TIDMCRS

RNS Number : 9672E

Crystal Amber Fund Limited

04 March 2020

4 March 2020

Crystal Amber Fund Limited

Interim results for the period ended 31 December 2019

The Company announces its interim results for the six months

ended 31 December 2019.

Highlights

-- Net Asset Value ("NAV") (1) per share fell by 28.1% over the

period or 26.4% after adjusting for dividends paid.

-- After adjusting for dividends, the Fund's fall in NAV of

26.4% compares to a 10.7% increase in the Numis Small Cap Index.

Over the 2019 calendar year, NAV per share fell by 17.3% after

adjusting for dividends paid. Over the same period, the Numis Small

Cap Index grew by 22.3%.

-- Share price discount to NAV averaged 16.4% throughout the

period as the Fund continued its buy-back programme.

For further enquiries please contact:

Crystal Amber Fund Limited

Christopher Waldron (Chairman) Tel: 01481 742

742

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner Tel: 020 7167

6431

Winterflood Securities - Broker

Joe Winkley/Neil Langford Tel: 020 3100

0160

Crystal Amber Advisers (UK) LLP - Investment

Adviser

Richard Bernstein Tel: 020 7478

9080

(1) All capitalised terms are defined in the Glossary of

Capitalised Defined Terms unless separately defined.

Chairman's Statement

After a strong performance in the first half of calendar year

2019, the first half of the current financial year proved

particularly difficult for Crystal Amber Fund Limited ("the Fund").

During the period from 30 June 2019 to 31 December 2019, net asset

value ("NAV") fell from GBP238.8 million (249.12 pence per share)

to an unaudited NAV of GBP167.9 million (179.21 pence per share).

After adjusting for dividends, the Fund's fall in NAV over the six

months to 31 December 2019 of 26.4% compares to a 10.7% increase in

the Numis Small Cap Index in the same period.

Activist investing requires a focussed portfolio, which

inevitably increases concentration risk. This can impact

performance both favourably and unfavourably, as we have

experienced in the past. Indeed, during the period from 31 March

2017 to 30 November 2017, net asset value declined by 23%, before

increasing over the following seven months by 31%. It is also

relevant that those holdings that contributed to this earlier

underperformance and subsequent recovery included both Hurricane

Energy and Northgate: key detractors to the Fund's performance of

late.

It is also important to note that the Fund's strategy and

activist tactics of patient engagement have remained consistent

over the period. There has been no change in focus or approach, but

there are clearly times when the investment environment is

favourable to the Fund's style and other times when it is not.

There is no doubt that since the June 2019 financial year end, the

investment climate for a UK focussed, small and mid-cap value

investor has been difficult. The global equity market has

increasingly been influenced by persistently accommodative monetary

policy that has driven down interest rates. Aside from the

potential effects of asset price bubbles and over-leveraging, this

manifests itself by increasing discounted cash flow valuations of

growth stocks. The proliferation of Exchange Traded Funds and asset

allocators favouring mega-cap stocks has also led to ratings

expansions that have not been reflected in the small and mid-cap

sectors. Since the period end, the Fund has also had to contend

with the increased volatility and economic uncertainty caused by

the coronavirus outbreak. This has already had a direct effect on

Hurricane Energy, as a result of the falling oil price and is

likely to impact Equals Group, if the demand for foreign travel

becomes weaker.

During the period under review, many UK domestically focussed

businesses suffered from Brexit related uncertainties. This also

adversely affected the appetite of potential corporate

acquirers.

In addition, increased redemption pressure has also affected

several small and mid-cap fund managers and has resulted in reduced

demand for, and an increased supply of, shares in many listed

companies. Over the medium term, this serves to increase the

potential attraction of these companies to trade or private equity

buyers, but in the shorter term, it has contributed to lower share

price ratings, which adversely affected the Fund's performance.

Specifically, despite a successful activist campaign at Allied

Minds, a large and persistent shareholder overhang has had a

material adverse impact on its share price.

The Fund has also provided regular updates on its view of the

scale of past mismanagement at De La Rue and further details can be

seen below in the Investment Manager's Report. Whilst this has

significantly affected the Fund's performance over the period,

exposing and highlighting these failings accelerated the departures

of the former Chief Executive and Chairman and has allowed the new

leadership to begin to take the corrective action necessary to

execute a turnaround. De La Rue is a good example of the time lag

that can exist between initiating an activist strategy and it

bearing fruit. This is particularly pronounced when corporate

governance shortcomings are highlighted, as the necessary changes

can take time. We have seen this not only at De La Rue, but also at

Northgate, Allied Minds and Equals Group.

Similar interactions with undervalued portfolio companies have

eventually proved successful over the life of the Fund and, until

the period under review, the Fund had delivered annual returns over

11 years of 11% per annum. Over the three years to June 2019,

returns exceeded 20% per annum. Since then, the portfolio's

composition is little changed, yet the factors referred to above

have resulted in recent poor performance. Given past recovery after

the previous period of poor performance, the fact that management

changes instigated by the Fund at both Northgate and De La Rue have

now taken place and the increased valuation anomalies relative to

the trade valuations of portfolio companies, are encouraging signs

for the future of the Fund.

The Board is very mindful of recent performance, which has been

exacerbated by the current volatility that has seen further

reductions in secondary market liquidity and wider discounts in the

closed ended sector. However, the Board believes that the interests

of shareholders are currently best served by encouraging the

Investment Manager to continue its consistent strategy of

engagement and to work on realising the value in the Fund's

portfolio. All three directors have bought shares since the end of

December 2019 and the Fund continued its discount management policy

through share buy-backs. During the six months to 31 December 2019

2,287,413 shares were acquired at an average price of 166.81 pence

per share whilst the Fund's shares traded at an average discount of

16.4%. Further measures to reduce the discount and improve

shareholder returns will be the Board's principal concerns as the

portfolio evolves.

Finally, in September 2019, the Fund issued and donated 125,000

ordinary shares of GBP0.01 each ("Ordinary shares") to five

different charities and I am pleased to announce that the Fund has

today resolved to issue a further 125,000 shares divided equally

amongst five charitable organisations.

Christopher Waldron

Chairman

3 March 2020

Investment Manager's Report

Strategy and performance

The Fund continued to maintain close engagement with its major

holdings during the period.

At 31 December 2019, equity investments in 16 companies

represented 98% of NAV. The Fund also held a loan note in one of

those companies, GI Dynamics Inc. The Fund's net cash and accruals

position was GBP1.0 million, net of GBP2.3 million accrued for the

2.5 pence per share dividend paid in January 2020.

During the period, the Fund received GBP18.8 million from a

capital redemption by Leaf Clean Energy Company ("Leaf"). The Fund

also booked profits on STV Group plc, reducing its position by 56%

and sold down 39% of its holding in Northgate plc. Two other

smaller holdings were sold outright. The Fund took the opportunity

of price weakness to increase holdings in Allied Minds plc and De

la Rue by GBP15 million and GBP13 million respectively.

After adjusting for dividends paid, the fall of 26.4% in the

Fund's NAV per share compares to a 10.7% increase in the Numis

Small Cap index. Over the calendar year 2019, NAV fell by 17.3%

after adjusting for the dividends paid. The Numis Small Cap index

grew by 22.3% over the same period.

The table below lists the top ten holdings as at 31 December

2019, showing the performance contribution made by each company

during the six-month period. In addition to these, trading in

FTSE100 put options reduced NAV by 0.5%.

Pence per Percentage Total return Contribution

Ten largest shareholdings share of investee over the to NAV performance

equity held period (1)

----------------------------- ---------- ------------- ------------- --------------------

Hurricane Energy

plc 36.1 5.1% -36.2% -7.8%

Equals Group plc 35.0 21.4% -30.1% -6.1%

Allied Minds plc 23.1 17.7% -29.5% -0.9%

De La Rue plc 23.1 14.6% -50.7% -4.3%

Northgate plc 20.5 4.6% -5.2% -0.7%

GI Dynamics Inc. 11.4 73.1% -43.6% -6.3%

STV Group plc 8.5 5.0% 22.1% 0.8%

Board Intelligence

Ltd* 6.5 * * 0.3%

Kenmare Resources

plc 4.8 1.8% 32.3% 0.4%

Sutton Harbour

Group plc 2.9 10.8% -11.5% -0.2%

Total of ten largest

shareholdings 171.9

Other investments 8.8

Cash and accruals -1.5

----------------------------- ----------

Total NAV 179.2

----------------------------- ----------

(1) Percentage contribution stated for equity holdings only.

* Board Intelligence Ltd is a private company and its shares are

not listed on a stock exchange. Therefore, the percentage held is

not disclosed.

Investee companies

Our comments on a number of our principal investments are as

follows:

Hurricane Energy plc ("Hurricane")

Hurricane made material operational and financial progress

during the period. The company generated meaningful revenues and

appraisal data from its Lancaster Early Production System ("EPS"),

confirmed the presence of oil in two Warwick wells and drilled a

successful production well within Lincoln. However, the share price

fell as investor uncertainty around fractured basement reservoirs

persisted and attention turned to carbon sustainability. Following

the period end, the company announced that contrary to its initial

guidance, it would not be able to tie back the Lincoln producing

well.

The company's 2019 three-well campaign in the Greater Warwick

Area was completed on time and on budget. The Warwick West and

Warwick Deep wells confirmed the presence of oil in a separate

fault-bounded area within the Greater Warwick Area. Warwick West

produced light oil, of similar character to Lincoln and Lancaster,

but the stabilised flow rate achieved on test was significantly

lower than at Lincoln and Lancaster. A detailed review of the

results will be required to understand whether the Warwick

structure is commercially viable. The campaign confirmed reservoir

productivity from Lincoln Crestal (where oil had been discovered in

2016) at depths 500 metres deeper than at Lancaster.

To secure extension of the oil & gas licenses in Dec 2019,

the Oil and Gas Authority ("OGA") has required the company to drill

two sub-vertical wells to confirm the depth of the Lincoln and

Lancaster reservoirs and oil water contacts.

Following the period end, the company announced that, contrary

to its initial guidance, it would not be able to tie back the

Lincoln Crestal well to the Lancaster EPS in 2020, because of a

ruling by the OGA. Unless this ruling is modified, it may not be

possible to tie back the Lincoln Crestal well at all, which could

mean that the tie back of future Lancaster producer wells to the

EPS would require Hurricane to fund any gas export solution at its

own cost.

Nine months since first oil, the EPS continues to deliver oil in

line with guidance. 2019's headline production figure of 2.8

million barrels of oil sales with average production of 13,300

barrels per day since start-up is very satisfactory. For 2020,

Hurricane should achieve 18,000 barrels per day of production at a

cost of $20 per barrel.

The excellent results from the EPS have however materially

de-risked the company's Lancaster asset. Cash generation from its

two wells gives Hurricane optionality to explore, invest to

increase production, or deliver cash returns to shareholders.

Notwithstanding this progress, the share price fell sharply by 36%

over the period. The Fund attributes this weakness to a lower oil

price, increasing focus on ESG investing and general concerns

around water content from the Lancaster well.

Following the negative developments after the period end,

investor confidence deteriorated further. At the current share

price, the Fund believes that a buyback of shares could be an

attractive use of capital in the interest of the company. The Fund

has consulted with other shareholders and engaged with the board to

consider the company's alternatives and has put forward specific

ideas regarding a sensible capital allocation strategy.

Equals Group plc ("Equals")

The share price of Equals Group declined by 30% over the

reporting period. The company is in a period of transition. Most

revenues now come from the corporate rather than the retail segment

on which the business was built. To reflect its wider service

offering, the company changed its name from FairFx to Equals Group

but the investment during 2019 to rebrand, enhance the technology

platform and hire personnel has been a drag on cashflows.

In 2019, Equals grew revenues at 20% and adjusted EBITDA by 30%

but Equals' growth was overshadowed by mismanagement of market

forecasts which has understandably damaged investor confidence. The

Fund believes the appointment of Richard Cooper as CFO will rectify

such issues. Richard is a very experienced executive, having served

as CFO of GVC from 2008 to 2017.

At an operating level, the company accomplished a lot over the

six months. It signed a five-year deal with Mastercard offering

better economic terms and assistance to become an issuer. It

announced a banking partnership with Citi, enabling faster

settlement across a wide range of currencies. It acquired HermexFX

and CasCo, and it launched a loan product with iwoca. It also

conducted a GBP14m placing to fund investment which gives further

scope for expansion in 2020.

The Fund continues to engage constructively with management to

refine strategy and enhance speed of execution. Equals' proposition

to SMEs is compelling relative to that offered by legacy banks. The

Fund believes that better clarity of the economics of higher

lifetime value business customers will improve perceptions of

Equals' prospects. The company's assets include over one million

customers, an upgraded technology platform and licences and

industry relationships built over many years. With larger players

keen to acquire fintech capabilities, the Fund believes Equals

would be an attractive takeover candidate, particularly given its

growing profits, strong net cash position and depressed rating at

six times enterprise value to EBITDA.

De La Rue plc ("De la Rue")

On 23 July 2019, the UK Serious Fraud Office announced the

commencement of an investigation into De La Rue and its associated

persons in relation to suspected corruption in the conduct of

business in South Sudan. This caused the share price to fall by 22%

over the subsequent two days.

Within its interim results announcement in November, De La Rue

pointed to full-year adjusted operating profits significantly below

sell-side analyst forecasts. In response to the cash outflow

experienced during the first half, the company sensibly decided to

suspend its dividend. The Currency division is now implicitly

expected to be loss-making this year, primarily driven by lower

banknote printing and security features volumes following the

withdrawal of Venezuela from the market, triggered by US sanctions.

In contrast, the Product Authentication and Traceability division

grew revenues by 70% year-on-year in the first half and generated

an operating margin of 23%.

The company's auditors required De La Rue to characterise as a

"material uncertainty" the risk that, in a multiple-downside

scenario and if no mitigating action was taken, the company might

breach a bank debt covenant. This attracted significant press

coverage and contributed to the 23.5% stock price fall on the day

of the interim results announcement. The share price weakness may

have been compounded by the inevitable selling by some income funds

following the dividend cancellation. Our analysis indicated that

the company was unlikely to breach its covenants.

In the Fund's view, De La Rue has until recently suffered from

very poor leadership and oversight, which has resulted in an

unacceptable financial performance over many years, despite

tailwinds from most of the company's end-markets and the consequent

benefits evidently enjoyed by its competitors. Shareholder

dissatisfaction was in evidence at the company's AGM in July, with

the near rejection of its Remuneration Report.

On 25 February 2020, De La Rue announced that it expects to

operate within its banking covenants for FY20, along with an

expanded GBP35m cost-cutting target that has been accelerated to H2

2020/21. This will return the Currency division to significant

profitability even if the banknote printing cycle has not yet

improved. Indeed, the company now targets a mid-teens % operating

margin in Currency from next year.

Furthermore, the company extended its growth target for the

Authentication division and is now aiming to achieve revenue of

GBP100m by FY22, up from GBP39m in FY19.

The Fund is encouraged by the recent appointments of De La Rue's

new chairman and CEO. We are also pleased to see that the CEO and

several other senior executives have purchased De La Rue shares

following the interim announcement. The Fund believes that De La

Rue's current valuation of less than one times expected revenue

reflects neither the operational upside now that new management is

at the helm, nor its strategic value when compared to previous

deals within the sector priced at around two times expected

revenue.

The Fund's intensive activism and the resultant changes in

senior executives have been instrumental in averting a

non-recoverable outcome for De La Rue. Whilst defending and

fighting for essential governance principles has had adverse

short-term consequences on its reported Net Asset Value, over the

medium and long-term, not shirking from the tough action that was

required will serve the Fund well.

Northgate plc ("Northgate")

Northgate's share price has fallen by 32% since it announced the

acquisition of Redde plc ("Redde") on 29 November 2019, adjusting

for the interim dividend. This compares to a -6% total return from

the Numis Small Cap Index over the same period.

The Fund notes that combined fees payable by both Northgate and

Redde to professional advisers in relation to the deal were more

than GBP25 million. This is equivalent to more than 8% of the

market capitalisation of Redde prior to completion of the

acquisition. The Fund is deeply disappointed by the quantum of

these fees, particularly as the transaction was an all share deal,

with no costs incurred in raising capital.

As previously stated, the Fund believes that Northgate's

well-managed Spanish business would be an attractive acquisition

candidate for several multinationals currently attempting to

increase their presence within the European flexible vehicle rental

market. These larger and more diversified peers operate with

greater leverage and lower costs of capital than Northgate and

would be able to realise multiple synergies unavailable to

Northgate. The Fund hopes that Northgate's ongoing strategic review

will conclude that it is in shareholders' interests to initiate an

auction of the Spanish business.

Allied Minds plc

During the period, Allied Minds achieved its first successful

exit, with the sale of its stake in HawkEye 360 for $65.6 million.

In September, Federated Wireless raised $51 million at a valuation

more than 20% higher than its prior round in 2018, of which $10

million was invested by Allied Minds. Subsequently, Federated

Wireless received US regulatory approval for both the initial and

full-scale commercial deployments of its Citizens Broadband Radio

Service ("CBRS") system.

In November, the Fund requisitioned a General Meeting ("GM") of

Allied Minds with the aim of changing the composition of its board

to help accelerate and maximise both cost reductions and cash

distributions. In December, Allied Minds announced a range of

developments including a $1.5 million reduction in recurring HQ

expenses, an increase in the Q1 2020 initial cash return from the

sale of the HawkEye 360 stake, the introduction of a cumulative

cash returns threshold before any further payments could be made

under the Phantom Plan, and the appointment of the Fund's proposed

new non-executive director, Mark Lerdal. Based on this package of

changes, the Fund agreed to withdraw its GM requisition.

Allied Minds' shares trade at below half of the Fund's estimate

of its NAV per share. Its market capitalisation is less than the

value of its stake in Federated Wireless at the time of the

September 2019 fundraising round, plus estimated parent-level cash.

Allied Minds also owns two other sizeable holdings in Spin Memory

and BridgeComm, both of which have raised capital from third

parties including strategic investors, as well as three smaller

investments.

GI Dynamics Inc ("GI Dynamics")

Over the period, the Fund agreed funding of $10 million in order

to initiate GI Dynamics' FDA approved trial. This regulatory step

should confirm the efficacy and safety of a treatment that has

already benefitted over four thousand patients and has been

confirmed in several scientific studies.

As part of this agreement, the Fund exercised its existing

warrants and following the period end, purchased a new convertible

note and received new warrants. The Fund negotiated and commenced a

board observer position in November 2019. Therefore, the Fund is

unable to comment on this company other than by reference to public

announcements made by GI Dynamics.

In January, the company announced the enrolment of the first

patient to the trial.

Hedging activity

During the period, the Fund purchased put options on the FTSE100

index as insurance against a significant market sell-off and to

protect unrealised gains in the portfolio. FTSE100 puts had a

negative 0.5% contribution to NAV growth over the period.

After the period end, the Fund continued to purchase put

options. In February 2020, these generated realised profits in

excess of GBP9 million.

Realisations

Over the period, the Fund realised profits of GBP14.3 million

from the Leaf Clean capital return and GBP2.1 million from

Hurricane. Losses of GBP3.6 million were realised from the

Northgate sales and GBP2.3 million from disposals of Cenkos

stock.

Outlook

Last September, the Fund stated that it was increasingly

cautious on the outlook for markets. During the period, the Fund

recorded a significant decline in its NAV. The Fund's focus on a

concentrated portfolio of mainly asset backed special situations

suffered from the specific issues referred to above as well as

Brexit and UK General Election inertia.

In recent months, the Fund has taken firm action within the

portfolio and expects to see positive outcomes at several portfolio

companies. Whilst there is increasing evidence that ultra-low

interest rates and spiralling debt to GDP has been a key cause of

positive performance in large cap stocks, the Fund remains focused

on re-establishing its hitherto excellent record of low risk, long

term performance.

Crystal Amber Asset Management (Guernsey) Limited

3 March 2020

Condensed Statement of Profit or Loss and Other Comprehensive

Income (Unaudited)

For the six months ended 31 December 2019

Six months ended 31 December Six months ended 31 December

2019 2018

(Unaudited) (Unaudited)

Revenue Capital Total Revenue Capital Total

Notes GBP GBP GBP GBP GBP GBP

Income

Dividend income from

listed equity

investments 3,187,696 - 3,187,696 3,048,961 - 3,048,961

Interest received 2,846 - 2,846 2,172 - 2,172

---------- ------------- ------------- ---------- ------------- -------------

3,190,542 - 3,190,542 3,051,133 - 3,051,133

Net losses on financial

assets designated at

FVTPL and derivatives

held for trading

Equities

Net realised gains 4 - 6,436,556 6,436,556 - 18,567,453 18,567,453

Movement in unrealised

losses 4 - (61,257,939) (61,257,939) - (36,142,677) (36,142,677)

Debt instruments

Movement in unrealised

gains 4 - 102,503 102,503 - 564,244 564,244

Derivative financial

instruments

Realised losses 4 - (1,159,632) (1,159,632) - (2,426,731) (2,426,731)

Movement in unrealised

(losses)/gains 4 - (6,503,873) (6,503,873) - 1,553,631 1,553,631

- (62,382,385) (62,382,385) - (17,884,080) (17,884,080)

---------- ------------- ------------- ---------- ------------- -------------

Total income/(loss) 3,190,542 (62,382,385) (59,191,843) 3,051,133 (17,884,080) (14,832,947)

---------- ------------- ------------- ---------- ------------- -------------

Expenses

Transaction costs - 330,788 330,788 - 271,340 271,340

Exchange movements on

revaluation of

investments and

working capital 134,996 607,773 742,769 (214,674) 118,654 (96,020)

Management fees 9 1,628,161 - 1,628,161 1,816,362 - 1,816,362

Directors' remuneration 78,804 - 78,804 72,500 - 72,500

Administration fees 114,150 - 114,150 144,159 - 144,159

Custodian fees 50,808 - 50,808 61,036 - 61,036

Audit fees 14,100 - 14,100 12,702 - 12,702

Other expenses 184,918 - 184,918 169,881 - 169,881

---------- ------------- ------------- ---------- ------------- -------------

2,205,937 938,561 3,144,498 2,061,966 389,994 2,451,960

Return/(Loss) for the

period 984,605 (63,320,946) (62,336,341) 989,167 (18,274,074) (17,284,907)

========== ============= ============= ========== ============= =============

Basic and diluted

earnings/(loss) per

share (pence) 2 0.99 (63.96) (65.84) 1.02 (18.82) (17.80)

========== ============= ============= ========== ============= =============

All items in the above statement derive from continuing

operations.

The total column of this statement represents the Company's

Statement of Profit or Loss and Other Comprehensive Income prepared

in accordance with IFRS. The supplementary information on the

allocation between revenue return and capital return is presented

under guidance published by the AIC.

The Notes to the Unaudited Condensed Financial Statements form

an integral part of these Interim Financial Statements.

Condensed Statement of Financial Position (Unaudited)

As at 31 December 2019

As at As at As at

31 December 30 June 31 December

2019 2019 2018

(Unaudited) (Audited) (Unaudited)

Assets Notes GBP GBP GBP

Cash and cash equivalents 818,969 931,915 8,916,616

Trade and other receivables 471,068 1,971,390 985,834

Financial assets designated at FVTPL and derivatives held for

trading 4 169,258,239 241,366,149 207,465,843

Total assets 170,548,276 244,269,454 217,368,293

------------- ------------ ------------

Liabilities

Trade and other payables 2,653,945 5,493,857 3,555,118

Total liabilities 2,653,945 5,493,857 3,555,118

------------- ------------ ------------

Equity

Capital and reserves attributable to the Company's equity

shareholders

Share capital 6 994,998 993,748 992,498

Treasury shares reserve 7 (10,711,341) (6,895,640) (5,346,498)

Distributable reserve 90,579,708 95,310,182 95,309,557

Retained earnings 87,030,966 149,367,307 122,857,618

Total equity 167,894,331 238,775,597 213,813,175

------------- ------------ ------------

Total liabilities and equity 170,548,276 244,269,454 217,368,293

------------- ------------ ------------

NAV per share (pence) 3 179.21 249.12 221.67

============= ============ ============

The Interim Financial Statements were approved by the Board of

Directors and authorised for issue on 3 March 2020.

Christopher Waldron Jane Le Maitre

Chairman Director

3 March 2020 3 March 2020

Condensed Statement of Changes in Equity (Unaudited)

For the six months ended 31 December 2019

Treasury

Share shares Distributable Retained earnings Total

Capital reserve Reserve Capital Revenue Total Equity

Note GBP GBP GBP GBP GBP GBP GBP

Opening

balance at 1

July 2019 993,748 (6,895,640) 95,310,182 152,452,180 (3,084,873) 149,367,307 238,775,597

Issue of

Ordinary

shares 6 1,250 - - - - - 1,250

Purchase of

Ordinary

shares into

Treasury 7 - (3,815,701) - - - - (3,815,701)

Dividends paid

in the period 8 - - (4,730,474) - - - (4,730,474)

(Loss)/Return

for the

period - - - (63,320,946) 984,605 (62,336,341) (62,336,341)

Balance at 31

December 2019 994,998 (10,711,341) 90,579,708 89,131,234 (2,100,268) 87,030,966 167,894,331

======== ============= ============== ============= ============ ============= =============

For the six months ended 31 December 2018

Treasury

Share shares Distributable Retained earnings Total

Notes capital reserve reserve Capital Revenue Total equity

GBP GBP GBP GBP GBP GBP GBP

Opening

balance at 1

July 2018 991,248 (3,212,448) 100,156,159 143,277,348 (3,134,823) 140,142,525 238,077,484

Issue of

Ordinary

shares 6 1,250 - - - - - 1,250

Purchase of

Ordinary

shares into

Treasury 7 - (2,134,050) - - - - (2,134,050)

Dividends paid

in the period 8 - - (4,846,602) - - - (4,846,602)

(Loss)/Return

for the

period - - - (18,274,074) 989,167 (17,284,907) (17,284,907)

Balance at 31

December 2018 992,498 (5,346,498) 95,309,557 125,003,274 (2,145,656) 122,857,618 213,813,175

======== ============ ============== ============= ============ ============= =============

Condensed Statement of Cash Flows (Unaudited)

For the six months ended 31 December 2019

Six months Six months

ended ended

31 December 31 December

2019 2018

(Unaudited) (Unaudited)

GBP GBP

Cash flows from operating activities

Dividend income received from listed equity investments 2,823,185 2,116,794

Bank interest received 3,847 4,498

Management fees paid (2,457,983) (1,816,362)

Performance fee paid (2,456,957) (10,964,740)

Directors' fees paid (82,500) (72,500)

Other expenses paid (432,972) (369,144)

------------- -------------

Net cash outflow from operating activities (2,603,380) (11,101,454)

------------- -------------

Cash flows from investing activities

Purchase of equity investments (45,498,009) (34,694,153)

Sale of equity investments 55,148,758 56,988,813

Purchase of debt instruments (1,827,410) (69,032)

Sale of debt instruments 1,892,069 -

Purchase of derivative financial instruments (3,521,230) (6,250,850)

Sale of derivative financial instruments 2,853,240 7,712,140

Transaction charges on purchase and sale of investments (361,109) (271,632)

------------- -------------

Net cash inflow from investing activities 8,686,309 23,415,286

------------- -------------

Cash flows from financing activities

Proceeds from issue of Company Shares 1,250 1,250

Purchase of Ordinary shares into Treasury (3,815,701) (2,134,050)

Dividends paid (2,381,424) (2,433,145)

------------- -------------

Net cash outflow from financing activities (6,195,875) (4,565,945)

------------- -------------

Net (decrease)/increase in cash and cash equivalents during the period (112,946) 7,747,887

Cash and cash equivalents at beginning of period 931,915 1,168,729

Cash and cash equivalents at end of period 818,969 8,916,616

============= =============

Notes to the Unaudited Condensed Financial Statements

For the six months ended 31 December 2019

General Information

Crystal Amber Fund Limited (the "Company") was incorporated and

registered in Guernsey on 22 June 2007 and is governed in

accordance with the provisions of the Companies Law. The registered

office address is PO Box 286, Floor 2, Trafalgar Court, Les

Banques, St Peter Port, Guernsey, GY1 4LY. The Company was

established to provide shareholders with an attractive total return

which is expected to comprise primarily capital growth with the

potential for distributions of up to 5 pence per share per annum

following consideration of the accumulated retained earnings as

well as the unrealised gains and losses at that time. The Company

seeks to achieve this through investment in a concentrated

portfolio of undervalued companies, which are expected to be

predominantly, but not exclusively, listed or quoted on UK markets

and which have a typical market capitalisation of between GBP100

million and GBP1,000 million.

GI Dynamics Inc., is a subsidiary of the Company and was

incorporated in Delaware. It has five wholly-owned subsidiaries and

its principal place of business is Boston. Refer to Note 9 for

further information.

The Company's Ordinary shares were admitted to trading on AIM,

on 17 June 2008. The Company is also a member of the AIC.

All capitalised terms are defined in the Glossary of Capitalised

Defined Terms unless separately defined.

1. SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of

these Interim Financial Statements are set out below. These

policies have been consistently applied to those balances

considered material to the Interim Financial Statements throughout

the current period, unless otherwise stated.

Basis of preparation

The Interim Financial Statements have been prepared in

accordance with IAS 34, Interim Financial Reporting.

The Interim Financial Statements do not include all the

information and disclosures required in the Annual Financial

Statements and should be read in conjunction with the Company's

Annual Financial Statements for the year to 30 June 2019. The

Annual Financial Statements have been prepared in accordance with

IFRS.

The same accounting policies and methods of computation are

followed in the Interim Financial Statements as in the Annual

Financial Statements for the year ended 30 June 2019.

The presentation of the Interim Financial Statements is

consistent with the Annual Financial Statements. Where

presentational guidance set out in the SORP "Financial Statements

of Investment Trust Companies and Venture Capital Trusts", issued

by the AIC in November 2014 and updated in February 2018, is

consistent with the requirements of IFRS, the Directors have sought

to prepare the Interim Financial Statements on a basis compliant

with the recommendations of the SORP. In particular, supplementary

information which analyses the Statement of Profit or Loss and

Other Comprehensive Income between items of a revenue and capital

nature has been presented alongside the total Statement of Profit

or Loss and Comprehensive Income.

The AIC issued a further update to the SORP in October 2019,

applicable for accounting periods beginning on or after 1 January

2019. The Directors do not anticipate that adoption of changes made

to the SORP will have a significant impact on the Annual Financial

Statements of the Company for the financial year ended 30 June

2020.

Going concern

The Directors are confident that the Company has adequate

resources to continue in operational existence for the foreseeable

future and do not consider there to be any threat to the going

concern status of the Company.

Continuation vote

The Directors have specifically considered the implications of

the continuation vote scheduled to occur every two years on the

application of the going concern basis. The next continuation vote

will be proposed at the 2021 AGM.

Segmental reporting

Operating segments are reported in a manner consistent with

internal reporting provided to the chief operating decision maker.

The chief operating decision maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board as a whole. The key

measure of performance used by the Board to assess the Company's

performance and to allocate resources is the total return on the

Company's NAV, as calculated under IFRS, and therefore no

reconciliation is required between the measure of profit or loss

used by the Board and that contained in these Interim Financial

Statements.

For management purposes, the Company is domiciled in Guernsey

and is engaged in a single segment of business mainly in one

geographical area, being investment in UK equity instruments, and

therefore the Company has only one operating segment.

2. BASIC AND DILUTED LOSS PER SHARE

Loss per share is based on the following data:

Six months Six months

ended ended

31 December 31 December

2019 2018

(Unaudited) (Unaudited)

Loss for the period ( GBP 62,336,341) (GBP17,284,907)

Weighted average number of issued Ordinary shares 94,680,571 97,085,658

Basic and diluted loss per share (pence) (65.84) (17.80)

---------------------------------------------------- ------------------ ----------------

3. NAV PER SHARE

NAV per share is based on the following data:

As at As at As at

31 December 30 June 31 December

2019 2019 2018

(Unaudited) (Audited) (Unaudited)

NAV per Condensed Statement of

Financial Position 167,894,331 238,775,597 213,813,175

Total number of issued Ordinary

shares (excluding Treasury shares) 93,684,567 95,846,980 96,455,780

-------------------------------------- ------------ ----------------------------- -----------------------------

NAV per share (pence) 179.21 249.12 221.67

-------------------------------------- ------------ ----------------------------- -----------------------------

4. FINANCIAL ASSETS DESIGNATED AT FAIR VALUE THROUGH PROFIT OR

LOSS AND DERIVATIVES HELD FOR TRADING

1 July 1 July 1 July

2019 to 2018 to 2018 to

31 December 30 June 31 December

2019 2019 2018

(Unaudited) (Audited) (Unaudited)

GBP GBP GBP

Equity investments 165,250,604 230,330,507 190,087,261

Debt instruments 4,002,635 4,035,127 5,706,034

---------------------------- ------------- --------------------------------- ----------------------------------

Financial assets designated

at FVTPL 169,253,239 234,365,634 195,793,295

Derivative financial

instruments held for

trading 5,000 7,000,515 11,672,548

----------------------------

Total financial assets

designated at FVTPL and

derivatives held for

trading 169,258,239 241,366,149 207,465,843

---------------------------- ------------- --------------------------------- ----------------------------------

Equity investments

Cost brought forward 183,283,825 172,761,740 172,761,740

Purchases 45,498,009 71,094,830 34,694,153

Sales (55,148,758) (90,557,836) (56,988,813)

Net realised gains 6,436,556 29,985,091 18,567,453

---------------------------- ------------- --------------------------------- ----------------------------------

Cost carried forward 180,069,632 183,283,825 169,034,533

Unrealised gains brought

forward 47,197,282 57,316,659 57,316,659

Movement in unrealised

losses (61,257,939) (10,119,377) (36,142,677)

---------------------------- ------------- --------------------------------- ----------------------------------

Unrealised (losses)/gains

carried forward (14,060,657) 47,197,282 21,173,982

Effect of exchange rate

movements on revaluation (758,371) (150,600) (121,254)

---------------------------- ------------- --------------------------------- ----------------------------------

Fair value of equity

investments 165,250,604 230,330,507 190,087,261

---------------------------- ------------- --------------------------------- ----------------------------------

Debt instruments

Cost brought forward 3,950,568 5,547,350 5,547,350

Purchases - 3,120,419 -

Conversion of loans - (7,257,760)

Net realised gains - 2,540,559 -

---------------------------- ------------- --------------------------------- ----------------------------------

Cost carried forward 3,950,568 3,950,568 5,547,350

Unrealised gains brought

forward 968,535 203,233 203,233

Movement in unrealised

gains 102,503 765,302 564,244

---------------------------- ------------- --------------------------------- ----------------------------------

Unrealised gains carried

forward 1,071,038 968,535 767,477

Effect of exchange rate

movements on revaluation (1,018,971) (883,976) (608,793)

---------------------------- ------------- --------------------------------- ----------------------------------

Fair value of debt

instruments 4,002,635 4,035,127 5,706,034

---------------------------- ------------- --------------------------------- ----------------------------------

Total financial assets

designated at FVTPL 169,253,239 234,365,634 195,793,295

---------------------------- ------------- --------------------------------- ----------------------------------

Derivative financial

instruments held for

trading

Cost brought forward 712,142 3,888,021 3,888,021

Purchases 3,521,230 11,742,025 6,250,850

Sales (2,853,240) (7,902,140) (7,712,140)

Net realised losses (1,159,632) (7,015,764) (2,426,731)

---------------------------- ------------- --------------------------------- ----------------------------------

Cost carried forward 220,500 712,142 -

Unrealised gains brought

forward 6,288,373 10,118,917 10,118,917

Movement in unrealised

(losses)/gains (6,503,873) (3,830,544) 1,553,631

---------------------------- ------------- --------------------------------- ----------------------------------

Unrealised (losses)/gains

carried forward (215,500) 6,288,373 11,672,548

---------------------------- ------------- --------------------------------- ----------------------------------

Fair value of derivatives

held for trading 5,000 7,000,515 11,672,548

---------------------------- ------------- --------------------------------- ----------------------------------

Total derivative financial

instruments held for

trading 5,000 7,000,515 11,672,548

---------------------------- ------------- --------------------------------- ----------------------------------

Total financial assets

designated at FVTPL and

derivatives held for

trading 169,258,239 241,366,149 207,465,843

---------------------------- ------------- --------------------------------- ----------------------------------

The following table details the Company's positions in

derivative financial instruments:

Nominal amount Value

(Unaudited) (Unaudited)

31 December 2019 GBP

Derivative financial instruments

Puts on FTSE100 Index P6700 (expiry: January 2020) 1,000 5,000

1,000 5,000

---------------------------------------------------- --------------- ------------

Nominal amount Value

(Audited) (Audited)

30 June 2019 GBP

Derivative financial instruments

Puts on FTSE100 Index P7100 (expiry: July 2019) 5,000 225,000

Puts on FTSE100 Index P7000 (expiry: August 2019) 1,000 190,000

GI Dynamics Inc. warrant (Expiry: May 2023) 97,222,200 1,546,564

GI Dynamics Inc. warrant (Expiry: June 2024) 78,984,823 1,262,671

GI Dynamics Inc. warrant (Expiry: July 2024) 236,220,480 3,776,280

412,433,503 7,000,515

---------------------------------------------------- --------------- ------------

5. FINANCIAL INSTRUMENTS

Fair value measurements

The Company measures fair values using the following fair value

hierarchy that prioritises the inputs to valuation techniques used

to measure fair value. The hierarchy gives the highest priority to

unadjusted quoted prices in active markets for identical assets or

liabilities (Level 1 measurements) and the lowest priority to

unobservable inputs (Level 3 measurements). The three levels of the

fair value hierarchy under IFRS 13 are as follows:

Level 1: Quoted price (unadjusted) in an active market for an identical instrument.

Level 2: Valuation techniques based on observable inputs, either

directly (i.e. as prices) or indirectly (i.e. derived from prices).

This category includes instruments valued using: quoted prices in

active markets for similar instruments; quoted prices for identical

or similar instruments in markets that are considered less than

active; or other valuation techniques for which all significant

inputs are directly or indirectly observable from market data.

Level 3: Valuation techniques using significant unobservable

inputs. This category includes all instruments for which the

valuation technique includes inputs that are not based on

observable data, and the unobservable inputs have a significant

effect on the instrument's valuation. This category includes

instruments that are valued based on quoted prices for similar

instruments for which significant unobservable adjustments or

assumptions are required to reflect differences between the

instruments.

The level in the fair value hierarchy within which the fair

value measurement is categorised in its entirety is determined on

the basis of the lowest level input that is significant to the fair

value measurement. For this purpose, the significance of an input

is assessed against the fair value measurement in its entirety. If

a fair value measurement uses observable inputs that require

significant adjustment based on unobservable inputs, that

measurement is a Level 3 measurement. Assessing the significance of

a particular input to the fair value measurement in its entirety

requires judgement, considering factors specific to the asset or

liability.

The determination of what constitutes 'observable' requires

significant judgement by the Company. The Company considers

observable data to be that market data that is readily available,

regularly distributed or updated, reliable and verifiable, not

proprietary, and provided by independent sources that are actively

involved in the relevant market.

The objective of the valuation techniques used is to arrive at a

fair value measurement that reflects the price that would be

received if an asset was sold or a liability transferred in an

orderly transaction between market participants at the measurement

date.

The following tables analyse, within the fair value hierarchy,

the Company's financial assets measured at fair value at 31

December 2019 and 30 June 2019:

Level 1 Level 2 Level 3 Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

31 December 2019 GBP GBP GBP GBP

Financial assets designated at FVTPL and derivatives held for

trading:

Equities - listed equity investments 159,121,605 - - 159,121,605

Equities - unlisted equity investments - - 6,128,999 6,128,999

Debt - loan notes - - 4,002,635 4,002,635

Derivatives - listed derivative instruments 5,000 - - 5,000

159,126,605 - 10,131,634 169,258,239

-------------------------------------------------------------- ------------ ------------ ------------ ------------

Level 1 Level 2 Level 3 Total

(Audited) (Audited) (Audited) (Audited)

30 June 2019 GBP GBP GBP GBP

Financial assets designated at FVTPL and derivatives held for

trading:

Equities - listed equity investments 224,804,265 - - 224,804,265

Equities - unlisted equity investments - - 5,526,242 5,526,242

Debt - loan notes - - 4,035,127 4,035,127

Derivatives - listed derivative instruments 415,000 - - 415,000

Derivatives - warrant instruments - 6,585,515 - 6,585,515

------------------------------------------------------------------ ------------ ---------- ---------- ------------

225,219,265 6,585,515 9,561,369 241,366,149

------------------------------------------------------------------ ------------ ---------- ---------- ------------

The Level 1 equity investments were valued by reference to the

closing bid prices in each investee company on the reporting

date.

The Level 2 derivative investments were valued using a Black

Scholes valuation technique.

The Level 3 equity investment in Board Intelligence was valued

by reference to the valuation multiples of publicly-listed cloud

software companies, after applying a discount equivalent to that

which prevailed at the time of investment in March 2018, resulting

in a write-up of GBP602,757. The loan notes were classified as

Level 3 debt instruments as there was no observable market data.

The Board has concluded that fair value is approximate to the share

market price had the loan notes been converted to equity and valued

at the closing bid price on the reporting date.

For financial instruments not measured at FVTPL, the carrying

amount is approximate to their fair value.

Fair value hierarchy - Level 3

The following table shows a reconciliation from the opening

balances to the closing balances for fair value measurements in

Level 3 of the fair value hierarchy:

Six months Six months

ended ended

31 December 31 December

2019 2018

(Unaudited) (Unaudited)

GBP GBP

Opening balance at 1 July 9,561,369 9,026,303

Movement in unrealised gain 705,261 1,504,151

Effect of exchange rate movements (134,996) (178,396)

Closing balance at 31 December 10,131,634 10,352,058

----------------------------------- ------------ ------------

The Company recognises transfers between levels of the fair

value hierarchy on the date of the event of change in circumstances

that caused the transfer.

There have been no transfers between levels during the period

ended 31 December 2019.

At the period end and assuming all other variables are held

constant:

-- If unobservable inputs in Level 3 debt investments had been

5% higher/lower (30 June 2019: 5% higher/lower), the Company's

return and net assets for the period ended 31 December 2019 would

have increased/decreased by GBP200,131 (30 June 2019: GBP161,405),

net of any impact on performance fee accrual in each case;

-- If the comparable revenue multiples used in the valuation of

Level 3 equity investments had been 25% higher/lower (30 June 2019:

25% higher/lower), while all other inputs remained constant, the

Company's return and net assets for the period ended 31 December

2019 would have increased/decreased by GBP1,378,340 (30 June 2019:

GBP971,387), net of any impact on performance fee accrual in each

case. If the discount to comparable multiples used in the valuation

of Level 3 equity investments had been 25% lower/higher (30 June

2019: 25% lower/higher), while all other inputs remained constant,

the Company's return and net assets for the period ended 31

December 2019 would have increased/decreased by GBP1,412,722 (30

June 2019: GBP995,617), net of any impact on performance fee

accrual in each case; and

-- There would have been no impact on the other equity reserves.

6. SHARE CAPITAL AND RESERVES

The authorised share capital of the Company is GBP3,000,000

divided into 300 million Ordinary shares of GBP0.01 each.

The issued share capital of the Company is comprised as

follows:

31 December 2019 30 June 2019

(Unaudited) (Audited)

Number GBP Number GBP

Issued, called up and fully paid Ordinary shares of GBP0.01 each 99,499,762 994,998 99,374,762 993,748

================================================================== =========== ======== =========== ========

During the period, the Company issued 125,000 Ordinary shares of

GBP0.01 divided equally amongst five charitable organisations, the

nominal value of which has been paid by Richard Bernstein, who is a

shareholder of the Company, a director and shareholder of the

Investment Manager and a member of the Investment Adviser.

7. TREASURY SHARES RESERVE

Six months ended Year ended

31 December 2019 30 June 2019

(Unaudited) (Audited)

Number GBP Number GBP

Opening balance (3,527,782) (6,895,640) (1,798,982) (3,212,448)

Ordinary shares purchased

during the period/year (2,287,413) (3,815,701) (1,728,800) (3,683,192)

Closing balance (5,815,195) (10,711,341) (3,527,782) (6,895,640)

=========================== ============ ============= ================ ================

During the period ended 31 December 2019: 2,287,413 (2018:

995,000) Ordinary shares were purchased at an average price of

166.81 pence per share (2018: 214.48 pence per share), representing

an average discount to NAV at the time of purchase of 16.4% (2018:

11.9%). During the period ended 31 December 2019, Nil (2018: Nil)

Treasury shares were sold.

8. DIVIDS

On 10 July 2019, the Company declared an interim dividend of

GBP2,381,425, equating to 2.5 pence per Ordinary share, which was

paid on 19 August 2019 to shareholders on the register on 19 July

2019.

On 10 December 2019, the Company declared an interim dividend of

GBP2,349,050, equating to 2.5 pence per Ordinary share, which was

paid on 13 January 2020 to shareholders on the register on 20

December 2019.

9. RELATED PARTIES

Richard Bernstein is a director and a member of the Investment

Manager, a member of the Investment Adviser and a holder of 10,000

(30 June 2019: 10,000) Ordinary shares in the Company, representing

0.01% (30 June 2019: 0.01%) of the voting share capital of the

Company at 31 December 2019.

During the period the Company incurred management fees of

GBP1,628,161 (2018: GBP1,816,362) none of which was outstanding at

31 December 2019 (30 June 2019: GBP829,822). No performance fees

were payable during the period (2018: GBPNil) (30 June 2019:

GBP2,456,957 was outstanding and included in trade and other

payables).

GI Dynamics Inc., an unconsolidated subsidiary of the Company,

was incorporated in Delaware, has five wholly-owned subsidiaries

and its principal place of business is Boston. The five

subsidiaries are as follows:

-- GI Dynamics Securities Corporation, a Massachusetts-incorporated nontrading entity;

-- GID Europe Holding B.V., a Netherlands-incorporated nontrading holding company;

-- GID Europe B.V., a Netherlands-incorporated company that

conducts certain European business operations;

-- GID Germany GmbH, a German-incorporated company that conducts

certain European business operations; and

-- GI Dynamics Australia Pty Ltd, an Australian-incorporated

company that conducts Australian business operations.

Following the exercise of GID warrants during the period, the

Company now holds 73.1% of the voting rights.

Under the terms of the IMA, the Investment Manager is entitled

to a performance fee in certain circumstances. This fee is

calculated by reference to the increase in NAV per Ordinary share

over the course of each performance period.

Payment of the performance fee is subject to:

1. the achievement of a performance hurdle condition: the NAV

per Ordinary share at the end of the relevant performance period

must exceed an amount equal to the placing price, increased at a

rate of: (i) 7% per annum on an annual compounding basis in respect

of that part of the performance period which falls from (and

including) the date of Admission up to (but not including) the date

of the 2013 Admission; (ii) 8% per annum on an annual compounding

basis in respect of that part of the performance period which falls

from (and including) the date of the 2013 Admission up to (but not

including) the date of the 2015 Admission and (iii) 10% per annum

on an annual compounding basis in respect of that part of the

performance period which falls from (and including) the date of the

2015 Admission up to the end of the relevant performance period

with all dividends and other distributions paid in respect of all

outstanding Ordinary shares (on a per share basis) during any

performance period being deducted on their respective payment dates

(and after compounding the distribution amount per share at the

relevant annual rate or rates for the period from and including the

payment date to the end of the performance period) ("the Basic

Performance Hurdle"). Such Basic Performance Hurdle at the end of a

performance period is compounded at the relevant annual rate to

calculate the initial per share hurdle level for the next

performance period, which will subsequently be adjusted for any

dividends or other distributions paid in respect of all outstanding

Ordinary shares during that performance period, and

2. the achievement of a "high-water mark": the NAV per Ordinary

share at the end of the relevant performance period must be higher

than the highest previously reported NAV per Ordinary share at

the end of a performance period in relation to which a

performance fee, if any, was last earned (less any dividends or

other distributions in respect of all outstanding Ordinary shares

declared (on a per share basis) since the end of the performance

period in relation to which a performance fee was last earned).

As the NAV per share at 31 December 2019 did not exceed the high

watermark of 244.12 pence per share at that date, a performance fee

has not been accrued in the Interim Financial Statements. In the

event that, on 30 June 2020, the NAV per share exceeds both the

performance hurdle and the high watermark, the performance

fee will be an amount equal to 20% of the excess of the NAV per

share at that date over the higher of these hurdles multiplied by

the time weighted average number of Ordinary shares in issue during

the year ending 30 June 2020. Depending on whether the Ordinary

shares are trading at a discount or a premium to the Company's NAV

per share at 30 June 2020, the performance fee will be either

payable in cash (subject to the Investment Manager being required

to use the cash payment to purchase Ordinary shares in the market)

or satisfied by the sale of Ordinary shares out of Treasury or by

the issue of new fully paid Ordinary shares at the mid-market

closing price on 30 June 2020, respectively.

As at 31 December 2019, the Investment Manager held 7,037,991

Ordinary shares (30 June 2019: 6,313,326) of the Company,

representing 7.44% (30 June 2019: 6.54%) of the voting share

capital.

The interests of the Directors in the share capital of the

Company at the period/year end, and as at the date of this report,

are as follows:

31 December 2019 30 June 2019

Number of Ordinary Total voting rights Number of Ordinary Total voting rights

shares shares

Christopher Waldron(1) 20,000 0.02% 15,000 0.02%

Jane Le Maitre(2) 6,000 0.01% 6,000 0.01%

Total 26,000 0.03% 21,000 0.03%

------------------------ ---------------------- -------------------- ---------------------- --------------------

(1) Chairman of the Company

(2) Ordinary Shares held indirectly

All related party transactions are carried out on an arm's

length basis.

10. POST BALANCE SHEET EVENTS

On 16 January 2020, Fred Hervouet purchased 7,500 Ordinary

shares. Following the purchase, the

total number of Ordinary shares held by Fred Hervouet was

7,500.

On 22 January 2020, Chris Waldron purchased a further 10,000

Ordinary shares. Following the purchase, the

total number of Ordinary shares held by Chris Waldron was

30,000.

On 23 January 2020, Jane Le Maitre purchased a further 7,500

Ordinary shares. Following the purchase, the

total number of Ordinary shares held by Jane Le Maitre was

13,500.

On 27 January 2020, Juan Morera, an employee of the Investment

Adviser to the Company, sold 2,500 Ordinary shares in the

Company.

The Company purchased 210,000 of its own Ordinary Shares during

the period between 1 January 2020 and 26 February 2020, which were

held as Treasury shares. Following these purchases, the total

number of Ordinary Shares held as Treasury shares by the Company is

6,025,195.

On 12 February 2020, the Company reported that its unaudited NAV

at 31 January 2020 was 147.10 pence per Ordinary share.

11. AVAILABILITY OF INTERIM REPORT

Copies of the Interim Report will be available to download from

the Company's website www.crystalamber.com.

Glossary of Capitalised Defined Terms

"AGM" means the annual general meeting of the Company;

"AIC" means the Association of Investment Companies;

"AIM" means the Alternative Investment Market of the London

Stock Exchange;

"Annual Financial Statements" means the audited annual financial

statements of the Company, including the Statement of Profit or

Loss and Other Comprehensive Income, the Statement of Financial

Position, the Statement of Changes in Equity, the Statement of Cash

Flows and associated notes;

"Black Scholes" means the Black Scholes model, a mathematical

model of a financial market containing derivative instruments;

"Board" or "Directors" or "Board of Directors" means the

directors of the Company;

"Brexit" means the departure of the UK from the European

Union;

"CEO" means chief executive officer;

"CFO" means chief financial officer;

"Citizens Broadband Radio Service" or "CBRS" means a 150 MHz

wide broadcast band of the 3.5 GHz band (3550 MHz to 3700 MHz) in

the United States.

"Company" or "Fund" means Crystal Amber Fund Limited;

"Companies Law" means the Companies (Guernsey) Law, 2008, (as

amended);

"EPS" or "Early Production System" means producing oil through a

temporary processing system and exporting the processed crude to a

storage vessel for subsequent transport to market;

"EBITDA" means earnings before interest, taxes, depreciation and

amortisation;

"GM" or "General Meeting" means a general meeting of the

Company;

"ESG" means Environmental, Social and Governance, referring to

the three central factors in measuring the sustainability and

societal impact of an investment in a company or business;

"FDA" means food and drug administration;

"FTSE" means Financial Times Stock Exchange;

"FVTPL" means Fair Value Through Profit or Loss;

"FY22" means the financial year 2022;

"GDP" means gross domestic product, a monetary measure of the

market value of all the final goods and services produced in a

specific time period;

"HQ" means headquarters;

"IAS" means international accounting standards as issued by the

Board of the International Accounting Standards Committee;

"IFRS" means the International Financial Reporting Standards,

being the principles-based accounting standards, interpretations

and the framework by that name issued by the International

Accounting Standards Board, as adopted by the European Union;

"IMA" means the investment management agreement between the

Company and the Investment Manager dated 16 June 2008, as amended

on 21 August 2013, further amended on 27 January 2015 and further

amended on 12 June 2018;

"Interim Financial Statements" means the unaudited condensed

interim financial statements of the Company, including the

Condensed Statement of Profit or Loss and Other Comprehensive

Income, the Condensed Statement of Financial Position, the

Condensed Statement of Changes in Equity, the Condensed Statement

of Cash Flows and associated notes;

"Interim Report" means the Company's interim report and

unaudited condensed financial statements for the period ended 31

December;

"Lancaster EPS" means Lancaster Early Production System;

"NAV" or "Net Asset Value" means the value of the assets of the

Company less its liabilities as calculated in accordance with the

Company's valuation policies and expressed in Pounds Sterling;

"NAV per share" means the Net Asset Value per Ordinary share of

the Company and is expressed in pence;

"Ordinary share" means an allotted, called up and fully paid

Ordinary share of the Company of GBP0.01 each;

"Phantom Plan" means the practice within Allied Minds plc of

paying to executives 10% of gains arising from any successful

individual investment independent of the scale of losses incurred

on other investments;

"Remuneration Report" means part of the Remuneration Statement

which provides information on the remuneration and other financial

benefits paid to the Board of Directors, the Group CEO and the

Group Executive Committee members during the previous financial

period.

"Small Cap Index" means an index of small market capitalisation

companies;

"SORP" means Statement of Recommended Practice;

"SMEs" means small and medium-sized enterprises and businesses

whose personnel numbers fall below certain limits. The abbreviation

"SME" is used by international organizations such as the World

Bank, the European Union, the United Nations and the World Trade

Organization.

"Treasury" means the reserve of Ordinary shares that have been

repurchased by the Company;

"Treasury shares" means Ordinary shares in the Company that have

been repurchased by the Company and are held as Treasury

shares;

"UK" or "United Kingdom" means the United Kingdom of Great

Britain and Northern Ireland;

"US" means the means the United States of America, its

territories and possessions, any state of the United States and the

District of Columbia;

"US$" or "$" means United States dollars; and

"GBP" or "Pounds Sterling" or "Sterling" means British pound

sterling and "pence" means British pence.

Directors and General Information

Directors Registered Office

Christopher Waldron (Chairman) PO Box 286

Fred Hervouet (Chairman of Remuneration and Management Floor 2, Trafalgar Court

Engagement Committee) Les Banques, St Peter Port

Jane Le Maitre (Chairman of Audit Committee) Guernsey GY1 4LY

Investment Adviser Investment Manager

Crystal Amber Advisers (UK) LLP Crystal Amber Asset Management (Guernsey) Limited

17c Curzon Street PO Box 286

London W1J 5HU Floor 2, Trafalgar Court

Les Banques, St Peter Port

Administrator and Secretary Guernsey GY1 4LY

Estera International Fund Managers (Guernsey) Limited

PO Box 286 Nominated Adviser

Floor 2, Trafalgar Court Allenby Capital Limited

Les Banques, St Peter Port 5 St. Helen's Place

Guernsey GY1 4LY London EC3A 6AB

Broker Legal Advisers to the Company

Winterflood Investment Trusts As to English Law

The Atrium Building Norton Rose Fulbright LLP

Cannon Bridge House 3 More London Riverside

25 Dowgate Hill London SE1 2AQ

London EC4R 2GA

As to Guernsey Law

Independent Auditor Carey Olsen

KPMG Channel Islands Limited PO Box 98

Glategny Court Carey House

Glategny Esplanade Les Banques

St. Peter Port St. Peter Port

Guernsey GY1 1WR Guernsey GY1 4BZ

Identifiers Custodian

ISIN: GG00B1Z2SL48 Butterfield Bank (Guernsey) Limited

Sedol: B1Z2SL4 PO Box 25

Ticker: CRS Regency Court

Website: http://crystalamber.com Glategny Esplanade

LEI: 213800662E2XKP9JD811 St. Peter Port

Guernsey GY1 3AP

Registrar

Link Asset Services

65 Gresham Street

London EC2V 7NQ

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FIFSDVEISIII

(END) Dow Jones Newswires

March 04, 2020 02:49 ET (07:49 GMT)

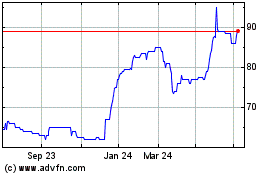

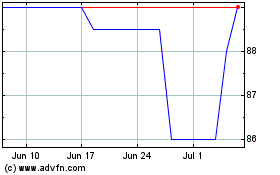

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024