TIDMCGH

RNS Number : 0865O

Chaarat Gold Holdings Ltd

05 February 2021

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

Not for release, publication, or distribution to United States

newswire services or for release, publication or dissemination in

the United States and does not constitute an offer of the

securities herein.

This press release does not constitute an offer to sell, or a

solicitation of an offer to buy, securities in the United States or

any other jurisdiction. Any securities described in this press

release have not been, and will not be, registered under the US

Securities Act of 1933, as amended, and may not be offered or sold

in the United States absent registration except in transactions

exempt from, or not subject to, registration under the US

Securities Act and applicable US state securities laws. There is no

public offering of the securities in the United States

expected.

05 February 2021

Chaarat Gold Holdings Limited - (AIM:CGH)

("Chaarat" or the "Company")

Fundraise and Planned Debt Reduction

Chaarat (AIM:CGH), the AIM-quoted gold mining company with

assets in the Kyrgyz Republic and Armenia is pleased to announce

that it is launching a fundraise for approximately US$ 25 million

(the "Fundraise") through the issue of new ordinary shares of US$

0.01 each nominal value in the Company (the "New Ordinary Shares")

at 26 pence per New Ordinary Share (the "Issue Price").

The Company has received commitments for US$ 23.5 million

through legally binding subscriptions (the "Initial Subscription")

representing 65,908,088 New Ordinary Shares (the "Initial

Subscription Shares") and US$ 1.4 million in the form of

non-binding commitments.

Chaarat has closed the Initial Subscription element of the

Fundraise but will keep the balance of the Fundraise open until

Tuesday 9 February 2021 at 4.30pm GMT to allow completion of the

above mentioned non-binding commitments and any additional

demand.

Alongside the Fundraise, the Company's largest shareholder,

Labro Investments Ltd. ("Labro"), has indicated to the Company its

willingness to convert the entirety of the outstanding term loan of

US$ 22 million plus accrued interest (the "Labro Term Loan") into

equity in the Company at the Issue Price. The conversion is subject

to approval by the independent directors of the Company and would

be satisfied through signing a subscription agreement between the

Company and Labro to issue approximately 62.4 million new ordinary

shares at the Issue Price (the "Labro Subscription Shares"). If

approved by the Chaarat Board, this would reduce the Chaarat debt

position to US$ 46.5 million, a reduction of 33% from the currently

outstanding US$ 68.5 million.

Highlights

The Company received strong demand for the Fundraise in the form

of binding and non-binding commitments for a total US$ 24.9 million

from new institutional investors and family offices as well as

existing shareholders.

With the progress made in 2019 and 2020 on the Tulkubash project

construction, it is expected that the funds received from the

binding and non-binding commitments would represent the remainder

of the upfront equity portion to fund the Tulkubash project in the

Kyrgyz Republic and fulfils one of the key criteria in order to

draw on any debt project finance facility that is arranged. The

Company has ongoing discussions on debt financing of approximately

US$ 80 million and anticipates having this completed during H1 2021

in order to fully fund the project construction capital of

approximately US$ 110 million.

Funds in excess of those required for Tulkubash will be used for

growth activities at both the Company's Kyzyltash project and the

East Flank development at the Kapan operation.

Fundraise

- Chaarat signed subscription agreements with several new

institutional investors and family offices which have committed to

a total of US$ 19.9 million, of which US$ 19.5 million are binding

commitments and have been signed.

- The Company has received further support from its existing

shareholders of US$ 5.0 million, of which US$ 4.0 million are

binding commitments and have been signed.

- The Company has decided to keep the Fundraise open until

Tuesday 9 February 2021 at 4.30pm GMT to allow non-binding

commitments to close and provide an opportunity for further demand

to participate.

- Furthermore, the Company has also received notice from Labro

that it is willing to convert US$ 22 million of outstanding debt

from the Labro Loan Facility to equity through subscribing for

approximately 62.4 million new ordinary shares. It is expected the

Company and Labro will enter into legally binding documentation,

which is anticipated to be confirmed later today, subject to

approval by the independent directors of the Company.

- The Fundraise allows Chaarat to proceed on several critical-path items including:

o Ongoing construction activities at the Tulkubash project in

order to maintain Chaarat's targeted timeline for first gold pour

in Q4 2022

o Metallurgical test work on the Kyzyltash project

o Initial development of the East Flank extension at our Kapan operation

o Efforts to advance potential M&A opportunities

Completion of the Initial Subscription is subject to admission

of the Initial Subscription Shares to trading on the AIM market of

the London Stock Exchange plc ("Admission"). Application has been

for the Initial Subscription Shares to be admitted to trading on 10

February 2021.

Following Admission of the Initial Subscription Shares, the

Company's enlarged issued share capital will comprise 605,970,298

ordinary shares of US$0.01 each. This figure may be used by

shareholders of the Company as the denominator for the calculations

by which they will determine whether they are required to notify

their interest in, or a change to their interest in, the Company

under the Financial Conduct Authority's Disclosure Guidance and

Transparency Rules Sourcebook.

The Company will make separate applications to trading for the

Labro Subscriptions Shares (once issued) and any further shares

issued pursuant to the Fundraise.

Debt outstanding

Following Labro's proposal for a debt-to-equity conversion of

approximately US$ 22 million plus accrued interest and approval by

the independent directors of the Company, the Labro Term Loan would

be extinguished, saving the Company US$ 2.1 million in interest

payments per year from 2021 to 2024.

The Company reduced its outstanding Kapan acquisition loan by

another US$ 2 million as of 01 January to US$ 26 million. A further

US$ 2.5 million payment is scheduled for April 2021.

In total the debt position would be reduced from currently US$

68.5 million to US$ 46.5 million after the Labro debt-to-equity

conversion, a reduction of 33%.

Listing considerations

As part of the Company's ongoing considerations to further

enhance liquidity and broaden Chaarat's investor base, Chaarat has

initiated the process for a secondary listing on the Moscow Stock

Exchange ("MOEX") given indications of strong demand from investors

in the former Soviet Union. Chaarat also remains focused on a move

to the London Stock Exchange ("LSE") main market at the appropriate

juncture as the Company advances its strategic initiatives or

completes a transformative transaction.

Artem Volynets, Chief Executive Officer of Chaarat, said:

"We are delighted by the strong demand of new investors and our

existing shareholders to support the Company to fund the required

remaining equity portion for the Tulkubash project financing.

Furthermore, it allows us to progress our strategic activities on

the Kyzyltash asset and the East Flank development at Kapan.

Moreover, we are grateful for the continued support from our major

shareholder Labro to optimise the Company's balance sheet

further.

The Fundraise will achieve a critical milestone in the execution

of our strategy to build one of the leading gold companies in the

former Soviet Union by providing the equity funding required to

arrange the project debt finance and start full scale construction

of our fully licensed and permitted Tulkubash project in Kyrgyz

Republic.

The next key step will be to complete the project financing for

the Tulkubash project, which we are well advanced on to complete in

H1 of this year."

Enquiries

Chaarat Gold Holdings Limited +44 (0)20 7499 2612

Artem Volynets (CEO) info@chaarat.com

Canaccord Genuity Limited (NOMAD and + 44 (0)20 7523

Joint Broker) 8000

Henry Fitzgerald-O'Connor

James Asensio

finnCap Limited (Joint Broker) +44 (0)20 7220 0500

Christopher Raggett

Panmure Gordon (UK) Limited (Joint Broker) +44 (0)20 7886 2500

John Prior

Hugh Rich

About Chaarat

Chaarat is a gold mining company which owns the Kapan operating

mine in Armenia as well as Tulkubash and Kyzyltash Gold Projects in

the Kyrgyz Republic. The Company has a clear strategy to build a

leading emerging markets gold company with an initial focus on the

FSU through organic growth and selective M&A.

Chaarat is engaged in active community engagement programmes to

optimise the value of the Chaarat investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high-quality gold and mineral deposits by

building relationships based on trust and operating to the best

environmental, social and employment standards. Further information

is available at www.chaarat.com/ .

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDXGDDUGGDGBS

(END) Dow Jones Newswires

February 05, 2021 02:00 ET (07:00 GMT)

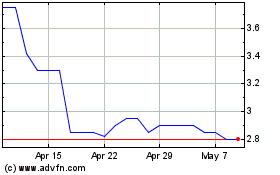

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Apr 2023 to Apr 2024