Ferguson PLC Share repurchase program (7389M)

January 16 2023 - 2:00AM

UK Regulatory

TIDMFERG

RNS Number : 7389M

Ferguson PLC

16 January 2023

January 16, 2023

FERGUSON PLC

Share repurchase program

Ferguson plc (the "Company") announces that, in continuation of

its $2.5 billion share repurchase program (the "Program"), it has

entered into a non-discretionary arrangement with its brokers J.P.

Morgan Securities PLC and J.P. Morgan Securities LLC (together,

"JPMS") commencing from January 16, 2023 and ending no later than

March 20, 2023. JPMS, an independent third party, will make trading

decisions concerning the timing of the purchases of the Company's

shares independently of the Company. JPMS will carry out the

instruction through the acquisition by JPMS, as principal for

resale to, or agent on behalf of, the Company, of ordinary shares

in the Company. JPMS may undertake transactions in shares (which

may include sales and hedging activities, in addition to purchases

which may take place on any available trading venue or on an over

the counter basis) during the period of this tranche of the Program

in order to manage its market exposure under this tranche of the

Program. Disclosure of such transactions will not be made by JPMS

as a result of or as part of this tranche of the Program, but JPMS

will continue to make any disclosures it is otherwise legally

required to make.

The maximum pecuniary amount allocated to this tranche of the

Program is GBP145 million. The value of shares repurchased by the

Company under the Program pursuant to the various arrangements

entered into with its brokers will not, in aggregate, exceed

US$2,500 million.

The Company's shareholders generally authorized the Company to

purchase up to a maximum of 20,845,062 of its ordinary shares at

its Annual General Meeting held on November 30, 2022. Pursuant to

such authority, the Company intends to continue purchasing shares

under the Program. The aggregate number of shares acquired under

such authority by the Company pursuant to the Program shall not

exceed the maximum number of shares which the Company is authorized

to purchase pursuant to such general authority. It is intended that

any shares repurchased under the Program will be transferred into

treasury.

The purpose of the Program is to reduce the capital of the

Company. To the extent required, the Company may in the future use

the repurchased shares to satisfy share awards. Any purchases of

shares by the Company in relation to this tranche of the Program

will be carried out on the London Stock Exchange and/or the New

York Stock Exchange (in accordance with the terms of the

arrangement entered into with JPMS) and in accordance with (and

subject to the limits prescribed by) the Company's general

authority to repurchase shares granted by its shareholders, the

Market Abuse Regulation 596/2014 (as it forms part of UK law

pursuant to the European Union (Withdrawal) Act 2018), Rule 10b5-1

and Rule 10b-18 under the U.S. Securities Exchange Act of 1934, as

amended.

For further information please contact

Ferguson plc

Brian Lantz, Vice President IR and +1 224 285

Communications Mobile: 2410

Pete Kennedy, Director of Investor +1 757 603

Relations Mobile: 0111

Media Inquiries

John Pappas, Director of Financial +1 484 790

Communications Mobile: 2727

About Ferguson plc

Ferguson plc (NYSE: FERG; LSE: FERG) is a leading value-added

distributor in North America providing expertise, solutions and

products from infrastructure, plumbing and appliances to HVAC,

fire, fabrication and more. We exist to make our customers' complex

projects simple, successful and sustainable. Ferguson is

headquartered in the U.K., with its operations and associates

solely focused on North America and managed from Newport News,

Virginia. For more information, please visit

http://www.corporate.ferguson.com or follow us on LinkedIn

https://www.linkedin.com/company/ferguson-enterprises.

Cautionary note regarding forward-looking statements

Certain information in this announcement is forward-looking

within the meaning of the United States Private Securities

Litigation Reform Act of 1995, including with relation to our share

repurchase program and its purpose and timetable. Forward-looking

statements cover all matters which are not historical facts and

speak only as of the date on which they are made. Forward-looking

statements can be identified by the use of forward-looking

terminology such as "will," "intend," or other variations or

comparable terminology. Many factors could cause actual results to

differ materially from those in such forward-looking statements,

including, but not limited to: risks associated with the relocation

of our primary listing to the US and any volatility in our share

price and shareholder base in connection therewith; weakness in the

economy, market trends, uncertainty and other conditions in the

markets in which we operate, and other factors beyond our control,

including any macroeconomic or other consequences of the current

conflict in Ukraine; failure to rapidly identify or effectively

respond to direct and/or end customers' wants, expectations or

trends, including costs and potential problems associated with new

or upgraded information technology systems; adverse impacts caused

by the COVID-19 pandemic (or related variants); unsuccessful

execution of our operational strategies; and the risks and

uncertainties set forth in our Form 10-K filed with the Securities

and Exchange Commission ("SEC") on September 27, 2022, under the

heading "Risk Factors," and in other documents we furnish to or

file with the SEC in the future. Forward-looking statements

regarding past trends or activities should not be taken as a

representation that such trends or activities will continue in the

future. Other than in accordance with our legal or regulatory

obligations we undertake no obligation to update publicly or revise

any forward-looking statement, whether as a result of new

information, future events or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSBRGDBSXBDGXX

(END) Dow Jones Newswires

January 16, 2023 02:00 ET (07:00 GMT)

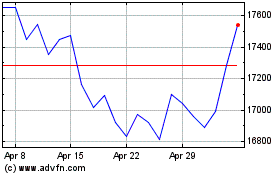

Ferguson (LSE:FERG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ferguson (LSE:FERG)

Historical Stock Chart

From Apr 2023 to Apr 2024