FirstGroup PLC AGM Trading Statement and Proposed Return of Value

September 13 2021 - 2:00AM

UK Regulatory

TIDMFGP

FIRSTGROUP PLC

AGM TRADING STATEMENT AND PROPOSED RETURN OF VALUE

AGM trading statement

FirstGroup plc ('FirstGroup', the 'Group') will be holding its Annual General

Meeting ('AGM') at 9.30am today. Ahead of the AGM, FirstGroup notes that

overall trading performance year to date has been in line, and there is no

change to management's expectations for the current financial year as outlined

in the full year results announcement on 27 July 2021.

First Bus passenger volumes have reached 65% of pre-pandemic levels on average

in recent weeks, and we expect this to increase further as the autumn terms for

schools and then universities get fully underway. The COVID-19 Bus Service

Support Grant ('CBSSG') programme formally came to end on 1 September, and

since that time delivery of local bus services across England has been

reinforced by the Department for Transport ('DfT')'s £226.5m bus recovery

funding package for the industry announced in early July. The grant scheme,

which is allocated to regional bus operators based on mileage and volumes, is

in place through to April 2022.

Since the year end, the DfT have formally approved the management and

performance-based fees to First Rail's contracted rail operations for the year

to 31 March 2021, which were in line with the amounts accrued. The DfT have

extended the current GWR and West Coast Partnership (incorporating Avanti)

agreements by six months to June and October 2022 respectively. The DfT have

also recently published Prior Information Notices which indicated that the West

Coast Partnership's National Rail Contract which will follow the current

agreement could last up to ten years to October 2032, and that GWR's could last

up to six years to June 2028. The Group continues to work with the DfT toward

signing these contracts, which will be more customer-centric and with an

appropriate balance of risk and reward for all parties, including no passenger

volume risk for operators.

Passenger mileage in our non-core Greyhound operation has been just over half

of pre-pandemic levels in recent weeks, supported in part by further awards

under federal schemes including the American Rescue Plan.

On 31 August 2021, the Group announced it had signed a new multi-year £300m

sustainability-linked Revolving Credit Facility ('RCF') with a group of its

relationship banks. The new RCF replaced all the Group's former committed

syndicated and bilateral banking facilities, which have been repaid and

cancelled. The Group has also repaid the UK Government's Covid Corporate

Financing Facility ('CCFF') commercial paper as well as all of its Private

Placement debt, and given notice to the holders of its £325m 5.25% bonds due

November 2022 that it will exercise its right to repay them early, completing

the reorganisation of the Group's debt arrangements following the sale of the

North American contract businesses.

As previously announced, Chief Executive Matthew Gregory and Non-Executive

Directors Martha Poulter and Steve Gunning will step down from the Board at the

end of the AGM today, and David Martin, Chairman, will become interim Executive

Chairman until a permanent Chief Executive is appointed following the

comprehensive search process which is underway.

Proposed return of value update

On 22 July 2021 the Group announced the completion of the First Student and

First Transit disposal and the increase to £500m in the amount intended to be

returned to shareholders. Having considered various methodologies and consulted

with a range of shareholders, the Board has concluded that a tender offer is

the optimal way to return such a significant amount in a short space of time,

while giving shareholders who wish to retain their current investment in

FirstGroup the option to do so.

Under the tender offer, qualifying shareholders will be invited to tender some

or all of their shares in the Group at a price per share that will be announced

at the time of launch. If the full amount is not returned to shareholders by

way of the tender offer, the Group intends to return any remaining surplus cash

in a second phase, principally by way of a special dividend with an

accompanying share consolidation, supplemented by on-market share buybacks.

Implementation of the planned return of value will require approval by

shareholders, and full details of the proposed tender offer, including the

tender price, the timetable and instructions on how to participate, will be

included in a tender offer circular that will be published and sent to

shareholders in due course.

Commenting, FirstGroup Chairman David Martin said:

"Trading is in line with our expectations year to date, and we continue to

support our passengers and other stakeholders as travel patterns evolve. While

we complete the search for a new Chief Executive, my focus is on ensuring we

continue to drive value from our strong positions in UK bus and rail, progress

our plans to resolve our non-core Greyhound operation and complete the return

of value to our shareholders following the sale of the North American contract

businesses.

"The vital role of public transport is clear and the policy backdrop has never

been more supportive. With a well-capitalised balance sheet and an operating

model that will support an attractive dividend for shareholders commencing in

2022, I am confident that FirstGroup is well-placed to deliver sustainable

value creation as a focused UK public transport leader."

Contacts at FirstGroup: Contacts at Brunswick PR:

Faisal Tabbah, Head of Investor Andrew Porter / Simone Selzer

Relations Tel: +44 (0) 20 7404 5959

Stuart Butchers, Group Head of

Communications

corporate.comms@firstgroup.co.uk

Tel: +44 (0) 20 7725 3354

Notes

Legal Entity Identifier (LEI): 549300DEJZCPWA4HKM93. Classification as per DTR

6 Annex 1R: 3.1.

FirstGroup plc (LSE: FGP.L) is a leading private sector provider of public

transport services. With £4.3 billion in revenue and around 30,000 employees,

our UK divisions transported nearly 700,000 passengers a day in the 52 weeks to

27 March 2021. First Bus is the second largest regional bus operator in the UK,

serving two-thirds of the UK's 15 largest conurbations with a fleet of c.5,000

buses. First Rail is the UK's largest rail operator, with many years of

experience running long-distance, commuter, regional and sleeper rail services.

We operate a fleet of c.3,750 rail vehicles on four contracted operations

(Avanti, GWR, SWR, TPE) and two open access routes (Hull Trains and the new

Lumo service launching in October 2021). We also operate Greyhound, the only

national operator of scheduled intercity coaches in the US, with a unique

network of 2,300 destinations and an iconic brand. We create solutions that

reduce complexity, making travel smoother and life easier. Our businesses are

at the heart of our communities and the essential services we provide are

critical to delivering wider economic, social and environmental goals. We are

formally committed to operating a zero-emission First Bus fleet by 2035 and to

cease purchasing further diesel buses after 2022; and First Rail will help

support the UK Government's goal to remove all diesel-only trains from service

by 2040. Visit our website at www.firstgroupplc.com and follow us

@firstgroupplc on Twitter.

END

(END) Dow Jones Newswires

September 13, 2021 02:00 ET (06:00 GMT)

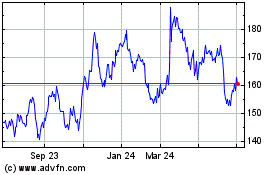

Firstgroup (LSE:FGP)

Historical Stock Chart

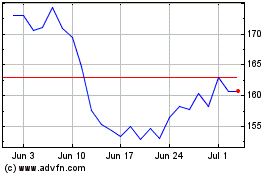

From Mar 2024 to Apr 2024

Firstgroup (LSE:FGP)

Historical Stock Chart

From Apr 2023 to Apr 2024