Edenville Energy PLC Rukwa Coal Project - Update (8910Y)

May 14 2019 - 2:01AM

UK Regulatory

TIDMEDL

RNS Number : 8910Y

Edenville Energy PLC

14 May 2019

14 May 2019

EDENVILLE ENERGY PLC

("Edenville" or the "Company")

Rukwa Coal Project - Update

Edenville Energy Plc (AIM: EDL), the AIM quoted company

developing the Rukwa coal project in southwest Tanzania (the

"Project"), is pleased to provide an update with respect to its

current and targeted operations for the remainder of 2019.

As announced on 1 April 2019, following the limited take up of

the Open Offer, the Company was forced to constrain operations in

order to maintain capital whilst an alternate funding scenario was

secured. This funding solution was provided through the Firm

Placing to raise GBP100,000 and Conditional Placing to raise a

further GBP410,000 as announced on 29 April 2019. With the Firm

Placing proceeds now received and the net proceeds from the

Conditional Placing expected shortly, subject to shareholder

approval at the General Meeting to be held on 17 May 2019, the

Company has recommenced activities as follows.

Plant

The Company has utilised the period of limited production to

further optimise the plant and facilities. The recalibration of

parts of the plant, orders of additional low capex items and

reorganisation of the workforce is under way and all upgrades are

expected to be completed by the end of June 2019. These are in

addition to the plant upgrades such as the installation of the

Lamella water treatment plant and the introduction of a

pre-screening plant, that have taken place over the last six months

and were summarised in the announcement of 29 April 2019.

Upon completion of this optimisation process, the Company

expects to eliminate the previous issues that had hindered the

throughput and operational capacity of the plant, thereby enabling

the plant to reach its targeted initial production capacity of

10,000 tonnes of washed coal per month. Total capital investment in

these recent upgrades is expected to be less than US$50,000 and the

Company's Directors believe this investment should enhance the

future performance of the Project.

Mining Operations

The Company has commenced site preparations for road

construction to the new mining area, to the north of current

operations. Upon completion of road construction, the Company

intends to open up this new pit and commence extracting coal from

it before the end of Q3 2019. Prior to opening the northern mining

area, the Company plans to continue to mine the existing pit to

build up stockpiles and supply to existing customers.

Sales (Washed Coal)

In recent times Edenville has only achieved modest levels of

production and as such the inventory of washed coal has been

exhausted. The Company has been able to sell all the washed coal it

has produced to date and believes the current contracts which are

in place for circa 8,000 tonnes per month in aggregate, will be

able to be satisfied from opening up the northern mining area.

From recent enquiries received the Company believes there is a

potential broader market for in excess of 10,000 tonnes of washed

coal per month. As the stockpiles build following the restart of

operations, the Company will recommence sales to its existing

client base and will continue to target additional orders from new

and existing customers.

Sales (Fine Coal)

The Company's Directors believe the Project will become cashflow

positive at a steady rate of 6,000 tonnes per month of washed coal

sales. The fine coal is effectively produced as a by-product and to

that end Edenville is continuing discussions with its previously

outlined buyers of fine coal.

Other opportunities available to Edenville with regards to sales

of fine coal are also being assessed. These include briquetting or

the introduction of secondary processing to beneficiate the coal

and improve the calorific value, thereby enhancing the desirability

of the product. Although this would require additional capital

expenditure, the Company believes this to be modest with a short

payback period. The Company's Directors expect to be able to fund

any upgrades to infrastructure from free cash flow from future

mining operations.

Power

Whilst Edenville's primary focus is to turn the Project cash

flow positive within the next 12 months through the sale of washed

and fine coal, the Company is continuing discussions relating to

power generation. As announced on 21 September 2016 an independent

feasibility study provided for an NPV of US$252 million and an IRR

of 23% on a 120MW coal-to-power project.

As reported on 14 February 2019, Edenville's Request for

Qualification, submitted to Tanzania Electric Supply Company

("Tanesco") in Q4 2018, has been rejected at this stage. However,

discussions with Tanesco continue to ascertain the rationale for

this decision and the Company continues to explore alternatives to

the initial terms proposed. The Directors believe an integrated

approach to development of the coal-to-power project in parallel

with the roll out of electricity transmission infrastructure in the

region is the preferred route forward.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

For further information please contact:

Edenville Energy Plc

Jeff Malaihollo - Chairman

Rufus Short - CEO +44 (0) 20 3934 6630

SP Angel Corporate Finance LLP

(Nominated Adviser and Joint

Broker)

David Hignell

Jamie Spotswood

Abigail Wayne +44 (0) 20 3470 0470

Brandon Hill Capital Ltd

(Joint Broker)

Oliver Stansfield, Jonathan Evans +44 20 7936 5200

IFC Advisory Limited

(Financial PR and IR)

Tim Metcalfe

Graham Herring

Heather Armstrong +44 (0) 20 3934 6630

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLGGUPPAUPBPUW

(END) Dow Jones Newswires

May 14, 2019 02:01 ET (06:01 GMT)

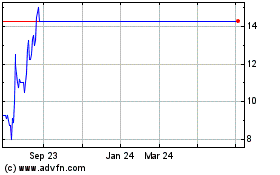

Edenville Energy (LSE:EDL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edenville Energy (LSE:EDL)

Historical Stock Chart

From Apr 2023 to Apr 2024