BlackRock Latin Am Portfolio Update

September 20 2022 - 11:12AM

UK Regulatory

TIDMBRLA

The information contained in this release was correct as at 31 August 2022.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK LATIN AMERICAN INVESTMENT TRUST PLC (LEI - UK9OG5Q0CYUDFGRX4151)

All information is at 31 August 2022 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five

month months year years years

% % % % %

Sterling:

Net asset value^ 10.1 -2.2 6.0 -3.5 -2.1

Share price 7.2 -11.1 8.1 0.3 2.3

MSCI EM Latin America 7.4 -3.7 9.9 0.1 1.7

(Net Return)^^

US Dollars:

Net asset value^ 5.3 -9.7 -10.4 -7.7 -11.6

Share price 2.5 -17.9 -8.6 -4.1 -7.7

MSCI EM Latin America 2.7 -11.1 -7.1 -4.4 -8.2

(Net Return)^^

^cum income

^^The Company's performance benchmark (the MSCI EM Latin America Index) may be

calculated on either a Gross or a Net return basis. Net return (NR) indices

calculate the reinvestment of dividends net of withholding taxes using the tax

rates applicable to non-resident institutional investors, and hence give a

lower total return than indices where calculations are on a Gross basis (which

assumes that no withholding tax is suffered). As the Company is subject to

withholding tax rates for the majority of countries in which it invests, the NR

basis is felt to be the most accurate, appropriate, consistent and fair

comparison for the Company.

Sources: BlackRock, Standard & Poor's Micropal

At month end

Net asset value - capital only: 407.83p

Net asset value - including income: 428.82p

Share price: 380.50p

Total assets#: £135.4m

Discount (share price to cum income NAV): 11.3%

Average discount* over the month - cum income: 11.2%

Net gearing at month end**: 5.6%

Gearing range (as a % of net assets): 0-25%

Net yield##: 5.9%

Ordinary shares in issue(excluding 2,181,662 shares held in treasury): 29,448,641

Ongoing charges***: 1.1%

#Total assets include current year revenue.

##The yield of 5.9% is calculated based on total dividends declared in the last

12 months as at the date of this announcement as set out below (totalling 26.27

cents per share) and using a share price of 442.75 US cents per share

(equivalent to the sterling price of 380.50 pence per share translated in to US

cents at the rate prevailing at 31 August 2022 of $1.1636 dollars to £1.00).

2021 Q3 interim dividend of 6.56 cents per share (paid on 8 November 2021).

2021 Q4 Final dividend of 6.21 cents per share (paid on 08 February 2022).

2022 Q1 Interim dividend of 7.76 cents per share (paid on 16 May 2022).

2022 Q2 Interim dividend of 5.74 cents per share (paid on 12 August 2022).

*The discount is calculated using the cum income NAV (expressed in sterling

terms).

**Net cash/net gearing is calculated using debt at par, less cash and cash

equivalents and fixed interest investments as a percentage of net assets.

*** Calculated as a percentage of average net assets and using expenses,

excluding interest costs for the year ended 31 December 2021.

Geographic % of % of Equity MSCI EM Latin

Exposure Total Assets Portfolio * America Index

Brazil 62.9 63.9 64.2

Mexico 23.9 24.3 24.3

Chile 3.7 3.8 7.1

Argentina 3.2 3.2 0.0

Peru 2.6 2.6 2.7

Panama 2.2 2.2 0.0

Colombia 0.0 0.0 1.7

Net current assets (inc. 1.5 0.0 0.0

fixed interest)

----- ----- -----

Total 100.0 100.0 100.0

===== ===== =====

^Total assets for the purposes of these calculations exclude bank overdrafts,

and the net current assets figure shown in the table above therefore excludes

bank overdrafts equivalent to 7.1% of the Company's net asset value.

Sector % of Equity Portfolio % of Benchmark*

*

Financials 28.2 24.6

Materials 18.0 20.5

Consumer Staples 13.1 14.3

Energy 11.1 13.8

Industrials 9.4 7.9

Real Estate 5.9 0.6

Health Care 4.9 2.4

Consumer Discretionary 4.0 2.9

Communication Services 2.7 6.4

Information Technology 1.8 0.4

Utilities 0.9 6.2

----- -----

Total 100.0 100.0

===== =====

*excluding net current assets & fixed interest

Country % of % of

Company of Risk Equity Benchmark

Portfolio

Petrobrás - ADR: Brazil

Equity 5.8 5.0

Preference Shares 3.9 5.7

Vale - ADS Brazil 7.1 9.3

Banco Bradesco - ADR Brazil 6.5 4.6

Itaú Unibanco - ADR Brazil 6.3 4.5

Grupo Financiero Banorte Mexico 4.5 2.9

AmBev - ADR Brazil 4.3 2.6

B3 Brazil 4.1 2.6

FEMSA - ADR Mexico 4.1 2.3

Hapvida Participacoes Brazil 3.4 1.2

Suzano Papel e Celulose Brazil 2.7 1.2

Commenting on the markets, Sam Vecht and Christoph Brinkmann, representing the

Investment Manager noted;

For the month of August 2022, the Company's NAV returned 10.1%1 with the share

price increasing by 7.2%1. The Company's benchmark, the MSCI EM Latin America

Index, returned 7.4%1 on a net basis (all performance figures are in sterling

terms with dividends reinvested).

Latin American (LatAm) equities posted a positive performance over the month

with Brazil and Chile leading the rise.

Security selection in Mexico and Brazil contributed most to relative

performance over the period. Our overweight position in Brazilian healthcare

company, Hapvida, was the top contributor to the portfolio after posting

positive 2Q22 earnings results. The company is gaining health care patients at

a faster pace than peers due to its newly launched national plan and is seeing

improving operating trends and margins as a result.. An off-benchmark position

in Brazilian logistics company, Santos Brasil, also benefitted the portfolio as

the company has performed well on the back of contract renegotiations and high

utilization rates. On the other hand, our underweight position in Brazilian

petroleum company, Petrobras, detracted most from relative performance as the

company posted positive 2Q22 earnings results. Our off-benchmark position in XP

Inc., a Brazilian investment management company, also weighed on relative

returns as the company has recently been negatively impacted by a jump in

expenses and investments in new projects.

Over the month we added to the Mexican beverages and retail company, Femsa, as

in our opinion the share price has been overly penalized for a debatable

capital allocation decision, which overshadows a strong operating environment

at its core convenience store business (Oxxo). The latter is recovering nicely

as mobility in Mexico keeps improving every month, which we believe will result

in further operating leverage. We reduced exposure to Mexican real estate

investment trust company, Fibra Uno, as we have been somewhat disappointed by

the degree to which it has been able to pass on cost inflation through to

rents for its office and retail assets. We sold our holding of the Brazilian

telecommunications company, TIM, as we expect to see underperformance within

the telecommunications sector.

The fundamentals around Latin American equities have steadily improved from a

challenging 2021 as investors learn to live with the region's political risk

and focus instead on soaring local interest rates and commodity prices. Latin

America currencies remains relatively cheap at current levels as the

combination of rising interest rates and low valuations has been attracting

investors to increase regional exposure. Central banks in the region were the

first to raise rates last year and policy makers have surprised markets with

steep hikes this year. For example, Brazilian policy makers have increased

borrowing costs to the highest levels in almost five years. As a result, Latin

America has been proactive in hiking rates and is considered to be ahead of the

curve from a monetary policy standpoint relative to developed markets. From a

positioning standpoint, we have been favoring domestic stocks that are more

sensitive to interest rates in Brazil, on the view that the nation's next

president is likely to implement relatively orthodox macro policies and the

Brazilian Central Bank should start an easing cycle in 2023. Although there are

some uncertainties ahead of the October Brazilian Presidential election, global

investors seem to be ready to put money to work in local Latin American equity

markets as other emerging-market nations such as China, Russia -and India

grapple with their own issues. We would argue that for many reasons LatAm

would seem well-positioned ahead of rising geopolitical tensions as the region

provides: i) geographic and economic insulation from the recent conflict; ii)

long and wide commodities exposure; iii) cheap currencies; iv) attractive

valuation entry points; and v) proactive monetary policy stances.

1Source: BlackRock, as of 31 August 2022.

20 September 2022

ENDS

Latest information is available by typing www.blackrock.com/uk/brla on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

September 20, 2022 11:12 ET (15:12 GMT)

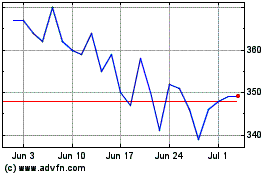

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From Apr 2023 to Apr 2024