TIDMCRS

RNS Number : 0989R

Crystal Amber Fund Limited

04 March 2021

4 March 2021

Crystal Amber Fund Limited

Interim results for the six months ended 31 December 2020

The Company announces its unaudited interim results for the six

months ended 31 December 2020.

Key Points

-- Net Asset Value ("NAV") (1) per share grew by 21.7% over the period to 129 pence per share.

-- The Fund's NAV per share growth compares to a 24.3% increase in the Numis Small Cap Index.

-- Successful completion of the turnaround plan at De La Rue plc.

-- Share price discount to NAV averaged 25.5% throughout the

period falling to 21.3% at 31 December 2020 as the Fund accelerated

its buy-back programme.

-- During the period, GBP6.2 million was allocated to share

buy-backs, acquiring 7.6 million shares at an average of 82.2 pence

per share.

-- An interim dividend of 2.5 pence per share was declared on 23

December 2020, which was paid on 5 February 2021 to shareholders on

the register on 8 January 2021.

For further enquiries please contact:

Crystal Amber Fund Limited

Christopher Waldron (Chairman) Tel: 01481 742

742

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner Tel: 020 3328

5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford Tel: 020 3100

0160

Crystal Amber Advisers (UK) LLP - Investment

Adviser

Richard Bernstein Tel: 020 7478

9080

(1) All capitalised terms are defined in the Glossary of

Capitalised Defined Terms unless separately defined.

Chairman's Statement

During the period from 30 June 2020 to 31 December 2020, net

asset value grew from GBP97.4 million (106 pence per share) to an

unaudited NAV of GBP108.9 million (129 pence per share). The Fund's

NAV per share performance over the six months to 31 December 2020

of 21.7%, compares to a 24.3% increase in the Numis Small Cap Index

in the same period.

The period under review saw ongoing uncertainty from the

COVID-19 pandemic, as well as final Brexit negotiations. The latter

adversely affected the appetite of global investors for UK stocks,

specifically small and medium sized companies, as well as the

appetite of corporate acquirers for attractively priced targets.

However, this has left many UK companies significantly undervalued

by international standards and if the UK's rapid vaccination

programme does translate into earlier economic recovery, we would

expect a re-rating of UK equities and fresh corporate activity.

As previously stated, the Board remains mindful that activist

investing requires a focussed portfolio, which inevitably increases

the concentration risk. During the period, there were no

significant changes in the composition of the Fund's core holdings.

The Fund's strategy and activist approach of patient engagement

remained consistent over the period. As described in the Investment

Manager's Report, there were important developments in several of

the Fund's core positions. Recent operational improvements are now

starting to be reflected in recovering share prices. This should

augur well for performance of the Fund as a whole.

The Fund continued its discount management policy through share

buy-backs. In October 2020, Invesco Perpetual sold its 20%

shareholding in the Fund, removing a longstanding stock overhang.

During the six months to 31 December 2020, 7,566,567 shares were

acquired by the Fund at an average price of 82.20 pence per share.

The share price discount to NAV averaged 25.5% throughout the

period and closed the period at a discount of 21.3%. During the

period, GBP6.2 million was allocated to share buy-backs. In

December, the Fund declared an interim dividend of 2.5 pence per

share, equivalent to GBP2.1 million.

The Fund's concentrated portfolio is well placed to benefit from

the anticipated economic recovery. Its past actions, most notably

the essential management changes at De La Rue plc propagated by the

Fund, have begun to bear fruit. Combined with other important

changes that the Fund has implemented within the portfolio,

including driving investee companies to take advantage of

structural shifts in the digital economy, including blockchain

technologies, the Board is confident of continued growth in

NAV.

Christopher Waldron

Chairman

3 March 2021

Investment Manager's Report

Strategy and Performance

During the period, the Fund achieved a considerable number of

positive changes in its major holdings. At 31 December 2020, equity

investments in 12 companies represented 99% of NAV. Three of those

are unlisted. The Fund also held a loan note in one of those

companies, GI Dynamics Inc. The Fund's net debt and accruals

position was GBP3.8 million, funded by a loan facility. The Fund's

top four holdings represented 82.9% of NAV.

During the period, the Fund exited STV Group and Redde Northgate

plc, realising a GBP9.4 million loss on the latter. The proceeds

from the sale of Redde Northgate plc were allocated to the share

buy-back programme. The Fund sold part of its investment in Board

Intelligence Ltd, realising a gain of GBP1.8 million. The Fund also

participated in De La Rue's fundraising at 110 pence per share and

continued to support GI Dynamics Inc., investing $5 million during

the period. The position in Allied Minds plc was reduced following

a near doubling of the share price after a period of share price

weakness in the spring of 2020, during which the Fund had increased

its holding.

The table below lists the top ten holdings as at 31 December

2020:

Pence per share Percentage of investee equity held

Ten largest shareholdings

------------------------------------ ---------------- -----------------------------------

De La Rue plc** 58.6 15.1%

Allied Minds plc** 19.1 20.5%

Equals Group plc 15.2 25.7%

GI Dynamics Inc. * 14.0 *

Hurricane Energy plc 6.6 11.2%

Board Intelligence Ltd* 4.6 *

Sutton Harbour Group plc 3.0 10.8%

Camellia plc** 2.5 1.1%

Kenmare Resources plc** 2.0 0.5%

Leaf Clean Energy Co* 1.6 *

Total of ten largest shareholdings 127.2

Other investments 5.4

Loan facility (3.8)

Cash and accruals 0.2

------------------------------------ ----------------

Total NAV 129.0

------------------------------------ ----------------

* Board Intelligence Ltd, GI Dynamics Inc. and Leaf Clean Energy

Co are private companies and their shares are not listed on a stock

exchange. Therefore, the percentage held is not disclosed.

**Within the percentage of investee company held in Allied Minds

plc and De La Rue plc, contracts for difference were held amounting

to 3.0% and 2.1%, respectively, of such holdings. The holdings in

Camellia plc and Kenmare Resources plc are also held on contracts

for difference.

Investee companies

Our comments on some of our principal investments are as

follows:

De La Rue plc ("De La Rue")

In July 2020, De La Rue completed its GBP100 million equity

fundraise, which was priced at 110 pence per share. The Fund

participated in the firm placing and open offer elements of the

raise. The company now has an almost debt-free balance sheet, a

vastly improved pension funding schedule, bank facilities extended

until December 2023 and, most significantly, a fully funded

turnaround plan.

The company's interim results in November 2020 and trading

update in January 2021 confirm that the company's turnaround plan

is proceeding well. The Fund continues to believe that De La Rue

enjoys a combination of strong competitive positions in high return

businesses and attractive growth opportunities. It holds a 30%

market share of global commercial banknote printing, which enables

the Currency division to accelerate and fully capitalise on the

structural shift towards polymer notes. The higher margin

Authentication division is forecasted to generate revenues for the

year to March 2022 of GBP100 million as against GBP68.5 million for

the year to March 2020.

Aside from its market positioning as the global market share

leader in banknote printing, De La Rue is well placed to deliver

significant earnings growth from its proprietary technology in both

security and authentication. Whilst COVID-19 immunity certification

is a fast-evolving situation, De La Rue is in discussions with

governments to provide solutions. Separately, De La Rue is

exploring the potential to use blockchain technology.

The Fund believes that De La Rue's current equity valuation is

significantly mispriced. At ten times calendar 2021 forecast

earnings, the Fund believes that the valuation fails to reflect

either its growth prospects or its operational upside. The Fund

strongly believes that its strategic value is far in excess of its

current market capitalisation.

Allied Minds plc ("Allied Minds")

Following its initial investment in the fourth quarter of 2018,

the Fund focused on securing a major reduction in excessive parent

company costs: ongoing HQ expenses were running at an estimated

US$17-20 million per annum at that time. These have now been

reduced to approximately $5.75 million per annum. In response to

concerted pressure exerted by the Fund, Allied Minds ended its

extraordinary practice of paying management 10% of gains arising

from any successful individual investment, without taking account

of the losses incurred on other investments in the portfolio.

In October 2020, Allied Minds released its interim results and

referred to the "underlying strength of the portfolio". Spin Memory

was described as "the preeminent MRAM IP provider [...]

transforming the semiconductor industry". Reassuringly, it was

stated that "Spin Memory has made significant progress against its

key operational objectives since its last funding round". Allied

Minds' 43% shareholding in Spin Memory was valued at $77 million

based on that last funding round. This compares with its $44

million cash cost since 2006. In July 2020, Allied Minds invested a

further $4 million in Spin Memory bringing the carrying value to

around 35% of the company's net asset value. Despite this, Spin

Memory still remains a "pre-revenue" business after 15 years.

Following this update, the Fund held detailed discussions with

the board of Allied Minds and expressed its concerns.

On 4 January 2021, Allied Minds announced that due to COVID-19,

the required testing of Spin Memory's chip had been delayed for

nearly nine months and this delay had affected Spin Memory's

ability to secure new customers. As a result, and coupled with an

unexpected loss of a government bid in late Q4 2020, Spin Memory is

now facing liquidity issues. The Fund expects the contemplated

funding round to be carried out at a far lower valuation than its

carrying value.

On 15 January 2021, Allied Minds announced that its Chief

Executive had "decided to step down from the board with immediate

effect". Going forward, the portfolio will be managed by the three

non-executive directors. The Fund welcomes the streamlined

management of the portfolio, in which three companies comprise more

than 90% of the latest reported carrying value.

The Fund notes that the current 28 pence per share price

compares with an estimated 26 pence per share carrying value of the

36.6% holding in Federated Wireless together with parent company

cash of 6 pence per share. Holdings in BridgeComm, Orbital

Sidekicks, TableUp and Spark Insights are together valued at 12

pence per share. Whilst there is uncertainty as to the current

value of the Spin Memory holding, the Fund estimates that at least

5 pence per share could be achievable. Overall, therefore, the

share price would have to increase by 75% to reach the Fund's

estimated net asset value of Allied Minds.

The Fund expects the Allied Minds' board to proactively seek to

realise the inherent value of the portfolio in a timely manner and

return proceeds to shareholders. It should be open to any structure

that could achieve this objective including, if considered

appropriate, reversing Federated Wireless into a Special Purpose

Acquisition Company (SPAC).

Equals Group ("Equals")

As an e-banking and international payment services provider

serving both retail and business customers mainly in the United

Kingdom under an e-money licence, Equals is well placed to benefit

from the structural shift in digital payments. Whilst Equals

provides faster, cheaper and more convenient money management than

traditional banking services, its payments platforms should be

capable of being repositioned to enable its one million customers

to access the latest evolving blockchain technologies and/or

products. The Fund regards last week's announcement as the first

step in Equals' journey to incorporate decentralised finance

("DeFi") accessibility.

Equals ended the period under review in a far better position

than at the start. Revenues for the year to December 2020 were

GBP29 million, just 6% lower than the prior year. Given Equals'

original focus on travel money, this was a creditable outcome. The

business also achieved cash breakeven and an improved net cash

position of GBP8 million.

The Fund believes that with a market capitalisation of GBP61

million and with the shares trading on a current year enterprise

value to revenue of just 1.5, the valuation fails to reflect both

its customer relationships and its digital and DeFi prospects.

GI Dynamics Inc ("GI Dynamics")

COVID-19 has placed the need to tackle Type 2 diabetes and

obesity at the top of the public health agenda. These two

conditions are key contributors to mortality outcomes in COVID-19

patients. GI Dynamics, with its EndoBarrier, brings a proven

treatment that can meet a large unmet clinical need.

During the period under review, the Fund was instrumental in the

recruitment of a new Chief Executive and the appointment of a new

board of directors with strong, relevant experience gained from

working formerly at Medtronic and Boston Scientific.

GI Dynamics is concentrating its focus in three areas. Firstly,

CE Mark certification, which will enable the company to quickly

deliver meaningful revenues. Secondly, enrolment for its FDA

approved clinical trial. Thirdly, to initiate enrolment in its

agreed pivotal trial in India, with its joint venture partner,

Sanofi backed, Apollo Sugar.

The pandemic has inevitably affected the pace of the regulatory

process and patient enrolment, but the CE Mark regulatory review is

due to complete in May 2021. As soon as COVID-19 restrictions are

eased, GI Dynamics intends to restart enrolment for its US clinical

trial. GI Dynamics' application for a joint trial with Apollo Sugar

has now been submitted for regulatory approval.

The Fund is encouraged that in recent weeks, it has received two

unsolicited approaches from third parties interested in partnering

and/or investing in GI Dynamics. Whilst these discussions are at an

early stage, they demonstrate the recent progress that has been

made.

In July 2020, GI Dynamics delisted from the Australian Stock

Exchange. Later this year, the Fund intends to assess the relative

merits for GI Dynamics to list either on the London Stock Exchange,

via a US listed SPAC or via a NASDAQ listing.

Hurricane Energy plc ("Hurricane")

The Fund has been a shareholder in Hurricane since March 2013.

In April 2016, Hurricane asked the Fund to invest GBP7 million to

enable it to commence its workstream. Six months later, when

Hurricane raised additional capital, the Fund invested GBP12.6

million at 34 pence per share. In the mishandled fundraise of June

2017, the Fund invested a further $10 million.

Aside from Kerogen Capital, which until recently was represented

on Hurricane's board, the Fund is Hurricane's largest shareholder

and the only disclosable institutional shareholder. Following last

year's oil price collapse, the Fund added to its shareholding and

currently owns more than 11% of its share capital.

The Fund regards itself as a long-term part owner of Hurricane.

In 2015, the Fund introduced Hurricane to its highly regarded

technical consultants who have engaged constructively with the

company on several occasions. The Fund believes that since 2013, it

has done everything possible to support the business.

Over the last six months, the Fund has experienced a dramatic

deterioration in the way that Hurricane is engaging with the Fund.

This is consistent with what the Fund considers to be inadequate,

confusing and poor messaging to market participants.

Within its regulatory news service announcement of 11 September

2020, Hurricane stated that it would be "engaging with all our key

stakeholders regarding our formal work programme and financial

arrangements and updating the market". On 8 October 2020, Hurricane

stated that "as disclosed in the interim results announcement, the

Company intends to engage with all key stakeholders regarding its

forward work programme, capital allocation and financing

arrangements". During September and October 2020, the Fund

suggested, following discussions with other Hurricane shareholders,

that it should allocate a portion of its cash to buy in some of the

Hurricane loan notes at below 50% of par value. The Chairman of

Hurricane had previously told the Fund that he regarded such a

purchase as "a commercial no brainer". No update on bond purchases

or capital allocation has been provided to the Fund or the

market.

On 18 December 2020, the Chief Executive of Hurricane told the

Fund that he would ask Hurricane's lawyers if, given that there had

been no covenant breaches and repayment was more than 18 months

away, bond holder consent would be required before the company

could enter into financial commitments on its forward workstream

and capital allocation. He said that he would revert back to the

Fund. The Fund followed up in writing on this point on 8, 13, 26,

27 and 30 January 2021. On 31 January 2021, the Chief Executive

responded to say that they had been advised to "be engaging with

the bond holders". There was no answer to the question as to

whether consent would be required.

On 8 January 2021, the Fund shared its updated technical report

with Hurricane. This stated why the Fund and its consultants

believe that the board of Hurricane does not seem to be focusing on

the upside potential of the fractured basement play within

Hurricane's licences. The Fund sought an explanation as to why

Hurricane was not keen to tie back the existing Lincoln Crestal

well which was reported to have tested at a sustained commercial

rate. Production from Lincoln could significantly increase overall

output with minimal pressure drawdown at Lancaster. The Fund

believes that the Lancaster basement play may contain resources

greatly in excess of the pool currently being developed by the

Lancaster EPS.

At the date of this report, the Fund has not been provided with

any explanation. On 14 February 2021, the Fund wrote to Hurricane

requesting a call between Hurricane and its technical consultants.

Despite follow up by the Fund, Hurricane has failed to arrange such

a call.

On 14 February 2021, the Fund wrote to the Chief Executive of

Hurricane requesting that Crystal Amber nominates a director to the

board of Hurricane. Other than responding to note that the request

had been shared with the board of Hurricane, the Fund has received

no response to this request.

On 2 March 2021, Hurricane stated that within its stakeholder

engagement, "discussions on the Company's formal work programme,

strategy, financing and balance sheet recapitalisation are

ongoing". As described above, the Fund has had no such discussions

with Hurricane,

The Fund notes that the seven board members of Hurricane own

shares with a total value of GBP60,000.

The Fund is no longer prepared to be excluded from participating

in the evaluation of impending critical decisions by those who have

virtually no skin in the game. The Fund always prefers to engage

privately and constructively with its investee companies. However,

the Fund has found the board of Hurricane to be both indecisive and

obstructive. Therefore, it now intends to take appropriate action

in order to maximise Hurricane's potential.

A trading update in January 2021 highlighted how cash generation

has recently improved as a result of the recovery in the oil price,

with the company generating $19 million in the month of December

2020 alone, taking cash to $106 million. The Fund notes that the

price of Brent crude has recently continued its strong recovery,

from $38 per barrel in October 2020 to more than $60 a barrel. The

Fund believes that in 2021, this increase alone should add more

than $100 million in cash to Hurricane. It should also

significantly increase the value of Hurricane's other, hitherto,

untapped resources if this level is maintained.

Leaf Clean Energy Company ("Leaf")

Leaf delisted in January 2020, following the return of proceeds

from the sale of its interest in Invenergy. The company is in the

process of completing tax returns for submission to the Internal

Revenue Service in connection with capital gains tax applicable to

the sale. Leaf issued an update to shareholders advising of the

expected timescales of this process and the quantum of the return.

Accordingly, the holding in Leaf has been revalued by the Fund to

reflect these expectations.

Hedging activity

The Fund did not engage in hedging activity during the

period.

Realisations

Over the period, the Fund realised losses of GBP9.1 million.

These relate mainly to the exit of Redde Northgate plc, which

realised a loss of GBP9.4 million. A partial exit from Board

Intelligence Ltd realised a gain of GBP1.8 million.

Outlook

Both during the period under review and since, the Fund has

worked closely and intensely with its portfolio companies.

Prospects at De La Rue are better than at any time during the

Fund's presence on its register. The Fund has succeeded in ensuring

that Allied Minds is now solely focused on realisations and returns

of capital in a timely manner. As the largest shareholder in

Equals, the Fund has not only been a key driver in its improved

operational focus but in its recent strategic repositioning to

capitalise on exciting opportunities within decentralised finance.

At GI Dynamics, the Fund has transformed the board and its

available skill set.

Crystal Amber Asset Management (Guernsey) Limited

3 March 2021

Condensed Statement of Profit or Loss and Other Comprehensive

Income (Unaudited)

For the six months ended 31 December 2020

Six months ended 31 December Six months ended 31 December

2020 2019

(Unaudited) (Unaudited)

Revenue Capital Total Revenue Capital Total

Notes GBP GBP GBP GBP GBP GBP

Income

Dividend income from

listed investments 269,645 - 269,645 3,187,696 - 3,187,696

Interest received - - - 2,846 - 2,846

------------ ------------ ---------- ------------- -------------

269,645 - 269,645 3,190,542 - 3,190,542

Net gains/(losses) on

financial assets

designated at FVTPL and

derivatives held for

trading:

Equities

Net realised

(losses)/gains 4 - (3,000,627) (3,000,627) - 6,436,556 6,436,556

Movement in unrealised

losses 4 - 30,709,787 30,709,787 - (61,257,939) (61,257,939)

Debt instruments

Movement in unrealised

gains 4 - 3,171,912 3,171,912 - 102,503 102,503

Derivative financial

instruments

Net realised losses 4 - (6,114,887) (6,114,887) - (1,159,632) (1,159,632)

Movement in unrealised

(losses)/gains 4 - (3,908,027) (3,908,027) - (6,503,873) (6,503,873)

- 20,858,158 20,858,158 - (62,382,385) (62,382,385)

------------ ------------ ------------ ---------- ------------- -------------

Total income/(expense) 269,645 20,858,158 21,127,803 3,190,542 (62,382,385) (59,191,843)

------------ ------------ ------------ ---------- ------------- -------------

Expenses

Transaction costs - 29,234 29,234 - 330,788 330,788

Exchange movements on

revaluation of

investments and

working capital 528,477 1,511,639 2,040,116 134,996 607,773 742,769

Management fees 10 737,204 - 737,204 1,628,161 - 1,628,161

Directors' remuneration 65,000 - 65,000 78,804 - 78,804

Administration fees 67,424 - 67,424 114,150 - 114,150

Custodian fees 30,297 - 30,297 50,808 - 50,808

Audit fees 17,550 - 17,550 14,100 - 14,100

Facility fees 6 265,941 - 265,941 - - -

Other expenses 161,344 - 161,344 184,918 - 184,918

------------ ------------ ---------- ------------- -------------

1,873,237 1,540,873 3,414,110 2,205,937 938,561 3,144,498

------------

(Loss)/return for the

period (1,603,592) 19,317,285 17,713,693 984,605 (63,320,946) (62,336,341)

============ ============ ============ ========== ============= =============

Basic and diluted

(loss)/earnings per

share (pence) 2 (1.80) 21.65 19.85 1.04 (66.88) (65.84)

============ ============ ============ ========== ============= =============

All items in the above statement derive from continuing

operations.

The total column of this statement represents the Company's

Statement of Profit or Loss and Other Comprehensive Income prepared

in accordance with IFRS. The supplementary information on the

allocation between revenue return and capital return is presented

under guidance published by the AIC.

The Notes to the Unaudited Condensed Financial Statements form

an integral part of these Interim Financial Statements.

Condensed Statement of Financial Position (Unaudited)

As at 31 December 2020

As at As at As at

31 December 30 June 31 December

2020 2020 2019

(Unaudited) (Audited) (Unaudited)

Assets Notes GBP GBP GBP

Cash and cash equivalents 237,957 5,916,155 818,969

Trade and other receivables 151,334 2,610,053 471,068

Financial assets designated at FVTPL and derivatives held

for trading 4 111,889,639 89,066,925 169,258,239

Total assets 112,278,930 97,593,133 170,548,276

------------- ------------- -------------

Liabilities

Trade and other payables 182,898 198,172 2,653,945

Loan facility 6 3,205,825 - -

Total liabilities 3,388,723 198,172 2,653,945

------------- ------------- -------------

Equity

Capital and reserves attributable to the Company's equity

shareholders

Share capital 7 997,498 996,248 994,998

Treasury shares reserve 8 (18,485,298) (12,265,601) (10,711,341)

Distributable reserve 90,579,709 90,579,709 90,579,708

Retained earnings 35,798,298 18,084,605 87,030,966

Total equity 108,890,207 97,394,961 167,894,331

------------- ------------- -------------

Total liabilities and equity 112,278,930 97,593,133 170,548,276

------------- ------------- -------------

NAV per share (pence) 3 128.99 106.02 179.21

============= ============= =============

The Interim Financial Statements were approved by the Board of

Directors and authorised for issue on 3 March 2021.

Christopher Waldron Jane Le Maitre

Chairman Director

3 March 2021 3 March 2021

The Notes to the Unaudited Condensed Financial Statements form

an integral part of these Interim Financial Statements.

Condensed Statement of Changes in Equity (Unaudited)

For the six months ended 31 December 2020

Treasury

Share shares Distributable Retained earnings Total

Capital reserve Reserve Capital Revenue Total Equity

Notes GBP GBP GBP GBP GBP GBP GBP

Opening

balance at 1

July 2020 996,248 (12,265,601) 90,579,709 20,511,896 (2,427,291) 18,084,605 97,394,961

Issue of

Ordinary

shares 7 1,250 - - - - - 1,250

Purchase of

Ordinary

shares into

Treasury 8 - (6,219,697) - - - - (6,219,697)

Return for the

period - - - 19,317,285 (1,603,592) 17,713,693 17,713,693

Balance at 31

December 2020 997,498 (18,485,298) 90,579,709 39,829,181 (4,030,883) 35,798,298 108,890,207

======== ============= ============== =========== ============ =========== ============

For the six months ended 31 December 2019

Treasury

Share shares Distributable Retained earnings Total

Capital reserve Reserve Capital Revenue Total Equity

Notes GBP GBP GBP GBP GBP GBP GBP

Opening

balance

at 1 July

2019 993,748 (6,895,640) 95,310,182 152,452,180 (3,084,873) 149,367,307 238,775,597

Issue of

Ordinary

shares 7 1,250 - - - - - 1,250

Purchase

of

Ordinary

shares

into

Treasury 8 - (3,815,701) - - - - (3,815,701)

Dividends

paid in

the

period - - (4,730,474) - - - (4,730,474)

Return for

the

period - - - (63,320,946) 984,605 (62,336,341) (62,336,341)

-------- ------------- -------------- ------------- ------------ ------------- -------------

Balance at

31

December

2019 994,998 (10,711,341) 90,579,708 89,131,234 (2,100,268) 87,030,966 167,894,331

======== ============= ============== ============= ============ ============= =============

The Notes to the Unaudited Condensed Financial Statements form

an integral part of these Interim Financial Statements.

Condensed Statement of Cash Flows (Unaudited)

For the six months ended 31 December 2020

Six months Six months

ended ended

31 December 31 December

2020 2019

(Unaudited) (Unaudited)

GBP GBP

Cash flows from operating activities

Dividend income received from listed equity investments 269,645 2,823,185

Bank interest received - 3,847

Management fees paid (737,204) (2,457,983)

Performance fee paid - (2,456,957)

Directors' fees paid (65,000) (82,500)

Other expenses paid (341,248) (432,972)

------------- -------------

Net cash outflow from operating activities (873,807) (2,603,380)

------------- -------------

Cash flows from investing activities

Purchase of equity investments (28,684,716) (45,498,009)

Sale of equity investments 50,502,804 55,148,758

Purchase of debt instruments (385,683) (1,827,410)

Sale of debt instruments - 1,892,069

Purchase of derivative financial instruments (32,222,870) (3,521,230)

Sale of derivative financial instruments 9,289,813 2,853,240

Transaction charges on purchase and sale of investments (22,169) (361,109)

------------- -------------

Net cash (outflow)/inflow from investing activities (1,522,821) 8,686,309

------------- -------------

Cash flows from financing activities

Proceeds from loan facility 12,370,000 -

Repayments of loan facility (9,439,633) -

Proceeds from issue of Ordinary Shares 1,250 1,250

Purchase of Ordinary shares into Treasury (6,213,187) (3,815,701)

Dividends paid - (2,381,424)

------------- -------------

Net cash outflow from financing activities (3,281,570) (6,195,875)

------------- -------------

Net decrease in cash and cash equivalents during the period (5,678,198) (112,946)

Cash and cash equivalents at beginning of period 5,916,155 931,915

Cash and cash equivalents at end of period 237,957 818,969

============= =============

The Notes to the Unaudited Condensed Financial Statements form

an integral part of these Interim Financial Statements.

Notes to the Unaudited Condensed Financial Statements

For the six months ended 31 December 2020

General Information

Crystal Amber Fund Limited (the "Company") was incorporated and

registered in Guernsey on 22 June 2007 and is governed in

accordance with the provisions of the Companies Law. The registered

office address is PO Box 286, Floor 2, Trafalgar Court, Les

Banques, St Peter Port, Guernsey, GY1 4LY. The Company was

established to provide shareholders with an attractive total return

which is expected to comprise primarily capital growth with the

potential for distributions of up to 5 pence per share per annum

following consideration of the accumulated retained earnings as

well as the unrealised gains and losses at that time. The Company

seeks to achieve this through investment in a concentrated

portfolio of undervalued companies, which are expected to be

predominantly, but not exclusively, listed or quoted on UK markets

and which have a typical market capitalisation of between GBP100

million and GBP1,000 million.

GI Dynamics Inc., is a subsidiary of the Company and was

incorporated in Delaware. As at 31 December 2020, it had five

wholly-owned subsidiaries and its principal place of business is

Boston. Refer to Note 10 for further information.

The Company's Ordinary shares were admitted to trading on AIM,

on 17 June 2008. The Company is also a member of the AIC.

All capitalised terms are defined in the Glossary of Capitalised

Defined Terms unless separately defined.

1. SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of

these Interim Financial Statements are set out below. These

policies have been consistently applied to those balances

considered material to the Interim Financial Statements throughout

the current period, unless otherwise stated.

Basis of preparation

The Interim Financial Statements have been prepared in

accordance with IAS 34, Interim Financial Reporting.

The Interim Financial Statements do not include all the

information and disclosures required in the Annual Financial

Statements and should be read in conjunction with the Company's

Annual Financial Statements for the year to 30 June 2020. The

Annual Financial Statements have been prepared in accordance with

IFRS.

The same accounting policies and methods of computation are

followed in the Interim Financial Statements as in the Annual

Financial Statements for the year ended 30 June 2020.

The presentation of the Interim Financial Statements is

consistent with the Annual Financial Statements. Where

presentational guidance set out in the SORP "Financial Statements

of Investment Trust Companies and Venture Capital Trusts" (issued

by the AIC in November 2014 and updated in February 2018 and

October 2019) is consistent with the requirements of IFRS, the

Directors have sought to prepare the Interim Financial Statements

on a basis compliant with the recommendations of the SORP. In

particular, supplementary information which analyses the Statement

of Profit or Loss and Other Comprehensive Income between items of a

revenue and capital nature has been presented alongside the total

Statement of Profit or Loss and Comprehensive Income.

Going concern

As at 31 December 2020, the Company had net assets of GBP108.9

million (30 June 2020: GBP97.4 million) and cash balances of GBP0.2

million (30 June 2020: GBP5.9 million) which are sufficient to meet

current obligations as they fall due.

In the period prior to 31 December 2020 and up to the date of

this report, the COVID-19 pandemic has continued to have a negative

impact on the global economy. As this situation is both

unprecedented and evolving, it raises some uncertainties and

additional risks for the Company.

The Directors and Investment Manager are actively monitoring the

potential effect on the Company and its investment portfolio. In

particular, they have considered the potential impact of the

following specific key matters:

-- Unavailability of key personnel at the Investment Manager or Administrator;

-- Increased volatility in the fair value of investments,

including any potential impairment in value; and

-- Increased uncertainty as to the timing and quantum of dividend receipts.

In considering the potential impact of COVID-19 on the Company

and its investment portfolio, the Directors have taken account of

the mitigation measures already in place. At Company level, key

personnel at the Investment Manager and Administrator have

successfully implemented business continuity plans to ensure

business disruption is minimised, including remote working where

required, and all staff are continuing to assume their day-today

responsibilities.

In relation to the Company's investment portfolio, 82% of the

Company's investments are valued by reference to the market bid

price as at the date of this report. As these are quoted prices in

an active market, any volatility in the global economy is therefore

reflected within the value of the financial assets designated at

fair value through profit or loss. As such, the Company has not

included any fair value impairments in relation to its

investments.

Based on the Board's assessment of those matters most likely to

be affected by COVID-19 and taking account of the various risk

mitigation measures already in place, the Directors do not consider

that the effects of COVID-19 are likely to create a material

uncertainty over the assessment of the Company as a going

concern.

On the basis of this review, and after making due enquiries,

including consideration of the continuation vote to

take place at the 2021 AGM (as noted below), the Directors have

a reasonable expectation that the Company has adequate resources to

continue in operational existence for at least 12 months from the

date of approval of this report. Accordingly, they continue to

adopt the going concern basis of accounting in preparing these

financial statements.

Continuation vote

The Company is subject to a continuation vote scheduled to occur

every two years. The next continuation vote will be proposed at the

2021 AGM and will require at least 75% of the votes cast in favour

to pass. In the event that the vote does not receive the required

75% of the votes cast, the Directors are required to formulate

proposals to be put to the shareholders to reorganise, reconstruct,

or wind up the Company.

Segmental reporting

Operating segments are reported in a manner consistent with

internal reporting provided to the chief operating decision maker.

The chief operating decision maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board as a whole. The key

measure of performance used by the Board to assess the Company's

performance and to allocate resources is the total return on the

Company's NAV, as calculated under IFRS, and therefore no

reconciliation is required between the measure of profit or loss

used by the Board and that contained in these Interim Financial

Statements.

For management purposes, the Company is domiciled in Guernsey

and is engaged in a single segment of business mainly in one

geographical area, being investment in UK equity instruments, and

therefore the Company has only one operating segment.

2. BASIC AND DILUTED EARNINGS/(LOSS) PER SHARE

Earnings/(loss) per share is based on the following data:

Six months Six months

ended ended

31 December 31 December

2020 2019

(Unaudited) (Unaudited)

Return/(loss) for the period GBP17,713,693 ( GBP 62,336,341)

Weighted average number of issued Ordinary shares 89,227,868 94,680,571

Basic and diluted earnings/(loss) per share (pence) 19.85 (65.84)

------------------------------------------------------ -------------- ------------------

3. NAV PER SHARE

NAV per share is based on the following data:

As at As at As at

31 December 30 June 31 December

2020 2020 2019

(Unaudited) (Audited) (Unaudited)

NAV per Condensed Statement of Financial

Position GBP108,890,207 GBP 97,394,961 GBP167,894,331

Total number of issued Ordinary shares

(excluding Treasury shares) 84,420,000 91,861,567 93,684,567

----------------------------------------------- ----------------------------- ---------------

NAV per share (pence) 128.99 106.02 179.21

----------------------------------------------- ----------------- ----------------------------- ---------------

4. FINANCIAL ASSETS DESIGNATED AT FAIR VALUE THROUGH PROFIT OR

LOSS AND DERIVATIVES HELD FOR TRADING

1 July 1 July 1 July

2020 to 2019 to 2019 to

31 December 30 June 31 December

2020 2020 2019

(Unaudited) (Audited) (Unaudited)

GBP GBP GBP

Equity investments 95,312,797 83,197,300 165,250,604

Debt instruments 3,645,619 5,848,545 4,002,635

---------------------------------------------------------- ----------------------- -------------- -------------

Financial assets designated at FVTPL 98,958,416 89,045,845 169,253,239

Derivative financial instruments held for trading 12,931,223 21,080 5,000

---------------------------------------------------------- -----------------------

Total financial assets designated at FVTPL and

derivatives held for trading 111,889,639 89,066,925 169,258,239

---------------------------------------------------------- ----------------------- -------------- -------------

Equity investments

Cost brought forward 167,187,388 183,283,825 183,283,825

Purchases 36,502,739 59,441,534 45,498,009

Sales (50,584,763) (77,221,490) (55,148,758)

Net realised (losses)/gains (3,000,627) 1,870,189 6,436,556

Adjustment to cost brought forward - (186,670) -

----------------------- --------------

Cost carried forward 150,104,737 167,187,388 180,069,632

---------------------------------------------------------- ----------------------- -------------

Unrealised (losses)/gains brought forward (84,056,730) 47,197,282 47,197,282

Movement in unrealised losses 30,709,787 (131,440,682) (61,257,939)

Adjustment to unrealised gains brought forward - 186,670 -

---------------------------------------------------------- ----------------------- -------------- -------------

Unrealised losses carried forward (53,346,943) (84,056,730) (14,060,657)

---------------------------------------------------------- ----------------------- -------------- -------------

Effect of exchange rate movements on revaluation (1,444,997) 66,642 (758,371)

---------------------------------------------------------- ----------------------- -------------- -------------

Fair value of equity investments 95,312,797 83,197,300 165,250,604

---------------------------------------------------------- ----------------------- -------------- -------------

Debt instruments

Cost brought forward 8,104,315 3,950,568 3,950,568

Purchases 4,056,625 4,153,747 -

Conversion of loans (8,902,986) - -

Cost carried forward 3,257,954 8,104,315 3,950,568

---------------------------------------------------------- ----------------------- -------------- -------------

Unrealised (losses)/gains brought forward (2,004,674) 660,939 968,535

Movement in unrealised gains/(losses) 3,171,912 (2,665,613) 102,503

---------------------------------------------------------- ----------------------- -------------- -------------

Unrealised gains/(losses) carried forward 1,167,238 (2,004,674) 1,071,038

---------------------------------------------------------- ----------------------- -------------- -------------

Effect of exchange rate movements on revaluation (779,573) (251,096) (1,018,971)

---------------------------------------------------------- -------------- -------------

Fair value of debt instruments 3,645,619 5,848,545 4,002,635

---------------------------------------------------------- ----------------------- -------------- -------------

Total financial assets designated at FVTPL 98,958,416 89,045,845 169,253,239

---------------------------------------------------------- ----------------------- -------------- -------------

Derivative financial instruments held for trading

Cost brought forward - 712,142 712,142

Purchases 32,222,870 6,237,568 3,521,230

Sales (9,289,813) (14,091,736) (2,853,240)

Net realised (losses)/gains (6,114,887) 7,142,026 (1,159,632)

---------------------------------------------------------- ----------------------- -------------- -------------

Cost carried forward 16,818,170 - 220,500

---------------------------------------------------------- ----------------------- -------------- -------------

Unrealised gains brought forward 21,080 6,288,373 6,288,373

Movement in unrealised (losses)/gains (3,908,027) (6,267,293) (6,503,873)

---------------------------------------------------------- ----------------------- -------------- -------------

Unrealised (losses)/gains carried forward (3,886,947) 21,080 (215,500)

---------------------------------------------------------- -------------- -------------

Fair value of derivatives held for trading 12,931,223 21,080 5,000

---------------------------------------------------------- ----------------------- -------------- -------------

Total financial assets designated at FVTPL and

derivatives held for trading 111,889,639 89,066,925 169,258,239

---------------------------------------------------------- ----------------------- -------------- -------------

The following table details the Company's positions in

derivative financial instruments:

Nominal amount Value

(Unaudited) (Unaudited)

31 December 2020 GBP

Derivative financial instruments

De La Rue plc - contracts for difference 3,998,312 6,717,164

Allied Minds plc - contracts for difference 7,320,182 2,379,059

Camellia plc - contracts for difference 30,000 2,130,000

Kenmare Resources plc - contracts for difference 550,000 1,705,000

11,898,494 12,931,223

-------------------------------------------------- --------------- ------------

Nominal amount Value

(Audited) (Audited)

30 June 2020 GBP

Derivative financial instruments

GI Dynamics Inc. warrant (Expiry: January 2025) 229,844,650 21,080

-------------------------------------------------- --------------- ------------

229,844,650 21,080

-------------------------------------------------- --------------- ------------

5. FINANCIAL INSTRUMENTS

Fair value measurements

The Company measures fair values using the following fair value

hierarchy that prioritises the inputs to valuation techniques used

to measure fair value. The hierarchy gives the highest priority to

unadjusted quoted prices in active markets for identical assets or

liabilities (Level 1 measurements) and the lowest priority to

unobservable inputs (Level 3 measurements). The three levels of the

fair value hierarchy under IFRS 13 are as follows:

Level 1: Quoted price (unadjusted) in an active market for an identical instrument.

Level 2: Valuation techniques based on observable inputs, either

directly (i.e. as prices) or indirectly (i.e. derived from prices).

This category includes instruments valued using: quoted prices in

active markets for similar instruments; quoted prices for identical

or similar instruments in markets that are considered less than

active; or other valuation techniques for which all significant

inputs are directly or indirectly observable from market data.

Level 3: Valuation techniques using significant unobservable

inputs. This category includes all instruments for which the

valuation technique includes inputs that are not based on

observable data, and the unobservable inputs have a significant

effect on the instrument's valuation. This category includes

instruments that are valued based on quoted prices for similar

instruments for which significant unobservable adjustments or

assumptions are required to reflect differences between the

instruments.

The level in the fair value hierarchy within which the fair

value measurement is categorised in its entirety is determined on

the basis of the lowest level input that is significant to the fair

value measurement. For this purpose, the significance of an input

is assessed against the fair value measurement in its entirety. If

a fair value measurement uses observable inputs that require

significant adjustment based on unobservable inputs, that

measurement is a Level 3 measurement. Assessing the significance of

a particular input to the fair value measurement in its entirety

requires judgement, considering factors specific to the asset or

liability.

The determination of what constitutes 'observable' requires

significant judgement by the Company. The Company considers

observable data to be that market data that is readily available,

regularly distributed or updated, reliable and verifiable, not

proprietary, and provided by independent sources that are actively

involved in the relevant market.

The objective of the valuation techniques used is to arrive at a

fair value measurement that reflects the price that would be

received if an asset was sold or a liability transferred in an

orderly transaction between market participants at the measurement

date.

The following tables analyse, within the fair value hierarchy,

the Company's financial assets measured at fair value at 31

December 2020 and 30 June 2020:

Level 1 Level 2 Level 3 Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

31 December

2020 GBP GBP GBP GBP

Financial

assets

designated

at FVTPL and

derivatives

held for

trading:

Equity

investments

- listed

equity

investments 78,265,999 - - 78,265,999

Equity

investments

- unlisted

equity

investments - - 17,046,798 17,046,798

Debt

instruments

- loan

notes - - 3,645,619 3,645,619

Derivatives

- contracts

for

difference

instruments 12,931,223 - - 12,931,223

91,197,222 - 20,692,417 111,889,639

------------- ------------------------------------------ ----------------------------- ----------------------------- -------------------------

Level 1 Level 2 Level 3 Total

(Audited) (Audited) (Audited) (Audited)

30 June 2020 GBP GBP GBP GBP

Financial assets designated at FVTPL and derivatives held for

trading:

Equities - listed equity investments 74,747,380 2,003,070 - 76,750,450

Equities - unlisted equity investments - - 6,446,850 6,446,850

Debt - loan notes - 610,415 5,238,130 5,848,545

Derivatives - warrant instruments - 21,080 - 21,080

74,747,380 2,634,565 11,684,980 89,066,925

----------------------------------------------------------------- ------------ ---------- ----------- ------------

The Level 1 equity investments were valued by reference to the

closing bid prices in each investee company on the reporting

date.

The Level 3 equity investment in Board Intelligence was valued

by reference to the valuation multiples of publicly-listed cloud

software companies, after applying a discount equivalent to that

which prevailed at the time of investment in March 2018. The Level

3 equity investment in Leaf Clean Energy Company was valued by

reference to the expected proceeds from the company's wind down, as

guided by management in its last shareholder letter. The Level 3

equity investment in GI Dynamics Inc was valued by reference to its

discounted cash flow valuation. The loan notes were classified as

Level 3 debt instruments as there was no observable market data.

The Board has concluded that the fair value of the loan note is

approximate to the loan principal plus accrued interest.

For financial instruments not measured at FVTPL, the carrying

amount is approximate to their fair value.

Fair value hierarchy - Level 3

The following table shows a reconciliation from the opening

balances to the closing balances for fair value measurements in

Level 3 of the fair value hierarchy:

Six months Year Six months

ended Ended Ended

30

31 December June 31 December

2020 2020 2019

(Unaudited) (Audited) (Unaudited)

GBP GBP GBP

Opening balance 11,684,980 9,561,369 9,561,369

Leaf Clean Energy Company - Transfer to Level 3 on 30 January 2020 - 105,908 -

GI Dynamics Inc - Transfer to Level 3 on 22 July 2020 1,494,943 - -

Purchases 11,784,561 3,551,095 -

Movement in unrealised gains/(losses) 7,318,480 (1,851,998) 705,261

Sales/conversion of loans (11,149,307) - -

Net realised gain 1,830,764 - -

Effect of exchange rate movements (2,272,004) 318,606 (134,996)

Closing balance 20,692,417 11,684,980 10,131,634

-------------------------------------------------------------------- -------------- ------------ ------------

The Company recognises transfers between levels of the fair

value hierarchy on the date of the event of change in circumstances

that caused the transfer.

During the period, the Company's equity investment in GI

Dynamics Inc. was transferred to Level 3 following the delisting of

the investee company on 22 July 2020.

Assuming all other variables are held constant:

-- If unobservable inputs in Level 3 debt investments had been

5% higher/lower (30 June 2020: 5% higher/lower), the Company's

return and net assets for the period ended 31 December 2020 would

have increased/decreased by GBP182,281 (30 June 2020:

GBP261,907);

-- If unobservable inputs in Level 3 equity investments had been

25% higher/lower (30 June 2020: 25% higher/lower), the Company's

return and net assets for the period ended 31 December 2020 would

have increased/decreased by GBP4,261,700 (30 June 2020:

GBP1,611,713); and

-- There would have been no impact on the other equity reserves.

6. LOAN FACILITY

On 1 July 2020, the Company entered into a loan facility with

Intertrader Limited whereby it transferred an amount of equity

holdings with a value of GBP19.1 million as at 1 July 2020 to

Intertrader Limited to be held as collateral for CFD instruments.

The interest charged on the loan facility is 2% per annum of the

daily overnight loan balance. The Company may draw on a loan

facility of up to 25% of the value of the initial equity holdings

transferred. The balance of this facility is as follows:

As at As at

31 December 30 June

2020 2020

(Unaudited) (Audited)

GBP GBP

Opening balance - -

Drawdowns 12,370,000 -

Repayments by way of sale of CFD instruments (9,289,813) -

Repayments by way of dividends receivable on CFD instruments (149,820) -

Facility fees payable 265,941 -

Facility commissions payable 9,517 -

Closing balance 3,205,825 -

------------------------------------------------------------- ---------------------- ----------------

As at the date of this report, the amount owed to Intertrader

Limited under the loan facility was GBP1.7 million.

7. SHARE CAPITAL AND RESERVES

The authorised share capital of the Company is GBP3,000,000

divided into 300 million Ordinary shares of GBP0.01 each.

The issued share capital of the Company, including Treasury

shares, is comprised as follows:

31 December 2020 30 June 2020

(Unaudited) (Audited)

Number GBP Number GBP

Issued, called up and fully paid Ordinary shares of GBP0.01 each 99,749,762 997,498 99,624,762 996,248

================================================================== =========== ======== =========== ========

During the period, the Company created and issued 125,000

Ordinary shares of GBP0.01 divided equally amongst five charitable

organisations, the nominal value of which has been paid by Richard

Bernstein, who is a shareholder of the Company, a director and

shareholder of the Investment Manager and a member of the

Investment Adviser.

8. TREASURY SHARES RESERVE

Six months ended Year ended

31 December 2020 30 June 2020

(Unaudited) (Audited)

Number GBP Number GBP

Opening balance (7,763,195) (12,265,601) (3,527,782) (6,895,640)

Treasury shares purchased

during the period/year (7,566,567) (6,219,697) (4,235,413) (5,369,961)

Closing balance (15,329,762) (18,485,298) (7,763,195) (12,265,601)

=========================== ============= ============== ============= =============

During the period ended 31 December 2020: 7,566,567 (2019:

2,287,413) Treasury shares were purchased at an average price of

82.20 pence per share (2019: 166.81 pence per share), representing

an average discount to NAV at the time of purchase of 9.18% (2019:

16.4%). During the period ended 31 December 2020, Nil (2019: Nil)

Treasury shares were sold.

9. DIVIDS

On 23 December 2020, the Company declared an interim dividend of

GBP2,111,638, equating to 2.5 pence per Ordinary share, which was

paid on 5 February 2021 to shareholders on the register following

the period end on 8 January 2021, as further disclosed in Note

11.

10. RELATED PARTIES

Richard Bernstein is a director and a member of the Investment

Manager, a member of the Investment Adviser and a holder of 10,000

(30 June 2020: 10,000) Ordinary shares in the Company, representing

0.01% (30 June 2020: 0.01%) of the voting share capital of the

Company at 31 December 2020.

During the period the Company incurred management fees of

GBP737,204 (2019: GBP1,628,161) none of which was outstanding at 31

December 2020 (30 June 2020: GBPNil). No performance fees were

payable during the period (2019: GBPNil) (30 June 2020: GBPNil) and

none outstanding at the period/year end.

As at 30 June 2020, the Company held 94.1% (30 June 2020: 73.1%)

of the issued shares of GI Dynamics Inc., meaning that GID is an

unconsolidated subsidiary. GID was incorporated in Delaware, had

five wholly-owned subsidiaries and its principal place of business

is Boston. The five subsidiaries were as follows:

-- GI Dynamics Securities Corporation, a Massachusetts-incorporated nontrading entity;

-- GID Europe Holding B.V., a Netherlands-incorporated nontrading holding company;

-- GID Europe B.V., a Netherlands-incorporated company that

conducts certain European business operations;

-- GID Germany GmbH, a German-incorporated company that conducts

certain European business operations; and

-- GI Dynamics Australia Pty Ltd, an Australian-incorporated

company that conducts Australian business operations.

Under the terms of the IMA, the Investment Manager is entitled

to a performance fee in certain circumstances. This fee is

calculated by reference to the increase in NAV per Ordinary share

over the course of each performance period.

Payment of the performance fee is subject to:

1. the achievement of a performance hurdle condition: the NAV

per Ordinary share at the end of the relevant performance period

must exceed an amount equal to the placing price, increased at a

rate of: (i) 7% per annum on an annual compounding basis in respect

of that part of the performance period which falls from (and

including) the date of Admission up to (but not including) the date

of the 2013 Admission; (ii) 8% per annum on an annual compounding

basis in respect of that part of the performance period which falls

from (and including) the date of the 2013 Admission up to (but not

including) the date of the 2015 Admission and (iii) 10% per annum

on an annual compounding basis in respect of that part of the

performance period which falls from (and including) the date of the

2015 Admission up to the end of the relevant performance period

with all dividends and other distributions paid in respect of all

outstanding Ordinary shares (on a per share basis) during any

performance period being deducted on their respective payment dates

(and after compounding the distribution amount per share at the

relevant annual rate or rates for the period from and including the

payment date to the end of the performance period) ("the Basic

Performance Hurdle"). Such Basic Performance Hurdle at the end of a

performance period is compounded at the relevant annual rate to

calculate the initial per share hurdle level for the next

performance period, which will subsequently be adjusted for any

dividends or other distributions paid in respect of all outstanding

Ordinary shares during that performance period, and

2. the achievement of a "high-water mark": the NAV per Ordinary

share at the end of the relevant performance period must be higher

than the highest previously reported NAV per Ordinary share at the

end of a performance period in relation to which a performance fee,

if any, was last earned (less any dividends or other distributions

in respect of all outstanding Ordinary shares declared (on a per

share basis) since the end of the performance period in relation to

which a performance fee was last earned).

As the NAV per share at 31 December 2020 did not exceed the

Basic Performance Hurdle of 252.34 pence per share at that date, a

performance fee has not been accrued in the Interim Financial

Statements. In the event that, on 30 June 2021, the NAV per share

exceeds both the performance hurdle and the high watermark, the

performance fee will be an amount equal to 20% of the excess of the

NAV per share at that date over the higher of these hurdles

multiplied by the time weighted average number of Ordinary shares

in issue during the year ending 30 June 2021. Depending on whether

the Ordinary shares are trading at a discount or a premium to the

Company's NAV per share at 30 June 2021, the performance fee will

be either payable in cash (subject to the Investment Manager being

required to use the cash payment to purchase Ordinary shares in the

market) or satisfied by the sale of Ordinary shares out of Treasury

or by the issue of new fully paid Ordinary shares at the mid-market

closing price on 30 June 2021, respectively.

As at 31 December 2020, the Investment Manager held 6,994,397

Ordinary shares (30 June 2020: 7,037,991) of the Company,

representing 8.29% (30 June 2020: 7.66%) of the voting share

capital.

The interests of the Directors in the share capital of the

Company at the period/year end, and as at the date of this report,

are as follows:

31 December 2020 30 June 2020

Number of Ordinary Total voting rights Number of Ordinary Total voting rights

shares shares

Christopher Waldron(1) 30,000 0.04% 30,000 0.03%

Jane Le Maitre(2) 13,500 0.02% 13,500 0.01%

Fred Hervouet 7,500 0.01% 7,500 0.01%

------------------------ ---------------------- -------------------- ---------------------- --------------------

Total 51,000 0.07% 51,000 0.05%

------------------------ ---------------------- -------------------- ---------------------- --------------------

(1) Chairman of the Company

(2) Ordinary Shares held indirectly

All related party transactions are carried out on an arm's

length basis.

11. POST BALANCE SHEET EVENTS

The Company declared an interim dividend of GBP2,111,638,

equating to 2.5 pence per Ordinary share, which was paid on 5

February 2021 to shareholders on the register on 8 January

2021.

The Company purchased 200,000 of its own Ordinary Shares during

the period between 1 January 2021 and 3 March 2021, which were held

as Treasury shares. Following these purchases, the total number of

Ordinary Shares held as Treasury shares by the Company is

15,529,762 .

On 16 February 2021, the Company reported that its unaudited NAV

at 31 January 2021 was 124.4 pence per Ordinary share.

12. AVAILABILITY OF INTERIM REPORT

Copies of the Interim Report will be available to download from

the Company's website www.crystalamber.com.

Glossary of Capitalised Defined Terms

"AGM" means the annual general meeting of the Company;

"AIC" means the Association of Investment Companies;

"AIM" means the Alternative Investment Market of the London

Stock Exchange;

"Annual Financial Statements" means the audited annual financial

statements of the Company, including the Statement of Profit or

Loss and Other Comprehensive Income, the Statement of Financial

Position, the Statement of Changes in Equity, the Statement of Cash

Flows and associated notes;

"Board" or "Directors" or "Board of Directors" means the

directors of the Company;

"Brexit" means the departure of the UK from the European

Union;

"CEO" means chief executive officer;

"CFD" means Contracts for Difference;

"CFO" means chief financial officer;

"Company" or "Fund" means Crystal Amber Fund Limited;

"Companies Law" means the Companies (Guernsey) Law, 2008, (as

amended);

"DeFi" means D ecentralised Finance;

"EBITDA" means earnings before interest, taxes, depreciation and

amortisation;

"EPS" or "Early Production System" means producing oil through a

temporary processing system and exporting the processed crude to a

storage vessel for subsequent transport to market;

"Equals" means Equals Group plc;

"GM" or "General Meeting" means a general meeting of the

Company;

"ESG" means Environmental, Social and Governance, referring to

the three central factors in measuring the sustainability and

societal impact of an investment in a company or business;

"FDA" means food and drug administration;

"FTSE" means Financial Times Stock Exchange;

"FVTPL" means Fair Value Through Profit or Loss;

"FY22" means the financial year 2022;

"GDP" means gross domestic product, a monetary measure of the

market value of all the final goods and services produced in a

specific time period;

"GID" or "GI Dynamics" means GI Dynamics, Inc.;

"HQ" means headquarters;

"IAS" means international accounting standards as issued by the

Board of the International Accounting Standards Committee;

"IFRS" means the International Financial Reporting Standards,

being the principles-based accounting standards, interpretations

and the framework by that name issued by the International

Accounting Standards Board, as adopted by the European Union;

"IMA" means the investment management agreement between the

Company and the Investment Manager dated 16 June 2008, as amended

on 21 August 2013, further amended on 27 January 2015 and further

amended on 12 June 2018;

"Interim Financial Statements" means the unaudited condensed

interim financial statements of the Company, including the

Condensed Statement of Profit or Loss and Other Comprehensive

Income, the Condensed Statement of Financial Position, the

Condensed Statement of Changes in Equity, the Condensed Statement

of Cash Flows and associated notes;

"Interim Report" means the Company's interim report and

unaudited condensed financial statements for the period ended 31

December;

"Lancaster EPS" means Lancaster Early Production System;

"Market Capitalisation" means the total number of Ordinary

shares of the Company multiplied by the closing share price;

"NAV" or "Net Asset Value" means the value of the assets of the

Company less its liabilities as calculated in accordance with the

Company's valuation policies and expressed in Pounds Sterling;

"NAV per share" means the Net Asset Value per Ordinary share of

the Company and is expressed in pence;

"Ordinary share" means an allotted, called up and fully paid

Ordinary share of the Company of GBP0.01 each;

"Remuneration Report" means part of the Remuneration Statement

which provides information on the remuneration and other financial

benefits paid to the Board of Directors, the Group CEO and the

Group Executive Committee members during the previous financial

period;

"Small Cap Index" means an index of small market capitalisation

companies;

"SMEs" means small and medium-sized enterprises and businesses

whose personnel numbers fall below certain limits. The abbreviation

"SME" is used by international organizations such as the World

Bank, the European Union, the United Nations and the World Trade

Organization;

"SORP" means Statement of Recommended Practice;

"SPAC" mean Special Purpose Acquisition Company;

"Treasury" means the reserve of Ordinary shares that have been

repurchased by the Company;

"Treasury shares" means Ordinary shares in the Company that have

been repurchased by the Company and are held as Treasury

shares;

"UK" or "United Kingdom" means the United Kingdom of Great

Britain and Northern Ireland;

"US" means the means the United States of America, its

territories and possessions, any state of the United States and the

District of Columbia;

"US$" or "$" means United States dollars; and

"GBP" or "Pounds Sterling" or "Sterling" means British pound

sterling and "pence" means British pence.

Directors and General Information

Directors Investment Manager

Christopher Waldron (Chairman) Crystal Amber Asset Management (Guernsey) Limited

Fred Hervouet (Chairman of Remuneration and Management PO Box 286

Engagement Committee) Floor 2, Trafalgar Court

Jane Le Maitre (Chairman of Audit Committee) Les Banques, St Peter Port

Guernsey GY1 4LY

Investment Adviser

Crystal Amber Advisers (UK) LLP Nominated Adviser

17c Curzon Street Allenby Capital Limited

London W1J 5HU 5 St. Helen's Place

London EC3A 6AB

Administrator and Secretary

Ocorian Administration (Guernsey) Limited Legal Advisers to the Company

PO Box 286 As to English Law

Floor 2, Trafalgar Court Norton Rose Fulbright LLP

Les Banques, St Peter Port 3 More London Riverside

Guernsey GYI 4LY London SE1 2AQ

Broker As to Guernsey Law

Winterflood Investment Trusts Carey Olsen

The Atrium Building PO Box 98

Cannon Bridge House Carey House

25 Dowgate Hill Les Banques

London EC4R 2GA St. Peter Port

Guernsey GY1 4BZ

Independent Auditor

KPMG Channel Islands Limited Custodian

Glategny Court Butterfield Bank (Guernsey) Limited

Glategny Esplanade PO Box 25

St. Peter Port Regency Court

Guernsey GY1 1WR Glategny Esplanade

St. Peter Port

Registered Office Guernsey GY1 3AP

PO Box 286

Floor 2, Trafalgar Court Registrar

Les Banques, St Peter Port Link Asset Services

Guernsey GYI 4LY 65 Gresham Street

London EC2V 7NQ

Identifiers

ISIN: GG00B1Z2SL48

Sedol: B1Z2SL4

Ticker: CRS

Website: http://crystalamber.com

LEI: 213800662E2XKP9JD811

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFAVLIVIIL

(END) Dow Jones Newswires

March 04, 2021 02:00 ET (07:00 GMT)

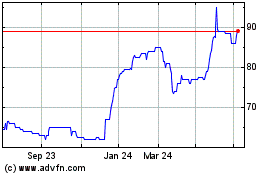

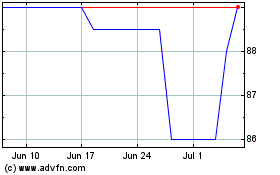

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024