Glencore Cuts 2021 Guidance on Operational Issues, Export Constraints, Weaker Coal Demand -- Commodity Comment

July 30 2021 - 3:16AM

Dow Jones News

By Jaime Llinares Taboada

Glencore PLC on Friday cut its 2021 production guidance for

nickel, zinc and coal. Here's what the natural resources company

had to say:

On copper and cobalt:

"Own-sourced copper and cobalt production of 598,000 [metric

tons] and 14,800 tons, respectively, was modestly higher than 1H

2020."

On zinc:

"Own-sourced zinc production of 581,800 tons was 31,700 tons

(6%) higher than 1H 2020, mainly relating to recovery from

Covid-related suspensions in 2Q 2020, particularly in Peru."

On nickel:

"Own-sourced nickel production of 47,700 tons was 7,500 tons

(14%) below 1H 2020 due to planned major maintenance at Murrin and

various operational issues at Koniambo."

"Nickel production was constrained by various operating issues

at Koniambo, with a restart of its second production line currently

expected in August."

On gold and silver:

"Own-sourced gold and silver production were, respectively, 3%

and 13% ahead of 1H 2020"

On ferrochrome:

"Attributable ferrochrome production of 773,000 tons was 307,000

tons (66%) higher than 1H 2020, reflecting that mining and smelting

operations were suspended for much of 2Q 2020 due to the South

African national lockdown."

On coal:

"Coal production of 48.7 million tons was 9.4 million tons (16%)

lower than 1H 2020, reflecting a full period of Prodeco care and

maintenance (3.8 million tons), various movements in the Australian

portfolio, mainly reflecting the continued market-driven supply

reductions initiated in 2H 2020 (5.0 million tons) and reduced

export rail capacity in South Africa (1.4 million tons), partly

offset by the recovery at Cerrejon from its Covid-related

restrictions in the base period."

"Prodeco's care and maintenance and market-driven Australian

supply reductions since 2H 2020 are mainly responsible for a 16%

period-on-period decline in coal production."

On oil:

"Entitlement interest oil production of 2.6 million barrels of

oil equivalent (boe) was broadly in line with 1H 2020, reflecting

the offsetting effects of the Chad oil fields placed on care and

maintenance in April 2020 and the gas phase of the Equatorial

Guinea project commencing in February 2021."

On 2021 production guidance changes:

"Changes to guidance mainly reflect: lower 2H for zinc, due to a

lengthier expected ramp-up at the recently-commissioned Zhairem

mine in Kazakhstan; extended maintenance at the Koniambo nickel

plant, delaying a return to a two-line processing operation; and

reduced coal production volumes, on account of export rail

constraints and weaker domestic demand in South Africa and a slower

recovery from the Australian market-driven supply reductions

initiated in 2H 2020."

On the marketing business:

"Our marketing business has again performed well, with

constructive market conditions allowing us to raise our full-year

2021 EBIT expectations to the top end of our $2.2 billion-$3.2

billion p.a. guidance range."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

July 30, 2021 03:05 ET (07:05 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

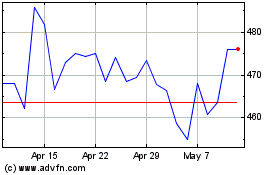

Glencore (LSE:GLEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

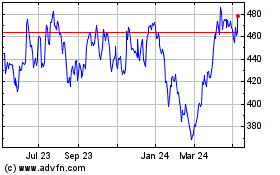

Glencore (LSE:GLEN)

Historical Stock Chart

From Apr 2023 to Apr 2024