Dukemount Capital PLC Completion of Purchase of Energy Generation Sites (8780N)

October 04 2021 - 2:19AM

UK Regulatory

TIDMDKE

RNS Number : 8780N

Dukemount Capital PLC

04 October 2021

Dukemount Capital Plc 4th October 2021

Dukemount Capital Plc

("Dukemount" or the "Company")

Completion of Purchase of two RTB energy generation sites with a

total output of 10MW, Issue of Equity and Registered Office Address

Change

Dukemount, the property management and long dated income

specialist, is pleased to announce that HSKB Limited ("HSKB"), in

which it holds a 50% interest, has successfully completed the

purchase of two special purpose companies. Each company contains an

11kV gas peaking facility, which are ready to build, with full

planning permission and grid access. HSKB has also changed its name

to DKE Flexible Energy Limited ("DKE Energy").

As previously announced, DKE Energy will initially build two gas

peaking facilities. Dukemount will manage the construction of the

two sites and provide its knowledge of long-dated income funding

and finance to optimize the capital structure. DKE Energy's

management brings its technical, operational and market expertise

of the UK flexible power market, as well as access to a pipeline of

further deals. Dukemount believes the opportunities presented by

this joint venture to be an important milestone for Dukemount to

meet its projected growth targets.

Dukemount is set to rollout further joint venture projects with

a focus on gas peaking and battery storage facilities. Both asset

types balance the fluctuating power requirements of the grid during

periods of high-level demand or shortfalls of electricity supply: a

problem which is set to become more acute in the transition to a

greater reliance on renewable energy sources. Dukemount is

therefore looking for further potential joint venture partners, for

a potential pipeline up to 100MW reaching value of approximately

GBP100m.

Issue of Equity

Further to its announcement of 15 September 2021 regarding the

signing of the subordinated funding package necessary to enable

completion of the senior debt funding for the gas peaking projects,

Dukemount has issued 15,119,442 ordinary shares ("New Shares") at a

subscription price of 0.3077 pence per ordinary share (being 93% of

the lowest daily VWAP of the last 10 Trading Days (being VWAP of

0.3308 pence reported on 13 September 2021) in settlement of the

implementation fees arising under such funding package.

When issued, the New Shares will be credited as fully paid and

will rank pari passu in all respects with the existing ordinary

shares in the share capital of the Company, including the right to

receive all dividends and other distributions declared, made or

paid on or in respect of such shares after the date of issue of the

New Shares.

Application will be made to the Financial Conduct Authority

("FCA") for admission of the New Shares to the standard listing

segment of the Official List and to the London Stock Exchange (the

"LSE") for admission to trading of the New Shares on the LSE's main

market for listed securities (together "Admission"). It is expected

that Admission will take place at 8 a.m. on or around 6 October

2021 and that dealings in the New Shares on the LSE's main market

for listed securities will commence at the same time.

Total Voting Rights

The Company does not hold any ordinary shares in treasury.

Therefore, following Admission, the total number of voting rights

in Dukemount Capital plc is 513,535,974. This figure may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change in their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules.

Registered Office Address Change

Dukemount announces that it has changed its registered office

address to: 70 Jermyn Street, St James's, London, SW1Y 6NY with

effect from 1 October 2021.

Market Abuse Regulation (MAR) disclosure

Certain statements in this announcement contain inside

information for the purpose of Article 7 of EU Regulation

596/2014.

For further information, please visit www.dukemountcapitalplc.com or contact:

Dukemount Capital Plc

Geoffrey Dart / Paul Gazzard

Media Enquries

Miriad Media, Zak Mir Tel: +44 (0)7867 527 659

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DOCGZMGGVDDGMZG

(END) Dow Jones Newswires

October 04, 2021 02:19 ET (06:19 GMT)

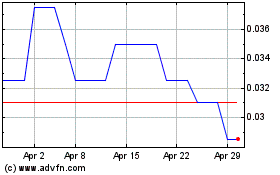

Dukemount Capital (LSE:DKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dukemount Capital (LSE:DKE)

Historical Stock Chart

From Apr 2023 to Apr 2024