TIDMCRS

RNS Number : 4481J

Crystal Amber Fund Limited

14 April 2020

14 April 2020

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value

Crystal Amber Fund announces that its unaudited net asset value

("NAV") per share at 31 March 2020 was 89.59 pence (29 February

2020: 133.08 pence per share).

The proportion of the Fund's NAV at 31 March 2019 represented by

the ten largest shareholdings, other investments and cash

(including accruals), was as follows:

Ten largest shareholdings Pence per share Percentage of investee equity

held

------------------------------------ ---------------- ------------------------------

Allied Minds plc 15.2 22.6%

Hurricane Energy plc 14.5 6.3%

De La Rue plc 12.3 19.2%

Redde Northgate plc 9.3 2.5%

Equals Group plc 9.1 21.4%

Board Intelligence Ltd 5.9 *

Kenmare Resources plc 4.3 1.8%

Camellia plc 2.2 1.1%

Sutton Harbour Group plc 1.9 10.8%

*GI Dynamics Inc. 1.5 73.1%

Total of ten largest shareholdings 76.2

Other investments 10.0

Cash and accruals 3.4

------------------------------------ ----------------

Total NAV 89.6

------------------------------------ ----------------

*Board Intelligence Ltd is a private company and its shares are

not listed on a stock exchange. Therefore, the percentage held is

not disclosed.

Recent unprecedented conditions resulted in widespread distress

selling and volatility, which led to the dramatic performance of

the Fund's concentrated portfolio. However, the Fund is closed

ended, has net cash and added to some of its core holdings at

extremely distressed levels. The Fund is confident that there is

very significant value to be realised from the portfolio once

markets have visibility that the worst of the pandemic and its

consequences are over. Since month end, several core holdings

including Hurricane Energy plc and Equals Group plc have seen

strong share price recoveries, with Hurricane Energy's share price

rising by 49 per cent and Equals Group plc by 39 per cent.

Investment Adviser's commentary on the portfolio

Over the quarter to 31 March 2020, NAV per share fell by 50.0%.

A 2.5p dividend declared on 10 December 2019 was paid on 13 January

2020.

The top three detractors to NAV over the quarter to 31 March

2020 were Equals Group plc (14.5%), Hurricane Energy plc (14.3%)

and De la Rue (9%).

Allied Minds plc ("Allied Minds")

In January 2020, Allied Minds declared a special dividend of $40

million, or 12.62p per share. This capital return was generated by

the sale of HawkEye 360, which completed in November 2019.

In February 2020, Allied Mind's investee company Federated

Wireless launched a new connectivity as a service product in the

US. Enterprises are able to buy and deploy 4G and 5G private

networks through the market places of Amazon Web Services and

Azure, two top global public clouds.

Allied Minds has a net asset value per share of around 75p,

which includes net cash of 15p a share. Against a 26p share price,

the portfolio (excluding cash) is therefore valued at 11p a share.

This compares with its carrying value of 60p a share, resulting in

the investment portfolio (excluding cash) trading at an 81.7%

discount to its latest reported carrying value.

During March 2020, the Fund increased its holding from 16.9% to

22.6% and is now the largest shareholder in Allied Minds. The Fund

firmly believes that there remains scope to reduce its $6 million

per annum overheads and in the current climate, Allied Minds should

take quick and decisive action to reduce its cost base.

Over the quarter, Allied Minds' share price fell by 49%.

Adjusting for the special dividend, the total return was a negative

33%.

De La Rue plc ("De La Rue")

Over the period, De La Rue announced its turnaround plans,

replaced its chief financial officer and met its covenant tests. A

trading update at the end of the quarter confirmed operating profit

guidance for the year to March 2020 of between GBP20 and GBP25

million. Financial year end net debt is expected to be

approximately GBP105 million, down from GBP171 million six months

earlier.

As part of its turnaround plans brought in by the new CEO, the

company has already realised annualised savings of GBP10 million.

It is targeting savings of GBP35 million by its financial year

2021/2022, exceeding previous cost reduction commitments of GBP20

million. The market has been advised that full details of the

turnaround plan will be presented together with its preliminary

results in May.

De La Rue has stated that it is too early to quantify the

effects of COVID 19. However, its share price, which until the end

of February was unchanged over the previous two months, in March,

fell by 60%, valuing its equity at around GBP50 million.

Over the quarter, De La Rue's share price fell by 60%.

Hurricane Energy plc ("Hurricane")

In January 2020, Hurricane concluded its single well tests on

its Early Production System (EPS) at Lancaster. It has since

increased production at both wells and reached 20,000 barrels of

production per day. This is the maximum it can produce under

current permissions.

Over the quarter, the oil price fell sharply due to the Covid-19

induced demand shock and a fallout between producing countries. The

company's EPS cost of production is $17 per barrel at its guided

production rate.

The Oil and Gas Authority (OGA) has acknowledged the impact of

Covid-19 on operators' ability to carry out work programmes.

Negotiations have started between Hurricane and the OGA to review

existing commitments. We expect the company's capex for 2020 to

fall relative to prior outlook.

In its final results announced on 19 March 2020, Hurricane

reported an unrestricted cash balance of GBP164.3 million. It

forecasts this to be sufficient to meet obligations and committed

costs as they fall due.

Over the quarter, Hurricane's share price fell by 68%.

GI Dynamics Inc ("GI Dynamics")

On 27 January 2020, GI Dynamics announced the enrolment of the

first patient on its US STEP-1 clinical trial. On 31 March 2020,

the Fund agreed to a one-month extension to its loan note.

Since November 2019, the Fund has held a board observer position

in GI Dynamics. As a consequence, it is not in a position to

comment other than by reference to public announcements made by the

company.

Over the quarter, GI Dynamic's share price fell by 83%.

Issue of shares to charities and transactions in own shares

During the quarter, the Fund issued 125,000 shares to five

charities following the authority granted at its Annual General

Meeting.

The Fund also bought back 1,265,000 of its own ordinary shares

at an average price of 82.52p per share as part of its buyback

programme.

For further enquiries please contact:

Crystal Amber Fund Limited

Chris Waldron (Chairman)

Tel: 01481 742 742

www.crystalamber.com

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner

Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford

Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVUKABRRRUSRAR

(END) Dow Jones Newswires

April 14, 2020 02:00 ET (06:00 GMT)

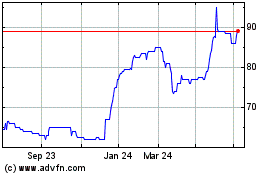

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

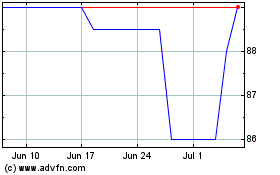

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024