TIDMFRES

RNS Number : 7113C

Fresnillo PLC

21 October 2020

Fresnillo plc

21 Upper Brook Street

London W1K 7PY

United Kingdom

www.fresnilloplc.com

21 October 2020

THIRD QUARTER PRODUCTION REPORT

FOR THE THREE MONTHSED 30 SEPTEMBER 2020

Octavio Alvídrez, Chief Executive Officer, said:

"The health and safety of our people remains our number one

priority, in particular during these challenging times in the face

of a global pandemic. I remain both proud and grateful for the

efforts our people across all our sites have made and the

resilience they have shown in adapting so quickly to the many

measures we have put in place to limit the spread of the virus. The

progress we have made at our Juanicipio development project in the

Fresnillo district is testament to this. In the quarter, the first

production stope at Juanicipio was completed on time and, as

expected, we are now processing development ore at the Fresnillo

plant. We continue to implement the mine improvement initiatives we

have previously outlined. Our silver mines are performing in line

with the forecasts we set out at the beginning of the year and our

silver production outlook is unchanged, despite the disruption of

this pandemic. As we set out at our half-year results, we have seen

some impact as a result of the additional working restrictions in

place at the open-pit mines and this has affected our gold

production, so we have marginally reduced our full-year guidance

for gold. Our development projects remain on track, with the

Pyrites Plant and optimisation of the beneficiation plant, both at

Fresnillo, due for completion this year. Overall, Fresnillo has

made good progress this year."

COVID-19 UPDATE

We continue to closely monitor the spread of the virus and

implement a range of safety measures across our business, following

guidelines in accordance with the World Health Organisation and

Mexican authorities. This includes stringent monitoring &

hygiene, temperature screening, social distancing, and working from

home for all office-based colleagues. Those measures are ongoing

and we remain vigilant to any localised increase in COVID cases.

Testing and contact tracing have proven to be successful measures

to identify potential cases and prevent the spread of the virus. We

continue to support our communities by providing food and personal

protective equipment. Fresnillo maintains an open dialogue with

government officials at both the Federal and local level.

TOTAL PRODUCTION

HIGHLIGHTS

Silver

-- Quarterly attributable silver production of 13.3 moz

(including Silverstream), down 2.3% vs. 2Q20 driven by a lower ore

grade and volume of ore processed at Fresnillo, mitigated by a

higher ore grade at San Julián Disseminated Ore Body (DOB) and

development ore from Juanicipio being processed for the first

time.

-- Quarterly attributable silver production (including

Silverstream) remained flat vs. 3Q19 due to the higher ore grade at

San Julián (DOB) and development ore from Juanicipio being

processed for the first time, offset by the lower volume of ore

processed at Fresnillo.

-- Year-to-date attributable silver production of 40.1 moz

(including Silverstream), down 1.8% vs. YTD19 due to the expected

lower ore grade at Saucito, and to a lesser extent, a decrease in

volume of ore processed and lower ore grade at San Julián Veins and

a lower contribution from the Silverstream, mitigated by the higher

ore grade at San Juli á n DOB and development ore from Juanicipio

being processed for the first time.

Gold

-- Quarterly attributable gold production of 172.7 koz, down

6.3% vs. 2Q20, due to the lower overall speed of recovery and ore

grade at both Herradura and Noche Buena. This resulted from the

lower volumes of ore deposited in 2Q20 following the COVID-19

operational restrictions, which affected the recovery cycle at the

leaching pads.

-- Quarterly and year-to-date attributable gold production

decreased 17.7% and 13.7% vs. 3Q19 and YTD19 respectively due to a

lower volume of ore processed at Herradura and Noche Buena as a

result of COVID-19 related restrictions, as described in the

previous quarter.

By-Products

-- Quarterly attributable by-product lead and zinc production

decreased 6.4% and 1.5% respectively vs. 2Q20, driven primarily by

lower ore grades at Fresnillo, mitigated by higher ore grades at

Saucito.

-- Quarterly attributable by-product lead production decreased

2.7% vs. 3Q19 due to a lower ore grade and volume of ore processed

at Fresnillo, mitigated by a higher ore grade at Saucito.

-- Quarterly attributable by-product zinc production increased

3.9% vs. 3Q19 due to a higher ore grade at Saucito, offset by a

lower volume of ore processed and ore grade at Fresnillo.

-- Year-to-date attributable by-product lead and zinc production

increased 11.1% and 11.7% vs. YTD19 respectively, mainly due to a

higher ore grade at Saucito.

Attributable 3Q20 2Q20 % Change 3Q19 % Change YTD 20 YTD 19 % Change

Silver (koz) 12,572 12,944 -2.9 12,624 -0.4 38,063 38,633 -1.5

--------------- --------------- --------- -------- --------- -------- -------- ---------

Silverstream

(koz) 709 648 9.4 659 7.6 2,037 2,207 -7.7

--------------- --------------- --------- -------- --------- -------- -------- ---------

Total Silver

(koz) 13,281 13,592 -2.3 13,283 -0.0 40,100 40,840 -1.8

--------------- --------------- --------- -------- --------- -------- -------- ---------

Gold (oz) 172,718 184,356 -6.3 209,752 -17.7 554,037 642,169 -13.7

--------------- --------------- --------- -------- --------- -------- -------- ---------

Lead (t) 15,144 16,180 -6.4 15,561 -2.7 45,229 40,725 11.1

--------------- --------------- --------- -------- --------- -------- -------- ---------

Zinc (t) 26,320 26,726 -1.5 25,340 3.9 75,701 67,746 11.7

--------------- --------------- --------- -------- --------- -------- -------- ---------

DEVELOPMENT PROJECTS

-- As expected, Juanicipio concluded the preparation of its

first production stope and development ore was processed at the

Fresnillo plant during the third quarter. Further progress was

achieved on the construction of the Juanicipio processing plant,

which is expected to start commissioning by mid-2021.

-- Construction of the Pyrites plant (phase II) at the Fresnillo

district is almost concluded. However, as previously announced,

there could be a possible delay in final inspections by the

authorities due to COVID-19 restrictions, which could defer

start-up to the end of 2020.

-- The Fresnillo flotation plant optimisation to cope with

higher content of lead and zinc is progressing according to plan

and is expected to be concluded on time during 4Q20.

2020 OUTLOOK

2020 silver production guidance remains in the range of 51 to 56

moz (including Silverstream) while gold production is now expected

to be in a range of 745 to 775 koz (previously 785 to 815 koz) as a

result of the reduced number of mine operators at Herradura due to

COVID-19 preventive measures to protect the vulnerable personnel

and lower than expected ore grades at the Dynamic Leaching Plant,

together with restricted access to deeper areas at the Noche Buena

mine.

For further information, please visit our website

www.fresnilloplc.com or contact:

FRESNILLO PLC Tel: +44 (0)20 7399 2470

London Office

Gabriela Mayor, Head of Investor

Relations

Patrick Chambers

Mexico City Office Tel: +52 55 52 79 3206

Ana Belem Zárate

POWERSCOURT Tel: +44 (0)7793 858 211

Peter Ogden

MINING OPERATIONS

FRESNILLO MINE PRODUCTION

3Q20 2Q20 % Change 3Q19 % Change YTD 20 YTD 19 % Change

Ore Processed

(t) 551,589 596,115 -7.5 648,646 -15.0 1,746,494 1,842,845 -5.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 3,085 3,611 -14.6 3,408 -9.5 9,841 9,815 0.3

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 9,295 10,828 -14.2 15,601 -40.4 28,903 40,535 -28.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 4.588 6,860 -33.1 7,037 -34.8 16,065 15,806 1.6

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 7,328 10,978 -33.3 10,225 -28.3 25,064 22,182 13.0

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 193 209 -7.5 183 5.7 195 186 5.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.77 0.79 -2.8 0.99 -22.5 0.73 0.91 -19.1

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 0.95 1.33 -28.3 1.24 -23.2 1.08 0.99 9.0

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 1.83 2.55 -28.0 2.14 -14.3 2.03 1.70 19.3

-------- -------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production was down 14.6% vs. 2Q20 as a result

of a decrease in the volume of ore processed driven by a reduced

number of personnel on site following COVID-19 preventive measures,

which has affected development rates and equipment availability.

Silver production was also impacted by the expected lower ore

grade, in accordance with the mine plan.

Quarterly silver production decreased 9.5% vs. 3Q19 driven by a

lower volume of ore processed for reasons mentioned above,

mitigated by a higher ore grade resulting from a combination of

incremental improvements achieved following the implementation of

our action plan, as set out at the end of last year and further

described below.

Year-to-date silver production remained flat vs. YTD19 due to

the higher ore grade for reasons mentioned below, offset by a lower

volume of ore processed due to COVID-19 preventive measures.

Our performance improvement plan, as set out on the Capital

Markets Day in December 2019, continues to be implemented, focusing

on controlling dilution and enhancing blasting and drilling

techniques to cope with the narrower veins.

Development rates decreased to an average of 2,878m per month in

3Q20 (2Q20: 3,118m per month), due to absenteeism resulting from

COVID-19 preventive measures. Year to date, development rates

remained at a similar level vs. YTD19 (3,060m per month vs. 3,071m

per month) as the contractor hired at the end of 2019, together

with the start-up of the tunnel boring machine, have mitigated the

negative impact of the higher absenteeism. We expect an increase in

development rates from current levels to approximately 3,300m per

month by the end of 2020 as absenteeism decreases but at a slower

rate than anticipated.

Quarterly by-product gold production decreased 14.2% vs. 2Q20

driven by a lower volume of ore processed and, to a lesser extent,

lower recovery rate.

Quarterly and year-to-date by-product gold production decreased

40.4% and 28.7% vs. 3Q19 and YTD19 respectively due to lower ore

grades, lower volumes of ore processed and lower recovery

rates.

The silver ore grade for 2020 continues to be in the range of

185-200 g/t, while the gold ore grade is estimated to remain around

0.7 g/t.

SAUCITO MINE PRODUCTION

3Q20 2Q20 % Change 3Q19 % Change YTD 20 YTD 19 % Change

Ore Processed (t) 710,618 715,338 -0.7 703,002 1.1 2,096,003 2,030,675 3.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 3,963 4,098 -3.3 4,040 -1.9 12,104 12,879 -6.0

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 20,105 20,398 -1.4 21,096 -4.7 61,679 57,812 6.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 7,267 6,255 16.2 4,906 48.1 19,239 15,345 25.4

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 10,993 8,842 24.3 6,655 65.2 28,736 21,707 32.4

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 207 207 0.2 207 0.3 209 230 -9.0

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 1.14 1.15 -0.7 1.22 -6.0 1.18 1.16 1.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 1.21 1.04 15.9 0.84 43.9 1.08 0.90 20.5

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 2.24 1.82 23.2 1.38 63.0 1.98 1.55 27.8

-------- -------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production decreased 3.3% vs. 2Q20 due to a

marginally lower recovery rate.

Quarterly silver production decreased 1.9% vs. 3Q19 as a result

of a slightly lower recovery rate, mitigated by a marginally higher

volume of ore processed.

As seen in previous quarters and in line with our expectations,

year-to-date silver production decreased 6.0% vs. YTD19 as a result

of the gradual depletion of higher ore grade areas at the Jarillas

vein. This decline was mitigated by a higher volume of ore

processed.

Quarterly by-product gold production decreased 1.4% and 4.7% vs.

2Q20 and 3Q19 mainly due to a lower ore grade.

Year-to-date gold production increased 6.7% vs. YTD19 due to a

higher volume of ore processed, and to a lesser extent, higher ore

grade and recovery rate.

The silver ore grade is expected to decrease significantly in

4Q20 in accordance with the mine plan as a higher portion of

material will be processed from several Western areas with lower

silver grade. However, the silver ore grade for 2020 continues to

be in the range of 200-220 g/t, while the gold ore grade is now

estimated to be around 1.2 g/t.

PYRITES PLANT (PHASE I)

3Q20 2Q20 % Change 3Q19 % Change YTD 20 YTD 19 % Change

Iron Concentrates

Processed (t) 43,871 39,049 12.6 38,572 13.7 124,373 125,557 -1.0

------- ------- --------- ------- --------- -------- -------- ---------

Production

------- ------- --------- ------- --------- -------- -------- ---------

Silver (koz) 221 249 -11.2 285 -22.3 726 923 -21.3

------- ------- --------- ------- --------- -------- -------- ---------

Gold (oz) 837 924 -9.4 954 -12.3 2,632 3,270 -19.5

------- ------- --------- ------- --------- -------- -------- ---------

Ore Grades

------- ------- --------- ------- --------- -------- -------- ---------

Silver (g/t) 212 261 -18.7 314 -32.4 238 308 -22.6

------- ------- --------- ------- --------- -------- -------- ---------

Gold (g/t) 1.87 2.10 -11.0 2.44 -23.2 2.02 2.35 -13.8

------- ------- --------- ------- --------- -------- -------- ---------

Quarterly silver and gold production decreased 11.2% and 9.4%

vs. 2Q20 respectively due to a lower ore grade of iron concentrates

produced by Saucito and to a lesser extent, lower recovery rate,

mitigated by a higher volume of iron concentrates processed.

Quarterly silver and gold production decreased 22.3% and 12.3%

vs. 3Q19 respectively as expected and as seen in the prior quarter.

This was primarily due to a lower ore grade from Saucito's

flotation plant, as material from the pre-operative high grade

stockpile was depleted following the plant's start-up in mid-2018,

mitigated by a higher volume of iron concentrates processed.

Year-to-date silver production decreased 21.3% vs. YTD19 due to

a lower ore grade of iron concentrates produced by Saucito.

Similarly, year-to-date gold production decreased 19.5% vs.

YTD19 as a result of a lower ore grade and lower recovery rate.

We continue to expect this plant to recover around 1 moz silver

and 3 koz gold from the ongoing Saucito tailings during 2020.

CIENEGA MINE PRODUCTION

YTD

3Q20 2Q20 % Change 3Q19 % Change 20 YTD 19 % Change

Ore Processed (t) 325,392 331,543 -1.9 335,493 -3.0 983,285 985,600 -0.2

-------- -------- --------- -------- --------- -------- -------- ---------

Production

-------- -------- --------- -------- --------- -------- -------- ---------

Gold (oz) 18,122 15,948 13.6 17,858 1.5 50,496 47,615 6.1

-------- -------- --------- -------- --------- -------- -------- ---------

Silver (koz) 1,522 1,573 -3.3 1,384 9.9 4,491 4,304 4.3

-------- -------- --------- -------- --------- -------- -------- ---------

Lead (t) 1,536 1,489 3.1 1,826 -15.9 4,772 4,160 14.7

-------- -------- --------- -------- --------- -------- -------- ---------

Zinc (t) 2,275 2,324 -2.1 2,755 -17.4 7,185 6,597 8.9

-------- -------- --------- -------- --------- -------- -------- ---------

Ore Grades

-------- -------- --------- -------- --------- -------- -------- ---------

Gold (g/t) 1.85 1.61 15.4 1.78 4.2 1.72 1.63 5.5

-------- -------- --------- -------- --------- -------- -------- ---------

Silver (g/t) 169 172 -1.3 151 12.4 165 159 3.9

-------- -------- --------- -------- --------- -------- -------- ---------

Lead (%) 0.71 0.69 4.2 0.81 -11.7 0.74 0.65 13.6

-------- -------- --------- -------- --------- -------- -------- ---------

Zinc (%) 1.18 1.19 -1.1 1.35 -13.2 1.22 1.12 8.8

-------- -------- --------- -------- --------- -------- -------- ---------

Quarterly gold production increased 13.6% vs. 2Q20 as a result

of a higher ore grade. This was driven by the higher proportion of

material extracted from the Eastern zone of the district with

higher gold content but lower silver content.

Quarterly silver production decreased 3.3% vs. 2Q20 due to lower

volumes of ore processed and lower ore grade.

Quarterly gold production increased 1.5% vs. 3Q19 due to a

higher ore grade, offset by a lower volume of ore processed.

Quarterly silver production increased 9.9% vs. 3Q19 as a result

of a higher ore grade in line with the mine plan.

Year-to-date gold and silver production increased 6.1% and 4.3%

vs. YTD19 respectively primarily due to the higher ore grades.

The gold and silver ore grades for 2020 are expected to remain

at around 1.65-1.75 g/t and 155-165 g/t respectively.

SAN JULIÁN MINE PRODUCTION

3Q20 2Q20 % Change 3Q19 % Change YTD 20 YTD 19 % Change

Ore Processed Veins

(t) 317,134 312,796 1.4 321,798 -1.5 939,107 983,478 -4.5

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Processed DOB

(t) 555,161 559,564 -0.8 559,693 -0.8 1,656,650 1,667,567 -0.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Total production

at San Julián

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 17,342 16,361 6.0 14,234 21.8 48,877 50,677 -3.6

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 3,298 3,104 6.3 3,080 7.1 9,576 9,622 -0.5

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production Veins

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 16,426 15,658 4.9 13,711 19.8 46,667 49,010 -4.8

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 944 1,047 -9.9 1,035 -8.8 3,065 3,365 -8.9

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production DOB

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 917 703 30.3 523 75.2 2,209 1,666 32.6

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 2,355 2,057 14.5 2,045 15.1 6,511 6,257 4.1

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 1,676 1,576 6.3 1,792 -6.5 5,076 5,413 -6.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 5,627 4,581 22.8 5,705 -1.4 14,618 17,261 -15.3

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades Veins

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 1.71 1.63 5.1 1.39 23.2 1.62 1.62 -0.1

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 100 113 -11.1 108 -7.0 110 116 -4.8

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades DOB

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.10 0.08 20.1 0.07 45.2 0.09 0.08 14.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 154 134 15.3 130 18.7 143 135 6.0

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 0.39 0.37 5.4 0.41 -4.1 0.39 0.43 -7.9

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 1.27 1.08 18.0 1.35 -6.1 1.16 1.38 -16.1

-------- -------- --------- -------- --------- ---------- ---------- ---------

SAN JULIÁN VEINS

Quarterly silver production decreased 9.9% and 8.8% vs. 2Q20 and

3Q19 respectively, primarily due to a lower ore grade resulting

from the depletion of high ore grade areas at San Julián and

Shalom.

Gold production increased 4.9% vs. 2Q20 driven by a higher ore

grade.

Quarterly gold production increased 19.8% vs. 3Q19 mainly due to

access to new areas with higher gold ore grades.

Year-to-date silver and gold production decreased 8.9% and 4.8%,

respectively vs. YTD19 as a result of a lower volume of ore

processed following the depletion of the stockpile, as described in

prior quarters and lower ore grades driven by the depletion of high

ore grade areas at San Julián and Shalom.

We continue to expect the 2020 silver and gold ore grades to

remain flat year on year, averaging 110-120 g/t and 1.6-1.7 g/t,

respectively.

SAN JULIÁN DISSEMINATED ORE BODY (DOB)

Quarterly and year-to-date silver production increased against

all comparable periods due to a higher ore grade. As previously

mentioned, the mine sequencing was changed in 2019 to maintain the

geotechnical stability of some high ore grade stopes. During 3Q20,

we regained access to these higher quality areas, resulting in the

higher ore grades.

The silver ore grade for 2020 is expected to remain within a

range of 140-150 g/t.

HERRADURA TOTAL MINE PRODUCTION

3Q20 2Q20 % Change 3Q19 % Change YTD 20 YTD 19 % Change

Ore Processed

(t) 4,791,585 3,283,104 45.9 5,591,746 -14.3 12,921,867 16,753,610 -22.9

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Total Volume

Hauled (t) 28,017,785 18,942,659 47.9 33,396,651 -16.1 80,801,385 94,629,850 -14.6

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Production

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Gold (oz) 85,102 95,253 -10.7 102,439 -16.9 290,848 339,305 -14.3

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Silver (koz) 251 300 -16.3 412 -39.1 1,075 1,045 2.8

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Ore Grades

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Gold (g/t) 0.72 0.90 -20.1 0.71 1.9 0.78 0.79 -0.5

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Silver (g/t) 2.18 3.28 -33.3 3.27 -33.1 3.21 2.89 11.3

----------- ----------- --------- ----------- --------- ----------- ----------- ---------

Quarterly gold production decreased 10.7% vs. 2Q20 mainly due to

a lower overall speed of recovery. This resulted mainly from the

lower volumes of ore deposited in 2Q20 following the COVID-19

operational restrictions, which affected the recovery cycle at the

leaching pads. Additionally, the measures put in place to maintain

social distancing have resulted in a decreased number of personnel

on site, thus affecting the preparation of the mine. This has

limited access to deeper areas of the pit, thus impacting the mine

plan. The lower ore grade and a slowdown in the leaching kinetic

due to the presence of more sulphides in the areas mined further

impacted quarterly gold production. These negative factors were

mitigated by the higher volume of ore processed as operations

ramped up in 3Q20 following the COVID-19 operational restrictions

in 2Q20.

Quarterly gold production decreased 16.9% vs. 3Q19 as a result

of a lower volume of ore deposited during the COVID-19 operational

restrictions. Additionally, the previously described effect on the

recovery cycle also affected quarterly gold production.

Nevertheless, the aforementioned factors were partially compensated

by the higher ore grade in 3Q20.

Year-to-date gold production decreased 14.3% vs. YTD19 as a

result of the lower volume of ore processed for reasons explained

above. However, these factors were mitigated by the higher speed of

recovery following the commissioning of leaching pad number 13 in

mid-2019 and an increased irrigation in new areas of the pads.

The gold ore grade is expected to remain around 0.75-0.80 g/t

during 2020.

NOCHE BUENA TOTAL MINE PRODUCTION

3Q20 2Q20 % Change 3Q19 % Change YTD 20 YTD 19 % Change

Ore Processed

(t) 1,714,258 1,366,909 25.4 3,215,167 -46.7 5,044,312 9,790,495 -48.5

---------- ---------- --------- ----------- --------- ----------- ----------- ---------

Total Volume

Hauled (t) 9,937,248 5,612,622 77.1 11,447,273 -13.2 25,654,647 37,562,882 -31.7

---------- ---------- --------- ----------- --------- ----------- ----------- ---------

Production

---------- ---------- --------- ----------- --------- ----------- ----------- ---------

Gold (oz) 21,574 24,643 -12.5 37,570 -42.6 70,261 102,956 -31.8

---------- ---------- --------- ----------- --------- ----------- ----------- ---------

Silver (koz) 11 9 19.4 14 -22.4 30 43 -30.9

---------- ---------- --------- ----------- --------- ----------- ----------- ---------

Ore Grades

---------- ---------- --------- ----------- --------- ----------- ----------- ---------

Gold (g/t) 0.49 0.54 -8.0 0.58 -15.4 0.52 0.55 -4.6

---------- ---------- --------- ----------- --------- ----------- ----------- ---------

Silver (g/t) 1.25 0.54 130.4 0.25 391.8 0.68 0.23 191.9

---------- ---------- --------- ----------- --------- ----------- ----------- ---------

Quarterly gold production decreased 12.5% vs. 2Q20 due to a

lower overall speed of recovery. This resulted from the lower

volumes of ore deposited in 2Q20 following the COVID-19 operational

restrictions, which affected the recovery cycle at the leaching

pads. The increased waste material hauled to solve a stability

problem in the south slope of the pit restricted access to the

deeper areas of the mine and further impacted gold production. This

was mitigated by the higher volume of ore processed as operations

ramped up following the COVID-19 operational restrictions in

2Q20.

Quarterly and year-to-date gold production decreased 42.6% and

31.8% vs. 3Q19 and YTD19 respectively driven by the lower volume of

ore deposited, for reasons explained above, in addition to the

expected depletion of the mine as it approaches closure. These were

mitigated by the higher speed of recovery due to increased

irrigation on the pads and the installation of the carbon columns

in 2019.

The expected gold ore grade is predicted to remain in the range

of 0.50-0.55 g/t in 2020.

SILVERSTREAM

Quarterly Silverstream production increased 9.4% vs. 2Q20 due to

higher ore grades, increased ore throughput and an improved

recovery rate.

Quarterly Silverstream production increased 7.6% vs. 3Q19 due to

a higher recovery rate and higher volume of ore processed.

Year-to-date Silverstream production decreased 7.7% vs. YTD19

due to lower volume of ore processed and the expected lower ore

grade resulting from narrower veins, as described in previous

quarters, which were partially compensated for by a higher recovery

rate.

Expected silver production in 2020 remains in the range of

2.7-3.0 moz.

SAFETY PERFORMANCE

We are deeply saddened to confirm a fatal accident at the

Fresnillo mine during the quarter. A full independent investigation

is being carried out with additional preventive measures put in

place and support offered to family and colleagues. We remain

absolutely committed to instilling a new safety culture across our

mines and the rolling out of the I Care We Care programme.

JUANICIPIO

A s planned, development ore from the Juanicipio project began

to be processed at the Fresnillo beneficiation plant, with 42,476

tonnes processed during the quarter . Total production was 394

thousand silver ounces, 610 gold ounces, 138 tonnes of lead and 174

tonnes of zinc (attributable: 220 thousand ounces of silver, 341

ounces of gold, 77 tonnes of lead and 97 tonnes of zinc).

The preparation of the first production stope was concluded

during the quarter and further progress was achieved in the

construction of the beneficiation plant with the foundations for

the milling area.

We expect to process an average of 16,000 tonnes per month

through to mid-2021 on a consolidated basis, at which time we

expect to start commissioning the Juanicipio beneficiation

plant.

UPDATE ON EXPLORATION

During 3Q20, 132,000 metres of drilling were completed at our

operating mines, as part of the 456,000 metre programme to convert

resources into reserves. Additionally, 60,000 metres of exploration

drilling were carried out, as part of the 228,000 metre programme

at projects.

Presently, drilling is taking place across ten areas.

Interesting results were obtained at Fresnillo, Guanajuato and

Supaypacha (Peru), on the new mineralised zones identified during

the first half of this year; at the San Julián district, drilling

continues on the southern vein system for resource conversion into

reserves. In Chile, drilling resumed focusing on several targets in

the Antofagasta and Coquimbo regions. Negotiations with communities

to obtain drilling access permits continues across several projects

in Mexico and Peru in a respectful and fair manner.

A fuller update on our exploration programme, together with the

audited reserves and resources statements, will be provided

alongside our preliminary results.

ABOUT FRESNILLO PLC

Fresnillo plc is the world's largest primary silver producer and

Mexico's largest gold producer, listed on the London and Mexican

Stock Exchanges under the symbol FRES.

Fresnillo plc has seven operating mines, all of them in Mexico -

Fresnillo, Saucito, Ciénega (including the San Ramón satellite

mine, Las Casas Rosario & Cluster Cebollitas), Herradura,

Soledad-Dipolos(1) , Noche Buena and San Julián (Veins and

Disseminated Ore Body), three development projects - the Pyrites

Plant at Fresnillo, the optimisation of the beneficiation plant

also at Fresnillo and Juanicipio, and four advanced exploration

projects - Orisyvo, Rodeo, Guanajuato and Pilarica, as well as a

number of other long term exploration prospects.

Fresnillo plc has mining concessions and exploration projects in

Mexico, Peru and Chile.

Fresnillo plc has a strong and long tradition of exploring,

mining, a proven track record of mine development, reserve

replacement, and production costs in the lowest quartile of the

cost curve for silver.

Fresnillo plc's goal is to maintain the Group's position as the

world's largest primary silver company and Mexico's largest gold

producer.

(1) Operations at Soledad-Dipolos are currently suspended.

FORWARD-LOOKING STATEMENTS

Information contained in this announcement may include

'forward-looking statements'. All statements other than statements

of historical facts included herein, including, without limitation,

those regarding the Fresnillo Group's intentions, beliefs or

current expectations concerning, amongst other things, the

Fresnillo Group's results of operations, financial position,

liquidity, prospects, growth, strategies and the silver and gold

industries are forward-looking statements. Such forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Forward-looking statements are not

guarantees of future performance and the actual results of the

Fresnillo Group's operations, financial position and liquidity, and

the development of the markets and the industry in which the

Fresnillo Group operates, may differ materially from those

described in, or suggested by, the forward-looking statements

contained in this document. In addition, even if the results of

operations, financial position and liquidity, and the development

of the markets and the industry in which the Fresnillo Group

operates are consistent with the forward-looking statements

contained in this document, those results or developments may not

be indicative of results or developments in subsequent periods. A

number of factors could cause results and developments to differ

materially from those expressed or implied by the forward-looking

statements including, without limitation, general economic and

business conditions, industry trends, competition, commodity

prices, changes in regulation, currency fluctuations (including the

US dollar and Mexican Peso exchanges rates), the Fresnillo Group's

ability to recover its reserves or develop new reserves, including

its ability to convert its resources into reserves and its mineral

potential into resources or reserves, changes in its business

strategy and political and economic uncertainty.

LEI: 549300JXWH1UV5J0XV81

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLLBLLLBBLLFBF

(END) Dow Jones Newswires

October 21, 2020 02:00 ET (06:00 GMT)

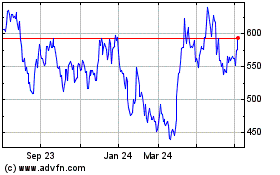

Fresnillo (LSE:FRES)

Historical Stock Chart

From Mar 2024 to Apr 2024

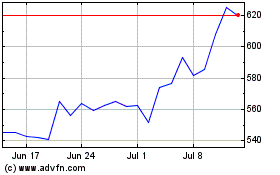

Fresnillo (LSE:FRES)

Historical Stock Chart

From Apr 2023 to Apr 2024