TIDMCHAR

RNS Number : 5288N

Chariot Oil & Gas Ld

25 September 2019

25 September 2019

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

H1 2019 Results

-- Secured the new venture, Lixus Offshore Licence, Morocco,

providing a near-term development opportunity and potential for

cashflow generation.

-- Integrated analysis of 2018 drilling operations complete,

resulting in refined giant prospect portfolio.

-- Data rooms open across the portfolio with the aim of securing partners to drill.

-- 30 June 2019 cash position US$12.1 million, no debt and all commitments fully funded.

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins

focused oil and gas exploration company, today announces its

unaudited interim results for the six-month period ended 30 June

2019.

Highlights:

Low Risk Production Opportunity Secured:

-- Award of near-term development opportunity, Lixus Offshore Licence, Morocco:

o Anchois-1 well gas discovery and satellites offer near-term

development opportunity.

o Deeper prospect offers additional prospective resource

potential.

o Material additional on-block exploration running room in

licence.

-- Competent Persons Report ("CPR") on the Anchois Discovery complete:

o Total remaining recoverable resource to be in excess of 1 Tcf

for Anchois and its satellite prospects (comprising 2C contingent

resources and 2U prospective resources).

o Anchois North confirmed as the low risk priority satellite

with 308 Bcf of 2U prospective resources and probability of

geologic success of 43%.

o Additional on-block prospects with a total remaining

recoverable resource in excess of 1.2 Tcf audited 2U prospective

resources.

-- Development Feasibility Study and Gas Market Assessment

completed for the Anchois Gas Field:

o Development of the Anchois Field is technically feasible with

the potential for either a single phase or a staged development to

commercially optimise access to different parts of the gas

market.

o Morocco has a fast-growing energy market with strong gas

prices that underpins a commercially attractive project.

-- Drilling Environmental Impact Assessment ("EIA") initiated;

data room for prospective partners open.

-- Seismic reprocessing work programme commitment fully funded.

Ongoing Giant Potential Portfolio Progression

Morocco:

o Data room open on the clastic prospects and leads with MOH-B

(gross mean prospective resource of 637mmbbls) and KEN-A (gross

mean prospective resource of 445mmbbls), priority targets, having

been significantly de-risked by the drilling of Rabat Deep 1 in

2018.

o Drilling EIA approved on Kenitra and Mohammedia.

o No remaining work programme commitments.

Brazil:

o Data room open with the aim of securing a partner for the

drilling of a single well at Prospect 1 as a fast follower. This

can penetrate the TP-1, TP-3 and KP-3 stacked targets, which have a

summed, independently audited, gross mean prospective resource of

911mmbbls.

o No remaining work programme commitments.

Namibia:

o Prospect S well (Q4 2018) analysis and integration of legacy

data complete. Prospects B, V & W possess characteristics of

the excellent reservoir potential of the turbidite sand systems

encountered with access to a different source kitchen. Each

prospect ranges from 284 - 469mmbbls of gross mean prospective

resources.

o No remaining work programme commitments.

o Three third party wells, including one in the block adjacent

to Chariot's, due to be drilled in the next year.

Cash Position

-- Unaudited cash balance as at 30 June 2019 of US$12.1 million.

-- No debt and all work commitments, which are less than US$1.0 million, fully funded.

Appointment of Non-Executive Director

-- Andrew Hockey appointed as Independent Non-Executive

Director. Andrew has extensive experience in the development and

production of gas assets.

Outlook

-- Secure partners to participate in the appraisal and

development of the Anchois Gas Field in order to generate cashflow

and sustain the broader exploration programme.

-- Attract industry partners to drill our giant potential

exploration prospects, with the aim of delivering transformational

value.

-- Continue to use expert in-house knowledge base to screen for

new ventures within the Atlantic Margin that will further balance

the risk profile of the Company.

-- Maintain capital discipline throughout the business.

Larry Bottomley, CEO of Chariot commented:

"Using the information acquired from the 2018 drilling campaigns

we have not only been able to de-risk and refine our giant prospect

portfolio, but also identified and acquired a low risk appraisal

asset with the capacity to generate significant cash flow for the

Company.

Chariot's risk portfolio is now balanced by a commercially

attractive production opportunity, capable of sustaining the high

impact exploration programmes of our giant potential prospects

within the wider portfolio. Our cash position substantially exceeds

our commitments and, with the significant interest received in our

data rooms, we are confident about our ability to achieve on our

near-term goals in Morocco. At the same time, we remain vigilant to

further new venture opportunities that can further de-risk the

portfolio whilst also looking to secure additional partners to

deliver wells in a fast follower position on our Namibian and

Brazilian assets."

Investor Conference Call:

Management will host a conference call for investors at 12.00

noon (BST) today, 25 September 2019. Dial-in details for the call

are shown below and participants should request to join the

"Chariot Oil & Gas - Investor Call".

Dial in number: +44 (0)330 336 9125

Conference Code: 8736798

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014.

For further information please contact:

Chariot Oil & Gas Limited

Larry Bottomley, CEO +44 (0)20 7318 0450

finnCap (Nominated Adviser and Broker)

Matt Goode, Christopher Raggett, Anthony Adams

(Corporate Finance) Andrew Burdis (ECM) +44 (0)20 7220 0500

Celicourt Communications (Financial PR)

Jimmy Lea +44 (0)208 434 2754

NOTES TO EDITORS

ABOUT CHARIOT

Chariot Oil & Gas Limited is an independent oil and gas

company focused on the Atlantic margins. It holds exploration

licences covering two blocks in Namibia, three blocks in Morocco

and four blocks in the Barreirinhas Basin offshore Brazil.

The ordinary shares of Chariot Oil & Gas Limited are

admitted to trading on the AIM Market of the London Stock Exchange

under the symbol 'CHAR'.

Chief Executive's Review

The progression of the Chariot portfolio in the last year has

been substantial. Through the participation in two wells and

subsequent associated technical analysis, the in-house team has

considerably developed its understanding of the petroleum systems

within its own portfolio as well as the broader Atlantic Margin. In

H1 2019 this has led to a refined prospect inventory of the giant

exploration portfolio as well as the identification and acquisition

of a low risk appraisal and development opportunity in the Lixus

Licence, offshore Morocco. This asset contains the Anchois gas

discovery which, combined with its satellite exploration prospects,

comprises in excess of 1 Tcf 2C contingent and 2U prospective

resources - the development of which could deliver substantial cash

flow to the Company and offer an important source of gas to

Morocco's strong and developing gas market.

As a small independent with an in-house team comprising

extensive geological knowledge and expert commercial understanding

of the areas in which the Company operates, we are often able to

move quickly to capitalise on opportunities and to rapidly progress

our assets. Within three months of acquiring Lixus the team has

re-evaluated significant quantities of 3D seismic and well data,

had an independent third party Competent Person's Report on the

recoverable resources identified within Anchois and its satellite

prospects, commissioned an independent analysis on the technical

feasibility of an Anchois development and a detailed analysis of

the Moroccan gas market to confirm the commercial potential of the

project and, based on the affirmations from these reports,

initiated a data room to secure partners to progress the

development. In addition, in order to facilitate timely appraisal

operations, the appropriate drilling EIA's have been initiated.

As with all of Chariot's assets, the broader Lixus portfolio is

believed to contain the potential for significant running room in

the success case and a further CPR has been completed on five

additional prospects which offer an attractive upside in excess of

1.2 Tcf 2U prospective resources.

At the same time as developing this lower risk part of the

portfolio, we have continued our focus on progressing our giant

potential exploration assets in which the Company looks to achieve

its long-term goal of discovering material quantities of

hydrocarbons. The integration of the information from the 2018

drilling campaign with our existing knowledge base is now complete,

enabling us to establish a de-risked and refined drilling prospect

portfolio. A data room has been opened with this integrated

information on priority prospects MOH-B and KEN-A (637mmbbls and

445mmbbls of gross mean prospective resource respectively) which

sit in the Mohammedia and Kenitra permits offshore Morocco and

associated drilling EIA's have been completed and approved.

In Namibia, the team will look to promote its priority targets

B, V and W (each ranging from 284 - 469mmbbls of gross mean

prospective resources) as a fast follower. Namibia remains a region

of significant industry interest, with three third party wells due

to be drilled in the next year, including a well in the block

adjacent to that of Chariot's. In a relatively underexplored region

such as this information from third party wells is crucial to

de-risking assets and we believe that these drilling campaigns will

offer important information on the prospectivity within the Central

Blocks.

The team will also continue to use this fast follower strategy

in its Brazilian acreage. A data room is open on priority Prospect

1 (911mmbbls of gross mean prospective resources in stacked

targets), with the aim of securing a partner to drill following the

results of a play opening third party well commitment in adjacent

acreage.

The goal of Chariot's ongoing new venture acquisition screening

process is to identify value accretive assets that will provide

balance to the wider portfolio. By adding recoverable resources to

the asset base the Company believes that it has created the

potential for a sustainable platform from which to progress the

giant exploration prospect portfolio - a discovery from which would

transform the Company.

Our half year cash balance of US$12.1 million is well in excess

of our current work commitments, which are less than US$1.0

million. With our continued focus on partnering to deliver on

drilling campaigns and a tight control over our cost base we

believe that we are in a secure position to achieve our near term

objectives, the success of which is anticipated to contribute

towards the development of the high impact exploration options

within the broader portfolio, and, ultimately, the delivery of

transformational value to stakeholders.

Operational Review

Morocco

Appraisal:

Lixus (75% Chariot (Operator), 25% ONHYM (carried interest));

all commitments fully funded

Since the acquisition of the low risk production opportunity

within Lixus in April 2019, the Company has completed an evaluation

of all the subsurface seismic and well data and an independent CPR

by Netherland Sewell & Associates Inc. has been carried out.

This third-party evaluation not only confirmed Chariot's analysis

but also upgraded the total remaining recoverable resource for

Anchois and its satellite prospects to in excess of 1 Tcf

(comprising 2C contingent resources and 2U prospective resources).

Anchois North is confirmed as the low risk priority satellite

prospect with 308 Bcf of 2U prospective resources and a probability

of geological success of 43%.

In line with its commitment to developing the gas market and

maturing development concepts for the Anchois gas field the team

commissioned a Development Feasibility Study and a Morocco Gas

Market and Anchois Field Monetisation Assessment. These studies

demonstrated that the development of the Anchois gas field project

is technically feasible and commercially attractive to the Company

as well as a potentially important source of gas to Morocco's

strong and developing gas market. The development scheme has

significant flexibility owing to the numerous satellite prospects

adjacent to the Anchois discovery.

The teams' re-evaluation of the subsurface identified

significant running room within the broader Lixus portfolio and a

further CPR on these additional five prospects within the licence

has been completed identifying an additional total remaining

recoverable resource in excess of 1.2 Tcf 2U prospective

resources.

A data room to identify partners to develop the project has been

opened and we have seen significant industry interest to date.

Consistent with all our exploration programmes, to accelerate

drilling where possible, we have looked to ensure that economically

viable long lead requirements are satisfied prior to securing

partners. A drilling EIA has been initiated to facilitate the

Anchois appraisal project that, subject to partnering, is

anticipated to commence in 2020.

High Impact Exploration:

Mohammedia and Kenitra (75% Chariot (Operator), 25% ONHYM

(carried interest); no remaining commitments)

An independent CPR has been completed on the integrated analysis

from the Rabat Deep 1 well with Chariot's legacy data. This

supports the Company's evaluation of MOH-B (gross mean prospective

resource of 637mmbbls) and KEN-A (gross mean prospective resource

of 445mmbbls) as priority drilling targets. These clastic prospects

show the potential for excellent quality upper Jurassic sandstone

reservoirs and seal encountered in the Rabat Deep 1 well as well

the potential for a hydrocarbon charge from Cretaceous source rocks

identified from extensive geochemical analysis.

A data room that includes this integrated analysis is now open

and the associated drilling EIAs have been completed and

approved.

Brazil

High Impact Exploration:

BAR-M-292, 293, 313 and 314 (100% Chariot (Operator); no

remaining commitments)

In Brazil, Chariot has a data room open on the independently

audited, large four-way dip-closed structure which consists of

seven reservoir targets, individually ranging up to 366mmbbls of

gross mean prospective resource. In particular, the Company is

promoting Prospect 1, which can penetrate a summed gross

prospective resource of 911mmbbls in TP-1, TP-3 and KP-3 by a

single vertical well.

In line with its fast follower approach, Chariot anticipates

partnered drilling to occur after third party drilling in adjacent

acreage. This will test the potential of the deeper outboard basin

and, crucially, directly de-risk Chariot's priority targets which

are located within the same play fairway, but, critically, in an

up-dip setting.

Namibia

High Impact Exploration:

PEL-71, "Central Blocks" (65% Chariot (Operator), 20% Azinam;

10% NAMCOR; 5% Ignitus; no remaining commitments)

Following the disappointing results of the Prospect S well in Q4

2018, the Company has carried out extensive post-well analysis to

determine the impact on the remaining prospectivity of the Central

Blocks, which span a vast 16,800km(2) .

The data recovered from the well has provided valuable

information about the excellent reservoir potential of the

turbidite sand systems which form the primary targets across many

of the remaining prospects, including the independently audited

Prospects B, V and W, each ranging from 284 - 469mmbbls of gross

mean prospective resources. These prospects access an outboard

source kitchen different to the inboard kitchen postulated for

Prospect S and have a geological chance of success ranging from

22-25%. The Company will look to promote these prospects to

interested parties using its "fast follower" strategy, with the aim

of drilling after integrating additional anticipated third-party

exploration well results in neighbouring acreage, likely to

commence in 2020.

New Ventures

Part of Chariot's ability to identify and progress its assets is

due to the strength of its in-house team and the experience built

in our regions of operation. The Company continues to use this

elevated level of knowledge and understanding to evaluate and

capitalise on further new venture opportunities that, like the

Lixus licence, can offer additional diversification to the risk

portfolio of the Company.

Financial Review

The Group is debt free and had a cash balance of US$12.1 million

at 30 June 2019 (US$28.4 million at 30 June 2018; US$19.8 million

at 31 December 2018), with all work commitments, which are less

than US$1.0 million, fully funded.

Other administrative expenses of US$1.5 million (30 June 2018:

US$1.5 million) remain in line with the prior period reflecting the

ongoing commitment to capital discipline and overhead control.

Finance income and expense net gain of US$0.1 million (30 June

2018: net loss US$0.1 million) comprises interest on cash and

foreign exchange movements on non-US$ cash. The net loss of US$0.1

million for the six months ended 30 June 2018 is due to the holding

of slightly higher cash balances in Sterling to meet prior year

drilling costs denominated in Sterling resulting in higher foreign

exchange movement. There has been no corresponding requirement to

hold Sterling cash balances in the current period.

Share-based payments charges of US$0.4 million are marginally

lower than the US$0.5 million incurred for the six months ended 30

June 2018 due to the vesting of historic awards of employee

deferred shares.

Corporate

Chariot looks to ensure that in all aspects of its work it has

the appropriate experience and background knowledge to progress

assets to the best of its ability. With the addition of this

appraisal opportunity to the portfolio, the Board has sought to

complement its already extensive and varied experience with that of

a new Non-Executive Director, Andrew Hockey. Andrew's expertise in

delivering gas appraisal and development projects will prove

invaluable to the Company's decision-making process as it looks to

progress its assets, in particular that of Lixus.

Outlook

Our objective in securing Lixus is for the substantial cashflow

anticipated to be generated from the appraisal and development of

Anchois to sustain our longer term, transformational potential

exploration drilling programmes across the wider portfolio.

Subject to partnering, we anticipate the appraisal and

development project of Anchois to commence in 2020, with first gas

achievable in 2023. At the same time, we will continue to promote

our giant exploration prospects to the industry, with the aim of

securing drilling partners to deliver this potential for

transformational value in the near term in Morocco and with a fast

follower positioning in Brazil and Namibia. We will also continue

to seek further opportunities that can offer additional balance to

the risk of the portfolio.

As ever, in all that we do we will remain vigilant to our cash

balance, applying capital discipline in all areas of our business.

We are excited about the coming months and believe that the quality

of the portfolio demonstrated by the significant work done to date,

our experienced and capable team and our clear strategic focus make

us well placed to achieve our objectives.

Larry Bottomley

Chief Executive Officer

24 September 2019

Chariot Oil & Gas Limited

Independent review report to Chariot Oil & Gas Limited

Introduction

We have been engaged by the Group to review the condensed set of

financial statements in the half-yearly financial report for the

six months ended 30 June 2019 which comprises the consolidated

statement of comprehensive income, the consolidated statement of

changes in equity, the consolidated statement of financial

position, the consolidated cash flow statement and the related

explanatory notes.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the Group's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

Our responsibility

Our responsibility is to express to the Group a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2019 is not prepared, in all material respects, in accordance

with the rules of the London Stock Exchange for companies trading

securities on AIM.

BDO LLP

Chartered Accountants

London

United Kingdom

24 September 2019

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Chariot Oil & Gas Limited

Consolidated statement of comprehensive income for the six

months ended 30 June 2019

Six months Six months Year ended

ended 30 ended 30 31 December

June 2019 June 2018 2018

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Share based payments (355) (507) (904)

Impairment of exploration

asset 4 - - (10,876)

Other administrative expenses (1,543) (1,521) (3,359)

--------------------------------------- ------- -------------- -------------- ---------------

Total operating expenses (1,898) (2,028) (15,139)

--------------------------------------- ------- -------------- -------------- ---------------

Loss from operations (1,898) (2,028) (15,139)

Finance income 102 158 371

Finance expense (69) (256) (356)

--------------------------------------- ------- -------------- -------------- ---------------

Loss for the period before

taxation (1,865) (2,126) (15,124)

Tax expense (11) (12) (12)

--------------------------------------- ------- -------------- -------------- ---------------

Loss for the period and total

comprehensive loss for the

period attributable to equity

owners of the parent (1,876) (2,138) (15,136)

--------------------------------------- ------- -------------- -------------- ---------------

Loss per ordinary share attributable 3 US$(0.01) US$(0.01) US$(0.04)

to the equity holders of the

parent - basic and diluted

--------------------------------------- ------- -------------- -------------- ---------------

Chariot Oil & Gas Limited

Consolidated statement of changes in equity for the six months

ended 30 June 2019

Share Total

based Foreign attributable

Share Share Contributed payment exchange Retained to equity

capital premium equity reserve reserve deficit holders of

the parent

US$000 US$000 US$000 US$000 US$000 US$000 US$000

---------------- ---------- ---------- -------------- ---------- ----------- ----------- --------------

For the six

months ended

30 June 2019

(unaudited)

As at 1

January 2019 6,264 356,336 796 4,928 (1,241) (277,124) 89,959

Loss and total

comprehensive

loss for the

period - - - - - (1,876) (1,876)

Share based

payments - - - 355 - - 355

Transfer of

reserves due

to issue of

share awards 4 167 - (171) - - -

As at 30 June

2019 6,268 356,503 796 5,112 (1,241) (279,000) 88,438

---------------- ---------- ---------- -------------- ---------- ----------- ----------- --------------

For the six

months ended

30 June 2018

(unaudited)

As at 1

January 2018 4,881 340,743 796 4,472 (1,241) (261,988) 87,663

Loss and total

comprehensive

loss for the

period - - - - - (2,138) (2,138)

Issue of

capital 1,355 16,258 - - - - 17,613

Issue costs - (1,085) - - - - (1,085)

Share based

payments - - - 507 - - 507

Transfer of

reserves due

to issue of

share awards 3 26 - (29) - - -

As at 30 June

2018 6,239 355,942 796 4,950 (1,241) (264,126) 102,560

---------------- ---------- ---------- -------------- ---------- ----------- ----------- --------------

For the year

ended 31

December 2018

(audited)

As at 1

January 2018 4,881 340,743 796 4,472 (1,241) (261,988) 87,663

Loss and total

comprehensive

loss for the

year - - - - - (15,136) (15,136)

Issue of

capital 1,355 16,258 - - - - 17,613

Issue costs - (1,085) - - - - (1,085)

Share based

payments - - - 904 - - 904

Transfer of

reserves due

to issue of

share awards 28 420 - (448) - - -

As at 31

December 2018 6,264 356,336 796 4,928 (1,241) (277,124) 89,959

---------------- ---------- ---------- -------------- ---------- ----------- ----------- --------------

Chariot Oil & Gas Limited

Consolidated statement of financial position as at 30 June

2019

30 June 30 June 31 December

2019 2018 2018

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Non-current assets

Exploration and appraisal

costs 4 76,006 74,383 74,236

Property, plant and equipment 134 128 100

Right of use asset: office 1,147 - -

lease

------------------------------------ ------- ----------- ----------- ------------

Total non-current assets 77,287 74,511 74,336

------------------------------------ ------- ----------- ----------- ------------

Current assets

Trade and other receivables 1,347 1,076 2,306

Inventory 524 645 524

Cash and cash equivalents 5 12,137 28,369 19,822

------------------------------------ ------- ----------- ----------- ------------

Total current assets 14,008 30,090 22,652

------------------------------------ ------- ----------- ----------- ------------

Total assets 91,295 104,601 96,988

------------------------------------ ------- ----------- ----------- ------------

Current liabilities

Trade and other payables 1,549 2,041 7,029

Lease liability: office lease 339 - -

------------------------------------ ------- ----------- ----------- ------------

Total current liabilities 1,888 2,041 7,029

------------------------------------ ------- ----------- ----------- ------------

Non-current liabilities

Lease liability: office lease 969 - -

------------------------------------ ------- ----------- ----------- ------------

Total non-current liabilities 969 - -

------------------------------------ ------- ----------- ----------- ------------

Total liabilities 2,857 2,041 7,029

------------------------------------ ------- ----------- ----------- ------------

Net assets 88,438 102,560 89,959

------------------------------------ ------- ----------- ----------- ------------

Capital and reserves attributable

to equity holders of the parent

Share capital 6 6,268 6,239 6,264

Share premium 356,503 355,942 356,336

Contributed equity 796 796 796

Share based payment reserve 5,112 4,950 4,928

Foreign exchange reserve (1,241) (1,241) (1,241)

Retained deficit (279,000) (264,126) (277,124)

------------------------------------ ------- ----------- ----------- ------------

Total equity 88,438 102,560 89,959

------------------------------------ ------- ----------- ----------- ------------

Chariot Oil & Gas Limited

Consolidated cash flow statement for the six months ended 30

June 2019

Six months Six months Year ended

ended 30 ended 30 31 December

June 2019 June 2018 2018

US$000 US$000 US$000

Unaudited Unaudited Audited

-------------------------------------------- -------------- -------------- ---------------

Operating activities

Loss for the period before taxation (1,865) (2,126) (15,124)

Adjustments for:

Finance income (102) (158) (371)

Finance expense 69 256 356

Depreciation and amortisation 196 28 56

Share based payments 355 507 904

Impairment of exploration asset - - 10,876

-------------------------------------------- -------------- -------------- ---------------

Net cash outflow from operating

activities before changes in working

capital (1,347) (1,493) (3,303)

Decrease / (increase) in trade and

other receivables 479 195 (560)

Increase / (decrease) in trade and

other payables 120 (597) (775)

Increase in inventories - (165) (44)

-------------------------------------------- -------------- -------------- ---------------

Cash outflow from operating activities (748) (2,060) (4,682)

Tax payment (11) (12) (12)

-------------------------------------------- -------------- -------------- ---------------

Net cash outflow from operating

activities (759) (2,072) (4,694)

-------------------------------------------- -------------- -------------- ---------------

Investing activities

Finance income 124 155 357

Payments in respect of property,

plant and equipment (66) (23) (23)

Payments in respect of intangible

assets (6,752) (1,196) (7,223)

Net cash outflow used in investing

activities (6,694) (1,064) (6,889)

-------------------------------------------- -------------- -------------- ---------------

Financing activities

Issue of ordinary share capital - 17,613 17,613

Issue costs - (1,085) (1,085)

Payment of lease liabilities (164) - -

Finance expense on lease (52) - -

Net cash inflow from financing activities (216) 16,528 16,528

-------------------------------------------- -------------- -------------- ---------------

Net (decrease) / increase in cash

and cash equivalents in the period (7,669) 13,392 4,945

Cash and cash equivalents at start

of the period 19,822 15,233 15,233

Effect of foreign exchange rate

changes on cash and cash equivalent (16) (256) (356)

Cash and cash equivalents at end

of the period 12,137 28,369 19,822

-------------------------------------------- -------------- -------------- ---------------

Chariot Oil & Gas Limited

Notes to the interim financial statements for the six months

ended 30 June 2019

1. Accounting policies

Basis of preparation

The interim financial statements have been prepared using

policies based on International Financial Reporting Standards (IFRS

and IFRIC interpretations) issued by the International Accounting

Standards Board (IASB) as adopted for use in the EU.

The interim financial information has been prepared using the

accounting policies which were applied in the Group's statutory

financial statements for the year ended 31 December 2018. The Group

has not adopted IAS 34: Interim Financial Reporting in the

preparation of the interim financial statements.

Other than IFRS 16 Leases there has been no impact on the Group

of any new standards, amendments or interpretations that have

become effective in the period. The Group has not early adopted any

new standards, amendments or interpretations.

New accounting standard adopted

The Group has adopted IFRS 16 Leases effective 1 January 2019.

On adoption, the Group recognised a lease liability in relation to

the UK office that had previously been classified as an operating

lease under the principles of IAS 17 Leases.

This affected the following items in the consolidated balance

sheet on 1 January 2019:

-- right-of-use assets - increase by US$1.3 million (30 June

2019: US$ 1.1 million)

-- lease liabilities - increase by US$1.5 million (30 June 2019:

US$ 1.3 million)

Each lease payment is allocated between the liability and

finance cost. The finance cost is charged to profit or loss over

the lease period to produce a constant periodic rate of interest on

the remaining balance of the liability for each period. The

right-of-use asset is depreciated over the shorter of the asset's

useful life and the lease term on a straight-line basis. Additional

disclosure will be provided in the 2019 Financial Statements

relating to leases where material.

2. Financial reporting period

The interim financial information for the period 1 January 2019

to 30 June 2019 is unaudited but was the subject of an independent

review carried out by the Company's auditors, BDO LLP. The

financial statements also incorporate the unaudited figures for the

interim period 1 January 2018 to 30 June 2018 and the audited

figures for the year ended 31 December 2018.

The financial information contained in this interim report does

not constitute statutory accounts as defined by sections 243-245 of

the Companies (Guernsey) Law 2008.

The figures for the year ended 31 December 2018 are not the

Group's full statutory accounts for that year. The auditors' report

on those accounts was unqualified, did not contain references to

matters to which the auditors drew attention by way of emphasis and

did not contain a statement under section 263 (3) of the Companies

(Guernsey) Law 2008.

3. Loss per share

The calculation of the basic earnings per share is based on the

loss attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2019 2018 2018

Loss for the period US$000 (1,876) (2,138) (15,136)

---------------- ---------------- --------------

Weighted average number of

shares 367,274,992 319,017,446 343,201,438

---------------- ---------------- --------------

Loss per share, basic and US$(0.01) US$(0.01) US$(0.04)

diluted*

---------------- ---------------- --------------

*Inclusion of the potential ordinary shares would result in a

decrease in the loss per share and, as such, is considered to be

anti-dilutive. Consequently a separate diluted loss per share has

not been presented.

4. Exploration and appraisal costs

30 June 2019 30 June 2018 31 December 2018

US$000 US$000 US$000

-------------- -------------- ------------------

Balance brought forward 74,236 72,770 72,770

-------------- -------------- ------------------

Additions 1,770 1,613 12,342

-------------- -------------- ------------------

Impairment - - (10,876)

-------------- -------------- ------------------

Net book value 76,006 74,383 74,236

-------------- -------------- ------------------

As at 30 June 2019 the net book values of the three cost pools

are Central Blocks offshore Namibia US$50.8 million (31 December

2018: US$50.5 million), Morocco US$9.8 million (31 December 2018:

US$8.5 million) and Brazil US$15.4 million (31 December 2018:

US$15.2 million).

The impairment charge in 2018 is in respect of drilling the

Prospect S well in the Central Blocks offshore Namibia. The Group

continues to see value in the remaining prospects within the

Central Blocks with recoverable amount assessed to be in excess of

carrying value.

5. Cash and cash equivalents

As at 30 June 2019 the cash balance of US$12.1 million (31

December 2018: US$19.8 million) contains the following cash

deposits that are secured against bank guarantees given in respect

of exploration work to be carried out:

30 June 2019 30 June 2018 31 December 2018

US$000 US$000 US$000

-------------- -------------- ------------------

Moroccan licences 650 3,550 800

-------------- -------------- ------------------

650 3,550 800

-------------- -------------- ------------------

The funds are freely transferrable but alternative collateral

would need to be put in place to replace the cash security.

6. Share capital

Allotted, called up and fully paid

At At At At 31 December 31

30 June 30 June 30 June 30 June 2018 December

2019 2019 2018 2018 2018

--------------- ---------- --------------- ---------- --------------- -----------

Number US$000 Number US$000 Number US$000

--------------- ---------- --------------- ---------- --------------- -----------

Ordinary

shares

of 1p

each 367,532,909 6,268 365,611,685 6,239 367,259,909 6,264

--------------- ---------- --------------- ---------- --------------- -----------

Details of the Ordinary shares issued during the six month

period to 30 June 2019 are given in the table below:

Date Description Price No of shares

US$

1 January

2019 Opening Balance 367,259,909

----------------------- ------- --------------

20 June 2019 Issue of share award 1.35 40,000

----------------------- ------- --------------

20 June 2019 Issue of share award 0.50 233,000

----------------------- ------- --------------

30 June 2019 367,532,909

------- --------------

The ordinary shares have a nominal value of 1p. The share

capital has been translated at the historic rate at the date of

issue, or, in the case of the LTIP, the date of grant.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR QZLFLKKFFBBL

(END) Dow Jones Newswires

September 25, 2019 02:00 ET (06:00 GMT)

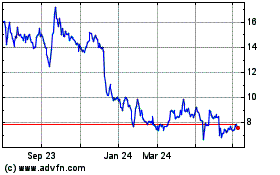

Chariot (LSE:CHAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

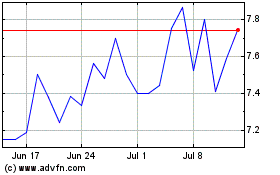

Chariot (LSE:CHAR)

Historical Stock Chart

From Apr 2023 to Apr 2024