BlackRock World Mng Portfolio Update

January 20 2021 - 12:18PM

UK Regulatory

TIDMBRWM

The information contained in this release was correct as at 31 December 2020.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at:

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK WORLD MINING TRUST PLC (LEI - LNFFPBEUZJBOSR6PW155)

All information is at 31 December 2020 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five

Month Months Year Years Years

Net asset value 10.8% 18.0% 31.0% 36.2% 225.4%

Share price 15.2% 31.2% 46.7% 56.3% 289.5%

MSCI ACWI Metals & Mining 30% Buffer 10/ 9.3% 15.0% 20.6% 22.8% 186.2%

40 Index (Net)*

* (Total return)

Sources: BlackRock, MSCI ACWI Metals & Mining 30% Buffer 10/40 Index,

Datastream

At month end

Net asset value (including income)1: 533.61p

Net asset value (capital only): 525.20p

1 Includes net revenue of 8.41p

Share price: 522.00p

Discount to NAV2: 2.2%

Total assets: 1,028.5m

Net yield3: 4.2%

Net gearing: 12.6%

Ordinary shares in issue: 173,550,814

Ordinary shares held in Treasury: 19,461,028

Ongoing charges4: 1.0%

2 Discount to NAV including income.

3 Based on quarterly interim dividends of 4.00p per share declared on 12

November, 19 August and 30 April 2020 in respect of the year ended 31 December

2020 and a final dividend of 10.00p per share announced on 27 February 2020 in

respect of the year ended 31 December 2019.

4 Calculated as a percentage of average net assets and using expenses,

excluding finance costs, for the year ended 31 December 2019.

Country Analysis Total Sector Analysis Total

Assets (%) Assets (%)

Global 64.9 Diversified 37.3

Australasia 9.5 Gold 25.8

Latin America 7.2 Copper 19.1

South Africa 5.3 Iron 3.3

Canada 5.2 Platinum Group Metals 3.3

United Kingdom 2.4 Iron Ore 2.8

Other Africa 1.6 Nickel 2.6

Indonesia 1.5 Steel 2.5

United States 1.4 Industrial Minerals 1.9

Russia 1.1 Materials 0.9

Net Current Liabilities -0.1 Silver & Diamonds 0.3

----- Zinc 0.3

100.0 Net Current Liabilities -0.1

===== -----

100.0

=====

Ten largest investments

Company Total Assets %

Vale:

Equity 6.8

Debenture 4.2

BHP 7.7

Rio Tinto 7.5

Anglo American 7.2

Freeport-McMoRan Copper & Gold 5.2

Newmont Mining 4.5

Barrick Gold 4.2

Wheaton Precious Metals 3.3

OZ Minerals:

Royalty 1.7

Equity 1.3

First Quantum Minerals:

Equity 1.2

Debt 1.6

Asset Analysis Total Assets (%)

Equity 94.3

Bonds 3.4

Preferred Stock 2.5

Option -0.1

Net Current Liabilities -0.1

-----

100.0

=====

Commenting on the markets, Evy Hambro and Olivia Markham, representing the

Investment Manager noted:

Performance

The Company's NAV returned +10.8% in December, outperforming its reference

index, the MSCI ACWI Metals and Mining 30% Buffer 10/40 Index (net return),

which returned +9.3% (Figures in GBP).

Despite renewed lockdowns across Europe and in parts of Asia, global equity

markets continued to ride a wave of optimism following the announcement of

progress in a COVID-19 vaccine, albeit at a slower rate than in November. For

reference, the MSCI AC World Index increased by 4.5%. Cyclical stocks were

buoyed by the news that the US government signed into law a $900 billion

pandemic relief bill that included enhanced unemployment benefits and direct

cash payments. A long-awaited post-Brexit trade deal between the UK and the EU

was finally struck on Christmas Eve but investors' spirits were dampened by the

emergence of a new, highly transmissible coronavirus variant that is spreading

across Europe and the rest of the world. Global economic activity data also

remained strong, with global manufacturing PMIs coming in at 53.8.

Against this macroeconomic backdrop, the mined commodities performed well

almost across the board, supporting the mining sector's outperformance of

broader equity markets. Iron ore was the standout performer, with the iron ore

62% fe. price rising by 22.4% to an 8-year high of $161/tonne. Early in the

month, Vale downgraded its 2021 iron ore production guidance to 315-335 million

tonnes versus consensus of circa 350 million tonnes, indicating continued

tightness in that market. Gold also performed well, its price rising by 7.0%

over the month, supported by declines in real interest rates and US dollar

weakness.

Within the Company, gearing contributed positively during a rising market. This

was partly offset by negative stock selection within the copper sub-sector.

Strategy and Outlook

The rebound in global economic activity remains robust, whilst COVID-19 vaccine

developments provide greater certainty around growth. Mined commodity prices

have performed well and we expect them to be well supported at these levels.

Overall, mined commodity supply has been impacted by COVID-19-related

disruptions and inventories are low relative to history for most commodities.

Longer term, we expect commodity supply to be constrained by the

underinvestment of recent years and continued capital discipline. Meanwhile,

commodity demand should continue to be buoyed by increased global

infrastructure spend as governments seek to kick-start their economies. Longer

term, we also expect the transition to a lower carbon global economy to support

demand for certain mined commodities.

Turning to the miners, balance sheets are in strong shape, whilst earnings and

dividends are rising. Meanwhile, we see strong arguments for inflation

exceeding current expectations and, historically, the mining sector has

performed well on an absolute basis and relative to broader equity markets

during periods of rising inflation. We maintain a quality bias in the portfolio

with a focus on companies with stronger balance sheets and lower costs.

All data points are in USD terms unless stated otherwise.

20 January 2021

Latest information is available by typing www.blackrock.com/uk/brwm on the

internet. Neither the contents of the Manager's website nor the contents of any

website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

January 20, 2021 12:18 ET (17:18 GMT)

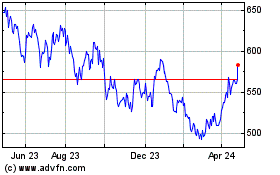

Blackrock World Mining (LSE:BRWM)

Historical Stock Chart

From Mar 2024 to Apr 2024

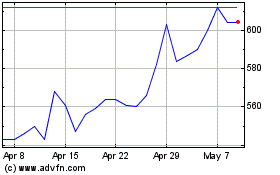

Blackrock World Mining (LSE:BRWM)

Historical Stock Chart

From Apr 2023 to Apr 2024