TIDMCRS

RNS Number : 0707G

Crystal Amber Fund Limited

20 November 2020

20 November 2020

Crystal Amber Fund Limited

(the "Company" or the "Fund")

Results of Annual General Meeting

The Company announces that at its Thirteenth Annual General

Meeting held earlier today, all ordinary resolutions (Resolutions 1

to 10) set out in the Notice of AGM dated 22 September 2020 (the

"Notice") were duly passed.

Special Resolutions 11 to 13 required a 75% majority of votes

cast. Resolutions 12 and 13 were duly passed. Resolution 11 secured

votes of 74.97% in favour, and therefore did not pass. The full

text of the Special Resolutions is noted below.

The breakdown of voting percentages for each resolution (on a

total votes cast basis) follows:

Total Votes Total % For Total Votes Total % Against Total Votes

For Against Withheld*

Resolution

1 55,398,141 100 0 0 0

------------ ------------ ------------ ---------------- ------------

Resolution

2 31,662,887 74.979 10,566,127 25.021 13,169,127

------------ ------------ ------------ ---------------- ------------

Resolution

3 42,457,927 76.641 12,940,214 23.359 0

------------ ------------ ------------ ---------------- ------------

Resolution

4 55,398,141 100 0 0 0

------------ ------------ ------------ ---------------- ------------

Resolution

5 42,198,254 99.950 21,000 0.050 13,178,887

------------ ------------ ------------ ---------------- ------------

Resolution

6 42,218,254 99.998 1,000 0.002 13,178,887

------------ ------------ ------------ ---------------- ------------

Resolution

7 42,218,254 99.998 1,000 0.002 13,178,887

------------ ------------ ------------ ---------------- ------------

Resolution

8 55,398,141 100 0 0 0

------------ ------------ ------------ ---------------- ------------

Resolution

9 29,286,800 69.352 12,942,214 30.648 13,169,127

------------ ------------ ------------ ---------------- ------------

Resolution

10 31,650,627 57.133 23,747,514 42.867 0

------------ ------------ ------------ ---------------- ------------

Resolution

11 31,645,127 74.967 10,567,127 25.033 13,185,887

------------ ------------ ------------ ---------------- ------------

Resolution

12 37,442,754 88.686 4,776,500 11.314 13,178,887

------------ ------------ ------------ ---------------- ------------

Resolution

13 34,650,132 82.080 7,565,122 17.920 13,182,887

------------ ------------ ------------ ---------------- ------------

Discretionary votes received were voted in favour of a

Resolution and are counted in the proportion of votes 'for'.

*Votes withheld are not included as a vote withheld is not a

vote in Law and is therefore not counted towards the proportion of

votes 'for' or 'against' a Resolution.

The Board notes the diversity of votes received in relation to

Resolutions 2, 3, 9, 10 and 11. As regards Resolution 2 in respect

of Board remuneration, the Board notes that the overall level of

director remuneration was lower than in the previous year. In

addition, the Board advises that there will be no increases in the

coming year. As regards Resolution 3, the Fund's auditor, KPMG,

proved the most competitive when the Fund's audit was tendered in

2017 but the Fund acknowledges that KPMG has been in situ for more

than a decade, which is considered by some proxy advisory services

not to be best practice. The Board intends therefore to re-assess

the tendering process. As regards Resolution 9, the Board believes

that the share buy-back authority provides the potential to enhance

net asset value. The Board has very recently consulted widely with

shareholders as regards the merits of share buy-backs. As regards

Resolution 10, since the authority granted in 2017, and following

consultation with and support from the Fund's then largest

investors, the Fund has to date created and gifted 750,000 shares

to more than two dozen separate charities. Over that time, these

share issues have diluted the issued share capital by less than one

per cent. on a cumulative basis. Despite Resolution 10 being

passed, the directors recognise that more recently, the shareholder

base has changed significantly and consequently, the directors have

decided that in recognition of the views articulated by newer

shareholders, the Fund will suspend future share issues to

charities at this time.

Resolution 11

THAT the Directors of the Company be and are hereby empowered to

exercise all powers of the Company to allot, issue, grant rights to

subscribe for, or to convert any security into, shares in the

Company up to the maximum permitted under the London Stock

Exchange's AIM market regulations, being up to 33% of the issued

share capital of the Company, which authority shall expire at the

conclusion of the next annual general meeting of the Company to be

held in 2021 (unless previously varied, revoked or renewed by the

Company in general meeting) or, if earlier, at close of business on

the date falling 18 months from the passing of these resolutions,

save that the Company may before such expiry make an offer or

agreement which grants rights to subscribe for or allows the

conversion of any security into ordinary shares or would or might

require shares to be allotted and issued after such expiry and the

Board may grant rights to subscribe for ordinary shares, consent

any security into ordinary shares, or allot and issue ordinary

shares in pursuance of such an offer or agreement as if the

authority conferred hereby had not expired.

Resolution 12

THAT the Directors be and are hereby empowered, in accordance

with the rights contained in the Company's Articles of

Incorporation, to allot and issue ordinary shares wholly for cash

and/or to sell ordinary shares from Treasury wholly for cash, on a

non pre-emptive basis, provided that this power shall be limited to

the allotment, issue or sale of up to the aggregate number of

ordinary shares of the Company as represent less than 10 per cent.

of the number of ordinary shares of the Company already admitted to

trading on the London Stock Exchange's AIM market for listed

securities immediately following the passing of this resolution and

shall expire at the conclusion of the next annual general meeting

of the Company to be held in 2021, save that the Company may,

before such expiry, make an offer which would or might require

ordinary shares to be allotted, issued or sold after such expiry

and the Directors may allot, issue or sell ordinary shares in

pursuance of such offer.

Resolution 13

THAT, conditional on Resolution 12 above having been passed, the

Directors be and are hereby empowered, in accordance with the

rights contained in the Company's Articles of Incorporation and in

addition to and without prejudice to the power granted by

Resolution 12 above, to allot and issue ordinary shares wholly for

cash and/or to sell ordinary shares from Treasury wholly for cash,

on a non pre-emptive basis, provided that this power shall be

limited to the allotment, issue or sale of an additional number of

ordinary shares of the Company that, in aggregate, represent less

than 10 per cent. of the number of ordinary shares of the Company

already admitted to trading on the London Stock Exchange's AIM

market for listed securities immediately following the passing of

this resolution and shall expire at the conclusion of the next

annual general meeting of the Company to be held in 2021, save that

the Company may, before such expiry, make an offer which would or

might require ordinary shares to be allotted, issued or sold after

such expiry and the Directors may allot, issue or sell ordinary

shares in pursuance of such offer.

For further enquiries please contact:

Crystal Amber Fund Limited

Chris Waldron (Chairman)

Tel: 01481 742 742

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner

Tel: 020 3328 5656

Winterflood Securities - Broker

Joe Winkley/Neil Langford

Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment

Adviser

Richard Bernstein

Tel: 020 7478 9080

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGURUNRRKUAUAA

(END) Dow Jones Newswires

November 20, 2020 11:30 ET (16:30 GMT)

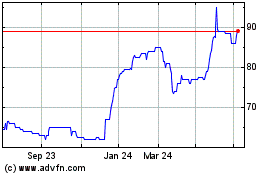

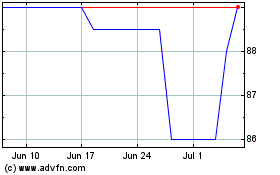

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024