TIDMGKP

RNS Number : 3041Z

Gulf Keystone Petroleum Ltd.

24 January 2022

24 January 2022

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP" or "the Company")

Operational & Corporate Update

Gulf Keystone, a leading independent operator and producer in

the Kurdistan Region of Iraq, today provides an operational and

corporate update.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

" We are pleased today to declare an additional interim dividend

of $50 million, bringing distributions over the past eight months

to $150 million in line with our commitment to balance investment

in growth with returns to shareholders.

Since the beginning of 2022, gross production peaked at just

over 50,000 bopd and has averaged c.46,800 bopd, versus the 2021

average of 43,440 bopd. However, the lower productivity of recently

completed wells, SH-13 and SH-14, and temporarily curtailed

production from SH-12, have resulted in a delay in gross production

increasing to 55,000 bopd. 2022 gross average production is

expected to be 44,000 to 50,000 bopd.

GKP's substantial production base at current oil prices

continues to generate significant cash flow and value for Gulf

Keystone's stakeholders. On approval of our recently submitted

Field Development Plan, we are well positioned to achieve

sustainable growth from the Shaikan Field, which has delivered

close to 100 MMstb, and has 489 MMstb of estimated 2P gross

reserves remaining."

Operational

-- Continued strong focus on safety in 2021 despite one

previously reported lost time incident ("LTI"); currently no LTIs

recorded for over 90 days

-- Gross average production for 2021 of 43,440 bopd, at the

upper end of guidance range; gross average production in 2022 year

to date of c.46,800 bopd

-- Drilling of SH-15 progressing well; continue to expect start-up in Q2 2022

-- Due to well productivity, the increase in gross production

towards 55,000 bopd has been delayed

o SH-13 & SH-14

-- Following completion of the acid stimulation programme on

SH-13, and the clean-up of SH-14, both wells were brought on stream

in December 2021 and their productivity has been below

expectations

-- An acid stimulation programme for SH-14 is currently

ongoing

o SH-12

-- Following the early appearance of trace quantities of water,

production from the well has been temporarily curtailed, in line

with the Company's prudent reservoir management strategy . The

Company is investigating options to maximise near-term production

from the well

-- Water ingress is common in fractured carbonate reservoirs

like the Shaikan Field. Gulf Keystone has historically experienced

trace amounts of water in a few other wells and has been

successfully optimising their production levels. The Company

continues to expedite plans to add water handling to further

optimise production

-- The Company does not expect any material impact on reserves

or medium-term production potential. Considering cumulative gross

production of c.99 MMstb, 2P gross reserves are estimated to be 489

MMstb at 31 December 2021, based on the 2020 Competent Person's

Report adjusted for 2021 production

Financial

-- Following $100m of dividends distributed in 2021, Gulf

Keystone is pleased to announce that the Board has approved the

declaration of an additional interim dividend of $50 million,

equivalent to 23.394 US cents per Common Share of the Company

-- The interim dividend is expected to be paid on 25 February

2022, based on a record date of 11 February 2022. The Company will

disclose the pounds sterling rate per share prior to the

ex-dividend date of 10 February 2022

-- $283.2 million ($221.7 million net to GKP) received from the

Kurdistan Regional Government in 2021 for payments of crude oil

sales and recovery of outstanding arrears, with an additional $89.0

million ($69.7 million net to GKP) received in January 2022 for the

combined September 2021 and October 2021 crude oil sales and

arrears payments

-- The current outstanding arrears balance is $28.6 million net

to GKP related to the January and February 2020 invoices

-- Robust balance sheet, with a cash balance of $228 million as at 21 January 2022

Outlook

-- The Company expects gross average production for 2022 of

44,000 to 50,000 bopd, reflecting the anticipated production

contribution from SH-15 and benefits of well workover

activities

-- Gulf Keystone continues to engage with the Ministry of

Natural Resources ("MNR") following the submission of a draft FDP

in 2021. The Company will revert to the market at an appropriate

time with details on the FDP and updated production guidance

-- With continuing strong oil prices and cash flow generation,

there may be opportunities to consider further distributions to

shareholders and to optimise the capital structure

This announcement contains inside information for the purposes

of the UK Market Abuse Regime.

Enquiries:

Gulf Keystone: +44 (0) 20 7514 1400

Aaron Clark, Head of Investor Relations aclark@gulfkeystone.com

Celicourt Communications: + 44(0) 20 8434 2754

Mark Antelme GKP@Celicourt.uk

Jimmy Lea

or visit: www.gulfkeystone.com

Notes to Editors:

Gulf Keystone Petroleum Ltd. (LSE: GKP) is a leading independent

operator and producer in the Kurdistan Region of Iraq. Further

information on Gulf Keystone is available on its website

www.gulfkeystone.com

Disclaimer

This announcement contains certain forward-looking statements

that are subject to the risks and uncertainties associated with the

oil & gas exploration and production business. These statements

are made by the Company and its Directors in good faith based on

the information available to them up to the time of their approval

of this announcement but such statements should be treated with

caution due to inherent risks and uncertainties, including both

economic and business factors and/or factors beyond the Company's

control or within the Company's control where, for example, the

Company decides on a change of plan or strategy. This announcement

has been prepared solely to provide additional information to

shareholders to assess the Group's strategies and the potential for

those strategies to succeed. This announcement should not be relied

on by any other party or for any other purpose.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBJMBTMTJTTJT

(END) Dow Jones Newswires

January 24, 2022 02:00 ET (07:00 GMT)

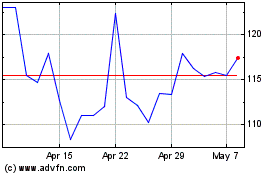

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Apr 2023 to Apr 2024