BlackRock Smll Cos Portfolio Update

June 18 2020 - 12:58PM

UK Regulatory

TIDMBRSC

The information contained in this release was correct as at 31 May 2020.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK SMALLER COMPANIES TRUST PLC (LEI: 549300MS535KC2WH4082)

All information is at 31 May 2020 and unaudited.

Performance at month end is calculated on a capital only basis

One Three One Three Five

month months year years years

% % % % %

Net asset value* 5.1 -11.9 -9.6 -2.5 32.1

Share price* -2.0 -13.5 -9.1 3.1 39.3

Numis ex Inv Companies + AIM Index 4.2 -10.6 -14.0 -19.4 -5.0

*performance calculations based on a capital only NAV with debt at par, without

income reinvested. Share price performance calculations exclude income

reinvestment.

Sources: BlackRock and Datastream

At month end

Net asset value Capital only (debt at par value): 1,364.42p

Net asset value Capital only (debt at fair value): 1,342.76p

Net asset value incl. Income (debt at par value)1: 1,388.66p

Net asset value incl. Income (debt at fair value)1: 1,367.01p

Share price 1,284.00p

Discount to Cum Income NAV (debt at par value): 7.5%

Discount to Cum Income NAV (debt at fair value): 6.1%

Net yield2: 2.5%

Gross assets3: GBP747.7m

Gearing range as a % of net assets: 0-15%

Net gearing including income (debt at par): 8.7%

2019 Ongoing charges ratio4: 0.7%

Ordinary shares in issue5: 48,829,792

1. includes net revenue of 24.24p.

2. Yield calculations are based on dividends announced in the last 12 months

as at the date of release of this announcement, and comprise the first

interim dividend of 12.8 pence per share (announced on 5 November 2019,

ex-dividend on 14 November 2019)and the second interim dividend of 19.7

pence per share (announced on 3 June 2020, ex-dividend on 11 June 2020).

3. includes current year revenue.

4. As reported in the Annual Financial Report for the year ended 28 February

2019 the Ongoing Charges Ratio (OCR) was 0.7%. The OCR is calculated as a

percentage of net assets and using operating expenses, excluding

performance fees, finance costs and taxation.

5. excludes 1,163,731 shares held in treasury.

Sector Weightings % of portfolio

Industrials 30.1

Financials 20.4

Consumer Services 17.5

Consumer Goods 11.1

Technology 6.7

Health Care 6.0

Basic Materials 4.7

Oil & Gas 1.9

Materials 0.9

Telecommunications 0.7

-----

Total 100.0

=====

Ten Largest Equity Investments

Company % of portfolio

Avon Rubber 2.4

YouGov 2.2

Games Workshop 2.0

IntegraFin 1.8

Breedon 1.7

Stock Spirits Group 1.7

4imprint Group 1.7

IG Design Group 1.5

Treatt 1.4

Calisen Plc 1.4

Commenting on the markets, Roland Arnold, representing the Investment Manager

noted:

During May the Company's NAV per share rose by 5.1%1 to 1,364.42p,

outperforming our benchmark index, Numis ex Inv Companies + AIM Index, which

returned 4.2%1; for comparison the FTSE 100 Index rose by 3.0%1 (all

calculations are on a capital only basis).

Equity markets continued to rise during May in response to signs that the worst

of the coronavirus may have passed, with the number of daily new deaths

globally falling by half from the peak in April. Countries around the world

continued to announce measures to gradually reduce lockdown restrictions, a

positive for a number of industries that have seen demand completely halted in

recent months. Meanwhile governments continued to provide unprecedented support

to economies both directly through furlough schemes, and indirectly through

central bank policy.

May saw a market rotation towards value, which isn't a favourable backdrop for

our quality growth investment style. However, some positive stock specific

successes during the month ensured that the portfolio outperformed its

benchmark. The largest contributor to performance was Games Workshop, the

creator of the Warhammer miniatures game, which continued to rise following the

positive trading update in April. Stock Spirits rose after the company reported

strong underlying revenue growth, benefitting from their off-trade channel,

which represents c.85% of the business, as consumers shifted to drinking at

home during the lockdown period. Shares in Avon Rubber performed well on the

back of positive half year results demonstrating the business's resilience

during the coronavirus crisis. The company delivered strong organic revenue and

profit growth during the first 6 months of the year, and their long-term

contracts provide a high level of earnings visibility for the remainder of the

year.

The largest detractor to performance was Countryside Properties, which fell in

response to a weak trading update, highlighting a significant fall in profits

as a result of coronavirus restrictions. Other notable detractors included

brick manufacturer, Forterra, and recruiter, Robert Walters, which both gave

back some of their strong share price performance from April, despite no stock

specific newsflow or change to the investment case for either.

As time passes newsflow around the virus is becoming more upbeat and we are

certainly seeing signs of economies returning to normal, or perhaps we should

say returning to the 'new normal'. However, the outlook for the global economy

has never been more uncertain. There is no historical parallel to current

events. Even the Global Financial Crisis of 2008 was at its heart a banking

crisis, something investors had seen before, COVID-19 is something very

different and we will be discussing the implications and impacts on a variety

of industries for many months to come. Our immediate outlook is that volatility

remains high as COVID-19 continues to dominate global events, but we must not

allow the focus on COVID-19 to let us overlook some of the other issues that

can and will drive volatility; Brexit, US / China relations or the coming US

election.

The impact of COVID-19 is unpredictable, unavoidable and unprecedented. But it

will get better. And this provides us with confidence in our strategy on a

medium-term view. Market volatility presents us with a fantastic investment

opportunity. The Company's investment strategy is focussed on quality growth

investment opportunities in smaller companies, a style that has demonstrably

worked for the long-term, and historically periods of sudden underperformance,

such as this, have proven to be excellent investment opportunities.

1Source: BlackRock as at 31 May 2020

18 June 2020

ENDS

Latest information is available by typing www.blackrock.co.uk/brsc on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

June 18, 2020 12:58 ET (16:58 GMT)

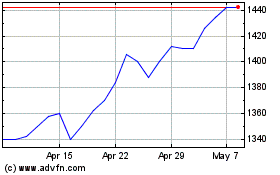

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

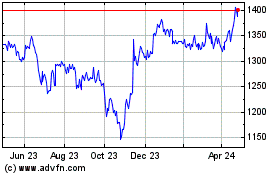

Blackrock Smaller (LSE:BRSC)

Historical Stock Chart

From Apr 2023 to Apr 2024