TIDMCGH

RNS Number : 3891M

Chaarat Gold Holdings Ltd

21 January 2021

21 January 2021

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

FY 2020 Production, Operational and Financial Update

Chaarat (AIM:CGH), the AIM-quoted gold mining Company with an

operating mine in Armenia, and assets at various stages of

development in the Kyrgyz Republic, is pleased to announce its

production and operational results for the full year ended 31

December 2020 (the "Year", "2020" or the "Period").

The Company has exceeded its production guidance at its Kapan

Mine ("Kapan") in Armenia and made good progress on the development

of the business despite the COVID-19 pandemic, and earlier

cross-border hostilities in Armenia and protests in the Kyrgyz

Republic.

Highlights

Kapan Gold Mine

-- FY 2020 production guidance of 55 thousand gold ounces

equivalent ("koz") exceeded by 6%, finishing the year at 58.2 koz

despite the ongoing COVID-19 situation and hostilities in H2 of

2020.

-- Exceeded processing target of 50 thousand tonnes ("kt") for

third party ore by 17.8 kt (+36%) in 2020, contributing

significantly to exceeding the production guidance of 55 koz.

-- All-in-sustaining cost ("AISC"(2) ) of USD 1,034/oz was in line with USD 1,040/oz for 2019.

-- A 50% increase in unaudited preliminary stand-alone EBITDA

contribution of approximately USD 19 million at Kapan level in 2020

before group accounting adjustments and non-cash items (2019: USD

12.7 million).

-- Peace deal signed in November 2020 between Armenia and

Azerbaijan led to stabilisation in country resuming sooner than

expected.

-- Limited impact from the COVID-19 pandemic with effective

management protocols in place since February 2020 continuing at all

of Chaarat's assets.

Tulkubash Development Project

* Advanced the construction preparation work and

detailed engineering with close to USD10 million

invested in 2020 despite the COVID-19 restrictions

and political unrest in Q4.

* Successfully completed a 2,000-metre confirmatory

drilling programme which is currently being

implemented in an updated JORC-compliant resources

and reserve statement.

* Tulkubash bankable feasibility study ("BFS") and

environmental and social impact assessment ("ESIA")

updates are now expected in Q1 2021 and the Kyzyltash

planned drilling programme later in 2021 due to

prevailing COVID-19 constraints.

* Tulkubash project finance discussions further

advanced with several banks awaiting the Tulkubash

BFS and ESIA updates before proceeding to

documentation stage.

Kyzyltash Development Project

* Comprehensive internal review completed, and external

expert opinions received in June 2020 for the next

stages and overall timeline to production, confirming

the current preliminary timeline to 2026.

* Independent assessment on metallurgy completed to

help define the ideal processing route.

Corporate Activities

* Strengthened balance sheet in 2020 through a capital

raise, extension of liabilities, decrease of interest

cost and reduction in debt.

* Raised USD13.8 million of equity in April 2020 in the

midst of the first COVID-19 pandemic.

* Continued strong support from major shareholder Labro

Investments Ltd. ("Labro") through participation in

the equity raise and the refinancing of the investor

loan into a new USD22 million facility maturing on 31

December 2024.

* Decreased average interest cost from 10.9% to 9.7% as

a result of refinancing and reduction in debt going

forward.

* Diversified the shareholder base with further

high-net-worth-individuals and retail shareholders.

* Reduced total debt from USD76.2 million as at 31(st)

December 2019 to USD70.5 million as at 31(st)

December 2020, primarily as result of reducing the

Kapan acquisition loan by USD8 million from Kapan

cash flows.

Outlook 2021

* Kapan - mine production guidance of 57 koz(3)

including treated third-party ore of 50 kt during the

year.

* Tulkubash - subject to further COVID-19 delays,

project financing expected to close in H1 2021

enabling the Company to utilise some of the 2021

construction season.

* Kyzyltash - drilling programme with metallurgical

test work during 2021 for the optimal processing

route decision by end of the year.

* Corporate - Chaarat will continue to appraise M&A

opportunities matching the target criteria and review

its existing balance sheet structure with a view to

further reducing its interest cost and improving the

balance sheet structure.

Update on our countries of operation

Armenia

On 27(th) September military action started in the

Nagorno-Karabakh region, 150km away from our Kapan operation and

lasted for more than a month. On 9(th) November, a peace deal

brokered by Russia was agreed between Azerbaijan and Armenia in

relation to the Nagorno-Karabakh region and Russia deployed

resources to keep the peace in the region for an initial period of

five years.

The situation in country is stable and people are back to their

normal lives following the cessation of hostilities in November.

The Company's precautionary measures in relation to the situation

and actions taken resulted in a limited operational impact on the

2020 performance but reduced the required development in the mine

that will impact Q1 2021 production. As a result, it is expected

that the output in Q1 2021 will be lower than previous quarters'

due to development lead times at the mine, although full-year

production is expected to be 57 koz Au Eq.

Kyrgyz Republic

In early October 2020 democratic elections were held in the

Kyrgyz Republic followed by protests concerning the election

results. Fortunately, these political disruptions following the

elections have not had any material impact on our operations. The

political situation in Kyrgyz Republic stabilised rapidly

culminating in a new president being elected in January 2021 and a

new government to be formed within the coming weeks.

COVID-19 update

COVID-19 prevention measures were implemented in February 2020

and remain in place at all Chaarat offices and sites. The Company

is continuing to follow best practice to prevent our employees

contracting or spreading COVID-19 in the workplace.

These measures have been successful to date in minimising the

number of cases at our sites, and operations were not significantly

impacted due to illness as a result. We will continue these

practices to ensure preparedness during this 20/21 winter season

and any future surges in cases in our countries of operation. We

are continuing to work with our local communities to help them with

their activities.

Kapan Mine ("Kapan")

-- Lost time injury frequency rate ('LTIFR') of 0.37 (per

one million hours worked) versus 0.39 in 2019 (-5.1%).

Since taking ownership in January 2019, there have been

two Lost Time Injuries ('LTI'), still significantly below

the 4.17 five-year average LTIFR of the 27 members of the

International Council of Metals and Mining (ICMM); Kapan 2020 2019 % Change

Production (oz AuEq) 58,178 56,513 +3

-------- -------- ---------

All-in sustaining

cost (USD/oz) (1) 1,034 1,040 -0.6%

-------- -------- ---------

55,255

Sales (oz) 48,387 oz -12%

-------- -------- ---------

Gold production (oz) 30,837 32,791 -6

-------- -------- ---------

Silver production

(oz) 587,718 557,001 +6

-------- -------- ---------

Copper production

(t) 2,154 1,719 +25

-------- -------- ---------

Zinc production (t) 7,625 6,476 +18%

-------- -------- ---------

Realised gold price

(USD/oz) 1,773 1,413 25%

-------- -------- ---------

Realised silver price

(USD/oz) 20.4 16.4 24%

-------- -------- ---------

Realised copper price

(USD/t) 6,117 6,008 +2%

-------- -------- ---------

Realised zinc price

(USD/t) 2,222 2,444 -9%

-------- -------- ---------

-- Gold equivalent production up 3% to 58,178 gold equivalent

ounces ("oz") from 56,513 oz in 2019 and above the 2020

guidance of 55,000 oz (+6%) due to improved grades in Q4

2020 and more third-party ore treated than budgeted.

-- All-in-sustaining cost ("AISC" (2) ) of USD 1,034/oz was

in line with USD 1,040/oz for 2019.

-- Total tonnes mined were 684,156t in line with 678,382t

(+0.8%) in 2019.

-- Mine head grade was 3.03g/t oz versus 2.93/t oz (+3%) in

2019. Mine schedule and shift changes were made to mining

in Q4 to adjust for the number of people called up for

military service. Lower tonnes were mined but with higher

grade.

-- Mill throughput was consistent at 744,705t compared to

742,402t (+0.3%) in 2019. Throughput included 67,838t of

third-party ore vs 8,543t (+794%) in 2019.

-- Mill feed grade for Kapan ore was 3.03g/t oz vs 2.92g/t

oz (+ 3.8%) in 2019.

-- Kapan ore recoveries were 79.9% compared 81.4% (-1.8%)

in 2019. Higher degrees of oxidation and pyrite levels

in the areas mined in H2 impacted mill performance. Mineralogy

work is being conducted to identify improved ways of treating

this type of material going forward.

-- Underground development was 21,985 metres, slightly lower

than the 23,136 metres in 2019 (-5%) as a result of the

hostilities in Q4 temporarily reducing the workforce.

-- A 50% increase in unaudited preliminary stand-alone EBITDA

contribution of c. USD19 million at Kapan level in 2020

before group accounting adjustments and non-cash items

(2019: USD 12.7 million).

-- The unaudited preliminary stand-alone EBITDA contribution

at Kapan has improved from USD 4.2 million in H1 2020 to

c. USD 14.8 million in H2 2020. The strong second half

performance was supported by the strong gains in precious

and base metals prices realising an average gold price

of USD 1,905/oz in H2 2020 versus USD1,665/oz in H1 2020

(+14%).

(1) AISC on an oz produced basis exclude smelter TC/RC charges,

others which add c. USD$ 130/oz. Sustaining capex of c. USD$ 6.9

million included in the AISC.

(2) Gold equivalent ounces for 2019 recalculated on 2020 budget

prices with Au at $1,500/oz and gold ratios of 83 for silver, 7,778

for copper and 20,968 for zinc. In last years' FY 2019 operations

update, 2019 oz were based on gold ratios of 81 for silver, 6,698

for copper and 16,075 for zinc leading to a higher AuEq number

reported in that previous year.

(3) Gold equivalent ounces for 2021 calculated on 2020 budget

prices with Au at $1,500/oz and gold ratios of 83 for silver, 7,778

for copper and 20,968 for zinc for comparison. 2021 AuEq based on

2021 budgeted prices will be 55.8 koz based on gold ratios of 88

for silver, 8,656 for copper and 23,443 for zinc.

Tulkubash

Construction Update

Construction in 2020 was slowed down due to the COVID-19

pandemic and from October 2020 onwards due to the political

disruptions in the country. Nevertheless, early construction led by

equity and construction partner Çiftay progressed to the extent

possible with approximately USD10 million of investment made

progressing project engineering and initial construction. Overall,

a number of activities were completed in 2020 which will support a

quick resumption of construction activity in 2021:

-- Completion of additional 80 bed temporary construction camp facilities

-- Continuation of ore haul road and platforms construction

-- Construction of bridge (from concrete culverts) over Kumbeltash stream

-- Finalisation of Issued for Construction (IFC) Detailed Design

Drawings for heap leach facility ("HLF")

-- Tree cutting in Dry Valley (HLF and process facilities)

-- Partial delivery of Phase 1 of shift camp

-- Delivery and storage of waste-water treatment plant ("WWTP")

The shortened 2020 drilling programme, comprising 2,000 meters,

started in July, and was successfully completed in October. This

additional infill drilling targeted increasing confidence in the

ore body and follows more conservative international best practice.

The results will be included in the upcoming mineral resource

estimate ("MRE") and ore reserves ("OR") updates. The construction

season focused on planned preparation works on the HLF and haul

road as well as the installation of first modules of the new

employee accommodation units.

The updates to the Environmental and Social Impact Assessment

("ESIA") and bankable feasibility study ("BFS") have been delayed

due to COVID restrictions mainly driven by delays caused by

external parties affected by COVID-19 related travel policies and

office restrictions. The studies will reflect the advances in

detailed engineering, design construction, and the comprehensive

environmental and social studies that have been carried out since

the last reports were finalised (2017 and 2019 respectively).

Preparations are underway to optimise work for the 2021 season

dependent on the project finance timing. The updated BFS and ESIA

documents are expected to be completed in Q1 2021 and are the key

outstandings for the project finance discussions. Based on the

information available to date, the conclusions of the updated BFS

are expected to be similar to the 2019 BFS.

Project Financing

While the COVID-19 situation impacted the decision-making

process for all banking groups earlier in the year, the Company has

managed to further advance its project financing efforts in 2020

having received three non-binding term sheets. As of year end,

discussions were in detailed due diligence stage awaiting the BFS

and ESIA update to complete due diligence efforts.

Chaarat is working to implement a debt facility that will fully

fund construction and bring the asset into production. It is

envisioned that the debt facility will comprise standard project

finance clauses regarding customary conditions precedent to

closing, including the requirement for the Company to contribute an

amount of equity to the project. This equity amount will be funded

through a combination of resources provided through the Çiftay

partnership, together with other funding alternatives the Company

is exploring.

The Tulkubash construction Capex of USD110 million will be fully

funded once the project finance is closed and based on discussions

with potential lenders it is expected that the financing facilities

will be concluded in H1 2021.

Corporate Finance Update

In 2020, Chaarat focused on improving the balance sheet with

successful initiatives to increase liquidity, refinancing of and an

overall reduction in debt.

In the midst of the COVID-19 pandemic first wave, Chaarat

completed an equity raise of USD13.8 million within the target

range of USD13-14 million and with confirmed support from existing

shareholder including Labro and other significant shareholders

committing further funds but also attracting new

high-net-worth-individuals and retail investors to the shareholder

register.

On the debt side, Chaarat successfully refinanced its maturing

investor loan of USD19 million with Labro at a reduced interest

cost of 9.5% versus the 14% on the investor loan. The overall

interest cost of the business was reduced from 10.9% to 9.7% in

2020 going forward. At the same time the maturity on the loan was

extended to 2024, when the Tulkubash project is expected to be in

full production. This refinancing further simplified the debt and

security profile outstanding providing further flexibility on the

balance sheet for the next years. In 2021, the only maturing debt

is the convertible loan with a conversion price of GBP 37 (October

2021).

Overall, the principal debt outstanding was reduced to USD70.5

million as of 31(st) December 2020 from USD76.2 million as of

31(st) December 2019. The Kapan acquisition loan of initially USD40

million was reduced to USD28 million outstanding, of which USD8

million was repaid in 2020, delivering on the agreed amortisation

schedule with AmeriaBank.

In 2021, the Company is planning to further optimise its balance

sheet, retaining an opportunistic approach to refinancing at

favourable terms and funding the Tulkubash project and Kapan East

Flank extension in order to maximise shareholder value.

Environmental, Social and Governance ("ESG")

Due to COVID-19, 2020 was in many ways a very different year to

those before. It was about putting the welfare of our employees,

our communities, and our key stakeholders first and foremost. As a

priority over other ESG initiatives, we worked with local health

care professionals and community groups to target providing

COVID-19 support to the most needed areas and also implemented

strict guidelines and measures to protect our employees,

communities, and other stakeholder from getting infected.

During the cross-border unrest in Armenia, Kapan's social aid

program was adjusted to provide support to various charities

carrying out humanitarian work such as providing food and shelter

to people displaced by the hostilities. A welcome initiative with

presents to the children arriving from the Nagorno-Karabakh region

to Kapan helped to integrate them into the community despite the

COVID-19 restrictions.

In financial terms, Chaarat has spent approximately USD 0.7

million for social and community support in 2020.

Chaarat will provide a more comprehensive update on our ESG

activities in our ESG report expected to be published around the

same time as the annual report.

Notice of audited Full Year Results

Any numbers mentioned in this press release are subject to

year-end closing process and audit. The Company will be announcing

its audited full year results for the period ended 31 December 2020

in April 2021.

Artem Volynets, Chief Executive Officer, commented:

"I am pleased to report that we exceeded our 2020 production

guidance at Kapan despite the challenges presented during the

year.

The ongoing COVID-19 pandemic and events in our countries of

operation have presented unprecedented challenges for Chaarat in

the period under review. In addition, a low commodity price

environment in H1 2020 had its impact on our first half performance

but the strong rebound in prices in H2 2020 supported the strong

performance overall despite the unrest in Armenia.

Thanks to the outstanding efforts of our employees, we continue

to deliver on our Kapan development plan and the mine has shown

stable production levels for almost two years running.

Construction progress at Tulkubash was heavily impacted by the

COVID-19 movement restrictions leading to a shift in first gold

pour date as previously reported. The hiatus did provide time to

carefully and conservatively assess the project to ensure its

robustness. The emphasis of 2021 will be to ramp up construction on

Tulkubash but also be to progress work on Kyzyltash to create

substantial long-term value for Chaarat shareholders.

Chaarat will continue placing great importance on sustainable

development and social investment programmes in the countries in

which we operate. We truly believe that respectful and open

dialogue and partnership with local communities is essential for

the long terms success of our operations."

Enquiries

+44 (0)20 7499

Chaarat Gold Holdings Limited 2612

Artem Volynets (CEO) info@chaarat.com

Canaccord Genuity Limited (NOMAD + 44 (0)20

and Joint Broker) 7523 8000

Henry Fitzgerald-O'Connor

James Asensio

+44 (0)20 7220

finnCap Limited (Joint Broker) 0500

Christopher Raggett

Panmure Gordon (UK) Limited (Joint +44 (0)20 7886

Broker) 2500

John Prior

Hugh Rich

About Chaarat

Chaarat is a gold mining company which owns the Kapan operating

mine in Armenia as well as Tulkubash and Kyzyltash Gold Projects in

the Kyrgyz Republic. The Company has a clear strategy to build a

leading emerging markets gold company with an initial focus on the

Former Soviet Union through organic growth and selective

M&A.

Chaarat is engaged in active community engagement programmes to

optimise the value of the Chaarat investment proposition.

Chaarat aims to create value for its shareholders, employees and

communities from its high-quality gold and mineral deposits by

building relationships based on trust and operating to the best

environmental, social and employment standards. Further information

is available at www.chaarat.com/ .

2020 PRODUCTION & OPERATIONAL SUMMARY

Production Summary

2020 2019

Tonnes ore mined (Kapan) 684,156 678,382

Tonnes ore milled (Kapan) 676,867 733,859

AuEq Grade (g/t)(3) (Kapan) 3.03 3.23

Tonnes ore milled (Third-Party

Ore) 67,838 8,543

Au Grade (g/t) (Third-Party

Ore) 5.86 4.70

AuEq Recovery Kapan (%) 79.9 81.4

Gold equivalent (oz)

Production(,4) 58,178 56,513

Incl. from Third-Party

Ore 5,512 650

Sales(4) 48,387 55,255

Gold production (oz) 30,837 32,791

Silver production (oz) 587,718 557,001

Copper production (t) 2,154 1,719

Zinc production (t) 7,625 6,476

Realised gold price (USD/oz) 1,773 1,413

AISC (USD/oz) 1,034 1,040

(4) AuEq calculated on 2020 budget prices based on gold price of

USD 1,500/oz and gold ratios of 83 for silver (Au/Ag), 7,778 for

copper (Au/Cu) and 20,968 for zinc (Au/Zn). Please note difference

in price assumptions used in 2019 press release may lead to

different numbers.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBMMTTMTTTTFB

(END) Dow Jones Newswires

January 21, 2021 02:00 ET (07:00 GMT)

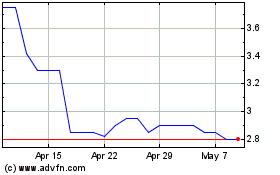

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chaarat Gold (LSE:CGH)

Historical Stock Chart

From Apr 2023 to Apr 2024