BlackRock Income Portfolio Update

August 17 2022 - 6:09AM

UK Regulatory

TIDMBRIG

The information contained in this release was correct as at 31 July 2022.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange website at:

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK INCOME & GROWTH INVESTMENT TRUST PLC (LEI:5493003YBY59H9EJLJ16)

All information is at 31 July 2022 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five Since

Month Months Year Years Years 1 April

2012

Sterling

Share price 10.4% 6.3% 4.4% 10.4% 16.2% 115.7%

Net asset value 4.2% -1.6% 4.5% 9.2% 17.3% 101.1%

FTSE All-Share Total Return 4.4% -1.2% 5.5% 9.9% 21.5% 97.8%

Source: BlackRock

BlackRock took over the investment management of the Company with effect from 1

April 2012.

At month end

Sterling:

Net asset value - capital only: 200.02p

Net asset value - cum income*: 201.66p

Share price: 196.00p

Total assets (including income): £46.7m

Discount to cum-income NAV: 2.8%

Gearing: 3.0%

Net yield**: 3.7%

Ordinary shares in issue***: 21,171,914

Gearing range (as a % of net assets): 0-20%

Ongoing charges****: 1.2%

* Includes net revenue of 1.64 pence per share

** The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 3.7% and includes the 2021

final dividend of 4.60p per share declared on 13 January 2022 and paid to

shareholders on 17 March 2022, and the 2022 interim dividend of 2.60p per share

declared on 22 June 2022 with pay date 1 September 2022.

*** excludes 10,081,532 shares held in treasury.

**** Calculated as a percentage of average net assets and using expenses,

excluding performance fees and interest costs for the year ended 31 October

2021.

Sector Analysis Total assets (%)

Support Services 12.3

Pharmaceuticals & Biotechnology 10.0

Oil & Gas Producers 8.4

Household Goods & Home Construction 7.8

Media 7.3

Life Insurance 5.8

Banks 5.7

Mining 5.1

Financial Services 4.6

Tobacco 3.4

Nonlife Insurance 3.3

Health Care Equipment & Services 2.6

Personal Goods 2.6

Electronic & Electrical Equipment 2.5

Travel & Leisure 2.4

Food Producers 2.3

General Retailers 1.7

Fixed Line Telecommunications 1.5

Gas, Water & Multiutilities 1.3

Industrial Engineering 1.1

Software & Computer Services 1.0

Electricity 0.8

Real Estate Investment Trusts 0.7

Net Current Assets 5.8

-----

Total 100.0

=====

Country Analysis Percentage

United Kingdom 85.8

United States 4.6

France 3.8

Net Current Assets 5.8

-----

100.0

=====

Fund %

Top 10 holdings

AstraZeneca 7.5

Shell 6.8

RELX 5.2

Reckitt Benckiser 4.8

Rio Tinto 3.8

Phoenix Group 3.7

British American Tobacco 3.4

3i Group 3.0

Rentokil Initial 2.9

Standard Chartered 2.8

Commenting on the markets, representing the Investment Manager noted:

Performance Overview:

The Company returned 4.2% during the month, modestly underperforming the FTSE

All-Share which returned 4.4%.

Global equity markets rose in July despite global economies feeling the impacts

of both high inflation and Central Banks' attempts to curb it. Central Banks

have continued to raise rates; the Fed by 75bps for the second consecutive

month and the European Central Bank (ECB) by a larger than expected 50 basis

points, marking the first ECB rate hike in 11 years1.

The US economy has slowed for two consecutive quarters technically putting the

US into a recession. Sentiment shifted during the period towards the view that

inflation was close to peaking enabling more dovish monetary policy in due

course. This prompted a recovery in global equities after heavy year-to-date

losses. Global growth stocks rallied and outperformed value stocks by 6.9% over

the month. Year-to-date, value stocks have still outperformed growth stocks by

12.8%2. The S&P 500 rose 9.1%, its best monthly performance since November

2020. The Nasdaq rose 12.3%, its biggest monthly gain since April 20201 and

highlighting the outperformance of information technology stocks more broadly

over the month.

The outlook for European economies remains unclear given the potential for

further gas disruption, the risk of energy rationing and its subsequent impact

on industrial production. Gas supplies benefitted from the reopening of the

Nordstream 1 pipeline, albeit at a limited capacity. However, this was followed

by Russia's announcement that capacity would be further reduced to enable

turbine repairs. Germany rejected this explanation, causing gas prices to rise

sharply towards the end of the month in response to renewed fears of gas supply

scarcity.

Emerging markets underperformed, with a -0.2% decline of the MSCI Emerging

Markets Index2, largely due to China's heavy weight in the index. China has

shown few signs of softening the zero-covid policy with rolling lockdowns still

enforced across various cities. However, positive actions were seen as Beijing

opened borders for direct inbound passenger flights for the first time in two

years and exports have significantly beaten expectations.

Boris Johnson resigned as the UK's Prime Minister after losing the support of

his party. The Conservative leadership race was narrowed to Rishi Sunak and Liz

Truss. However, the UK economy is more sensitive to global forces than the

fiscal spending plans of candidates.

Stocks:

The Company's more cyclical holdings, including RS Group and Rentokil,

performed better during the month, helped by solid reporting. RS Group

delivered strong results; while the market continues to be worried about the

macro backdrop, the company continues to deliver strong growth benefitting from

its long term investments in people, technology and product breath made over

several years. Rentokil, a long-term holding for the Company, is expecting the

completion of the Terminix deal in the next couple months which we believe will

enhance the long-term growth opportunity giving them greater density in their

existing footprint whilst opening up new geographical markets in the US to gain

share. 3i continued to execute strongly, delivering an encouraging update, once

again highlighting the continued strong performance of Action, its European

discount retailer. Whilst we remain cautious on the backdrop for the consumer,

it is clear that Action has built a strong value- based economic model and

acquired a loyal and growing customer base.

Direct Line Insurance was the top detractor from performance during the period.

The company fell after issuing a profit warning as claims inflation has moved

ahead of pricing in the short term. We believe this is towards the bottom of

the motor cycle and we would expect the industry to raise prices in the medium

term to protect profitability. Smith & Nephew also detracted as a defensive

share on a weak second quarter print which highlighted ongoing supply chain

challenges partly as a result of COVID challenges and some self-inflicted

operational issues. We continue to engage with the new CEO on his plans to

improve execution. BT fell in part due to the defensive nature of the shares

and the concern over the threat from competitors building out broadband network

infrastructure.

Portfolio Activity:

Trading was limited ahead of results reporting. Following further

disappointment around the company's control of its cost base, we sold the

remaining holding in IntegraFin.

Outlook

The headwinds facing global equity markets have grown steadily over the first

half of 2022. Inflation has surprised in its depth and breadth so far, driven

by ongoing COVID related disruption, the war in Ukraine, rising labour costs

and the persistence of these factors. Central banks and governments are

tightening monetary and fiscal policy as interest rates rise and stimulus is

withdrawn. The subsequent rise in the risk-free or discount rate has many

consequences, not least the pressure on valuation frameworks and, notably, on

un-profitable or extremely highly valued businesses. We are mindful of this and

feel it is incredibly important to focus on companies with strong, competitive

positions, at attractive valuations that can deliver in this environment.

The political and economic impact of the war in Ukraine has been significant in

uniting Europe and its allies, whilst exacerbating the demand/supply imbalance

in the oil and soft commodity markets likely pushing inflation higher for

longer. We are conscious of the impact this will likely have on the cost of

energy, and we continue to expect divergent regional monetary approaches with

the US being somewhat more insulated from the impact of the conflict, than for

example, Europe. Complicating this further, is the continued impact COVID is

having on certain parts of the world, notably China, which has used lockdowns

to control the spread of the virus impacting economic activity during the first

half. We also see the potential for longer-term inflationary pressure from

decarbonisation and deglobalisation. It is difficult to have a high degree of

confidence in how these evolve but we believe there is rising risk of a policy

mistake as central banks attempt to curb inflation; too late to tighten and/or

tightening too hard. We expect this, and the geopolitical ramifications of the

Ukraine war, to be the prevailing debate of 2022 and beyond.

Although demand remains strong at present, the outlook for corporate revenue

and earnings growth is likely to worsen over the course of 2022 as the pressure

on real incomes raises the spectre once again of stagflation. A notable feature

of our conversations with a wide range of corporates in 2021 was the ease with

which they were able to pass on cost increases and protect or even expand

margins. We believe that when the transitory inflationary pressures start to

fade (e.g. commodity prices, supply chain disruption) then pricing

conversations will become more challenging. We are also increasingly focused on

wage inflation which may be more persistent and yet, in our experience, harder

to pass on. Corporates have already pointed to wages picking up, the

introduction of bonuses and growing pressure on employee retention rates as

competition for labour intensifies. We therefore believe that employee

retention will be an important differentiator in 2022 given the productivity

benefits of a stable workforce as labour markets tighten further.

The FTSE 100, with a majority of international weighted revenues, high

commodity weighting and low starting valuation, has proven to be a port in the

storm, as one of the best performing developed markets during the first half.

The FTSE 250, with its higher domestic focus and lower liquidity has suffered

given the weakness in the domestic economy. We would expect the FTSE 100 to

continue to be advantaged until we see a stabilisation in the domestic economy

and subsequent strengthening of sterling or, more likely, a weakening of the

dollar. Whilst we anticipate further volatility ahead as earnings estimates

moderate, we know that in the course of time, risk appetites will return. We

are currently spending time identifying our 'wish list' of opportunities

utilising our flexible approach, experience and strong absolute valuation

framework.

As a reminder, we continue to concentrate the portfolio on businesses with

pricing power and durable, competitive advantages as we see these as best

placed to protect margins and returns over the medium and long-term. Further,

we continue to have conviction in cash generative companies with exceptional

management teams and underappreciated growth potential. At present, whilst we

are excited by the attractive stock-specific opportunities on offer, we

continue to approach the year with balance in the portfolio.

1 Source: July 2022, Financial Times https://www.ft.com/content/

37e49144-2b1d-45f1-9516-73cda646261d

2 Source: July 2022, JP Morgan Monthly Market Review Monthly Market Review |

J.P. Morgan Asset Management (jpmorgan.com)

17 August 2022

END

(END) Dow Jones Newswires

August 17, 2022 06:09 ET (10:09 GMT)

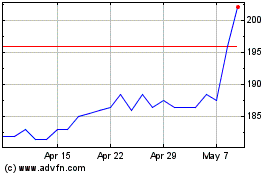

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Apr 2023 to Apr 2024