BlackRock World Mng Portfolio Update

March 25 2020 - 12:41PM

UK Regulatory

TIDMBRWM

BLACKROCK WORLD MINING TRUST plc (LEI - LNFFPBEUZJBOSR6PW155)

All information is at 29 February 2020 and unaudited.

The information contained in this release was correct as at 29 February 2020.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html

Performance at month end with net income reinvested

One Three One Three Five

Month Months Year Years Years

Net asset value -9.9% -8.9% -7.0% -0.2% 30.9%

Share price -10.5% -8.5% -5.8% 1.9% 35.6%

EMIX Global Mining Index (Net)* -9.4% -8.5% -2.5% 8.2% 34.2%

MSCI ACWI Metals and Mining 30% -9.2% -9.3% -6.8% -4.3% 23.2%

Buffer 10/40 Index (Net)*

* (Total return)

Sources: BlackRock, EMIX Global Mining Index, MSCI ACWI Metals and Mining 30%

Buffer 10/40 Index, Datastream

At month end

Net asset value including income1: 368.63p

Net asset value capital only: 357.86p

1 Includes net revenue of 10.77p

Share price: 319.50p

Discount to NAV2: 13.3%

Total assets: GBP744.7m

Net yield3: 6.9%

Net gearing: 15.6%

Ordinary shares in issue: 173,605,020

Ordinary shares held in treasury: 19,406,822

Ongoing charges4: 0.9%

2 Discount to NAV including income.

3 Based on three quarterly interim dividends of 4.00p per share declared on

20 August 2019, 2 May 2019 and 14 November 2019 and a final dividend of 10.00p

per share announced on 27 February 2020 in respect of the year ended 31

December 2019.

4 Calculated as a percentage of average net assets and using expenses,

excluding finance costs, for the year ended 31 December 2019.

Sector % Total Country Analysis % Total

Assets Assets

Diversified 38.7 Global 64.4

Gold 26.4 Australasia 9.9

Copper 15.7 Latin America 8.3

Silver & Diamonds 5.8 Canada 5.9

Industrial Minerals 4.5 United Kingdom 3.3

Nickel 2.7 South Africa 3.1

Platinum Group Metals 2.3 Russia 1.1

Iron Ore 2.0 Other Africa 1.1

Diversified Mining 0.8 Sweden 0.8

Coal 0.4 Indonesia 0.7

Aluminium 0.1 USA 0.7

Zinc 0.1 Argentina 0.1

Steel -0.1 Current assets 0.6

Current assets 0.6 -----

----- 100.0

100.0 =====

=====

Ten Largest Investments

% Total

Company Assets

Vale:

Equity 4.6

Debenture 3.8

BHP 8.4

Rio Tinto 8.2

Anglo American 6.2

Barrick Gold 5.4

Newmont Mining 5.3

First Quantum Minerals 4.2

Wheaton Precious Metals 4.1

OZ Minerals Brazil:

Royalty 2.5

Equity 1.3

Franco-Nevada 3.4

Commenting on the markets, Evy Hambro and Olivia Markham, representing the

Investment Manager noted:

Performance

The Company's NAV decreased by 9.9% in February, underperforming its

reference index, the MSCI ACWI Metals and Mining 30% Buffer 10/40 Index (net

return), which returned -9.2%. (Figures in GBP)

Global equity markets fell sharply in February as it became apparent that

the coronavirus was spreading globally with a likely greater impact on

economic activity. For reference, the MSCI World Index fell 8.5%. China's

response to attempt to contain the spread of the virus included placing a

number of cities and towns on lockdown, which meant Chinese factories could

not operate. This caused supply issues across many industries, whilst air

travel was restricted to certain high virus risk destinations.

Mined commodity prices came under pressure, with zinc and iron ore returning

-9.1% and -12.7% respectively. Aluminium and copper were broadly flat over

the month returning -1.7% and +1.2% following price declines last month. The

gold price was flat on the month and remains 5% higher than at the start of

the year at $1,587/oz, reaffirming its safe haven status in times of market

volatility. Similar to last month, gold equities lagged the gold price,

partly reflecting the strong performance of the mid-cap gold companies in Q4

2019.

Strategy and Outlook

We see an attractive valuation opportunity in mining today. Mining companies

have sold off in recent weeks in anticipation of a lower level of global

economic growth in 2020. We expect any economic stimulus measures from China

to disproportionately benefit the mined commodity sector.

The mining sector is generating close to record free cash flow, whilst

balance sheets are in strong shape and companies remain focused on capital

discipline. Our base case remains that we have positive global economic

growth for the next 12-18 months, albeit at a slower rate than was expected

this time last year. Barring an economic recession, we expect the mining

sector to re-rate into a post coronavirus economic recovery as the miners

continue to generate robust free cash flow and return capital to

shareholders through dividends and buybacks.

We expect most mined commodity prices to be stable to rising through 2020.

On the commodity demand side, we do not anticipate a hard-landing type event

in China and we have been encouraged by stimulus measures beginning to feed

through into improvements in some economic data points. On the commodity

supply side, supply is tight in most mined commodity markets and, given the

cuts in mining sector spending since 2012 (down 66%), we expect it to

remain so.

All data points are in USD terms unless stated otherwise.

25 March 2020

Latest information is available by typing www.blackrock.co.uk/brwm on the

internet. Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any

other website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

March 25, 2020 12:41 ET (16:41 GMT)

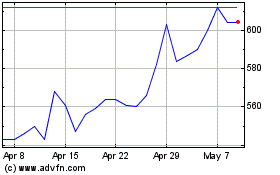

Blackrock World Mining (LSE:BRWM)

Historical Stock Chart

From Mar 2024 to Apr 2024

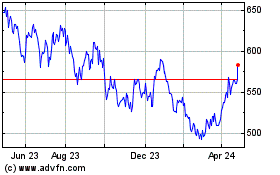

Blackrock World Mining (LSE:BRWM)

Historical Stock Chart

From Apr 2023 to Apr 2024