TIDMCCL

September 15, 2020

CARNIVAL CORPORATION & PLC REPORTS SUMMARY THIRD QUARTER RESULTS AND OTHER

MATTERS

Carnival Corporation & plc (the "company") is disclosing summary preliminary

financial information for the quarter ended August 31, 2020, on Form 8-K with

the U.S. Securities and Exchange Commission ("SEC").

* Schedule A contains Carnival Corporation & plc's summary preliminary

financial information for the quarter ended August 31, 2020

The Directors consider that within the Carnival Corporation and Carnival plc

dual listed company arrangement, the most appropriate presentation of Carnival

plc's results and financial position is by reference to the Carnival

Corporation & plc U.S. GAAP consolidated financial statements.

MEDIA CONTACT

INVESTOR RELATIONS CONTACT

Roger

Frizzell

Beth Roberts

001 305 406

7862

001 305 406 4832

The Form 8-K is available for viewing on the SEC website at www.sec.gov under

Carnival Corporation or Carnival plc or the Carnival Corporation & plc website

at www.carnivalcorp.com or www.carnivalplc.com.

Carnival Corporation & plc is one of the world's largest leisure travel

companies with a portfolio of nine of the world's leading cruise lines. With

operations in North America, Australia, Europe and Asia, its portfolio features

- Carnival Cruise Line, Princess Cruises, Holland America Line, P&O Cruises

(Australia), Seabourn, Costa Cruises, AIDA Cruises, P&O Cruises (UK) and

Cunard.

Additional information can be found on www.carnivalcorp.com,

www.carnivalsustainability.com, www.carnival.com, www.princess.com,

www.hollandamerica.com, www.pocruises.com.au, www.seabourn.com,

www.costacruise.com, www.aida.de, www.pocruises.com and www.cunard.com.

SCHEDULE A

THIRD QUARTER 2020 SUMMARY PRELIMINARY FINANCIAL INFORMATION

* U.S. GAAP net loss of $(2.9) billion for the third quarter of 2020, which

includes $0.9 billion of non-cash impairment charges.

* Third quarter 2020 adjusted net loss of $(1.7) billion.

* Cash burn rate in the third quarter 2020 and the expected rate for the

fourth quarter are both in line with the previously disclosed expectation.

* Third quarter 2020 ended with $8.2 billion of cash and cash equivalents.

The company expects to further enhance future liquidity, opportunistically.

* Costa successfully resumed guest cruise operations on September 6, 2020.

* AIDA has announced plans to restart guest cruise operations during the fall

2020.

* A total of 18 less efficient ships have left or are expected to leave the

fleet, representing approximately 12 percent of pre-pause capacity and only

three percent of operating income in 2019.

* Cumulative advanced bookings for the second half of 2021 capacity currently

available for sale are at the higher end of the historical range, despite

minimal advertising or marketing.

Carnival Corporation & plc President and Chief Executive Officer Arnold Donald

noted, "Just six months after we paused cruise operations across our global

fleet, this past weekend, we successfully completed our first seven day cruise

on our Italian brand Costa. Soon a second of our nine World's Leading Cruise

Lines' brands will resume guest operations, our German sourced brand AIDA. Our

business relies solely on leisure travel which we believe has historically

proven to be far more resilient than business travel and cannot be easily

replaced with video conferencing and other means of technology. Our portfolio

includes many regional brands which clearly position us well for a staggered

return to service in the current environment.

We continue to take aggressive action to emerge a leaner more efficient

company. We are accelerating the exit of 18 less efficient ships from our

fleet. This will generate a 12% reduction in capacity and a structurally lower

cost base, while retaining the most cash generative assets in our portfolio.

With two thirds of our guests repeat cruisers each year, we believe the

reduction in capacity leaves us well positioned to take advantage of the proven

resiliency of, and the pent up demand for cruise travel - as evidenced by our

being at the higher end of historical booking curves for the second half of

2021.

We will emerge with a more efficient fleet, with a stretched out newbuild order

book and having paused new ship orders, leaving us with no deliveries in 2024

and only one delivery in 2025, allowing us to pay down debt and create

increasing value for our shareholders."

Resumption of Guest Operations

In the face of the global impact of COVID-19, the company paused its guest

cruise operations in mid-March. The company resumed limited guest operations on

September 6, 2020, with Costa Cruises' ("Costa") successful voyage visiting

five destinations in Italy. The company plans to continue the limited

resumption of its guest cruise operations with additional Costa ships over

September and October, as well as with AIDA Cruises' ("AIDA") during the fall

2020. These brands are beginning the company's anticipated gradual, phased-in

resumption of guest cruise operations. The initial cruises will continue to

take place with adjusted passenger capacity and enhanced health protocols

developed with government and health authorities, and guidance from our roster

of medical and scientific experts.

Other brands and ships are expected to return to service over time to provide

guests with unmatched joyful vacations in a manner consistent with the

company's highest priorities, which are compliance, environmental protection

and the health, safety and well-being of its guests, crew, shoreside employees

and the people in the communities its ships visit. Many of the company's brands

source the majority of their guests from the geographical region in which they

operate. In the current environment, the company believes this will benefit it

in resuming guest cruise operations.

Costa and AIDA

Costa successfully restarted guest cruise operations with one initial ship,

Costa Deliziosa, sailing from Italian Ports on September 6, 2020, and is

expected to be followed by an additional ship, Costa Diadema, departing from

Genoa beginning September 19, 2020. After the September restart with these two

ships exclusively for Italian guests, Costa expects to gradually increase the

number of ships that will resume operations, offering cruises for residents in

Europe. AIDA expects to resume its guest cruise operations during the fall 2020

with sailings in the Canary Islands and the western Mediterranean.

Health and Safety Protocols

Working with global and national health authorities and medical experts, Costa

and AIDA have a comprehensive set of health and hygiene protocols to help

facilitate a safe and healthy return to cruise vacations. Both brands are

providing guests with detailed information about enhanced protocols, which are

modeled after shoreside health and mitigation guidelines as provided by each

brand's respective country, and approved by the flag state, Italy. Protocols

will be updated based on evolving scientific and medical knowledge related to

mitigation strategies.

Costa is the first cruise company to earn the Biosafety Trust Certification

from RINA. The certification process examined all aspects of life onboard and

ashore and assessed the compliance of the system with procedures aimed at the

prevention and control of infections. Costa's comprehensive set of measures and

procedures implemented on Costa Deliziosa cover key areas such as crew health

and safety, the booking process, guest activities, entertainment and dining,

and medical care on board, as well as pre-boarding, embarkation and

disembarkation operations, which includes testing for all guests prior to

embarkation.

More broadly, as the understanding of COVID-19 continues to evolve, the company

has been working with a number of world-leading public health, epidemiological

and policy experts to support its ongoing efforts with enhanced protocols and

procedures for the return of cruise vacations. These advisors will continue to

provide guidance based on the latest scientific evidence and best practices for

protection and mitigation.

Optimizing the Future Fleet

The company expects future capacity to be moderated by the phased re-entry of

its ships, the removal of capacity from its fleet and delays in new ship

deliveries. Since the pause in guest operations, the company has accelerated

the removal of ships in fiscal 2020 which were previously expected to be sold

over the ensuing years. The company now expects to dispose of 18 ships, eight

of which have already left the fleet. In total, the 18 ships represent

approximately 12 percent of pre-pause capacity and only three percent of

operating income in 2019. The sale of less efficient ships will result in

future operating expense efficiencies of approximately two percent per

available lower berth day ("ALBD") and a reduction in fuel consumption of

approximately one percent per ALBD. The company expects only two of the four

ships originally scheduled for delivery in 2020, following the start of the

pause, to be delivered prior to the end of fiscal 2020. The company currently

expects only five of the nine ships originally scheduled for delivery in fiscal

2020 and 2021 to be delivered prior to the end of fiscal year 2021. The company

currently expects 9 cruise ships and 2 smaller expedition ships of the 13 ships

originally scheduled for delivery prior to the end of fiscal year 2022 to be

delivered by then.

Based on the actions taken to date and the scheduled newbuild deliveries

through 2022, the company's fleet will be more efficient with a roughly 13

percent larger average berth size and an average age of 12 years in 2022 versus

13 years, in each case as compared to 2019.

Update on Bookings

While the company believes bookings in the first half of 2021 reflect

expectations of the phased resumption of its guest cruise operations and

anticipated itinerary changes, as of August 31, 2020, cumulative advanced

bookings for the second half of 2021 capacity currently available for sale are

at the higher end of the historical range and similar to where booking

positions were in 2018 for the second half of 2019. The company believes this

demonstrates the long-term potential demand for cruising. Pricing on these

bookings are lower by mid-single digits versus the second half of 2019, on a

comparable basis, reflecting the effect of future cruise credits ("FCC") from

previously cancelled cruises being applied. The company continues to take

bookings for both 2021 and 2022.

The company is providing flexibility to guests with bookings on sailings

cancelled by allowing guests to receive enhanced FCCs or elect to receive

refunds in cash. Enhanced FCCs increase the value of the guest's original

booking or provide incremental onboard credits. As of August 31, 2020,

approximately 45 percent of guests affected by the company's schedule changes

have received enhanced FCCs and approximately 55 percent have requested

refunds.

Total customer deposits balance at August 31, 2020, was $2.4 billion, the

majority of which are FCCs, compared to total customer deposits balance of $2.9

billion at May 31, 2020. The decline in customer deposits is consistent with

previous expectations. As of August 31, 2020, the current portion of customer

deposits was $2.1 billion with $0.1 billion relating to fourth quarter

sailings. Approximately 55 percent of bookings taken during the quarter ending

August 31, 2020 were new bookings, as opposed to FCC re-bookings, despite

minimal advertising or marketing.

Increasing Liquidity

Carnival Corporation & plc Chief Financial Officer and Chief Accounting Officer

David Bernstein noted, "We have over $8 billion of available cash and

additional financing alternatives to opportunistically further improve our

liquidity profile. We have recently begun to optimize our capital structure

with the early extinguishment of debt on favorable economic terms and the

extension of debt maturities. Once we fully resume guest cruise operations, we

expect our cash flow potential will build a path to further strengthen our

balance sheet and return us to an investment grade credit rating over time."

Due to the pause in guest operations, the company has taken significant actions

to preserve cash and secure additional financing to increase its liquidity.

Since March, the company has raised nearly $12 billion through a series of

financing transactions, including the following transactions that occurred

during the third quarter:

* Borrowed an aggregate principal amount of $2.8 billion in two tranches

under a first priority senior secured term loan facility on June 30, 2020

* Issued $1.3 billion aggregate principal amount of second priority senior

secured notes in two tranches on July 20, 2020

* Entered into Debt Holiday amendments, deferring certain principal

repayments otherwise due through March 2021. (Certain export credit

agencies have offered a 12-month debt amortization and financial covenant

holiday ("Debt Holiday"))

* Completed a registered direct offering of 99 million shares of its common

stock and used the proceeds to repurchase $886 million of its 5.75%

Convertible Senior Notes due 2023 on August 10, 2020

* Issued $900 million aggregate principal amount of second priority senior

secured notes on August 18, 2020

As of August 31, 2020, the company has a total of $8.2 billion of cash and cash

equivalents.

Currently, the company is unable to predict when the entire fleet will return

to normal operations, and as a result, unable to provide an earnings forecast.

The pause in guest operations continues to have a material negative impact on

all aspects of the company's business, including the company's liquidity,

financial position and results of operations. The company expects a net loss on

both a U.S. GAAP and adjusted basis for the quarter and year ending November

30, 2020.

The company's monthly average cash burn rate for the third quarter 2020 was

$770 million, which was in line with the anticipated monthly cash burn rate.

The company expects the monthly average cash burn rate for the fourth quarter

of 2020 to be approximately $530 million. This results in an average monthly

burn rate for the second half of the year of $650 million as previously

disclosed. This rate includes approximately $250 million of ongoing ship

operating and administrative expenses, working capital changes (excluding

changes in customer deposits and reserves for credit card processors), interest

expense and committed capital expenditures (net of committed export credit

facilities) and also excludes scheduled debt maturities. The company continues

to explore opportunities to further reduce its monthly cash burn rate.

The company estimates non-newbuild capital expenditures during the fourth

quarter of 2020 to be approximately $130 million. The company's scheduled debt

maturities are as follows:

(in billions) 4Q 2020 1Q 2021 2Q 2021 3Q 2021 4Q 2021

Principal $ 1.0 $ 0.5 $ 0.3 (b) $ 0.6 $ 0.2 (b)

Payments (a)

a. Excluding the Revolving Facility. As of May 31, 2020, borrowings under the

Revolving Facility were $3.0 billion, which were drawn in March 2020 for an

initial term of six months. We may re-borrow such amounts subject to

satisfaction of the conditions in the Revolving Facility Agreement. The

company has principal balance of $0.5 billion and $0.8 billion of debt,

otherwise due through 2032, for which covenant waivers expire during the

second quarter 2021 and fourth quarter 2021, respectively. The company is

working on extending these covenant waivers. If the covenant waiver

extensions are not received, the company would be required to prepay the

outstanding principal balance.

Cautionary Note Concerning Factors That May Affect Future Results

Carnival Corporation and Carnival plc and their respective subsidiaries are

referred to collectively in this document as "Carnival Corporation & plc,"

"our," "us" and "we." Some of the statements, estimates or projections

contained in this document are "forward-looking statements" that involve risks,

uncertainties and assumptions with respect to us, including some statements

concerning future results, operations, outlooks, plans, goals, reputation, cash

flows, liquidity and other events which have not yet occurred. These statements

are intended to qualify for the safe harbors from liability provided by Section

27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. All statements other than statements of historical facts are

statements that could be deemed forward-looking. These statements are based on

current expectations, estimates, forecasts and projections about our business

and the industry in which we operate and the beliefs and assumptions of our

management. We have tried, whenever possible, to identify these statements by

using words like "will," "may," "could," "should," "would," "believe,"

"depends," "expect," "goal," "anticipate," "forecast," "project," "future,"

"intend," "plan," "estimate," "target," "indicate," "outlook," and similar

expressions of future intent or the negative of such terms.

Forward-looking statements include those statements that relate to our outlook

and financial position including, but not limited to, statements regarding:

* Net revenue yields * Estimates of ship depreciable lives and

residual values

* Booking levels * Goodwill, ship and trademark fair values

* Pricing and occupancy * Liquidity

* Interest, tax and fuel expenses * Adjusted earnings per share

* Currency exchange rates * Impact of the COVID-19 coronavirus global

pandemic on our financial condition and

* Net cruise costs, excluding fuel results of operations

per available lower berth day

Because forward-looking statements involve risks and uncertainties, there are

many factors that could cause our actual results, performance or achievements

to differ materially from those expressed or implied by our forward-looking

statements. This note contains important cautionary statements of the known

factors that we consider could materially affect the accuracy of our forward

looking statements and adversely affect our business, results of operations and

financial position. Additionally, many of these risks and uncertainties are

currently amplified by and will continue to be amplified by, or in the future

may be amplified by, the COVID-19 outbreak. It is not possible to predict or

identify all such risks. There may be additional risks that we consider

immaterial or which are unknown. These factors include, but are not limited to,

the following:

* COVID-19 has had, and is expected to continue to have, a significant impact

on our financial condition and operations, which impacts our ability to

obtain acceptable financing to fund resulting reductions in cash from

operations. The current, and uncertain future, impact of the COVID-19

outbreak, including its effect on the ability or desire of people to travel

(including on cruises), is expected to continue to impact our results,

operations, outlooks, plans, goals, growth, reputation, litigation, cash

flows, liquidity, and stock price

* As a result of the COVID-19 outbreak, we may be out of compliance with a

maintenance covenant in certain of our debt facilities, for which we have

waivers for the period through March 31, 2021 with the next testing date of

May 31, 2021

* World events impacting the ability or desire of people to travel may lead

to a decline in demand for cruises

* Incidents concerning our ships, guests or the cruise vacation industry as

well as adverse weather conditions and other natural disasters may impact

the satisfaction of our guests and crew and lead to reputational damage

* Changes in and non-compliance with laws and regulations under which we

operate, such as those relating to health, environment, safety and

security, data privacy and protection, anti-corruption, economic sanctions,

trade protection and tax may lead to litigation, enforcement actions,

fines, penalties, and reputational damage

* Breaches in data security and lapses in data privacy as well as disruptions

and other damages to our principal offices, information technology

operations and system networks, including the recent ransomware incident,

and failure to keep pace with developments in technology may adversely

impact our business operations, the satisfaction of our guests and crew and

lead to reputational damage

* Ability to recruit, develop and retain qualified shipboard personnel who

live away from home for extended periods of time may adversely impact our

business operations, guest services and satisfaction

* Increases in fuel prices, changes in the types of fuel consumed and

availability of fuel supply may adversely impact our scheduled itineraries

and costs

* Fluctuations in foreign currency exchange rates may adversely impact our

financial results

* Overcapacity and competition in the cruise and land-based vacation industry

may lead to a decline in our cruise sales, pricing and destination options

* Geographic regions in which we try to expand our business may be slow to

develop or ultimately not develop how we expect

* Inability to implement our shipbuilding programs and ship repairs,

maintenance and refurbishments may adversely impact our business operations

and the satisfaction of our guests

The ordering of the risk factors set forth above is not intended to reflect our

indication of priority or likelihood.

Forward-looking statements should not be relied upon as a prediction of actual

results. Subject to any continuing obligations under applicable law or any

relevant stock exchange rules, we expressly disclaim any obligation to

disseminate, after the date of this document, any updates or revisions to any

such forward-looking statements to reflect any change in expectations or

events, conditions or circumstances on which any such statements are based.

CARNIVAL CORPORATION & PLC

NON-GAAP FINANCIAL MEASURES

Three Months Ended Nine Months Ended

August 31, August 31,

(in millions) 2020 2019 2020 2019

Net income (loss)

U.S. GAAP net income (loss) $ (2,858) $ 1,780 $ (8,014) $ 2,567

(Gains) losses on ship sales and 937 14 3,819 -

impairments

Restructuring expenses 3 - 42 -

Other 220 25 223 47

Adjusted net income (loss) $ (1,699) $ 1,819 $ (3,930) $ 2,614

Explanations of Non-GAAP Financial Measures

Non-GAAP Financial Measures

We use adjusted net income as a non-GAAP financial measure of our cruise

segments' and the company's financial performance. This non-GAAP financial

measure is provided along with U.S. GAAP net income (loss).

We believe that gains and losses on ship sales, impairment charges,

restructuring costs and other gains and losses are not part of our core

operating business and are not an indication of our future earnings

performance. Therefore, we believe it is more meaningful for these items to be

excluded from our net income (loss), and accordingly, we present adjusted net

income excluding these items.

The presentation of our non-GAAP financial information is not intended to be

considered in isolation from, as substitute for, or superior to the financial

information prepared in accordance with U.S. GAAP. It is possible that our

non-GAAP financial measures may not be exactly comparable to the like-kind

information presented by other companies, which is a potential risk associated

with using these measures to compare us to other companies.

END

(END) Dow Jones Newswires

September 15, 2020 07:15 ET (11:15 GMT)

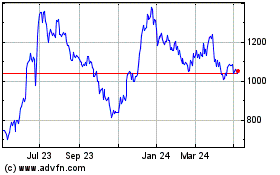

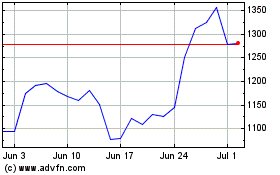

Carnival (LSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carnival (LSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024