TIDMFGP

11 August 2021

FirstGroup plc

LEI: 549300DEJZCPWA4HKM93

Annual Report and Financial Statements and Annual General Meeting

In accordance with LR 9.6.1R, FirstGroup plc (the "Company") has today

submitted copies of the documents listed below to the Financial Conduct

Authority's National Storage Mechanism. These documents will shortly be

available for inspection at https://data.fca.org.uk/#/nsm/

nationalstoragemechanism:

* 2021 Annual Report and Financial Statements (the "2021 Annual Report");

* Notice of the 2021 Annual General Meeting (the "2021 AGM Notice");

* Form of Proxy; and

* Notice of Availability.

As required by DGTR 6.3.5R (3), the 2021 Annual Report and the 2021 AGM Notice

are also available on the Company's website at www.firstgroupplc.com.

A condensed set of the FirstGroup plc financial statements, including

information on important events that have occurred during the year and their

impact on the financial statements, were included in the Company's announcement

of its full year results published on 27 July 2021 ("Final Results

Announcement." The Final Results Announcement is available for viewing on the

Company's website at www.firstgroupplc.com.

DGTR 6.3.5R requires that certain information relating to all listed companies'

financial results be communicated in unedited full text through a Regulatory

Information Service. The content of the Final Results Announcement, together

with the information set out below in the Appendix, which is extracted from the

2021 Annual Report, constitute the material required to satisfy the

requirements of DGTR 6.3.5R. Cross-references and page numbers in the Appendix

refer to sections in the 2021 Annual Report. This announcement is not a

substitute for reading the 2021 Annual Report.

Enquiries:

Seema Kamboj

Deputy Company Secretary

+44 (0) 7583 675724

APPIX

DIRECTORS' RESPONSIBILITY STATEMENT

Statement of Directors' responsibilities in respect of the Financial Statements

The Directors are responsible for preparing the Annual Report and the Financial

Statements in accordance with applicable law and regulation.

Company law requires the Directors to prepare Financial Statements for each

financial year. Under that law the Directors have prepared the Group Financial

Statements in accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 and the Company Financial

Statements in accordance with United Kingdom Generally Accepted Accounting

Practice (United Kingdom Accounting Standards, comprising FRS 101 "Reduced

Disclosure Framework", and applicable law). Additionally, the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules require the Directors to

prepare the Group Financial Statements in accordance with international

financial reporting standards adopted pursuant to

Regulation (EC) No 1606/2002 as it applies in the European Union.

Under Company law, Directors must not approve the Financial Statements unless

they are satisfied that they give a true and fair view of the state of affairs

of the Group and Company and of the profit or loss of the Group for that

period. In preparing the Financial Statements, the Directors are required to:

* select suitable accounting policies and then apply them consistently;

* state whether applicable international accounting standards in conformity

with the requirements of the Companies Act 2006 and international financial

reporting standards adopted pursuant to Regulation (EC) No 1606/2002 as it

applies in the European Union have been followed for the Group Financial

Statements and United Kingdom Accounting Standards, comprising FRS 101 have

been followed for the Company Financial Statements, subject to any material

departures disclosed and explained in the Financial Statements;

* make judgements and accounting estimates that are reasonable and prudent;

and

* prepare the Financial Statements on the going concern basis unless it is

inappropriate to presume that the Group and Company will continue in

business.

The Directors are also responsible for safeguarding the assets of the Group and

Company and hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

The Directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Group's and Company's transactions and

disclose with reasonable accuracy at any time the financial position of the

Group and Company and enable them to ensure that the Financial

Statements and the Directors' Remuneration Report comply with the Companies Act

2006.

The Directors are responsible for the maintenance and integrity of the

Company's website. Legislation in the United Kingdom governing the preparation

and dissemination of Financial Statements may differ from legislation in other

jurisdictions.

Directors' confirmations

The Directors consider that the Annual Report and Accounts, taken as a whole,

is fair, balanced and understandable and provides the information necessary for

shareholders to assess the Group's and

Company's position and performance, business model and strategy.

Each of the Directors, whose names and functions are listed in Board of

Directors confirm that, to the best of their knowledge:

* the Group Financial Statements, which have been prepared in accordance with

international accounting standards in conformity with the requirements of

the Companies Act 2006 and international financial reporting standards

adopted pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union, give a true and fair view of the assets, liabilities,

financial position and profit of the Group;

* the Company Financial Statements, which have been prepared in accordance

with United Kingdom Accounting Standards, comprising FRS 101, give a true

and fair view of the assets, liabilities, financial position and loss of

the Company; and

* the Strategic Report includes a fair review of the development and

performance of the

business and the position of the Group and Company, together with a description

of the

principal risks and uncertainties that it faces.

In the case of each Director in office at the date the Directors' report is

approved:

* so far as the Director is aware, there is no relevant audit information of

which the Group's and Company's auditors are unaware; and

* they have taken all the steps that they ought to have taken as a Director

in order to make themselves aware of any relevant audit information and to

establish that the Group's and Company's auditors are aware of that

information.

Ryan Mangold

Chief Financial Officer

RELATED PARTY TRANSACTIONS

Transactions between the Company and its subsidiaries, which are related

parties, have been eliminated on consolidation and are not disclosed in this

note.

Remuneration of key management personnel

The remuneration of the Directors, which comprise the plc Board who are the key

management personnel of the Group, is set out below in aggregate for each of

the categories specified in IAS 24 Related Party Disclosures. Further

information about the remuneration of individual Directors is provided in the

Directors' Remuneration Report on pages 108 to 131.

52 weeks 52 weeks

ending 27 ending 28

March 2021 £ March 2020

m £m

Basic salaries1 1.1 1.2

Benefits in kind 0.1 0.1

Fees 0.7 0.8

Share based payment 0.1 0.8

2.0 2.9

1 Basic salaries include cash emoluments in lieu of retirement benefits and car

allowance

PRINCIPAL RISKS

To deliver our strategy, it is important that we understand and manage the

risks that face the Group. The table below outlines our principal risks:

Impact of sale of

Impact of sale First Student and

of First Student First Transit, if

and First Comment on risk any, to the risk

Risk Transit to risk change change during the

description, description Mitigation during the year year

full Group

External Risks

Economic

conditions

The Group's With the sale of In order to adapt Although it is not The Group's First

success depends First Student to market yet clear the Rail division has

on adapting to and First uncertainties and lasting impacts entered into no

economic Transit, the continue to drive the pandemic will risk and low cost

fluctuations ongoing Group is demand, the Group have on commuting risk contracts to

which may less susceptible continues to be behaviours, lock protect the

negatively to changes in customer-focused down orders have remaining

impact economic and strives to begun to lift, business from

performance conditions. The provide innovative resulting in economic

through new transport increased travel fluctuations.

increased concession-based solutions. Whilst demands within the Further, if

costs, changing National Rail the Group has UK; First Bus saw lockdown

customer needs, Contracts have temporarily reduced volumes increase procedures or

reduced demand low revenue and certain capital to c.60% of shelter in place

and/or reduced contingent investments, pre-pandemic orders are

opportunities capital risk. we continue to levels during extended the

for growth. Additionally, focus on strategic the most recent ongoing Group will

Globally, the the Group has ventures to develop lockdown easement. be able to

economic capacity and new innovative We expect right-size bus

outlook is less demand planning service offerings increased demand schedules based on

certain, and processes in (e.g. electric over real-time demand

the Group place to fleet and the summer monitoring and

specifically efficiently autonomous holidays as we government support

has experienced adapt to vehicles, ticket anticipate arrangements

a change in changing initiatives) in travellers largely in First Bus are

travel economic and order to provide taking domestic expected to be

behaviour and demand our customers with trips instead of extended to allow

new policies conditions. As a transport solutions travelling for social

and procedures result, the that reduce internationally. distanced public

related to the Group's complexity and transport to

pandemic. All performance is retain customer continue.

these market less impacted by demand through

changes have economic unstable economic

the potential volatility. conditions.

to decrease the

Group's In 2020 the Group

available accelerated

financial implementation of

resources to real-time seating

invest capital capacity on our

in innovative First Bus app to

solutions that support social

drive demand. distancing

requirements as

Additionally, well as a number of

when these further customer

economic engagement actions

uncertainties through technology

are combined to provide greater

with lower fuel insight to manage

prices, operations. Through

they may this tracking the

further reduce Group is able to

demand for adapt bus schedules

public to real-time demand

transportation to better manage

particularly in operational costs.

our

Greyhound and

First Bus

divisions.

Climate change

Businesses The Group is The Group's The Group With the sale of

globally committed to strategic framework recognises the the US businesses,

continue to accelerating the for sustainability, continued the regulatory

come under transition to a Mobility Beyond pressure and environment on

increasing zero-carbon Today, sets out opportunity to climate

pressure from world, which the company's create a more change simplifies

all includes ambition to be the sustainable world for us as we will

stakeholders, responding to partner of choice and maintains our deal

particularly the clear for innovative and commitment to predominantly with

investors, to mandate and sustainable invest in new UK policy which is

demonstrate binding net-zero transport. technologies and well defined and

strong progress targets collaborate with which we are on

on their currently set In 2021, FirstGroup partners to create track to meet with

climate-related within the UK became the first a cleaner future. our current

performance. for greenhouse bus and rail The commitments we commitments.

Inadequate gas emissions. operator in the UK have made this The physical risks

attention to Although the US to formally year - of climate change

our government has commit to setting particularly our are also less

climate-related not yet an ambitious science-based variable and with

programmes announced the science-based target and zero less extreme

and emerging same binding target aligned with emission fleet weather events in

technologies targets, the limiting global target for First the UK than North

could current warming to 1.5°C Bus - and the America.

negatively administration's and reaching strategies we are

impact the position is net-zero emissions developing to meet

Group's clear and we by 2050 or earlier. them will ensure

performance, expect these to we are managing

reputation and/ result in coming Within First Bus we our climate

or result in years. However, have committed to transition risks

decreased we do not investing in only effectively.

demand. anticipate zero-emission

adverse impacts vehicles from

Within the UK, and/or changes December 2022, and

the government to these risks to have a 100%

has set a and/or zero-emission fleet

legally binding operations with by 2035. The

target for the sale of National Bus

net-zero First Student Strategy, announced

greenhouse and First on 15 March 2021,

gas emissions Transit. pledged £3bn for

by 2050. All buses in England

companies that outside London,

operate in the including a

UK or are owned commitment to

by support the

UK-based purchase of at

companies will least 4,000 new

be zero emission buses

substantially for the UK, from

impacted by which the Group is

decarbonisation well positioned to

policies benefit.

introduced to

meet this We also publicly

target. As a support the UK

result, the Government's

Group is under ambition to remove

increased diesel-only trains

pressure and from the network by

scrutiny from 2040. As outlined

both investors in the Government's

and government rail White Paper,

bodies to published in May

provide 2021,

evidence of our electrification of

strategic plans Britain's rail

in place to network will be

mitigate expanded, and

climate change alternative

risks. technologies such

as hydrogen and

There are also battery power will

physical risks help to achieve

resulting from zero emissions from

climate change trains. We look

(e.g. extreme forward to working

weather events) with the government

which could and industry

impact our partners in support

customers, of the government's

service investment plans to

reliability, decarbonise

and disrupt our Britain's rail

energy supply network.

and/or supply

chain. Our externally

assured carbon and

Delays in energy performance

implementing can be found in the

our strategic KPI section on

plans to pages 55-56 and in

mitigate our TCFD reporting

climate-related on pages 57-60,

risks, with a more

including detailed breakdown

transitioning in our 2021

our fleets to Environmental

zero emissions, Performance Report,

could result in available on our

lost business, website.

reduced

revenue and Business continuity

reduced plans are in place

profitability. for all areas of

our businesses in

case of extreme

weather or other

physical events.

Geopolitical

The political The sale of While the Group The UK government Although the new

landscape First Student collaborates with announced its contracts are

within which and First industry bodies to intention to bring expected

the Group Transit help anticipate the UK's current to be based on a

operates is constitutes the government rail franchising more appropriate

constantly majority of the policy or funding system to an end balance of risk

changing. Group's North regime changes in and replace it and reward, First

The Group's American order to adjust with a new rail Rail is a

operations business, as a operations, the contract model for proportionately

depend on result of which Group is an delivery of rail larger part of the

government there is a apolitical passenger Retained Group and

policy, funding reduction in the organization and service by private therefore the

regimes and operational and does not have the operators. See future

infrastructure geographical ability to control pages 22-24 for performance of the

initiatives diversity of the or substantially additional ongoing Group will

continuing to ongoing Group. influence information on be intrinsically

support private The ongoing government policy. the termination aligned with

company Group is sum agreements of successful

operators in therefore more The Group has been the pre-existing negotiations of

public dependent on the able to mitigate franchising new rail contracts

transportation. performance of, supply chain contracts and and continued

Inability to and revenue disruptions by details of the government

maintain rail from, its UK utilising newly negotiated support.

contracts and/ divisions (i.e. mechanical National

or leverage First Bus and parts from vehicles Rail Contracts

national First Rail). As not in use due to (NRC).

funding and a result, decreased demand Additionally, the

develop changes in levels as a result UK government also

government government of the pandemic. announced new

partnerships policies, infrastructure

may result in funding regimes investments,

the reduction and including c. £3bn

and/or an infrastructure to transform bus

elimination of initiatives in services across

rail contracts the UK have a the country

and/or an greater overall providing the

inability to impact on the Group with new

sustain and ongoing Group. opportunities to

develop new bus grow the First Bus

routes division.

resulting in

adverse

financial

impacts.

Group

operations are

also dependent

on obtaining

the necessary

mechanical

pieces to

maintain our

fleets. Changes

in the

political

landscape may

have supply

chain

implications

and decrease

the number of

vehicles

available to

support demand.

Strategic Risks

Contracted

business

The Group's With the sale of The new contract The transition With the sale of

contracted First Student structure will be from franchising First Student and

businesses are and First concession-based to contracts will First Transit,

dependent on Transit, the with performance lead to a better First Rail is a

the ability to ongoing Group incentives balance of risk proportionally

secure and has less resulting in a far and reward via greater part of

renew contracts geographic better balance of reduced revenue the ongoing Group.

on profitable diversity and risk and reward. As risk, Although this

terms, comply therefore is the largest minimal cost and results in a less

with contract more dependent incumbent with contingent capital diverse portfolio,

terms and avoid on the four UK rail risk, and will the new National

termination. performance of operations expected provide more Rail Contract

Additionally, the UK to be in place consistent cash structure provides

the ability of divisions; until at least generation each a strong base

the Group to however, the new 2023, we have the year. As the business for the

achieve National Rail extensive largest ongoing Group and

performance Contracts will operational incumbent the provides

targets is provide the expertise needed to Group has the opportunities to

dependent ongoing Group meet new contract operational build on that

on our ability with a performance structure and foundation with no

to exceed consistent incentives. expertise to revenue risk and

passenger single-digit We have dedicated exceed limited cost risk.

performance margin, more departments that passenger

metrics laid cash generation, focus on DfT performance

out in rail and overall negotiations and targets and to

contracts. greater ensure that build on our base

resilience. future commitments business with no

Failure to do These contracts to UK rail will revenue risk.

so would result have low cost, have an appropriate

in reduced contingent balance of

revenue and capital and potential risks and

profitability revenue risk. rewards for

and / or shareholders.

negative

impact on

delivering the

Group's

strategic

objectives.

Competition and

emerging

technologies

The Group's The sale of To meet our goal to Low fuel prices Due to the sale of

market share First Student be the partner of and changes in First Student and

and and First choice for our demand for public First Transit the

competitiveness Transit allows customers' transportation ongoing Group has

is dependent on the ongoing transport due to the increased

effectively Group to further solutions, pandemic have led capacity to

competing in focus we continue to to reduced strategically

areas of on our digital focus on service passenger volumes. focus innovation

pricing and innovation, quality and Although the efforts on markets

service enhance business delivery in order lasting impact to within the UK,

options. Our efficiency and to attract commuting particularly in

success is also flexibility, and passengers behaviours and left behind towns

dependent on target and other customers consumer travel and cities where

identifying and opportunities in to our portfolio of demand continues public

developing adjacent markets businesses. We are to be unknown, the transportation,

innovative and geographies. leaders in the Group saw specifically

offerings in operation and passenger buses, are

line with the maintenance of volumes reach c60% integral to

Group's goal to electric and of pre-pandemic meeting the UK

be the autonomous levels in some Government's

partner of vehicles, and we areas during the economic growth

choice for our continue to invest most recent agenda.

customers' in the technology lockdown easement.

transport and services to

solutions, support connected The Group has

accelerating and on-demand continued to

the transition travel, including invest in emerging

to a zero Mobility as a technologies this

carbon world. Service (MaaS). year, including

Our main autonomous and

competitors The Group also electric vehicles,

include the continues to have a and services to

private car and dedicated support connected

other cross-divisional and on-demand

transportation consumer experience travel, including

service team who help mobility as a

providers (e.g. implement service (MaaS).

ride share, innovative customer

price convenience We continue to

comparison solutions (e.g. increase the

websites, real-time seat number of low and

etc.). capacity, zero emission

Airline contactless and vehicles operating

competition capped ticketing, in our road and

also impacts smart tickets, 5G/ rail fleets, and

demand for bus Wi-Fi, data driven to focus on

and rail pricing) which providing easy and

travel, focus on improving convenient

especially in access to our mobility,

Greyhound's services and our encouraging the

long-haul overall service to switch from

business. Zero customers. private car

emission and journeys to our

emerging The Group has also services.

technologies identified

such expansion

as autonomous opportunities in

vehicles and adjacent markets

on-demand and new

schemes provide geographies to

opportunities support the

to grow and expansion of public

develop our transport

market throughout the UK.

segments. The

Group may also Wherever possible

begin to the Group works

experience more with local and

competitors for national bodies to

rail contracts promote

as a result of measures aimed at

the decreased increasing demand

contingent for public

capital transport and the

requirements of other services that

the National we offer.

Rail Contract

structure.

Failure to

effectively

compete in the

market and/or

develop new and

innovative

options could

result in

decreased

customer

retention,

decreased

demand and/or

adverse

financial and

reputational

impacts.

Operational

Risks

Financial

resources

As set out in The sale of The Group monitors As a result of The Group will

further detail First Student our leverage ratios varying passenger apply the net

in note 25 to and First and overall demand proceeds from the

the financial Transit allows liquidity throughout the sale to discharge

statements on us to consistently to fiscal year, the certain long-term

pages 192-197, significantly ensure we Group secured liabilities,

treasury risks reduce the level remain within our additional funding including the £

include of debt for the target range and to support 300m CCFF loan.

liquidity ongoing Group have adequate liquidity during Additionally, c£

risks, risks and also financial resources the pandemic. 100m pro

arising from includes a cash on a two to three Additionally, we forma net debt

changes to reserve to year look forward. secured covenant position to be

foreign provide adequate amendments for retained to

exchange financial Although the both our March and ensure the ongoing

and interest resources until completion of the September 2021 Group has adequate

rates and fuel end markets sale of First testing dates. The financial

price risk. begin to emerge Student and First Group has resources

from the Transit decreases continued with our available while UK

Liquidity risk pandemic. the ongoing Group's strategy to sell end markets begin

includes the revenue stream, S&P First Student and to emerge from the

risk that the While the sale Global Ratings and First Transit in pandemic over and

Company is provides Fitch currently order to invest above the

unable to significant debt rate us as and focus on our estimated

refinance debt decreases and investment grade UK divisions which short-term capital

as it becomes working capital and we do not are less needs. As a

due. Foreign reserves, it anticipate a susceptible to result, the

currency and also decreases reduction in our impacts from ongoing Group has

interest rate the Group's ability to secure passenger demand a

movements may revenue streams credit, including and will provide significantly

impact the and may impact the targeted debt us strong cash de-risked balance

profits, the ongoing facilities. In the generation and sheet and strong

balance sheet Group's event the ongoing liquidity in financial position

and cash flows ability to Group did not future. to unlock growth

of the Group. obtain credit obtain the targeted in our target

Ineffective when the ongoing debt facilities we markets.

hedging Group targets have additional

arrangements new debt capacity within our

may not fully facilities. current financial

mitigate losses structures to

or may increase continue our strong

them. financial

positions, such as

The Group is extending our 2022

credit rated by bonds.

S&P Global

Ratings and

Fitch. A

downgrade in

the Group's

credit ratings

to below

current

investment

grade may lead

to increased

financing costs

and other

consequences

and affect the

Group's ability

to invest in

its operations

Pandemic

The pandemic The Group is To adapt our While the Group With the sale of

has altered the committed to the operations to has implemented First Student and

way in which health and impacts resulting safeguards across First Transit, the

the Group safety of our from the pandemic our fleet to ongoing Group is

operates and employees, the Group has prevent less susceptible

how we serve customers and implemented new further spread of to changes in

our others with policies and the pandemic, consumer

communities. which we do procedures across guidance regarding commuting

Our success business. With all vehicle fleets. the methods of behaviour and

depends on the sale of These policies and spread and demand.

continuing to First Student procedures include effective

anticipate and and First providing personal containment

adapt to Transit, the protective procedures

changes in ongoing Group is equipment to continue to

consumer less susceptible drivers and develop.

commuting and to changes in technicians,

travel consumer increased These methods and

behaviours, community sanitation and procedures are

implementing behaviour and appropriate social further impacted

safeguards to demand. The new distancing by the new

prevent spread National Rail requirements. The variants

and complying Contracts Group complies with of the coronavirus

with new laws include a all applicable developing

and regulations management fee public health throughout

relating to the that is not authority guidance, the world,

pandemic. dependent on include the use of including in the

demand and face coverings UK. This changing

Failure to within First Bus where mandated. knowledge could

balance we have the continue to

operational ability to Additionally, affect the ways in

changes whilst adjust and during 2020 the which we must

also change Group fast-tracked adjust our

implementing schedules in implementation of operations to

appropriate order to adapt real-time seating protect the safety

safeguards and to changing capacity on our Bus of our

procedures to demand patterns. app to support customers,

prevent social distancing employees and

additional requirements. third parties

spread of the who interact with

pandemic and Under the new our business.

promote National Rail

containment may Contracts First

result in Rail will not

adverse experience revenue

reputational or risk as a

financial result of decreased

impacts. demand, except for

in our Hull Trains

open access

service. Our other

divisions, have a

greater risk of

loss caused by

decreased demand.

While First Bus saw

passenger volumes

increase to c.60%

of pre-pandemic

levels during the

most recent

lockdown easement,

to adapt our

operations to

potential changes

in commuting and

travel behaviour,

the division has

dedicated teams to

assess and

monitor workforce

and route planning.

The dedicated teams

use advanced data

analytics that

provide an

efficient way to

adjust schedules.

Once end markets

have emerged from

the pandemic, the

Group also has

plans ready

to reshape routes

and timelines to

align with observed

demand. The actions

taken via

these plans will be

based on real-time

passenger flow data

now available

following digital

transformation

initiatives.

Safety

The Group is Safety is one of In order to promote Although the Group In relation to the

committed to the Group's core and maintain our continues to sale of First

fostering and values and the culture of safety, assess, update and Student and

maintaining a sale of First all divisions have implement safety First Transit, as

culture of Student and extensive safety procedures across previously stated

safety. First Transit plans and safety our businesses, the legal climate

However, public has no impact on training for our risk mitigation in in North America

transport our unwavering drivers and this area continues to

inherently commitment to employees. Points continues to be a deliver judgements

includes safety safety. Despite of access to focus. Even disproportionately

related risks, our commitment vehicles are with this in favour of

many of which to safety, we secured to prevent attention, the plaintiffs. While

are out of our recognise that, against malicious legal climate in the Group has

control. These regretably, access. Mechanical North America, legal claim risk

risks include incidents and safety controls particularly in in the UK, the

terrorism, legal claims do (speed monitoring, the US, continues ongoing Group's

adverse occur. As North cameras, etc.) are to deliver overall insurance

weather, human America has a implemented across judgements which risk has

error and higher degree of our fleet of are decreased.

increased litigious vehicles. disproportionately Although the

traffic / activity, the in favour of ongoing Group's

congestion on sale of First While the Group has plaintiffs, and at insurance risk has

public Student and implemented times decreased, the

roadways. A First preventative safety unpredictable. ongoing Group also

safety Transit reduces measures and has less

incident, or a the Group's procedures, we Additionally, the geographical

threat of an liability recognise that extent to which diversity to

incident, insurance risk incidents may be the claims offset

could lead to and associated caused by factors environment may be any decrease in

reduced public costs. Although that are ultimately impacted by demand following a

confidence in the ongoing out of our control the effects of the terrorist attack

public Group will and do at times pandemic is not and / or safety

transportation continue to result in legal yet clear. incident within

overall and operate in North claims. As a the UK.

potentially America via the result, the Group

reduce demand Greyhound has dedicated

for our division, a departments,

services. portion of the utilising third

sale proceeds party experts when

has been needed, to analyse

retained to and maintain

de-risk any effective insurance

remaining structures and

self-insurance levels.

requirements.

Whilst the sale

of First Student

and First

Transit reduces

the ongoing

Group's

insurance risk,

it also reduces

our geographical

diversity. In

the event of a

terrorist

attack and / or

safety incident

within the UK,

the Group may

experience a

decrease in

demand which

will not be

offset by stable

demand within

the US.

Pension scheme

funding

The Group Following the In order to The Group has Following the sale

sponsors or sale of First effectively monitor closed most of its of First Student

participates in Student and our funding defined benefit and First Transit,

several First Transit, requirements, all schemes in its a portion of the

significant the ongoing our cash models/ road divisions to net disposal

defined benefit Group continues forecasts future accrual. proceeds was used

pension to include significant This will lead to to materially

schemes, be responsible pension deficit the natural improve pension

primarily in for all pension funding. The Group reduction of the scheme funding and

the UK. Within plans other than also utilises third size and thereby

our North those relating party experts volatility of the decrease our

American to the sold to monitor pension funding overall funding

subsidiaries, divisions for movements in risk over time. risk.

we participate which the discount rates and

in several liability has inflation Through our

multi-employer transferred as expectations. membership of the

pension schemes part of the Rail Delivery

in which our sale. We continue to Group we are

contributions replace our defined engaged in an

are pooled with Although the benefit schemes industry-wide

the Group used some with defined project to

contributions of the net contribution consider the

of other disposal arrangements where long-term funding

contributing proceeds to possible. We are model for the

employers. improve pension also focusing on Railways Pension

In both schemes scheme funding, diversifying asset Scheme.

the Group's the ongoing classes and

future cash Group's ability reallocating

contributions to contribute to riskier investments

and funding the Pension to investments that

requirements Schemes on an better match the

are dependent ongoing basis characteristics of

on investment will be the liabilities as

performance, dependent on the funding levels

movements in profits of a improve.

discounts less diversified

rates, business with a Under the First

expectations of reduced Rail franchise

future operating cash arrangements, the

inflation and flow, in Group's train

life particular, in operating companies

expectancy. relation to the are not responsible

Within North First UK Bus for any residual

America, Pension Scheme. deficit at the end

funding of the of a franchise so

schemes is also there is only

reliant on the short-term cash

ongoing flow risk within

participation any particular

by the other franchise.

contributing

employers. The Group intends

to use £337m of the

In order to net disposal

maintain proceeds to

adequate cash contribute to the

funding and Bus and Group

prevent adverse pension schemes.

financial Additionally, the

impacts increase in funding

or reputational levels allows for

damage, the greater flexibility

Group must for the management

monitor the of the pension

performance of liabilities

our fund including buy-ins

investments and and further

movements in liability hedging.

other

contributing

factors (e.g.

discount rates,

life

expectancy,

etc.).

Data security

and consumer

privacy,

including

cyber-security

The Group The Group is To protect our Despite the The sale of First

continues to committed to customers' data and Group's continued Student and First

see an increase protecting the comply with all mitigation Transit has no

of mobile and privacy and data privacy efforts, the risk impact to the risk

internet sales personal data of regulations, IT of a cyber change during

across all our customers, infrastructure security attack the year.

divisions. employees and controls have been for all companies

These mobile others with implemented continues to

and internet which we do Group-wide. We also increase. This

channels gather business. The have dedicated risk has been

large amounts sale of First compliance officers additionally

of data which Student and in each division. impacted by the

require First Transit The Group also increase of a

safeguards in has no impact on administers a remote workforce

order to our commitment training during the

protect our to protect our programme to all pandemic.

customers' data consumers' data employees,

and to comply and our business communicating their

with the systems against role in protecting

General Data security and preventing

Protection breaches and / the unauthorised

Regulation or comply with access to sensitive

(GDPR) and all GDPR and data. Additionally,

California CCPA in order to comply

Consumer regulations. with user

Privacy Act preferences, the

(CCPA). Whilst Group is

this data implementing a

requires software solution

compliance with that makes it

consumer easier to record

privacy and update customer

regulations, it preferences.

also makes us a

target of data

security

attacks by

third parties.

In addition to

maintaining

infrastructures

that protect

our consumers'

data, our

operations rely

on information

technology

systems.

Cyber-attacks,

computer

malware,

viruses,

spamming and

phishing

attacks have

become more

prevalent and

may result in a

breach of our

systems. A

breach of our

facilities and

/ or network

could disrupt

our operations

and impair our

ability to

protect

consumer data,

and / or

compromise our

confidential

business

information.

A failure to

prevent,

mitigate or

detect security

breaches and /

or improper

access to our

business and /

or customer's

information and

/ or comply

with consumer

privacy

regulations

could result in

disruption to

our operations,

significant

penalties and

have an adverse

impact on

consumer

confidence in

the Group.

Regulatory

compliance

The Group's The Group is To help the Group Although our The sale of First

operations are dedicated to comply with all legislative and Student and First

subject to a maintaining legislation and regulatory Transit has no

wide range of compliance with regulations, we environment impact to the risk

legislation and the regulatory have dedicated continues to change during the

regulation. environment compliance change, the year.

Complying with within which it professionals who Group maintains

such works and the ensure applicable our commitment to

legislation and sale of First laws by locality assess and adapt

regulations may Student and and state are not only our

increase the First Transit followed. We also insurance

Group's has no impact on engage with third structure but also

operating our commitment party legal experts our policies and

costs, and to comply with when necessary to procedures to

non-compliance our regulatory advise on policies prevent

could lead to requirements. and procedures and non-compliance.

financial other related

penalties, compliance matters.

investigation We also provide a

expenses, hotline for

legal costs or employees and third

reputational parties to report

damage. The concerns.

Group's

corporate Whilst we strive to

governance, maintain compliance

which is within the

recognised by regulatory

external ESG environment, we

ratings as also maintain

strong and well insurance for third

aligned with party injury claims

stakeholder arising from

interests, vehicle and general

supports our operations,

ability to employee injuries

respond to, and and property

prepare for, damage.

financial and

ESG laws To help mitigate

and non-compliance risk

regulations. with anti-bribery

and anti-trust

The main regulations we

regulatory maintain robust

compliance policies and

risks specific procedures and our

to the Group employees receive

that are not regular training on

covered the policies. We

in other also complete

principal risks periodic audits of

include our training

workplace programmes to

compliance ensure consistent

(employee wage training and

and hour, meal participation.

and break

matters, etc.),

workplace

health and

safety and

anti-trust/

anti-bribery

regulations.

Human resources

Employee costs The attraction, In order to The lasting impact With the sale of

represent the development, increase retention the pandemic will First Student and

largest retention, and decrease have on the labour First Transit, the

component of reputation and employee costs, the market and ongoing Group has

the Group's succession of Group has enhanced employee reduced

operating senior recruitment work conditions in size and

costs. These management and practices, continues to includes a less

costs include individuals with including develop and will diverse portfolio

expenses key skills are leveraging online require the Group which, if combined

related to critical factors channels for all to assess and with any negative

recruitment, in the roles. The Group adapt our publicity

retention and successful also has operations in the associated with

talent execution of the implemented all future. the sale, may

development. Group's necessary Additionally, impact the ongoing

The costs are strategy, and coronavirus-related employee and Group's

impacted by operation of the safety protocols to community ability to attract

changes in Group's support the health expectations and retain

employment divisions. and safety of our continue to impact employees.

markets, new drivers and our recruitment,

regulatory The reduction in technicians. retention,

requirements size and diversity and

from Brexit and diversification In response to development

diversity and of the ongoing Brexit employment strategies.

inclusion Group following regulations, we

programmes. A the sale of have secured

failure to First Student Sponsorship Status

effectively and First and are in the

recruit and Transit may make process of

retain a it more implementing new

diverse and difficult for employment record

talented the Group to requirements to

workforce could attract and comply with

have adverse retain regulations.

financial, employees.

reputational To help prevent

and operational overall employee

impacts. turnover, we

continue to focus

Our driver and on improving

technician communication with

employment employees,

market has been investing in

affected by the employee

pandemic development and

which has diversity and

increased our inclusion, and

recruitment and providing market

retention costs competitive wages

and may impact and benefits.

operations

as consumer

travel demand

increases. Our

employee

turnover rate

may also be

impacted by

Brexit

employment

regulations and

the

announcement of

the intent to

sell the North

American

businesses.

END

(END) Dow Jones Newswires

August 11, 2021 10:10 ET (14:10 GMT)

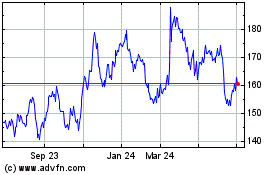

Firstgroup (LSE:FGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

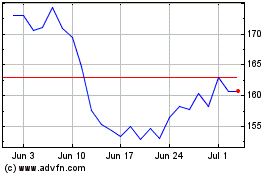

Firstgroup (LSE:FGP)

Historical Stock Chart

From Apr 2023 to Apr 2024