TIDMEUA

RNS Number : 3566M

Eurasia Mining PLC

16 September 2019

Eurasia Mining plc (AIM: EUA)

("Eurasia" or the "Company")

Senior management team appointment

Eurasia Mining PLC, the palladium, platinum, rhodium, iridium

and gold producing company, is pleased to announce that it has

appointed Mr. Alexei Churakov as a Strategic Advisor to the board

of the Company (the "Board"). Mr. Churakov is a former Goldman

Sachs and Morgan Stanley senior investment banker specialized in

the mining sector. He has been involved in multiple mining

cross-border M&A transactions operating from Moscow, London and

New York. Alexei brings his extensive experience in mining M&A

to the Company, as well as his top level contacts with major

international and Russian mining and trading companies operating in

the platinum group metals, gold and base metals sectors including

Lesego Platinum, Boliden Group, Gold Fields, Glencore

International, Sumitomo Corporation, Norilsk Nickel, Polyus Gold,

Polymetal International, Ural Mining and Metallurgical Company,

Russian Platinum and many others.

Highlights:

In his capacity as an adviser:

-- Mr. Churakov has assisted in negotiations with Sinosteel

helping structure the EPCF contract to include a $50m subcontract

through which Sinosteel provides CJSC Terskaya Mining Company

(TGK), a Eurasia's subsidiary developing the Monchetundra project,

with the start-up financing. The first payments comprising $26.5m

from the $50m subcontract will allow Eurasia to finance its

obligations under the EPCF contract with Sinosteel without

shareholder dilution and make the Monchetundra project

self-financed.

-- Mr. Churakov has assisted in developing the West Kytlim

phased production increase strategy involving both Eurasia's own

team and its contractors. Under his guidance, the team has designed

a new and extensive project development programme, with the

specific objectives of reaching stable and sustainable growth as

measured by mine output alongside reserve and resource upgrade

programmes at the West Kytlim Mine. Eurasia has, today, also

acquired its own enrichment plant from West Kytlim's operating free

cash flow and will continue producing hereafter on an owner

operator basis with 100% of mine revenue payable to the

Eurasia.

-- Mr. Churakov has recently helped arrange detailed due

diligence and multi-day visits to both Monchetundra mine and

Eurasia's office in Ekaterinburg to study the West Kytlim project

by James Nieuwenhuys, CEO and Director of Lesego Platinum, a South

African PGM company developing a c 50M ounce project in the Eastern

limb of the Bushveld Complex, as part of Lesego Platinum's due

diligence of both the Monchetundra and West Kytlim projects.

Further details of which are set out below.

-- Mainly for his assistance with Lesego Platinum and to ensure

Mr. Churakov's motivation without further dilution of Eurasia

shareholders, Mr. Dmitry Suschov has transferred 25.472% of the

share capital of DELOAN INVESTMENTS LIMITED ("Deloan") (a company

beneficially owned and controlled by Mr. Dmitry Suschov) to VENUS

GARDEN HOLDINGS LIMITED a company beneficially owned and controlled

by Mr. Churakov for a nominal consideration with effect from today.

Deloan holds a substantial shareholding in Eurasia.

Christian Schaffalitzky, Chairman at Eurasia, commented: "We are

grateful to Mr. Churakov for his contribution to developments at

the West Kytlim mine, which as of next season will be operated

without contactors, and on arranging the purchase of the enrichment

plant. We are also delighted that Mr. Churakov has taken a role as

Strategic Advisor to the Company and brings both his extensive

mining M&A experience along with his top level contacts with

mining companies including South African Lesego Platinum. We are

grateful to our long-term Director Mr. Dmitry Suschov for providing

a motivation package to Mr. Churakov while at the same time keeping

the existing shareholders intact. We are working on further

strengthening our Company with both international experts and top

mining executives. In addition, acquiring a washplant to commence

and continue mining on a 100% of revenue basis is a significant

development for the Company. We now have a very well established

team at site with the necessary skills and experience to ensure a

successful operation through the rest of the 2019 season and to

ensure timely commencement of mining in 2020.".

Details on Mr. Churakov's role in Sinosteel deal structuring

Since 2014, Mr. Churakov has advised the board in talks with

Sinosteel helping structure the EPCF contract with the $50m

subcontract agreement between Sinosteel and Eurasia's subsidiary

TGK. The first payments comprising $26.5m under this subcontract

will allow Eurasia to fulfil its obligations under the EPCF

contract without shareholder dilution and make the Monchetundra

project self-financed. As per the originally signed Sinosteel EPCF

contract (see RNS date 10 October 2016), one of the conditions

precedent to be fulfilled by Eurasia Mining before Sinosteel

commences construction works was the upfront payment of 15% of the

EPCF contract value by the Company. The structure of Eurasia's

contractual relations with Sinosteel fulfils the abovementioned

pre-requisite. Another important condition precedent, which is also

now fulfilled, is the production license that was successfully

received by TGK at the end of last year, as announced on 20

November 2018.

Mr. Churakov's role in West Kytlim phased mine development

Mr. Churakov has advised the board in developing a coherent and

comprehensive strategy to achieve sustainable growth at the West

Kytlim Mine. Following the successful launch of the industrial

production of PGMs (palladium, platinum, iridium and rhodium) and

gold in 2018, the team has developed a detailed West Kytlim

development programme to convert all C2 class reserves (according

to the Russian classification) into C1 class reserves with the aim

to allow the Company to become fully prepared for stable production

growth from 2020 onwards. The development programme also includes

dedicated measures intended at conversion of the considerable P

category resources into C2+C1 class reserves - this is expected to

further increase the West Kytlim project capitalisation and

intrinsic value of the asset.

2019 production summary to date

The above mentioned development programme, as well as the

automation and a number of upgrades to the flowsheet at West Kytlim

aimed at improving metal recovery, has impacted initial 2019

production volumes. Production commenced in mid-May and production

volumes, to date, are standing at a total of c.55kg (c. 1,770 oz)

raw platinum.

From the next season Eurasia's own in-house team will manage

production at the mine site, having purchased the necessary

equipment including the enrichment plant. This major development

increases Eurasia's share in top line platinum sales from 30-35% to

100% and the Directors expect to see a concurrent increase in the

profit margin at West Kytlim, which the directors believe sits

towards the bottom of the global platinum production cost curve.

Platinum, palladium, iridium, rhodium and gold prices have seen

recent gains - platinum is today trading 21.5% higher than at this

point in the production season last year ($950/oz versus $792/oz on

14(th) Sept 2018, source Kitco.com). Acquiring the enrichment plant

from the operating free cash flow ensures a smooth transition to

further production next year. Mining is expected to continue until

the close of the 2019 season.

Lesego Platinum due diligence and CEO site visits of both

Monchetundra and West Kytlim

Mr. Churakov has recently helped to arrange detailed due

diligence and multi-day site visits by James Nieuwenhuys, CEO and

Director of Lesego Platinum as part of the Lesego Platinum's

evaluation of both Monchetundra and West Kytlim projects. Over the

past few months Lesego Platinum performed due diligence of

Eurasia's assets accompanied by several days of visits of

Monchetundra mine and Eurasia's office in Ekaterinburg to study the

West Kytlim mine.

Over the course of the site visit, Lesego Platinum studied and

evaluated infrastructure availability and logistics access, drill

core samples, results of laboratory test works along with other

information and raw data, which form the ground for assessment of

both Monchetundra and West Kytlim projects to consider, amongst

other options, potential partial acquisition of Eurasia's

subsidiaries and joint venture opportunities at the sites. Despite

the synergies and the motivations of Lesego Platinum, there can be

no guarantee that any transaction will occur. Further updates will

be provided in due course including the potential of James

Nieuwenhuys joining Eurasia's board if these matters progress. This

appointment is subject to customary approvals, amongst other

things, due diligence on James Nieuwenhuys, contracts and Nomad

checks. Further updates will also be provided on this if it

progresses.

Lesego Platinum owns, what the Directors' rate as a world class

PGM assets located some 300 km North-East of Johannesburg, at the

northern end of the Eastern limb of the platinum rich Bushveld

Complex. James Nieuwenhuys, its CEO and Director, has significant

experience in Russia including 5 years as Chief Operating Officer

for Polyus Gold, the largest gold producer in Russia and held

Managing Director positions in two of the most active EPC

organizations, being Bateman Projects and SNC-Lavalin.

Mr. Churakov's motivation

Mainly for his assistance with Lesego Platinum to ensure Mr.

Churakov's motivation and to avoid dilution of the other

shareholders of Eurasia, Mr. Dmitry Suschov has agreed to transfer

25.472% of the share capital of Deloan Investments Limited, a

company beneficially owned and controlled by Mr. Suschov and

holding 275,377,066 shares in the Company (11.07% of issued share

capital) to a company beneficially owned and controlled by Mr.

Churakov for a nominal consideration. Accordingly Mr Churakov is

deemed to have an indirect interest in Eurasia shares through this

holding.

Please see our website, Vimeo channel and Twitter feed for

further updates;

www.eurasiamining.co.uk

https://twitter.com/eurasiamining

https://vimeo.com/user71951711

Enquiries:

Eurasia Mining PLC Tel: +44 (0)207 932 0418

Christian Schaffalitzky / Keith

Byrne

WH Ireland Limited (Nominated Adviser Tel: +44 (0)161 832 2174

& Broker)

Katy Mitchell / James Sinclair-Ford

First Equity Limited (Joint Broker) Tel: +44 (0)20 7374 2212

Jason Robertson

Optiva Securities (Joint Broker)

Christian Dennis

Tel: +44 (0) 20 3137 1902

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKNDBOBKDQCD

(END) Dow Jones Newswires

September 16, 2019 02:00 ET (06:00 GMT)

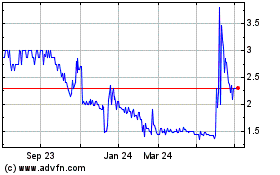

Eurasia Mining (LSE:EUA)

Historical Stock Chart

From Mar 2024 to Apr 2024

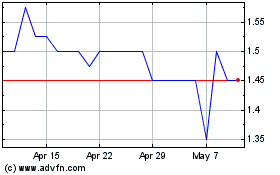

Eurasia Mining (LSE:EUA)

Historical Stock Chart

From Apr 2023 to Apr 2024