TIDMBRLA

BlackRock Latin American Investment Trust plc

(Legal Entity Identifier: UK9OG5Q0CYUDFGRX4151)

Information disclosed in accordance with Article 5 Transparency Directive and

DTR 4.2

Half Yearly Financial Results Announcement for Period Ended 30 June 2022

PERFORMANCE RECORD

As at As at

30 June 2022 31 December

2021

Net assets (US$'000)1 135,199 194,838

Net asset value per ordinary share (US$ cents) 459.10 496.28

Ordinary share price (mid-market) (US$ cents)2 431.13 461.19

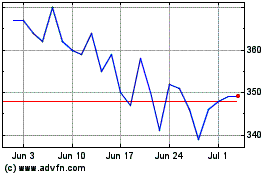

Ordinary share price (mid-market) (pence) 355.00 340.50

Discount3 6.1% 7.1%

Performance (with dividends reinvested)

Net asset value per share (US$ cents)3 -5.1% -12.5%

Ordinary share price (US$ cents)2,3 -4.0% -11.8%

Ordinary share price (pence)3 7.2% -11.0%

MSCI EM Latin America Index (net return, on a US Dollar -0.6% -8.1%

basis)4

For the For the

six months six months

ended ended

30 June 2022 30 June 2021 Change %

Revenue

Net profit on ordinary activities after 6,767 3,414 +98.2

taxation (US$'000)

Revenue earnings per ordinary share (US$ 18.11 8.70 +108.2

cents)

Dividends per ordinary share (US$ cents)

Quarter to 31 March 7.76 6.97 +11.3

Quarter to 30 June 5.74 7.82 -26.6

Total dividends paid and payable 13.50 14.79 -8.7

PERFORMANCE FROM 31 DECEMBER 2016 TO 30 JUNE 2022

MSCI EM Latin

America Index

Share price NAV (net basis)

2017 31.3 29.0 23.7

2018 -6.9 -5.4 -6.6

2019 22.0 18.2 17.5

2020 -9.3 -14.5 -13.8

2021 -11.8 -12.5 -8.1

2022* -4.0 -5.1 -0.6

Sources: BlackRock Investment Management (UK) Limited and Datastream.

Performance figures are calculated in US Dollar terms with dividends

reinvested.

* Six month performance to 30 June 2022.

1 The change in net assets reflects the market movements during the period,

the tender offer in the period and dividends paid.

2 Based on an exchange rate of US$1.21445 to £1 at 30 June 2022 and US$1.35445

to £1 at 31 December 2021, representing a change of 10.3% in the value of the

US Dollar against British Pound Sterling.

3 Alternative Performance Measures, see Glossary contained within the Half

Yearly Financial Report.

4 The Company's performance benchmark (the MSCI EM Latin America Index) may be

calculated on either a gross or a net return basis. Net return (NR) indices

calculate the reinvestment of dividends net of withholding taxes using the tax

rates applicable to non-resident institutional investors, and hence give a

lower total return than indices where calculations are on a gross basis (which

assumes that no withholding tax is suffered). As the Company is subject to

withholding tax rates for the majority of countries in which it invests, the NR

basis is felt to be the more accurate, appropriate, consistent and fair

comparison for the Company.

CHAIRMAN'S STATEMENT

Dear Shareholder

I am pleased to present the Half Yearly Financial Report to shareholders for

the six months ended 30 June 2022.

OVERVIEW AND PERFORMANCE

The global macro-economic and geopolitical backdrop through the first half of

2022 has been challenging, with concerns over global inflation, lagging growth

in China and the war between Russia and Ukraine all posing significant

headwinds for markets. Despite these concerns, Latin American markets have

outperformed both developed market and MSCI Emerging Markets indices over the

period under review with the MSCI EM Latin America Index up by 10.9% in

Sterling terms and down by just 0.6% in US Dollar terms, compared to a fall in

the MSCI Emerging Markets Index of 8.1% in Sterling terms and 17.6% in US

Dollar terms and a decline in the MSCI World Index of 11.3% in Sterling terms

and 20.5% in US Dollar terms respectively. Elevated commodity prices have been

a significant contributor to this regional outperformance, driving improvements

in terms of trade and economic growth and enabling commodity-rich countries in

the region to reduce fiscal deficits. From a country perspective, markets in

Chile and Brazil performed best over the period under review, up by 8.9% and

2.8% respectively; Mexico and Peru were among the weakest equity markets in the

region down by 7.9% and 5.9% respectively.

Against this backdrop, the Company's net asset value per share fell by 5.1%

over the period in US Dollar terms (lagging the benchmark by 4.5%). In Sterling

terms the NAV rose by 5.9% over the same period and the benchmark rose by

10.9%. The share price fell by 4.0% in US Dollar terms (but increased by 7.2%

in Sterling terms). The underperformance was largely driven by stock selection

in Brazil, as tighter global liquidity and a reduced risk appetite drove

valuations down for a number of what your portfolio managers believe to be

quality, domestic growth stocks. Another factor impacting the stock performance

of these quality, domestic growth equities include the steep hiking of local

interest rates in Brazil. As a result, the domestic Brazilian equity market saw

a great deal of redemptions from local investment funds forcing prices down in

a somewhat indiscriminate manner. We believe this has created a degree of

disconnect between underlying bottom-up fundamentals of Brazilian equities and

stock market valuations. Additional information on the main contributors to and

detractors from performance for the period under review is given in the

Investment Manager's Report below.

DIVIDS DECLARED IN RESPECT OF THE YEAR TO 30 JUNE 2022

Dividend Announcement

(cents per date Pay date

share)

Quarter to 30 September 2021 6.56 1 October 2021 8 November 2021

Quarter to 31 December 2021 6.21 4 January 2022 8 February 2022

Quarter to 31 March 2022 7.76 1 April 2022 16 May 2022

Quarter to 30 June 2022 5.74 1 July 2022 12 August 2022

Total 26.27

REVENUE RETURN AND DIVIDS

Revenue return for the six months ended 30 June 2022 was 18.11 cents per share

(2021: 8.70 cents per share).

The Company has declared dividends totalling 26.27 cents per share in respect

of the twelve months to 30 June 2022 representing a yield of 6.1% (calculated

based on a share price of 431.13 cents per share, equivalent to the Sterling

price of 355.00 pence per share translated into cents at a rate of US$1.21

prevailing on 30 June 2022).

Under the Company's dividend policy, dividends are calculated and paid

quarterly, based on 1.25% of the US Dollar NAV at close of business on the last

working day of March, June, September and December respectively; additional

information in respect of the payment timetable is set out in the Annual Report

and Financial Statements. Dividends will be financed through a combination of

available net income in each financial year and revenue and capital reserves.

The dividends paid and declared by the Company in the last twelve months have

been funded from current year revenue and brought forward revenue reserves.

As at 30 June 2022, a balance of US$5.1 million remained in revenue reserves.

Dividends will be funded out of capital reserves to the extent that current

year revenue and revenue reserves are fully utilised. The Board believes that

this removes pressure from the investment managers to seek a higher income

yield from the underlying portfolio itself which could detract from total

returns. The Board also believes the Company's dividend policy will enhance

demand for the Company's shares and help to narrow the Company's discount,

whilst maintaining the portfolio's ability to generate attractive total

returns. It is promising to note that since the dividend policy was introduced

in July 2018, the Company's discount has narrowed from 14.9% as at 1 July 2018

to 6.1% as at 30 June 2022.

PERFORMANCE TRIGGERED TER OFFER

Your Company's Directors have always recognised that our role is to act in the

best interests of our shareholders. We have regularly consulted with our major

shareholders to understand their objectives and used their input to guide our

strategy and policies. We note their desire for the Company to continue with

its existing investment policy and the overwhelming shareholder support for the

vote on the continuation of the Company at the AGM in May 2022. We also

recognise that it is in the long-term interests of shareholders that shares do

not trade at a significant discount to their prevailing NAV and to this end,

the Board put in place a discount control mechanism covering the four years to

31 December 2021 to offer a tender for up to 24.99% of shares in issue to the

extent that certain performance and average discount targets over the four year

period to 31 December 2021 were not met (more detail on the performance and

discount targets and the tender mechanism can be found in the Company's Annual

Report for the year to 31 December 2021 on pages 37 and 43). This resulted in a

tender offer for 24.99% of the Company's shares being put to shareholders for

approval at a General Meeting held on 19 May 2022 and subsequently implemented

as summarized below.

A total of 22,844,851 shares were validly tendered under the tender offer,

representing approximately 58.2% of the Company's issued share capital,

excluding shares held in treasury. As the offer was oversubscribed, it was

scaled back and eligible shareholders who validly tendered shares in excess of

their basic entitlement of 24.99% had their basic entitlement satisfied in full

plus approximately 19.70895% of the excess amount they tendered, in accordance

with the process described in the tender circular published on 5 April 2022. In

total, 9,810,979 shares (representing 24.99% of the eligible share capital)

were repurchased by the Company and subsequently cancelled.

The price at which tendered shares were repurchased was equal to 98% of the Net

Asset Value per share as at a calculation date of 20 May 2022, as adjusted for

the estimated related portfolio realisation costs per tendered share, and

amounted to 417.0889 pence per share. Tender proceeds were paid to shareholders

on 26 May 2022.

DISCOUNT MANAGEMENT AND NEW DISCOUNT CONTROL MECHANISM

The Board remains committed to taking appropriate action to ensure that the

Company's shares do not trade at a significant discount to their prevailing NAV

and have sought to reduce discount volatility by offering shareholders a new

discount control mechanism covering the four years to 31 December 2025. This

mechanism will offer shareholders a tender for 24.99% of the shares in issue

excluding treasury shares (at a tender price reflecting the latest cum-income

NAV less 2% and related portfolio realisation costs) in the event that the

continuation vote to be put to the Company's AGM in 2026 is approved, where

either of the following conditions have been met:

(i) the annualised total NAV return of the Company does not exceed the

annualised benchmark index (being the MSCI EM Latin America Index) US Dollar

(net return) by more than 50 basis points over the four year period from 1

January 2022 to 31 December 2025 (the Calculation Period); or

(ii) the average daily discount to the cum-income NAV exceeds 12% as calculated

with reference to the trading of the shares over the Calculation Period.

In respect of the above conditions, the Company's total NAV return on a

US Dollar basis for the six month period from 1 January 2022 to 30 June 2022

was -5.1%, underperforming the benchmark return of -0.6% for the same period by

4.5%. The cum-income discount of the Company's ordinary shares has averaged

6.1% for this period and ranged from a premium of 0.6% to a discount of 11.0%,

ending the period on a discount of 6.1% at 30 June 2022.

Other than the shares repurchased under the tender offer implemented in May

2022, the Company has not bought back any shares during the six months ended 30

June 2022 and up to the date of publication of this report (no shares were

bought back in the year to 31 December 2021).

CHANGE OF PORTFOLIO MANAGER

As announced on 9 September 2022, Sam Vecht, who has co-managed the portfolio

alongside Ed Kuczma since December 2018, became the lead portfolio manager of

the Company with Mr Kuczma stepping down from his role. Christoph Brinkmann has

been appointed as deputy portfolio manager. Mr Vecht is a Managing Director

in BlackRock's Global Emerging Markets Equities team and has extensive

experience in the investment trust sector, having managed a number of UK

investment trusts since 2004. He has also been portfolio manager for the

BlackRock Emerging Markets Equity Strategies Fund since September 2015, and the

BlackRock Frontiers Investment Trust plc since 2010, both of which have

invested in the Latin American region since launch.

Mr Brinkmann, a Vice President in the Global Emerging Markets Equities Team,

has covered multiple sectors and countries across the Latin American region. He

joined BlackRock in 2015 after graduating from the University of Cologne with a

Masters in Finance and a CEMS Masters in International Management.

Mr Vecht and Mr Brinkmann are supported by the extensive resources and

significant expertise of BlackRock's Global Emerging Market team which has a

proven track record in emerging market equities. The team is made up of c.40

investment professionals researching over 1,000 companies across the global

emerging markets universe inclusive of Latin America.

Your Board notes that Mr Vecht's new role as lead portfolio manager provides

continuity for the Company and welcomes the addition of Mr Brinkmann to the

team as deputy portfolio manager. The Board are grateful to Mr Kuczma for his

commitment and contribution to the Company and wish him well in his future

endeavours.

OUTLOOK

After a challenging year in 2021, markets in the Latin American region saw a

very strong start to 2022. Higher commodity prices and historically cheap

currencies have helped to cushion Latin America from the global economic

headwinds over the first half of the year. Moving into the second half of 2022,

the region faces the challenges of sharply rising core inflation and political

uncertainty. In particular, uncertainty over the outcome of the upcoming

presidential election in Brazil (by far the largest component of the benchmark

at circa 70%) has depressed markets and valuations are at unprecedented lows.

Despite this, our portfolio managers believe that companies in Latin America

are well-versed in dealing with inflationary pressures and should benefit from

rising geopolitical tensions which have sharply increased the focus on Latin

America as an investment destination in an emerging market context. The region

provides significant opportunities for direct investment as governments and

businesses globally re-think supply chain configurations and seek to diversify

risk.

Whilst the global economic outlook appears to be increasingly sombre, the Board

remains hopeful for the relative outlook for Latin American equities.

Carolan Dobson

Chairman

14 September 2022

INVESTMENT MANAGER'S REPORT

MARKET OVERVIEW

As highlighted in the Investment Manager's report contained within the Annual

Report for the year to 31 December 2021, the team was optimistic that the Latin

American region could be a bright spot for investors in 2022. In line with

these expectations, Latin America did indeed outperform both developed markets

(as represented by the MSCI World Index) and the MSCI Emerging Markets Index

for the six months ended 30 June 2022. Through the year to date so far, the

major events that have influenced markets relate to global inflation, mainland

Chinese growth and the war between Russia and Ukraine. Despite these

challenges, Latin American equities have delivered a strong start to the year

in relative terms and opportunities remain for further outperformance in the

region going forward.

Latin America has proven to be resilient despite myriad challenges in 2022,

helped in large part by elevated commodity prices leading to broad improvements

in terms of trade, economic growth and a reduction in fiscal deficits. Taking

stock of the first half of 2022, the rise in commodity prices has come at a

beneficial time as most countries in the region had already enacted grand

fiscal stimulus programmes over the past few years to bridge the gap in

economic activity due to the COVID-19 pandemic. The higher raw material prices

have allowed commodity rich nations to expedite the process of reducing fiscal

deficits and levels of indebtedness as increased royalties have led to

better-than-expected tax revenues for governments in the region. However,

markets remain uncertain over growth prospects for the second half of 2022

given significant inflation concerns and interest rate expectations, both this

year and in 2023. These potential growth concerns come despite very positive

terms of trade, which historically have led to increased investment in the

region. Lingering uncertainties over macroeconomic policy frameworks is a key

part of the headwind, especially as failure to control inflation remains a

prominent risk in the United States and European Union.

% Return (with Local currency Local indices2

MSCI Country % Price change dividends (% vs. USD) (% change)

Indices reinvested)1

Argentina -16.5 -14.6 -18.0 -4.8 (MERVAL)

Brazil -2.1 2.8 6.0 -6.0 (Ibovespa)

Chile 7.0 8.9 -7.2 11.2 (IGPA)

Colombia -7.3 -3.7 -2.1 -3.0 (COLCAP)

Mexico -9.2 -7.9 2.0 -7.5 (IPC)

Peru -8.6 -5.9 4.5 -9.0 (S&P/BVL)

% Return (with Commodity prices

Indices % Price change dividends Commodity/Index (% change)

reinvested)1

MSCI EM Latin -4.2 -0.6 CRB Index3 3.2

America

MSCI Emerging Asia -18.1 -17.2 Oil (WTI)4 40.6

MSCI Emerging -18.8 -17.6 Gold -1.2

Markets

MSCI World -21.2 -20.5 Copper -16.8

S&P 500 -20.6 -20.2 Corn 25.4

MSCI Europe -22.2 -20.8 Soybeans 26.1

1 MSCI total return indices are net of withholding taxes.

2 Indices listed are the local market indices in that country.

3 Commodity Research Bureau Index.

4 West Texas Intermediate.

Sources: Bloomberg and MSCI for the six months to 30 June 2022.

The MSCI returns shown above are on a USD basis. However, the local indices are

on a local currency basis.

From a country perspective, Chile and Brazil performed the most strongly,

posting region-leading returns in the first half of 2022. Brazilian markets

returned +2.8%, with domestic economic activity recovering and an upward bias

to earnings estimates, all while inflation continues to climb higher, leading

to an aggressive interest rate hiking cycle. Broadly speaking, we find

valuations remain very low and earnings expectations are reasonable. The

market has remained volatile ahead of the Presidential election in the fourth

quarter of 2022, and we see the prospects of a possible relief rally once the

election results are known and the uncertainty clears. In Chile, markets

returned +8.9% over the period due in part to robust economic activity as the

country was quick to reopen following rapid vaccination distribution and a new

program of allowed pension withdrawals providing liquidity to consumers.

Additionally, Chilean banks have been supported by a low level of default on

debt and a high level of provisioning. Conversely, Mexico and Peru were the

weakest equity markets in Latin America in the first half of 2022, returning

-7.9% and -5.9% respectively. In Mexico, the post-pandemic recovery in economic

growth has been lacklustre given high inflation, rising interest rates and

persistent frictions between the government and the private sector. In Peru,

continued political uncertainty has similarly weighed on private investment and

consumer confidence as President Castillo has spent much of his first year in

office focused on defending impeachment attempts from the Congress.

Having delivered steep and persistent policy rate hikes for several quarters,

Latin American monetary tightening cycles are well advanced. We believe that a

peak in inflation may be reached in the second half of 2022 as higher prices

have a strong behavioural impact on consumption through demand destruction

while supply should increase in response to high prices. Brazil specifically

has enacted a number of fiscal measures to reduce taxes in essential goods as a

measure to ease inflation. A strong coordinated response by global central

banks to raise interest rates should also help to ease further price

escalations but will remain a headwind to growth as a consequence. The strong

policy action will have consequences for growth in the US and Europe at the

same time that China is facing mobility restrictions related to their zero

COVID-19 policy. Tighter liquidity measures will be detrimental for growth in

emerging economies; however we feel that Latin American central banks have a

long history of experience dealing with inflationary environments. The

pre-emptive front loading of interest rate hikes in the region will allow Latin

American countries to be amongst the first globally to be in a position to

start cutting interest rates to support domestic economic development. We

believe this will prove to be a catalyst for Latin American equities going

forward.

PERFORMANCE FROM 1 JANUARY 2022 TO 30 JUNE 2022

MSCI EM Latin

America Index

Share price NAV (net basis)

December 21 100.00 100.00 100.00

January 22 105.67 108.18 107.38

February 22 111.13 112.22 112.56

March 22 127.85 126.66 127.26

April 22 113.38 109.37 110.74

May 22 121.82 115.76 119.80

June 22 96.02 94.88 99.43

Sources: BlackRock Investment Management (UK) Limited and Datastream.

Performance figures are calculated in US Dollar terms, with dividends

reinvested, rebased to 100 as at 1 January 2022.

TOP PORTFOLIO CONTRIBUTORS/DETRACTORS TO THE COMPANY'S NAV

Top contributors: Total effect Top detractors: Total effect

(bps): (bps):

BB Seguridade 67.9 Globant -112.6

Participações

Magazine Luiza 47.5 Hapvida Participações -99.8

B3 44.8 CEMEX -86.7

Lojas Americanas 37.0 Sociedad Quimica y Minera de -82.1

Chile

Natura & Co 32.8 Marfrig Global Foods -57.0

Source: BlackRock.

PORTFOLIO POSITIONING

The Company underperformed its benchmark during the first half of 2022. Over

the period, the Company's NAV returned +5.9% with the share price returning

+7.2%. The Company's benchmark, the MSCI EM Latin America Index, returned

+10.9% on a net basis (all performance returns in Sterling terms with dividends

reinvested).

Security selection in Peru and a lack of exposure to Colombia contributed most

to relative performance, while allocation to Argentina and security selection

in Chile detracted the most from relative performance.

At a security level, an overweight in Brazilian insurance company BB Seguridade

Participações, and Brazilian stock exchange B3, were top relative contributors

over the six-month period. BB Seguridade Participações outperformed as the

stock benefitted from higher investment income given the rapid rise in

Brazilian interest rates. For B3, the stock rallied early in the year on

resilient trading volumes and increased demand from foreign investors in the

local equity market. The Company's lack of exposure to one of Brazil's largest

electronics and appliance retail chains, Magazine Luiza, also contributed

positively to relative performance as the stock underperformed following

concerns around competition and personal consumption in Brazil.

On the other hand, an off-benchmark holding of Globant, an Argentinian

information technology (IT) and software development company, detracted most

from relative performance (although in our opinion, Globant's investment themes

remain strong). The company has about 30% of its work force in Argentina,

while the majority of its revenues come from serving multinational, blue-chip

companies such as Disney and Electronic Arts operating mainly in the developed

markets. The company is well skilled in regard to transforming business models

to adapt to an increasingly digitalised world by offering services such as

augmented coding, artificial intelligence and virtual reality applications. We

believe the company is in a strong position as an exporter of low-cost computer

programming talent to developed markets. An overweight in Brazilian healthcare

company, Hapvida Participações, also detracted from relative performance as the

stock has been challenged this year following a COVID-19 related spike in

healthcare costs which have eroded the company's profitability. We continue to

have strong conviction in the stock as Hapvida Participações recently merged

with Intermedica, another large healthcare peer which will give the combined

entity greater scale and translate into better procurement terms going forward.

Aside from that, our position in Mexican cement player CEMEX also detracted

from performance as higher energy prices impacted the company's profitability.

CURRENT PORTFOLIO POSITIONING

The Company ended the period with its largest country overweight in Brazil and

Mexico. While Argentina also shows as a regional overweight, the Company holds

a single holding in Argentina through the IT consulting company, Globant.

Additional position increases have been allocated to Brazilian staples and

Mexican financials.

The Company was overweight in Brazil during the six-month period. There is

considerable uncertainty ahead of the November 2022 election and some strains

are appearing in the public finances. Despite this, we are finding plenty of

opportunity at the individual stock level as we believe valuations are low and

positioning is light. We are taking positions in traditional banks and

insurance companies that should be beneficiaries of rising interest rates. We

also see opportunities in healthcare, as countries aim to rectify the

weaknesses in their health infrastructure exposed by COVID-19. Over the period

we added to Rede D'Or São Luiz, a Brazilian healthcare company, as earnings

momentum remains strong as the company accelerates its leadership position

through both organic expansion and acquisitions in a market with attractive

long term growth opportunities. We have also been adding to Brazilian

healthcare company, Hapvida Participações. We continue to have strong

conviction in the stock as we see the name trading at attractive fundamentals

following recent underperformance.

The Company continues to have no exposure to Colombia (as was the case

throughout 2021). The country has a rising fiscal deficit and need for tax and

social reform. We believe the recent presidential election poses a serious risk

of macro policy regime change, which could materially impact corporate earnings

growth and profitability.

At the sector level, we are overweight financials as we see potential for

profitability to improve in a high interest rate environment. We are also

overweight real estate as we are attracted to inflation protected rents and

realignment of supply-chains benefitting industrial warehousing in Mexico.

Conversely, we are underweight energy as we find the current spike in oil

prices is unsustainable given demand destruction, supply and substitution

responses.

OUTLOOK

Over the past two-plus years, global equities have transitioned from one

unimaginable health crisis to a period of escalating inflation driven by supply

constraints from geopolitical conflict caused by the war in Ukraine. Latin

America has also gone through a heavy political cycle over this time with most

countries in Latin America facing changes in leadership creating additional

uncertainties. We look forward to some of the external noise potentially going

back to "normal" levels as the dramatic whipsaws seen in monetary, fiscal,

political, inflationary and productivity variables return to pre-COVID-19

trends. Despite the many factors generating volatility for equity markets, in

our opinion Latin American markets have the potential to prove resilient in

many ways to global stresses. Rising commodity prices have been supportive for

external current accounts and fiscal accounts. High gaps in interest rate

differentials between Latin American central banks and developed market peers

have emerged and this combined with strong terms of trade have started to push

currencies towards appreciation from depressed levels in the recent past. Core

inflation has moved sharply higher, and the expectations are for an easing in

terms of this spike but the run-rate for inflation should (in our view) remain

elevated with a struggle to return to target ranges any time soon. We would

argue that the concern regarding global inflation is more an issue for

developed markets where consumers and central banks have become accustomed to

low levels of inflation. Latin America has a strong history of dealing with

inflation and we believe the strong proactive measures taken by the region's

central banks allow for greater comfort on a relative basis.

We remain overweight in Brazilian equities. While the Company's asset

allocation in Brazil looks to gain strategic exposure to the current commodity

cycle, there are some positive signs emerging on the domestic side (growth,

fiscal and labour market). Inflation has the potential to come down faster than

expected due to reduction in taxation for consumers and interest rate cuts in

2021, which we expect should support Brazilian stocks. Uncertainty regarding

the upcoming presidential election is priced-in, in our view, as valuations are

at an unprecedented low.

We have grown more cautious on Chilean equities as the strong performance

year-to-date has been mostly concentrated in commodity related stocks. This

leaves the vast majority of the index constituents trading at a significant

discount to historical levels. We are cautious on earnings momentum as the

economy faces a tough backdrop and subdued business confidence related to

changes to the regulatory environment and higher taxation.

We enter the second half of 2022 overweight in Mexican equities but have

reduced our exposure relative to the start of the year given less compelling

valuations compared to the rest of Latin American markets and lack of

catalysts. Inflationary pressure is a concern in the near term which implies

additional monetary tightening by the central banks in the coming months. Also,

higher commodity prices have a net negative impact on the external current

accounts and fiscal accounts.

We remain underweight in Colombia as policy risk continues to weigh on

equities, on top of weak fundamentals stemming from Colombia's twin deficits.

We expect the policy uncertainty, tightening monetary policy and inflationary

pressure to weigh down the benefits of higher oil prices, increased consumer

spending, and attractive valuations.

Finally, we are neutral on Peru as further downside risks related to Castillo's

administration currently look limited: the proposal for a Constitutional

Assembly was defeated in Congress, and there is no support with which the

unpopular President can enact structural reforms to the economic model. The

country has also maintained fiscal discipline and an independent monetary

policy (possibly the only two positive highlights from this administration).

Peru continues to have one of the lowest debt/gross domestic product (GDP)

ratios in the region, at 36%, relatively small fiscal and current deficits,

and, despite the political volatility, its real GDP is expected to grow by

above the region's average in 2022.

In summary, we remain optimistic on the prospects for Latin American equities

despite the impact of external risks (possible US recession, weak growth in

China) as well as domestic risks (presidential elections in Brazil, persistent

high inflation/high interest rates).

Given the level of valuations, we believe risks are more than reflected in

current prices.

Furthermore, earnings expectations have consistently risen for 2022 on higher

commodity prices and better than expected economic activity. For 2023, we

anticipate that earnings growth expectations excluding Materials and Energy

should remain robust. We have argued that companies in Latin America are

well-versed in dealing with inflationary pressures and the pre-emptive hiking

measures in the region should provide a buffer to start stimulating for growth

from a point of high interest rates. Geopolitical and governance tensions in

Russia and China have amplified the interest in Latin America as an investment

destination in an emerging market context. The region's productive, skilled and

low-cost labour base with close proximity to the United States provides ample

opportunities for direct investment as current supply chain configurations are

being reconsidered with nearshoring in mind. Given the balance of risks, light

positioning and appealing valuations, we continue to believe investors can

benefit from improving fundamentals in the region.

Sam Vecht

BlackRock Investment Management (UK) Limited

14 September 2022

PORTFOLIO ANALYSIS

as at 30 June 2022

GEOGRAPHICAL WEIGHTING (GROSS MARKET EXPOSURE) VS MSCI EM LATIN AMERICA INDEX

Country % of net assets MSCI EM Latin

America Index

Brazil 64.6 61.9

Mexico 31.1 26.9

Chile 6.5 6.4

Peru 2.8 2.8

Argentina 2.5 0.0

Panama 2.3 0.0

Colombia 0.0 2.0

Sources: BlackRock and MSCI.

SECTOR ALLOCATION (GROSS MARKET EXPOSURE) VS MSCI EM LATIN AMERICA INDEX

Sector % of net assets MSCI EM Latin

America Index

Financials 30.0 23.4

Materials 22.8 23.2

Consumer Staples 15.9 14.6

Industrials 9.4 7.2

Energy 8.6 12.0

Communication Services 5.7 8.0

Real Estate 5.3 0.6

Health Care 4.5 2.0

Consumer Discretionary 4.2 2.5

Information Technology 2.5 0.5

Utilities 0.9 6.0

Sources: BlackRock and MSCI.

TEN LARGEST INVESTMENTS

1= Vale (2021: 1st)

Materials

Market value - American depositary share (ADS): US$13,004,000

Share of investments: 8.8% (2021: 7.6%)

is one of the world's largest mining groups, with other business in logistics,

energy and steelmaking. Vale is the world's largest producer of iron ore

and nickel but also operates in the coal, copper, and manganese and

ferro-alloys sectors.

2= Petrobrás (2021: 2nd)

Energy

Market value - American depositary receipt (ADR): US$6,575,000

Market value - Preference shares ADR: US$5,016,000

Share of investments: 7.8% (2021: 7.5%)

is a Brazilian integrated oil and gas group, operating in the exploration and

production, refining, marketing, transportation, petrochemicals, oil product

distribution, natural gas, electricity, chemical-gas and biofuel segments of

the industry. The group controls significant assets across Africa, North and

South America, Europe and Asia, with a majority of production based in Brazil.

3+ Banco Bradesco (2021: 4th)

Financials

Market value - ADR: US$9,097,000

Share of investments: 6.1% (2021: 5.3%)

is one of Brazil's largest private sector banks. The bank divides its

operations in two main areas - banking services and insurance services,

management of complementary private pension plans and savings bonds.

4+ Itaú Unibanco (2021: 21st)

Financials

Market value - ADR: US$8,439,000

Share of investments: 5.7% (2021: 1.9%)

is a Brazilian financial services group that services individual and corporate

clients in Brazil and abroad. Itaú Unibanco was formed through the merger of

Banco Itaú and Unibanco in 2008. It operates in the retail banking and

wholesale banking segments.

5+ Walmart de México y Centroamérica (2021: 6th)

Consumer Staples

Market value - Ordinary shares: US$6,872,000

Share of investments: 4.6% (2021: 4.5%)

is the Mexican and Central American division of Walmart Stores Inc, with

operations in Mexico, Guatemala, El Salvador, Honduras, Nicaragua and Costa

Rica. The group operates eight brands in the region, covering the discount,

winery, supermarket and supercenter segments.

6+ Grupo Financiero Banorte (2021: 7th)

Financials

Market value - Ordinary shares: US$6,624,000

Share of investments: 4.5% (2021: 4.5%)

is a Mexican banking and financial services holding company and is one of the

largest financial groups in the country. It operates as a universal bank and

provides a wide array of products and services through its broker dealer,

annuities and insurance companies, retirements savings funds (Afore), mutual

funds, leasing and factoring company and warehousing.

7+ FEMSA (2021: 15th)

Consumer Staples

Market value - ADR: US$6,354,000

Share of investments: 4.3% (2021: 2.5%)

is a Mexican beverages group which engages in the production, distribution, and

marketing of beverages. The firm also produces, markets, sells, and distributes

Coca-Cola trademark beverages, including sparkling beverages.

8- B3 (2021: 5th)

Financials

Market value - Ordinary shares: US$5,889,000

Share of investments: 4.0% (2021: 4.6%)

is a stock exchange located in Brazil, providing trading services in an

exchange and OTC environment. B3's scope of activities include the creation and

management of trading systems, clearing, settlement, deposit and registration

for the main classes of securities, from equities and corporate fixed income

securities to currency derivatives, structured transactions and interest rates,

and agricultural commodities. B3 also acts as a central counterparty for most

of the trades carried out in its markets and offers central depository and

registration services.

9+ AmBev (2021: 26th)

Consumer Staples

Market value - ADR: US$5,734,000

Share of investments: 3.9% (2021: 1.6%)

is a Brazilian brewing group which engages in the production, distribution, and

sale of beverages. Its products include beer, carbonated soft drinks, and other

non-alcoholic and non-carbonated products with operations in Brazil, Central

America and the Caribbean (CAC) and Canada.

10+ Suzano Papel e Celulose (2021: 12th)

Materials

Market value - Ordinary shares: US$4,670,000

Share of investments: 3.1% (2021: 3.0%)

is a Brazilian pulp and paper group. The pulp segment produces and sells

hardwood eucalyptus pulp and fluff mainly to supply the export market, with any

surplus destined to the domestic market. The paper segment consists of

production and sale of paper to meet the demands of both domestic and export

markets.

All percentages reflect the value of the holding as a percentage of total

investments. For this purpose, where more than one class of securities is held,

these have been aggregated. The percentages in brackets represent the value of

the holding as at 31 December 2021.

Together, the ten largest investments represent 52.8% of the total investments

(ten largest investments as at 31 December 2021: 51.3%).

PORTFOLIO OF INVESTMENTS

as at 30 June 2022

Market

value % of

US$'000 investments

Brazil

Vale - ADS 13,004 8.8

Petrobrás - ADR 6,575 } 7.8

Petrobrás - preference shares - ADR 5,016

Banco Bradesco - ADR 9,097 6.1

Itaú Unibanco - ADR 8,439 5.7

B3 5,889 4.0

AmBev - ADR 5,734 3.9

Suzano Papel e Celulose 4,670 3.1

Hapvida Participações 3,898 2.6

BB Seguridade Participações 3,295 2.2

TIM 3,211 2.2

Sendas Distribuidora 2,537 1.7

Gerdau - preference shares 2,313 1.6

Movida Participações 2,209 1.5

Santos Brasil Participações 2,127 1.4

Rede D'Or São Luiz 2,102 1.4

Afya 1,947 1.3

CIA Locação das Américas 1,736 1.2

Neoenergia 1,254 0.8

Arezzo Indústria e Comércio 1,080 0.7

XP Inc 760 0.5

Smartfit Escola 439 0.3

87,332 58.8

Mexico

Walmart de México y Centroamérica 6,872 4.6

Grupo Financiero Banorte 6,624 4.5

FEMSA - ADR 6,354 4.3

CEMEX - ADR 4,283 2.9

América Movil - ADR 4,088 2.7

Corporación Inmobiliaria Vesta 3,638 2.4

Grupo Aeroportuario del Pacifico - ADS 3,580 2.4

Fibra Uno Administración - REIT 3,526 2.4

Grupo México 3,241 2.2

42,206 28.4

Chile

Empresas CMPC 3,462 2.3

Banco Santander-Chile - ADR 2,734 1.9

Falabella 2,561 1.7

8,757 5.9

Peru

Credicorp 3,760 2.5

3,760 2.5

Argentina

Globant 3,354 2.3

3,354 2.3

Panama

Copa Holdings 3,048 2.1

3,048 2.1

Total Investments 148,457 100.0

All investments are in equity shares unless otherwise stated.

The total number of investments held at 30 June 2022 was 36 (31 December 2021:

40). At 30 June 2022, the Company did not hold any equity interests comprising

more than 3% of any company's share capital (31 December 2021: nil).

INTERIM MANAGEMENT REPORT AND RESPONSIBILITY STATEMENT

The Chairman's Statement and the Investment Manager's Report give details of

the events which have occurred during the period and their impact on the

financial statements.

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks faced by the Company can be divided into various areas as

follows:

* Counterparty;

* Investment performance;

* Income/dividend;

* Legal and regulatory compliance;

* Operational;

* Market;

* Financial; and

* Marketing.

The Board reported on the principal risks and uncertainties faced by the

Company in the Annual Report and Financial Statements for the year ended 31

December 2021. A detailed explanation can be found on pages 44 to 47 and in

note 16 on pages 95 to 102 of the Annual Report and Financial Statements which

are available on the website maintained by BlackRock at www.blackrock.com/uk/

brla.

The ongoing COVID-19 pandemic has had a profound impact on all aspects of

society in recent years. The impact of this significant event on the Company's

financial risk exposure is disclosed in note 16 of the Annual Report and

Financial Statements.

The Directors have assessed the impact of market conditions arising from the

COVID-19 outbreak on the Company's ability to meet its investment objective.

Based on the latest available information, the Company continues to be managed

in line with its investment objective, with no disruption to its operations.

Certain financial markets have fallen towards the end of the financial period

due primarily to geopolitical tensions arising from Russia's invasion of

Ukraine and the impact of the subsequent range of sanctions, regulations and

other measures which impaired normal trading in Russian securities.

In the view of the Board, other than those matters noted above, there have not

been any material changes to the fundamental nature of these risks since the

previous report and these principal risks and uncertainties, as summarised, are

as applicable to the remaining six months of the financial year as they were to

the six months under review.

GOING CONCERN

The Board remains mindful of the ongoing uncertainty surrounding the potential

duration of the COVID-19 pandemic and its longer term effects on the global

economy and the current heightened geopolitical risk. Nevertheless, the

Directors, having considered the nature and liquidity of the portfolio, the

Company's investment objective and the Company's projected income and

expenditure, are satisfied that the Company has adequate resources to continue

in operational existence for the foreseeable future and is financially sound.

RELATED PARTY DISCLOSURE AND TRANSACTIONS WITH THE INVESTMENT MANAGER

BlackRock Fund Managers Limited (BFM) was appointed as the Company's AIFM

(Alternative Investment Fund Manager) with effect from 2 July 2014. BFM has

(with the Company's consent) delegated certain portfolio and risk management

services, and other ancillary services, to BlackRock Investment Management (UK)

Limited (BIM (UK)). Both BFM and BIM (UK) are regarded as related parties under

the Listing Rules. Details of the fees payable are set out in note 11 to the

financial statements below.

The related party transactions with the Directors are set out in note 12 to the

financial statements below.

DIRECTORS' RESPONSIBILTY STATEMENT

The Disclosure Guidance and Transparency Rules (DTR) of the UK Listing

Authority require the Directors to confirm their responsibilities in relation

to the preparation and publication of the Interim Management Report and

Financial Statements.

The Directors confirm to the best of their knowledge and belief that:

* the condensed set of financial statements contained within the Half Yearly

Financial Report has been prepared in accordance with the applicable UK

Accounting Standard FRS 104 Interim Financial Reporting; and

* the Interim Management Report, together with the Chairman's Statement and

the Investment Manager's Report, include a fair review of the information

required by 4.2.7R and 4.2.8R of the Financial Conduct Authority's (FCA)

Disclosure Guidance and Transparency Rules.

The Half Yearly Financial Report has not been audited or reviewed by the

Company's Auditor.

The Half Yearly Financial Report was approved by the Board on 14 September 2022

and the above Responsibility Statement was signed on its behalf by the

Chairman.

Carolan Dobson

For and on behalf of the Board

14 September 2022

INCOME STATEMENT

for the six months ended 30 June 2022

Six months ended 30 Six months ended 30 Year ended 31 December

June 2022 June 2021 2021

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

(Losses)/ - (8,655) (8,655) - 14,049 14,049 - (36,963) (36,963)

gains on

investments

held at

fair value

through

profit or

loss

(Losses)/ - (231) (231) - 283 283 - 173 173

gains on

foreign

exchange

Income from 2 7,599 - 7,599 4,367 - 4,367 12,199 - 12,199

investments

held at

fair value

through

profit or

loss

Other 2 18 - 18 - - - - - -

income

Total 7,617 (8,886) (1,269) 4,367 14,332 18,699 12,199 (36,790) (24,591)

income/

(loss)

Expenses

Investment 3 (186) (558) (744) (229) (689) (918) (431) (1,295) (1,726)

management

fee

Other 4 (308) (6) (314) (404) 4 (400) (783) (10) (793)

operating

expenses

Total (494) (564) (1,058) (633) (685) (1,318) (1,214) (1,305) (2,519)

operating

expenses

Net profit/ 7,123 (9,450) (2,327) 3,734 13,647 17,381 10,985 (38,095) (27,110)

(loss) on

ordinary

activities

before

finance

costs and

taxation

Finance (30) (90) (120) (24) (71) (95) (53) (158) (211)

costs

Net profit/ 7,093 (9,540) (2,447) 3,710 13,576 17,286 10,932 (38,253) (27,321)

(loss) on

ordinary

activities

before

taxation

Taxation (326) 11 (315) (296) - (296) (685) - (685)

(charge)/

credit

Net profit/ 6,767 (9,529) (2,762) 3,414 13,576 16,990 10,247 (38,253) (28,006)

(loss) on

ordinary

activities

after

taxation

Earnings/ 7 18.11 (25.50) (7.39) 8.70 34.58 43.28 26.10 (97.44) (71.34)

(loss) per

ordinary

share (US$

cents)

The total column of this statement represents the Company's profit and loss

account. The supplementary revenue and capital accounts are both prepared under

guidance published by the Association of Investment Companies (AIC). All items

in the above statement derive from continuing operations. No operations were

acquired or discontinued during the period. All income is attributable to the

equity holders of the Company.

The net profit/(loss) on ordinary activities for the period disclosed above

represents the Company's total comprehensive income/(loss).

STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2022

Called Share Capital Non-

up premium redemption distributable Capital Revenue

share

capital account reserve reserve reserves reserve Total

Note US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

For the six

months ended

30 June 2022

(unaudited)

At 31 December 4,144 11,719 4,843 4,356 165,947 3,829 194,838

2021

Total

comprehensive

(loss)/income:

Net (loss)/ - - - - (9,529) 6,767 (2,762)

profit for the

period

Transaction

with owners,

recorded

directly to

equity:

Tender offer (981) - 981 - (51,017) - (51,017)

Tender offer - - - - (376) - (376)

costs

Dividends 5 - - - - - (5,484) (5,484)

paid1

At 30 June 3,163 11,719 5,824 4,356 105,025 5,112 135,199

2022

For the six

months ended

30 June 2021

(unaudited)

At 31 December 4,144 11,719 4,843 4,356 206,047 3,042 234,151

2020

Total

comprehensive

income:

Net profit - - - - 13,576 3,414 16,990

for the period

Transaction

with owners,

recorded

directly to

equity:

Dividends 5 - - - - - (5,661) (5,661)

paid2

At 30 June 4,144 11,719 4,843 4,356 219,623 795 245,480

2021

For the year

ended 31

December

2021

(audited)

At 31 December 4,144 11,719 4,843 4,356 206,047 3,042 234,151

2020

Total

comprehensive

(loss)/income:

Net (loss)/ - - - - (38,253) 10,247 (28,006)

profit for the

year

Transactions

with owners,

recorded

directly to

equity:

Dividends 5 - - - - (1,847) (9,460) (11,307)

paid3

At 31 December 4,144 11,719 4,843 4,356 165,947 3,829 194,838

2021

1 Quarterly dividend of 6.21 cents per share for the year ended 31 December

2021, declared on 4 January 2022 and paid on 8 February 2022; quarterly

dividend of 7.76 cents per share for the year ending 31 December 2022, declared

on 1 April 2022 and paid on 16 May 2022.

2 Quarterly dividend of 7.45 cents per share for the year ended 31 December

2020, declared on 4 January 2021 and paid on 8 February 2021; quarterly

dividend of 6.97 cents per share for the year ended 31 December 2021, declared

on 1 April 2021 and paid on 10 May 2021.

3 Quarterly dividend of 7.45 cents per share for the year ended 31 December

2020, declared on 4 January 2021 and paid on 8 February 2021; quarterly

dividend of 6.97 cents per share for the year ended 31 December 2021, declared

on 1 April 2021 and paid on 10 May 2021; quarterly dividend of 7.82 cents per

share for the year ended 31 December 2021, declared on 1 July 2021 and paid on

6 August 2021; quarterly dividend of 6.56 cents per share for the year ended 31

December 2021, declared on 1 October 2021 and paid on 8 November 2021.

For information on the Company's distributable reserves, please refer to note 9

below.

BALANCE SHEET

as at 30 June 2022

30 June 2022 30 June 2021 31 December

2021

(unaudited) (unaudited) (audited)

Notes US$'000 US$'000 US$'000

Fixed assets

Investments held at fair value 148,457 273,440 212,182

through profit or loss

Current assets

Debtors 1,217 2,340 466

Cash and cash equivalents 58 297 463

Total current assets 1,275 2,637 929

Creditors - amounts falling due

within one year

Bank overdraft (12,993) (27,599) (16,980)

Other creditors (1,516) (2,963) (1,258)

Total current liabilities (14,509) (30,562) (18,238)

Net current liabilities (13,234) (27,925) (17,309)

135,223 245,515 194,873

Creditors - amounts falling due after

more than one year

Non-current tax liability 6 - (11) (11)

Non-equity redeemable shares 6 (24) (24) (24)

(24) (35) (35)

Net assets 135,199 245,480 194,838

Capital and reserves

Called up share capital 8 3,163 4,144 4,144

Share premium account 11,719 11,719 11,719

Capital redemption reserve 5,824 4,843 4,843

Non-distributable reserve 4,356 4,356 4,356

Capital reserves 105,025 219,623 165,947

Revenue reserve 5,112 795 3,829

Total shareholders' funds 7 135,199 245,480 194,838

Net asset value per ordinary share 7 459.10 625.27 496.28

(US$ cents)

STATEMENT OF CASH FLOWS

for the year ended 30 June 2022

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

(unaudited) (unaudited) (audited)

US$'000 US$'000 US$'000

Operating activities

Net (loss)/profit on ordinary activities (2,447) 17,286 (27,321)

before taxation

Add back finance costs 120 95 211

Losses/(gains) on investments held at fair 8,655 (14,049) 36,963

value through profit or loss

Losses/(gains) on foreign exchange 231 (283) (173)

Sales of investments held at fair value 92,179 71,615 144,427

through profit or loss

Purchases of investments held at fair value (37,120) (80,184) (142,206)

through profit or loss

Increase in other debtors (751) (421) (21)

Increase in other creditors 209 1,093 318

Taxation on investment income (326) (296) (685)

Net cash generated from/(used in) operating 60,750 (5,144) 11,513

activities

Financing activities

Interest paid (120) (95) (211)

Tender offer (51,017) - -

Tender costs paid (316) - -

Dividends paid (5,484) (5,661) (11,307)

Net cash used in financing activities (56,937) (5,756) (11,518)

Increase/(decrease) in cash and cash 3,813 (10,900) (5)

equivalents

Cash and cash equivalents at the beginning of (16,517) (16,685) (16,685)

the period/year

Effect of foreign exchange rate changes (231) 283 173

Cash and cash equivalents at the end of the (12,935) (27,302) (16,517)

period/year

Comprised of:

Cash at bank 58 297 463

Bank overdraft (12,993) (27,599) (16,980)

(12,935) (27,302) (16,517)

NOTES TO THE FINANCIAL STATEMENTS

for the six months ended 30 June 2022

1. PRINCIPAL ACTIVITY AND BASIS OF PREPARATION

The principal activity of the Company is that of an investment trust company

within the meaning of Section 1158 of the Corporation Tax Act 2010.

The financial statements of the Company are prepared on a going concern basis

in accordance with Financial Reporting Standard 104 Interim Financial Reporting

(FRS 104) applicable in the United Kingdom and Republic of Ireland and the

revised Statement of Recommended Practice - Financial Statements of Investment

Trusts Companies and Venture Capital Trusts (SORP) issued by the Association of

Investment Companies (AIC) in October 2019, and updated in July 2022, and the

provisions of the Companies Act 2006.

The accounting policies and estimation techniques applied for the condensed set

of financial statements are as set out in the Company's Annual Report and

Financial Statements for the year ended 31 December 2021.

2. INCOME

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December

2021

(unaudited) (unaudited) (audited)

US$'000 US$'000 US$'000

Investment income:

Overseas dividends 7,066 4,059 11,655

Overseas REIT distributions 254 164 307

Overseas special dividends 258 133 223

Fixed interest income 21 11 14

7,599 4,367 12,199

Other income:

Deposit interest 18 - -

Total income 7,617 4,367 12,199

Dividends and interest received in cash during the period amounted to

US$6,382,000 and US$42,000 (six months ended 30 June 2021: US$3,575,000 and

US$12,000; year ended 31 December 2021: US$12,285,000 and US$12,000).

There were no special dividends recognised in capital in the period (six months

ended 30 June 2021: US$nil; year ended 31 December 2021: US$nil).

3. INVESTMENT MANAGEMENT FEE

Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Investment 186 558 744 229 689 918 431 1,295 1,726

management

fee

Total 186 558 744 229 689 918 431 1,295 1,726

Under the terms of the investment management agreement, BFM is entitled to a

fee of 0.80% per annum based on the Company's daily Net Asset Value (NAV). The

fee is levied quarterly.

The investment management fee is allocated 25% to the revenue account and 75%

to the capital account of the Income Statement. There is no additional fee for

company secretarial and administration services.

4. OTHER OPERATING EXPENSES

Six months Six months Year

ended ended ended

30 June 2022 30 June 31 December

2021 2021

(unaudited) (unaudited) (audited)

US$'000 US$'000 US$'000

Allocated to revenue:

Custody fee 23 31 61

Depositary fees1 7 12 22

Auditors' remuneration2 24 31 60

Registrar's fees 15 20 40

Directors' emoluments 104 126 254

Employer NI contributions 10 17 27

Marketing fees 54 65 101

Postage and printing fees 14 50 73

AIC fees 6 4 22

Broker fees 19 31 56

FCA fees 5 7 12

Write back of prior year expenses3,4 (10) (36) (42)

Other administration costs 37 46 97

308 404 783

Allocated to capital:

Custody transaction charges4,5 6 (4) 10

314 400 793

1 All expenses other than depositary fees are paid in Sterling and are

therefore subject to exchange rate fluctuations.

2 No non-audit services are provided by the Company's auditors.

3 Relates to prior year accrual for printing fees, postage fees and

miscellaneous fees written back during the six month period ended 30 June 2022.

4 Relates to prior year accrual for AIC fees, Director search fees and custody

transaction charges written back during the year ended 31 December 2021.

5 For the six month period ended 30 June 2022, expenses of US$6,000 (six months

ended 30 June 2021: income of US$4,000; year ended 31 December 2021: expenses

of US$10,000) were charged to the capital account of the Income Statement.

These relate to transaction costs charged by the custodian on sale and purchase

trades.

The direct transaction costs incurred on the acquisition of investments

amounted to US$60,000 for the six months ended 30 June 2022 (six months ended

30 June 2021: US$72,000; year ended 31 December 2021: US$136,000). Costs

relating to the disposal of investments amounted to US$86,000 for the six

months ended 30 June 2022 (six months ended 30 June 2021: US$105,000; year

ended 31 December 2021: US$178,000). All transaction costs have been included

within the capital reserves.

5. DIVIDS

The Company's cum-income US Dollar NAV at 31 March 2022 was 620.97 cents per

share, and the Directors declared a first quarterly interim dividend of 7.76

cents per share. The dividend was paid on 16 May 2022 to holders of ordinary

shares on the register at the close of business on 19 April 2022.

In accordance with FRS 102 Section 32 Events After the End of the Reporting

Period, the final dividend payable on ordinary shares is recognised as a

liability when approved by shareholders. Interim dividends are recognised only

when paid.

Dividends on equity shares paid during the period were:

Six months Six months Year

ended ended ended

30 June 2022 30 June 2021 31 December 2021

(unaudited) (unaudited) (audited)

US$'000 US$'000 US$'000

Quarter to 31 December 2020 - dividend of - 2,925 2,925

7.45 cents

Quarter to 31 March 2021 - dividend of - 2,736 2,736

6.97 cents

Quarter to 30 June 2021 - dividend of - - 3,070

7.82 cents

Quarter to 30 September 2021 - dividend - - 2,576

of 6.56 cents

Quarter to 31 December 2021 - dividend of 2,438 - -

6.21 cents

Quarter to 31 March 2022 - dividend of 3,046 - -

7.76 cents

5,484 5,661 11,307

6. CREDITORS - AMOUNTS FALLING DUE AFTER MORE THAN ONE YEAR

As at As at As at

30 June 2022 30 June 31 December

2021 2021

(unaudited) (unaudited) (audited)

US$'000 US$'000 US$'000

Non-current tax liability - 11 11

Non-equity redeemable shares 24 24 24

24 35 35

At 30 June 2022 the Company had net surplus management expenses of US$1,030,000

(30 June 2021: US$992,000; 31 December 2021: US$844,000) and a non-trade loan

relationship deficit of US$1,308,000 (30 June 2021: US$1,095,000; 31 December

2021: US$1,308,000). A deferred tax asset was not recognised in the period

ended 30 June 2022 or in the year ended 31 December 2021 as it was unlikely

that there would be sufficient future taxable profits to utilise these

expenses.

Non-equity redeemable shares

The redeemable shares of £1 each carry the right to receive a fixed dividend at

the rate of 0.10% per annum on the nominal amount thereof. They are capable of

being redeemed by the Company at any time and confer no rights to receive

notice of, attend or vote at general meetings except where the rights of

holders are to be varied or abrogated. On a winding up, the capital paid up on

such shares ranks pari passu with, and in proportion to, any amounts of capital

paid to the holders of ordinary shares, but does not confer any further right

to participate in the surplus assets of the Company.

7. EARNINGS AND NET ASSET VALUE PER ORDINARY SHARE

Revenue, capital earnings/(loss) and net asset value per ordinary share are

shown below and have been calculated using the following:

Six months Six months Year

ended ended ended

30 June 2022 30 June 31 December

2021 2021

(unaudited) (unaudited) (audited)

Net revenue profit attributable to ordinary 6,767 3,414 10,247

shareholders (US$'000)

Net capital (loss)/profit attributable to (9,529) 13,576 (38,253)

ordinary shareholders (US$'000)

Total (loss)/profit attributable to ordinary (2,762) 16,990 (28,006)

shareholders (US$'000)

Total shareholders' funds (US$'000) 135,199 245,480 194,838

The weighted average number of ordinary shares in 37,362,470 39,259,620 39,259,620

issue during the period on which the earnings per

ordinary share was calculated was:

The actual number of ordinary shares in issue at 29,448,641 39,259,620 39,259,620

the end of each period on which the net asset

value per ordinary share was calculated was:

The number of ordinary shares in issue, including 31,630,303 41,441,282 41,441,282

treasury shares at the period/year end was:

Earnings per share

Calculated on weighted average number of ordinary

shares:

Revenue earnings per share (US$ cents) - basic 18.11 8.70 26.10

and diluted

Capital (loss)/earnings per share (US$ cents) - (25.50) 34.58 (97.44)

basic and diluted

Total (loss)/earnings per share (US$ cents) - (7.39) 43.28 (71.34)

basic and diluted

As at As at As at

30 June 2022 30 June 31 December

2021 2021

(unaudited) (unaudited) (audited)

Net asset value per ordinary share (US$ cents) 459.10 625.27 496.28

Ordinary share price (mid-market) (US$ cents)1 431.13 565.01 461.19

1 Based on an exchange rate of US$1.21445 to £1 (30 June 2021: US$1.3814; 31

December 2021: US$1.35445).

There were no dilutive securities at 30 June 2022 (30 June 2021: nil; 31

December 2021: nil).

8. CALLED UP SHARE CAPITAL

Ordinary Treasury Total Nominal

shares shares shares value

number number number US$'000

Allotted, called up and fully paid

share capital comprised: Ordinary

shares of 10 cents each:

At 31 December 2021 39,259,620 2,181,662 41,441,282 4,144

Tender offer (9,810,979) - (9,810,979) (981)

At 30 June 2022 29,448,641 2,181,662 31,630,303 3,163

During the period to 30 June 2022, 9,810,979 ordinary shares were purchased for

cancellation as a result of a tender offer for a total cost of US$51,393,000

(six months ended 30 June 2021: nil; year ended 31 December 2021: nil).

The ordinary shares give shareholders voting rights, the entitlement to all of

the capital growth in the Company's assets, and to all income from the Company

that is resolved to be distributed.

9. RESERVES

The share premium and capital redemption reserve are not distributable profits

under the Companies Act 2006. In accordance with ICAEW Technical Release 02/

17BL on Guidance on Realised and Distributable Profits under the Companies Act

2006, the special reserve and capital reserves may be used as distributable

profits for all purposes and, in particular, the repurchase by the Company of

its ordinary shares and for payments as dividends. In accordance with the

Company's Articles of Association, the special reserve, capital reserves and

the revenue reserve may be distributed by way of dividend. The loss on capital

reserve arising on the revaluation of investments of US$11,041,000 (30 June

2021: gain of US$52,558,000; 31 December 2021: gain of US$7,247,000) is subject

to fair value movements and may not be readily realisable at short notice, as

such it may not be entirely distributable. The investments are subject to

financial risks; as such capital reserves (arising on investments sold) and the

revenue reserve may not be entirely distributable if a loss occurred during the

realisation of these investments.

10. VALUATION OF FINANCIAL INSTRUMENTS

Market risk arising from price risk

Price risk is the risk that the fair value or future cash flows of a financial

instrument will fluctuate because of changes in market prices (other than those

arising from interest rate risk or currency risk), whether those changes are

caused by factors specific to the individual financial instrument or its

issuer, or factors affecting similar financial instruments traded in the

market. Local, regional or global events such as war, acts of terrorism, the

spread of infectious illness or other public health issues, recessions, climate

change or other events could have a significant impact on the Company and its

investments.

Valuation of financial instruments

Financial assets and financial liabilities are either carried in the Balance

Sheet at their fair value (investments) or at an amount which is a reasonable

approximation of fair value (due from brokers, dividends and interest

receivable, due to brokers, accruals, cash and cash equivalents and

overdrafts). Section 34 of FRS 102 requires the Company to classify fair value

measurements using a fair value hierarchy that reflects the significance of

inputs used in making the measurements. The valuation techniques used by the

Company are explained in the accounting policies note on page 88 of the Annual

Report and Financial Statements for the year ended 31 December 2021.

Categorisation within the hierarchy has been determined on the basis of the

lowest level input that is significant to the fair value measurement of the

relevant asset.

The fair value hierarchy has the following levels:

Level 1 - Quoted market price for identical instruments in active markets

A financial instrument is regarded as quoted in an active market if quoted

prices are readily and regularly available from an exchange, dealer, broker,

industry group, pricing service or regulatory agency and those prices represent

actual and regularly occurring market transactions on an arm's length basis.

These include exchange traded derivatives. The Company does not adjust the

quoted price for these instruments.

Level 2 - Valuation techniques using observable inputs

This category includes instruments valued using quoted prices for similar

instruments in markets that are considered less than active, or other valuation

techniques where all significant inputs are directly or indirectly observable

from market data. Valuation techniques used for non-standardised financial

instruments such as over-the-counter derivatives, include the use of comparable

recent arm's length transactions, reference to other instruments that are

substantially the same, discounted cash flow analysis, option pricing models

and other valuation techniques commonly used by market participants making the

maximum use of market inputs and relying as little as possible on entity

specific inputs.

Level 3 - Valuation techniques using significant unobservable inputs

This category includes all instruments where the valuation technique includes

inputs not based on market data and these inputs could have a significant

impact on the instrument's valuation.

This category also includes instruments that are valued based on quoted prices

for similar instruments where significant entity determined adjustments or

assumptions are required to reflect differences between the instruments and

instruments for which there is no active market. The Investment Manager

considers observable data to be that market data that is readily available,

regularly distributed or updated, reliable and verifiable, not proprietary, and

provided by independent sources that are actively involved in the relevant

market.

The level in the fair value hierarchy within which the fair value measurement

is categorised in its entirety is determined on the basis of the lowest level

input that is significant to the fair value measurement. If a fair value

measurement uses observable inputs that require significant adjustment based on

unobservable inputs, that measurement is a Level 3 measurement.

Assessing the significance of a particular input to the fair value measurement

in its entirety requires judgement, considering factors specific to the asset

or liability. The determination of what constitutes 'observable' inputs

requires significant judgement by the Investment Manager.

Fair values of financial assets and financial liabilities

The table below is an analysis of the Company's financial instruments measured

at fair value at the balance sheet date.

Financial assets at fair value Level 1 Level 2 Level 3 Total

through profit or loss at 30 June

2022

(unaudited) US$'000 US$'000 US$'000 US$'000

Equity investments 148,457 - - 148,457

Total 148,457 - - 148,457

Financial assets at fair value Level 1 Level 2 Level 3 Total

through profit or loss at 30 June

2021

(unaudited) US$'000 US$'000 US$'000 US$'000

Equity investments 273,406 - - 273,406

Fixed interest investments - 34 - 34

Total 273,406 34 - 273,440

Financial assets at fair value Level 1 Level 2 Level 3 Total

through profit or loss at 31 December

2021

(audited) US$'000 US$'000 US$'000 US$'000

Equity investments 212,151 - - 212,151

Fixed interest investments - 31 - 31

Total 212,151 31 - 212,182

The Company held no Level 3 securities as at 30 June 2022 (30 June 2021: nil;

31 December 2021: nil).

For exchange listed equity investments the quoted price is the bid price.

Substantially all investments are valued based on unadjusted quoted market

prices. Where such quoted prices are readily available in an active market,

such prices are not required to be assessed or adjusted for any price related

risks, including climate risk, in accordance with the fair value related

requirements of the Company's financial reporting framework.

11. TRANSACTIONS WITH THE INVESTMENT MANAGER AND AIFM

BlackRock Fund Managers Limited (BFM) provides management and administration

services to the Company under a contract which is terminable on six months'

notice. BFM has (with the Company's consent) delegated certain portfolio and

risk management services, and other ancillary services, to BlackRock Investment

Management (UK) Limited (BIM (UK)). Further details of the investment

management contract are disclosed on pages 49 and 50 of the Directors' Report

in the Company's Annual Report and Financial Statements for the year ended 31

December 2021.

The investment management fee is levied quarterly, based on 0.80% per annum of

the net asset value. The investment management fee due for the six months ended

30 June 2022 amounted to US$744,000 (six months ended 30 June 2021: US$918,000;

year ended 31 December 2021: US$1,726,000). At the period end, an amount of

US$751,000 was outstanding in respect of these fees (30 June 2021:

US$1,399,000; 31 December 2021: US$815,000).

In addition to the above services BIM (UK) has provided the Company with

marketing services. The total fees paid or payable for these services for the

period ended 30 June 2022 amounted to US$54,000 excluding VAT (six months ended

30 June 2021: US$65,000; year ended 31 December 2021: US$101,000). Marketing

fees of US$162,000 were outstanding at 30 June 2022 (30 June 2021: US$191,000;

31 December 2021: US$108,000).

During the period, the Manager pays the amounts due to the Directors. These

fees are then reimbursed by the Company for the amounts paid on its behalf. As

at 30 June 2022, an amount of US$109,000 (30 June 2021: US$250,000; 31 December

2021: US$124,000) was payable to the Manager in respect of Directors' fees.

The ultimate holding company of the Manager and the Investment Manager is

BlackRock, Inc., a company incorporated in Delaware, USA.

12. RELATED PARTY DISCLOSURE

The Board consists of five non-executive Directors, all of whom are considered

to be independent of the Manager by the Board. None of the Directors has a

service contract with the Company. The Chairman receives an annual fee of £

47,800, the Chairman of the Audit Committee receives an annual fee of £36,700,

the Senior Independent Director and Chairman of the Remuneration Committee

receives an annual fee of £34,600 and each of the other Directors receives an

annual fee of £32,600.

At the period end and as at the date of this report members of the Board held

ordinary shares in the Company as set out below:

As at As at

13 September 30 June 2022

2022

Ordinary Ordinary

shares shares

Carolan Dobson (Chairman) 4,792 4,792

Craig Cleland 10,000 10,000

Mahrukh Doctor 686 686

Laurie Meister 2,915 2,915

Nigel Webber 5,000 5,000

13. CONTINENT LIABILITIES

There were no contingent liabilities at 30 June 2022 (30 June 2021: nil; 31

December 2021: nil).

14. PUBLICTION OF NON-STATUTORY ACCOUNTS

The financial information contained in this Half Yearly Financial Report does

not constitute statutory accounts as defined in Section 435 of the Companies

Act 2006. The financial information for the six months ended 30 June 2022 and