TIDMCMCL

RNS Number : 6140V

Caledonia Mining Corporation PLC

11 August 2022

Caledonia Mining Corporation Plc

Results for the Quarter ended June 30, 2022

(NYSE AMERICAN: CMCL; AIM: CMCL)

August 11, 2022: Caledonia Mining Corporation Plc ("Caledonia"

or the "Company") announces its operating and financial results for

the quarter and the six months ended June 30, 2022 (the "Quarter"

and "First Half" respectively). Further information on the

financial and operating results for the Quarter and First Half can

be found in the management discussion and analysis ("MD&A") and

the unaudited financial statements which are available on the

Company's website, and which have been filed on SEDAR.

Financial Highlights for the Quarter ended June 30, 2022

-- Gross revenues of $36.99 million, a 23.4 per cent increase on

the $29.98 million achieved in the second quarter of 2021 ("Q2

2021").

-- Gross profit of $17.9 million, a 28.8 per cent increase on the $13.9 million in Q2 2021.

-- EBITDA (excluding asset impairments, depreciation and net

foreign exchange gains) of $17.8 million, a 23.8 per cent increase

on the $14.0 million in Q2 2021. This represents EBITDA (excluding

asset impairments, depreciation and net foreign exchange gains) for

the six months ended June 30, 2022 of $31.5 million (H1 2021: $23.5

million).

-- On-mine cost of $692 per ounce (Q2 2021: $715 per ounce).

-- All-in sustaining cost ("AISC") [1] of $925 per ounce (Q2

2021: $901 per ounce). The 3 per cent increase to the comparable

quarter reflects the lower on-mine cost per ounce offset by higher

administrative costs.

-- Basic IFRS earnings per share ("EPS") of 87.7 cents (Q2 2021: 21.1 cents).

-- Adjusted EPS of 56.2 cents (Q2 2021: 62.6 cents).

-- Net cash from operating activities of $16.7 million (Q2 2021: $12.7 million).

-- Net cash and cash equivalents of $10.9 million (Q2 2021, $16.7 million).

-- Total dividend paid in the Quarter of 14 cents per share paid

in April 2022; a further dividend at the same rate of 14 cents per

share was paid in July 2022.

Operating Highlights

-- 20,091 ounces of gold were produced in the Quarter, 20 per

cent higher than the 16,710 ounces produced in Q2 2021 and a new

production record for any quarter.

-- 38,605 ounces were produced in the First Half, 29 per cent

higher than the 29,907 ounces produced in the first half of

2021.

Other highlights - Transaction to acquire the Bilboes gold

project

-- On 21 July 2022, Caledonia announced that it had signed an

agreement to purchase Bilboes Gold Limited, the parent company

which owns, through its Zimbabwe subsidiary, the Bilboes g old

project in Zimbabwe ("Bilboes" or the "Project") [2] . Subject to

satisfaction of the conditions to completion, the total

consideration for the acquisition will be 5,123,044 Caledonia

shares, representing approximately 28.5 per cent of Caledonia's

fully diluted equity, and a 1 per cent net smelter royalty ("NSR")

on the Project's revenues.

-- Bilboes hosts NI 43-101 compliant proven and probable mineral

reserves of 1.96 million ounces of gold in 26.6 million tonnes at a

grade of 2.29 g/t, measured and indicated mineral resources of 2.56

million ounces of gold in 35.2 million tonnes at a grade of 2.26

g/t and inferred mineral resources of 577,000 ounces of gold in 9.5

million tonnes at a grade of 1.89 g/t [3] .

-- The feasibility study which has been prepared by the vendors

indicates the potential for an open-pit gold mine producing an

average of 168,000 ounces per year over a 10-year life of mine.

Caledonia will prepare a feasibility study to identify the most

judicious way to commercialise the Project (with regard to the

availability of funding on acceptable terms).

Outlook

-- Increase production at Blanket Mine ("Blanket") to the target

of 80,000 ounces of gold per annum [4] , reduce operating costs and

increase the flexibility to undertake further development and

exploration, thereby safeguarding and enhancing Blanket's long-term

future.

-- Satisfy the conditions to enable the completion of the

acquisition of Bilboes Gold Limited and, thereafter, prepare a

feasibility study to identify the most judicious way to

commercialise the Project with regard to the availability of

funding on acceptable terms.

-- Restart the oxides operation at Bilboes under the terms of a

tribute arrangement with a view to creating a cash-generative

operation within approximately six months.

-- Upgrade the NI 43-101 compliant inferred mineral resources at

the Maligreen mining claims which are currently estimated to host

approximately 940,000 ounces of gold in 15.6 million tonnes at a

grade of 1.88g/t [5] .

-- Commission the 12MWac solar plant, which is expected to

provide 27 per cent of Blanket's total electricity demand.

-- Continue to evaluate other investment opportunities in the

Zimbabwe gold sector and elsewhere.

Commenting on the announcement, Mark Learmonth, Chief Executive

Officer, said:

"This has been a terrific quarter and, indeed, half year with

second quarter production of just over 20,000 ounces which set a

record for any quarter. The first half of 2022 exceeded our

expectations and we have now achieved our quarterly production

target. Excellent production, along with a higher gold price and

good cost control, has contributed to a 321% increase in IFRS

earnings per share and a 31% increase in net cash from operating

activities over the comparable quarter in 2021.

"In July, Caledonia announced that it had signed an agreement to

purchase Bilboes Gold Limited, which is the holding company for a

large, high-grade, open-pittable gold resource. We have followed

the progress of the project for several years and believe that

Bilboes is the premier gold development project in Zimbabwe, and

indeed one of the best gold development projects in Africa .

"The completion of the transaction is subject to several

conditions, but once achieved we can prepare a feasibility study to

identify the most judicious way to commercialise the project with

regard to the availability of funding on acceptable terms.

Caledonia also intends to re-start the oxides operation at Bilboes

under a tribute arrangement before completion of the transaction

with a view to creating a cash-generative operation within

approximately six months.

"Our immediate strategic focus continues to be on Blanket and we

are on track to meet our target production of between 73-80,000

ounces of gold for this year, with first half production of 38,605

ounces of gold. We will also continue to reduce our operating costs

and increase the flexibility to undertake further development and

exploration, thereby safeguarding and enhancing Blanket's long-term

future.

" The proposed acquisition of Bilboes also builds on the recent

acquisition of the Maligreen claims, where we continue to evaluate

the existing geological information and are focused on increasing

the confidence of the resource base. Caledonia will also consider

other investment opportunities in the Zimbabwe gold sector within

the constraints of its financing and management capacity.

" 2022 has been an outstanding year so far and I would like to

thank the team for their continued hard work."

Caledonia will host an online presentation and Q&A session

open to all investors on 12 August 2022 at 14:00 London Time

The Zoom details for this call are set out below.

Topic: Q2 2022 Results Call for Shareholders.

Please click the link below to join the webinar:

https://caledoniamining.zoom.us/j/95386976088?pwd=NDV4OFFaU2syMnNzeG42Y2FUcGswUT09

Webinar ID: 953 8697 6088

Passcode: 147538

International numbers available:

https://caledoniamining.zoom.us/u/afz b3xKSY

Enquiries:

Caledonia Mining Corporation Plc

Mark Learmonth Tel: +44 1534 679 800

Camilla Horsfall Tel: +44 7817 841 793

Cenkos Securities plc (Nomad and Joint Broker)

Adrian Hadden Tel: +44 207 397 1965

Neil McDonald Tel: +44 131 220 9771

Pearl Kellie Tel: +44 131 220 9775

Liberum Capital Limited (Joint Broker)

Scott Mathieson/Kane Collings Tel: +44 20 3100 2000

BlytheRay Financial PR (UK)

Tim Blythe/Megan Ray Tel: +44 207 138 3204

3PPB (Financial PR, North America)

Patrick Chidley Tel: +1 917 991 7701

Paul Durham Tel: +1 203 940 2538

Curate Public Relations (Zimbabwe)

Debra Tatenda Tel: +263 77802131

IH Securities (Private) Limited (VFEX Sponsor

- Zimbabwe) Tel: +263 (242) 745 119/33/39

Lloyd Mlotshwa

Note: This announcement contains inside information which is

disclosed in accordance with the Market Abuse Regulation (EU) No.

596/2014 (" MAR ") as it forms part of UK domestic law by virtue of

the European Union (Withdrawal) Act 2018 and is disclosed in

accordance with the Company's obligations under Article 17 of MAR

.

Cautionary Note Concerning Forward-Looking Information

Information and statements contained in this news release that

are not historical facts are "forward-looking information" within

the meaning of applicable securities legislation that involve risks

and uncertainties relating, but not limited, to Caledonia's current

expectations, intentions, plans, and beliefs. Forward-looking

information can often be identified by forward-looking words such

as "anticipate", "believe", "expect", "goal", "plan", "target",

"intend", "estimate", "could", "should", "may" and "will" or the

negative of these terms or similar words suggesting future

outcomes, or other expectations, beliefs, plans, objectives,

assumptions, intentions or statements about future events or

performance. Examples of forward-looking information in this news

release include: production guidance, estimates of future/targeted

production rates, and our plans and timing regarding further

exploration and drilling and development. This forward-looking

information is based, in part, on assumptions and factors that may

change or prove to be incorrect, thus causing actual results,

performance or achievements to be materially different from those

expressed or implied by forward-looking information. Such factors

and assumptions include, but are not limited to: failure to

establish estimated resources and reserves, the grade and recovery

of ore which is mined varying from estimates, success of future

exploration and drilling programs, reliability of drilling,

sampling and assay data, assumptions regarding the

representativeness of mineralization being inaccurate, success of

planned metallurgical test-work, capital and operating costs

varying significantly from estimates, delays in obtaining or

failures to obtain required governmental, environmental or other

project approvals, inflation, changes in exchange rates,

fluctuations in commodity prices, delays in the development of

projects and other factors.

Security holders, potential security holders and other

prospective investors should be aware that these statements are

subject to known and unknown risks, uncertainties and other factors

that could cause actual results to differ materially from those

suggested by the forward-looking statements. Such factors include,

but are not limited to: risks relating to estimates of mineral

reserves and mineral resources proving to be inaccurate,

fluctuations in gold price, risks and hazards associated with the

business of mineral exploration, development and mining, risks

relating to the credit worthiness or financial condition of

suppliers, refiners and other parties with whom the Company does

business; inadequate insurance, or inability to obtain insurance,

to cover these risks and hazards, employee relations; relationships

with and claims by local communities and indigenous populations;

political risk; risks related to natural disasters, terrorism,

civil unrest, public health concerns (including health epidemics or

outbreaks of communicable diseases such as the coronavirus

(COVID-19)); availability and increasing costs associated with

mining inputs and labour; the speculative nature of mineral

exploration and development, including the risks of obtaining or

maintaining necessary licenses and permits, diminishing quantities

or grades of mineral reserves as mining occurs; global financial

condition, the actual results of current exploration activities,

changes to conclusions of economic evaluations, and changes in

project parameters to deal with unanticipated economic or other

factors, risks of increased capital and operating costs,

environmental, safety or regulatory risks, expropriation, the

Company's title to properties including ownership thereof,

increased competition in the mining industry for properties,

equipment, qualified personnel and their costs, risks relating to

the uncertainty of timing of events including targeted production

rate increase and currency fluctuations. Security holders,

potential security holders and other prospective investors are

cautioned not to place undue reliance on forward-looking

information. By its nature, forward-looking information involves

numerous assumptions, inherent risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and various future events will

not occur. Caledonia undertakes no obligation to update publicly or

otherwise revise any forward-looking information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law.

This news release is not an offer of the shares of Caledonia for

sale in the United States or elsewhere. This news release shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of the shares of Caledonia, in any

province, state or jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of such province, state or

jurisdiction.

Condensed Consolidated Statement of Profit or Loss and Other

Comprehensive Income (unaudited)

($'000's) 3 months ended 6 months ended

June 30 June 30

2021 2022 2021 2022

Revenue 29,977 36,992 55,697 72,064

Royalty (1,503) (1,854) (2,792) (3,612)

Production costs (12,362) (14,502) (25,219) (28,861)

Depreciation (2,199) (2,639) (3,392) (4,702)

---------------- -------------- ------------ --------------

Gross profit 13,913 17,997 24,294 34,889

Other income 7 1 30 3

Other expenses (3,883) (490) (4,141) (1,283)

Administrative expenses (1,745) (2,908) (3,355) (5,279)

Net foreign exchange (loss)/gain (345) 4,172 (72) 5,081

Cash-settled share-based

expense (31) 57 (183) (310)

Equity-settled share-based

expense - - - (82)

Derivative financial instrument

gain/(expense) 7 41 (107) (1,697)

---------------- -------------- ------------ --------------

Operating profit 7,923 18,870 16,466 31,322

Net finance costs (223) (175) (341) (291)

---------------- -------------- ------------ --------------

Profit before tax 7,700 18,695 16,125 31,031

Tax expense (3,893) (5,314) (6,895) (10,033)

---------------- -------------- ------------ --------------

Profit for the period 3,807 13,381 9,230 20,998

---------------- -------------- ------------ --------------

Other comprehensive income

Items that are or may

be reclassified to profit

or loss

Exchange differences on

translation of foreign

operations 383 (852) 181 (159)

Total comprehensive income

for the period 4,190 12,529 9,411 20,839

---------------- -------------- ------------ --------------

Profit attributable to:

Owners of the Company 2,694 11,378 7,244 17,318

Non-controlling interests 1,113 2,003 1,986 3,680

---------------- -------------- ------------ --------------

Profit for the period 3,807 13,381 9,230 20,998

---------------- -------------- ------------ --------------

Total comprehensive income

attributable to:

Owners of the Company 3,077 10,526 7,425 17,159

Non-controlling interests 1,113 2,003 1,986 3,680

---------------- -------------- ------------ --------------

Total comprehensive income

for the period 4,190 12,529 9,411 20,839

---------------- -------------- ------------ --------------

Earnings per share (cents)

Basic 21.1 87.7 58.4 132.3

Diluted 21.1 87.7 58.4 132.3

Adjusted earnings per

share (cents)

Basic 62.6 56.2 114.2 118.8

Dividends declared per

share (cents) 12.0 14.0 23.0 28.0

----------------------------------- ---------------- -------------- ------------ --------------

Condensed Consolidated Statement of Cash Flows

(unaudited)

($'000's)

3 months ended 6 months ended

June 30 June 30

2021 2022 2021 2022

Cash flows from operating activities

Cash generated from operations 14,987 18,341 17,537 30,185

Interest paid (124) (59) (247) (89)

Tax paid (2,134) (1,567) (2,598) (3,226)

---------- ---------------- ------------ ------------------

Net cash from operating activities 12,729 16,715 14,692 26,870

Cash flows used in investing

activities

Acquisition of property, plant

and equipment (7,425) (13,011) (13,769) (22,745)

Acquisition of exploration and

evaluation assets (784) (412) (974) (636)

Realisation of Gold ETF 1,083 - 1,083 -

Proceeds from disposal of subsidiary - - 340 -

---------- ---------------- ------------ ------------------

Net cash used in investing activities (7,126) (13,423) (13,320) (23,381)

Cash flows from financing activities

Dividends paid (1,814) (2,700) (3,506) (4,488)

Repayment of gold loan - (3,698) - (3,698)

Acquisition of call option - (176) - (176)

Term loan repayments (102) - (206) -

Payment of lease liabilities (33) (39) (65) (79)

---------- ---------------- ------------ ------------------

Net cash used in financing activities (1,949) (6,613) (3,777) (8,441)

Net increase/(decrease) in cash

and cash equivalents 3,654 (3,321) (2,404) (4,952)

Effect of exchange rate fluctuations

on cash and cash equivalents (12) (247) (18) (451)

Net cash and cash equivalents

at beginning of the period 13,027 14,430 19,092 16,265

Net cash and cash equivalents

at end of the period 16,669 10,862 16,669 10,862

------------------------------------------------ ---------- ---------------- ------------ ------------------

Summarised Consolidated Statements of Financial Position (unaudited)

($'000's) As at Dec 31 Jun 30

2021 2022

Total non-current assets 157,944 179,354

Inventories 20,812 20,535

Prepayments 6,930 3,518

Trade and other receivables 7,938 7,748

Income tax receivable 101 182

Cash and cash equivalents 17,152 10,862

Total assets 210,877 222,199

-----------------

Total non-current liabilities 12,633 7,256

Lease liabilities - short

term portion 134 127

Trade and other payables 9,957 12,761

Derivative financial liabilities 3,095 122

Income tax payable 1,562 3,327

Overdraft 887 -

Cash-settled share-based payments - short term

portion 2,053 813

----------------- ---------------

Total liabilities 30,321 24,405

----------------- ---------------

Total equity 180,556 197,793

----------------- ---------------

Total equity and liabilities 210,877 222,199

---------------------------------- ---------------------------------------- ----------------- ---------------

[1] Non-IFRS measures such as "on-mine cost per ounce", "all-in

sustaining cost per ounce" and "adjusted EPS" are used throughout

this announcement. Refer to section 10 of the MD&A for a

discussion of non-IFRS measures.

[2] See press release dated July 21, 2022 entitled " Transaction

to acquire the Bilboes gold project in Zimbabwe".

[3] Refer to the technical report entitled "BILBOES GOLD PROJECT

FEASIBILITY STUDY" dated with effective date 15 December 2021

prepared by DRA Projects Africa Holdings (Pty) Ltd and filed by the

Company on SEDAR (www.sedar.com) on July 21, 2022.

[4] Refer to the technical report entitled "Caledonia Mining

Corporation Plc NI 43-101 Technical Report on the Blanket Gold

Mine, Zimbabwe" dated May 17, 2021 prepared by Minxcon (Pty) Ltd

and filed by the Company on SEDAR on May 26, 2021.

[5] Refer to technical report entitled "Caledonia Mining

Corporation Plc NI 43-101 Mineral Resource Report on the Maligreen

Gold Project, Zimbabwe" by Minxcon (Pty) Ltd dated November 2, 2021

and filed on SEDAR on November 5, 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVETLIILIF

(END) Dow Jones Newswires

August 11, 2022 02:00 ET (06:00 GMT)

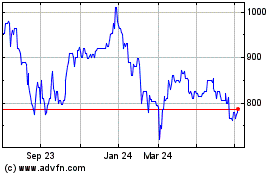

Caledonia Mining (LSE:CMCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

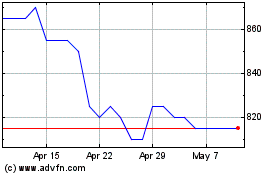

Caledonia Mining (LSE:CMCL)

Historical Stock Chart

From Apr 2023 to Apr 2024