BlackRock Income and Growth Investment Trust Plc - Portfolio Update

October 21 2019 - 10:43AM

PR Newswire (US)

| BLACKROCK INCOME AND

GROWTH INVESTMENT TRUST PLC (LEI:5493003YBY59H9EJLJ16) |

| All information is at

30 September 2019 and unaudited. |

|

| Performance at month end

with net income reinvested |

|

|

|

|

|

|

|

|

One

Month |

Three

Months |

One

Year |

Three

Years |

Five

Years |

Since

1 April

2012 |

| Sterling |

|

|

|

|

|

|

| Share price |

3.1% |

3.1% |

5.3% |

17.7% |

38.7% |

96.3% |

| Net asset value |

3.2% |

1.9% |

1.5% |

18.3% |

42.8% |

84.2% |

| FTSE All-Share Total Return |

3.0% |

1.3% |

2.7% |

21.7% |

38.9% |

78.7% |

|

|

|

|

|

|

|

| Source: BlackRock |

|

|

|

|

|

|

| BlackRock took over the investment

management of the Company with effect from

1 April 2012. |

| At month end |

|

| Sterling: |

|

| Net asset value - capital only: |

201.66p |

| Net asset value - cum income*: |

205.98p |

| Share price: |

200.00p |

| Total assets (including

income): |

£51.4m |

| Discount to cum-income NAV: |

2.9% |

| Gearing: |

5.1% |

| Net yield**: |

3.5% |

| Ordinary shares in issue***: |

23,017,476 |

| Gearing range (as a % of net

assets) |

0-20% |

| Ongoing charges****: |

1.1% |

| * includes net revenue of 4.32 pence

per share |

| ** The Company’s yield based on

dividends announced in the last 12 months as at the date of the

release of this announcement is 3.5% and includes the 2018 final

dividend of 4.40p per share declared on 20 December 2018 and paid

to shareholders on 19 March 2019 and the 2019 interim

dividend of 2.60p per share declared on 25 June 2019 and

paid to shareholders on 27 August 2019. |

| *** excludes 9,916,456 shares held

in treasury |

| **** Calculated as a percentage of

average net assets and using expenses, excluding performance fees

and interest costs for the year ended

31 October 2018. |

| Sector Analysis |

Total assets

(%) |

| Oil & Gas Producers |

9.8 |

| Pharmaceuticals &

Biotechnology |

9.2 |

| Media |

9.1 |

| Life Insurance |

8.1 |

| Support Services |

7.1 |

| Banks |

6.8 |

| Financial Services |

5.6 |

| Household Goods & Home

Construction |

5.4 |

| Food Producers |

5.1 |

| Travel & Leisure |

4.3 |

| Tobacco |

3.7 |

| Food & Drug Retailers |

3.3 |

| Gas, Water & Multiutilities |

3.2 |

| Mining |

3.1 |

| Health Care Equipment &

Services |

2.9 |

| Industrial Engineering |

2.6 |

| Mobile Telecommunications |

2.2 |

| Nonlife Insurance |

2.0 |

| Electronic & Electrical

Equipment |

1.2 |

| Construction & Materials |

0.9 |

| Chemicals |

0.6 |

| General Retailers |

0.5 |

| Beverages |

0.3 |

| Net current assets |

3.0 |

|

------ |

| Total |

100.0 |

|

====== |

|

|

| Ten Largest Equity

Investments |

|

| Company |

Total assets

(%) |

| Royal Dutch Shell 'B' |

6.4 |

| AstraZeneca |

4.9 |

| GlaxoSmithKline |

4.3 |

| RELX |

4.2 |

| British American Tobacco |

3.7 |

| BP Group |

3.5 |

| Tesco |

3.3 |

| National Grid |

3.2 |

| BHP |

3.1 |

| Prudential |

3.1 |

| Commenting on the markets, Adam

Avigdori and David Goldman representing the Investment Manager

noted: |

|

| The UK equity market traded sideways

over the quarter, disguising a period of weakness in August and a

marked style rotation, out of momentum and into value, at the

beginning of September. Concerns around geopolitical risk, global

trade uncertainty and weakening global economic data did though

create headwinds, with intraday share prices influenced by ongoing

news flow surrounding trade tensions. Market concern spiked in

August, with investors turning to safe-haven assets as global

government yields plunged to historical lows and the US Treasury

curve inverted between the 2 and 10-year yields, resuming fears of

impending recession as it has previously been a lead-indicator.

Market risk was balanced by central banks shifting monetary policy

to a more dovish stance. The US Federal Reserve cut rates by 50

basis points in Q3, aiming to ease inflationary pressures and

offset rising geopolitical tensions. The European Central Bank

introduced a comprehensive easing package, cutting the deposit

facility rate by 10 basis points to -0.5% and restarting asset

purchases at the pace of 20bln EUR per month, with a commitment to

run the programme until its 2% inflation target was met. Emerging

markets detracted the most throughout the third quarter. Chinese

assets took the biggest hit as disruptions in global trade have

begun to be reflected in the economic data. In August, Chinese

industrial production slowed to +4.8% year-on-year, the weakest in

17 years and well below market expectations. In the UK, in June,

newly-elected UK Prime Minister Boris Johnson pledged to leave the

European Union on October 31st with or without a deal.

Ever since, the Brexit debate has become more heated, with the

risks of a disruptive ‘no-deal’ Brexit still looming large. This,

plus the contraction in domestic GDP in the second quarter, led to

additional weakness in Sterling. |

|

| Over the quarter, the Company

returned 2.01%, outperforming the benchmark index, the FTSE All

Share, which returned 1.27% in the same period. |

|

| The largest contributor was London

Stock Exchange Group, one of the fund’s core holdings, whose shares

rose further this month as the market further appreciated the

synergies and growth potential of the Refinitiv deal. Shares in

pest control specialist Rentokil also contributed this month. After

the positive set of trading results late in July, we met with the

company’s management team and would note that the pest control

division continues to be the key driver with strong structural

drivers in a fragmented industry. Medtech player Smith & Nephew

also contributed as shares rose further after a strong trading

statement released at the end of July where they upgraded revenue

guidance further. Shares were rallying through August as the

investment community further appraised what this entails for the

company. |

|

| The largest detractor to the fund

was Prudential whose shares were weak, not only due to further

potential rate cuts from the Fed against the ongoing US-China trade

tensions, but also the social unrest in Hong Kong. Its shares saw a

sharp sell-off prior to reporting H1 2019 results. The results

themselves highlighted that they are embarking on a strategy of

organic and inorganic diversification for their US business into

Fixed Annuities, noting the poorer conditions in the Variable

Annuities market as distribution shifts from broker to advised.

Elsewhere in the group, Asia continues to deliver with no change in

its structural growth story, despite the aforementioned concerns.

Shares in John Laing detracted following a weak H1 2019 update with

sizeable write-downs on their wind assets in Australia and Germany

citing issues of transmission/regulatory and lack of wind

respectively. These write-downs were more than offset by value

enhancements and project completions elsewhere such that NAV still

increased. Bodycote also detracted from performance. As a global

cyclical it is sensitive to market concerns about global growth. We

felt its results were reassuring in light of news flow from sector

peers and where its highest margin areas delivered. In our view,

this is a differentiated and well-capitalised industrial, with a

management team we rate highly. |

|

| Over the quarter we initiated a

position in Aviva, WPP and Grafton Group. We added to positions in

Standard Chartered, Taylor Wimpey, Phoenix Group, Smith &

Nephew, St James's Place, National Grid and Fuller Smith and

Turner. We sold our position in Imperial Brands. We have also

trimmed exposure to Lloyds, John Laing, BP, Rentokil, Barclays,

Elementis and MoneySupermarket.com. |

|

| We continue to see a period of

sustained growth. Importantly, we expect nominal growth to remain

modest as we see structural pressures from demographics, corporate

underinvestment and new technology continuing to act as a drag on

inflation. The dovish tilt from central banks is clearly supportive

for markets, however from time to time we expect markets to worry

about a shift to a more hawkish stance. With heightened political

uncertainty and investor nervousness, we expect volatility to

return to markets. This provides us, as active managers of a

concentrated portfolio, with a great opportunity to identify

high-quality cash generative businesses, with robust balance

sheets, that can weather various market cycles and help to deliver

long term capital and income growth for our clients. |

|

| We continue to like cash generative

consumer staple companies, especially those exposed to the emerging

market consumer given the prevalent demographic trends in certain

markets. These companies often generate substantial cash flow which

allows them to invest in innovation, marketing and distribution to

ensure the longevity of their brands while also paying attractive

and growing dividends to shareholders. We have also sought exposure

to infrastructure spend whilst at the same time we are watching for

signs of overheating in the US and monitoring economic growth in

China. We also note that inflationary pressures are

starting to build and therefore we seek those companies with

sufficient pricing power and efficiency potential to withstand

rising costs. As the recent past has demonstrated, it is

crucial to be selective and to focus on those companies that are

strong operators, that provide a differentiated service or product

and that boast a strong balance sheet. |

|

|

|

Copyright r 21 PR Newswire

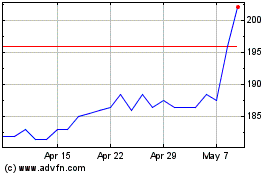

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Apr 2023 to Apr 2024