The option violates the fixed-for-fixed criteria for equity

classification as the number of shares is variable and as a result

is classified as a liability.

The fair value of the conversion feature is determined at each

reporting date with changes recognised in profit or loss. The

initial fair value was GBP0.6m based on a probability assessment of

conversion and future share price. This is a level 3 valuation as

defined by IFRS 13. The fair value as at 31 December 2018 was

GBP0.2m (2017: GBP0.6m) based on revised probabilities of when and

if the option will be exercised. The key inputs into the valuation

model included timing of exercise by the counterparty (based on a

probability assessment) and the share price.

The initial fair value of the host debt was calculated as

GBP2.7m, being the present value of expected future cash outflows.

The rate used to discount future cashflows was 14.1%, being the

Group's incremental borrowing rate. This rate was calculated by

reference to the Group's cost of equity in the absence of reliable

alternative evidence of the Group's cost of borrowing given it is

predominantly equity funded. Expected cashflows are based on

directors' judgement that a change in control event would not

occur. Subsequently the loan is carried at amortised cost.

The residual GBP0.2m of proceeds were allocated to the

obligation to provide free services.

Fair Obligation Fair Total

value to provide value

of debt free services of derivative

host Liability

GBP GBP GBP

------------------------------- ---------- ---------------- ---------------- ----------

At 1 January 2018 2,630,469 213,000 600,000 3,443,469

Change in fair value - - (400,000) (400,000)

Cost relating to issue

of convertible debt (24,846) - - (24,846)

Utilisation of free services - (4,000) - (4,000)

Effective interest (14.4%) 360,475 - 360,475

Interest paid (170,495) - (170,495)

------------------------------- ---------- ---------------- ---------------- ----------

At 31 December 2018 2,795,603 209,000 200,000 3,204,603

------------------------------- ---------- ---------------- ---------------- ----------

11. Share capital

Ordinary shares

2018 2018 2017 2017

Number GBP Number GBP

---------------------

Ordinary shares of 284,428,747 28,442,874 284,428,747 28,442,874

------------ ----------- ------------ -----------

10 pence each

--------------------- ------------ ----------- ------------ -----------

On 11 August 2017 10,295,455 shares were issued at GBP0.11 per

share for a total consideration of GBP1,132,500.

12. Post balance sheet events

On 21 February 2019 Gaming Realms Plc entered into an agreement

("Transaction") with River to sell the remaining B2C real money

operations via the sale of Bear Group Ltd, a Company incorporated

in Alderney for total consideration of GBP11.5m, which includes

settlement of the deferred consideration, disposal of the associate

and settlement of the put/call option. The Company also has gaming

licences issued by the UK Gambling Commission and the Alderney

Gambling Commission. The Transaction also provides for the transfer

of the 30% shareholding Gaming Realms has in River UK Casino and

the acquisition of a sole perpetual licence for the use,

development and distribution of a gaming platform. River have now

received UK GC approval and expect to complete very shortly.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BCGDLRGDBGCR

(END) Dow Jones Newswires

June 28, 2019 02:01 ET (06:01 GMT)

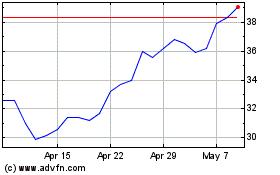

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Apr 2023 to Apr 2024